Freight Shipping between UK and Mexico | Rates – Transit times – Duties and Taxes

Ever try to smuggle a crumpet into a salsa party? When it comes to shipping freight from the UK to Mexico, the process might feel equally baffling – especially if you're grappling with understanding rates, transit times, and the intricacies of customs regulations. Our comprehensive guide is designed to demystify this journey, diligintly explaining different freight options whether by air, sea, road or rail, illuminating the shadows of customs clearance, duties and taxes, and offering solid advice tailored exclusively to the needs of businesses. We’ll arm you with the knowledge to confidently navigate the challenges of international logistics. If the process still feels overwhelming, let DocShipper handle it for you! We're here to streamline your shipping journey, from doorstep to destination, transforming challenges into success stories for businesses like yours!

Which are the different modes of transportation between UK and Mexico?

The UK and Mexico, two nations separated by land and sea - quite a stretch! This distance necessitates smart decisions about transportation. Air travel leaps out as a swift choice; nothing beats flying over thousands of miles. For the budget-conscious, sea freight is a solid contender, like a dependable tortoise winning a race slow and steady. Land transportation? That's a no-go. Multiple borders and a long distance would be like weathering a storm in a teacup. The key here? Pairing your unique shipping needs with the perfect transport option, just like matching the right key with the right lock. Never has geography played such a vital role in logistics!

Need help with your shipment?

Need assistance with your shipment? Dont hesitate to contact us even for a simple question. Choose the option that suits you

Live chat with an expert Chat on WhatsApp Free Quote 24hHow can DocShipper help you

Sea freight between UK and Mexico

Ocean transportation bridges the gap between UK and Mexico, two nations whose bustling trade partnership thrives on goods ranging from car parts to tequila. UK’s major ports like Felixstowe and London Gateway to Mexico’s vibrant hubs in Veracruz and Manzanillo serve as significant lifelines, facilitating the secure flow of high-volume cargos. Indeed, while sea freight isn’t the fastest kid on the block, it’s the sturdy mule – economical and reliable for hauling substantial loads.

Now, let’s be honest: shipping between these nations isn’t always smooth sailing – paperwork snags, complex regulations, and container choices can often befuddle shippers. But, fear not; navigating such complexities can be simplified. Imagine the process like assembling a flat-pack furniture; a daunting task, yet with the right blueprint, things fall into place. This chapter unfolds this blueprint, proffering strategies to sail past the common challenges, and helping you master the art of sea shipping between the UK and Mexico.

Main shipping ports in UK

Port of Felixstowe

Location and Volume: Located on the East coast of England, the Port of Felixstowe is the UK’s busiest container port reaching a volume of over 4 million TEU annually.

Key Trading Partners and Strategic Importance: As a vital inflection point in the trans-European shipping network, its primary trading partners include the rest of Europe, North America and East Asia. Strategic importance lies in its ability to handle the world’s largest cargo ships due to its deep-water capabilities.

Context for Businesses: If you’re considering trade within Europe or are looking to target the American and Asian markets, the Port of Felixstowe might be a crucial addition to your strategic plan given its large volume of trading.

Port of Southampton

Location and Volume: Positioned on the South Coast, the Port of Southampton maneuvers over 1.9 million TEU annually and specializes in a broad range of cargo fromontainers to vehicles.

Key Trading Partners and Strategic Importance: The port is known for its significant trading ties within Europe, Asia, and the United States. Dutifully, it provides one of the fastet most efficient turnaround times of any UK port.

Context for Businesses: If efficient operations and diverse cargo capabilities are a high priority for your business, the Port of Southampton could be an instrumental component of your logistics strategy.

Port of London

Location and Volume: Spanning the River Thames, the geographic advantage of the Port of London is significant, handling approximately 50 million tonnes of cargo annually.

Key Trading Partners and Strategic Importance: Principal trading partners are Europe, Asia, and Americas, with a particular focus on bulk commodities.

Context for Businesses: If your business is involved with bulk commodities, the Port of London’s specialized capabilities and central location could provide an advantageous opportunity.

Port of Liverpool

Location and Volume: Residing by the River Mersey in the North West of England, the Port of Liverpool processes over 33 million tonnes of goods yearly.

Key Trading Partners and Strategic Importance: Trading links stretch across the globe with main partners being Americas, Asia, and Europe. It’s particularly noteworthy for its extensive warehouse services.

Context for Businesses: If warehouse services and global trading capabilities are key to your business endeavors, the Port of Liverpool may serve a pivotal role in your logistics.

Port of Grimsby & Immingham

Location and Volume: Positioned at the mouth of the Humber, the Port of Grimsby & Immingham is the busiest port by tonnage in the UK, handling over 59 million tonnes per year.

Key Trading Partners and Strategic Importance: Significant trading partners are predominantly European with a strategic focus on ro-ro freight, liquid and dry bulks.

Context for Businesses: If your business specializes in ro-ro freight or bulk commodities, this port’s specific capabilities and partnerships may be strategically beneficial.

Port of Dover

Location and Volume: Nestled in the south-east of England, the Port of Dover moves approximately 13 million passengers and 2.5 million trucks annually.

Key Trading Partners and Strategic Importance: Being the shortest sea crossing between England and mainland Europe, it plays a critical role in European trade.

Context for Businesses: If your focus is on European markets, with a need for fast and frequent crossings, the Port of Dover could significantly streamline your logistics plan.

Main shipping ports in Mexico

Port of Veracruz

Location and Volume: Located on the Gulf of Mexico, Port of Veracruz crucially serves the agricultural and automotive industries. It handles over one million TEU annually, making it one of the busiest ports in Mexico.

Key Trading Partners and Strategic Importance: The United States, Central, and South America are among its primary trading partners. It’s strategically important due to its extensive connection with global maritime routes enabling diversified merchandise flow.

Context for Businesses: If you’re growing your business in the automotive or agricultural sector, the Port of Veracruz could serve as your key entry or exit point in Mexico, given its specialized infrastructure and services for these industries.

Port of Manzanillo

Location and Volume: Located on the Pacific Coast, the Port of Manzanillo is the most productive port in Mexico, handling over 2.8 million TEU.

Key Trading Partners and Strategic Importance: Being the gateway to the Asia-Pacific region, it majorly trades with China, Korea, Japan, and the United States. It holds strategic importance being Mexico’s largest container port.

Context for Businesses: If you’re seeking expansion into Asian markets or the U.S., the Port of Manzanillo could be an integral part of your supply chain due to its large capacity and extensive trans-Pacific networks.

Port of Lazaro Cardenas

Location and Volume: Situated on Mexico’s southwestern Pacific coast, Lazaro Cardenas moves over a million TEU annually.

Key Trading Partners and Strategic Importance: The Port primarily serves Far East Asian countries and holds a unique strategic position in Mexico due to its deepwater facilities capable of accommodating large vessels.

Context for Businesses: If your business deals with large volume shipments to or from Asia, utilizing the Port of Lazaro Cardenas could be strategically beneficial, especially because of its convenience for larger vessels and its rail connection to the U.S.

Port of Altamira

Location and Volume: Located on Mexico’s northeastern coast, the Port of Altamira handles over 700,000 TEU annually.

Key Trading Partners and Strategic Importance: Predominantly serves the United States and European Union and is of strategic importance due to its location and ability to efficiently handle all types of cargo.

Context for Businesses: If you’re importing or exporting a range of cargo to the U.S. or Europe, Altamira provides comprehensive cargo-handling facilities. Moreover, its proximity to major Mexican industrial centers facilitates efficient inland transportation.

Port of Ensenada

Location and Volume: Nestled on Mexico’s Pacific coast, near the U.S. border, the Port of Ensenada manages about 200,000 TEU per year.

Key Trading Partners and Strategic Importance: Primarily serves the United States. Its strategic proximity to the California markets makes it a valuable logistics hub.

Context for Businesses: If your company operates in or targets the Californian market, the Port of Ensenada, with its short sea shipping routes to California, might be an ideal choice for streamlined logistics.

Port of Guaymas

Location and Volume: Located on the Gulf of California, the Port of Guaymas handles about 50,000 TEU annually.

Key Trading Partners and Strategic Importance: Primary trading partners include the United States and Asian countries. This port provides essential economic connections, especially for northern Mexico’s industries.

Context for Businesses: If your operations are based in the Northwestern states of Mexico or if you’re trading with North Asian countries, the Port of Guaymas could aid in consolidating your supply chain due to its location and economic ties.

Should I choose FCL or LCL when shipping between UK and Mexico?

Deciding between a full container load (FCL) or less-than-container load (LCL), also known as consolidation, for your sea freight shipments from the UK to Mexico can significantly sway the balance of your logistics operation. It’s not just about the size of your shipment; your choice directly impacts the cost, delivery timeframe, and overall success of your cargo’s journey. This section will help you grasp the differences between these two options, enabling you to make a choice that fits your specific shipping requirements perfectly. Let’s dive into the details.

Full container load (FCL)

Definition: FCL, or Full Container Load, is a term used in fcl shipping where a shipment occupies a complete container, either a 20'ft or a 40'ft container. The full container is sealed at the origin and remains as is until reaching its destination.

When to Use: If your cargo exceeds roughly 13-15 CBM (Cubic Meter), FCL is the better option. With its high-volume capacity and assurances that your goods remain secure and untouched in the sealed fcl container, it allows for cost and safety efficiency.

Example: For instance, a manufacturer from the UK needing to ship 400 cartons of auto parts together to Mexico, and each carton measures 0.04 CBM, utilizing a 20'ft container (capacity approx. 33 CBM) for a FCL shipment would be optimal.

Cost Implications: It's necessary to factor in the volumetric efficiency brought by FCL when considering cost. It may seem expensive initially when procuring an fcl shipping quote, but when that container is filled to capacity, the per unit price to ship each of those cartons decreases significantly, making FCL shipping a sound financial decision.

Less container load (LCL)

Definition: Less than Container Load (LCL) shipping, also known as consolidation, denotes a freight transportation method where a shipment does not fill an entire container. It's a cost-efficient choice for smaller cargo as it shares the container space and cost with other shipments (LCL freight).

When to Use: It's apt to choose LCL shipment when your cargo is less than 13 to 15 cubic meters (CBM). This provides flexibility for low-volume needs without waiting for enough stock to fill an entire container.

Example: For instance, a small UK company exporting artisanal crafts to Mexico might not have substantial stock. Their average shipment size might be around 10 CBM, making LCL shipping an economical and efficient choice.

Cost Implications: With LCL, you only pay for the space you use, which makes it pocket-friendly for smaller shipments. However, bear in mind that LCL might have extra costs like deconsolidation fees upon reaching Mexico. Still, overall, it's generally less than the cost of shipping a half-empty full container load.

Remember, every LCL shipping quote will vary depending on the freight forwarder, cargo volume, and current market conditions. Always engage a reliable freight forwarder who can negotiate the best price for you.

Hassle-free shipping

Shipping across borders can feel daunting. At DocShipper, we're committed to transforming complexity into simplicity. Our Ocean Freight Experts analyze the volume, size, and urgency of your shipment to help decide between consolidation or a full container. We unpack all the logistics involved, from transport organization to customs clearance. Are you exporting or importing between the UK and Mexico? Save time and cost. Request your free shipping estimation with DocShipper today and experience hassle-free cargo shipping.

The transit time for sea freight between the UK and Mexico averages 18-30 days, a window that considers various influential factors. Depending on the specific sea ports involved, as well as the weight and nature of the goods being shipped, this duration can fluctuate. For an exact quote tailored to your specific needs, we recommend reaching out to a competent freight forwarder like DocShipper.

Now let’s look at average transit times for some of the main freight ports in both countries:

| UK Port | Mexico Port | Average Transit Time |

| London | Veracruz | 18 |

| Southampton | Manzanillo | 23 |

| Liverpool | Altamira | 18 |

| Felixstowe | Lazaro Cardenas | 24 |

*Please note that these are rough estimates and actual shipping times will vary based on numerous factors.

How much does it cost to ship a container between UK and Mexico?

Determining the exact ocean freight rates to ship a container from the UK to Mexico can be akin to unravelling a complex puzzle; varying factors come into play. These include the Point of Loading, Point of Destination, the shipping carrier, the nature of your goods, and even monthly market fluctuations. Consequently, the shipping costs per CBM can vary widely. However, fear not! Our shipping experts excel at this puzzle, working tirelessly on a case-by-case basis to ensure you get the most competitive rates. Rest assured, with us, you’ll witness the blend of expert navigation and optimum costing.

Special transportation services

Out of Gauge (OOG) Container

Definition: Out of Gauge (OOG) Containers are specially designed for cargo that doesn’t fit within the standard shipping container dimensions due to its size and shape. OOG containers have one opening side, enabling easy loading of the Out of gauge cargo.

Suitable for: Large machinery, construction equipment, industrial parts and other heavy-duty items that exceed standard shipping container limitations.

Examples: Large generators, industrial boilers and turbines are classic examples of what may be shipped in an OOG container.

Why it might be the best choice for you: If your business deals with bulky items, oversized or long goods on a regular basis, OOG container is the practical and most economical option.

Break Bulk

Definition: Break Bulk shipping refers to goods that need to be loaded individually and not in containers. These goods are typically grouped on pallets and crated before transportation.

Suitable for: Non-containerized loads, oversized or heavy items, and cargo that isn’t suitably sized or shaped for container shipping.

Examples: Construction materials, machinery components and other non-standardized goods often use break bulk shipping.

Why it might be the best choice for you: Opting for break bulk could be beneficial for your business if your freight doesn’t fit neatly into standard containers.

Dry Bulk

Definition: Dry Bulk shipping is the transportation of loose cargo load like grains, iron ore or coal in large quantities, without packaging, and often poured directly into the vessel’s hold.

Suitable for: Bulk commodities such as grains, coal, cement, ores, or sugar.

Examples: Iron ore being transported from mines to a steel plant, grains shipped to a processing facility.

Why it might be the best choice for you: If your business focuses on handling commodities in large volumes, Dry Bulk shipping, with its ability to handle massive quantities, might be the most effective solution.

Roll-on/Roll-off (Ro-Ro)

Definition: Roll-On/Roll-Off shipping (Ro-Ro) uses vessels equipped with built-in ramps so wheeled vehicles and machinery can easily be driven on and off.

Suitable for: Cars, trucks, trailers, mobile machinery, and anything else that can be rolled on and off the ro-ro vessel.

Examples: Cars being transported from factories to global markets, tractors shipped to overseas dealerships.

Why it might be the best choice for you: A cost-effective solution if you’re dealing with vehicles or wheeled machinery as it allows for easy loading and unloading.

Reefer Containers

Definition: Reefer containers are temperature-controlled containers used to ship perishable goods that need a certain temperature to maintain their quality during the transit.

Suitable for: Foods, pharmaceuticals, flowers and other perishable items requiring refrigerated or frozen transportation.

Examples: Fresh fruits and vegetables, frozen meat or fish, temperature-sensitive medications.

Why it might be the best choice for you: If your business deals in goods that require strict temperature control, then investing in reefer containers would be a wise choice to maintain the optimal quality of your products.

Understanding your shipping needs and choosing the right option plays a significant role in ensuring your goods reach their destination safely and efficiently. If you’re in need of more guidance or a free shipping quote, don’t hesitate to contact DocShipper. We’re committed to helping you navigate the complexities of international shipping, with responses in less than 24 hours.

Air freight between UK and Mexico

When shipping products swiftly from the UK to Mexico, air freight trumps all other options. Think of it as a supercharged delivery system for your fragile porcelain or runway-fashion gears, ensuring speed, safety, and reliability. It’s like your own flash for small, high-value cargo, streaking across the sky while the alternatives crawl on the ground.

But wait, before you recruit the Justice League for your international enterprise, you need to do your homework. Not all superheroes wear capes, but they do cost more. Many shippers falsely estimate shipping costs, using the wrong weight formula like calculating their own BMI, overlooking many crucial factors. Failing to understand best practices, they end up paying more, equivalent to buying a diamond when all you needed was a glass slipper. Let’s dive deeper into this in the following section.

Air Cargo vs Express Air Freight: How should I ship?

Looking to fly your goods from the UK to Mexico but tangled up in the air freight options? This section breaks it down for you, pitting the economical Air Cargo, that sails in regular airlines, against the high-speed Express Air Freight hopping aboard its own dedicated plane. Together, let’s detangle these options and discover the best route for your specific business needs. Stay tuned!

Should I choose Air Cargo between UK and Mexico?

Air cargo might be your ideal choice to move goods between the UK and Mexico, fitting your budget and efficiency needs. This option becomes more attractive when dealing with 100/150 kg (220/330 lbs) shipments. Airlines like British Airways and Aeromexico frequently handle this type of cargo, linking these two countries. Despite longer transit times due to fixed schedules, air cargo’s reliability and cost-effectiveness might be your best bet. Research more about their routes and rates on the official websites of British Airways and Aeromexico.

Should I choose Express Air Freight between UK and Mexico?

Express air freight is a fast, dedicated service employing solely cargo planes, ideal for shipments under 1 CBM or 100/150 kg (220/330 lbs). Major players include FedEx, UPS, and DHL. Renowned for their speed and reliability, these firms can deliver your parcels swiftly across the UK-Mexico corridor. If your business requires urgent, time-critical deliveries, or transports lightweight, high-value items, this might be your best choice. So, think express air freight when time is of the essence.

Main international airports in UK

Heathrow Airport

Cargo Volume: Heathrow moves approximately 1.7 million tons of cargo every year, making it the busiest airport in the UK and one of the largest in Europe.

Key Trading Partners: The primary trading partners include the United States, China, Germany, Canada, and the UAE.

Strategic Importance: Heathrow sits near London, one of the world’s leading financial hubs, offering easy access to markets in Europe and beyond. It’s an essential hub for businesses shipping to and from the UK.

Notable Features: With dedicated cargo handling facilities and infrastructure, it offers a wide range of services including express services, specialized cargo like pharmaceuticals and perishables, and transshipment facilities.

For Your Business: If you’re dealing with high-value, time-sensitive goods, or exporting products to the marked trading partners, Heathrow would be your ideal choice given its extensive flight network and advanced cargo handling capacity.

Gatwick Airport

Cargo Volume: Gatwick handles about 100,000 tons of cargo annually.

Key Trading Partners: Key trading partners mainly include EU countries, the United States, and China.

Strategic Importance: Located in South London, Gatwick’s good position enables quick transfer times to London and other major UK cities.

Notable Features: Gatwick offers dedicated air cargo services and facilities like temperature-controlled storage for sensitive goods.

For Your Business: If your goods need to be transported to or from Southern UK, particularly London, and want excellent domestic and international connections, Gatwick Airport can serve as a reliable and efficient gateway.

Manchester Airport

Cargo Volume: Manchester Airport deals with over 120,000 tons of import and export freight and mail annually.

Key Trading Partners: Major trading partners are the United States, UAE, and European countries.

Strategic Importance: As the gateway to the North of the UK, it provides unmatchable access to this region.

Notable Features: Manchester Airport boasts top-tier infrastructure to handle all kinds of cargo, including a World Freight Terminal.

For Your Business: If you have customers in the North of the UK, Manchester Airport is an efficient choice, with a wide international flight network and first-rate cargo handling facilities to ensure smooth logistics.

East Midlands Airport

Cargo Volume: East Midlands is a major cargo hub with over 300,000 tons of cargo passing through it every year.

Key Trading Partners: Its major trading partners are European Union countries and some parts of North America.

Strategic Importance: Its central location in the country aids the rapid circulation of goods.

Notable Features: It is a dedicated freight airport that works 24/7, offering superior adaptability.

For Your Business: If you’re trading in the Midlands or need flexible, round-the-clock shipment times, East Midlands Airport is an excellent choice for swift and efficient cargo service.

Stansted Airport

Cargo Volume: Stansted handles 250,000 tons of cargo per year.

Key Trading Partners: The main partners are the European Union, Dubai, USA, etc.

Strategic Importance: Being the third-busiest airport in London, it provides strong connectivity to different regions.

Notable Features: Stansted is known for specifically handling the express courier payload and features a large cargo terminal to cater to various cargo requirements.

For Your Business: Stansted can be the right choice if you’re seeking faster freight services via express couriers for the rapid supply of goods.

Main international airports in Mexico

Mexico City International Airport

Cargo Volume: Mexico City International Airport is the busiest airport in Latin America, handling around 500,000 metric tons of cargo annually.

Key Trading Partners: The United States, Europe, and parts of Asia are major trading partners.

Strategic Importance: As the country’s main airport, it is at the heart of Mexico’s global transportation infrastructure. Its location makes it especially important for trade with the USA, Central and South America.

Notable Features: The airport has two parallel runways and 24/7 cargo operations. A range of value-added services, including warehousing and cargo handling, is available.

For Your Business: If your trade routes include Central America, the USA or Europe, this hub offers an integral connection for both outgoing and incoming freight. It’s especially ideal for businesses that require a high volume of international shipping.

Guadalajara International Airport

Cargo Volume: Guadalajara International Airport processes over 340,000 metric tons of cargo annually, making it another key player in Mexico’s freight industry.

Key Trading Partners: The USA, Asia, and Europe, with a strong emphasis on technology and electronics.

Strategic Importance: Given its geographical location, this airport is strategically positioned to serve the Northern Pacific and Central regions.

Notable Features: It has 24/7 cargo operations, two runways, and warehousing for different types of cargo. It also houses a hub for UPS.

For Your Business: If you are in the tech industry, Guadalajara’s capacity and expertise for handling sensitive electronics could be beneficial to your logistics strategy.

Monterrey International Airport

Cargo Volume: The third busiest cargo airport in Mexico, handling over 200,000 metric tons annually.

Key Trading Partners: Primarily the U.S, but also Europe and parts of Asia.

Strategic Importance: Labelled as Mexico’s industrial city, Monterrey is especially important for material and manufacturing trades.

Notable Features: The airport boasts a cargo terminal with cold storage, animal cargo, and other specialized cargo facilities.

For Your Business: If you’re operating in the manufacturing, automotive, or technology sectors, this airport’s capacity and connectivity could provide a significant boost to your supply chain effectiveness.

Cancun International Airport

Cargo Volume: Handles more than 30,000 metric tons of cargo annually.

Key Trading Partners: The USA, South America, and Europe.

Strategic Importance: Connects with Caribbean markets and also serves as a connection point for goods entering the southeast region of Mexico.

Notable Features: New terminal facilities specifically cater to cargo and logistics needs.

For Your Business: If you regularly transit Caribbean routes or need to ship goods in and out of the southern part of Mexico, Cancun’s connectivity and state-of-the-art facilities could be the right fit.

Tijuana International Airport

Cargo Volume: Handles over 35,000 metric tons of cargo annually.

Key Trading Partners: Mainly the United States due to proximity, but also connects with Asia.

Strategic Importance: It is the gateway to the fast-growing economies of the Pacific Rim, due to its location near the US/Mexico border.

Notable Features: Contains specialized infrastructure for efficient cross-border freight handling and provides immediate trucking connectivity to the USA.

For Your Business: If your business requires frequent and rapid ground transport shipments to or from the US, the Tijuana International Airport may hold the solution to your logistics challenges.

How long does air freight take between UK and Mexico?

The average shipping time from the UK to Mexico by air freight typically ranges from 1 to 3 days. However, please note that this is an estimate and actual transit times can vary considerably. The specific airports involved, the total weight of the shipment, and the nature of the goods all influence the duration of a delivery. For the most accurate and reliable information, it’s best to consult a freight forwarder like DocShipper who can provide a time estimate tailored to your unique requirements.

How much does it cost to ship a parcel between UK and Mexico with air freight?

Shipping air freight from the UK to Mexico typically ranges from $3 to $8 per kg. However, it’s important to note that this is a sweeping estimate – actual costs can vary greatly. Variables influencing the price include distance from departure and arrival airports, parcel size and weight, and nature of goods. Every shipment is unique, and that’s why our team tailors quotes case by case, to ensure we’re providing the most competitive rates for your circumstances. Feel free to contact us today; we’ll get back to you with a personalized quote within 24 hours.

What is the difference between volumetric and gross weight?

The gross weight of a shipment refers to the actual physical weight of your cargo, including all packing materials. On the other hand, volumetric weight, also known as dimensional weight, reflects the space your package occupies in relation to its weight.

In air cargo freight, calculating gross weight is straightforward – it’s just the total weight of all items, plus the weight of containers and packaging. For volumetric weight though, the calculation is often: Length x Width x Height (in cm) / 6000, to output the result in kilograms.

As an illustration, imagine you’re shipping a 25kg box with dimensions of 40cm x 50cm x 60cm using air freight. The gross weight is 25kg or 55.1 lbs. For the volumetric weight, calculate as (40x50x60) / 6000, which gives you 20kg or 44.1 lbs.

In Express Air Freight services like FedEx, DHL, etc., the calculation method for volumetric weight is slightly different: Length x Width x Height (in cm) / 5000. Using the same box measurements as above, the calculation would be (40x50x60) / 5000, resulting in 24kg or 52.9 lbs.

These weight measurements are crucial as they help freight carriers ascertain costs. Shipping charges are determined based on the greater of the two weights – known as chargeable weight. If your shipment is light but bulky, you could end up paying more because of its volumetric weight. It’s essential to correctly calculate both weights to avoid unexpected shipping costs.

Rail freight between UK and Mexico

Ever considered that your cargo could embark on the great British-Mexican rail adventure? Since the first connection was established around the mid-19th century, rail freight between the UK and Mexico has been a fascinating journey, complementing air and sea freight. It travels through stunning routes laced with history, passing countries like the US and Canada, enabling the transport of goods like machinery, vehicles, and food products.

Over the years, this rail freight connection has stirred trade and economic cooperation, binding ties between Mexico’s Margaritas and Britain’s Shakespeare. While it may take a tad longer compared to air freight, the cost-efficiency is a tempting trade-off. However, customs procedures could feel like navigating through a chapter of Harry Potter en español – intricate but manageable. Now, grab your conductor’s hat, consider your shipment’s timeframe, budget, and customs pitfalls, and explore whether your cargo is ready for a rail journey!

What are the main train stations between UK and Mexico?

If you’re looking to ship goods via rail freight between the UK and Mexico, there are a number of train stations that may play a key role in your shipping strategy. These specific stations are strategically connected to their respective countries’ international rail networks, designed to comfortably handle cargo train. Let’s take a closer look.

Felixstowe Freightliner Terminal, UK

This is the busiest rail freight terminal in the UK, which handled about 810,000 TEUs annually. Its strategic location on the British east coast offers a seamless connection to main rail networks and major UK business areas. With state-of-the-art loading equipment and a high-frequency schedule, it allows for efficient handling and prompt dispatch of cargo.

Crewe Basford Hall, UK

Crewe Basford Hall is a primary Freightliner and container traffic terminal. It’s central position allows for excellent connectivity across the UK. It plays an essential role in the transport of imported goods from ports to the UK’s key trading centers enhancing its strategic importance.

Pantaco Station, Mexico

As the most critical rail freight station in Mexico City, Pantaco handles a significant volume of Mexico’s import/export traffic. This station features an advanced terminal operating system offering efficient and accurate tracking of containers. Furthermore, its proximity to commercial and industrial zones in Mexico City makes it a vital point in your logistics chain.

Guadalajara Station, Mexico

This station has considerable strategic importance due to its location in the heart of Jalisco state. Guadalajara’s industrial profile makes it a robust hub for businesses, particularly for the tech and consumer goods sectors.

To understand how these train stations can benefit your business, consider the volume of your shipments, destination, and the time-sensitivity of your goods. For instance, if your goods are headed to central or southern parts of the UK, Felixstowe Freightliner Terminal might be the best option. If your goods are destined for Latin America, consider Pantaco or Guadalajara in Mexico. Just keep in mind, each station has its unique strengths that might be leveraged to optimize your shipping package.

Door to door between UK and Mexico

Unpacking the nuts and bolts of international Door to Door shipping, this method refers to comprehensive transport service from a shipper’s location in the UK to a specified location in Mexico. Its winning pros? Simplicity and convenience. Imagine seamless, hassle-free shipping right from your doorstep to your recipient’s. Intriguing, isn’t it? So, let’s dive into this exciting shipping solution.

Overview – Door to Door

Embarking on shipping between the UK and Mexico? Door to door service could be your seamless pathway, sidestepping the labyrinth of logistics. With the complexities of diverse customs regulations and cargo transportation options, it unravels all knot-points with its evident advantages. Although detriments like cost might niggle, the relief of a simplified journey outweighs. A stress-free logistics solution, it’s the pick of the pack amongst our DocShipper clients. Read further for practical insights about this sought-out service. Dive in, because shipping needn’t dampen your zeal for successful international trade.

Why should I use a Door to Door service between UK and Mexico?

Ever tried wrestling a taco into a Tsarina? That’s what handling international shipping can feel like! Stepping in to plate for you, a Door to Door service between the UK and Mexico can take the complexity out of the equation. Here are five knockout reasons to opt for this service:

1. Stress-No-More Logistics: Forget about arranging multiple logistical steps – pickup, transit, paperwork, delivery, phew! Door to Door service smothers all your logistics woes with a big, chunky logistics-free blanket.

2. Spot-On, Speedy Delivery: Urgent shipments? No sweat! Timeliness is our chant and punctuality, our mantra. Your deliveries reach on time, every time, right from the UK to Mexico.

3. Complex Cargo? Consider it Done: Fragile, hazardous, or just plain weirdly-shaped – we’ve got it covered. We handle complex cargo with the specialized care it deserves, ensuring it reaches safe and sound.

4. Convenient Trucking: You won’t touch a forklift! We ensure your goods are not just shipped but also trucked right to the final destination, freeing you from load-bearing nightmares.

5. All-In-One Cost: One fee covers it all. From transport, customs clearance to delivery, it’s a sweet deal wrapped in convenience, giving you great value for money.

Rely on Door to Door service. It’s as tantalisingly convenient as a ready-to-eat taco, right from the UK to Mexico!

DocShipper – Door to Door specialist between UK and Mexico

Entrust your UK to Mexico shipping needs to DocShipper. Our comprehensive, efficient service takes care of everything, from packing to transport across all shipping methods to customs clearance. We assign a dedicated Account Executive to guide you, eliminating stress for a seamless door-to-door experience. Step back as we manage the intricate aspects, utilizing our proficiency in this domain. No waiting times, receive a free estimate within 24 hours or reach out to our consultants anytime. Discover true ease with DocShipper.

Customs clearance in Mexico for goods imported from UK

Navigating customs clearance when importing goods from the UK to Mexico can be a complex and sometimes puzzling endeavor. With potential risks lurking at each step, from unexpected fees to the danger of goods being halted at customs, it’s no place for guesswork. Understanding and preparing for customs duties, taxes, quotas, and licenses isn’t just important – it’s essential. Without the right knowledge, missteps are inevitable, potentially costing time and money. That’s where we come in. In the following sections, we’ll guide you through this intricate process. Remember, DocShipper is your partner in this journey, ready to assist you with any goods, anywhere, at any time. To expedite your project’s budget estimate, just share the origin and value of your goods and the HS Code. These details are vital to progress.

How to calculate duties & taxes when importing from UK to Mexico?

As an integral part of the importing process from the UK to Mexico, anticipating your duties and taxes can ultimately save you from unexpected expenses and delays. Reckoning these costs revolves around several key determinants, namely the country of origin, the Harmonized System (HS) Code, the customs value, the applicable tariff rate, and any additional taxes or charges. To begin the estimation process, your first port of call should be determining the country where your goods were derived or manufactured, as this is the foundation upon which the rest of your calculations will be built.

Step 1 – Identify the Country of Origin

Determining the exact Country of Origin sets the basis for accurate import duties and taxes. First, it helps avoid miscalculations. Imagine overpaying due to a simple oversight! Second, you can’t overlook trade agreements. The UK and Mexico have a trade continuity agreement preserving tariff-free trade after Brexit. So, you could benefit from reduced or eliminated duties.

Third, it offers a clear path to abide by import restrictions. Each country imposes unique rules on goods entering the country. For Mexico, there are stringent regulations regarding agriculture and dairy imports from the UK.

Knowing your Country of Origin also allows you to accurately classify goods according to the Harmonized System (HS). Your HS code determines what rate of duty applies to your goods – got it wrong, and you might be hit with fines! Lastly, it gives peace of mind. Completing this step ensures full compliance with customs laws, saving you from sleepless nights over potential audits.

So, don’t skimp on this step, ensure you have your Country of Origin down pat. Once that’s set, procuring your HS code should be a breeze. Remember, a thorough approach leads to smooth sailing (or shipping!).

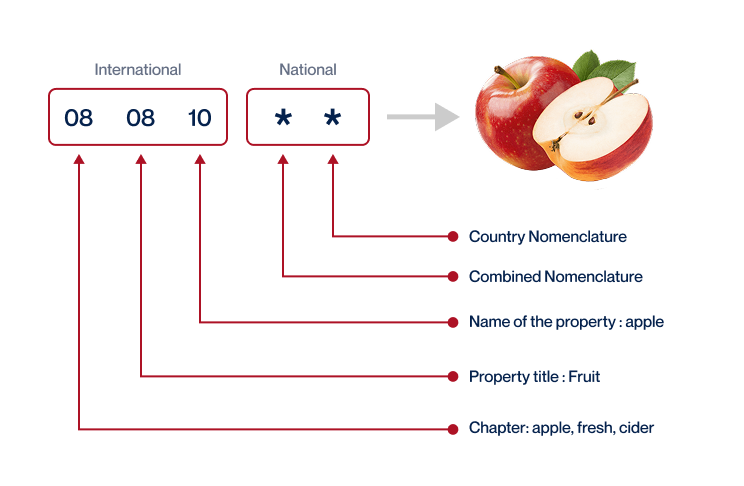

Step 2 – Find the HS Code of your product

The Harmonized System (HS) Code is a globally standardized coding system that classifies products for international trade. It assists in defining each product and determining international trade duties.

You might be wondering how to pinpoint the HS code for your specific product. A straightforward approach is to reach out to your supplier. They’re often well-versed with the products they’re importing and the corresponding regulations, including the HS code.

However, if reaching out to your supplier isn’t an option, don’t worry, we have you covered. An easy step-by-step process to find your product’s HS code using the Harmonized Tariff Schedule consists of:

1. Visit the Harmonized Tariff Schedule

2. Type your product’s name into the search bar

3. Check the Heading/Subheading column where you’ll find the HS code

Please bear in mind the HS code’s accuracy is crucial. An incorrect code can result in potential delays and additional fines. Therefore, utmost care is necessary while identifying your product’s HS code.

Here’s an infographic showing you how to read an HS code.

Step 3 – Calculate the Customs Value

Finding your way around customs value can be daunting. Think of it as the real fiscal value of your shipment, differing slightly from the mere product worth. It’s not just your goods, but also the cost of bringing them all the way to Mexico from UK included. This is your CIF Value- the cost of the goods, international shipping charge, and the insurance expense, all totaled up. Suppose you’re shipping designer shoes valued at $200. Now, tack on $50 for shipping and garnish it with a $10 insurance cost – your customs value will be a rounded $260. This acts as the groundwork for any further duty calculations, a pivotal figure in your shipping costs booking sheet. It’s understandable, then, your concern to get this correct from the get-go. It might just save you some unsuspected stern glances from the customs officer.

Step 4 – Figure out the applicable Import Tariff

An import tariff is essentially a tax imposed by a country’s government on goods imported from other countries. For your goods shipped from the UK to Mexico, the tariff used is most likely the Most Favored Nation (MFN) rate.

To determine the applicable tariff, follow these steps:

Visit the UK Trade Tariff: look up commodity codes, duty and VAT rates page on the UK government’s site. There, enter your previously identified Harmonized System (HS) code, and your product’s country of origin.

If, for instance, you’re importing ceramic mugs (HS code 691110) from the UK, the tool might show an average MFN tariff rate of 15% for these goods entering Mexico.

Let’s say the total Cost, Insurance, and Freight (CIF) value of your mugs is $1000. To find out your import duties, you’d multiply the CIF value by the tariff rate. Your calculation would look like this: $1000 (CIF) x 15% (tariff rate) = $150. So, your import duties would be $150.

Remember, understanding your import tariffs ahead of time helps avoid unexpected costs and ensures a smooth customs clearance process.

Step 5 – Consider other Import Duties and Taxes

In importing goods to Mexico from the UK, aside from the standard tariff rate, some additional taxes may apply based on the goods type and origin. For instance, there might be an Excise Duty for specific items such as alcohol and tobacco. Similarly, products deemed as ‘dumped’ – i.e., exported at a price lower than its original value – might attract Anti-Dumping Taxes to protect national industries from unfair competition.

But the significant duty you should always consider is the Value Added Tax (VAT), which is a tax on the consumption of goods and services. In Mexico, the standard VAT rate is 16%. If, for example, your goods are worth $10,000 USD, the VAT amount would be $1,600 USD ($10,000 x 16%).

It’s crucial to budget for these potential additional costs when importing goods. This is just a sample calculation and actual rates may vary depending on several factors including the nature and classification of the goods. Therefore, always consult with a logistics expert or customs broker to get accurate and precise information for your situation.

Step 6 – Calculate the Customs Duties

In calculating customs duties for goods exported from the UK to Mexico, several components are taken into account: the customs value of goods, VAT, anti-dumping taxes, and excise duty when relevant. Let’s use three examples to elucidate this.

1. Suppose you have a consignment valued at $10,000 and the duty rate in Mexico is 20%, your customs duty would be $10,00020%=$2,000.

2. Let’s take the same consignment value but add 16% VAT, the standard rate in Mexico. So, $2,000 (customs duty) + 16% of $10,000 (VAT) = $2,000 + $1,600 = $3,600.

3. For some goods, anti-dumping taxes or excise duties may apply. If a 5% anti-dumping tax and a $50 excise duty are applicable on this consignment, you would end up with $2,000 (customs duty) + $1,600 (VAT) + $500 ($10,0005% anti-dumping tax) + $50 (excise duty) = $4,150.

Customs calculation isn’t exactly a walk in the park, isn’t it? With DocShipper, all the complexities of customs clearance become our responsibility. Our team ensures you’re not overcharged and guarantees an accurate assessment each time. Reach out today and get a free quote within 24 hours!

Does DocShipper charge customs fees?

DocShipper, while being a customs broker in the UK and Mexico, doesn’t levy any customs duties. Instead, our charges include customs clearance fees but not customs duties/taxes which are payable directly to the government. Remember, these two are not the same. For instance, imagine you’re shipping machinery from London to Mexico City. Our charge would cover the clearance process, but any import tax on the machinery would be your liability, paid straight to the government. But don’t worry – we’ll share official documentation from customs, so you know you’re paying just what the government charges, no more, no less.

Contact Details for Customs Authorities

UK Customs

Mexico Customs

Required documents for customs clearance

Cracking the code of customs clearance is no small task. Here, we shed light on essential documents – Bill of Lading, Packing List, Certificate of Origin, and Documents of Conformity (CE standard). These are your keys to a smoother, less stressful shipping experience. Let’s simplify your journey through the labyrinth of paperwork.

Bill of Lading

Navigating UK to Mexico shipping? The Bill of Lading, your most crucial passport for your goods, marks the transition of ownership from you to your buyer. Commonly abbreviated as B/L, it’s as important as a boarding pass to a passenger. Today, a digital revolution is underway in the form of ‘telex’ release, allowing you to speed up the process by bypassing paper B/L. Instead, your goods, be it artisanal teapots or automotive parts, can be released upon their arrival in Mexico, and that’s a real game-changer. For air cargo, don’t forget your Air Waybill (AWB). Much like the B/L, it’s your ticket to a smooth, streamlined process. Plus, it’s just as digital-friendly. So, keep these documents ace-high, and you’ll find the shipping process slick, smooth, and hassle-free.

Packing List

Imagine you’re shipping artisanal cheese from the UK to Mexico. Your Packing List is not just an itinerary; it’s an essential cross-check for freight forwarders, importers, and customs officials. As a shipper, your Packing List must precisely detail your shipment’s content, quantity, value, and weight. Say you’re shipping 20 wheels of cheese, each weighing 2 kilos. If your list states 40 kilos total weight, but it crosses the scales at 50 kilos due to packing materials, customs might delay, enforce fines, or even seize your cheese; whether by sea or air, your cheese could go off during delays. So, think of your Packing List as the key to smooth sailing (or flying) through customs from the UK to Mexico. Get it right and your cheese will be melting on Mexican tacos in no time.

Commercial Invoice

Drafting a Commercial Invoice for UK-Mexico shipments can feel tricky, but a few key points can streamline the process. Complete all sections of the document meticulously. This invoice is the customs officer’s roadmap to your shipment, detailing essential information like product descriptions, seller and buyer details, and total value of goods. Always ensure consistency between the Commercial Invoice and other shipping documents. Remember, an accurate Commercial Invoice is crucial for smooth customs clearance. Misaligned information can result in delays or even fines. Here’s an insider’s tip: natural Timber products require a specific declaration in the invoice. So, if you’re in the furniture business, bear this in mind. With careful attention to these details, you’ll avoid common pitfalls and ensure a seamless freight experience between the UK and Mexico.

Certificate of Origin

Navigating the customs landscape between the UK and Mexico can appear daunting. Here comes the hero – the Certificate of Origin. It illustrates the provenance of your goods, essentially where they were produced. This invaluable document might earn your shipment preferential customs duty rates, making your venture more profitable. Think of it like this: You’re shipping artisanal chocolates from a quaint town in Northern England. By stating this location on your Certificate of Origin, your delightful treats would benefit from the trade agreements in place between the two countries. So don’t breeze past the ‘country of manufacture’ section. Being precise here could save you considerable expenditure while easing your journey through the legalese maze that is international shipping.

Certificate of Conformity (CE standard)

Shipping goods between the UK and Mexico? You’ll need a Certificate of Conformity. This critical document proves your product meets applicable regulatory standards – like the CE marking often used in Europe. However, it’s important to know, in the post-Brexit era, the UK introduced its own marking, the UKCA. Unlike quality assurance, which largely focuses on process consistency, these standards focus on the safety and compliance of your product. Say, for instance, you’re shipping electronics. You’d need to prove they’re safe, won’t interfere with other devices, and don’t emit harmful radiation. Concerned about US standards? Think of the CE or UKCA mark as the European or UK equivalent to the FCC declaration in the States. And remember, this certificate isn’t optional – it’s a must-have for a smooth customs clearance.

Your EORI number (Economic Operator Registration Identification)

Nailing the logistics of shipping goods from the UK to Mexico can feel like a daunting task. But the EORI (Economic Operator Registration Identification) number can streamline the process tremendously. This unique ID, used to track imports and exports, isn’t something you can do without. From minimizing misplacement to speeding up customs clearance, an EORI number keeps everyone in the know. Registering for one is a fairly straightforward process, handled by the UK government for native businesses. Just one EORI number does the trick for shipping across multiple countries, giving you less paperwork to worry about. So, stay a step ahead in your shipping journey and get yourself an EORI number pronto!

Get Started with DocShipper

Prohibited and Restricted items when importing into Mexico

Understanding what you can and can’t ship into Mexico is crucial to avoid legal troubles and costly hold-ups. Familiarize yourself with Mexico’s import restrictions as every violation can mean time lost, fines, or seized freight. Let’s dig into prohibited and restricted items.

Are there any trade agreements between UK and Mexico

Yes, shipping between UK and Mexico offers distinct advantages due to the recently ratified UK-Mexico Trade Continuity Agreement. This interim deal ensures tariff-free trade on most goods, benefiting your business by lowering costs. Keep an eye on ongoing developments; extensive negotiations for a more comprehensive trade deal aiming to cover digital trade and climate change are in progress. So, the future looks promising for businesses trading between these countries.

UK – Mexico trade and economic relationship

In the world of international trade, the economic relationship between the UK and Mexico boasts a rich history and thriving present. Dating back to the 19th-century railway and mining investments, the trade between these nations has moved from strength to strength, crossing multiple sectors. Now, the key sectors are automotive, energy, and pharmaceuticals, with the UK’s direct investment in Mexico surpassing $2 billion in 2023 alone. Trade between them has also grown impressively. Exports from the UK to Mexico exceeded $2.8 billion in the same year, representing 3.5% of Mexico’s total imports. As mature economies with shared interests, your next steps in navigating this bustling trade route should be calculated yet optimistic. Understanding their long-running ties and the mutual love for commodities like whiskies and avocados could lend a unique perspective to your shipping decisions.

Your first steps with DocShipper

Additional logistics services

Warehousing

Looking for reliable warehousing in Mexico from the UK? It's no walk in the park, especially when your goods need precise temperature control. With our solutions, forget the headache. Puzzled about storing chocolates in Cancun or wines in Mexico City? We've got you covered! Temperatures are regulated to keep your product in perfect condition. Want to dive deeper? Check this out: Warehousing.

Packing

In the shipping world, proper packaging is essential for safely transporting goods from the UK to Mexico. It shields items from damage, guards against cargo pilfering, and avoids unnecessary customs problems. When it comes to special items, such as fragile arts, repackaging could be a lifesaver. Trustworthy agents like us handle this critical element with utmost priority. For instance, delicate medical equipment needs a meticulous touch, while massive machinery demands robust wrapping.

For more details, check our dedicated page: Freight packaging.

Transport Insurance

Securing your shipped goods with transport insurance, unlike fire insurance, is a preventative step that directly addresses the unpredictability of international transport. Let's say your container faced rough seas; cargoes often endure damage during transit. Don't fret! Insurance could cover these unexpected costs. Prevention is better than cure after all. Find out more about securing your freight here: Cargo Insurance.

Household goods shipping

Relocating from the UK to Mexico with fragile or bulky items? Ease your stress with our expert Personal Effects Shipping. Professionals pack your precious items, ensuring they reach their destination safe and sound, despite the ocean journey. For instance, Grandma’s antique mirror arrives intact, ready to adorn your new abode! Check out the specifics now on our dedicated page: Shipping Personal Belongings.

Procurement in Thailand

Wrestling with procurement between the UK and Mexico? DocShipper eases the hardship of sourcing & manufacturing in Asia, East Europe, and beyond. We knock-out language hurdles and pilot you through the entire process, from finding suppliers to finalising the procurement. Enjoy simpler, faster supplier management without the headache. Discover relief on our dedicated page: Sourcing services.

Quality Control

Gone are the days of unpleasant surprises with defective products shipped from the UK to Mexico. Picture this: you order a batch of custom-made machine parts but they arrive with irregular dimensions. Our Quality Control service steps in to combat such nightmares before your goods hit the road. It's like having your personal watchdog during manufacturing, ensuring your products pass all standards. Unease begone! More info on our dedicated page: Quality Inspection.

Conformité des produits aux normes

Shipping goods requires having regulatory green lights, and that's where our Product Compliance Services can support your business. By thoroughly testing in a laboratory, we can gain necessary certifications, ensuring that your products meet all required regulations. That's one less pain point for your supply chain! .