Freight Shipping between UK and Oman | Rates – Transit times – Duties and Taxes

Haven't shipped anything between UK and Oman before? Fret not, you're not alone! Many businesses find themselves puzzled by understanding the rates, transit times, and customs regulations specific to this route. In this comprehensive destination guide, we'll delve into the ins and outs of shipping goods from the shores of Britain to the ports of Oman. We'll walk you through different types of freight options, the entire customs clearance process, including duties and taxes, and provide advice tailored specifically for businesses venturing into this route. If the process still feels overwhelming, let DocShipper handle it for you! As an international freight forwarder, we make the complex seem simple by managing every logistical step, transforming any challenges into success stories for your business. There is much to learn, so let's get started!

Which are the different modes of transportation between UK and Oman?

Shipping goods between the UK and Oman can be quite an adventure. Imagine it's like choosing a route for a long-distance road trip. With vast seas and multiple countries in between, driving isn't an option, so we are left with two practical choices - air or sea. Similar to choosing between a quick, albeit expensive, flight or a scenic cruise, businesses must consider factors like cost, speed, and cargo type. Selecting the best method is crucial for a smooth journey in the world of international shipping.

Need help with your shipment?

Need assistance with your shipment? Dont hesitate to contact us even for a simple question. Choose the option that suits you

Live chat with an expert Chat on WhatsApp Free Quote 24hHow can DocShipper help you

Sea freight between UK and Oman

Welcome to the world of ocean shipping between the UK and Oman! Wedged between the spirited waves, these two nations share a dynamic trade relationship, with sea traffic humming between ports such as Sohar in Oman and Felixstowe in the UK. This is the grand theatre of high-volume goods exchange – at an affordable rate, despite ocean freight’s turtle-like pace compared to other transport modes.

However, for shippers and businesses inexperienced in this route, the journey can be as tricky as finding a pearl in the ocean. Fret not! By knowing your ropes about customs regulations, weight limits and packaging standards, you can avoid plunging into the common mistakes like overboard cargo. Let’s dive in to uncover the streamlined strategies and best practices to ensure your maritime freight experience is as smooth as sailing on a serene sea. Brace yourself for practical insights into the complex world of transportation made easy. The details are anchored in the upcoming sections. So, all aboard?

Main shipping ports in UK

Port of Felixstowe

Location and Volume: The Port of Felixstowe is located in Suffolk, on the east coast of England. It’s the largest and busiest container port in the UK, handling over 4 million Twenty-Foot Equivalent Units (TEUs) each year.

Key Trading Partners and Strategic Importance: Trade partners include Europe, North America and Asian markets. Beyond its volume, the port’s strategic importance lies in its state-of-the-art terminal—The North Rail Terminal—which significantly increased the port’s rail capacity.

Context for Businesses: If you’re looking to penetrate European and Asian markets, the Port of Felixstowe, with its modern facilities and access to main shipping lanes, can play a critical part of your expansion strategy.

Port of London

Location and Volume: The Port of London is along the Thames River, in the south east of England. The port handles around 50 million tons of cargo annually, making it the second-largest in the UK.

Key Trading Partners and Strategic Importance: It has diverse trading partners worldwide, from Europe to North America, Africa, and Asia. Its strategic significance lies in its versatility—it can handle various types of cargo, from containers to vehicles and fresh produce.

Context for Businesses: Suppose your business includes mixed cargo or you want versatility in shipping types. In that case, the Port of London could be a valuable part of your logistics strategy, given its ability to deal with an assortment of shipments.

Port of Southampton

Location and Volume: The Port of Southampton is on the south coast of England and handles about 1.9 million TEUs annually.

Key Trading Partners and Strategic Importance: Key trade partners span Europe, North America, and Asia. The port is strategically significant as the UK’s number one port for automotive trade.

Context for Businesses: If your company is in the automotive sector or your shipping requirements include vehicle transport, the Port of Southampton is well-equipped to be a significant part of your logistics approach, given its specialty in automotive trade.

Port of Grimsby and Immingham

Location and Volume: The Port of Grimsby and Immingham are two combined ports on the east coast of England. Together, they handle around 60 million tons of cargo annually, making them the UK’s largest port by tonnage.

Main shipping ports in UK

Port of Felixstowe

Location and Volume: The Port of Felixstowe is located in Suffolk, on the east coast of England. It’s the largest and busiest container port in the UK, handling over 4 million Twenty-Foot Equivalent Units (TEUs) each year.

Key Trading Partners and Strategic Importance: Trade partners include Europe, North America and Asian markets. Beyond its volume, the port’s strategic importance lies in its state-of-the-art terminal—The North Rail Terminal—which significantly increased the port’s rail capacity.

Context for Businesses: If you’re looking to penetrate European and Asian markets, the Port of Felixstowe, with its modern facilities and access to main shipping lanes, can play a critical part of your expansion strategy.

Port of London

Location and Volume: The Port of London is along the Thames River, in the south east of England. The port handles around 50 million tons of cargo annually, making it the second-largest in the UK.

Key Trading Partners and Strategic Importance: It has diverse trading partners worldwide, from Europe to North America, Africa, and Asia. Its strategic significance lies in its versatility—it can handle various types of cargo, from containers to vehicles and fresh produce.

Context for Businesses: Suppose your business includes mixed cargo or you want versatility in shipping types. In that case, the Port of London could be a valuable part of your logistics strategy, given its ability to deal with an assortment of shipments.

Port of Southampton

Location and Volume: The Port of Southampton is on the south coast of England and handles about 1.9 million TEUs annually.

Key Trading Partners and Strategic Importance: Key trade partners span Europe, North America, and Asia. The port is strategically significant as the UK’s number one port for automotive trade.

Context for Businesses: If your company is in the automotive sector or your shipping requirements include vehicle transport, the Port of Southampton is well-equipped to be a significant part of your logistics approach, given its specialty in automotive trade.

Port of Grimsby and Immingham

Location and Volume: The Port of Grimsby and Immingham are two combined ports on the east coast of England. Together, they handle around 60 million tons of cargo annually, making them the UK’s largest port by tonnage.

Main shipping ports in Oman

Port of Salalah

Location and Volume: Located on the Arabian Sea in Southern Oman, the Port of Salalah is essential for its direct access to major East-West shipping lanes, with a shipping volume of over 4 million TEU.

Key Trading Partners and Strategic Importance: It serves as an integral trade link between the Middle East, Indian subcontinent, and the Far East, with key trade partners including China, UAE, and India. Its geographic location and depth make it strategically important for ultra-large container vessels.

Context for Businesses: If you’re looking to expand your reach to the emerging markets of the Middle East and South Asia, the Port of Salalah may be a vital part of your shipping plan, given its capacity to handle large shipments and its free trade agreement with the USA.

Port of Sohar

Location and Volume: Situated in the Al Batinah region, the Port of Sohar is essential for being a major industrial and free trade zone, with a shipping volume of over 1 million TEU.

Key Trading Partners and Strategic Importance: The port boasts of a diverse trade portfolio with key partners in China, UAE, India, and several others. Its strategic importance lies in its global shipping connectivity and proximity to the Middle East and European markets.

Context for Businesses: If you’re thinking of setting up an industrial or manufacturing unit, the Port of Sohar and its free trade zone can provide significant value for importing machinery and exporting finished goods.

Port of Duqm

Location and Volume: The Port of Duqm, located in central-eastern Oman, plays a crucial role due to its strategic location with access to the Arabian Sea and Indian Ocean, handling around 2.5 million metric tons of cargo.

Key Trading Partners and Strategic Importance: Its main trading partners include India and several other countries from the GCC. Its strategic importance lies in the redevelopment project, transitioning it from a fishing town to a key industrial and shipping center.

Context for Businesses: If you’re planning to enter new markets in the Arabian Peninsula, the rapidly developing Port of Duqm, with its increasing shipping and industrial capabilities, might be an essential part of your logistics strategy.

Should I choose FCL or LCL when shipping between UK and Oman?

Embarking on a sea freight journey from the UK to Oman? Your choice of shipping method – Full Container Load (FCL) or Less than Container Load (LCL), also known as consolidation, might seem like a minor detail, but it’s a pivotal decision. It directly influences your shipping costs, delivery timelines, and the overall success of your operations. This section will delve into the differences between these two sea freight options, equipping you with the knowledge to tailor your shipping strategy to your specific needs. Let’s set sail on this educational voyage!

Full container load (FCL)

FCL, or Full Container Load, is a term used in fcl shipping when you reserve an entire container (20'ft or 40'ft) exclusively for your goods. The main advantage? Cost-effectiveness for high volume cargo and enhanced safety as the fcl container remains sealed from the origin to the destination.

Utilize FCL when your cargo volume exceeds 13/14/15 CBM. This is roughly equivalent to half the capacity of a standard 20'ft container.

Consider this: You're exporting machinery parts from Sheffield to Muscat. The parts weigh 15 CBM, so booking an entire container would maximize cost savings and ensure your parts remain untouched during transit - giving peace of mind knowing your cargo will arrive safely.

Lastly, the cost implications; an fcl shipping quote can seem hefty up front. However, if you're shipping voluminous cargo, the cost per unit drastically drops, making it cheaper than if you'd opted for LCL (Less Cargo Load). Always verify pricing for the 20'ft and 40'ft container options, to optimize your shipping expenses.

Less container load (LCL)

Definition: Less than Container Load (LCL) shipping refers to a method of cargo transportation where items from several shippers are combined to fill a single container. This offers a cost-effective solution for smaller shipments, as you only pay for the space your goods occupy within the container.

When to Use: LCL is the logical choice when shipping smaller loads, particularly when your cargo volume is less than 13, 14, or 15 cubic meters (CBM). It provides flexibility in that you don't need to wait until you have enough goods to fill an entire container.

Example: Consider a UK based manufacturer exporting cogs to a machinery company in Oman. If the shipment only covers 10 CBM out of a possible 20 CBM (standard size container), LCL shipping allows the manufacturer to pay only for the 10 CBM, sharing the remaining space - and costs - with other businesses.

Cost Implications: On a per CBM basis, LCL freight could be pricier than Full Container Load (FCL) shipping. However, it becomes cost-efficient if the volume of goods is low. Moreover, you save additional warehouse storage costs as you can ship your goods as and when they are ready. Thus, understanding the nuances of LCL shipment can translate to notable savings in your logistics budget.

Hassle-free shipping

Streamlining your cargo shipping between the UK and Oman, DocShipper stands out as a stellar freight forwarder. Our specialized team of ocean freight experts analyze key factors like cargo type, volume, and urgency. This careful evaluation promises a seamless transit, be it through consolidation shipping or full container load. Fret not about the complexities, as our mission is to demystify cargo shipping for your business. Ready to make international shipping straightforward as ever? Request a free estimate today.

Shipping your goods by sea freight from the UK to Oman typically takes between 20 to 30 days. That’s an average time, but remember that exact timescales can vary based on factors like the specific ports used, the weight, and the nature of the goods being transported. For instance, heavy machinery will require separate shipping arrangements than perishable goods. For a more precise quote tailored to your specific shipment, it’s best to get in contact with a reliable freight forwarder like DocShipper.

Here’s an example of how average transit times might look between key ports in the UK and Oman:

| From (UK) | To (Oman) | Avg. Transit Time (Days) |

| Port Of Felixstowe | Port Of Sohar | 23 |

| Port Of Felixstowe | Port Of Salalah | 21 |

| Port Of Southampton | Port Of Sohar | 23 |

| Port Of Southampton | Port Of Salalah | 21 |

*Please note that these times are an average and individual shipments may vary.

How much does it cost to ship a container between UK and Oman?

Understanding the cost to ship a container from UK to Oman is essential for your planning. Ocean freight rates are influenced by numerous factors, making it tricky to give an exact shipping cost. Everything from Point of Loading, Point of Destination, chosen carrier, nature of goods, to pesky monthly market fluctuations can affect the final price. As such, you’ll find an extensive range of shipping rates per CBM. Don’t fret – our shipping specialists are ever-ready to navigate these variables. They’ll work closely with you, quoting on a case-by-case basis to ensure you get the best deal possible.

Special transportation services

Out of Gauge (OOG) Container

Definition: Out of Gauge (OOG) containers are specifically designed for cargo that exceeds the dimensions of a standard shipping container.

Suitable for: OOG containers are ideal for larger, oversized items that won’t fit into regular containers.

Examples: This includes any Out of gauge cargo like industrial machinery, boats, or large automotive parts.

Why it might be the best choice for you: If your items are too large for standard containers but can be safely exposed to environmental conditions, an OOG container would be the most fitting choice.

Break Bulk

Definition: Break bulk is the term used when cargo must be loaded individually, and not in shipping containers. It’s an effective method for cargo that’s too large or heavy to fit in a container.

Suitable for: Goods that are heavyweight, oversized, or awkwardly shaped, that cannot be transported efficiently using conventional means.

Examples: Machinery parts, pipelines, yachts, and windmills make ideal candidates for break bulk shipping.

Why it might be the best choice for you: If your cargo doesn’t fit in standard containers and requires special handling during loading and unloading, the break bulk option is likely best for you.

Dry Bulk

Definition: Dry bulk refers to the transportation of homogeneous cargo, loaded directly into the ship’s hold in large quantities.

Suitable for: Solid raw materials in large, loose quantities that can be shoveled or scooped, known as loose cargo load.

Examples: Commodities such as coal, grain, or metal ores are commonly transported as dry bulk.

Why it might be the best choice for you: If you’re looking to transport large quantities of loose cargo load, Dry bulk shipping is the most efficient method.

Roll-on/Roll-off (Ro-Ro)

Definition: Roll-on/Roll-off (Ro-Ro) freight involves vehicles or machinery on wheels that are rolled on and off a specialized ro-ro vessel.

Suitable for: Cars, trucks, trailers, mobile machinery, or any goods that can roll onto the ship under their power or with assistance.

Examples: Automobiles, trucks, semi-trailer trucks, trailers, and railroad cars are all viable for Ro-Ro shipping.

Why it might be the best choice for you: If you’re shipping wheeled cargo that can roll onto the ship, a ro-ro vessel would be perfect for your needs.

Reefer Containers

Definition: Reefer containers, or refrigerated containers, are shipping containers that feature inbuilt refrigeration systems to transport temperature-sensitive cargo.

Suitable for: Goods that need to be transported at a constant temperature, like fresh food, pharmaceuticals, or certain chemicals.

Examples: Meat, seafood, fruits, dairy products, and pharmaceutical products are some items transported in reefer containers.

Why it might be the best choice for you: If you need to maintain a specific temperature level for your goods during transportation and delivery, a reefer container would be the best option for you.

Remember, different cargo has different requirements. If you’re still unsure what suits your needs best, DocShipper offers expert guidance to navigate shipping options between the UK and Oman. Get a free shipping quote in less than 24h and explore suitable solutions for your business.

Air freight between UK and Oman

Flying your goods from the UK to Oman? There’s no quicker way than air freight– it’s the Usain Bolt of international shipping. Think fast, efficient, and surprisingly cost-effective when your cargo is compact and precious. Perfect for jewellery, high-tech gear, or special chocolates to sweeten the deal at your next meeting in Muscat!

However, unwary shippers often let bills skyrocket like an unplanned space mission by neglecting essential factors for air freight calculation. Misjudging the weight formula is a common culprit – like baking without the recipe, your costs can puff up unexpectedly! Knowing the quirks and hacks of air freight can save you from such financial turbulence. Let’s dive deeper in the following section.

Air Cargo vs Express Air Freight: How should I ship?

Unsure whether to opt for air cargo or express air freight for your UK to Oman shipment? In a nutshell, air cargo shares space in a commercial airline but express is the VIP ticket, reserving a dedicated plane only for your goods. This part of our guide will delve into these two shipping options, breaking down the pros and cons to help give clarity to your business’s shipping strategy. Grab a cuppa and let’s demystify your options!

Should I choose Air Cargo between UK and Oman?

Opting for air cargo in your UK-Oman shipping could be a wise decision for you, especially with heavier loads (100/150 kg or 220/330 lbs). Renowned airlines such as British Airways and Oman Air often ensure reliable freight transportation. While cost-effective, you may experience longer transit times due to scheduled flights. But rest assured, these airlines prioritize reliability and budgetary needs. This could be an attractive solution for your international logistics.

Should I choose Express Air Freight between UK and Oman?

Express Air Freight is a swift shipping solution using cargo-only planes. It’s overwhelmingly suitable for packages not exceeding 1 CBM or between 100 and 150 kg, making it the optimal choice for lighter, smaller shipments. Renowned couriers like FedEx, UPS , and DHL offer this specialised service, boasting speed and reliability. If your cargo from the UK to Oman fits these parameters, opting for express air freight could definitely be a savvy move, merging speed with efficiency for your intercontinental shipment.

Main international airports in UK

Heathrow Airport

Cargo Volume: Heathrow is the busiest airport in Europe, handling over 1.7 million metric tons of cargo each year.

Key Trading Partners: Major trading partners include the USA, Germany, China, Hong Kong, and Japan.

Strategic Importance: Being the busiest airport in the UK, Heathrow acts as a crucial hub for global cargo movements, especially for businesses located in London and southern England.

Notable Features: This airport is home to a World Distribution Centre, offering freight-forwarding services and bonded warehousing.

For Your Business: If your business relies on fast, efficient connections to markets in Europe, North America, and Asia, Heathrow’s frequency and diversity of flights make it a strong option for your cargo shipping needs.

Manchester Airport

Cargo Volume: Manchester airport handles over 120,000 tons of import and export freight and mail annually.

Key Trading Partners: Significant trading partners include the USA, Germany, Spain, UAE, and China.

Strategic Importance: As the third largest airport in the UK, it’s of vital importance to Northern England’s import and export industries.

Notable Features: The airport’s World Freight Centre is a dedicated space for freight handling.

For Your Business: If your business operates in the North of England, Manchester offers a logistical advantage due to its geographical location and strong global connectivity.

East Midlands Airport

Cargo Volume: East Midlands Airport process over 320,000 tons of cargo annually.

Key Trading Partners: Major trading partners include the EU, especially France, Germany and Spain, as well as the USA and UAE.

Strategic Importance: It is the UK’s most important airport for cargo traffic after Heathrow, handling e-commerce shipments for companies like Amazon, Royal Mail, and DHL.

Notable Features: The airport operates a 24/7 cargo operation and hosts a ‘Cargo West’ apron dedicated to freight aircraft.

For Your Business: If you’re engaged in e-commerce and need late-night freight capabilities, this airport’s 24/7 operations can help meet your shipping deadlines.

Stansted Airport

Cargo Volume: Roughly 250,000 tons of cargo are processed each year at Stansted.

Key Trading Partners: Top trade partners include the USA, Hong Kong, China, Spain, and UAE.

Strategic Importance: Located just outside London, Stansted serves as a crucial logistics hub for air-freight operations in the South of England.

Notable Features: The airport features a dedicated Cargo Centre and is a leading base for several major cargo airlines.

For Your Business: Your company could benefit from Stansted’s proximity to London and the southeast, its modern facilities, and its high frequency of cargo flights.

Gatwick Airport

Cargo Volume: Processing around 100,000 tons of cargo each year, Gatwick handles less volume than the other airports on this list, but still plays an important role.

Key Trading Partners: Principal trading partners are the EU, US, UAE, and China.

Strategic Importance: Although smaller, Gatwick plays a sentinel role through its connections with emerging markets.

Notable Features: Gatwick boasts extensive road and rail connections ensuring easy access to South-East and Midland regions of England.

For Your Business: If you’re servicing the South East and Midlands or looking to connect with emerging markets, consider Gatwick in your shipping strategy.

Main international airports in Oman

Muscat International Airport

Cargo Volume: Over 200,000 tonnes per annum

Key Trading Partners: UAE, Qatar, India, China, UK

Strategic Importance: As the largest airport in Oman, Muscat International offers connectivity to Asia, Africa, and Europe. It is a significant hub for Oman Air.

Notable Features: The airport has an exclusive air cargo terminal, regulated by Transom Handling. It offers fast, efficient, and secure handling for a wide range of goods.

For Your Business: Muscat International’s extensive flight network and strategic location make it a good choice for businesses shipping internationally. The specialized cargo terminal ensures handling tailored to specific cargo needs.

Salalah International Airport

Cargo Volume: Around 15,000 tonnes annually

Key Trading Partners: Qatar, UAE, Saudi Arabia, India, the Netherlands

Strategic Importance: Salalah International Airport supports Oman’s thriving agricultural exports, and serves as a strategic point for cargo transit to Africa, the Middle East, and Europe.

Notable Features: The airport possesses advanced cargo handling facilities and is home to free zones, providing tax benefits and encouraging transshipment.

For Your Business: Salalah International can be a strategic shipping point for perishable goods. Additionally, the free zones can provide benefits such as customs tax exemptions, making it an economically attractive option.

Sohar International Airport

Cargo Volume: N/A (The airport is primarily used for cargo, but exact figures are not publicly available)

Key Trading Partners: UAE, Qatar, India

Strategic Importance: Being within the Sohar Industrial Port area, the airport is perfectly positioned for businesses operating in or around the industrial complex.

Notable Features: Private and dedicated cargo flights can be arranged, providing flexibility for your shipping operations.

For Your Business: If you’re working in the Sohar Industrial Port area, using Sohar International Airport can make your operations more efficient with less ground transport time.

How long does air freight take between UK and Oman?

Air freight between the UK and Oman typically takes between 5-8 days. However, do remember that this transit time can vary significantly based on factors such as the specific airports involved, the weight of the shipment, and the type of goods being transported. For the most accurate estimates, consulting with a well-established freight forwarder like DocShipper is the right approach.

How much does it cost to ship a parcel between UK and Oman with air freight?

Air freight cost between the UK and Oman can range widely; let’s say, around £2 to £15 per kg. The exact rate isn’t easily generalized due to varying factors including distance from departure and arrival airports, parcel dimensions and weight, and the nature of goods. Rest assured, our well-tailored, case-by-case quotations ensure you receive the best rates. We excel in crafting shipping solutions that cater to your unique needs. Should you require a quote, simply contact us. Receive it within 24 hours, free of charge.

What is the difference between volumetric and gross weight?

Gross weight is the actual physical weight of an item, including all packaging and materials. Volumetric or dimensional weight, on the other hand, is a pricing method which accounts for the overall size of a shipment, not just its actual weight.

To calculate the gross weight in air freight shipping, you just weigh the shipment in its packaging. Hence, if a shipment weighs 60 kg, it’s 60 kg gross weight (or 132.28 lbs).

Volumetric weight is calculated differently. In Air cargo, it’s calculated by multiplying the length, width, and height of your shipment (in centimeters) and dividing by 6000. Here’s an example: Say you have a shipment that’s 60 cm long, 50 cm wide and 40 cm high. This would equal a volumetric weight of 605040/6000 = 20 kg (or 44.09 lbs).

In Express Air Freight, the calculation is made under a slightly different factor, the shipment’s dimensions are divided by 5000. In our previous scenario, this calculation would result in a volumetric weight of 605040/5000 = 24 kg (or 52.91 lbs).

Understanding gross and volumetric weight is important because the cost of the freight is determined based on the higher of these two. Therefore, a lightweight but bulky item could cost more to ship than a smaller, heavier item.

Door to door between UK and Oman

Door to door shipping, an all-inclusive service where goods are picked up from a location in the UK and delivered seamlessly to their final destination in Oman, embodies efficiency. This convenience-focused service mitigates logistical headaches, saving you precious time and resources, and is particularly beneficial for this UK-Oman corridor. Now, let’s dive into the specifics.

Overview – Door to Door

Transporting goods from the UK to Oman can be challenging, encompassing a maze of administrative procedures and customs clearance. Door to Door shipping circumvents these pressures, providing a smooth, hassle-free journey for your freight. Despite potentially being pricier, the unparalleled convenience and time-savings that DocShipper’s most sought-after service offers far outweigh the cost. Imagine: your goods picked up, transported, cleared through customs, and delivered directly to their destination – it’s logistics made easy, putting your mind at ease. This stress-free solution enables you to focus on what truly matters – your business.

Why should I use a Door to Door service between UK and Oman?

Ever thought about magic teleportation for your cargo from the UK to Oman? Well, we don’t quite have fairy dust, but our Door to Door service is the next best thing! Here are five reasons why you should consider it.

1. Easier logistics: Door to Door service is your all-in-one stress-buster. We pick up your goods and manage everything, from start to finish, so you don’t have to.

2. Time is money: Got an urgent shipment? This service excels in time efficiency. With precise coordination and streamlined process, quick delivery times are a norm, not an exception.

3. Extra TLC: Complex cargo? No problem. With specialized handling and dedicated care, you can ship those odd-shaped or delicate items without a worry.

4. Unwavering convenience: Convenience is king when it comes to Door to Door. Why juggle multiple handlers and carriers when we can manage it all? From trucking to final delivery at your desired destination, we’ve got you covered.

5. Reliability: Above all, reliability sets this service apart. The certainty of your cargo reaching its destination, safe and sound, makes logistics a breeze.

As you can see, Door to Door service is a fantastic balance of care, timing, and convenience – making your shipping journey from the UK to Oman smooth, stress-free, and efficient. It’s almost like that magic teleportation we mentioned earlier. Almost.

DocShipper – Door to Door specialist between UK and Oman

Experience stress-free door-to-door shipping between the UK and Oman with DocShipper. We provide you an effortless A-Z shipping solution, leaving no need for your direct involvement. Our proficiency and expertise in packing, transportation, customs clearance, and various shipping methods ensure seamless service. Each client receives guidance from a dedicated Account Executive. Reach out to us for a free, quick estimate within 24 hours, or connect with our consultants at no charge. Let us handle your shipping, you focus on your business.

Customs clearance in Oman for goods imported from UK

Customs clearance is a critical, albeit complex part of importing goods from the UK to Oman. It involves the payment of potential duties, taxes, quotas, and acquiring any necessary licenses. Missteps or oversights can lead to unexpected costs, or worse, your goods may get stuck in customs. In the following sections, we’ll delve into these complex issues, helping to decode the process and avoid pitfalls. Remember, DocShipper is here to streamline the whole process for goods of any kind and any location. We can provide an estimate for your project. All we need is the origin of your goods, their value, and the HS code. Reach out to our team today, and let’s make your freight forwarding smoother!

How to calculate duties & taxes when importing from UK to Oman?

When importing goods from the UK to Oman, the calculation of duties and taxes involves a blend of key elements. First and foremost, you need to identify the country where the goods were manufactured or produced, known as the country of origin. This is because your import duties are based, to a large extent, on this factor.

Next, you’ll need to determine the Harmonized System Code (HS Code) for your products. This universal coding system helps to categorize your goods for customs purposes and plays a critical role in determining applicable tariffs. Alongside this, calculating the customs value of your goods is necessary. This number represents the total cost of your goods, including the purchase price and shipping costs.

Once you have gathered all these necessary components, knowing the applicable tariff rate for your goods based on their HS Code is essential in calculating customs duties. There might be other taxes and fees that apply to your products, so it’s important to account for these as well.

Keep in mind, every detail matters in this complex process. Accurate estimation will help ensure smooth customs clearance and avoid unforeseen costs. Remember, the key to successful importing starts at the very beginning: identifying where your goods were manufactured or produced.

Step 1 – Identify the Country of Origin

Determining your product’s country of origin is step one to unravel the duties and taxes puzzle.

Firstly, it’s essential because trade agreements between the UK and Oman directly impact the customs duties. These pacts could mean deducting a percentage or complete exemption from duties. Protecting their local businesses, every nation has unique import restrictions that vary depending on the country of origin. While the UK and Oman enjoy liberal trade agreements, identifying your goods’ source ensures compliance with these restrictions.

Secondly, several goods have different duty rates based on origin. This distinction helps maintain international trade balance.

Thirdly, international disputes can affect trade deals and rates. Up-to-date knowledge of the nation of origin safeguards against sudden cost changes.

Fourthly, for some parts, nation-based duties get levied, impacting your final product cost if it contains these components.

Lastly, accurate paperwork is less liable to customs checkpoints or delays. Designating the correct country swiftly eases your goods through customs, avoiding costly hold-ups.

Remember, a Harmonized System Code provides precise information on customs duties. But, without knowing your goods’ origin country, you won’t find the correct code.

Remember, this all starts with your surety of your product’s origin. It paves the way for a hassle-free, cost-effective import process.

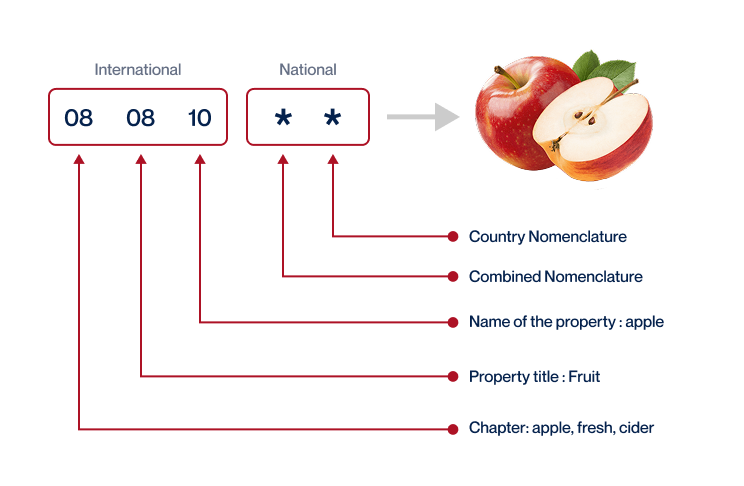

Step 2 – Find the HS Code of your product

Harmonized System (HS) Code is a standardized system of names and numbers designed to classify traded products, used by customs authorities around the world. This code is critical as it determines the tariffs, duties, and regulations applied to the product.

Often the easiest way to find the HS code for your cargo is to ask your supplier. They are typically knowledgeable about the products they’re exporting and will be familiar with the associated rules and regulations.

In case you can’t access this information from your supplier, our guide provides simple steps to find this vital data:

1. Navigate to the Harmonized Tariff Schedule online tool.

2. Search for your product using its common name.

3. Look for the ‘Heading/Subheading’ column in the search results.

Keep in mind that the HS codes are typically listed in the ‘Heading/Subheading’ column.

Please note that accuracy is paramount when determining the HS Code. Any mistakes can lead to clearance delays and other potentially costly consequences such as fines.

To assist you further, we’ve included an infographic below on deciphering the HS Code’s structure. Here’s an infographic showing you how to read an HS code.

Step 3 – Calculate the Customs Value

You might be tempted to think that the ‘customs value’ is simply what you paid for your products. But it’s a bit more complicated. Customs value is the CIF (Cost + Insurance + Freight) value, not just the product price. That means it encompasses the total shipping cost from the UK to Oman, which comprises the actual price of your goods (in USD), international shipping costs (in USD), and any insurance costs (also in USD). Let’s take an example. If you bought a product for $100, spent $30 on freight, and $20 on insurance, your customs value would be $150 ($100+$30+$20). This is the figure that Oman customs will use to calculate relevant duties and taxes upon entry. Understanding this concept is crucial for accurate cost estimation.

Step 4 – Figure out the applicable Import Tariff

An import tariff is essentially a tax imposed on goods crossing international borders. In the case of Oman, they utilize a Harmonized System (HS), an international standard for categorizing traded products.

To determine how much import tariff you’ll need to pay when shipping goods from the UK to Oman, peer into the UK’s Trade Tariff tool:

1. Begin by identifying the HS code of your product; let’s use 610910 – T-shirts, singlets, and other vests of cotton.

2. Visit the UK’s Trade Tariff tool to find the product’s tariff rate. In this example, the tool might display a rate of 5%.

For practical illustration, if your insurance and freight (CIF) costs equate to $1000, your import tariff is calculated as follows:

Tariff = CIF value Tariff rate

= $1000 5%

= $50

Hence, you’ll be required to pay an import duty of $50. Knowledge of your product’s HS Code and using the right tools enable you to anticipate the cost implications of shipping to your chosen destination. In this example, you’d know ahead of time to account for an additional $50 in costs when shipping T-shirts to Oman from the UK.

Step 5 – Consider other Import Duties and Taxes

Be aware that apart from the standard tariff rate for importing goods from the UK to Oman, several other duties and taxes might apply, depending on your products’ nature and origin.

For instance, specific goods may incur an excise duty, which is a tax on items like alcohol and tobacco. Imagine you’re importing a wine shipment worth $10,000. With an excise duty of, say, 50%, you’d be shelling out an additional $5000 for this specific tax.

There’s also the possibility of anti-dumping taxes. These aim to protect domestic industries from foreign competition selling items below market price. Suppose your imported electronics are flagged for anti-dumping; an extra duty of around 10% ($1000 on a $10,000 shipment) could apply.

The standard Value Added Tax (VAT) rate in Oman is currently 5%. Importing goods worth $10,000 would mean an additional $500 paid for VAT.

Keep in mind these are just examples, meant to give an insight; the actual rates can vary widely. No matter whether it’s excise duties, anti-dumping taxes, or VAT—your freight forwarding partner can help streamline the process and apply the correct duties and taxes, alleviating any potential headaches.

Step 6 – Calculate the Customs Duties

Calculating customs duties when importing goods from the UK to Oman involves understanding different financial elements. Let’s break down those elements and explain them with three real-world examples.

First off, we have the ‘customs value.’ Imagine you are importing goods worth $8000; the customs value here is $8000. Oman generally levies a 5% customs duty. Your customs duty, in this case, would be $400 (5% of $8000).

Secondly, there’s ‘Value Added Tax’ or VAT, which Oman sets at 5%. Suppose your goods are also subject to VAT. With a customs value of $8000, your VAT is $400 (5% of $8000), making the total cost $8800 ($8000 + $400 customs duty + $400 VAT).

Thirdly, consider ‘anti-dumping taxes’ and ‘excise duty.’ If you import a good under these two conditions, and let’s say an anti-dumping tax of 10% and an excise duty of 15% apply, you’ll have extra costs. Your total cost would be $10200 ($8000 + $400 customs + $400 VAT + $800 anti-dumping + $600 excise duty).

Navigating these calculations can be tricky, but don’t worry! DocShipper’s customs clearance services have got you covered. We’ll ensure you don’t overpay and handle all worldwide customs clearance steps, providing a free quote within 24 hours. Don’t wait, contact us now!

Does DocShipper charge customs fees?

While DocShipper, a customs broker in the UK and Oman, charges for customs clearance services, this doesn’t include customs duties. These duties are independent charges that go directly to the government. Consider our fee as an administrative cost for streamlining your shipments and navigating intricate paperwork. To ensure transparency, we’ll provide documents from the customs office itself, proving you’re only paying what’s rightfully due. This way, businesses can confidently track their shipment expenses. So it’s like paying someone to do your taxes, while your tax due still goes to the taxman!

Contact Details for Customs Authorities

UK Customs

Oman Customs

Official name: The Royal Oman Customs

Official website: http://www.customs.gov.om/

Required documents for customs clearance

Ever been stumped by customs clearance paperwork? We’ve got you covered. In this guide, we’ll break down the must-have documents – the Bill of Lading, Packing List, Certificate of Origin, and Documents of conformity (CE standard) – making your journey through customs a breeze.

Bill of Lading

Shipping goods from the UK to Oman? Pay close attention to your Bill of Lading. Critical in international trade, it moves ownership from shipper to receiver. Picture it like a baton in a relay race – when handed over, your goods officially belong to the recipient. Nowadays, most prefer an electronic or telex release. Why? It’s faster, reduces paper handling, and removes the need for original documents. Plus, with AWB (Air Waybill) for air cargo, you’ve got added versatility for different transport modes. Remember, the smoother your paper trail, the quicker and more efficient your customs clearance can be. Keep these in hand, and you’re already one step closer to successful shipping.

Packing List

Shipment from the UK to Oman? The Packing List is your loyal companion. Think of it as the DNA of your cargo – it tells customs what’s inside your ‘transit body’, including an exhaustive record of each item’s quantity, description, and weight. This isn’t just a document; it’s your passage through customs. If there’s a discrepancy between what’s inside the cargo and what’s on the Packing List, expect delays – and we all know time is money in shipping. Whether by sea or air, the accuracy of the Packing List is paramount. Let’s say you’re shipping auto parts: If your list accurately records ’20 car engines, 40 brake pads sets, 10 exhaust systems…’ and such, smooth transition lies ahead. But if something’s amiss? Brace yourself. There’s no understating the role of the Packing List in your UK-Oman shipping journey.

Commercial Invoice

In your shipping journey from UK to Oman, the Commercial Invoice is an indispensable document. It’s your declaration of the goods’ details to customs, stating product description, quantity, value, and purchase terms. Importantly, this information crosses over into your other shipping documents, thus it must be consistent to avoid discrepancies or delays.

One tip is to always stipulate the currency on the invoice, like USD or OMR. Misunderstandings about currency can lead to misclassifications in duty calculations. For example, if you’re shipping specialized machinery parts valued at £10,000, the correct identification could save you from overpaying duties.

Keep in mind, efficiency at Oman customs often hinges on your Commercial Invoice’s clarity. So, give it the attention it deserves. Review it for accuracy and harmony with your other documents to streamline the journey of your shipment across borders.

Certificate of Origin

When shipping goods from the UK to Oman, a Certificate of Origin (CoO) goes beyond just a piece of paper–it’s a crucial tool that can help you navigate the customs clearance landscape. It provides evidence of your item’s manufacturing origins, whether it was a car made in Birmingham or a case of Scottish whisky. Any mistake could invite unwelcome delays or costs, so ensure the country of manufacture is spot on. This certificate might also unlock preferential customs duty rates, reducing your shipping costs and strengthening profitability. Remember, well-prepared documentation can be the difference between a smooth ride and a logistics nightmare. So, your CoO? It’s more than a certificate, it’s a strategic advantage.

Certificate of Conformity (CE standard)

If you’re shipping goods from the UK to Oman, securing a Certificate of Conformity (CE standard) is crucial. This document proves that your goods comply with the stringent safety, health, and environmental protections set by the European Economy Area (EEA). Although the CE mark is different from quality assurance – it’s about safety and compliance, not necessarily product quality. Yet, remember, the UK left the EU, so the UKCA (UK Conformity Assessed) marking is the new requirement in the UK, similar to the CE standard. If your products are targeting both the UK and EEA markets, they would need both CE and UKCA markings. Comparatively, in the US, similar standards are upheld with the FCC Declaration of conformity. Key tip: Always validate your goods require this marking and procure it before shipping, or risk border delays.

Your EORI number (Economic Operator Registration Identification)

If you’re planning to ship goods between the UK and Oman, the EORI (Economic Operator Registration Identification) number is an important document. Post-Brexit, while the UK isn’t part of the EU, British businesses need an EORI number beginning with ‘GB’ for trading goods with non-EU countries as well. This unique ID is crucial for customs to identify you and track your consignments, thereby avoiding any unnecessary delays. To get your EORI, you’ll need to apply online at the UK Government website. Remember, it’s a vital piece of your shipping puzzle – don’t leave the port without it!

Get Started with DocShipper

Prohibited and Restricted items when importing into Oman

Figuring out what goods you can’t ship to Oman can be a real headache, right? Bypass those restrictions and dodge potential fines with our comprehensive guide on prohibited items. Let’s sort this process out together.

Are there any trade agreements between UK and Oman

Yes, there is a significant trade agreement between the UK and Oman – the UK-Oman Free Trade Agreement (FTA), which has been active since 1st January 2021. This brings benefits like tariff-free trade on all industrial goods and preferential tariff treatment for agricultural goods. Currently, efforts are ongoing to further enhance trade relationships, including infrastructure projects like Duqm port, designed to improve maritime trade. This FTA and such initiatives can provide your business with great opportunities for smoother, cost-efficient shipping between these two nations.

UK – Oman trade and economic relationship

The UK-Oman trade relationship, dating back to the 17th century, has been marked by mutual respect and economic growth. In recent years, this relationship has flourished with bilateral trade hitting £3.4 billion in 2023. Oil and gas dominate Oman’s exports to the UK, while mechanical appliances, cars, and pharmaceutical products form the bulk of the UK’s exports. The 2019 UK-Oman Joint Venture (JV) in the oil sector accelerates the growth, while the 2020 Joint Economic and Trade Committee (JETCO) agreement enhances bilateral trade ties. Diversifying investments are on the rise too, with Oman’s sovereign wealth fund, the State General Reserve Fund (SGRF), investing in several sectors in the UK, showcasing a broadening economic landscape. UK investments in Oman, meanwhile, primarily channeled into the Duqm free zone, reached £ 3billion in 2023, signifying deepening economic ties. With an intertwined history and shared economic interests, this robust partnership continues to shape the trade landscape between the UK and Oman.

Your first steps with DocShipper

Additional logistics services

Warehousing

Seeking robust warehousing in Oman or the UK? It's a real headache, isn't it? Don't underestimate the need for the right temperature control - it can make all the difference for goods like chocolates or pharma products. We know it can be overwhelming, but we're here to guide your business. More info on our dedicated page: Warehousing.

Packing

When shipping goods from UK to Oman, ensuring proper packaging is paramount. This can make the difference between your products reaching safely or incurring damage. Trust in our network of reliable agents to expertly cater your packaging needs – whether it's delicate porcelain or bulky machinery. More info on our dedicated page Freight Packaging

Transport Insurance

Transporting goods doesn't have to feel like walking on eggshells, especially compared to unpredictable fire insurance. To prevent unpleasant surprises, consider Cargo Insurance, a lifeline that guards against transport risks. Remember that container that got lost at sea? Or that shipment damaged during transit? These instances underline the critical security blanket Cargo Insurance provides.

Household goods shipping

Moving from the UK to Oman with personal items? It's a breeze. Whether it's your grandmother's vintage piano or a set of delicate china, we get it there safely. Professional care meets flexibility as we handle everything, even the biggest, most fragile pieces. See how at Shipping Personal Belongings.

Procurement in Thailand

Engaging in international trade between the UK and Oman? Let us simplify it for you. DocShipper manages all your sourcing and manufacturing needs - from finding suppliers in Asia and East Europe to the nth detail of procurement. We help make sense of the language barriers and procedural intricacies. Just like we did for 'Company X', your supply chain can become a breeze too. Curious about how it all works? Discover more on our Sourcing services .

Quality Control

Quality control can make or break your UK-Oman shipping journey. Think of a vibrant rug from Oman: you expect rich, flawless hues. That's where our top-notch product inspections step in, testing color fastness and verifying dimensions before shipping, ensuring impeccable pieces. Or imagine shipping British tea to Oman: our teams scrutinize moisture levels and packaging to maintain freshness.

Conformité des produits aux normes

Shipping your goods can be a breeze, or a bottleneck if they don't meet regulatory standards. Not to worry, our Product Compliance Services are specially designed to understand these complex rules. We'll run lab tests to certify your products for compliance, ensuring a smooth delivery.