Freight Shipping between UK and UAE | Rates – Transit times – Duties and Taxes

Who knew logistics could be such an emotional roller coaster? One day you're learning about shipping rates and transit times, the next you're neck-deep in customs regulations and duties. It's no small task. By taking a deep dive into this guide, businesses shipping goods between the UK and UAE will unlock the secrets to an efficient, worry-free freight process.

Unravel the complexities of air and sea modes of transportation. Discover the ins-and-outs of customs clearance while getting a grip on the nuances of duties and taxes relevant to your business. Gain practical advice to navigate the logistical maze.

If the process still feels overwhelming, let DocShipper handle it for you! As a renowned international freight forwarder, we transform the seemingly daunting task of logistics and customs clearance into a success story for your business.

Which are the different modes of transportation between UK and UAE?

The UK and UAE's geographical distance creates a cross-border puzzle for shippers. Imagine the two nations as cities at opposite ends of an old treasure map. There are several paths to choose from: traversing the high seas like pirates - a bit long but cost-effective (ocean freight), flying like a falcon over continents (air freight), or a mix of the two, akin to a multi-stage adventure (multi-modal). But, remember, the quickest route isn’t always the best. It's all about matching your cargo’s needs - size, urgency, and type - with the ideal path to hit the 'X' mark efficiently.

Need help with your shipment?

Need assistance with your shipment? Dont hesitate to contact us even for a simple question. Choose the option that suits you

Live chat with an expert Chat on WhatsApp Free Quote 24hHow can DocShipper help you

Sea freight between UK and UAE

Sea freight, as the bridge between the UK and UAE, links key industrial hubs efficiently and at a cost-effective rate. The vast ocean liners slice through the waves, loaded with high-volume goods from London’s Port of Tilbury to the towering cranes of Jebel Ali Port in Dubai – delivering the lifeblood of a bustling trade relationship. Just like a slower, but frugal marathon runner, sea freight takes its time but gets the job done without breaking the bank.

Yet, with complexity comes confusion, and for many businesses, sailing through the choppy waters of cross-border shipping can feel like navigating a labyrinth in the dark. Mistakes are common, but not inevitable. From paperwork errors and inaccurate calculations, to misunderstandings about regulations, the list of potential pitfalls is as long as a ship’s journey from UK to UAE.

But fear not! With clear guidelines, practical examples, and best practices on hand, demystifying this process is not just possible, it’s inevitable. Let’s unravel this knot together, to ensure your shipping experience is smooth sailing.

Main shipping ports in UK

Port of Felixstowe

Location and Volume: Located on the East coast of England, in the county of Suffolk, the Port of Felixstowe is the biggest and busiest container-port in the country, moving over 4 million TEUs a year.

Key Trading Partners and Strategic Importance: The port features prominently in the UK trade with China, the USA, and parts of Europe. Its strategic location serves as a gateway to and from Northern Europe, engaging heavily in roll-on/roll-off and container traffic.

Context for Businesses: If you’re looking to tap into the European and Chinese markets, Felixstowe proves to be an indispensable part of your logistics portfolio because of its exceptional worldwide connectivity and high frequency of vessel calls.

Port of London

Location and Volume: The Port of London, situated on the River Thames, is one of the top three ports in the UK, handling over 50 million tonnes of cargo each year.

Key Trading Partners and Strategic Importance: Trading partners are mainly from Europe and North America. The port is strategically vital to the UK’s supply chain, handling a wide variety of goods, including foods, fuels, metals, and construction materials.

Context for Businesses: For businesses planning to diversify their product types, the Port of London could be central to your shipping strategy due to its versatility in cargo handling.

Port of Southampton

Location and Volume: Located on the South coast of England, the Port of Southampton is the UK’s number-one vehicle handling port, moving just under a million vehicles annually and handling over 1.9 million TEUs.

Key Trading Partners and Strategic Importance: The port sees heavy traffic from North America, the Far East, and Europe. It’s also a critical point for the UK’s automotive industry with its vehicle handling services.

Context for Businesses: If you’re an automotive business looking to reach global customers, the Port of Southampton should be a key consideration in your logistical plans for its outstanding proficiency in vehicle handling.

Main shipping ports in UK

Port of Felixstowe

Location and Volume: Located on the East coast of England, in the county of Suffolk, the Port of Felixstowe is the biggest and busiest container-port in the country, moving over 4 million TEUs a year.

Key Trading Partners and Strategic Importance: The port features prominently in the UK trade with China, the USA, and parts of Europe. Its strategic location serves as a gateway to and from Northern Europe, engaging heavily in roll-on/roll-off and container traffic.

Context for Businesses: If you’re looking to tap into the European and Chinese markets, Felixstowe proves to be an indispensable part of your logistics portfolio because of its exceptional worldwide connectivity and high frequency of vessel calls.

Port of London

Location and Volume: The Port of London, situated on the River Thames, is one of the top three ports in the UK, handling over 50 million tonnes of cargo each year.

Key Trading Partners and Strategic Importance: Trading partners are mainly from Europe and North America. The port is strategically vital to the UK’s supply chain, handling a wide variety of goods, including foods, fuels, metals, and construction materials.

Context for Businesses: For businesses planning to diversify their product types, the Port of London could be central to your shipping strategy due to its versatility in cargo handling.

Port of Southampton

Location and Volume: Located on the South coast of England, the Port of Southampton is the UK’s number-one vehicle handling port, moving just under a million vehicles annually and handling over 1.9 million TEUs.

Key Trading Partners and Strategic Importance: The port sees heavy traffic from North America, the Far East, and Europe. It’s also a critical point for the UK’s automotive industry with its vehicle handling services.

Context for Businesses: If you’re an automotive business looking to reach global customers, the Port of Southampton should be a key consideration in your logistical plans for its outstanding proficiency in vehicle handling.

Main shipping ports in UAE

Jebel Ali Port

Location and Volume: Positioned in Dubai, Jebel Ali Port is the busiest port in the Middle East and the 11th busiest globally. Its annual shipping volume exceeds 13 million TEU.

Key Trading Partners and Strategic Importance: This port is a serious contender in the international marine trade, with key trading partners in Asia, Europe, and the Americas.

Context for Businesses: For businesses seeking a hub for their distribution and logistics strategy, Jebel Ali Port’s wide range of facilities and status as a Free Zone might make it the go-to choice given its location and reach.

Port of Khalifa

Location and Volume: The Port of Khalifa is set in the heart of Abu Dhabi and is the deepest port in the UAE, geared to accept the largest shipping vessels. Its annual volume stands at 1.5 million TEU.

Key Trading Partners and Strategic Importance: Khalifa’s main trading partners are located in the Middle East, India, and East Africa. The port’s geographical location and high tech facilities give it a unique advantage.

Context for Businesses: If your business anticipates shipping large or heavy goods, or necessitates proximity to Abu Dhabi’s industrial zone, then opting for the Port of Khalifa would apply strategically.

Port of Zayed

Location and Volume: Sited in Abu Dhabi, the Port of Zayed is one of the regional leaders in bulk and general cargo. The port handles over 900,000 TEU annually.

Key Trading Partners and Strategic Importance: Zayed’s key trading partners are in the Middle East, Asia, and North America, particularly in bulk trade.

Context for Businesses: For businesses needing bulk or general cargo shipping, or those seeking a port near the UAE’s capital city, the Port of Zayed stands as a sound selection.

Port of Fujaira

Location and Volume: The Port of Fujairah, located on the eastern part of the UAE, is known for its strategic oil storage capability, handling over 1 million TEU annually.

Key Trading Partners and Strategic Importance: This port has extensive trade connections, especially with the Asian subcontinent and the GCC countries.

Context for Businesses: If your business involves shipping oil, derivatives, or related freight, then the Port of Fujairah’s established oil-centric services could signify the perfect choice.

Port Rashid

Location and Volume: Nestled in Dubai, Port Rashid is the second busiest port in the UAE, shipping over 500,000 TEU annually.

Key Trading Partners and Strategic Importance: Asia and European nations are major trading partners with Port Rashid that also serves as a popular tourist attraction due to its cruise terminal.

Context for Businesses: If your strategy encompasses both trade and tourism, Port Rashid’s dual focus on shipping and cruise capabilities might play a key role.

Khorfakkan Container Terminal

Location and Volume: Based in Sharjah, the Khorfakkan Container Terminal manages more than 4 million TEU annually.

Key Trading Partners and Strategic Importance: This major transshipment hub conducts trade extensively with the Asian and European markets.

Context for Businesses: If you aim to combine efficient shipping with a fast turnaround, the Khorfakkan Container Terminal and its acceleration-focused services may be the missing component in your logistics strategy.

Should I choose FCL or LCL when shipping between UK and UAE?

Making the right sea freight choice between the UK and UAE can dramatically affect your shipping success – both in terms of cost and delivery period. Are you deliberating between Full Container Load (FCL) and Less than Container Load (LCL)?

In the delightful puzzle of international shipment, we’ll unravel each option, equipping you with the know-how to tailor your shipping decisions to your unique needs. Stick with us as we embark on a voyage of strategic freight decision-making. Let’s dive in!

Full container load (FCL)

Definition: Full Container Load (FCL) shipping is a type of ocean freight service where a whole 20’ft or 40’ft container is dedicated to one shipper's cargo.

When to Use: FCL shipping is highly advised if your cargo exceeds 13/14/15 cubic meters (CBM). It stands out for its cost-effectiveness when shipping large volumes and for the increased safety it provides, as the container remains sealed from origin to destination.

Example: Imagine you're a UK-based electronics company shipping three hundred 50 inch TVs to UAE. Choosing FCL, you'd book an entire 40'ft container, ensuring your TVs are the only goods inside and minimizing the risk of damage during transit.

Cost Implications: In such a scenario, FCL shipping usually results in a lower cost per unit. Moreover, asking for an FCL shipping quote lets you predict your total shipping cost more accurately because it's usually a flat rate per container, not dependent on volume or weight of the cargo. Bear in mind, however, that any additional services like customs declaration or insurance will be separate charges.

Less container load (LCL)

Definition: LCL (Less than Container Load) shipments are a method of sea freight where your cargo shares a shipping container with other goods. This is an ideal solution for smaller shipments where you're not buying or selling enough goods to fill a whole container.

When to Use: If the cargo volume is less than 13 to 15 CBM (Cubic Meter), it's more cost-effective and flexible to opt for LCL freight. This method allows you to pay only for the space you use in the shared container, making it a more affordable choice for smaller shipping volumes.

Example: Suppose a company manufacturing artisanal soaps in the UK plans to export a small batch to a boutique in Dubai. Given the low-volume nature of the shipment, it could benefit from using LCL shipment – decreasing costs and providing more shipping schedule options.

Cost Implications: Because LCL uses shared containers, costs are spread across multiple shippers - allowing for lower-priced shipping for each party involved. However, be mindful of charges at the point of consolidation and deconsolidation, as these supplementary costs can affect the total freight cost.

Hassle-free shipping

Understanding whether to ship by consolidation or a full container from UK to UAE can be complex. Would you prefer seasoned experts to make this process hassle-free for you? At DocShipper, our team specializes in streamlining ocean freight. We consider essential factors such as cargo size, budget, and delivery timelines to help you make an informed choice. Ready for a smoother shipping experience? Contact us today for a free estimation. Your seamless shipping journey starts here.

Shipping goods via sea freight between the UK and UAE typically takes an average of 35 to 50 days. It’s important to remember that this transit period can depend on factors such as the specific ports used, the weight of your cargo, and the nature of the goods. To receive a tailored quote for your specific needs, engaging with a dedicated freight forwarder like DocShipper would be beneficial.

Here’s an approximate table of transit times between the major ports of both countries:

| UK Ports | UAE Ports | Average Transit Time in Days |

| Port of Felixstowe | Port of Jebel Ali | 43 |

| Port of Southampton | Port of Abu Dhabi | 35 |

| Port of Liverpool | Port of Sharjah | 45 |

| Port of London | Port of Ajman | 30 |

*Please remember that these transit times are averages and actual time can vary. Consulting with a freight forwarder can offer a more accurate timeline tailored to your cargo’s specific needs.

How much does it cost to ship a container between UK and UAE?

Comprehending the cost of shipping a container from the UK to UAE can feel daunting given the fluctuating ocean freight rates. However, establishing an exact shipping cost is not a simplistic equation due to contrasting factors: the points of loading and destination, the carrier, the nature of the goods, and the ever-changing monthly market trends.

Rather than rigid numbers, expect a broad price range per CBM. Fear not, our adept shipping specialists are at your service, tailoring bespoke quotes to match your individual needs and circumstances, assuring that you receive the most competitive and affordable rates.

Special transportation services

Out of Gauge (OOG) Container

Definition: An OOG container is an excellent shipping method when your cargo dimensions exceed the standard container size. Out of Gauge stands for any item that exceeds the dimensions of standard shipping containers.

Suitable for: This type of sea freight is perfect for large items that don’t fit into other containers because it can handle substantial volume and weight.

Examples: Machinery, industrial equipment, large pieces of art, or boats could effectively use the OOG container service for transportation between the UK and UAE.

Why it might be the best choice for you: If your business deals with cargo that falls outside standard container measurements, OOG container shipping is a reliable option. You don’t need to disassemble large machines, which saves time and reduces the risk of damage during transit.

Break Bulk

Definition: Break bulk is a method where goods are loaded individually rather than in containers. It’s the older, more traditional method of shipping.

Suitable for: It’s best for oversized goods or those that require special handling.

Examples: Goods such as machinery, timber, and construction materials are typically shipped as break bulk.

Why it might be the best choice for you: If your cargo is too big or oddly shaped for standard containers but not suitable for OOG containers, break bulk shipping is the solution.

Dry Bulk

Definition: Dry Bulk refers to the transportation of commodities in large, unpackaged amounts. It’s another form of loose cargo load.

Suitable for: This shipping option is ideal for transporting raw materials.

Examples: Items like grains, coal, cement, or minerals are often transported via dry bulk.

Why it might be the best choice for you: If your business deals with loose, granular commodities in large quantities, this method provides an economically effective solution for shipping between UK and UAE.

Roll-on/Roll-off (Ro-Ro)

Definition: The Ro-Ro service refers to shipping where vehicles are driven directly onto the ro-ro vessel and secured for transport.

Suitable for: This method is perfect for transportation of wheeled cargo, trailers, trucks, cars, and machinery with wheels.

Examples: Cars, trucks, trailers, or any heavy wheeled machinery can be shipped via this method.

Why it might be the best choice for you: If you deal with automobiles or heavy machinery on wheels, Ro-Ro shipping can be the fastest and most cost-effective option for you.

Reefer Containers

Definition: Reefer containers are refrigerated containers used for shipping goods that require temperature-controlled conditions.

Suitable for: Best suited for goods that are sensitive to temperature changes, from food produce to pharmaceuticals.

Examples: Fresh fruits, vegetables, meat, fish, dairy products, and certain chemicals/pharmaceuticals are most often shipped in reefer containers.

Why it might be the best choice for you: If your business deals with temperature-sensitive goods and needs to maintain their quality during transit, then reefer containers offer an optimal solution.

Remember, the right choice of shipping method is crucial to ensure the safe and efficient delivery of your goods from the UK to UAE. At DocShipper, we’re here to help you assess your specific requirements and choose the best sea freight option. Contact us today, and receive a comprehensive shipping quote in less than 24 hours.

Air freight between UK and UAE

When shipping goods from the UK to the UAE, air freight shines with speed and reliability. Imagine: Your high-priced electronics or luxury fashion items flying business class, arriving safely within days.

This method is perfect for small, valuable cargo, saving cash and time. However, it’s a tricky game: many falter by underestimating factors. Using incorrect weight formulas to price items, for example, can be a costly error. Similarly, not knowing best shipping practices can hit your pocket hard.

We’ll delve into these often-overlooked aspects, helping you sidestep expensive blunders and ensuring your precious cargo enjoys a smooth, cost-effective journey.

Air Cargo vs Express Air Freight: How should I ship?

Taking your business global doesn’t have to be a maze. When shipping from the UK to UAE, the choice is yours: go with air cargo, which gets your goods on a standard airline, or opt for express air freight, where your goods fly high on a dedicated plane.

But how do you choose? In this section, we’ll cut out the jargon and lay bare these two options, making your next shipping decision clearer and easier. Let’s take this off your plate, one air-freight option at a time.

Should I choose Air Cargo between UK and UAE?

Air cargo offers a blend of cost-effectiveness and reliability when shipping between the UK and UAE. Airlines such as British Airways and Emirates SkyCargo are reputable choices for this mode of freight.

However, consider that fixed schedules can lead to longer transit times. As a business, if this aligns with your budgetary needs and freight weight exceeds 100/150 kg (220/330 lbs), then this option becomes significantly more attractive. Your requirements and cargo volume should guide your decision.

Should I choose Express Air Freight between UK and UAE?

If you’re dealing with shipments under 1 CBM or 100/150 kg (220/330 lbs), express air freight may just be your best bet. This specialized shipping service exclusively uses cargo planes, sans passengers, for faster transportation.

Efficient systems of internationally recognized courier firms such as FedEx, UPS, and DHL ensure swift, streamlined delivery. Choosing this service can be a game-changer, offering speed, reliability, and the luxury of swift shipment tracking. Aimed at smaller package sizes, this could be the optimal choice for your UK-UAE transport needs.

Main international airports in UK

Heathrow Airport

Cargo Volume: Handles approximately 1.7 million tonnes of cargo annually.

Key Trading Partners: The USA, Germany, China, and many other countries worldwide.

Strategic Importance: Heathrow is the busiest airport in Europe and significantly contributes to the economy through its well-established cargo operations.

Notable Features: Heathrow provides a secure environment with highly proficient cargo handling designated for multiple types of goods including perishable, fragile, valuable, or dangerous goods.

For Your Business: Its central location and high-frequency flights provide the opportunity for prompt and flexible shipping arrangements. Its comprehensive handling specialties allow for various types of goods to be shipped safely and efficiently.

Gatwick Airport

Cargo Volume: Handles over 100,000 tonnes of cargo annually.

Key Trading Partners: Primarily services Europe, but also includes Middle East and USA.

Strategic Importance: As the UK’s second-largest international airport, it plays a key role in connecting suppliers with consumers, especially within Europe.

Notable Features: Boasts a new £200 million Pier 6 for efficient cargo handling and a direct motorway connection to the airport.

For Your Business: For operations that require swift delivery in Europe, Gatwick’s extensive connectivity within the region is a reliable option, with daily flights to major cities.

East Midlands Airport

Cargo Volume: Handles over 360,000 tonnes of flown cargo annually.

Key Trading Partners: Europe, USA, Asia, and Australia.

Strategic Importance: The airport is a major hub for cargo traffic to and from the North and Midlands.

Notable Features: Home to companies such as DHL, TNT, and UPS, providing 24-hour operations.

For Your Business: If your business operates in northern regions or requires round-the-clock shipping, East Midlands, with its 24-hour operations, could be a fitting choice.

Manchester Airport

Cargo Volume: Handles over 120,000 tonnes of import and export freight and mail annually.

Key Trading Partners: USA, Singapore, United Arab Emirates, and across Europe.

Strategic Importance: It is the North’s only major international gateway, dealing with over 100 airlines.

Notable Features: Offers two runways, extensive cargo handling infrastructure, and a World Freight Terminal.

For Your Business: If your business operates in the northern UK regions and requires diverse global connectivity, Manchester Airport could be an ideal choice due to its wide network of destinations and accommodating facilities.

Stansted Airport

Cargo Volume: Handles more than 250,000 tonnes of cargo annually.

Key Trading Partners: USA, Europe, and Middle East.

Strategic Importance: As one of the largest cargo airports in the UK, Stansted plays a major role in connecting UK businesses with global markets.

Notable Features: British Airways’ global cargo operation is headquartered here, and the airport houses one of the largest freight hubs in the UK.

For Your Business: Its proximity to London and ample freight handling capabilities makes it an excellent consideration for your business if you’re looking to connect to extensive worldwide networks.

Main international airports in UAE

Dubai International Airport (DXB)

Cargo Volume: The airport handles over 2 million tons of cargo per year, making it one of the world’s busiest hubs for international cargo.

Key Trading Partners: Key freight partners include China, the USA, and India, among others in Europe and the Middle East.

Strategic Importance: DXB’s strategic location connects the East and West, providing a logistics gateway to over 240 destinations across six continents.

Notable Features: The airport boasts of specialized facilities for perishable goods and has a dedicated Flower Centre for handling, storage, and transshipment of flowers and plants.

For Your Business: If your business deals with perishable goods or flora, Dubai International Airport could be an ideal choice due to its specialized facilities.

Abu Dhabi International Airport

Cargo Volume: The airport processes over one million metric tons of cargo annually.

Key Trading Partners: Key partners include countries in the Middle East, Asia, Europe, and North America.

Strategic Importance: Its prime location allows for shorter delivery times to major capitals of the Middle East, Asia and Europe.

Notable Features: Its cargo village offers key services in cargo handling, warehousing and transportation.

For Your Business: Offering a range of cargo services and shorter delivery times, Abu Dhabi International could be crucial for your business if quick delivery is a must.

Sharjah International Airport

Cargo Volume: Cargo volume reached over 140 000 tons in 2023.

Key Trading Partners: Europe, the Middle East, and Africa are major trading partners.

Strategic Importance: Sharjah Airport is conveniently positioned near the crossroads of major air routes.

Notable Features: The airport hosts a free trade zone, offering a variety of warehousing capacities and facilities.

For Your Business: If your business involves heavy cargo capacity, Sharjah International Airport, along with access to free trade zone benefits, could be an ideal choice.

Al Maktoum International Airport (DWC)

Cargo Volume: DWC manages over 900,000 tons of cargo per year.

Key Trading Partners: Major freight partners include Asian and European Nations.

Strategic Importance: DWC serves as Dubai’s second airport but is planned to become the largest airport in the world in the future.

Notable Features: It currently has the capacity for 16 million tons of cargo annually, with plans for expansion.

For Your Business: Al Maktoum International Airport’s large cargo facilities could be a crucial choice if your business requires large cargo volume.

Fujairah International Airport

Cargo Volume: Fujairah International handles several thousand tons of cargo each month.

Key Trading Partners: Primarily enhances trading with Gulf countries and South-East Asia.

Strategic Importance: Located on the East Coast of the UAE, it has direct access to the Indian Ocean, making it a key transit point for cargo carriers.

Notable Features: Fujairah International has a range of specialized services, including a large aircraft stand, cargo aircraft parking, and handling of Dangerous Goods.

For Your Business: With its specialized approach and direct access to the Indian Ocean, Fujairah International could be an ideal location for your business if it deals with specialized cargo or has dealing primarily in the Gulf or South-East Asian countries.

How long does air freight take between UK and UAE?

Typically, air freight from the UK to UAE spans between 1-3 days en route. However, it’s noteworthy that this transition isn’t an absolute constant.

Factors like the actual airports involved, cargo weight, and the type of goods can considerably sway your shipment’s transit time. So, if you’re after a more definite window, consider engaging with a professional freight forwarder like DocShipper for tailored assistance.

How much does it cost to ship a parcel between UK and UAE with air freight?

Air freight costs between the UK and UAE vary greatly, averaging around £3-£7 per kg. However, an exact price isn’t possible to quote due to factors such as distance from departure and arrival airports, parcel dimensions, weight, and the nature of goods. Thus, every shipping project has its unique cost.

Rest assured, our team works diligently to provide the best possible rates tailored to your specific needs. We calculate every quote on a case-by-case basis to ensure our clients get the most out of their investment. If shipping is on your agenda, reach out today. Contact us and receive a free quote in less than 24 hours.

What is the difference between volumetric and gross weight?

Gross weight refers to the actual weight of your shipment, including all packaging and materials. Volumetric weight, on the other hand, considers the space a package occupies in an aircraft rather than its actual weight.

To calculate gross weight in air cargo or express air freight services, simply weigh the shipment in its entirety. For instance, your 1m x 1m x 1m shipment might weigh 15kg (approx. 33lbs).

Calculating volumetric weight involves a bit more math. It’s determined by multiplying the length, width, and height of your shipment (in cm), and then dividing the result by a specific factor. In air freight shipping, the factor frequently used is 6000. Following our previous example, the volumetric weight would be (100cm x 100cm x 100cm) / 6000 = 166.67kg (approx. 367lbs).

Why does this matter? Airfreight charges are often determined based on whichever is higher between the gross and volumetric weight. Therefore, calculating both weights can help you predict and optimize your shipment costs.

Door to door between UK and UAE

Breezing past the complexities of international shipping, ‘Door to Door’ delivery acts as your personal valet, collecting goods from your business in the UK and delivering straight into the eager hands of clients in the UAE. Enjoy the perks of convenience, time-savings, and reliability. Excited to discover how it transforms your shipping process? Let’s dive in!

Overview – Door to Door

Stress no more about your shipping complexities between the UK and UAE. Our most sought-after service, door-to-door shipping, is the white-glove logistics solution that turns the strenuous task into a piece of cake. Notably advantageous for its single point of contact and holistic service scope, it might raise some cost concerns.

However, rest assured, eliminating the tedious customs clearance among other administrative hurdles is a game-changer. Dive into practical insights on how DocShipper’s door-to-door option can transform your logistics experience from a chore into a breeze, consistently favored by our clients – your business might just be the next proponent.

Why should I use a Door to Door service between UK and UAE?

Ever muttered the words, I wish my cargo could teleport straight to its destination? Well, using Door to Door service between UK and UAE isn’t quite Harry Potter wizardry, but it’s darn close. Here’s why you might want to give it a try.

1. Say Goodbye to Stress: Let’s face it, logistics can be a headache. By going Door to Door, the details – like arranging pickup, paperwork, customs, and drop-off – are all taken care of for you. You’ll sleep easier knowing your shipment is in good hands throughout its journey, leaving you free to focus on your core business.

2. Embrace the Need for Speed: Got an important shipment to deliver quickly? Door to Door has your back. From the moment your goods are picked up, a tight timeline is followed to ensure timely delivery. No more worrying about multiple carriers causing delays – everything runs like clockwork.

3. Custom care for Complex cargo: Complicated cargo needs a gentle touch and a bit of pampering. Whether it’s fragile or needs special conditions, a Door to Door service ensures your special goods get the extra attention they deserve, reducing the risk of damage in transit.

4. Convenience that counts: Imagine skipping the merry-go-round of coordinating between multiple shipping agencies. Door to Door does exactly that. It takes care of the entire shipping process, from pickup at your premises to delivery at the final destination. No multiple phone calls, no confusion – just one seamless process.

5. Truck On with Confidence: Ever feared the dreaded last mile? It can be a sink or swim moment for certain shipments. However, Door to Door service includes trucking till the final destination. Your freight remains under integrated supervision, reducing the risk of mismanagement and ensuring it reaches the right hands.

So, fancy levitating your logistics experience to a more magical plane? Door to Door could be the spell you’re looking for. Give it a shot; it might just be the time and sanity-saver you need in your freight-forwarding journey.

DocShipper – Door to Door specialist between UK and UAE

Seamless door-to-door shipping from the UK to the UAE is our expertise. With DocShipper, you simply sit back and relax while we handle every intricate detail from packing to customs, employing the best shipping methods. Get a personalized touch with your dedicated Account Executive.

For a stress-free, complete A-Z shipping solution, reach out for a quick, free estimate within 24 hours or dial our consultants for complimentary advice. Let DocShipper’s proficiency make your shipping endeavor effortless.

Customs clearance in UAE for goods imported from UK

Customs clearance refers to the process through which goods are authorized to enter or leave a country. It might sound straightforward, but it’s actually a complex procedure laden with potential traps. One notable hazard is getting hit with unexpected fees or charges.

The clearance process also highlights the significance of understanding associated customs duties, taxes, quotas, and licenses. Any overlooking or missteps here might mean your goods getting jammed up in customs. Happily, the subsequent sections will be here to guide you through this labyrinth.

Remember, at DocShipper, we’re ready to lend a hand, tailoring the process to suit any type of good, no matter the origin. For an estimate, do reach out to us with the origin, the value of the goods, and the HS Code. That way, we can work together to accurately budget your project.

How to calculate duties & taxes when importing from UK to UAE?

When importing goods from the UK to the UAE, it’s essential to accurately estimate the duties and taxes that may apply. This isn’t just about the cost of your goods. You’ll also need to consider where your goods were originally made or produced, their Harmonized System (HS) Code, the customs value of your goods, the tariff rate applicable to this specific category of goods, and any additional taxes or fees that might be applied by the UAE customs authorities.

In simple terms, the Customs Value is the cost of the goods, including any shipping or insurance fees, while the HS Code is a globally used system of product categorization. Both these factors will be vital in assessing the amount of duty you’ll have to pay. Other fees, like warehouse handling or service charges, could also contribute to your final customs bill.

The process begins with identifying the country of manufacture or production for your items. This is a critical step because national duty rates differ significantly based on the origin of the goods. The country of origin doesn’t necessarily have to be the country from which you’re shipping your goods. Instead, it’s about where your goods were created or put together. Start by understanding this aspect thoroughly to avoid any confusion or possible customs duties miscalculations.

Step 1 – Identify the Country of Origin

Understanding where your goods came from – the Country of Origin – sets the foundation for your import activities from the UK to the UAE. Here’s why it matters:

1) Trade pacts: The UAE and the UK have unique economic understandings that affect customs duties. Knowing the Country of Origin helps determine if such benefits apply.

2) HS Codes: This step sets you up to accurately determine the Harmonized System (HS) tax codes, which depend on the product and where it’s from.

3) Custom Duties: Custom fees may vary depending on the Country of Origin. Knowledge here could save you a lot of money.

4) Import restrictions: The UAE enforces certain restrictions based on the Country of Origin. Be aware – navigating blindly could lead to unexpected issues.

5) Smooth Customs Process: An accurate Country of Origin paves the way for a clear and hiccup-free customs clearance process.

Stay informed about the specific trade agreements between the UK and the UAE. Recognize how each pact influences customs duties and abide by the import restrictions the UAE imposes.

Remember: The ‘Country of Origin’ isn’t just a box to tick off. It’s the compass that can guide you towards a more predictable, smoother, and cost-effective import process. Plan ahead, stay updated, and let the import journey be an adventurous one.

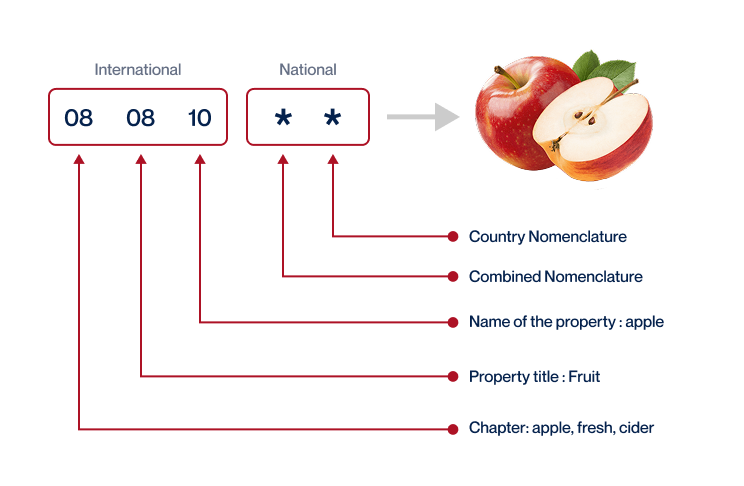

Step 2 – Find the HS Code of your product

The Harmonized System (HS) code is a standardized numbering system for international trade that classifies traded products. It is a universally accepted method, used in over 200 countries to classify more than 98% of merchandise in international trade. The code is crucial for determining the tariffs, taxes, and rules of trade that apply to a specific product.

In most cases, the simplest means to identify the HS code of a product is to ask the supplier. Suppliers are highly familiar with the products they sell and the associated regulations, including the correct HS code. However, in situations where asking the supplier is not possible, a great alternative is at hand.

Our easy, step-by-step procedure for finding an HS code:

1. Utilize an HS lookup tool, for instance, go to the Harmonized Tariff Schedule.

2. Type the name of your product into the search bar.

3. Locate the HS code in the Heading/Subheading column.

A word of caution though – accuracy is paramount when choosing an HS code. An incorrect HS code may lead to complications like shipment delays and even potential fines. So always make sure to be precise when determining your product’s HS code.

Here’s an infographic showing you how to read an HS code.

Step 3 – Calculate the Customs Value

Customs value – an often misleading term, right? It’s not about the bare cost of your goods. Actually, here’s where the cost of insurance, freight, and the product itself come together, known as CIF value.

A simple formula would be: Product Price + Shipping Cost + Insurance = Customs Value. Picture this: you’ve imported equipment worth $1000 from the UK to the UAE, the international shipping cost is $300, and a $200 insurance policy keeps your goods safe. Adding all these, your Customs Value is $1500, not a mere $1000.

So, while preparing for the customs clearance in UAE, keep this in mind. Proper understanding of your Customs Value ensures smooth shipping procedures, and sidesteps any unexpected costs.

Step 4 – Figure out the applicable Import Tariff

Import tariffs, sometimes called customs duties, are the taxes imposed on goods imported into a country. In the UAE, they utilize the Common Customs Law of the GCC States. Now, let’s consider a real-world situation where you’re importing children’s bicycles from the UK, hypothetically with an HS code of 8712.00.

First, refer to the UK’s Trade Tariff Look Up Tool by visiting this site – UK Trade Tariff Tool. Input the HS code (in this case, 8712.00) and from the results given, you’ll then be able to determine the specific tariff rate that applies to the goods you’re importing.

Suppose the tariff rate is 5%. This means that for every $100 worth of bicycles you import into the UAE, you’ll pay $5 in import tariffs. Furthermore, custom duties for imported goods in UAE are usually calculated on the CIF value (Cost + Insurance + Freight).

Let’s say, you have $5000 worth of bicycles, $200 for insurance, and $300 for freight. Your CIF value is $5500. The total import duty would be 5% of $5500, which equals $275. The understanding and correct calculation of the applicable import tariff is an essential part of successful shipping.

Step 5 – Consider other Import Duties and Taxes

Engaging in cross-border trade can sometimes usher in unexpected costs. Beyond the basic tariff rate, you could be faced with additional import duties and taxes specific to the country of origin and product type. A few examples include the excise duty and anti-dumping taxes.

Consider a hypothetical case where you’re importing electronics from the UK. You could be liable to an excise duty of 2%-5%, designed to control the importation of such items. Likewise, anti-dumping taxes, introduced to protect domestic production, might apply if your goods are sold cheaper overseas than in the UK – the rates for this vary widely.

However, the most significant additional expense you need to factor in is the VAT rate. In UAE, VAT stands at 5%. So, if the value of your goods is $10,000, you’ll be paying $500 as VAT.

Please bear in mind, though, these are illustrative examples and the actual rates you face may differ dramatically, making it critical to research and consider these factors in your financial planning. This will ensure your import will not hit any unexpected roadblocks, financially or otherwise.

Step 6 – Calculate the Customs Duties

Calculating customs duties can be an entangling task, but breaking it down is the key. Consider it as a combination of three elements: customs value (CV), VAT, and, in certain cases, anti-dumping duties (ADT) and Excise Duty.

Let’s consider three different scenarios:

1. If you’re importing electronics worth $10,000 from the UK with no VAT, simply multiply the CV by the UAE’s standard duty rate of 5%. So, $10,000 x 0.05 = $500 in customs duties.

2. For books valued at $8,000 with a VAT of 20%, first calculate the duty which would be $400. The VAT is calculated on the CV + Duty, thus ($8,000 + $400) x 0.20 = $1,680 in VAT taxes.

3. Importing alcoholic beverages worth $6,000? Here at 5% duty, you’ll also need to consider an ADT of 15% and an Excise Duty of 50%. So, first calculate the duty ($300), then the ADT on (CV + Duty), hence ($6,300 x 0.15 = $945). To find the Excise Duty, take (CV + Duty + ADT) x 50%, giving you a hefty $3,622.5.

Remember, formulae can be confusing, and mistakes costly. Here at DocShipper, our expert team can handle your customs clearance, ensuring accurate calculations and saving you from unexpected expenses. Contact us for a free quote in less than 24h, because precision and proficient service is our priority, no matter where in the world you’re shipping.

Does DocShipper charge customs fees?

DocShipper, as your customs broker in the UK and UAE, ensures transparency in fee handling. While we manage the customs clearance process – a service with its own fees – remember, customs duties and taxes are distinct, paid directly to the government.

We provide documented proof from customs, confirming you have only paid governmental charges. Think of it like lunch in a restaurant: you pay for the meal (goods), tax on your bill (duties/taxes), and a tip for the service (clearance fee). In this way, we simplify the complex customs process while keeping cost control in your hands.

Contact Details for Customs Authorities

UK Customs

Official name: Her Majesty’s Revenue and Customs (HMRC)

Official website: https://www.gov.uk/government/organisations/hm-revenue-customs

UAE Customs

Required documents for customs clearance

Clearing customs can seem like decoding a foreign language, especially with a string of documentation such as the Bill of Lading, Packing List, and Certificate of Origin, not forgetting those elusive CE standard conformity papers. Our guide demystifies each document so you’ll conquer customs with confidence. Let’s unravel this form-filling labyrinth together!

Bill of Lading

Navigating shipping between the UK and UAE, businesses often grapple with complex documents, and the Bill of Lading is no exception. Acting as your freight’s proof of ownership, it has immense influence over your shipping journey. When your consignment reaches Dubai’s shores or airports, the possession of this document is pivotal in determining whether the freight gets into your hands or not. Consider a telex release – a digitalized version of this document – for quicker handling and lower costs.

For air cargo, an Air Waybill (AWB) substitutes the Bill of Lading, offering similar proof of ownership. One wise tip? Double-check all details in these forms for accuracy, as a minor discrepancy can result in delayed UAE customs clearances and increased costs. Every second and every dirham counts in global logistics!

Packing List

Navigating through international shipping between the UK and UAE can seem tricky, but armed with the right documents like the Packing List, you’re set to conquer the waves or the skies. This document, meticulously curated by you, is like a detailed diary of everything you’re shipping.

Whether it’s antique furniture or countless boxes of clothing, the Packing List notes quantity, description, and weight of each item. The devil’s really in the detail here! This accuracy is pivotal as both the British and Emirati customs rely on it to keep track and ensure nothing unlawful slips through.

For instance, if you’re shipping a pallet of books, the list needs to detail the exact count. It’s your responsibility in both sea and air freight, and it’s absolutely non-negotiable. Because when it comes to customs clearance, ‘approximations’ could mean prolonged delays, and that’s a cost you don’t want on your books!

Commercial Invoice

When exporting goods from the UK to the UAE, your Commercial Invoice is the customs authority’s best friend. It’s the key document that contains details like product description, HS code, country of origin, and the buyer/seller’s details.

Say you’re shipping antique furniture, your invoice needs a precise description, like ’19th-century oak table,’ not just ‘antique table.’ Make sure this aligns with the information on the Bill of Lading to avoid delays. Errors in your Commercial Invoice can lead to costly delays or even confiscation. So, keep it precise, comprehensible, and aligned with other shipping documents. Happy shipping!

Certificate of Origin

Navigating customs clearance from the UK to UAE? Make sure you have your Certificate of Origin (COO) ready. This crucial document verifies where your goods were manufactured — it’s like a passport for your shipment. It could even score you preferential duty rates, making your overall shipping costs lighter on your wallet.

For instance, a business exporting watches made in London would need to mention ‘United Kingdom’ as the country of manufacture on their COO. Not having it, or errors in your COO, could tie your shipment up in red tape, causing frustrating delays. It’s short, simple, and saves you time – a little document that makes a big difference. Be mindful of your COO, it’s not to be underestimated!

Get Started with DocShipper

Prohibited and Restricted items when importing into UAE

Understanding what you can’t ship to UAE can be frustrating, right? Scrutinizing the fine line between prohibited and restricted items can save your business from costly mistakes and delays. It’s a tricky field, but we’ve got it covered for you here.

Are there any trade agreements between UK and UAE

Yes, the UK and UAE have enjoyed robust trading relations, although currently, no formal Free Trade Agreement (FTA) or Economic Partnership Agreement (EPA) is signed between them. Nevertheless, the UK-UAE trade has been strengthened with regular partnerships across key sectors.

Ongoing discussions and an increased focus on infrastructure development, such as potential railway projects, hint toward future growth and opportunity. As a business owner, prepare for your shipping needs in anticipation of such developments; keeping an eye on these trade talks could bring significant advantages.

UK – UAE trade and economic relationship

The UK – UAE alliance, established in the 1820s, has increasingly become economically robust. Both nations have seen significant economic interaction, with UAE being one the UK’s largest export market outside Europe. In 2023, total trade in goods and services between the two countries reached £24.2 billion.

Heavily invested sectors include renewable energy, health, and education, with major commodities primarily revolving around aerospace, chemicals, and electrical goods. Investments flow both ways: UK’s FDI in UAE penned at £10.5 billion, whereas UAE’s investment in UK exceeded £5 billion. Over 5,000 UK companies operate in UAE, demonstrating the thriving trade and economic relationship between the two nations.

Your first steps with DocShipper

Additional logistics services

Warehousing

A warehouse in the wrong temperature zone can leave your UK to UAE cargo compromised. Need an easier way to secure reliable, climate-controlled storage? We've got your back. With our extensive, tailored solutions, your shipment will always be in the optimum condition.

Packing

When shipping between the UK and UAE, your goods' security lies in robust packaging. With a reliable partner like our team, you're secured from teabags to technology, perishables to porcelain. It's not just about preventing damage, but also meeting international standards. Want your antique grandfather clock shipped harm-free or your artisanal chocolates in pristine condition? That's what our packaging prowess can deliver.

Transport Insurance

Cargo insurance extinguishes the burning worries about your assets, unlike fire insurance. It's proactive: think guarding your shipment against mishaps, not just temperature-induced issues. For instance, consider a container crashing onto the dock - our cover controls such risks.

Household goods shipping

Moving between the UK and UAE? Our moving service ensures your treasured possessions, from grandmother's antique china to Billy's bulky drum set, are handled with the utmost care. We flexibly cater to both fragile and large items, adopting a ‘handle with care’ approach every step of the way.

Procurement in Thailand

Expanding your business between the UK and UAE but struggling with finding reliable suppliers in Asia or East Europe? DocShipper transforms your procurement process into child's play. We bridge language and knowledge gaps, help you find the perfect supplier, and oversee your entire procurement chain - as smoothly as ordering a cup of coffee.

Quality Control

In your UK-UAE shipping journey, you don't want bad quality to blow your progress off course. Think of quality inspections as your risk compass, ensuring products meet the grade before they make the trip. It's like when a toy manufacturer spots a design fault - catch it early, and you save yourself hundreds of recalls. So, don't leave it to chance.

Conformité des produits aux normes

Shipping goods often require adherence to specific regulations, which can be overwhelming without the right assistance. Our product compliance services simplify this process, offering in-lab testing to certify that your goods are compliant with destination norms. No more guessing or struggling through foreign policies - think of it like a GPS guiding you smoothly through the compliance landscape.