Freight Shipping between UK and Thailand | Rates – Transit times – Duties and Taxes

Do you know why ducks are the world's best freight forwarders? They always deliver with a quack! Jokes aside, the process of shipping goods from the UK to Thailand can be daunting, with multiple factors to consider, including understanding rates, transit times and customs regulations. This guide aims to decomplexify this task, offering comprehensive assistance for businesses navigating this difficult path. Expect detailed insights into different freight options - whether air, sea, road, or rail is best suited for your needs - as well as a deep dive into customs clearance, duty and tax implications. We'll also deliver tailored advice for businesses, ensuring your shipping operations are smooth and uncomplicated. If the process still feels overwhelming, let DocShipper handle it for you! We are experts in turning complicated freight forwarding challenges into seamless business success.

Which are the different modes of transportation between UK and Thailand?

Picking the best transport for shipping goods from the UK to Thailand is a bit like choosing a vehicle for a vacation. Are you seeking a cost-efficient but slower 'bus ride' (sea freight)? Or would you prefer an 'express train' that's faster but possibly more expensive (air freight)? Consider the longer sea route via the Suez Canal, versus the direct flight over multiple nations. Each journey has varying costs, timelines, and customs considerations. Your decision should reflect your cargo’s nature, your budget, and delivery needs. Let's deep dive into your best options!

Need help with your shipment?

Need assistance with your shipment? Dont hesitate to contact us even for a simple question. Choose the option that suits you

Live chat with an expert Chat on WhatsApp Free Quote 24hHow can DocShipper help you

Sea freight between UK and Thailand

Shipping goods via sea from UK to Thailand has its unique perks and pitfalls. This trade route between Europe’s financial heart and Southeast Asia’s trading hub is bustling, no surprises since both the nations are key economic players. The journey spans thousands of nautical miles, with merchandise sailing from ports like London’s Tilbury to Bangkok’s Laem Chabang. It’s the transportation mode of choice for large volumes of goods, given its cost-effectiveness compared to air freight. But, the long shipping times are its worthy adversary.

Many businesses, however, hit choppy waters when navigating this path, mostly due to a lack of understanding regarding customs clearance, duties, and documentation. Not unlike trying to solve a Rubik’s cube blindfolded. It’s quite like following a complex recipe – even if you have all the ingredients, you need the right steps and techniques for the perfect outcome. We’ll break down these best practices and specifications in this guide, turning the daunting into doable. Your shipping process will feel like brewing your morning cup of coffee effortless and second nature.

Main shipping ports in UK

Port of London

Location and Volume: The Port of London, located on the River Thames, is the second-largest port in the UK, handling 48 million tonnes of cargo per annum.

Key Trading Partners and Strategic Importance: Its key trading partners include Europe, North and South America, and Asia. Its strategic location provides direct access to London, making it a vital gateway for a range of goods.

Context for Businesses: If you’re looking to extend your logistical reach within the UK, particularly to London, the Port of London can be a useful link due to its central location and extensive handling capacity.

Port of Southampton

Location and Volume: Situated on the south coast of England, the Port of Southampton is the UK’s number one port for automotive trade, handling around 900,000 cars every year. Also, it supports a cargo volume of over 36 million tonnes.

Key Trading Partners and Strategic Importance: It has transoceanic connections with North America, Asia, and Europe. This port’s strategic role is highlighted by its status as the country’s primary cruise terminal.

Context for Businesses: For businesses operating in the automotive sector or those requiring extensive intercontinental connections, the Port of Southampton might be central to your shipping strategies.

Port of Liverpool

Location and Volume: The Port of Liverpool, situated on the west coast of England, handles over 32.2 million tonnes of cargo each year, making it one of the busiest ports in the country.

Key Trading Partners and Strategic Importance: Major trading partners include the United States, Asia, and several countries within the EU. Its strategic importance is dominated by its comprehensive network to North America.

Context for Businesses: If your supply chain involves the US market, the Port of Liverpool, with its fast and frequent services, could be a key part of your shipping plans.

Felixstowe Port

Location and Volume: Felixstowe Port, located on the southeast coast of England, is the largest container port in the UK, handling approximately 4 million TEU annually.

Key Trading Partners and Strategic Importance: Its main trading partners are scattered across Asia, Europe, and North America. Capacitated with major container terminals, it plays a strategic role in the global supply chain.

Context for Businesses: If your business deals with large container volumes, Felixstowe Port might be the cornerstone of your logistics operations, ensuring efficient handling and rapid turnover of goods.

Port of Bristol

Location and Volume: Nestled in the southeast of England, the Port of Bristol manages a substantial freight volume, handling over 12 million tonnes of goods per year.

Key Trading Partners and Strategic Importance: The port maintains strong trading connections with Europe, North America, and Africa. It’s strategically favoured for its multi-modal facilities, including deep-water berths and specialist handling services.

Context for Businesses: If you’re looking to leverage multimodal shipping and specific handling services, the Port of Bristol could be a boon to your transportation efforts.

Port of Grimsby

Location and Volume: Located on the River Humber’s south bank, the Port of Grimsby specialises in handling cars and perishable commodities, serving over 300,000 cars and 70,000 tonnes of fish per year.

Key Trading Partners and Strategic Importance: The port has strong European trading partnerships. Its strategic importance is defined by its specialised facilities for handling perishable goods and automotive logistics.

Context for Businesses: If your logistics demands involve perishable goods or auto parts, the Port of Grimsby’s specialist handling facilities might play an integral role in your shipping strategy.

Main shipping ports in Thailand

Port of Laem Chabang

Location and Volume: The port is strategically located in the Chon Buri Province, around 25 km north of Pattaya. As Thailand’s biggest and busiest port, it handles a shipping volume of approximately 7.2 million TEUs annually.

Key Trading Partners and Strategic Importance: Its key trading partners are China, the USA, and Japan. Laem Chabang is of strategic importance because it’s a gateway to Asia, hence ensuring a smooth flow of goods within the region.

Context for Businesses: If you’re seeking an efficient way to transport goods to Asian markets, Laem Chabang port could be a crucial link in your supply chain because of its high capacity and proximity to key economic countries in Asia.

Port of Bangkok

Location and Volume: Bangkok’s port is located along the Chao Phraya River in Khlong Toei District. This port handles a shipping volume of about 1.5 million TEUs per year.

Key Trading Partners and Strategic Importance: It’s vital mainly to trade with neighboring countries such as China, Malaysia, and Myanmar. The Port of Bangkok holds strategic importance due to Bangkok’s status as Thailand’s capital and the country’s primary economic hub.

Context for Businesses: Looking to target the thriving consumer market of Bangkok? The Port of Bangkok can play a vital role in your logistics strategy due to its extensive cargo-handling facilities and excellent connectivity to the city’s marketplace.

Port of Map Ta Phut

Location and Volume: Map Ta Phut Port is located in Rayong Province, Thailand’s eastern seaboard. This port specializes in handling industrial products, with a yearly shipping volume of around 19 million tons.

Key Trading Partners and Strategic Importance: Its main trading partners are Japan, China, and South Korea. As one of the world’s largest ports for petrochemical products, it holds strategic value for businesses involved in the industrial sector.

Context for Businesses: Venturing into the industrial sector? Map Ta Phut port serves as an ideal shipping point for petrochemical and other large-scale industrial goods, thanks to its specialised terminals and facilities.

Port of Songkhla

Location and Volume: Located in Southern Thailand, the port of Songkhla manages a significant bulk and container shipping volume with approximately 3 million tons per year.

Key Trading Partners and Strategic Importance: Its key trading partners include Malaysia and Singapore, possibly because of its geographical proximity. The port is strategically crucial for serving the Southern Thailand region and linking it with international trade routes.

Context for Businesses: If you plan to expand your business operations into Southern Thailand or nearby countries, Songkhla Port’s significant shipping volume and strategic location might be a beneficial part of your logistics plan.

Port of Sriracha Harbor

Location and Volume: Sriracha Harbor is located in the Gulf of Thailand, with a yearly shipping volume of approximately 13 million tons.

Key Trading Partners and Strategic Importance: The port’s key trading partners are primarily countries within the region and it holds strategic importance for serving the Eastern Thailand region and connecting it to international trade routes.

Context for Businesses: If your business entails shipping bulky commodities, Sriracha Harbor’s significant bulk cargo-handling capacity can assist you in connecting your goods to both local and international markets rapidly and efficiently.

Port of Sattahip

Location and Volume: The port of Sattahip is located in Chonburi Province, along the Gulf of Thailand, administering over 20 million tons of shipping volume annually.

Key Trading Partners and Strategic Importance: Trading mainly with neighbouring countries, it’s strategic to Thailand’s import/export industry due to its capacity to handle large cargo volumes and its proximity to Laem Chabang and Sriracha Harbor.

Context for Businesses: Interested in leveraging Thailand’s vibrant import/export industry? Sattahip’s considerable capacity and strategic location create an advantageous link between your goods and huge consumer markets.

Should I choose FCL or LCL when shipping between UK and Thailand?

Making the choice of full container load (FCL) or less than container load (LCL) could be the game-changer in your UK-Thailand shipping journey. Your decision touches everything from costs and timings to how smoothly the voyage goes. No one-size-fits-all here—it all zeroes in on your business’s unique needs. Let’s dive in to unravel the hows and whys of LCL and FCL, equipping you with savvy insights to choose what’s best for your shipment. You’re the captain of your shipping process, making the calls that drive your freight’s destiny!

Full container load (FCL)

Definition: FCL, or Full Container Load, refers to a shipping method where a single container is used for one customer's goods only, making it an ideal option for larger consignments. It commonly includes options for a 20'ft container or a 40'ft container.

When to Use: Opt for FCL shipping when your cargo volumes exceed 13-15 cubic meters (CBM). This is due to the cost and efficiency advantages it offers for higher-volume shipping. Plus, the added security of a sealed container from origin to destination provides peace of mind.

Example: For instance, a UK-based furniture wholesale company looking to ship a large volume of products to Thailand would greatly benefit from FCL shipping. Given the volume of their merchandise, an FCL container would yield cost benefits while ensuring safe delivery.

Cost Implications: When calculating an FCL shipping quote, keep in mind that FCL shipping tends to be more cost-effective per unit for larger volumes compared to LCL (Less than container load). Despite the initial higher cost for container usage, shipping larger quantities can substantially decrease the cost per unit, driving overall cost savings.

Less container load (LCL)

Definition:

LCL, or Less than Container Load, refers to a method of shipping that consolidates multiple shipments from different shippers into one container. This means you only pay for the space you need, making it a cost-effective and flexible option for smaller volumes.

When to Use:

LCL shipping is ideal when you're moving cargo that is less than 13/14/15 CBM (Cubic Meters), as you're not obliged to pay for the space you're not using in the container.

Example:

Consider a UK-based small furniture manufacturer shipping a few units to a new store in Thailand. With an LCL shipment, the company's merchandise could be packed with other shipments in one container, saving them money and allowing for more logistical flexibility - a crucial advantage for small businesses.

Cost Implications:

In terms of cost, an LCL freight charges you based on the volume rather than a fixed container cost, effectively lowering the export expense. However, it’s not always the cheapest option, as other costs like handling and customs clearance may be higher with multiple cargoes. It’s essential to gauge the overall cost considering these factors before choosing LCL shipping.

Hassle-free shipping

Deciding between consolidation or a full container for shipping between the UK and Thailand? Trust DocShipper, your freight forwarder committed to simplifying cargo shipping for businesses. Our ocean freight experts analyze factors like volume, weight, and budget to recommend the best shipping solution. Elevate your global trade experience with strategic shipping solutions. It's your turn to streamline your shipping approach. Request a free estimate from us today!

Sea freight from the UK to Thailand typically takes around four to six weeks on average. However, transit times can vary based on several factors. These factors include the specific ports used, the weight and the type of goods being shipped. To get a more accurate idea of transit times for your specific shipment, it’s often advisable to directly contact a freight forwarder like DocShipper for a tailored quote.

Now, let’s take a look at the shipping times in days between the main freight ports in both countries:

| UK Port | Thailand Port | Average Transit Time (Days) |

| Felixstowe | Laem Chabang | 45 |

| Southampton | Laem Chabang | 45 |

| London Gateway | Laem Chabang | 45 |

| Liverpool | Laem Chabang | 45 |

*Please bear in mind that this table only provides an average and actual shipping times may vary. It’s always best to check your specific circumstances with a freight forwarder to get a more accurate estimate.

How much does it cost to ship a container between UK and Thailand?

Ever wondered about the cost to ship a container from the UK to Thailand? Well, ocean freight rates can fluctuate. This variation arises due to differing factors such as the Point of Loading, Point of Destination, the designated carrier, nature of goods, and the whims of monthly market fluctuations. Pinning down an exact shipping cost isn’t a one-size-fits-all scenario. Nevertheless, our dedicated shipping specialists stand ready to navigate these complexities and sharpen their pencils to provide bespoke rates, quoting specifically for your unique shipping needs. Rest assured, we’re committed to securing the best value for your specific requirements!

Special transportation services

Out of Gauge (OOG) Container

Definition: Out Of Gauge (OOG) containers, also known as special equipment, are used for items that exceed the dimensions of standard shipping containers.

Suitable for: OOG containers are ideal if you’re transporting out of gauge cargo, i.e., oversized goods that can’t fit into a standard 20 or 40-foot container.

Examples: These could be large machinery, boats, or industrial equipment.

Why it might be the best choice for you: If your cargo is not able to be dismantled or exceeds standard container sizes, an OOG container offers the solution, ensuring safe and efficient transportation.

Break Bulk

Definition: Break bulk refers to goods that need to be loaded individually rather than in shipping containers or bulk.

Suitable for: It’s the go-to option for cargo that’s too large to fit into containers and can be handled individually.

Examples: Items like timber, construction equipment, or large reels of cable are common types of break bulk.

Why it might be the best choice for you: For oversized or heavy cargo that requires special handling, break bulk shipping ensures your goods are safely transported and loaded onto the vessel.

Dry Bulk

Definition: Dry Bulk shipping involves transport of commodities in large quantities, transported without packaging, and usually poured into the cargo hold of a ship.

Suitable for: Perfect for the transportation of loose cargo load that is not packaged individually.

Examples: Commodities such as coal, grain, or mineral ore are typical types of dry bulk goods.

Why it might be the best choice for you: If your business involves large quantities of un-packaged goods, Dry Bulk shipping can offer a cost-effective and efficient solution.

Roll-on/Roll-off (Ro-Ro)

Definition: Roll-on/Roll-off (Ro-Ro) shipping involves vessels designed to carry wheeled cargo that are driven on and off the ship on their own wheels or a flatbed trailer.

Suitable for: Ro-Ro is a perfect option for wheeled cargo such as automobiles, trucks, semi-trailers, trailers, and railroad cars.

Examples: A car manufacturer exporting vehicles from the UK to Thailand would likely use a ro-ro vessel.

Why it might be the best choice for you: If your cargo is motorized and can be driven directly into the ship, this can be a remarkably convenient and efficient method of transportation.

Reefer Containers

Definition: Reefer containers are refrigerated shipping containers used to transport temperature-controlled cargoes such as fruits, meat, fish, seafood, vegetables, dairy, and other products.

Suitable for: They are required for any goods that need to be transported at a precise temperature to maintain their quality.

Examples: A cheese producer looking to export from the UK to Thailand would utilize reefer containers to maintain product freshness.

Why it might be the best choice for you: If you’re in the business of exporting goods that require specific temperature control, reefer containers could be essential for your supply chain.

At DocShipper, we strive to help businesses find the most suitable shipping solution. To discuss these options further or for a free shipping quote in less than 24 hours, don’t hesitate to contact us.

Air freight between UK and Thailand

Speedy and reliable, air freight from the UK to Thailand adds supreme value to businesses trading in time-sensitive high-value goods. These precision shipments, like designer watches or critical pharmaceuticals, soar over borders in the blink of an eye. Yet, bumpy turbulence can hit if you don’t understand the weighty impact of correct price estimation or the best practices in air freight. You see, many shippers stumble on these seemingly trivial details and end up paying a hefty price. Like a marathon runner with no calculated pacing strategy, they burn out early. Let’s together pace your air freight race to victory. We’ll teach you each twist and turn, making sure you’re on course and cost-savvy.

Air Cargo vs Express Air Freight: How should I ship?

Puzzled over whether to opt for air cargo or express air freight for your UK-Thailand shipments? Here’s a quick hint: air cargo enjoys a scenic route in a shared airline while express freight zooms straight to your destination in its own dedicated plane. With these options, let’s explore what’ll give your business the edge, factoring in speed, cost, and the nature of your goods. This’ll help you steer clear of costly blunders and keep your business beating on time!

Should I choose Air Cargo between UK and Thailand?

If you’re shipping cargo in the 100/150 kg (220/330 lbs) range between the UK and Thailand, air cargo may be an ideal option. With credible international airlines like British Airways and Thai Airways, you can expect cost-effectiveness and reliability, albeit longer transit times due to fixed schedules. These airlines offer competitive freight rates, making air cargo an attractive solution – especially for businesses needing to manage costs. However, remember that this method suits your budgetary needs best for shipments around this weight range.

Should I choose Express Air Freight between UK and Thailand?

Express Air Freight is a dedicated service, utilizing cargo-only planes, ideal for transporting small shipments under 1 CBM or 100/150 kg (220/330 lbs), without the delays associated with passenger flights. It’s popular among businesses needing swift, reliable transport. Consider it if rapid delivery or space constraints are key factors for your cargo. Companies like FedEx, UPS, and DHL are well-known providers of this service, ensuring your goods swiftly and securely travel from the UK to Thailand. This choice might serve you admirably if your priority is speed and efficiency.

Main international airports in UK

Heathrow Airport

Cargo Volume: Heathrow is the busiest cargo airport in the UK, processing over 1.7 million metric tonnes of cargo each year.

Key Trading Partners: Main trading partners include the US, China, and European Union countries, particularly Germany and France.

Strategic Importance: Located just outside of London, its position makes it ideal for connections to the rest of the world — with service reaching over 200 countries.

Notable Features: Heathrow’s centralised cargo hub expedites domestic and international freight, with a dedicated cargo terminal operated by specialist airlines and freight companies.

For Your Business: As a central global connection, it offers your business unparalleled access to global markets. Combined with a state-of-the-art infrastructure and efficient processing systems, Heathrow is a favorable choice for international shipping needs.

Cargo Volume: As the UK’s third-largest airport, Manchester handles nearly 120,000 tonnes of import and export freight and mail annually.

Key Trading Partners: Major partners include the US, Middle East, and several European Union countries.

Strategic Importance: It’s strategically positioned in the centre of the country, making it a vital hub for trade, particularly for businesses in Northern England.

Notable Features: Its World Freight Terminal is equipped to handle all kinds of goods, with dedicated facilities for perishable and valuable goods.

For Your Business: If located in the Midlands or the North of England, you could reduce transport costs and possibly expedite shipping times using Manchester Airport. Additionally, its diverse handling facilities ensure a safe transit for any special goods you have.

Stansted Airport

Cargo Volume: Stansted Airport processes over 250,000 tonnes of cargo annually.

Key Trading Partners: Major trading partners are mostly within the European Union, including Germany, Spain, and Belgium.

Strategic Importance: Located about 40 miles northeast of Central London, Stansted is especially critical for cargo transport within Europe.

Notable Features: One of its key features is its cargo airport area designed for large freighters, with advanced scanning equipment and warehousing facilities.

For Your Business: If Europe is a vital market for your business, Stansted Airport’s strategic position and robust European network make it a viable option for your shipping needs. Its advanced cargo handling abilities can provide your goods with safe and timely transit.

East Midlands Airport

Cargo Volume: East Midlands Airport, although smaller in passenger volume, manages over 320,000 tonnes of freight annually.

Key Trading Partners: Top trading regions include the European Union, North America, and Asia.

Strategic Importance: Its central UK location and 24-hour operational abilities make it appealing for logistics operations looking to work around the clock.

Notable Features: It’s home to DHL’s UK hub and, as such, has a high competence in handling express and courier shipments.

For Your Business: Consider East Midlands if you need reliable, round-the-clock service. With DHL’s UK hub on-site, you can also rely on express and courier shipment handling capabilities, making this airport a strategic choice for urgent shipping requirements.

Gatwick Airport

Cargo Volume: While it’s the second-largest airport for passenger traffic in the UK, Gatwick handles about 100,000 tonnes of cargo annually.

Key Trading Partners: Key partnerships are focused in Europe, particularly Spain, France, and Germany, though Gatwick also maintains strong relationships with transatlantic partners.

Strategic Importance: Its Southern England location and strong European links make it a viable transit point for freight entering and exiting the UK.

Notable Features: It offers dedicated cargo facilities, providing high-standard security and handling a range of goods from perishables to hazardous materials.

For Your Business: If your business operates principally within Europe, Gatwick Airport’s strong regional links, security standards, and wide-ranging goods handling make it an ideal partner for you.

Main international airports in Thailand

Suvarnabhumi Airport

Cargo Volume: Suvarnabhumi processes 2.9 million tonnes of cargo annually, making it the biggest cargo airport in Thailand.

Key Trading Partners: Main trading partners include China, Japan, and the United States.

Strategic Importance: Suvarnabhumi is a major connecting hub for Southeast Asia, directly connecting you to Asia’s dynamic economies.

Notable Features: Its vast cargo area can accommodate both regular and temperature-sensitive cargo types including perishables and pharmaceuticals.

For Your Business: Whether shipping goods that need special handling or mass cargo, this airport has the freight facilities to meet your needs, including a strong network of freight forwarders and customs brokers.

Don Mueang International Airport

Cargo Volume: Don Mueang handles over 160,000 tonnes of cargo annually.

Key Trading Partners: The airport is a primary gateway to domestic destinations, with connections to large Asian cities like Hong Kong, Seoul, and Singapore.

Strategic Importance: This is Bangkok’s secondary airport, primarily serving domestic and regional international flights.

Notable Features: Specializes in e-commerce cargo and mail services, turning it into an increasingly important hub for Thailand’s rapidly booming e-commerce sector.

For Your Business: Don Mueang’s specialization in e-commerce traffic can help you capitalize on Thailand’s fast-growing digital economy.

Chiang Mai International Airport

Cargo Volume: Processes more than 30,000 tonnes of cargo annually.

Key Trading Partners: Has strong trade linkages with China and Southeast Asia.

Strategic Importance: It’s Northern Thailand’s main airport, serving as an important gateway to the northern region.

Notable Features: Has an active free trade zone theoretically allowing goods to enter duty-free for trans-shipment or re-export.

For Your Business: If your shipping needs involve Northern Thailand or surrounding countries, Chiang Mai’s free trade zone is helpful – potentially reducing your customs duties.

Hat Yai International Airport

Cargo Volume: Cargo capacity of approximately 9,500 tonnes per year.

Key Trading Partners: Ships to key markets in Malaysia, Singapore, and China.

Strategic Importance: Serves as an important southern gateway, contributing to the development of trade and tourism in the lower southern region.

Notable Features: Notable for its capacity to handle both domestic and some medium-sized international cargo shipments.

For Your Business: If your shipping routes include Southern Thailand or nearby countries, particularly for smaller cargo loads, Hat Yai may be a cost-effective gateway.

Phuket International Airport

Cargo Volume: Handles approximately 73,500 tonnes of cargo per year.

Key Trading Partners: Key trading ties with China, India, and Australia.

Strategic Importance: As Thailand’s third busiest airport, it’s a significant point of connectivity for the country’s popular southern islands.

Notable Features: The airport houses a Free Zone Area in its Cargo Terminal, ideal for managing your imports and exports more efficiently.

For Your Business: If your trade routes encompass the Andaman Sea region, do consider Phuket for its strategic location and increasingly modern cargo facilities.

How long does air freight take between UK and Thailand?

On average, shipping from the UK to Thailand by air freight usually takes between 2 to 5 days. However, the actual transit time may vary based on factors such as the specific origin and destination airports, the weight of the goods, and the type of goods being transported. For precise shipping times tailored to your specific situation, you should consult with a freight forwarder like DocShipper.

How much does it cost to ship a parcel between UK and Thailand with air freight?

Air freight charges between the UK and Thailand could range between £2.50 – £4.50 per kg, approximately. However, don’t bank on this as the final price. Several elements such as airport distance, parcel dimensions, weight, and contents can significantly sway the cost. Each shipment is unique, which is why our team works closely with clients, providing customized quotes that optimally fit their needs. Our expertise and experience allow us to secure the most cost-effective solutions for you. So, why wait? Contact us now and get your free quote within the next 24 hours!

What is the difference between volumetric and gross weight?

Gross weight refers to the total weight of your shipment, including the goods and its packaging. On the other hand, volumetric weight represents the total amount of space your package occupies. Both are calculated differently in air freight.

Air cargo uses a standard calculation, dividing the total cubic centimeters (length x width x height) by 6,000to get the volumetric weight in kilograms. For example, if your package measures 50x30x20 cm, it is 300,000 cubic cm. Dividing by 6,000, your volumetric weight is 50 kg, or 110.23 lbs.

Express Air Freight services, on the other hand, uses a different factor, dividing by 5,000 instead. Using the same package dimensions, your volumetric weight is now 60 kg or 132.28 lbs.

Your gross weight is simply the weight reading on the scale, say, 45 kg, or 99.21 lbs.

Freight charges come into play using both weights. If your gross weight is less than your volumetric weight, freight companies will charge based on the volumetric weight. Essentially, your freight charges are determined by whichever is higher between gross and volumetric weight, ensuring the carrier is compensated for space or weight, whichever is greater.

Door to door between UK and Thailand

Door to Door shipping is a comprehensive service that handles your goods from the heart of the UK straight to any location within Thailand. With its ease and efficiency, it could be the prime choice for businesses aiming for a hassle-free shipping experience. Great benefits, aren’t they? So, without delay, let’s dive in to explore more about this all-inclusive shipping method!

Overview – Door to Door

Handling shipments between the UK and Thailand seems daunting, right? It involves complex processes, paperwork, and countless customs rules. This is where Door to Door shipping shines as a stress-free logistics solution. This popular service, highly-sought by DocShipper’s clients, handles everything from pick-up, transport, customs, to delivery. While it might be costlier than other methods, the convenience it brings is unparalleled. Remember, the goal is an efficient, trouble-free shipping process. Door to Door shipping could be your shortcut to making it happen. Why endure headaches when a better solution awaits?

Why should I use a Door to Door service between UK and Thailand?

Ever tried juggling flaming torches while riding a unicycle? Managing international freight between the UK and Thailand can feel a bit like that. Thankfully, Door to Door service is here to put out the fire and save the day.

1. Stress-Free Shipping: Let’s start by removing stressful logistics from your plate. Door to Door services handle every process from pick-up to delivery, turning the headache of international freight into a breeze. From your warehouse in the UK to your recipient’s doorstep in Thailand, everything gets sorted.

2. Saves Time: Have a deadline reaching faster than a sprinter? Door to Door service ensures that your consignment arrives on time. Its express nature is perfect for urgent shipments, keeping meticulous track of schedules and ensuring deadlines are met.

3. Specialized Handling: Got something more complicated than a Rubik’s cube? Special cargo like chemical goods, heavy machinery, or delicate porcelain requires expert handling. Door to Door service has skilled professionals for these jobs to ensure your complex freight arrives unscathed in Thailand.

4. International Customs and Duties Management: No need to get tangled in the messy web of customs clearances and duty payments. Your Door to Door service deciphers the jargon, liaises with customs, prepares necessary paperwork, and handles import duties.

5. Convenience: Ultimately, why carry a grand piano up seven flights of stairs when you could simply use the lift? Door to Door service provides that lift by handling all the trucking from the port until the final destination in Thailand.

So, there you have it! Door to Door service – the unicycle to your logistic juggling act. Its secret sauce ensures you get the convenience, care, speed and smooth handling you need when shipping from UK to Thailand.

DocShipper – Door to Door specialist between UK and Thailand

Unsure of shipping goods between the UK and Thailand? DocShipper steps in to simplify it for you, offering door-to-door, stress-free shipping. From packing and transport to navigating customs, we handle everything from A to Z with proficiency. Never worry about different shipping methods, we’ve got it covered. A dedicated Account Executive is always ready to assist you. Request a free estimate within 24 hours or call our consultants for a prompt response. Let DocShipper make your shipping experience seamless and effortless.

Customs clearance in Thailand for goods imported from UK

Customs clearance is the critical process of obtaining permissions to import goods into Thailand from the UK. Given its complexities, unforeseen expenses such as duties, taxes, quotas, and licensing fees can emerge. These could even delay your consignment, causing it to get stuck at customs. However, understanding the nuances of customs duties, taxes, quotas, and licenses can help you navigate this intricate process smoothly. The forthcoming sections will demystify these areas for you. To make things easier, DocShipper can handle all processes for any type of goods, anywhere globally. If you need to budget your project, our team can provide an estimate. Just share the origin, value, and HS Code of your goods. These details are essential to proceed with an accurate estimation. Trust in our expertise, and let’s make your shipping process a breeze.

How to calculate duties & taxes when importing from UK to Thailand?

Navigating the intricacies of import taxes can initially feel like a daunting task. However, take a deep breath – it’s all about understanding a few key components. The calculation of customs duties requires you to know the country of origin, the HS Code, the Customs Value, the Applicable Tariff Rate, and any other taxes and fees that may impact your products. Once armed with this knowledge, you are better positioned to take on the international freight landscape head-on. Important to remember is the first step: Identifying the country where your products came into being, their place of birth so to speak. This is where the complex web of import duties begins to unravel, becoming an open map for you to navigate.

Step 1 – Identify the Country of Origin

Knowing your goods’ correct country of origin is, without a doubt, the first and foremost step in estimating dutiful expenses when importing from the UK to Thailand. Why? Let’s dive into the five core reasons:

1) Trade Agreements: The UK and Thailand share multiple trade accords. These agreements directly impact custom duties, reducing or sometimes even eliminating them.

2) Import Restrictions: Each country has distinct import limitations. Getting familiar with Thailand’s specific restrictions for UK goods safeguards against any setbacks.

3) Differential Duty Rates: Customs charges can vary according to the country of origin. Hence, correctly identifying the origin can save your wallet a lot of heartache.

4) Compliance: Regularly, customs authorities conduct audits. If your goods’ listed origin doesn’t align with reality, your business might face penalties or delays.

5) Market Access: Certain goods can only enter a country based on their origin, so it’s essential to know where your products hail from.

Remember, UK-Thailand relations and related trade accords can shift. Stay updated to leverage every opportunity. And, if you find navigating customs duties and restrictions challenging, a local freight forwarder can be a cost-effective and stress-free solution. Their expert knowledge can avoid any tedious customs snafus.

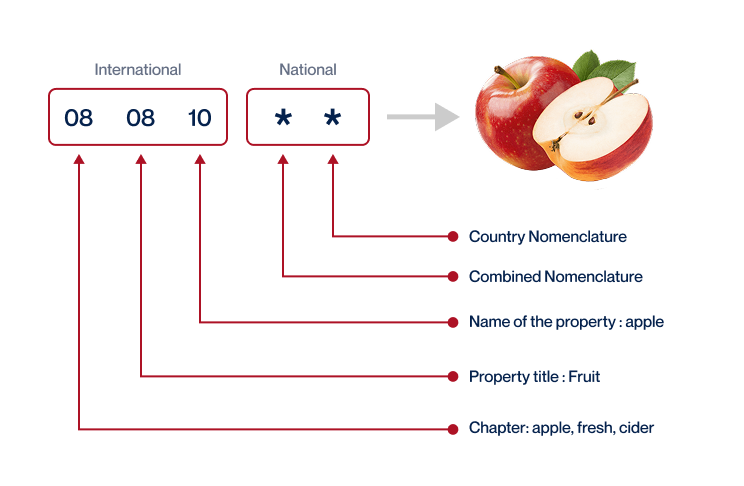

Step 2 – Find the HS Code of your product

The Harmonized System Code or HS Code is used worldwide for classifying traded products for customs purposes. It plays a vital role in determining how much tax or duty you’ll have to pay upon the shipment’s arrival at its destination. An HS Code involves a 6-10 digit figure, depending on the country, allocated to every item that can be imported or exported, facilitating the process of shipping goods across international borders.

The ideal approach to retrieve the HS Code of your product often involves asking your supplier. They’re typically accustomed to the import regulations and have experience dealing with the product codes.

However, if that’s not feasible, don’t fret. We’re here to guide you through an easy step-by-step procedure to locate the HS Code. Let’s unfold the process:

1. To begin with, access this Harmonized Tariff Schedule on the United States International Trade Commission’s website.

2. Your next move is to input the name of the product in the search bar.

3. Once you proceed with the search, browse through the ‘Heading/Subheading’ column to locate your product’s HS Code.

Exercise prudence though. Ensuring accuracy in selecting your HS Code cannot be overemphasized; even a slight deviation might cause delays in your shipment and possible fines for incorrect declaration.

Here’s an infographic showing you how to read an HS Code. Take a moment to grasp the concept and you’ll find yourself navigating this integral process much more efficiently.

Step 3 – Calculate the Customs Value

Understanding the customs value of your goods sent from the UK to Thailand can at first seem a bit tricky. It’s crucial to note that this isn’t simply the actual product value. Instead, it reflects the CIF value – that’s the sum of the cost of the goods, international shipping fees, and insurance costs.

Imagine you’re exporting electronics valued at $1000 (include cost to produce, buy or replace the item), and you’re paying $200 for shipping and $50 as an insurance safety net. Your customs value isn’t $1000, but $1250 because it includes everything that it takes to get your goods safely to their destination.

Knowing how to calculate this accurately will smooth your customs clearance process in Thailand and help bulletproof your shipping budget. Keep in mind, understanding your customs value is key to unanticipated costs down the line.

Step 4 – Figure out the applicable Import Tariff

Understanding and identifying the applicable import tariff is crucial when shipping goods from the UK to Thailand. An import tariff is essentially a tax imposed on goods imported into a country. In Thailand, these tariffs often fall under two categories: Free Trade Agreement (FTA) Tariffs and Most Favored Nation (MFN) Tariffs.

To determine the applicable tariff rate for your product, you can use the UK’s Trade Tariff tool. Here’s how:

1. Go to the UK Government’s Trade Tariff Tool .

2. Enter the Harmonized System (HS) code identified in Step 4 and the country of origin which is UK in this case.

3. You’ll then see the duties and taxes applied to your particular product.

As an example, let’s consider you’re shipping bicycles (HS Code 8712) with a Cost, Insurance, and Freight (CIF) value of $10,000. According to the Trade Tariff Tool, the tariff rate for bicycles is 15%. You’ll calculate import duties by multiplying the CIF value by the tariff rate:

$10,000 (CIF) 15% (Tariff Rate) = $1,500.

So, you’ll owe $1,500 in import duties for your bicycles. This step-by-step guide should help you predict costs and navigate your shipping journey efficiently.

Step 5 – Consider other Import Duties and Taxes

When importing goods from the UK to Thailand, aside from standard tariff rates, there are potentially additional import duties that hinge on your product nature and origin country. These can include excise duty, typically assigned to luxury items like alcohol or cosmetics, and anti-dumping duties, enforced on certain imported goods sold significantly lower than the market value to protect domestic industries.

For instance, if you’re importing cosmetics priced $1000, and the excise duty is 20%, you’ll need to factor in an extra $200 for this duty. Keep in mind this is an illustrative example, and rates may differ.

Most crucially, you must consider the Value Added Tax (VAT). In Thailand, the current Standard VAT rate is 7% (again, example rate and might not reflect the actual). This applies to the cumulative value of your goods, plus any import duties incurred. Continuing our cosmetics example, if the combined cost and duties amount to $1200, your VAT would be $84.

Understand, comprehend and calculate these duties rightly to prevent surprises and ensure a smooth import process.

Step 6 – Calculate the Customs Duties

When goods enter Thailand from the UK, you’ll encounter customs duties determined by a specific formula: customs value (or CIF in shipping lingo, which stands for Cost, Insurance and Freight) multiplied by the duty rate. But wait, there’s more!

Take for example a shipment of designer dresses with a customs value of $1000, assuming a duty rate of 10%. The customs duty would be $100 (100010%). That’s straightforward when there’s no additional tax.

Suppose we expand that to include a Value Added Tax (VAT) at 7%. The total amount subject to VAT would be the sum of customs value, insurance, shipping costs, and customs duties. So if we’re still looking at the dresses, the VAT would be 7% of $1100 ($1000 customs value plus $100 duties) hence, $77.

Now, let’s get fancy and add anti-dumping taxes and Excise Duty to this. Let’s say a shipment of bikes valued at $2000, with anti-dumping tax at 10% and Excise Duty of 20%. First calculate the customs duty, VAT the same way as before. Then add 10% of the customs value for anti-dumping and 20% of the final value including VAT and customs duties for Excise Duty. Tough calculation, right? That’s where DocShipper services shine.

Trust DocShipper to handle your customs clearance anywhere in the world, ensuring it’s done right and you’re not overcharged. Interested? We’ll provide you with a free quote in less than 24 hours.

Does DocShipper charge customs fees?

At DocShipper, we separate customs fees into two distinct categories. As customs brokers in the UK and Thailand, we charge for customs clearance, helping you negotiate the complexities of shipping regulations. However, customs duties and taxes go directly to the government, not us. These two transactions are separate and transparent; we provide all official customs documents to prove only government-set charges were passed onto you. Remember, navigating customs doesn’t have to be a maze; lean on us for guidance.

Contact Details for Customs Authorities

UK Customs

Thailand Customs

Required documents for customs clearance

Stumped by the pile of paperwork needed for customs clearance? You’re not alone. Let’s break down key documents such as the Bill of Lading, Packing List, Certificate of Origin, and Documents of conformity (CE standard), simplifying what can feel like a paperwork mountain.

Bill of Lading

Here’s your road map to understanding the Bill of Lading, crucial when shipping between the UK and Thailand. Picture it as your golden ticket! This official document marks the hand-off of cargo ownership and is vital for clearing customs without a hitch. Frustrated with traditional paperwork? The electronic, or telex release, is a game-changer, offering timely and hassle-free document processing. Swap stacks of papers for a couple of clicks! If air’s your way to go, the AWB (Air Waybill) performs the same duty; it’s the airline industry’s equivalent to the Bill of Lading. Knowing your key documents can smooth your freight journey, giving you the upper hand in dealing with unexpected shipping obstacles. Remember, ticking all these boxes adds up to a slick, seamless customs experience. Happy shipping!

Packing List

Navigating the shipping route between UK and Thailand, the value of your Packing List can’t be overstated. It’s your lifeline document, detailing your shipment contents accurately, from electronics to furniture. Why so crucial? Well, imagine you’re shipping a batch of smartphones by sea, or antique Thai silk by air. Customs officials need to know exactly what you’re bringing in to abide by both UK and Thai regulations, and dodging any unpleasant surprises. It’s your job to ensure precision – a mismatch can lead to delays, or worse, confiscation. Just picturing a container stuck at a Thai dock, or an air freight pallet held up in Heathrow, highlights the importance of getting your Packing List right. Do it well, your business will thank you for it.

Commercial Invoice

When you’re shipping goods from the UK to Thailand, never underestimate the power of a well-prepared Commercial Invoice. This key document can be the oil that keeps your customs clearance process running smoothly. Here’s why: a Commercial Invoice includes crucial details about your goods like the description, HS codes, and valuation. Customs authorities rely on it to assess duties and taxes. Also, it’s pivotal for alignment with your other shipping documents, such as the Bill of Lading or Airway Bill. Imagine it as your goods’ passport, speaking volumes about their origin and value. So, always ensure it’s completed accurately and is consistent with your other paperwork. That way, you’ll be well-positioned for a speedy customs clearance between the UK and Thailand.

Certificate of Origin

A Certificate of Origin (COO) assures Thai customs that your goods were indeed manufactured in the UK. The nitty-gritty lies in this document’s power to unlock preferential customs duty rates under the UK-Thailand Free Trade Agreement. For instance, a Yorkshire-based furniture manufacturer shipping oak tables would mention ‘UK’ as the country of manufacture in their COO. This clear categorization would pave the way for reduced duty rates in Thailand, easing your financial load. So ensure that COO is part of your shipping documents – it’s your golden key to smoother, more cost-effective shipping.

Get Started with DocShipper

Prohibited and Restricted items when importing into Thailand

Understanding Thailand’s complex import regulations can be daunting. If you’re struggling with what you can or can’t ship, you’re not alone. Our guide aims to clear the fog, providing clarity on prohibited and restricted items. Let’s spare your business the hassle and expense of overturned shipments.

Are there any trade agreements between UK and Thailand

Yes, there are trade relationships between the UK and Thailand which could benefit your business. They are currently not covered by a Free Trade Agreement or an Economic Partnership Agreement, but discussions are underway to establish a potential UK-Thailand FTA. This would streamline your shipping process and may reduce tariffs. Plan your logistics keeping in mind upcoming infrastructure projects like the high-speed rail line, indicating promising future collaboration.

UK – Thailand trade and economic relationship

The UK and Thailand share a vibrant trade history, dating back to the Treaty of Friendship in 1855. This enduring relationship has fostered substantial economic growth in key sectors like automotive, pharmaceuticals, and food and beverages. For instance, the UK is Thailand’s top European trading partner, representing 12% of Thailand’s total trade with Uk in 2023, with an impressive trade volume exceeding £6.1 billion. Furthermore, Thailand is an attractive investment hub for Britons, with UK Foreign Direct Investment (FDI) reaching £29.2 billion in 2022. Key commodities moving between our countries span from machinery and transport equipment to edible goods. As the complex trading landscape evolves, businesses must be aware of regulatory changes and leverage the potential benefits this lasting bond offers.

Your first steps with DocShipper

Additional logistics services

Warehousing

Storing your goods can be a tough gig, especially between the UK and Thailand. The key? Reliable warehousing with conditions like temperature control to protect your speciality goods from harm. Secure, efficient storage could be the game-changer your business needs. Curious? Learn more at our dedicated page on Warehousing.

Packing

Shipping between the UK and Thailand? Make sure your goods are safely packed. Every item, from delicate antiques to industrial equipment, needs expert packaging or repackaging. It could mean the difference between delivering in prime condition or facing heartbreaking damages. Your trustworthy agent is key here – they've got the know-how to protect your property.

Transport Insurance

Cargo insurance isn't your usual fire insurance. It's all about prevention, keeping your goods safe while they're being shipped around. Picture this: A storm hits the ocean and your shipment is damaged. That's where cargo insurance steps in, covering losses while your goods are in transit. Avoid dire straits and choose the safety net of Cargo Insurance. More info on our dedicated page: Cargo Insurance.

Household goods shipping

When moving between the UK and Thailand, rest easy knowing your personal items – be it that delicate family heirloom or your oversized home gym – are in safe, professional hands. We understand these objects demand extra care and flexibility. Just like Tom, who traded London rain for the Thai sun, his fragile pottery collection arrived intact, thank to our expert handling.

Procurement in Thailand

Looking to source goods from Thailand for your UK business? DocShipper has got you covered. We find and liaise with trustworthy suppliers, managing your procurement from start to finish. Even language barriers will no longer be an issue, as we bridge the gap with our multilingual team. Imagine worry-free procurement from Asia, East Europe, and beyond. More info on our dedicated page: Sourcing services.

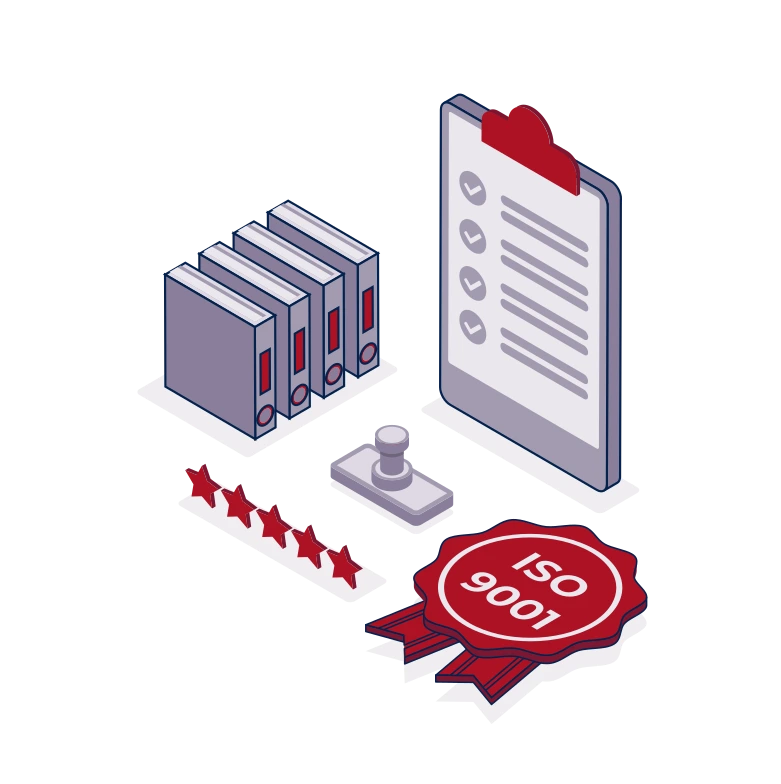

Quality Control

Quality inspections are your safeguard when shipping between the UK and Thailand. Imagine stumbling on a defect halfway through the cargo journey; that's both time and money wasted. Our thorough checks during manufacturing and customization prevent such hiccups and ensure all products meet the high standards expected. Whether electronics or fashion items, standards don't slip. More info on our dedicated page: Quality Inspection.

Conformité des produits aux normes

Avoid nasty surprises when shipping your goods! Our Product Compliance Services ensure that your cargo meets all the necessary regulations. We even conduct laboratory tests for certification, saving you time and eviction later. For example, suppose your product falls under restricted categories; we'll help you secure the required permits, saving precious time and effort.