Freight Shipping between UK and Hong Kong | Rates – Transit times – Duties and Taxes

Why did the cargo ship paint itself blue? So it could hide in the sea when pirates came! Jokes aside, tackling the challenges of shipping goods from the UK to Hong Kong can be as elusive as our cargo ship. The complexities of understanding rates, transit times, and customs regulations can often lead to headaches. Fear not, for this guide is designed to simplify these complexities for you. It offers valuable insights into different freight options, from air to ocean, road, and rail. It also gives a deep dive into the customs clearance process, duties, taxes, and practical advice for businesses on how to navigate this often taxing journey successfully. If the process still feels overwhelming, let DocShipper handle it for you! As an accomplished international freight forwarder, we turn each potential challenge into success by managing every aspect of your shipping process.

Which are the different modes of transportation between UK and Hong Kong?

When you think of delivery from the UK to Hong Kong, you might picture an epic journey across mountains, deserts, and seas - a real-life Lord of the Rings-style adventure. But it doesn't need to be complicated! It's more like choosing the fastest lane in a swimming pool, with ocean freight and air transport as your top picks. Both offer distinctive advantages, saving you time, money, or sometimes both! So put on your swim cap, we're diving deep to find the best route for your goods.

Need help with your shipment?

Need assistance with your shipment? Dont hesitate to contact us even for a simple question. Choose the option that suits you

Live chat with an expert Chat on WhatsApp Free Quote 24hHow can DocShipper help you

Sea freight between UK and Hong Kong

When it comes to heavy, non-urgent shipments, ocean freight from the UK to Hong Kong is a fantastic money-saving option. Robust trade links between these two realms revolve around bustling ports like Felixstowe and Hong Kong’s Kwai Tsing, acting as arteries for the exchange of numerous goods. But it’s not always smooth sailing across these economic waters. For many shippers, the voyage can be riddled with technical errors and hefty fines if documentation, packaging, or shipping protocols aren’t followed to the letter. It’s much like navigating a challenging maritime map, where the correct course is a series of specific decisions and in-depth knowledge–something this guide strives to deliver.

In the coming sections, we’ll break this journey down. From explaining customs clearance to identifying common speedbumps, we aim to transform your shipping obstacle course into a straightforward freeway. Take those first steps towards a pain-free shipping experience between the UK and Hong Kong with us today.

Main shipping ports in UK

Port of Felixstowe

Location and Volume: Positioned in the Southeast coast of England, this port is crucial for its access to North Europe, with a shipping volume of approximately 3.8 million TEUs.

Key Trading Partners and Strategic Importance: The main trading partners are China, America, and Eastern European countries, playing a crucial role in cementing the UK’s trade relationships.

Context for Businesses: If you’re considering Europe or Asia for market expansion, the Port of Felixstowe might be key to your logistics, with its advanced facilities and large shipping volume.

Port of Southampton

Location and Volume: Located on the South coast, this port is significant for its access to the Atlantic, with a yearly shipping volume of about 2 million TEUs.

Key Trading Partners and Strategic importance: Major trading partners include China, North America, and South America. It plays a critical role in facilitating global trade due to its strategic location.

Context for Businesses: If you’re considering broadening your global markets, especially in America and China, the Port of Southampton could be highly beneficial given its diverse trade routes.

London Gateway Port

Location and Volume: Situated on the river Thames, this port holds year-round importance because of the city’s economic significance across the globe, handling 1.6 million TEUs annually.

Key Trading Partners and Strategic Importance: Its main trading partners encompass Europe, Asia, and the USA, bearing a central role in strengthening London’s economic impact.

Context for Businesses: If you aim to establish a presence in London or access European markets, London Gateway’s proximity to this major city can benefit your logistics, given its round-the-clock operational facilities.

Port of Liverpool

Location and Volume: Located in the North West of England, this port is important for its extensive connections to the Irish Sea, shipping approximately 700,000 TEUs per year.

Key Trading Partners and Strategic Importance: Major trading partners are Ireland, the USA, and Spain, serving as a key hub for transatlantic shipments.

Context for Businesses: If your business plans to expand in Ireland or the USA, the Port of Liverpool can serve as a backbone to your logistics, due to its well-established transatlantic routes.

Port of Tilbury

Location and Volume: Located in the Southeastern side of the River Thames, it’s crucial for providing access to London, handling around 500,000 TEUs annually.

Key Trading Partners and Strategic Importance: Its major trade partners include the EU countries, and it plays a vital role in connecting the UK capital to the continent.

Context for Businesses: If you’re considering entering the London market or doing business with European partners, the Port of Tilbury should be considered, given its accessibility and significant trading volume.

Location and Volume: Situated in the Southwest, this port is vital for its access to the Severn Estuary, with a shipping volume of 350,000 TEUs.

Key Trading Partners and Strategic Importance: Major trading partners include the USA and Ireland, and it’s strategically important to southwest England’s economic dynamics.

Context for Businesses: If you plan to grow in the USA or Ireland, the Port of Bristol should be incorporated into your logistics due to its pivotal role in regional trade.

Main shipping ports in Hong Kong

Port of Hong Kong

Location and Volume: Located at the mouth of the Pearl River in the South China Sea, the Port of Hong Kong is a gateway between the East and West, handling a shipping volume of around 19.8 million TEUs in 2020.

Key Trading Partners and Strategic Importance: Key trading partners include Mainland China, the United States and Taiwan. The port, which is one of the busiest in the world, has strategic importance due to its proximity to China and extensive network of services.

Context for Businesses: If you’re looking to tap into the Asian market, particularly China, the Port of Hong Kong could be instrumental in your logistics given its advanced infrastructure and efficient customs procedures.

Port of Kwai Tsing

Location and Volume: Situated in the Kwai Chung and Tsing Yi area of Hong Kong, the Port of Kwai Tsing. has nine modern container terminals, handling over 80% of the total throughput of the Port of Hong Kong, making it one of the globe’s major container ports.

Key Trading Partners and Strategic Importance: The port has regular connections with over 550 ports around the world. Along with its advanced logistics and supply chain facilities, it positions Hong Kong as a major re-export hub.

Context for Businesses: If you are looking to access a diversified network of shipping routes, the Port of Kwai Tsing, with its robust maritime network, can be a significant asset in your shipping strategy, especially for re-exporting goods.

River Trade Terminal at Tuen Mun

Location and Volume: The River Trade Terminal at Tuen Mun is near the estuary of the Pearl River, making it the consolidation center for both ocean-going and river trade cargo. The total annual shipping volume is over 23 million tonnes.

Key Trading Partners and Strategic Importance: The terminal serves Ports in the Pearl River Delta and has growing trade relationships with Southeast Asian countries. It aims to enhance the cost-effectiveness of river trade between Hong Kong and the Mainland.

Context for Businesses: If you’re keen on tapping into the booming markets in the Chinese mainland and Southeast Asia, the River Trade Terminal at Tuen Mun offers robust facilities and multimodal logistics services.

Please note that while Hong Kong is famous for its deep-sea port, it also accommodates river trade, making it unique in its overall maritime logistics capabilities. The ports mentioned above are significant segments of Hong Kong’s broader shipping and logistics infrastructure.

Should I choose FCL or LCL when shipping between UK and Hong Kong?

Deciding between Full Container Load (FCL) and Less than Container Load (LCL) or consolidation for your sea freight from the UK to Hong Kong is akin to choosing your business strategy game plan. This choice will have ripple effects on your cost, delivery timings, and the overall success of your shipping process. Unravel the differences in this section, acquire the insights to make an informed decision that suits your distinct shipping requirements, and ensure smoother sailing for your cargo. Get ready to master the sea of shipping options!

Full container load (FCL)

Definition: Full Container Load (FCL) shipping is a type of ocean freight where a container is exclusively dedicated to a single shipper's cargo. It involves using a 20'ft or 40'ft container depending on cargo volume.

When to Use: FCL shipping between the UK and Hong Kong is most cost-efficient when you have a bulky shipment, usually upwards of 14 CBM. Larger cargos are effectively protected, as the container is sealed from origin to destination, enhancing the safety of your goods.

Example: Consider you're a machinery distributor. You need to ship 15 CBM of heavy machinery parts in a 20'ft FCL container. The benefits of FCL are twofold: your goods remain sealed until the destination, and the cost per unit is cheaper as the volume increases.

Cost Implications: The cost for FCL shipping tends to be higher upfront compared to Less than Container Load (LCL). However, a single FCL shipping quote can handle larger volumes, thereby making it cheaper per unit. The secure seal also saves you from possible damage costs, a worthy trade-off to consider.

Less container load (LCL)

Definition: LCL, or Less than Container Load, refers to shipments that don't fill up a whole container and must be consolidated with other shipments inside a container.

When to Use:

LCL shipment is the ideal freight solution when your cargo is less than 13 to 15 cubic meters. This option facilitates smaller, more frequent shipments, ensuring flexibility and cost benefits for businesses dealing in lower volumes of goods.

Example:

For instance, a British apparel brand looking to export a small batch of items to stores in Hong Kong might opt for LCL freight. This option would be more economical than booking an entire container and would allow them to continuously deliver fresh styles to their stores.

Cost Implications:

The cost implication of using an LCL shipment mainly lies in its price advantage for smaller volumes. However, given the need for consolidation and de-consolidation, the process may incur additional handling charges. It's essential to factor in these costs when considering an LCL freight quote for your shipping requirements.

Hassle-free shipping

Ready to simplify your UK-to-Hong Kong shipments? Let DocShipper take the helm. Our knowledgeable ocean freight experts guide businesses, helping you choose between consolidation or full container options based on your cargo's volume, nature, and urgency. With us, global shipping becomes streamlined and stress-free. Take the first step towards hassle-free cargo shipping – click here for a free estimation. Your perfect shipping solution awaits!

Delivering goods between the UK and Hong Kong through sea freight typically takes about 30-35 days on average. However, keep in mind that transit times can vary. Factors such as the specific ports of departure and arrival, the weight of the cargo, and the nature of the goods can considerably affect the final delivery timeframe. For accurate and tailored estimates, we recommend consulting with an experienced freight forwarder like DocShipper.

Here is a text-based representation of average transit times between some of the main freight ports in the UK and Hong Kong:

| UK Ports | Hong Kong Ports | Average Transit Time (Days) |

| Port of Felixstowe | Port of Hong Kong | 29 |

| Port of Southampton | River Trade Terminal | 35 |

| Port of London | Port of Kwai Tsing | 29 |

| Port of Liverpool | Port of Hong Kong | 34 |

*These are rough estimations and actual transit times may vary based on many factors. For the most precise information, be sure to get in touch with a freight forwarder.

How much does it cost to ship a container between UK and Hong Kong?

Determining the exact cost of shipping a container between the UK and Hong Kong can akin to hitting a moving target. Ocean freight rates for shipping a container can greatly vary, largely dependent on factors such as Points of Loading and Destination, the carrier chosen, the nature of the goods, and monthly market shifts. This vast array of variables makes it impractical to provide a definitive quote upfront. However, don’t let uncertainty deter you! Our dedicated team of shipping specialists are always at hand, meticulously assessing each case to bring you the most competitive shipping cost. Tailoring rates to your specific needs is our modus operandi, so you always get the best deal. Let us facilitate your international logistics, ensuring a seamless shipping experience from the UK to Hong Kong.

Special transportation services

Out of Gauge (OOG) Container

Definition: An Out of Gauge (OOG) container is designed specifically for cargo that doesn’t fit into standard containers due to their abnormal size or weight.

Suitable for: Large or heavy goods, including machinery or equipment, that exceed the dimensions of a standard shipping container.

Examples: Large scale construction equipment, turbines, factory components.

Why it might be the best choice for you: If your business regularly ships oversized or unusually heavy items, OOG containers can provide a flexible and secure sea freight option for your UK to Hong Kong shipment.

Break Bulk

Definition: Break bulk refers to goods that are loaded individually onto the ship, not in containers. These goods are generally larger and are often packed on pallets or in crates.

Suitable for: Large items that can’t be split into smaller units, such as machinery, construction equipment, or even smaller loose cargo loads, but which don’t require the full space of a container.

Examples: Construction materials, steel, wood, or other such commodities used in manufacturing or industry.

Why it might be the best choice for you: If your cargo is considerably big but not enough to necessitate the use of an entire container, break bulk could be the most cost-effective shipping option.

Dry Bulk

Definition: Dry bulk shipping involves transporting unpackaged goods in large quantities. This type of cargo is usually poured or dropped into a bulk carrier ship’s hold.

Suitable for: Commodities that are shipped in large volumes, such as minerals, grains, or coal.

Examples: Packaged grain, loose construction aggregate, brittle products

Why it might be the best choice for you: If your business deals in mass quantities of loose, granular products, dry bulk shipping is a logical and cost-effective choice.

Roll-on/Roll-off (Ro-Ro)

Definition: A Ro-Ro vessel has built-in ramps which allow cargo vehicles to be driven on at origin and off at destination. It is the simplest and cheapest way of shipping wheeled cargo.

Suitable for: All types of rolling cargo, including cars, trucks, semitrailer trucks, trailers, and railroad cars.

Examples: Vehicles, loaded truck trailers, large pieces of equipment on wheels.

Why it might be the best choice for you: If you specialize in vehicles or large mobile machinery, using a ro-ro vessel for your UK to Hong Kong shipments is a seamless, easy-to-manage option.

Reefer Containers

Definition: Reefer containers are refrigerated shipping containers for goods requiring temperature-controlled conditions throughout the shipment.

Suitable for: Perishable goods like food, pharmaceuticals, and certain chemical or biological goods.

Examples: Fresh and frozen food, pharmaceuticals, plants, and some types of personal care products.

Why it might be the best choice for you: If your business revolves around transporting perishable items, reefer containers are crucial to maintain product integrity and quality during transit.

When shipping goods from the UK to Hong Kong, understanding each sea freight option’s nuances will ensure your cargo reaches its destination safely, efficiently, and cost-effectively. You’ve seen how various methods might be the best choice for you, but remember, every business is unique, and so are your shipping needs.

At DocShipper, your shipping needs are our specialty, contact us to receive a free shipping quote in less than 24 hours.

Air freight between UK and Hong Kong

With wind on your side, flying goods from the UK to Hong Kong is more than just quick travels. Air freight shines when it comes to small, precious cargo – think a handful of Swiss watches or boxes of Italian leather goods. It might cost more up front, but you save on storage and insurance, making it a savvy choice for high-value, low-volume shipments.

But wait! Just like not factoring in cookies for Santa could put you on the naughty list, neglecting key details in air freight can ramp up your costs. Missteps, like miscalculating your shipment’s weight or overlooking best practices, can tip the financial scales against you. We’ll dive into these potential hiccups and tricks on how to fly right without emptying your pockets.

Air Cargo vs Express Air Freight: How should I ship?

Looking to ship from the UK to Hong Kong and weighing your options? Each choice has its merits and quirks; air cargo puts your shipment on a commercial airline, while express air freight reserves a spot on a dedicated plane. Let’s dig deeper to figure out which method ticks all your business needs and delivers ultimate efficiency. Stay with us to decode the journey your goods take from the British Isles to the Pearl of the Orient.

Should I choose Air Cargo between UK and Hong Kong?

Considering air cargo for shipping goods from UK to Hong Kong? Favorable for its cost-effectiveness and reliability, air cargo becomes attractive starting from 100/150 kg (220/330 lbs) of cargo. Firms like British Airways and Cathay Pacific are worthy mentions in this space. However, brace for longer transit times owing to fixed schedules. While British Airways caters to wide range business needs, Cathay Pacific is renowned for its reliable services. Explore more on their official websites, British Airways and Cathay Pacific. So, if meeting budget constraints is your priority, opting for air cargo could be a beneficial decision.

Should I choose Express Air Freight between UK and Hong Kong?

Express air freight is a targeted service utilising cargo-exclusive planes, tailor-made for shipments that don’t exceed 1 CBM or 100/150 kg (220/330 lbs). If you’re dealing with smaller, time-sensitive items, this could be your go-to choice. Renowned express courier companies like FedEx , UPS , and DHL offer this premium service. Think of it as a fast track for your goods – speedy, dedicated, and with less red tape. Good for urgent orders or high-value cargo, but be mindful of the cost – it comes at a premium compared to regular freight options.

Main international airports in UK

London Heathrow Airport

Cargo Volume: Handles approximately 1.7 million tonnes of freight every year.

Key Trading Partners: Significant trading partnerships with USA, China, India, Canada and Australia.

Strategic Importance: As Europe’s largest passenger hub and the second busiest airport in terms of cargo traffic, its strategic location allows easy access to multiple markets.

Notable Features: Offers specialized warehousing solutions including pharmaceutical and perishable goods capabilities.

For Your Business: Heathrow’s extensive air link network, destinations diversity, and robust cargo handling capabilities can expedulously facilitate your business’s global shipping needs.

Cargo Volume: Manages around 100,000 tonnes of goods on an annual basis.

Key Trading Partners: Major trading partners include the European Union, USA, and Canada.

Strategic Importance: Gatwick plays a vital role in the supply chain for fresh produce due to its connectivity to multiple countries.

Notable Features: Its dedicated cargo terminal caters to various types of goods including perishable and dangerous goods.

For Your Business: Gatwick can provide fast and reliable air freight services for your company, especially if you are dealing in time-sensitive or perishable goods.

Cargo Volume: Handles over 120,000 tonnes of import and export freight annually.

Key Trading Partners: Notable relationships with USA, China, Middle East, and Africa.

Strategic Importance: As the North’s only major gateway, it’s critical for handling cargo for industrial businesses within the region.

Notable Features: Provides comprehensive freight processing services and a World Freight Terminal for integrated logistics.

For Your Business: Manchester Airport is a choice port for businesses in the north of England, offering robust links to global markets and comprehensive cargo handling services.

Cargo Volume: Processes over 320,000 tonnes of flown cargo each year.

Key Trading Partners: Has strong partnerships with European Union countries, particularly for e-commerce.

Strategic Importance: As UK’s largest pure cargo airport, it is a primary hub for mail and express freight in the country.

Notable Features: Specialized in handling e-commerce packages, providing extensive services around the clock.

For Your Business: The East Midlands Airport is pivotal if your operations involve e-commerce, offering rapid processing and extensive flight options.

Cargo Volume: Approaches 250,000 tonnes of freight every year.

Key Trading Partners: Major connections include the European Union, Middle East, and USA.

Strategic Importance: Strongly connected to the UK’s technology and pharmaceutical industries, enabling timely delivery of specialised goods.

Notable Features: Advanced facilities for handling secure or sensitive freight, including pharmaceuticals and technology.

For Your Business: Stansted is an ideal choice for businesses trading precious or high-value goods, promising secured transit and a variety of destinations.

Main international airports in Hong Kong

Hong Kong International Airport

Cargo Volume: Hong Kong International Airport is one of the busiest airports worldwide, handling 4.5 million metric tonnes of cargo in 2020.

Key Trading Partners: Its prevalent trading partners include China, the United States, and Japan.

Strategic Importance: The airport’s world-class infrastructure and strategic location make it a significant gateway for global air freight routes, especially for shipments moving through the Asia-Pacific region.

Notable Features: It offers 24/7 operations without restrictions and is served by more than 100 airlines, further enhancing its shipment handling efficiency.

For Your Business: Given its large cargo volume and strategic location, Hong Kong International Airport could be a prime choice if your business primarily ships to or from Asia. Its efficient operations can ensure faster transit times and better handling of your shipments.

How long does air freight take between UK and Hong Kong?

On average, air freight shipping from the UK to Hong Kong takes approximately 8-10 days. However, keep in mind that these are not fixed times. Your package’s transit time could swing either way depending on the airports involved, the weight of your consignment, and the nature of your goods. For precise timings tailored to your specific shipment, consider consulting with a professional freight forwarder like DocShipper.

How much does it cost to ship a parcel between UK and Hong Kong with air freight?

Shipping costs for air freight between the UK and Hong Kong can average between 4-6 GBP per kg. However, an exact price is elusive due to factors such as distance from departure and arrival airports, the parcel’s dimensions, weight, and the nature of goods. Understandably, this might create some uncertainty, but rest assured, our experts are here to help. We approach each shipment individually to secure the best possible rates tailored to your specific needs. Reach out to us, and we’ll swiftly provide you with a customised quote at no charge, usually within 24 hours. Contact us now for your free quote.

What is the difference between volumetric and gross weight?

When shipping goods via air freight, it’s essential to understand two key concepts: gross weight and volumetric weight. Gross weight refers to the physical weight of your shipment, including packaging material, which is measured in kg. Volumetric weight, on the other hand, projects the weight of your shipment but focuses on the space it will occupy in the aircraft, again measured in kg.

Calculating gross weight is straightforward – you just need a scale! It’s the sum of the weights of all your goods and their packaging.

For the more complex volumetric weight computation, different procedures apply for Air cargo and Express Air Freight services.

In traditional Air cargo, the volumetric weight is calculated using the formula: (Length cm x Width cm x Height cm) / 6000. For Express Air Freight services, carriers use a slightly different formula: (Length cm x Width cm x Height cm) / 5000. The difference lies in what is known as the dimensional factor, which in the first case is 6000 and in the second is 5000.

To illustrate, let’s say you’re shipping a parcel with dimensions 40cm x 40cm x 40cm and a gross weight of 25kg.

– For Air cargo, the volumetric weight would be (40 x 40 x 40) / 6000 = 10.67kg. In lbs, that’s roughly 23.5 lbs.

– For Express Air Freight, the volumetric weight is (40 x 40 x 40) / 5000 = 12.8kg or approximately 28.2 lbs.

Evidently, the gross weight (25kg/55.1 lbs) would apply for your freight charges in this example, as it’s larger than both calculated volumetric weights.

So why do these weights matter? Freight charges are generally determined based on whichever is higher between the gross and volumetric weight. This system ensures optimal use of cargo space, preventing overly bulky but lightweight shipments from using up valuable space. Understanding these calculations allows you to predict your shipping costs more accurately, essential for your business budgeting.

Door to door between UK and Hong Kong

Kicking off a whole new chapter in shipping – door-to-door delivery, a service where we collect your goods and ensure they arrive safely at their destination in Hong Kong, all from the UK. Offering convenience on a silver shipping tray, it strips away usual shipping hassles. Fancy bidding adieu to complex logistics? Then, let’s dive right in.

Overview – Door to Door

Door to Door shipping from the UK to Hong Kong? Don’t sweat it! Crafted for your utmost convenience, this service is a lifesaver for businesses wary of shipping complexities. It’s not only admired, but the most demanded solution by DocShipper’s clientele. This all-in-one service manages everything – transport, customs, duties and more. Alleviating your workload, it’s as simple as shipping from your doorstep to your recipient’s. Beware though! While it’s quite a time-saver, costs might run high. Stay with us to explore why door-to-door service has earned its spot as a stress-free logistics solution, and whether it’s the best fit for you.

Why should I use a Door to Door service between UK and Hong Kong?

Ever tried herding cats? Shipping goods from the UK to Hong Kong can feel that chaotic – but it doesn’t have to be, thanks to Door to Door services. Here’s the rundown on why this might just be your panic-free passport in international logistics:

1. Hassle-Free Process: Imagine a logistics fairy who lovingly whisks away your goods from your doorstep and delivers them to your desired location overseas. That’s practically what Door to Door does. No need for you to mingle with multiple freight companies or get tangled in a web of paperwork!

2. Timely Deliveries: We live in an age where waiting is the new ‘ugh’. And in business, time is literally money. Door to Door service saves you precious time with their wham-bam-thank-you-ma’am approach to punctuality, making it an attractive choice for those rush orders.

3. Specialized Cargo Handling: Have a sensitive, oversized, or otherwise elaborate consignment? Not to worry! Door to Door services provide specialized treatment to every type of cargo. Your goods aren’t just items on a list, they’re trusted cargo given the VIP handling they deserve.

4. Stress-free Customs: Navigating customs can be as fun as accidentally stepping on Lego. With Door to Door service, there’s no need to sweat over the complexities of customs. They clear all the hurdles for you, handling duties, taxes, and all that nit-picky paperwork.

5. End-to-End Responsibility: With everything, from pickup to trucking until the final destination, under their umbrella, Door to Door services offer a seamless transportation chain. This means less coordinating, less worry, and a lot more peace of mind.

Choosing Door to Door service between the UK and Hong Kong is like opting for a personal butler for your freight – it’s about convenience, assurance, and getting your goods where they need to be with minimal fuss. Time to welcome a smoother shipping experience!

DocShipper – Door to Door specialist between UK and Hong Kong

Unlock hassle-free shipping between the UK and Hong Kong with DocShipper’s comprehensive door-to-door freight services. Savour a stress-free experience as we handle each step proficiently – from packing your goods to ensuring efficient transport across all shipping modes, along with seamless customs clearance. Look forward to your very own dedicated Account Executive, there to guide and assist you. Reach out today for a free, no-obligation estimate within 24 hours. For any queries, our consultants are standing by, ready to serve you. At DocShipper, we’re all about making your shipping experience effortless and efficient.

Customs clearance in Hong Kong for goods imported from UK

Customs clearance refers to the procedures and processes needed to import goods into a new country, in this case, Hong Kong from the UK. It’s a labyrinth of complexity with the risk of unexpected fees and charges lying in wait. Not fully understanding customs duties, taxes, quotas, or licenses could see your goods stuck in limbo. But worry not, we’ll delve into each element in the sections to come. As part of the service, DocShipper assists you in navigating this tricky terrain for any type of goods anywhere globally. To move forward with an estimate, simply share the origin of your goods, their value, and HS Code. We’re here to make your international shipping experience as seamless as possible.

How to calculate duties & taxes when importing from UK to Hong Kong?

Understanding exactly how much you’ll need to pay in duties and taxes for your shipment from the UK to Hong Kong shouldn’t be a guessing game. The key components of a precise estimate include the country of origin, the HS code of your products, the customs value, and the applicable tariff rate. It’s also important to factor in any additional taxes or fees that could apply to your goods. So how do you piece together this financial jigsaw? Start by identifying the manufacturing or production location of your goods, because the country of origin can greatly influence the final duty calculations.

Step 1 – Identify the Country of Origin

Identifying the country of origin, in this case, the United Kingdom, is not a step to be rushed. First and foremost, it defines customs duties. Trade agreements with Hong Kong can significantly lower your operational costs. Second, it determines whether the goods meet import restrictions or unnecessarily strict standards. Next, it confirms eligibility criteria for tariff exemptions or reductions. Fourth, proofs of origin can stop disputes and streamline the import process. Finally, it allows businesses to promote the provenance of their goods.

Trade agreements such as the UK-HK Bilateral Agreement on Trade in Goods have a massive impact on customs duties, dropping some to zero! Stay updated with such agreements to maximize your savings.

Be cautious! Even seemingly harmless goods can face rigorous import restrictions. From food products to electronic devices, always double-check. When it comes to practical advice: Knowledge is power! Stay informed, study trade agreements, respect import restrictions and handle your shipment decisions wisely. A well-informed decision saves both time and money.

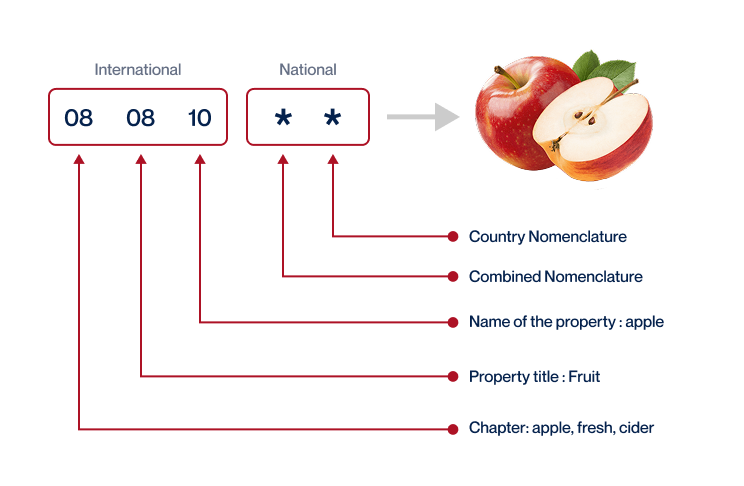

Step 2 – Find the HS Code of your product

The Harmonized System (HS) Code is a standardized numerical method of classifying traded products. It’s used by customs authorities around the world to identify products when assessing duties and taxes and other regulations like import restrictions.

Typically, the most straightforward way to find the HS code of your product is by asking your supplier. They are usually familiar with the products they’re shipping and the corresponding regulations.

However, if you can’t obtain the code from your supplier, don’t worry. We have an easy step-by-step process for you. Your journey starts with using an HS lookup tool.

The Harmonized Tariff Schedule is an excellent tool you can use for this. This tool allows you to type in the name of your product in the search bar to find its HS code.

In the results, you will look in the Heading/Subheading column to find the HS code for your product.

Please keep in mind: Accuracy is key when it comes to HS Codes. Errors or inaccuracies can lead to shipment delays and potential fines, so ensure you are as precise as possible to prevent any unforeseen issues.

Here’s an infographic showing you how to read an HS code. Understanding this will provide a better picture of how your product is classified globally.

Step 3 – Calculate the Customs Value

Understanding what a customs value is might seem complex, but it’s simpler than you think. It’s not purely the value of your goods – it involves more than that. The customs value is the CIF value, which is the sum of the price of the goods, cost of international shipping, and insurance cost.

So, let’s take a real-world scenario: if you’re importing a batch of tea from the UK that costs $10,000, and you paid $2,000 for shipping and $500 for insurance, your customs value won’t be $10,000, it’d be $12,500 – this is what Hong Kong’s customs will calculate your duties on. Remember, it’s the CIF – Cost, Insurance, and Freight that matter here!

Step 4 – Figure out the applicable Import Tariff

An import tariff represents the tax imposed on imported goods and can be a significant cost in your shipping process. In the case of Hong Kong, you’ll encounter the Most Favoured Nation (MFN) Tariff rates when importing from the UK.

To identify the applicable tariff rate for your goods, you’ll first have to determine the specific Harmonized System (HS) code. Let’s use the HS code 080520, which represents Clementines as an example.

You can then use the UK Trade Tariff tool to identify the tariff rate for your product.

1. Visit the site

2. Insert the HS code ‘080520’ in the search bar.

3. Enter ‘Hong Kong’ as the destination country.

Upon doing this, let’s say you are provided with a tariff rate of 6.1%.

Next, you’ll need to establish the Cost, Insurance, and Freight (CIF) value for your goods. In our example, let’s assume the CIF costs amount to $1,000 USD.

To calculate the import duties, you’ll need to multiply the CIF value by the tariff rate:

$1,000 (CIF) 6.1% (Tariff Rate) = $61 USD

To summarize, this means you’ll be expected to pay an import duty of $61 USD for your Clementines shipped from the UK to Hong Kong. Understanding this process can greatly assist in accurate costings when planning your international shipments.

Step 5 – Consider other Import Duties and Taxes

Beyond the standard tariff rate, you may need to account for different import duties when shipping goods from the UK to Hong Kong. Depending on the product’s country of origin and nature, and the prevailing import regulations, additional charges could be applied such as excise duty or anti-dumping taxes.

For instance, a high-end wine from the UK may attract excise duty in Hong Kong. The excise duty is a tax levied on certain types of goods produced or manufactured within or imported into a country. However, remember that this is a hypothetical scenario and rates may vary on different factors.

Also, there’s the anti-dumping tax, a protectionist tariff imposed on foreign imports priced below their normal value in the home market. This tax can help protect domestic manufacturers in Hong Kong from unfair competition.

One of the most crucial charges to consider is the Value-Added Tax (VAT). In our example of shipping wine, if the cost, insurance, and freight (CIF) value of the shipment is $10,000 and the VAT rate is 20%, the VAT would amount to $2,000 (20% of $10,000). Again, the formula is simple but actual charges can vary based on current rates and laws.

Understanding each of these charges helps in ensuring a more accurate budget for your shipping needs and prevents unforeseen expenditure.

Step 6 – Calculate the Customs Duties

In this step, traders calculate Hong Kong customs duties. The primary factors include the customs value of your goods, Value-Added Tax (VAT), and potential anti-dumping taxes.

Let’s demystify this with examples:

1. Suppose you’re importing stylish British hats valued at $1000 to Hong Kong and the customs duty rate is 5%. You would pay $50 in duties. But since there’s no VAT in Hong Kong, that’s all you need to pay.

2. Let’s import the same hats into a country with a 20% VAT rate. Your customs duty remains $50, plus VAT on ($1000+$50) which equals $210. That totals $260!

3. Lastly, let’s add a hypothetical anti-dumping tax of 15% and a 10% Excise Duty. Now your payment calculation becomes more complex, involving customs duty, VAT, anti-dumping tax, and Excise Duty on the cumulative sum. Stick with us, it’s not that scary! You would pay $50 (Customs Duty) + $315 (VAT on sum of value+duty+anti-dumping tax) + $150 (Anti-dumping Tax on $1000) + $151.50 (10% Excise Duty on sum of all prior charges and value). The total charge works out at $666.50.

Such calculations can be complex. That’s where we come in! At DocShipper, we ensure seamless customs clearance globally and save you from overpaying. Let us take care of all your logistics details. We provide quotes free of cost within 24 hours. Get in touch now!

Does DocShipper charge customs fees?

Although DocShipper acts as your customs broker in the UK and Hong Kong, we don’t charge customs duties. Our role involves handling customs clearance, while duties and taxes go directly to the government. Picture it like a shopping mall: we’re the mall staff facilitating your shopping (for which we charge), while your purchases (customs duties and taxes) get paid to the respective shop owners. To ensure transparency, we furnish you with official customs documents, proving you’ve only paid what’s due to the customs office. It’s all a part of streamlining your shipping experience.

Contact Details for Customs Authorities

UK Customs

Hong Kong Customs

Official name: The Customs and Excise Department of the Hong Kong Special Administrative Region (HKSAR)

Official website: https://www.customs.gov.hk

Required documents for customs clearance

Unsure about what paperwork you need for customs clearance? It can be tough juggling terms like Bill of Lading, Packing List, or Certificate of Origin—not to mention the ominous-sounding Documents of Conformity (CE standard). This straight-to-the-point guide is here to explain them comprehensively, smoothing your path through the customs maze.

Bill of Lading

When you’re shipping goods from the UK to Hong Kong, you can’t ignore the importance of the Bill of Lading. This document isn’t just a shipping receipt; it marks the ownership transition from you to the receiver. So, if you’re exporting high-value engineering equipment, for instance, the Bill of Lading is your proof that you’ve done your part. Plus, it’s adaptable; shipping is going digital and so is the Bill of Lading. Opting for an electronic (telex) release expedites the process, getting your goods where they need to be faster. For air cargo, the AWB (Air Waybill) does much the same job. Remember, preparing the Bill of Lading correctly is vital. A perfectly completed document will make customs clearance a breeze, helping your business save valuable time and resources.

Packing List

Shipping goods from the UK to Hong Kong? You’ll definitely need an accurate Packing List! It’s your cheat-sheet detailing everything from quantity to weight and product descriptions of your shipment. Picture it as a handy guide for customs officials, making their task simpler and helping your goods sail through customs swiftly. Whether you’re shipping laptops via air freight or toys via sea freight, an error in your Packing List could result in costly delays or even confiscations. Let’s say you forget to list the battery weight in a shipment of electronic toys; this could land you in a sea of bureaucratic hurdles. Keep it accurate, keep it up-to-date and your trade journey between the UK and Hong Kong will be smoother.

Commercial Invoice

Navigating customs between UK and Hong Kong? Consider the Commercial Invoice as your map. This crucial document lists key details like the buyer and seller, shipment description, terms of trade, and total value. Remember, Hong Kong’s customs regulations strictly adhere to the invoice’s accuracy. Misaligned facts between the Commercial Invoice and other shipping documents could mean delays, penalties, or even shipment seizure. A pro tip: use the Incoterms specified in your contract on your invoice to avoid confusion. An informed approach to your Commercial Invoice might just make the difference between a shipping hiccup and smooth sailing.

Certificate of Origin

Navigating the UK-Hong Kong shipping landscape can feel like navigating a labyrinth without a guiding torch—complex and confusing. Here’s a helping hand: a Certificate of Origin (COO). This document is like your shipment’s passport, stating its birthplace or where it’s manufactured. For example, let’s say you’re exporting designer jewellery; your COO validates these glimmering pieces were indeed crafted in the UK. It pays off—literally. Honesty is rewarded with preferential duty rates at the Hong Kong customs. So instead of piling up extra costs, you’re efficiently saving your dollars. A quick tip: Be meticulous while mentioning the manufacturing country in your COO. A small error could cause a big mix-up. Remember, every dollar saved on duty is a dollar added to your bottom line!

Get Started with DocShipper

Prohibited and Restricted items when importing into Hong Kong

Facing roadblocks with your Hong Kong imports? Spotting prohibited and restricted items early can save you from headaches like customs delays or penalties. Let’s dive straight into the essentials and simplify your shipping journey.

Are there any trade agreements between UK and Hong Kong

There’s good news for businesses shipping between Hong Kong and the UK. These two regions enjoy strong trade relations, although no formal Free Trade Agreement (FTA) or Economic Partnership Agreement (EPA) exists. Their strong ties are signposted by vibrant trade associations and dynamic bilateral trade forums, fostering cooperation and negotiation. Further economic integration may come from significant infrastructure projects on the horizon. Keep an eye out for updates, as these advancements could streamline your shipping processes and open new opportunities.

UK – Hong Kong trade and economic relationship

With a trade history dating back to the 19th century, the UK-Hong Kong relationship is firmly established. This partnership has evolved through significant milestones like the Hong Kong handover and Brexit. Today, Hong Kong ranks as the UK’s 15th largest trading partner with an impressive £9.3 billion goods traded annually.

Prominent sectors comprise of Pharmaceuticals, machinery, and precious metals from the UK, while Hong Kong specializes in electronic devices. Notably, British direct investment in Hong Kong has soared to £33 billion, in fields like banking and insurance. In return, Hong Kong’s investment in the UK nears £49.4 billion, creating opportunity and employment across many sectors, consolidating their robust economic ties. This substantial exchange of trade and investment captures the vitality of the UK-Hong Kong economic relationship.

Your first steps with DocShipper

Additional logistics services

Warehousing

Finding the right warehousing in the UK and Hong Kong shouldn't give you a headache. Let's say you're shipping chocolates; you need a cooler warehouse, right? We've got your back with our tailored services.

Packing

Shipping between the UK and Hong Kong? It's crucial to get packaging right—goods often face a sea journey of more than 9,800 miles. From ceramics to electronics, you need an agent who ensures your products withstand this distance. Think precise padding for fragile glassware or heat-resistant packaging for your tech products.

Transport Insurance

Transporting goods naturally carries risks, different from those in fire insurance. Cargo insurance is your safety net. Suppose a container falls overboard during a storm, or there's damage in transit - it covers these unforeseen incidents. For instance, your gourmet teas could lose their aroma due to moisture - a big financial hit. Get peace of mind with the right coverage.

Household goods shipping

Moving between UK and Hong Kong with fragile or bulky items? No need to fret! Our personal effects shipping service ensures your belongings are handled professionally, providing utmost care and flexibility. Like the valuable heirloom or that bulky piece of furniture, we've got them covered.

Procurement in Thailand

Sourcing or manufacturing in Asia or East Europe? DocShipper streamlines your procurement process, efficiently handling supplier searches and procurement. Our expertise eradicates language barriers and lends clarity to your journey. Imagine a world where you efficiently tap into prodigious markets without the crippling communication issues.

Quality Control

Experience has shown us that meticulous quality control is crucial when shipping goods from the UK to Hong Kong. It's your shield against non-compliant or defective products. An example? We had a client who shipped automotive parts. Our in-depth inspections caught defects at the source, saving them thousands in returns, recalls, and reputation damage.

Conformité des produits aux normes

Shipping abroad requires adherence to precise product standards. Our Product Compliance Services ensure your goods pass every regulation test, eliminating delays or rejections. With laboratory testing, we secure necessary certifications, giving your product a smooth journey. Gain peace of mind, knowing your items conform to all destination regulations. More info on our dedicated page: Product compliance services