Why was the shipping container feeling blue? It was sea-sick of turbulence over tariffs and transit times! Indeed, freight transport between the UK and Turkey can often feel as complex as unraveling a Gordian knot, especially if you're grappling with understanding rates, transit times, and customs regulations.

In this destination guide, you'll gain clarity on key aspects of transport modes - be it air, sea, road, or rail, and demystify the tricky terrain of customs clearance, duties, and taxes. As we delve deeper, we'll also equip you with business-centric advice, ensuring your shipments never falter amidst transnational nuances.

If the process still feels overwhelming, let DocShipper handle it for you! As an international freight forwarder, we take the complexity out of the equation, transforming shipping challenges into streamlined success stories!

Which are the different modes of transportation between UK and Turkey?

Strategizing the goods movement from the bustling sphere of the UK to the culturally rich terrains of Turkey? Let's imagine you're on a rally race; geographic hurdles might stagnate your speedy ride.

Just like our intrepid racers, freight choices too hit the brake seeing the significant distance and restrictive borders. Your options may be pegged down, leaving you with the practical route of air and oceanic transport.

Aligning your choice with the particular cargo needs is like picking the swift sportscar for a fast-paced track - it's instrumental in winning your shipping race!

How can DocShipper help?

Shipping goods from the UK to Turkey? Let DocShipper's expertise guide you through. We handle every detail - from paperwork to customs - ensuring a smooth journey for your products. Curious about cost? Our consultants are ready to provide a free estimate in under 24 hours. Let's get your shipment moving!

![]()

DocShipper Tip: Ocean freight might be the best solution for you if:

- You're dealing with large quantities or oversized items. Sea freight offers a budget-friendly way to maximize space, a particularly useful option given the UK's extensive port network.

- Your shipment isn't on a tight schedule. Ocean transport typically takes longer than air or rail, but it offers reliability.

- Your supply chain involves key ports, allowing you to take advantage of a wide-reaching network of sea lanes.

Sea freight between UK and Turkey

The UK and Turkey share an impressive trade relationship, one graced by numerous high-demand and high-volume goods sailing the sea's tide. This bustling maritime commerce is primarily centered around key cargo ports such as the Port of Felixstowe and London Gateway in the UK, and Ambarli and Mersin in Turkey.

For businesses on a budget, ocean shipping is a cost-effective way of getting your goods from point A to B, although it might need a pinch more patience due to sea freight’s slower pace.

However, where there's shipping, there's complexity. Many businesses grapple with intricate customs procedures, an often-confusing array of rates, and ever-changing regulations for overseas trade. Picture being at the helm of a ship in foggy weather - tricky, isn't it? That's where we step in, offering practical guidelines to steer your business through these choppy waters.

From understanding duty rates to smart packing, we've got the hands-on advice to help your sea freight journey run smoothly. Stay tuned for more details in our comprehensive guide.

Main shipping ports in UK

Port of Felixstowe

Location and Volume: Situated in Suffolk on the North Sea, the Port of Felixstowe is the busiest container port in the UK, handling over 3 million TEUs in 2022.

Key Trading Partners and Strategic Importance: It's the main UK port for trade with Asia, offering regular services to and from China, South East Asia, and other key regions. It plays a pivotal role in European trade routes.

Context for Businesses: For those considering expansion into Asian markets, the Port of Felixstowe’s strong links and regular services provide a strategic advantage for import and export activities.

Port of Southampton

Location and Volume: The Port of Southampton, on England's south coast, handles around 2 million TEUs annually.

Key Trading Partners and Strategic Importance: The port plays a significant role in trade relations with the USA and Far East, along with inter-European routes. Southampton is also the UK's number one port for automotive trade.

Context for Businesses: If you’re involved in the automotive industry, or looking to reach North American and Far Eastern markets, Port of Southampton offers a direct and dynamic shipping solution.

Port of London

Location and Volume: Based on the River Thames, the Port of London managed a volume of about 12.6 million metric tons in 2023.

Key Trading Partners and Strategic Importance: With an extensive network, it serves over 80 ports worldwide covering both short and deep-sea destinations. The port is also a key player in the UK's domestic supply chain.

Context for Businesses: If you're after efficient distribution within the UK or to across Europe, The Port of London’s extensive network can significantly streamline your logistics process.

Port of Grimsby & Immingham

Location and Volume: Located on the Humber Estuary in North East Lincolnshire, Grimsby & Immingham shipped about 11.7 million metric tons in 2023.

Key Trading Partners and Strategic Importance: Its critical role lies in handling fuel, cars, and food from all over Europe, especially Scandinavia and the Baltic states.

Context for Businesses: Should you focus on food or automotive sectors, or regularly ship goods from Northern Europe, Grimsby & Immingham may be a natural choice for your logistics plan.

Port of Teesport

Location and Volume: Based on the River Tees in Middlesbrough, Teesport handled 56 million tonnes of goods in 2022.

Key Trading Partners and Strategic Importance: Diversified trade relationships span across Northern Europe and East Asia. The port provides value-added logistics services, including warehousing.

Context for Businesses: For businesses prioritizing storage for goods-in-transit, or seeking market penetration in Northern Europe and East Asia, Port of Teesport could be beneficial for streamlined logistics.

Port of Liverpool

Location and Volume: Located on the River Mersey in Northwest England, the Port of Liverpool manages 32 million tonnes of cargo annually.

Key Trading Partners and Strategic Importance: It primarily works with North America, East and West Africa, the Middle East, and Europe. The port is a key player in transatlantic trade.

Context for Businesses: If your growth plans involve the American, Middle Eastern, or certain African markets, the Port of Liverpool’s strategic position offers reliable and diversified shipping lanes.

Main shipping ports in Turkey

Port of Ambarli

Location and Volume: Located on the western coast of Istanbul, this port is crucial for European trade links, managing approximately 3.2 million TEU annually.

Key Trading Partners and Strategic Importance: Europe is a key trading partner, indeed its strategic location offers direct access to the Black Sea region and beyond.

Context for Businesses: Businesses aiming to expand in the European market may find Ambarli an asset, thanks to its geographically advantageous position and robust handling capacity.

Port of Mersin

Location and Volume: Mersin is a key port in southern Turkey, with a shipping volume of over 2 million TEU.

Key Trading Partners and Strategic Importance: It's a crucial link in the Mediterranean region with key trading partners spread across Europe, North Africa, and the Middle East.

Context for Businesses: If businesses are eager to build strong trading ties in the Mediterranean region, Mersin, with its extensive network, could facilitate this growth.

Port of Izmir

Location and Volume: This Aegean Sea port, situated in Western Turkey, processes more than 1.1 million TEU each year.

Key Trading Partners and Strategic Importance: Key trading partners largely include European nations thanks to its proximity, making it a strategic hub for businesses targeting both Eastern and Western Europe.

Context for Businesses: Companies pursuing expansion in Europe may find Izmir ideal for their strategy given its impressive connections to key European ports.

Port of Haydarpasa

Location and Volume: Located in Istanbul, this port provides a pivotal link to both Europe and Asia, handling more than 600,000 TEU annually.

Key Trading Partners and Strategic Importance: Vital trading partners are scattered across Europe and Asia, enhancing the port's strategic importance as a bridge between the two continents.

Context for Businesses: Haydarpasa port's uniquely advantageous location is perfect for businesses seeking to extend their reach across several key markets in Europe and Asia at once.

Port of Iskenderun

Location and Volume: Positioned on Turkey's Mediterranean coast, Iskenderun port handles over 500,000 TEU a year.

Key Trading Partners and Strategic Importance: This port is crucial for trade with countries in the Levant region and North Africa.

Context for Businesses: Iskenderun could be indispensable for businesses looking to penetrate markets in the Levant and North Africa due to its strategic position linked to these regions.

Port of Gemlik

Location and Volume: Located in Bursa, this port handles over 1 million TEU annually, making it an important part of Turkey's import and export economy.

Key Trading Partners and Strategic Importance: Its geographic location makes it an essential touchpoint for trade with European and Middle Eastern countries.

Context for Businesses: Gemlik port serves as an excellent option for businesses requiring quick access to key markets in Europe and the Middle East, owing to its strategic location and heavy cargo handling capacity.

Should I choose FCL or LCL when shipping between UK and Turkey?

Choosing between Full Container Load (FCL) or Less than Container Load (LCL), also known as consolidation, is crucial for cost-effective, efficient shipping from the UK to Turkey. It's not solely about filling containers. It impacts your bottom line, delivery speed, and your cargo's safety. Understanding the ins and outs of these options allows you to leverage them for your business gain. Dive into this section, and let's pinpoint the best solution tailored to your unique shipping needs.

LCL: Less than Container Load

Definition: LCL (Less than Container Load) shipment refers to the method of shipping whereby assorted cargo from various clients is consolidated into one container for transportation.

When to Use: LCL freight tends to be the optimal choice when your goods volume is less than 15 cubic meters (CBM). This offers price flexibility for those shipping lower volumes, greatly reducing costs by sharing the container space and costs with other shippers.

Example: Consider, for instance, an SME exporting ceramics from the UK to Turkey. If their cargo only takes up 12 CBM, they could opt for LCL shipment to avoid paying for unused space in a full container.

Cost Implications: LCL freight can significantly lower transportation costs, especially for smaller volume shipments. Since the shipping cost is shared among all those whose cargo is in the container, it's price-effective. However, it's imperative to note that per unit shipping costs may be higher than FCL if the volume is close to or exceeds a half-container load.

FCL: Full Container Load

Definition: FCL or Full Container Load shipping is a type of ocean freight service where the entire container is filled by a single shipper's cargo.

When to Use: If your cargo volume exceeds 13 to 15 cubic meters (CBM), FCL shipping could be more cost-effective and safer. The containers are sealed at origin and unsealed at destination, ensuring minimal risk of loss or damages.

Example: Let's say a UK based auto parts manufacturer supplies to a company in Turkey and they have to ship 16 CBM of components. In this circumstance, an FCL container – either a 20'ft or 40'ft container based on the weight, size and the configuration of the goods – would be an ideal choice.

Cost Implications: Although the FCL shipping quote may seem high initially, it is cheaper on a per-unit basis for high-volume shipments compared to LCL (Less than Container Load). Moreover, compared to LCL, FCL reduces handling costs and eliminates the risk of damage due to less handling, potentially saving more money in the long run.

Unlock hassle-free shipping

Shipping internationally doesn't have to be a puzzle. Let DocShipper solve it for you. We're determined to simplify sea freight for businesses. Our team of ocean-freight gurus will guide you through the decision-making process - considering cargo volume, desired frequency of shipments, and budget matching - to determine if consolidation or full container shipping suits you most between the UK and Turkey. Don't be overwhelmed, we're here to help. Reach out for a free estimation today. Our mission is to make your shipping hassle-free.

How long does sea freight take between UK and Turkey?

Sea freight between the UK and Turkey, on average, takes around 30 and 40 days. This time frame, known as transit time, varies based on factors such as the specific ports used, the weight, and the nature of the goods being transported.

For an accurate estimate specific to your shipment, it's recommended to consult with a freight forwarder like DocShipper for a tailored quote.

How much does it cost to ship a container between UK and Turkey?

Determining an exact figure for container shipping between the UK and Turkey can be complex with ocean freight rates typically ranging broadly. Influential factors include the Points of Loading and Destination, your selected carrier, the nature of your goods, and dynamic market conditions.

Thus, the shipping cost can't be pinned down to a flat fee. Rest assured, our savvy shipping specialists are committed to understanding your specific requirements and will diligently work towards providing a customized, cost-effective solution.

Every quote we prepare is bespoke, designed to suit your unique shipping needs while optimizing efficiencies and keeping your bottom line in perspective.

Special transportation services

Out of Gauge (OOG) Container

Definition: Out of Gauge shipping, also known as OOG container shipping, pertains to the transport of cargo that exceeds standard container dimensions. These shipments require extra attention as their size or weight doesn't fit into a conventional shipping container.

Suitable for: This method is particularly suited to oversized or heavy items that cannot be broken down into smaller units.

Examples: This would include heavy machinery, large vehicles, industrial equipment, and oversized industrial or construction materials.

Why it might be the best choice for you: If your business deals with goods outside the conventions of standard dimensions, then this approach facilitates secure and efficient transport between the UK and Turkey.

Break Bulk

Definition: Break bulk refers to cargo that is too large or heavy to fit into containers but can be individually loaded onto a vessel. This might mean Out of gauge cargo, but it can also cover lower-volume shipments.

Suitable for: This is an excellent choice for items too bulky or heavy for standard containers, such as heavy machinery, steel products, or wooden crates.

Examples: Vehicles, large drums of cables, or smaller out-of-gauge cargos are often transported using this method.

Why it might be the best choice for you: If your cargo is large in volume or quantity, break bulk shipping can be a more efficient and less costly option.

Dry Bulk

Definition: Dry bulk refers to commodities like grain, coal, or ore that are shipped in large quantities and not packaged individually. These are types of loose cargo loads.

Suitable for: This method is best suited for homogenous goods that can be scooped or poured.

Examples: Industries that typically rely on this type of transport include agriculture, mining, or construction.

Why it might be the best choice for you: If your business trades in large quantities of a single commodity which does not require individual packaging, dry bulk shipping may offer considerable cost-efficiencies.

Roll-on/Roll-off (Ro-Ro)

Definition: Roll-on/Roll-off, or ro-ro vessels, are ships with built-in ramps that allow vehicles and machinery to be driven on and off at the port.

Suitable for: Ro-Ro shipping is typically used for any type of vehicle or machinery, including cars, trucks, trailers, and locomotives, that can use their own wheels or can be placed on a wheeled platform.

Examples: Agricultural, mining, and construction vehicles are just a few types of cargo that benefit from this shipping method.

Why it might be the best choice for you: If your business is involved in transportation of operational vehicles or machines between the UK and Turkey, Ro-Ro vessel shipping ensures your cargo remains intact and ready for use upon arrival.

Reefer Containers

Definition: Reefer containers are refrigerated containers used to transport goods that need to be kept at a certain temperature.

Suitable for: They're ideal for perishable goods like fruits, vegetables, dairy products, and pharmaceutical drugs.

Examples: From chilled food products and beverages to sensitive medicines, a variety of goods can benefit from this type of shipping.

Why it might be the best choice for you: If you're in a business where temperature control is paramount, then this freeze-proof transportation option will ensure your goods arrive in Turkey as fresh as they were in the UK.

The choice depends on the nature of your cargo, its size, and specific requirements, with each method having its own advantages. DocShipper can support you throughout the shipping process, ensuring that your goods arrive safely and efficiently. Reach out to us for a free shipping quote in less than 24 hours. We'll evaluate your needs and find the most appropriate shipping method for your business.

![]()

DocShipper Tip: Air freight might be the best solution for you if:

- You're facing tight deadlines or need rapid delivery. Air freight is your quickest option, which aligns well with the fast-paced business environment.

- Your shipment is relatively small, under 2 CBM. Air freight is ideal for these more compact loads.

- Your cargo's destination isn't easily reached via sea or rail. This makes air freight a viable option, especially given the extensive network of airports available.

Air freight between UK and Turkey

Air freight from the UK to Turkey offers a sweet spot of rapid, reliable transport, especially handy for compact, high-value products. Can you visualize your tiny electronic gadgets or all-important legal documents covering nearly 2500 miles within just a day? That's the power of air freight. But remember, it's not just about booking a flight for your cargo.

Many shippers stumble by underestimating the real-world subtleties of air freight. Take, for example, correctly calculating the freight weight - it’s not only the actual weight but also the volumetric weight of your cargo that counts - a misstep here could burn a hole in your pocket!

Worse, overlooking certain best practices might transform air freight from a boon to a sinkhole of unnecessary costs. In this guide, we'll unwrap these complexities to save you from unexpected surprises in your air freight journey.

Air Cargo vs Express Air Freight: How should I ship?

Looking to fly your goods from the UK to Turkey fast and efficiently but tangled in the choice between air cargo and express air freight?

Let's settle this - opt for air cargo if you don't mind sharing room in a commercial airline, but if you need your goods to have a plane all to themselves for a speedy journey, go with express air freight. Stay tuned as we dig in deeper to pick what's best for your business!

Should I choose Air Cargo between UK and Turkey?

Considering shipping between the UK and Turkey? Air cargo might suit your needs, especially if your cargo weighs around 100/150 kg (220/330 lbs). This method offers cost-effectiveness and reliability, with carriers like Turkish Airlines and British Airways World Cargo providing prime services. However, be aware of longer transit times due to fixed schedules. Look to air cargo as a viable option, calculatedly aligning your budget and timing needs to ensure smooth, proficient shipping.

Should I choose Express Air Freight between UK and Turkey?

Express air freight, a service delivered by renowned courier firms like FedEx, UPS, or DHL, is ideal for transporting cargo under 1 CBM or within the 100/150 kg (220/330 lbs) mark.

Shipping goods between the UK and Turkey? This dedicated, passenger-free service can ensure rapid, timely delivery. For your business, this could mean beating deadlines, gratifying clients with lightning-fast shipment times, or just simplifying logistical planning.

So, if your shipment doesn't exceed these limits, express air freight might be your best choice.

Main international airports in UK

Heathrow Airport

Cargo Volume: Over 1.6 million metric tonnes of cargo annually.

Key Trading Partners: United States, Germany, China, Australia.

Strategic Importance: As the busiest airport in Europe, Heathrow provides numerous connections to international hubs and has a reputation for excellent handling and security.

Notable Features: Extensive cargo infrastructure, including a dedicated cargo terminal and state-of-the-art facilities.

For Your Business: If you're trading with partners in key markets such as the U.S and China, Heathrow's massive cargo handling ability ensures your goods get where they need to go swiftly and securely.

East Midlands Airport

Cargo Volume: Above 358,000 tonnes of goods each year.

Key Trading Partners: Europe, United States.

Strategic Importance: East Midlands Airport is the UK's largest pure freight airport and a key component of the logistics network, offering direct access to the UK's main arterial road network.

Notable Features: Designated an 'EMA Freeport' as part of the UK government's Freeports initiative, providing customs benefits and duty deferment.

For Your Business: With cost-effective handling and transport services in a location central to the UK, it’s an efficient choice for businesses shipping goods to and from mainland Europe and North America.

Manchester Airport

Cargo Volume: Handles over 120,000 tonnes a year.

Key Trading Partners: United Arab Emirates, United States, China.

Strategic Importance: Manchester Airport is well-connected to key international markets and serves a broad catchment area which encompasses several major cities and regions in the North of England.

Notable Features: The airport boasts World Freight Terminal, handling all cargo operations, equipped with 550,000 sq ft of warehouse and office space.

For Your Business: Beneficial for businesses based in Northern England, this airport provides robust cargo services that connect you to primary global markets while eliminating the need to transport goods down to the more congested airports in the South.

Stansted Airport

Cargo Volume: Manages about 250,000 tons of freight per year.

Key Trading Partners: Europe, North America, Asia.

Strategic Importance: Serving as London's third-busiest airport, Stansted is strategically located with easy access to the Southern UK and London itself.

Notable Features: Its dedicated cargo terminal and airport-city development plans promise a streamlined shipping process.

For Your Business: Stansted is a leading choice for many courier companies, from e-commerce giants to smaller independent firms. If speed is a priority, Stansted's emphasis on efficiency can serve your business well.

Gatwick Airport

Cargo Volume: Handles over 100,000 tons of goods annually.

Key Trading Partners: Europe, United States, Middle East.

Strategic Importance: Offering a myriad of both low-cost and full-service airlines, Gatwick Airport maintains a strong global linkage, especially with Europe.

Notable Features: Offers special services for hazardous or high-value shipments ensuring safety and security.

For Your Business: Gatwick is an excellent option if your business relies on cost-effectiveness without compromising on a wide network of destinations. Its specialized services give you added peace of mind when shipping sensitive or valuable goods.

Main international airports in Turkey

Atatürk International Airport

Cargo Volume: 4 million tons of cargo annually.

Key Trading Partners: Germany, USA, Russia, China, Iran

Strategic Importance: As Turkey's primary and major airport, Atatürk Airport acts as a central hub connecting Eastern and Western worlds. It has a robust after-sales support infrastructure, making it perfect for time-sensitive cargo.

Notable Features: Modern facilities, a cargo terminal of over 120,000 square meters, accommodating both traditional cargo and e-commerce.

For Your Business: Ideal if your business has high volumes and requires swift, vast, and reliable cargo services.

Sabiha Gökçen International Airport

Cargo Volume: 63,000 tonnes in 2023.

Key Trading Partners: Russia, Germany, UAE, Iraq, Italy

Strategic Importance: Sabiha Gökçen serves as a stable alternative to Atatürk. Its location in Istanbul's Pendik district means it is well placed to serve the Asian side of Istanbul, a manufacturing and production powerhouse.

Notable Features: Ease of access from industrial zones, robust infrastructure, and modern cargo processing facilities.

For Your Business: If you're located on the Asian side of Istanbul or are shipping goods from the Asian manufacturing zones, this airport is a must-consider.

İzmir Adnan Menderes Airport

Cargo Volume: Amounted to 3.5 million tons.

Key Trading Partners: Germany, Italy, France, USA, Russia

Strategic Importance: Positioned in the Aegean region, rich with a number of industrial zones and export-oriented fields like textiles, food, and automotive. İzmir Adnan Menderes Airport offers an alternative for businesses located in the Western Turkey.

Notable Features: State-of-the-art facilities, modern cargo processing, and easy access from prominent commercial and business regions.

For Your Business: If your business is centered on products from the Western Turkey, prioritizing cargo routes from this airport would be strategic.

Esenboğa International Airport

Cargo Volume: 4 million tons in 2022.

Key Trading Partners: Germany, China, UK, France, USA

Strategic Importance: Located in Ankara, the capital city of Turkey, it caters to the abundant local manufacturers and international businesses based in this major city.

Notable Features: Renowned for its commitment to exceptional service, including 24/7 operations, and excellent flight connections.

For Your Business: If your operations are focused around the capital or require quick access to governmental offices, Esenboğa is your optimal choice.

Adana Şakirpaşa Airport

Cargo Volume: Around 8,099 metric tons in 2023.

Key Trading Partners: Germany, Russia, UK, France, USA

Strategic Importance: Due to its location in the southern part of Turkey, it allows ease of access to the Mediterranean, making it ideal for export-oriented businesses in the region.

Notable Features: Easy customs procedures, being close to multiple Free Trade Zones and industrial hubs.

For Your Business: If your business includes fresh produce or needs quick sea shipping after short air transit, this airport makes a strategic choice.

How long does air freight take between UK and Turkey?

Typically, shipping goods from the UK to Turkey using air freight takes approximately 1 to 3 days. However, it's essential to note that these timelines can fluctuate based on a few variables.

Your specific departure and arrival airports, the weight and type of the goods being shipped, and various other factors can impact the actual transit time.

To ensure you have the most accurate timeline for your consignment, reaching out to a seasoned freight forwarder such as DocShipper for precision is the best course of action.

How much does it cost to ship a parcel between UK and Turkey with air freight?

The cost of shipping via air freight between the UK and Turkey can widely range from £3 to £10 per kg. But don't pin your hopes on these rates just yet. Numerous factors such as exact departure and arrival points, cargo dimensions, weight, and nature of goods significantly influence the final shipping cost.

Therefore, every quote is uniquely tailored. Our team is primed to understand your shipping needs and provide you with the most cost-effective rate. Ready to ship? Contact us and receive a free quote in less than 24 hours.

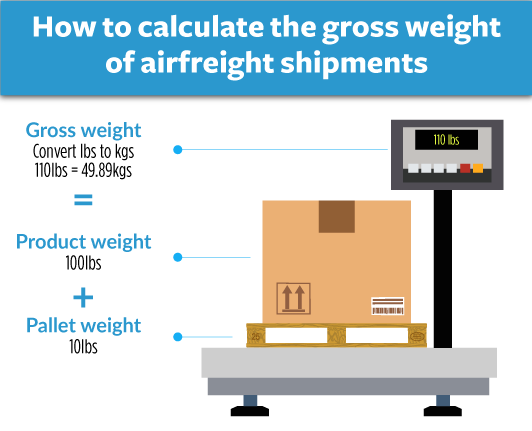

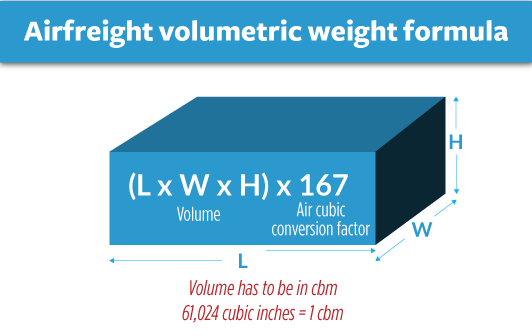

What is the difference between volumetric and gross weight?

Gross weight in air freight represents the actual weight of your shipment, meaning everything included: the products, packaging, pallets, etc. Volumetric weight, also known as dimensional weight, is a pricing technique for commercial freight transport which uses an estimated weight that is calculated from the length, width, and height of a package.

To determine the gross weight of your shipment in air cargo, simply place your prepared goods (products and packaging included) on a scale. The result is your gross weight. For instance, if your shipment weighs 35 kg, that's 77 lbs when converted.

Calculating volumetric weight for Air cargo appears to be slightly different. You'll need to measure the length, width, and height of your package in centimetres. Once done, calculate the volume by multiplying these three measurements. Then divide the total by 6000 to get your volumetric weight in kg. Here's an example: If your package is 40 cm x 50 cm x 60 cm, the volume is 120000 cubic cm. Divide it by 6000, and you get a volumetric weight of 20 kg or about 44 lbs.

Express Air Freight uses a slightly different divisor. Instead of dividing by 6000, divide by 5000 to get the volumetric weight. Given the same dimensions as above, you'd get a volumetric weight of 24 kg or roughly 53 lbs.

Understanding gross vs. volumetric weight is critical as carriers charge based on whichever is higher. This method ensures that carriers are compensated for the space a shipment takes up on their aircraft, not just the shipment's physical weight.

![]()

DocShipper tip: Road freight might be the best solution for you if:

- You're seeking a budget-friendly solution for shorter hauls. Road freight often comes out on top in terms of cost-effectiveness and speed for these kinds of distances.

- Your end destination is either within your own continent or just across the border. For such regional or intra-continental shipments, road freight is typically the most direct and rapid method.

- Your cargo has unique dimensions or shapes. The adaptability of trucking allows for a wide range of goods that may not conform to the size limitations of sea or air transport.

Trucking between UK and Turkey

Navigating the highways from the UK to Turkey offers an adventurous, cost-saving option to consider. This flexible and highly efficient trucking route, spanning across borders and through various terrains, features attractive transit times that keep businesses moving.

From idyllic English countrysides to bustling Turkish markets, the road's condition, while diverse, largely accommodates smooth rides. Plus, compared to other freight modes, road freight can offer cost benefits, like lower insurance rates.

Businesses will find it advantageous, although time management can be a downside due to unpredicted traffic or weather conditions. Rewarding for the mindful planner, this option gives you a distinct, economic edge.

What if I can't fill a truck between UK and Turkey?

Discovering the differences between Less Than Truckload (LTL) and Full Truckload (FTL) freight can pave the way for savvy, cost-effective shipping between the UK and Turkey.

For businesses seeking flexible solutions, understanding these two key shipping options is a game-changer. Let's deep-dive to find your best-fit solution.

LTL: Less than Truck Load

Under the umbrella of logistics, Less Than Truck Load (LTL) is a handy term. Simply put, LTL freight is when shipments do not require a full trailer. Instead, multiple businesses share the same trailer for different shipments.

For instance, imagine you're shipping a local food vendor's wares from the UK to Turkey that weighs around 10 CBM. You wouldn't need the full capacity of the truck for your shipment. Here, LTL shipment is the perfect solution, saving both finances and resources.

So, when should you choose LTL?

- When shipment volume ranges between 1-15 Cubic Meters (CBM).

- In case of a tight budget, as sharing the truck space can cut down transport costs.

- For flexible delivery timelines, as LTL can sometimes take a bit longer than Full Truck Load (FTL).

- If you prefer professional handling and less risk associated with freight loss.

Every punnet of strawberries or bottle of olive oil you’re shipping can get where it needs to be, at reduced costs and an environmentally-conscious way when you choose LTL.

FTL: Full Truck Load

Full Truck Load (FTL) is a mode of transport where a truck carries one dedicated shipment. In other words, the entire space of the truck is monopolized by one single cargo. This gets your shipment from point A to B with no pit stops, offering quicker turnaround times and improved security.

For example, let's say you have a hefty cargo of 16 CBM to transport from London to Istanbul. Choosing FTL would allocate the entire truck to your cargo, thus lowering the risk of damage and ensuring on-time arrival.

When you should consider FTL:

- Time-sensitive: with no other pickups or drop-offs, FTL is faster.

- Large quantities: FTL freight can accommodate sizes over 13/14/15 CBM.

- Fragile shipments: FTL reduces the risk of damage.

- Need for flexibility: FTL shipments allow you to dictate the schedule.

So, if your shipment ticks one of these boxes, Full Truck Load can save the day. Whether it's a huge shipment of machinery parts for your Istanbul factory or an antique collection heading for an exhibition, FTL makes sure your shipment steals the entire truck's spotlight.

What are the main routes between UK and Turkey?

Road freight between the UK and Turkey mainly relies on two extensive routes. The predominant one first charts a course through mainland Europe, specifically via France, Belgium, Germany, Austria, Hungary, and Bulgaria before reaching Turkey. Cities like Brussels, Munich, and Sofia are significant pit-stops along this trail.

Alternatively, trucks can traverse a southern corridor via Italy and Greece, though this necessitates ferries across the Adriatic and Aegean seas. Both routes are subject to substantial traffic, varying weather conditions, and changing regulations, making flexibility paramount in planning and executing such journeys.

What are the road transit times between UK and Turkey?

Typically, road transport between the UK and Turkey takes approximately 6-7 days. However, keep in mind that duration can vary significantly due to unpredictable traffic, circulation issues, and occasionally poor road conditions – for instance, challenging highways in rural Bulgaria.

Therefore, these are merely preliminary estimates. For a more accurate cross-border freight quote tailored to your specific needs, feel free to contact us, and we guarantee a response within 24 hours.

How much does trucking cost between UK and Turkey?

Think pinning down a trucking cost between UK and Turkey is as easy as plucking a number out of thin air? Hang on to your hats, folks, it's not that simple! Just like in our air and sea freight chats, factors like weight, volume, and type of goods can twist the numbers quicker than a cat chasing its tail.

But don't fret! Our ace team, fond of a good challenge, will wrestle these variables for you, quoting on a case-by-case basis to find you a deal that'll have you beaming.

![]()

DocShipper tip: Door to Door might be the best solution for you if:

- You prioritize ease and a hassle-free shipping experience. Door-to-door services manage the entire process, from collection to final delivery.

- You appreciate the efficiency of having one dedicated contact. With door-to-door, a single agent is responsible for overseeing all elements of your shipment.

- You want to limit the number of times your cargo is transferred. Door-to-door services minimize the switches between various transport methods, lowering the chances of damage or loss.

Door to door between UK and Turkey

Door-to-door shipping is a hassle-free logistics service that manages your freight from the UK to Turkey, from origin to final destination. It's a convenient way to transport goods without juggling multiple carriers - a time saver with less paperwork. Experienced in navigating custom protocols, door-to-door shipping simplifies this overseas venture. Eager to unpack this? Let's dive in!

Overview – Door to Door

Shipping goods from the UK to Turkey? DocShipper's door-to-door service is an ideal, stress-free solution for you. It's favored by our clients for its ease and effectiveness, despite occasional higher costs.

This comprehensive service minimizes complexities in logistics by shouldering transport, customs clearance, and more. However, it's crucial to understand that speed relies heavily on customs operations.

Yet, the top-notch convenience it offers—taking the headache out of dealing with multiple entities—proves its worth. Step into smooth shipping territory with door-to-door service!

Why should I use a Door to Door service between UK and Turkey?

Look, logistics can be as complicated as untangling earphone wires after they've spent a day in your pocket. So to save you a headache (and a whole lot of time), Door to Door services from the UK to Turkey can transform your shipping process to a drama-free experience. Here are five convincing reasons:

1. Alleviates Stress in Logistics: With Door to Door service, you're no longer playing the chaotic logistics puzzle. Your shipping agent handles everything from pickup in the UK right to the Turkish doorstep, allowing you to pour all your focus into business growth.

2. Ensures Timely Delivery: For urgent shipments, every second counts. Door to Door services speed up the process, eliminating the waiting game at each transport interchange and reducing chances of delays. It's a race against the clock with a winning advantage!

3. Provides Specialized Care: Got valuable, fragile, or complex cargo? Door to Door service offers expert handling, ensuring your goods receive the TLC they deserve. Coupled with tracking facilities, you're always in the know about your precious cargo.

4. End-to-End Management: With Door to Door service, you’re handed the golden key to convenience. Everything from customs clearance to the trucking until the final destination is catered for. You're the conductor, not the orchestra!

5. Cost-Effective: Although it may seem more expensive initially, Door to Door services are cost-effective when considering the operational efficiency, convenience, and reduced risk of damage or loss.

Ultimately, Door to Door service between the UK and Turkey is a hands-off yet high-control process that brings your goods safely home, while you chill with a cuppa!

DocShipper – Door to Door specialist between UK and Turkey

Enjoy hassle-free door-to-door shipping between the UK and Turkey with DocShipper. Experts manage every step, including packing, transportation, and customs, utilizing all shipping methods to suit your needs. With us on your side, you won’t lift a finger.

A personal Account Executive will be appointed to you, anticipating and meeting your every need. Need a ballpark figure? Request a free estimate within 24 hours or consult our experts for free anytime. Let us streamline your shipping experiences – safe, efficient, and worry-free!

Customs clearance in Turkey for goods imported from UK

Navigating customs clearance from the UK to Turkey can be a maze of unexpected costs and hiccups. From grasping the ins and outs of duties, taxes, quotas to obtaining the correct licenses, every step counts toward a smooth transit for your goods. Miss a beat, and your shipment could end up in customs limbo. Fear not!

This guide will help you sidestep these pitfalls, detailing each aspect of these crucial areas. Plus, DocShipper is here to walk through the process with you, no matter the good, no matter the location. For a project estimate, simply reach out with the origin and value of your goods, along with their HS Code. With these details, we’re ready to help make your shipping endeavour a success.

How to calculate duties & taxes when importing from UK to Turkey?

Working out the customs duties and taxes for importing goods from the United Kingdom to Turkey doesn't have to be daunting. It's a matter of knowing a few key elements: the country of origin (where your goods were manufactured or produced), the Harmonized System (HS) Code corresponding to your goods, the customs value, the applicable tariff rate, and any additional taxes or fees your product may be subjected to.

Once you've got this information at your fingertips, the duty estimation becomes fluid. Let's start from the beginning; the first step in this process is to pin down the exact country where your goods were crafted or produced. By understanding the basics, the procedure of shipping goods internationally can go from a usually stressful chore to a straightforward task.

Step 1 - Identify the Country of Origin

First off, don't skip this crucial step, even if the Country of Origin feels obvious. This term holds the key to your customs duties. Here's why:

1. HS Code Accuracy: The Country of Origin sets a path to the right HS code. You want to avoid mismatches that pave the way for penalties.

2. Trade Agreements: UK and Turkey share intricate trade relationships. The UK-Turkey Free Trade Agreement of 2020 adjusts customs duties depending on the Country of Origin. Knowledge here equals savings!

3. Import Barriers: Certain products have unique restrictions. Identify these early on and plan around them effectively.

4. Rate of Duty: It decides the amount of customs duty levied on an item. An accurate Country of Origin sets you on the path to precise estimations.

5. Preference Eligibility: Some goods qualify for preferential duty rates under specific agreements. You'll want to catch these benefits!

From electronic equipment to textiles, each product has different import rules. Do not shy away from seeking advice. Tailor your approach as per needs - whether you're a startup shipping initial product samples or an established conglomerate finalizing a bulk deal. Stay mindful, read up, and save up!

Step 2 - Find the HS Code of your product

The Harmonized System (HS) Code is a universal economic language for goods. It's a six-digit code established by the World Customs Organization, designed to classify over 5,000 commodity groups. This universal coding system is used globally by customs authorities for trading goods across borders, to assess tariffs, monitor controlled goods and manage statistics.

The simplest way to determinate the HS code of your goods is to ask your supplier, as they're usually well-versed with the importing regulations and the goods they're exporting.

If getting the code from your supplier is not feasible, fear not, we provide an easy-to-follow process on how to find it.

Start by using an HS lookup tool. Enter the name of the product you're exporting in the search bar. From the results, check the 'Heading/Subheading' column - it's here where you'll find the HS code corresponding to your product.

Do note, however, it's crucially important for the code you choose to be as accurate as possible. Misclassification or misuse of HS Codes can result in delays in shipment, unexpected duties and penalties, or even legal issues.

Here's an infographic showing you how to read an HS code, ensuring you the precision and accuracy required in this step of your exporting process.

Step 3 - Calculate the Customs Value

Having the accurate customs value is key to a smooth clearance process. Contrary to what might seem obvious, it's not just the price of your goods. What you need is the CIF (Cost, Insurance, and Freight) value. Say, for instance, you're shipping a consignment of textiles worth $5000 from the UK. If your international shipping fees amount to $1000 and insurance cost is $200, your CIF value isn't $5000, but $6200. This is the figure you'll use to compute import duties and taxes. Precise calculation of CIF value, although it seems laborious, clears the path towards an efficient and successful customs clearance process in Turkey. Remember, inaccurate declarations can lead to delays and penalties, disrupting your logistics chain.

Step 4 - Figure out the applicable Import Tariff

An import tariff is essentially a tax that countries impose on goods imported from abroad to regulate trade. It's a crucial component of your overall shipping cost, and accurate calculation can save you from unexpected expenses. Turkey applies the Harmonized System Tariff, which is recognized globally and contains thousands of commodity codes to classify goods.

In determining the appropriate tariff for your goods sourced from the UK, the critical step is finding the correct tariff code for your product. This is where we utilise the Trade Tariff lookup tool provided by the UK government. Below is a step-by-step guide:

1. Visit the Trade Tariff Lookup of United Kingdom and enter the HS code that was identified earlier and the importing country as Turkey.

2. Check the tariff rates that apply to the product.

Let's illustrate with an example, say we're importing ceramic vases from UK to Turkey, with HS code 6913.10. The tool indicates a tariff rate at 5%. If the CIF (Cost, Insurance, Freight) is $10,000, the import tariff will be calculated as 5% of $10,000, equating to $500.

Understanding tariffs can take time and expertise, but mastering this step can lead to significant savings and smoother customs clearance. The aim is to make sure you're not caught off guard!

Step 5 - Consider other Import Duties and Taxes

When you're importing goods into Turkey from the UK, besides the standard tariffs, you may also need to pay additional import duties and taxes. These charges depend on the product's nature and its country of origin. For instance, the excise duty applies to items like alcohol and tobacco. If the imported goods are under an anti-dumping investigation, anti-dumping taxes might apply to protect local industries.

One key tax you can't sidestep is the Value Added Tax (VAT). The standard rate in Turkey is 18%, but it can be reduced to 8% or 1% for certain goods. Here's a quick formula to help you: VAT = Value of the goods (in USD) x VAT rate (%). So, if you import goods worth $1000, your VAT would be $180 (1000x0.18).

Do keep in mind these are just examples and real rates can vary. Always check with local authorities or a reliable freight forwarder for the latest duty and tax rates to avoid nasty surprises upon arrival. It's complex but knowing these extra costs upfront can save you headaches and keeps your business moving smoothly.

Step 6 - Calculate the Customs Duties

Understanding the calculation of customs duties is vital to grasping the import process in Turkey. It's a mix of various elements: customs value, VAT, and potentially anti-dumping taxes, and excise duty.

Consider a shipment with a $1000 customs value. If the rate is 10% and there's no VAT, your customs duty will be $100.

Now, let's add a 5% VAT. Your VAT ($50) is levied on the customs value plus the customs duties ($1100 in this case), giving a total cost of $1150.

Lastly, suppose anti-dumping taxes of 5% and an Excise Duty of $100 apply. The anti-dumping taxes will be levied on the $1000 value ($50), and Excise Duty would be included separately, making the total cost $1300.

Remember, nuances of such calculations can vary. Relying on experienced hands, like DocShipper, can ensure smooth sailing through the customs clearance process anywhere in the world. Let us work out the customs math, so you don't pay more. Get in touch with us for a free quote in under 24 hours!

Does DocShipper charge customs fees?

In the world of shipping, fees can get confusing. As a customs broker, DocShipper does not impose customs duties. What's charged are the customs clearance fees, while customs duties and taxes go directly to the government. Imagine buying a piece of art. The broker's fee (that's us) is like the gallerist arranging the sale and shipment, but any import taxes? That's between your government and you. We ensure transparency by providing documents from customs, just to show you've only paid what the authorities instructed.

Contact Details for Customs Authorities

UK Customs

Official name: Her Majesty's Revenue and Customs (HMRC)

Official website: https://www.gov.uk/

Turkey Customs

Official name: Republic of Turkey Ministry of Trade Customs and Trade Regulation

Official website: https://www.trade.gov.tr/customs-formalities

Required documents for customs clearance

Sweating over which papers are needed for customs clearance? No more. Let's simplify this vital but complex process. We'll unpack the essentials - Bill of Lading, Packing List, Certificate of Origin, and Documents of Conformity (CE standard). Get ready to conquer documentation like a pro.

Bill of Lading

Shipping your goods from the UK to Turkey? Remember, a Bill of Lading is your golden ticket. It's not just a document, but an ownership stamp that hinges on the trade agreement between the two nations. And here comes the best part! You can ditch the traditional methods and switch to a Telex release. Everyone loves quick and efficient, and that's what electronic releases offer. No more chasing for a physical document. As for you air cargo aficionados, you're not left out. The AWB, Air Waybill, is your equivalent to the Bill of Lading. What's the next step? Keep these documents handy, know their power, and let them pave your hassle-free shipping pathway from the UK to Turkey.

Packing List

A Packing List can make or break your sea or air freight shipping from the UK to Turkey. It's your responsibility as a shipper to craft a detailed and accurate list. Picture this - you're sending a batch of designer lamps, each component meticulously packed. Your Packing List should be a clear mirror of your cargo, depicting item descriptions, quantities, weight, packaging type and dimensions. An accurate Packing List expedites customs clearance, preventing delays and disruptions commonly seen in import/export. Failure to include all information might result in your shipment stalled at Istanbul customs. Always double-check your Packing List before sending. It's your passport to smooth shipping!

Commercial Invoice

Navigating customs between the UK and Turkey? A well-prepared Commercial Invoice is your key. This document outlines the details of your goods, from their value to the HS codes, all of which are key for determining the exact customs duties payable upon entrance. An irregularity, such as mismatch in your cargo's reported value and your Bill of Lading, could stall your shipment.

To simplify the process, ensure that your Commercial Invoice aligns with other shipping documents. For example, a shipment with 100 widgets valued at $1 each should reflect this same information throughout documents. Get this right, and your shipment's chances of a quick, hassle-free clearance go up significantly. Remember, accurate, consistent documentation helps keep the transit time of your goods predictable and your business moving.

Certificate of Origin

Navigating the waters between the UK and Turkey? Your freight's Certificate of Origin (CoO) is a non-negotiable part of the journey. This nifty document verifies the country where your goods were produced, making it vital for customs clearance. Imagine you're shipping exclusive British textiles to Turkey; your CoO guarantees they're genuinely British, potentially unlocking preferential customs duty rates. And who doesn't love a smooth, cost-efficient shipping process? Remember, it's not just stamping 'Made in UK' on your products; proper certification can be the difference between sailing through customs or facing delays. So, invest time in getting it right– your business will thank you.

Get Started with DocShipper

Finding customs clearance between the UK and Turkey complex and time-consuming? EntryPoint Logistics is here to streamline the process for you! We handle every step, adhering to the latest regulations to ensure a smooth and hassle-free custom clearance experience. Take the guesswork out of shipping - reach out to us and receive a tailor-made quote within 24 hours. End your shipping woes today!

Prohibited and Restricted items when importing into Turkey

When importing goods into Turkey, it's crucial you're aware of what's restricted or completely banned. Getting it wrong can be a costly, time-consuming error. Let's help you steer clear of any sticky situations by outlining the items you need to tread carefully with.

Restricted Products

1. Precious Metals and Stones: You have to apply for a license from the Ministry of Trade before you can import precious metals and stones into Turkey.

2. Pharmaceuticals and Medical Equipment: Importing pharmaceuticals and medical equipment requires a permit from the Turkish Pharmaceuticals and Medical Devices Agency.

3. Live Animals and Animal Products: To import live animals and animal products you must have a permit from the Ministry of Agriculture and Forestry.

4. Firearms and Ammunition: You need a special license from the Ministry of Interior to bring firearms and ammunition into Turkey.

5. Tobacco Products: For importing tobacco products, apply for a license through the Tobacco and Alcohol Market Regulatory Authority.

6. Food and Agricultural Products: To import food and agricultural products, get an agricultural import license from the Ministry of Agriculture and Forestry.

7. Radioactive Materials: You need to apply for a permit from the Turkish Atomic Energy Authority to import radioactive materials into Turkey.

8. Cryptographic Equipment: For importing cryptographic equipment, you need a special license from the Information and Communication Technology Authority.

9. Plants and Plant Products: If you plan on importing plants and plant products, a phytosanitary certificate from the Ministry of Agriculture and Forestry is a must.

10. Chemicals: Import of chemicals requires an appropriate license from the Ministry of Environment and Urbanization.

Remember to apply for the necessary permits and licenses ahead of time to make your shipping process smoother. The more you're prepared, the fewer hurdles you'll face.

Prohibited products

- Narcotics and drugs: All unlawful drugs including Marijuana, Cocaine, Heroin, etc. are not allowed.

- Weaponry and ammunition: Imports of guns, explosives, and other weapons are prohibited unless with a special license.

- Obscene or immoral items: Products including pornographic material or other items that could be regarded as immoral.

- Counterfeit money and goods: Customs will seize any counterfeit money or goods.

- Endangered animals and plants: Including body parts or products made from them.

- Radioactive substances: Including nuclear waste and certain metals.

- Unauthorised medicines: Including certain prescribed drugs

- Certain dairy and meat products: From certain countries to prevent disease transmission.

- Cultural artifacts and antiques: That are regarded as national heritage.

- Soil: You're not permitted to bring soil into Turkey; this includes small quantities attached to shoes or camping equipment.

- All forms of Asbestos: Import of Asbestos is strictly prohibited in Turkey.

- Precursor chemicals: Those used in the production of illicit drugs are banned.

Are there any trade agreements between UK and Turkey

Yes, there is a Free Trade Agreement (FTA) between the UK and Turkey. This lowers your shipping costs via tariff reductions or eliminations.

In addition, ongoing negotiations poised to facilitate trade and boost logistics infrastructure, such as rail projects, could present promising future opportunities for your business. Always consider these arrangements when planning your shipments.

UK - Turkey trade and economic relationship

The UK and Turkey share a long-standing trade history, dating back centuries, the economic relationship between them being reinforced considerably over the past decades.

Key sectors of engagement include automotive, machinery, chemicals, and textiles, with commodities such as vehicles and iron constituting major trade items. British direct investments in Turkey reached a remarkable £680 million in 2023.

In the same year, the total trade volume peaked as it crossed the £19 billion mark, with the UK exporting goods worth around £26.3 billion, signaling a robust purchasing interest from Turkish markets.

Your Next Step with DocShipper

Shipping between the UK and Turkey can feel daunting: a myriad of duties, complex procedures, different transportation methods! Why not let DocShipper handle all these intricacies? Our expertise allows seamless, cost-effective shipping solutions. Don’t let logistics stress you out any longer — connect with us today and ease your shipping process!

Additional logistics services

Discover how we simplify your supply chain process, from warehousing to distribution. At DocShipper, we manage more than shipping, ensuring a seamless journey for your goods every step of the way.

Warehousing and storage

Looking for dependable warehousing in the UK or Turkey? It's not without its challenges – especially when it comes to precise conditions like temperature control for food or pharmaceutical products. Don't sweat it, though. We've got it handled. Interested in more? Dig into our Warehousing page.

Packaging and repackaging

Securing your cargo's safety during UK-Turkey transit hinges on optimum packaging and repackaging. It's vital that you partner with an experienced freight agent to manage this critical task – whether it's delicate ceramics or bulky industrial equipment! Just picture flawless handles of crystal glassware shipped undamaged, or spare auto parts making it to auto shops in perfect nick. Trust us to safeguard your goods. Learn the ins and outs on our dedicated page: Freight Packaging.

Cargo insurance

In freight forwarding, protecting your assets is crucial. Unlike fire insurance, cargo insurance goes beyond incident coverage by safeguarding against damage during transit. Imagine your goods bashed about at sea or your container encountering an accident on the road – it's these unforeseen hazards that cargo insurance covers. Button up your business against transport risks, put potential headaches on ice and let your goods journey with a safety net. Dive deeper into the details at our dedicated page: Cargo Insurance.

Supplier Management (Sourcing)

Struggling to locate reliable suppliers in Asia or Eastern Europe? With DocShipper, you can eliminate this hassle. Our team deftly handles supplier sourcing and manages the entire procurement process. We'll break down language barriers and expertly guide you through complexities. This service lets you focus on what you do best - building your business. Interested? Delve deeper into our Sourcing services.

Personal effects shipping

Relocating from the UK to Turkey, and got some beloved items that are just too bulky or delicate to handle alone? Imagine packing and shipping your grandma's antique armoire or your art collection professionally, without a scratch. Our Personal Effects Shipping ensures your chattels are moved with utmost care and flexibility. Curious to learn more? Find all the details on our dedicated page: Shipping Personal Belongings.

Quality Control

Quality control is a deal-breaker in UK-Turkey shipping. Imagine, you've got a large consignment of artisan Turkish lamps, only to find the glasswork subpar on arrival in the UK. Heartbreaking isn't it? QC inspections nip such issues in the bud, ensuring your goods are exactly as you expect. For complete peace of mind, delve deeper into our Quality Inspection services.

Product compliance services

Shipping goods internationally can be complex without proper product compliance. Missteps can lead to costly delays or even merchandise confiscation. But rest assured, our Product Compliance Services can help. We handle all the legwork, from rigorous laboratory testing to securing necessary certifications, ensuring your goods meet destination regulations. Experience smooth shipping, no matter the destination's rules. Up for more? Check out our Product compliance services.

FAQ | For 1st-time importers between UK and Turkey

What is the necessary paperwork during shipping between UK and Turkey?

When shipping goods from the UK to Turkey, there are several key documents you'll need to present. The first one is either a Bill of Lading for sea freight or an Air Waybill for air freight, which we at DocShipper take care of for you. However, you'll be responsible for providing us with a packing list and a commercial invoice. These documents detail your shipment's specifics. Depending on the nature of your goods, you might need to provide more paperwork. For example, Material Safety Data Sheets (MSDS) or particular certifications may be required for certain items. Please consult with us to ensure you have all the necessary documents for a smooth shipping process.

Do I need a customs broker while importing in Turkey?

Yes, using a customs broker when importing goods into Turkey is highly beneficial due to the complex procedures involved. The customs process demands a detailed understanding and provision of essential paperwork. We, at DocShipper, offer our expertise to ensure a smooth, hassle-free experience. We represent your cargo at customs for most shipments, handling mandatory customs interactions and documentation. Leverage our knowledge and experience to navigate through the intricacies of customs clearance, saving yourself time and effort.

Can air freight be cheaper than sea freight between UK and Turkey?

While it's tricky to determine whether air freight is cheaper than sea freight between the UK and Turkey due to various factors such as route, weight, and volume, here's a helpful guideline. If your cargo is less than 1.5 cubic meters or weighs under 300kg (660 lbs), air freight could indeed be more cost-effective. At DocShipper, we prioritize finding the most economical options for your unique shipping needs. You can trust our dedicated account executives to present you with the best, most competitive freight options for your convenience and peace of mind.

Do I need to pay insurance while importing my goods to Turkey?

At DocShipper, we often get asked about insurance during goods import, and it's a valid concern. While it's not mandatory to have insurance for shipping goods, including to Turkey, we highly advise it. Why? The world of freight has its fair share of risks – goods could get lost, damaged, or even stolen. Insuring your shipment provides a safety net against these potential pitfalls. Remember, it's always better to be safe than sorry when it comes to protecting your valuable goods.

What is the cheapest way to ship to Turkey from UK?

For shipping goods from the UK to Turkey, we at DocShipper recommend using sea freight if the cargo is not time-sensitive. Thanks to the short geographical distance and the convenience of port-to-port transfers, sea freight offers a cheap, but slower, solution. However, if you're in a hurry, air freight is quicker but more costly. Additionally, considering customs regulations and handling fees is crucial for an accurate cost estimation.

EXW, FOB, or CIF?

Choosing between EXW, FOB, or CIF greatly depends on your relationship with your supplier. Keep in mind, suppliers are not typically logistics professionals. Hence, delegating the process to an agent such as us, DocShipper, especially for international freight and destination procedures, can be beneficial. It’s common for suppliers to sell under EXW (you pick up at their factory door) or FOB (they handle all local charges up to the origin terminal). Regardless, we are capable of providing a door-to-door service to ensure your shipment gets where it needs to go with ease and efficiency.

Goods have arrived at my port in Turkey, how do I get them delivered to the final destination?

At DocShipper, if we manage your goods under CIF/CFR incoterms, you'll need a customs broker or freight forwarder for clearance, import charges, and final delivery. However, our team can handle all these under DAP incoterms. It's advisable to confirm these details with your account executive for clarity.

Does your quotation include all cost?

Absolutely, we strive for transparency in all our dealings. Our quotation encompasses all fees excluding destination duties and taxes. However, your dedicated account executive can provide an estimate of these additional costs. With DocShipper, you rest easy knowing there are no hidden charges to worry about.