Our Customs Clearance Department works with a number of reputed international organizations, forwarders, and shipping lines, providing a discreet and impartial service. Our specialists can give detailed and precise advice on customs processes, commodity codes, and good practices.

Customs clearance is probably one of the most crucial step on the logistics process. It is at this moment that customs department will check documents and certifications to make sure your goods are complying with local regulation. If not, your shipment can get stuck at customs and this might be the beginning of a painful and expensive process to release them !

Table of Contents

Import customs clearance

We fully recognize the significance of submitting proper and timely customs declarations on behalf of our clients. It is becoming more clear that customs audits may take place up to four years after an import statement is filed in the United Kingdom. Misdeclarations of import duty or VAT discovered during an audit will result in customs making a demand for the difference to the importer !

We know that importers cannot afford to be slapped with such post-clearance requests, and we collaborate with our clients to ensure that our declarations are filed properly the first time! Direct computer linkages to customs and all major UK ports mean that customs processes are completed within hours of a vessel arriving.

Indeed, in the case of containerized cargo, contemporary boats are so enormous that our client's cargo is often customs cleared before being physically evacuated from the vessel.

We understand that dock rent and container demurrage costs paid by shipping lines may be exorbitant, and our quick customs clearance service assists our clients in avoiding/reducing these expenses, which might have a significant effect on their bottom line. Surprisingly, expedited customs clearance is not always advantageous to our consumers. We recognize that duty rates fluctuate with frightening frequency during the season, that's the case for vegetables and fruits for example. Waiting a few days to file a customs entry may save you thousands of pounds in import tax.

Crucially, we maintain a sizable customs deferral account that ensures import duty and VAT are paid to HMRC on our client's behalf. We also communicate with the many government departments/agencies/bodies that may wish to examine your cargo upon arrival in the UK, such as Port Health, DEFRA (HMI, PHSI, and Forestry Commission), Customs (X-Ray examinations and full out inspections), Trading Standards, and the UK Border Force.

Plus DocShipper : We hope this provides you an idea of the intricacies required in properly clearing import goods. Our customs clearance services are tailored to your specific requirements, and our expertise is backed by decades of industry experience.

Export declaration

DocShipper has been in the front line of making export declarations via this system since the New Export System (NES) was deployed at all UK maritime ports. Individuals, businesses, forwarders, and large shipping lines hire us to execute NES entries on their behalf or on behalf of their customers.

The significance of precise and timely export declarations cannot be overstated. Failing to achieve an export entry on time might result in goods being left on the dock unshipped, resulting in extra storage expenses and delays. We can certify properly filled EUR1 and ATR1 preference certificates, since we are members of the Institute of Chartered Shipbrokers. HMRC has also authorized us to authenticate T2L papers.

How to calculate customs duties and taxes?

Calculating customs duties is an important process for you to budget for your business. Unfortunately, this is not an easy task given the volatility of taxes and restrictions submitted for certain product categories. However, this task is mandatory to bring your goods into the UK legally.

In this part, we will take you through the different steps so that you can calculate your costs on your own. It's a pretty straightforward process, but you have to know it:

- Step 1 - Obtain the HS Code

- Step 2 - Determine the customs duties

- Step 3 - Calculate customs duties and taxes

Note DocShipper: As mentioned above, calculating customs duties is not easy since a multitude of factors will impact the level of taxes you will have to pay to bring your goods into the country: trade agreements between countries, monitoring of quotas, status of the importer, country of origin ... And because things would be too childish if they were sustainable, customs duties also evolve over time and with temporary and / or transitional amendments.

Step 1 - Obtain the HS Code

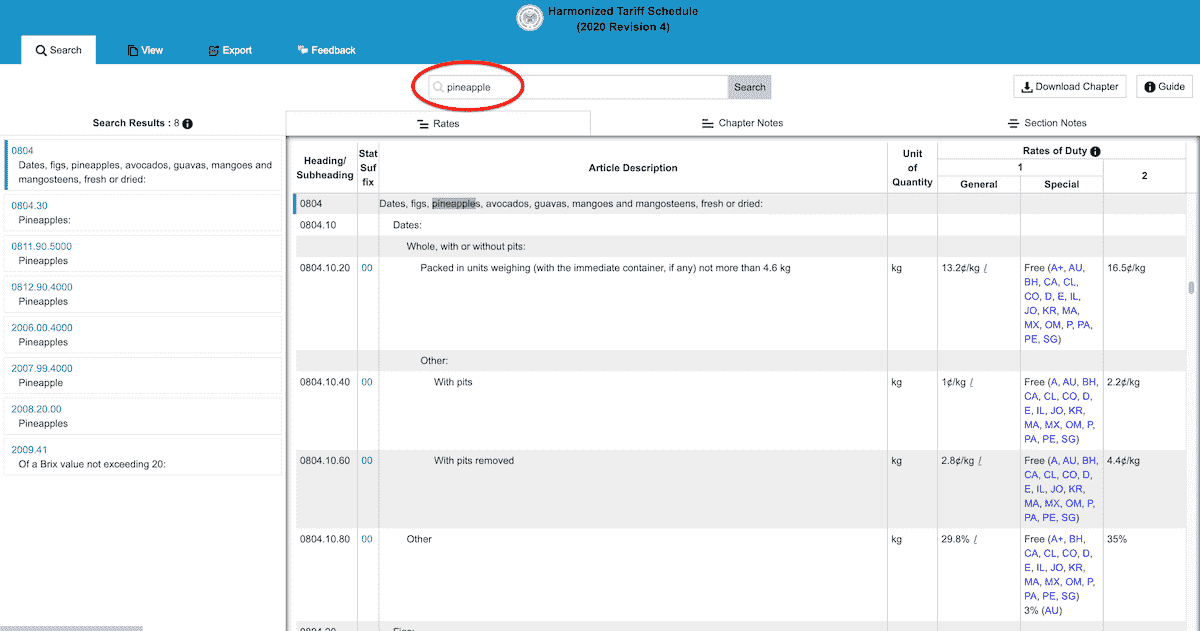

The HS Code (Harmonized System in English) is a number that exactly identifies the nature of your products. It is difficult if not impossible for customs officials to rely on designations which can fluctuate rapidly to determine duties and taxes, so they rely on this HS code. As an example, here is the structure of an HS Code:

Usually your supplier should give you the HS Code for the products they sell to you. Besides, if he can't, that's usually a bad sign! If so, don't panic! You can find it directly online with sites like this: HTS - HS code finder.

We will simulate a search based on the example of Pineapple:

If you can't find it on your own, we can help you, so please don't hesitate to contact us!

Step 2 - Determine the customs duties

Here is a very accurate explanation of the method you must follow in order to assess the customs duties and taxes for your future imports:

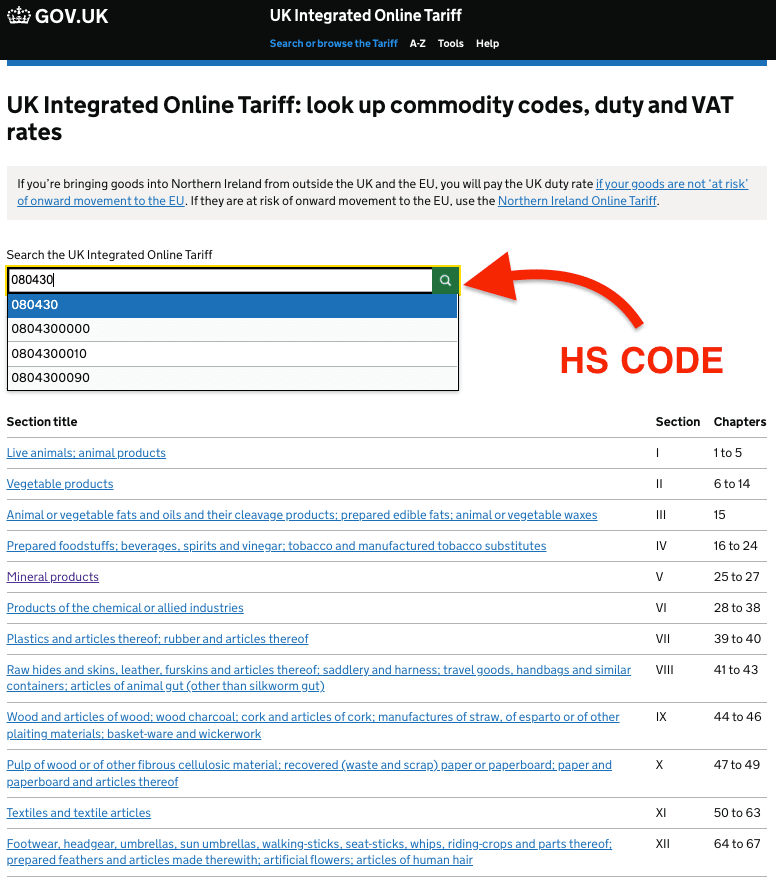

- Go to the UK Customs website at the following link: UK Integrated Online Tariff

- Then click on the green button "START NOW" (or click on this 2nd link directly)

- You will then arrive on the United Kingdom customs database, it is in the search bar that you will enter your HS Code.

- You will then select the HS Code corresponding to your products, for example 0804300000 in our case.

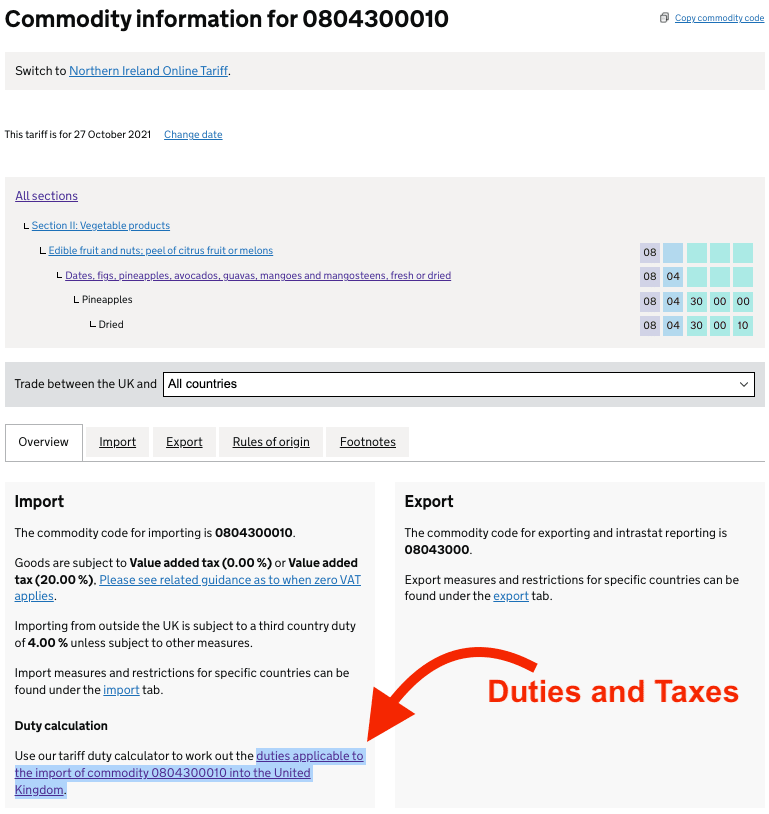

- You will then come across the following screen (photo below). You can then navigate through the tabs for more details, or you can directly do a simulation to assess your customs duties and taxes.

Step 3 - Calculate customs duties and taxes

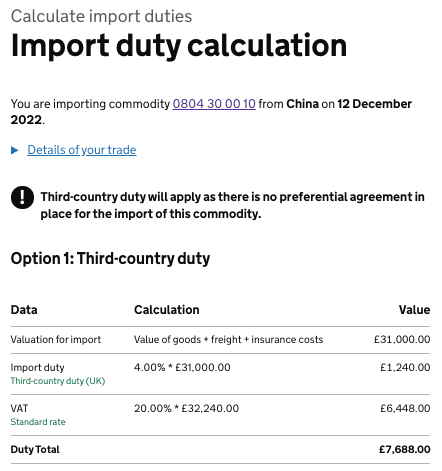

We have found the product(s) related to your cargo on the customs database, you clicked on the link shown in the last image, now it is time to calculate how much you will have to pay:

- First, you must indicate the arrival date of your cargo (ETA - Estimated Time of Arrival):

- Then, you will indicate "Where are you going to import your goods?":

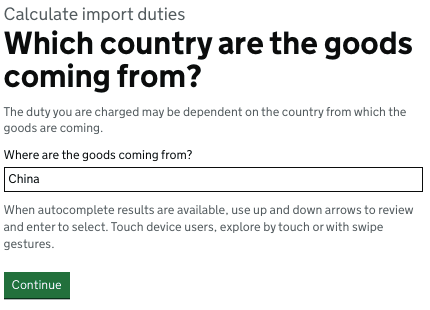

- Then you will indicate "the origin of the cargo", in our example we will take China:

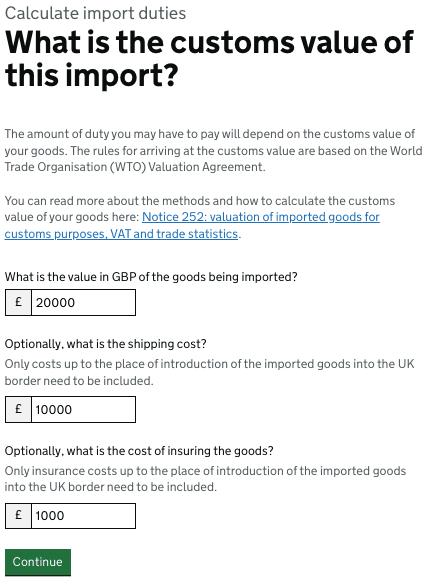

- Then indicated the value of the goods as well as the value of transport and insurance. Keep in mind that customs duties and taxes are indexed to the CIF value of your goods, that is to say that the tax base also includes transport and insurance in its basis of calculation:

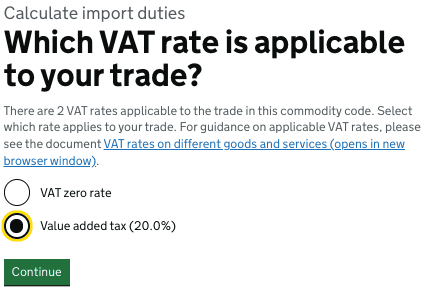

- You will then indicate which regime you are subject to with regard to VAT:

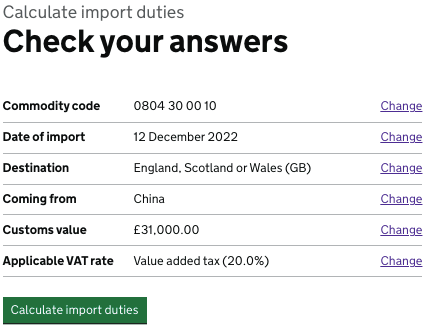

- Penultimate step, you will double-check all the information before validating the simulation and obtaining the customs duties and taxes to pay:

- You then click on "Calculate import duties" to find the future customs duties and taxes that you will pay for your import:

Conclusion: So we can see that in our example, based on a CIF value of £ 31,000, you are going to have to pay a total of £ 7,688 to import them.

Conclusion

As we have been able to explain, customs clearance is not a stage of transport to be taken lightly! It is simply the opposite, this step requires extreme rigor, so you don't have any problem on the D-Day. Indeed, the slightest missing document, the slightest miscalculation badly formulated ... And your business can potentially take a big hit!

At DocShipper, we always ensure that documents are checked before departure! The formula is quite simple, if we have the slightest doubt about the documentary bundle, we will not launch the operations.

And what's more, we support you throughout the process to make sure that the whole operation goes as planned: your satisfaction, our priority!

Do you need a customs clearance service? Do not hesitate to contact our experts!

FAQ | UK customs clearance

Can an individual import goods?

No problem if you are importing goods that will have personal and non-commercial use. Of course, it will be difficult (if not impossible) to import 1,000 phone cases and trick customs officials into believing that they are for personal use only.

How to avoid disputes during customs clearance?

It is essential to comply with the requirements imposed by customs in the importing country. Whether at the level of documents, procedures or questions of quotas ... Not complying will lead to a dispute with the local authorities, and it can end badly, very badly... The goods will be blocked, a (charged) customs inspection will be executed, and the goods will not be released until the cargo is brought into conformity.

How much can customs duties and taxes reach?

This is a question that we cannot answer since a multitude of factors will condition this point: the CIF value of the cargo, the country of origin, your status, trade agreements ... Anyway, customs clearance consists of 2 main items: customs duties and VAT. If you want more details, do not hesitate to follow our explanations above in this same page.

How to pay customs duties and taxes?

When we do customs clearance, an invoice is issued by customs officials. From this point on, there are 2 options: either settle customs yourself by making a bank transfer, or go through your freight forwarder (such as DocShipper) to finalize the release of the cargo.