Ever tried to juggle while riding a unicycle? Shipping goods from the UK to Egypt can feel a bit like that. Between deciphering complex rate charts, head-scratching over transit times, and complying with the labyrinth of customs regulations - it's a lot to deal with. This destination guide is your beacon, designed to help businesses overcome these challenges.

We delve into the world of air, sea, rail, and road transportation options, unravel the mysteries of customs clearance, unpack the secrets behind duties and taxes, and bring it all together with practical, business-centric advice. If the process still feels overwhelming, let DocShipper handle it for you! As an experienced international freight forwarder, we turn the complexities and challenges of international shipping into success stories for businesses every day.

Which are the different modes of transportation between UK and Egypt?

Traveling from the UK to Egypt is a bit like planning a trip to the beach: your options depend on how quickly you want to get there and what you're packing. You might swim if you're alone and have time, but not with a cooler full of sandwiches.

Similarly, quick air freight is perfect for light, urgent shipments, while ocean freight manages bulk loads cost-effectively. However, road and rail aren't options given the Mediterranean Sea acting like a moat. The best choice will be the one that caters to your shipping needs and challenges while considering the geographical realities.

How can DocShipper help?

Shipping goods from the UK to Egypt? Let DocShipper simplify the process for you. We manage every detail, from transport organization to customs clearance. Benefit from our world-class expertise. Got questions? Reach out to our consultants for free. Ready to begin? Request a free estimate and get a response in less than 24 hours. Your global trading adventure starts here.

![]()

DocShipper Tip: Ocean freight might be the best solution for you if:

- You're dealing with large quantities or oversized items. Sea freight offers a budget-friendly way to maximize space, a particularly useful option given the UK's extensive port network.

- Your shipment isn't on a tight schedule. Ocean transport typically takes longer than air or rail, but it offers reliability.

- Your supply chain involves key ports, allowing you to take advantage of a wide-reaching network of sea lanes.

Sea freight between UK and Egypt

The pivotal role of the mighty oceans in connecting the industrious shores of the UK and Egypt is a testament to how our planet, despite its size, is incredibly intertwined. The bustling ports of Alexandria and Port Said in Egypt, and London and Liverpool in the UK facilitate a thriving trade relationship that propels economies on both ends.

The deep blue waters offer a cost-effective solution for shipping high-volume goods, despite the pace of this method taking its environment-friendly time.

But, let's acknowledge the elephant in the room. The complexity of legislation, customs clearance, and port protocols have left many businesses swimming in a sea of ambiguity. It's like trying to assemble flat-pack furniture without the instruction manual. But fear not, fellow sea shippers, we have a detailed guide to untangle these knots.

We'll explore the best practices and tips that ensure your cargo arrives safely, timely, and most importantly, without turning your logistics into a Herculean task. Get ready to set sail with practical insights and valuable knowledge.

Main shipping ports in UK

Location and Volume: Located on the River Thames, the Port of London is critical for commerce in the UK, with a shipping volume of over 45 million tonnes.

Key Trading Partners and Strategic Importance: The Port of London has a wide range of trading partners across the globe and holds strategic importance due to its proximity to London's vast commercial and consumer markets.

Context for Businesses: If you're planning to reach markets in southern England or require distribution capabilities closer to London, the Port of London can be a vital node in your supply chain given its vast network and comprehensive facilities.

Location and Volume: Situated on the south coast of England, the Port of Southampton is fundamental for the UK's trade as it handles over 42 million TEU annually.

Key Trading Partners and Strategic Importance: It maintains strong partnerships with Asia, North America and Europe. The port holds strategic importance as it's the UK's busiest cruise terminal and second-largest container port.

Context for Businesses: If your merchandise involves cars or you plan to frog-leap into European markets, the Port of Southampton, renowned for its automotive and ro-ro capabilities, might form an ideal point in your logistics.

Location and Volume: The Port of Liverpool is found on the northwest coast of England and is vital for the region's trade, handling over 33 million TEU per annum.

Key Trading Partners and Strategic Importance: Preferring strong ties with North American and Irish markets. It is strategically essential by serving as a primary freight terminal for the west coast.

Context for Businesses: When considering expanding in the US, Canadian or Irish market, the Port of Liverpool would be invaluable in your logistics due to its direct connections with these destinations.

Location and Volume: The Port of Felixstowe, located on the Eastern coast of England, is instrumental for the UK's global trade, handling approximately 4 million TEU each year - making it the busiest port in the UK.

Key Trading Partners and Strategic Importance: Primary trading partners include European and Asian countries. Its strategic importance lies in it being the UK's largest container port and having the country's largest customs-approved ERTS.

Context for Businesses: If your merchandise is containerized, or you're targeting Asian or European markets, the Port of Felixstowe, offers excellent container-handling facilities.

Location and Volume: The Port of Dover is based on the South East coast of England, crucial for European trade with a shipping volume of over 25 million trucks, trailers, and passenger cars each year.

Key Trading Partners and Strategic Importance: Its main trading partner is France due to its short cross-channel routes. It has strategic importance as the nearest English port to France.

Context for Businesses: If you're seeking quick road freight options to France and beyond, the Port of Dover, with its efficient cross-channel freight and passenger services, can be integral to your logistics.

Location and Volume: Located on the Humber Estuary, the Port of Grimsby plays an essential role for automotive trade, handling over 10 million vehicles annually.

Key Trading Partners and Strategic Importance: It mainly partners with European countries, and its strategically crucial as a leading port for car imports.

Context for Businesses: If your business involves automobiles and targets European markets, the Port of Grimsby, renowned for being a major car import hub, can be a key consideration in your shipping strategy.

Main shipping ports in Egypt

Port of Alexandria

Location and Volume: Positioned strategically on the West Verge of the Nile Delta in Alexandria, the port plays a central role in Egypt's economy, dealing with around 60% of Egypt's foreign trade with a shipping volume exceeding 32 million metric tons annually.

Key Trading Partners and Strategic Importance: Trade from the Port of Alexandria extends to more than 50 nations. It is particularly significant in the Mediterranean trade circuit, engaging with countries like France, Greece, and Italy. The port stands as a key intersection linking the Suez Canal, the Mediterranean Sea, and the Nile.

Context for Businesses: If you're planning to penetrate the Mediterranean markets or deal with heavy and diverse cargo, this port, given its substantial capacity and strategic positioning, could be crucial in providing a feasible route.

Port of Damietta

Location and Volume: Located about 15 km west of the Nile, this port serves predominantly as a major container, cargo, and grain terminal. It features an annual shipping volume of over 40 million tons.

Key Trading Partners and Strategic Importance: The Port of Damietta fosters commercial ties across Europe, the Middle East, and Africa. It is renowned for its enviable proximity to the Suez Canal, leading to numerous transit shipments.

Context for Businesses: If your enterprise revolves around wood, furniture, or agri products like grains, the Port of Damietta can offer an excellent network and efficient handling facilities to facilitate your worldwide trade.

Port of Said

Location and Volume: Positioned at the northern entrance of the Suez Canal, the Port of Said is a significant maritime hub. Its cargo handling capacity is 17 million tons of cargo per year.

Key Trading Partners and Strategic Importance: This port partners with a wide array of global nations, particularly Asia and Europe. Its strategic location at the Suez Canal’s mouth boosts trade across continents, contributing to its high transit cargo volume.

Context for Businesses: Should you aim to establish an efficient supply chain across Asia, Africa, and Europe, the Port of Said’s robust infrastructure and strategic position can smooth the transit process to ensure timely delivery.

Sokhna Port

Location and Volume: The Port of Sokhna, resting on the Gulf of Suez's western shore, is known for its versatility, accommodating around 12 million tons of cargo per year.

Key Trading Partners and Strategic Importance: It plays a pivotal role in Egypt’s imports, especially coal and building materials. Besides, with custom-free access to COMESA countries, it boosts trade within Africa.

Context for Businesses: If your business is seeking efficient routes and reduced administrative procedures, capitalizing on Sokhna's close proximity to Cairo and free trade advantages can offer you an agile and seamless trading experience.

Port of Suez

Location and Volume: Situated on the southern tip of the Suez Canal, this port offers a yearly shipping volume of roughly 10 million tons, primarily petroleum, petrochemical products, and LNG.

Key Trading Partners and Strategic Importance: Countries from the Middle East and European Union, particularly Saudi Arabia, and the Netherlands are key recipients of the exports from the port. The port's position facilitates the oil and dual commodities trading.

Context for Businesses: For industries dealing with petrochemical and LNG shipments, this port's specialized handling facilities and position at the energy export crossroads can prove pivotal.

Port of Nuweiba

Location and Volume: This smaller port on the Gulf of Aqaba handles around 2 million tonnes of cargo annually, mainly serving ferry services and bulk goods.

Key Trading Partners and Strategic Importance: Jordan stands as a significant trading partner, due to the Aqaba-Nuweiba sea line. The port is crucial for Egypt's connectivity with countries beyond the Red Sea.

Context for Businesses: If operating in the cattle trade and agricultural products, considering the utilization of Port of Nuweiba for access to marketplaces beyond Red Sea can assist in reaching a broader customer base.

Should I choose FCL or LCL when shipping between UK and Egypt?

Choosing between Full Container Load (FCL) and Less than Container Load (LCL), also known as consolidation, for your UK-Egypt sea freight journey isn't just a toss-up; it's a strategic decision impacting cost, delivery time, and overall shipping success. This section demystifies these two options, guiding you to tailor an informed decision that best fits your specific needs.

Let's dive into understanding these differences and decode which mode of sea freight is best suited for your business. Buckle up and join us on this journey to smarter and more effective international shipping!

LCL: Less than Container Load

Definition: LCL, or Less than Container Load, is a method of shipping that groups multiple shippers’ cargo into one container. The term 'LCL shipment' refers to a freight forwarding strategy designed for smaller cargo volumes that don't fill a whole container.

When to Use: LCL shipping is particularly beneficial when your cargo volume is less than 13, 14, or 15 CBM. If you're not on a tight schedule and have a smaller budget, LCL can allow for flexibility and cost-effectiveness as you only pay for the space you use.

Example: Suppose your business needs to transport 10 CBM of machinery parts from Manchester, UK to Alexandria, Egypt. With LCL freight, your cargo would be grouped into a container with other shippers' cargo going the same route, saving you from costly empty space in a full container.

Cost Implications: LCL saves money by splitting the container costs among multiple shippers. However, note that this method may have additional handling charges due to the consolidation and deconsolidation of cargo, and it's slightly riskier due to more handling. Ultimately, LCL shipping offers an affordable solution for businesses with smaller shipping volumes.

FCL: Full Container Load

Definition: FCL or Full Container Load is a type of ocean freight shipping where a complete container is used exclusively for a single shipment.

When to Use: FCL shipping becomes particularly advantageous when cargo volumes exceed roughly 14 cubic meters. This is roughly the tipping point where the cost per cubic meter starts to become cheaper with an FCL ship. It also provides peace of mind with the container sealed from origin to destination, ensuring your goods' safety.

Example: For instance, if you're a machinery manufacturer in the UK, sending multiple pallets of heavy equipment to Egypt, you may find an FCL container more economical. Due to the bulkier and high-volume nature of your shipment, getting an FCL shipping quote for a 20'ft or 40'ft container would bring cost efficiencies.

Cost Implications: The cost of FCL shipping is affordable for high volume; roughly, the larger the shipment, the lower the cost per unit. The cost also includes the peace of mind of minimizing risk as the sealed container remains unopened until its destination. However, remember, using FCL means you pay for the entire container, even if it's not full.

Unlock hassle-free shipping

With ocean freight complexities and international regulations, choosing between consolidation or full container shipping from the UK to Egypt can be daunting. Trust in DocShipper's expertise in freight forwarding to simplify your cargo shipping process. Our experienced ocean freight advisors take into consideration load size, time constraints, and cost effectiveness to guide you towards the best shipping choice. Make the right business decisions with our support. Contact us for a free, no-obligation estimation.

How long does sea freight take between UK and Egypt?

Sea freight between the UK and Egypt typically takes about 10-20 days, averaging at about 15 days. However, please note that the exact shipping time can vary depending on many factors, including the specific ports used, weight, and characteristics of the goods being transported. For the most precise delivery times, we strongly suggest getting in contact with a professional freight forwarder like DocShipper, who can provide you with a tailored quote.

Moving on, let's take a look at the estimated shipping times between the four main ports in each country. Remember, these are average times and can vary greatly based on the factors we've earlier mentioned:

| UK Port | Egypt Port | Average Transit Time (Days) |

| Port of Felixstowe | Port of Alexandria | 14 |

| Port of Southampton | Port of Damietta | 14 |

| Port of Liverpool | Port of Port Said | 15 |

| Port of Bristol | Port of Suez | 14 |

*Remember: the information above is an estimate. Contacting your freight forwarder will provide a much more accurate, tailored shipping time frame.

How much does it cost to ship a container between UK and Egypt?

Determining the exact cost of shipping a container from the UK to Egypt could feel like unlocking a complex puzzle, but fear not! Ocean freight rates and shipping costs can widely range due to variables - everything from your Point of Loading, destination, to the precise nature of your goods, the carrier chosen and even monthly market fluctuations.

But here's the good news - each of your shipping needs is unique to your business, that's why we quote on a case-by-case basis. Our skilled shipping specialists are eager to offer the best rates, helping you unravel this conundrum and guide you through the financial maze with ease.

Special transportation services

Out of Gauge (OOG) Container

Definition: An Out of Gauge (OOG) container is a specialized shipping container designed to accommodate cargo that does not fit the standard dimensions of regular containers, hence the name 'out of gauge' cargo.

Suitable for: OOG containers are perfect for bulky, oversized, or irregular-shaped goods.

Examples: Examples include large machinery, construction materials, pre-fabricated units, or any substantial equipment that exceeds traditional shipping volumes.

Why it might be the best choice for you: If your business tends to ship items that remain outside the standard size metrics, going with an OOG container can offer both safety and versatility for your shipping needs.

Break Bulk

Definition: Break bulk shipping involves goods that are loaded individually instead of in containers. Each item is handled separately from stowage tothe delivery point.

Suitable for: This method is used commonly for oversized or over-dimensioned goods that cannot fit into standard containers.

Examples: Industrial equipment, pipelines, windmills, yachts, and building materials are often transported as break bulk.

Why it might be the best choice for you: If your business specializes in manufacturing or handling uniquely shaped or exceptionally large goods, break bulk shipping would be a beneficial option.

Dry Bulk

Definition: Dry bulk shipping refers to the transportation of homogeneous raw materials in large quantities. This term often refers to cargo shipped in loose form rather than packaged or containerized.

Suitable for: Consider this option for large volumes of unpackaged raw materials.

Examples: Commodities such as coal, cement, grains, ores, and minerals are ideal candidates for dry bulk shipping.

Why it might be the best choice for you: If your company regularly deals with hefty quantities of raw materials, dry bulk shipping ensures efficient and bulk handling, thereby saving on cost and time.

Roll-on/Roll-off (Ro-Ro)

Definition: Roll-on/Roll-off (Ro-Ro) shipping involves vessels designed to carry wheeled cargo such as cars, trucks, semi-trailer trucks, trailers, and railroad cars. The goods roll on and roll off the vessel on their wheels, hence the name.

Suitable for: Vehicles or heavy machinery that can be driven on and off the carrier makes an ideal shipment for this method.

Examples: Cars, trucks, trains, construction equipment, and oversized machinery are typical of ro-ro vessel cargo.

Why it might be the best choice for you: If you are in the automotive or heavy machinery industry that requires movement of units or vehicles between locations, Ro-Ro can seamlessly cater to your shipping needs.

Reefer Containers

Definition: Reefer containers are temperature-controlled shipping containers. They are designed to transport perishable goods that require a certain temperature to remain fresh.

Suitable for: Any goods sensitive to temperature changes qualify for this method.

Examples: Groceries, plants, pharmaceuticals, and certain chemicals all require reefer containers for their transportation.

Why it might be the best choice for you: If your business handles perishable or temperature-sensitive products, using reefer containers ensures the freshness and quality of your goods during the shipping process.

In need of support to manage your sea freight between the UK and Egypt? At DocShipper, our experienced team can assist you with everything from choosing the right container type to navigating complex logistics requirements. Don't hesitate to contact us for a free, no-obligation shipping quote in less than 24 hours.

![]()

DocShipper Tip: Air freight might be the best solution for you if:

- You're facing tight deadlines or need rapid delivery. Air freight is your quickest option, which aligns well with the fast-paced business environment.

- Your shipment is relatively small, under 2 CBM. Air freight is ideal for these more compact loads.

- Your cargo's destination isn't easily reached via sea or rail. This makes air freight a viable option, especially given the extensive network of airports available.

Air freight between UK and Egypt

When speed and reliability make or break your trade, air freight between the UK and Egypt can deliver the win. Picture this - premium electronics, like the latest smartphones, require swift yet secure transit. In this scenario, air freight shines as it gets your valuable cargo to its destination in record time with robust safety.

This said, some mistakes, simple yet costly, are no strangers to shippers. Using the incorrect weight calculation can unknowingly drive up costs. Consider you're shipping laptops. With air freight, you pay for space your cargo consumes on the plane, not just its weight - incorrectly using actual weight instead of volume weight might have you grossly overpaying.

Offering clarity, best practices, and effective price estimating will be our journey in the guide's upcoming sections. Avoid the traps that see your profits take flight faster than your cargo.

Air Cargo vs Express Air Freight: How should I ship?

Choosing between air cargo and express air freight for your shipping needs between the UK and Egypt can seem daunting. Air cargo typically ships via commercial airlines, while express uses dedicated planes for faster delivery. It's all about weighing up the convenience of speed against cost. Let's dive into the nitty-gritty of these two options to ensure your business gets the best balance of speed, efficiency, and value.

Should I choose Air Cargo between UK and Egypt?

Choosing air cargo for freight between the UK and Egypt can strike a balanced budgetary sweet spot for your business, especially from 100/150 kg (220/330 lbs) of cargo. International airlines such as British Airways and Egypt Air are known for their reliable air freight services while remaining cost-effective.

Although longer transit times due to fixed schedules might pose a challenge, the overall delivery speed is significantly faster compared to other modes of shipping. Hence, it's definitely a viable freight option to consider.

Should I choose Express Air Freight between UK and Egypt?

Express air freight is a specialized service leveraging dedicated cargo planes void of passengers. Ideal for shipments under 1 CBM or 100/150 kg (220/330 lbs) of cargo, it's perfect for timely transfers of limited quantities. Renowned international express courier firms such as FedEx , UPS , or DHL provide these services. If you need swift, punctual delivery of smaller loads, this could be your best option.

The distinct advantage of express air freight over other methods is its speed and efficiency, which can be crucial in business. Delays in the damands of modern commerce can be costly, indeed. Therefore, aligning with these specialists who guarantee rapid delivery might be worth considering.

Main international airports in UK

Heathrow Airport

Cargo Volume: Heathrow is the busiest airport in the UK in terms of cargo, handling over 1.7 million metric tonnes annually.

Key Trading Partners: Has strong cargo trade relationships with the USA, Asia, and Europe.

Strategic Importance: As one of Europe's major cargo hubs, Heathrow's extensive flight network provides crucial links to emerging markets.

Notable Features: Provides a specialized perishable goods handling area, and access to air cargo handling services.

For Your Business: If your business engages in trade with Europe and Asia, Heathrow's vast network and high cargo handling capacity may expedite your cargo shipping processes.

London Gatwick Airport

Cargo Volume: Handles over 100,000 metric tonnes of cargo each year.

Key Trading Partners: Primarily trades with European countries, the Middle East, and North America.

Strategic Importance: Acts as a major link for cargo freight between the UK, Europe, and North America.

Notable Features: Houses a number of cargo handling agents and freight forwarders.

For Your Business: If your business requires frequent shipments to/from Europe and North America, Gatwick's strength in handling significant cargo volumes may be a viable option.

East Midlands Airport

Cargo Volume: Handles over 430,000 metric tonnes of cargo annually.

Key Trading Partners: Key trading routes include European countries, US, and Asia-Pacific countries.

Strategic Importance: As the UK's largest pure cargo airport, it plays a critical role in connecting the UK to international markets.

Notable Features: Home to the UK hub of several major global courier companies.

For Your Business: If express courier services are essential for your business, East Midlands, as a courier hub, may offer you faster shipping times to global markets.

Manchester Airport

Cargo Volume: Processes over 120,000 metric tonnes of cargo every year.

Key Trading Partners: Connects primarily with North America, Asia, and Middle Eastern countries.

Strategic Importance: As Northern UK’s primary airport, it benefits from less congestion than airports in the south.

Notable Features: Known for its exceptional freight handling and cargo storage facilities.

For Your Business: If you're considering less congested shipping routes, Manchester Airport might secure a more efficient movement of your goods.

Stansted Airport

Cargo Volume: Handles more than 260,000 metric tonnes of cargo annually.

Key Trading Partners: Services trade routes with European countries and North America.

Strategic Importance: Is the third-busiest airport in the UK in terms of cargo traffic.

Notable Features: Host to several major global courier companies and freight-forwarding agents.

For Your Business: If your business operates in European or North American markets, Stansted's strategic location and solid trade routes could improve your freight shipping efficiencies.

Main international airports in Egypt

Cairo International Airport

Cargo Volume: Handles over 350,000 tonnes of cargo annually.

Key Trading Partners: Mainly Europe, the Middle East, and East Asia.

Strategic Importance: As Egypt's largest airport, it is the chief freight gateway to the nation and a significant connection hub for Africa and the Middle East.

Notable Features: Features cargo terminals managed by Egyptair Cargo and three runways. It's equipped with modern facilities for storage, handling, and customs clearance.

For Your Business: It offers regular flights to most global destinations, making it an excellent choice if you're looking to reach any major market efficiently.

Alexandria International Airport

Cargo Volume: Facilitates approximately 20,000 tonnes of freight annually.

Key Trading Partners: Primarily serves Europe, the Middle East, and domestic routes.

Strategic Importance: Located near Alexandria, one of the busiest ports in the world, providing a strong shipping link.

Notable Features: One dedicated cargo terminal and a free zone, enabling efficient custom processes.

For Your Business: If your cargo delivery pairs with sea freight through the port of Alexandria, this airport is the preferable means of air cargo to streamline your logistics.

Sharm El-Sheikh International Airport

Cargo Volume: Handles around 10,000 tonnes of cargo annually.

Key Trading Partners: Primarily serves markets in Europe, the Middle East, and North Africa.

Strategic Importance: It's the third busiest airport in Egypt and an important base for seasonal charter airlines.

Notable Features: Two passenger terminals and a cargo terminal that cater to the needs of international and local freight.

For Your Business: With tailored charter flight services, you can schedule and plan your cargo deliveries as per your business requirements and peak seasons.

Hurghada International Airport

Cargo Volume: Facilitates over 8,000 tonnes of cargo annually.

Key Trading Partners: Mostly serves Europe, the Middle East, and North Africa.

Strategic Importance: As the second busiest airport in Egypt, it's a key link for freight transport to tourist-heavy Red Sea.

Notable Features: Newly expanded with upgraded cargo handling and storage facilities.

For Your Business: If your shipments have a market in the Red Sea's tourism industry, Hurghada can provide efficient logistics and potential cost savings.

Luxor International Airport

Cargo Volume: Around 5,000 tonnes of cargo pass through annually.

Key Trading Partners: Primarily serves European cities.

Strategic Importance: Prominent due to its location near the historical city of Luxor, with direct flights to several European cities.

Notable Features: Although smaller in operation, it has a fully equipped cargo terminal.

For Your Business: For goods that are niche-specific or cater to the historic and tourism market in Luxor, this airport can be a strategic pivot.

How long does air freight take between UK and Egypt?

On average, air freight shipping between the UK and Egypt takes about 1-3 days. However, this transit time is not fixed as it relies on various factors. These include the specific airports being utilized, the weight of goods, as well as their nature. It's important to consider all these aspects to get an accurate estimate. To get pinpoint precise transit times, interface directly with a freight forwarder such as DocShipper.

How much does it cost to ship a parcel between UK and Egypt with air freight?

Shipping air freight from the UK to Egypt? You can expect a ballpark figure of $3-$6 per Kg on average. However, providing a precise cost is challenging due to multiple factors, including distance from departure and arrival airports, parcel dimensions, weight, and nature of goods.

But don't worry: our experienced team evaluates individual circumstances to ensure you get the most affordable and efficient service. Our quotes are tailored to your specific shipping needs, giving you the best value for every shipment. Don't hesitate, reach out to us and receive your free quote within 24 hours!

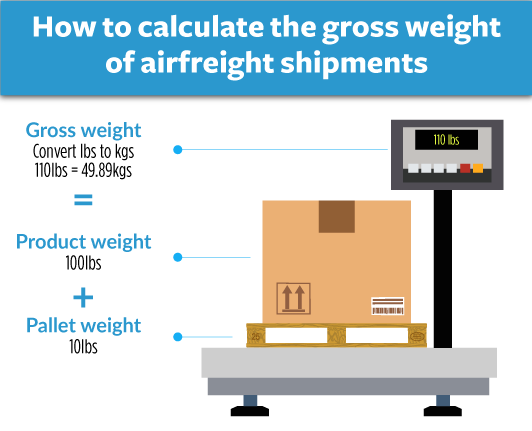

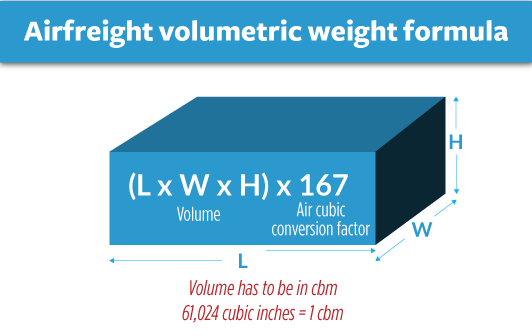

What is the difference between volumetric and gross weight?

Let's start with understanding these two concepts: gross weight and volumetric weight. Gross weight is the actual physical weight of a shipment, measured in kilograms (kg). On the other hand, volumetric weight, also known as dimensional weight, reflects how much space your shipment takes up on an aircraft, not necessarily its actual weight.

Calculating these for air cargo and Express Air Freight services differ slightly. For air cargo, the volumetric weight is estimated by multiplying the Length (cm) x Width (cm) x Height (cm) of your shipment and then dividing by a standard factor of 6000. In express airfreight, the same rule applies but the standard divisor is 5000.

Let's say you're shipping a box from the UK to Egypt that is 40cm long, 30cm wide, and 20cm high, and it weighs 15kg. Its volumetric weight (Air Cargo) would be (40 x 30 x 20) / 6000 = 4 kg (or about 8.8 lbs). However, in express airfreight, the volumetric weight would be (40 x 30 x 20) / 5000 = 4.8 kg (or about 10.6 lbs).

As you can see, the gross weight (15 kg or 33 lbs) is higher than the volumetric weight in both calculations, so that's what the freight charges would be based on.

The reason these calculations matter is because freight charges are determined based on whichever is higher - the gross weight or the volumetric weight. It ensures that carriers are paid sufficiently for the space your shipment occupies, regardless of its physical weight. So it's wise to have an idea of both measures when planning your shipment.

![]()

DocShipper tip: Door to Door might be the best solution for you if:

- You prioritize ease and a hassle-free shipping experience. Door-to-door services manage the entire process, from collection to final delivery.

- You appreciate the efficiency of having one dedicated contact. With door-to-door, a single agent is responsible for overseeing all elements of your shipment.

- You want to limit the number of times your cargo is transferred. Door-to-door services minimize the switches between various transport methods, lowering the chances of damage or loss.

Door to door between UK and Egypt

Door to door shipping is a comprehensive solution that takes your goods from a UK address right to an Egyptian doorstep. It eases out the logistical hassles, with duties handled and no need to juggle multiple points of contact. Consider it your hassle-free, all-inclusive ticket on the international trade highway. Ready to explore why door to door could be your golden ticket? Let's dive in!

Overview – Door to Door

Overwhelmed by shipping complexities from the UK to Egypt? Door to door shipping can eliminate stress, providing convenience and cost-effectiveness. As the most-demanding service by. our beloved clients at DocShipper, the complete handling of your goods - from pick-up to customs clearance and delivery - is managed under one roof.

Though pricier, it saves enormous time and spares you setback from regulatory complexities. Just bear in mind that remote areas may pose logistical challenges for delivery. Understandably, shipping can be a hassle, but with door-to-door, relax and leave the heavy lifting to us.

Why should I use a Door to Door service between UK and Egypt?

Caught in a logistic-limbo between the UK and Egypt? Door-to-Door service might just be your knight in shining armour. Here's why!

1. Stress-Buster: Who wants an added dose of stress? Not you! This service pulls the weight off your shoulders by managing all aspects of the shipping process, letting you rest easy.

2. Clock-Watcher: Every minute counts in business - we get it. A door-to-door service ensures timely delivery for urgent shipments. No more nail-biting waits or nervously checking the clock!

3. Specialized Care: Got a one-of-a-kind, tricky cargo to ship? Fear not! This service is adept at handling complex cargo requirements with the utmost care. Your goods are in safe hands.

4. Convenience Champion: From origins in the UK with their eccentric weather to the majestic dunes of Egypt, door-to-door services handles trucking all through the way. It's like a Royal Mail Service, but for your freight!

5. Reliability Riveter: Uncertainty can be a killer in logistics. With this service, you get a committed schedule and a defined transit time. You can rely on it like the perfect cup of British tea on a rainy day!

So, whether you're new to freight forwarding or just tired of the hassle, using a door-to-door service between the UK and Egypt brings unparalleled benefits to the table. So why not give this logistic powerhouse a chance?

DocShipper – Door to Door specialist between UK and Egypt

Experience seamless door-to-door shipping with DocShipper, your partner in efficient, hassle-free freight forwarding from the UK to Egypt. Our hands-on approach means you won't lift a finger - from packing, transportation, to handling complex customs procedures, we've got you covered.

We offer you a dedicated Account Executive, ensuring personalized service tailored to your requirements. Reach out today for a free, quick estimate, or engage with our expert consultants for free shipping advice. Your global logistics, simplified with DocShipper.

Customs clearance in Egypt for goods imported from UK

Customs clearance is a critical stage in the import-export journey, swinging open the gates to Egypt from the UK. It’s an intricate dance where missing a beat, like unexpected fees, might trip you over. Delve into duties, taxes, quotas, and licenses to avoid your goods hitting the brakes at the border. Your success hinges on knowing how this puzzle fits together - a challenge we're about to unpack!

With DocShipper navigating the ship, you're not alone. No matter the type or origin of your cargo, our team is ready to iron out the wrinkles. Need to crunch numbers on your project? Drop us the goods' origin, their value, and HS Code. That's your ticket to a seamless entry into Egypt! Stay tuned as we sail through these key areas.

How to calculate duties & taxes when importing from UK to Egypt?

Navigating the complex waters of customs duties and taxes can feel a bit like untangling a knotty mess. But with a solid understanding of some key terms, you can set sail comfortably from the UK to Egypt with your cargo.

The customs duties calculation flows from five critical data points: the goods' country of origin, the Harmonized System (HS) code, the budget-friendly customs value, the applicable tariff rate, and additional taxes or fees relevant to your particular cargo. And while it may seem a mouthful, hang tight! Things are about to become radiant!

For starters, the first compass point in our customs journey is establishing the origin country. Simply put, this is the place where your goods sprouted wings or wheels, saying 'cheerio' to manufacturing or production. So, if your products were born and bred in jolly old England before hopping aboard for Egypt, Britain would be your country of origin. Illuminate that, and you've taken a firm first stride on your customs journey!

Step 1 - Identify the Country of Origin

Establishing the country of origin is a stepping stone towards hassle-free import. Here are the main five reasons why:

1. Trade Agreements: Egypt and the UK are bound by certain trade agreements. Identifying the country of origin allows you to leverage these pacts, which directly impact customs duties.

2. HS Code: The Harmonized System code gives detailed product classification in international trade. Country of origin determination is foundational to acquiring the right code.

3. Goods' Description: Comprehensive goods' description corresponds directly with the land of origin, which leads to smoother customs clearance.

4. Regulations: Egypt imposes import restrictions based on the source country. Pinpointing your goods' origin simplifies regulation navigation.

5. Taxes: Your import's source country determines the tax bracket it falls in, greatly influencing any additional cost.

Make sure you study the trade agreements between Egypt and the UK for possible exclusions or reduced taxes. Look into any import restrictions tied to your product, this may forestall any potential hiccups. The focus should always be on aligning your business with the established trade practices. Practicality beats theory, every time.

Step 2 - Find the HS Code of your product

The Harmonized System (HS) Code, sometimes referred to as the Harmonized Commodity Description and Coding System, plays a fundamental role in international trade. This system is a globally recognized method for classifying traded products. It's composed of a series of numbers that identify a product, serving as a universal economic language and code for goods. This assists in crossing language barriers and reducing misunderstanding among traders.

Since they're intimately familiar with the goods they're exporting and the associated regulations, your supplier is typically the best source for obtaining the HS Code of your product. However, if that's not feasible, don't worry! We have a simple process to assist you in finding this code.

The first step is to use an HS lookup tool such as the Harmonized Tariff Schedule. Once you're on the webpage, write the name of your product in the search bar to find possible matches. Once you have the results, look for the HS code under the Heading/Subheading column.

A word of caution: accuracy is key when choosing an HS Code. Mistakes can lead to shipment delays and could potentially incur fines. So, ensure you are selecting the correct HS Code for your product.

Here's an infographic showing you how to read an HS code. This visual reference is designed to guide you through each section of an HS Code, making it easier for you to understand and find the right code for your commercial products.

Step 3 - Calculate the Customs Value

Overwhelmed by customs duties? Let's ease the tough task with a clear understanding of how to calculate the customs value. It's not the same as the value of your products; it encompasses a bit more! For importing goods from the UK to Egypt, you're looking at the CIF value, which comprises the cost of the products, international shipping fee, and insurance expenses.

So, imagine you have products valued at $20,000, shipping costs at $2,000, and an insurance worth $300. Your customs value isn't stuck at $20,000. It's the sum of all three - $22,300! Remember, each component influences your final dues. Breaking them down helps keep an eye on your costs and avoids any surprising bills at Egypt's customs clearance!

Step 4 - Figure out the applicable Import Tariff

An import tariff, also known as a customs duty, is a tax imposed on goods when they are transported across international borders. It's one of the key elements calculated for customs clearance. The tariff used in the UK is determined by their own Trade Tariff Tool. This allows you to determine the necessary cost of your imported goods from the UK to Egypt.

Here's a step-by-step method to use it:

1. Navigate to the Trade Tariff Tool - UK Government .

2. Type in the HS code of your product that you identified earlier, along with the country of origin (in this case, the UK).

3. This will provide the relevant details, including the duties and taxes applicable to your product.

Let's run through an example:

Say you're importing plastic kitchenware (HS Code: 3924.10) from the UK. Using the Trade Tariff Tool, you find that the tariff rate is 12%. If your total CIF (Cost, Insurance, and Freight) is valued at $10,000, the import duties can be calculated like so:

Import Duties = CIF cost Tariff Rate = $10,000 12/100 = $1,200

This means an additional $1,200 will need to be paid in import duties, on top of the CIF cost. Remember, the customs authorities in the destination country may also levy additional taxes, so factor these into your final cost calculation.

Step 5 - Consider other Import Duties and Taxes

Being aware of various additional import duties and taxes when importing goods from the UK to Egypt is crucial. Not every product coming into Egypt will be subjected to standard customs tariff alone. Depending on the product's nature and its origin, charges like excise duty, anti-dumping taxes, or most significantly, Value Added Tax (VAT) can apply.

For example, let's imagine you're importing handbags. The standard tariff might be 10% of the product's value, but the excise duty could add another 15%. On top of that, you might face an anti-dumping tax of, say, 5% if it's found that these handbags are being sold in Egypt below their fair market value. Additionally, a 14% VAT is applicable on the total customs value (product value+standard tariff+excise duty) for many items.

So, your total payable duties and taxes would be:

Handbags' Value ($1000) + Standard Tariff ($100) + Excise Duty ($150) + Anti-dumping tax ($50) = $1300.

And then, VAT = 14/100 $1300 = $182.

Please remember, these are approximate values and actual rates will depend on specific product categories and other factors. It's advisable to consult a clearance agent or your forwarder to confirm these duties and taxes.

Step 6 - Calculate the Customs Duties

In calculating customs duties in Egypt for UK imports, the 'customs value' of your shipment is the figure to which Egypt's Customs Authority applies your goods' applicable tariff percentage. Suppose you've imported machinery valued at $5000 with a tariff rate of 20%, your duty payable is $1000 (5000 20%).

VAT (Value Added Tax) is computed separately. If your machinery has a VAT rate of 14%, and the sum of its customs value and duty is $6000, you'll pay $840 for VAT (6000 14%).

Occasionally, 'anti-dumping' taxes are levied for goods imported below market price that may harm domestic industry. Including this tax in your total payable will depend on the nature of your goods. And some goods are required to pay excise duty.

For instance:

1. A $750 textile shipment with 10% tariff rate will incur $75 in duty.

2. An $800 tech gadget shipment at 15% tariff, and 14% VAT on ($800 + $120) equals $128.8 VAT.

3. Consumables worth $1000 with a 10% tariff, 14% VAT on ($1000+$100), and an anti-dumping tax of $50, will total $159.4 VAT.

As this process can be complex, DocShipper offers assistance with customs clearance, ensuring the correct calculations free of overcharge. Contact us for a free quote within 24 hours.

Does DocShipper charge customs fees?

Distinguishing between customs fees might seem complex, but let's break it down. DocShipper, acting as your custom broker both in the UK and Egypt, charges you for the customs clearance process - a key service ensuring your goods pass smoothly through customs. However, the customs duties and taxes that stem from the goods themselves are paid directly to the government, not to DocShipper.

To maintain trust and transparency, documents from the customs office are provided to you, clarifying exactly what costs have been applied and to which government entity they've been paid. Understanding these key distinctions can help dispel potential shipping cost worries.

Contact Details for Customs Authorities

UK Customs

Official name: Her Majesty's Revenue and Customs (HMRC)

Official website: https://www.gov.uk/government/organisations/hm-revenue-customs

Egypt Customs

Official name: Egyptian Customs Authority

Official website: http://www.customs.gov.eg/

Required documents for customs clearance

Confounded with customs clearance? Don't fret! This section demystifies the documents you need: Bill of Lading, Packing List, Certificate of Origin, and Documents of Conformity (CE Standard). We're unlocking the codes so you can keep your cross-border freight moving smoothly. Let's dive in.

Bill of Lading

Understanding the Bill of Lading is crucial when shipping goods from the UK to Egypt. Think of it as your shipment's passport; it marks the transfer of ownership and verifies the goods have been loaded. But here's the beauty of modern logistics: You can opt for an electronic (or 'telex') release, doing away with the need for a physical document and speeding up your process.

If you're shipping by air, however, you'll need an Air Waybill (AWB) instead. No exceptions there. Practical tip: Ensure all details in the Bill of Lading or AWB are accurate to avoid customs delays. Remember, this document is the cornerstone of your shipping venture. When done right, it ensures smooth sailing (or flying) for your goods.

Packing List

Navigating customs between the UK and Egypt can feel like a challenge, but preparing a comprehensive Packing List can smooth your path. Without it, your sea or air freight might be stuck in limbo. Imagine you're sending a large assortment of fabrics - the Packing List should detail each type, weight, and quantity. It's your responsibility to ensure all the information is spot-on. Why? Because Egyptian customs officers rely on this document to verify what's entering their country.

The same applies when the items leave the UK. A miscalculation could spell trouble – truckloads of your textiles could be rejected at Cairo port just because of a typing error. So, always take time to check and double-check your Packing List. It's your best ally for a seamless shipping experience between these two vibrant markets.

Commercial Invoice

To breeze through customs when shipping between the UK and Egypt, your Commercial Invoice is indispensable. Think of it as the 'Who, What, Where' of your shipment. It outlines who is buying and selling, what is being shipped, and where it's going. For instance, if you're a Cornwall pottery manufacturer shipping artisanal mugs to Cairo, this invoice will detail your business contacts, product descriptions, and shipment destination.

Make sure it aligns perfectly with your other shipping documents like the Bill of Lading or Airway Bill to avoid unnecessary delays. Divergencies could flag issues leading to meticulous checks by customs officials. So, keep it crystal-clear, consistent, and accurate! A well-prepared invoice empowers you to navigate the customs labyrinth with confidence.

Certificate of Origin

When shipping goods from the UK to Egypt, don't underestimate the power of the Certificate of Origin (CoO). This pivotal document can significantly smooth your shipping journey. It declares the birthplace of your goods, whether it's high-quality British textiles or speciality tea. Let's say your textiles are manufactured in Manchester; highlighting this in the CoO might unlock preferential duty rates, reducing the cost of your shipment.

This becomes essential in complex trade landscapes like Egypt, where duties can vary drastically. Think of your CoO as your product's passport, demonstrating its pedigree and adding value to your business transactions. Completing it versus facing shipping delays? The choice is clear—dedicate time to get your CoO spot on.

Get Started with DocShipper

Unsure of how to navigate the challenging customs clearance process between the UK and Egypt? DocShipper has got you covered! We facilitate every step, eliminating complexities and saving you precious time. Forget the paperwork stress and trust our expertise. Request a free quote now and receive it within 24 hours. Simplify your shipping today with DocShipper!

Prohibited and Restricted items when importing into Egypt

Looking to import goods into Egypt? Be savvy about what you can ship, as the list of prohibited and restricted items might catch you off guard. Let's ensure your business doesn't face unexpected hurdles or costly fines by understanding the risks and rules.

Restricted Products

- Agricultural Seeds and Seedlings: To import these, you have to secure an Agricultural Quarantine Permission from the Ministry of Agriculture and Land Reclamation in Egypt.

- Pharmaceuticals: To ship pharmaceuticals, you need to apply for a Special Pharmaceutical Permit from the Ministry of Health and Population's Central Administration of Pharmaceutical Affairs.

- Live animals and Animal Products: Import of these requires a Veterinary Quarantine Permission from General Organization for Veterinary Services.

- Wireless communication devices: To bring these in, you'll need a National Telecommunications Regulatory Authority Permit.

- Firearms, ammunition and explosives: You'll need a permit from the Ministry of Interior for these.

- Radioactive Materials: If dealing with these, apply for a permission with the Egyptian Atomic Energy Authority.

- Antiques and Artifacts: For these, you have to secure a permit from the Ministry of Tourism and Antiquities.

- Chemicals: Importation of this category involves getting a Chemical Handling License from the Ministry of Environment.

Remember, taking the time to understand import rules will help smooth your shipping process and avoid potential delays. Each product category might require additional permits or licenses based on their precise composition or traits. Always verify with the appropriate authorities before initiating your shipping process.

Prohibited products

- Narcotics drugs and psychotropic substances

- Explosive and radioactive materials

- Firearms, ammunition, and other weapons

- Pirated or counterfeit goods

- Certain types of printed publications, recordings, films due to content

- Some types of live, dead, and preserved animals

- Endangered species of plants and animals (acc. to CITES)

- Counterfeit currency and other fraudulent financial instruments

- Materials that infringe on national security or public morals

- Waste, soil, and pests

- Unregistered pharmaceuticals, pesticides, and cosmetic products

- Precious and semi-precious stones not set in gold

- Human remains

- Goods imported from Israel

- Goods intended for commercial use amounting over a value of 2000 EGP.

Are there any trade agreements between UK and Egypt

In 2023, the UK and Egypt held the first meeting of the Subcommittee on Trade and Investment under this agreement, focusing on various sectors including agriculture, renewable energy, pharmaceuticals, and financial services. Both sides discussed enhancing trade, reducing barriers, and promoting investment, with a particular emphasis on intellectual property and market access.

Another significant agreement was the Sustainable Cities and Infrastructure MoU, signed in February 2024. This pact aims to develop sustainable urban infrastructure in Egypt by sharing technical knowledge and best practices. A joint working group will be established to identify and manage infrastructure projects, promoting sustainable development and increasing foreign investment in Egypt's construction sector.

UK - Egypt trade and economic relationship

Trade between the two countries remains significant, with total trade in goods and services reaching £4.8 billion as of September 2023. The UK's exports to Egypt accounted for £2.6 billion of this total. British investments in Egypt are substantial, totaling $48 billion across sectors like oil and gas, telecommunications, pharmaceuticals, and consumer goods. The UK continues to be one of Egypt's largest foreign investors, reflecting a strong commitment to supporting Egypt's economic development

The UK and Egypt maintain a strong development partnership focused on climate action, economic prosperity, security, and stability. Key initiatives include supporting economic reforms, improving market conditions for UK companies, and addressing food and water security issues. The UK also provides technical assistance and development aid through various programs, including a $2 billion portfolio guarantee to support additional lending in Africa, including Egypt

Your Next Step with DocShipper

Shipping from UK to Egypt, or vice versa, can be a complex task riddled with paperwork and customs clearance headaches. Let the experts at DocShipper shoulder the burden. With our efficient services, rest assured your goods will reach their destination hassle-free. So why wait? Contact us today to smooth the path of your international shipping needs!

Additional logistics services

Discover how DocShipper eases your journey beyond merely shipping and customs. Unravel how we simplify every facet of your supply chain for smoother, hassle-free operations. Let's exceed logistics expectations together.

Warehousing and storage

Balancing adequate storage while trying to ship your goods from the UK to Egypt is no small feat. Whether it's delicate antiques needing regulated temperatures or conventional items, choosing a reputable warehousing solution is crucial. With our support, you're not navigating alone. For specifics on how we can assist, explore our warehousing page: Warehousing

Packaging and repackaging

Crafting the right packaging is critical when shipping from the UK to Egypt. Your goods' safe arrival hinges on effective packaging. A reliable partner like DocShipper ensures items, whether fragile ceramics or industrial machinery, are appropriately packed and repacked for the journey. With our expertise, worry less about damage and focus on your business growth. More info on our dedicated page : Freight packaging

Cargo insurance

Imagine your inventory vanishing en route, with nothing but a fire insurance policy in hand. Unlucky scenario? Yes, but without cargo insurance, you're playing a risky game. Unlike fire insurance, cargo insurance safeguards your shipment both at sea and ashore, serving as a lifeboat against unexpected events and potential financial losses.Say your containers tumble overboard in a storm, cargo insurance has got you covered. Mitigate uncertainty and keep your business sailing smoothly. More info on our dedicated page: Cargo Insurance

Supplier Management (Sourcing)

Looking to source and manufacture in Asia, East Europe, or elsewhere? DocShipper aids companies, bridging language gaps and unraveling complexities involved. From finding suppliers to supervising procurement, we streamline the process. An example? A clothing brand wanting to tap into Egyptian cotton suppliers - that's us ensuring seamless supplier management. More info on our dedicated page: Sourcing services

Personal effects shipping

Shipping personal effects from the UK to Egypt? With our expert handling, your fragile or bulky items get a safe and smooth journey. We customize solutions for artworks, antiques, or your favorite couch, never compromising on care or flexibility. Picture shipping grandma's vintage piano with no hassles. For more in-depth information, visit our dedicated page: Shipping Personal Belongings

Quality Control

Ensuring your items live up to UK-Egypt trade standards is crucial, and that's where quality control comes in. Whether you're shipping bespoke furniture or off-the-shelf tech goods, rigorous inspections can spot quality issues early. Remember that time your shipment of textiles was held at Alexandria Port due to incorrect thread count? With thorough quality checks, you won't risk costly customs issues. More info on our dedicated page: Quality Inspection

Product compliance services

Confused about adhering to import regulations? Our Product Compliance Services help streamline your shipping process. We provide rigorous laboratory tests to certify your goods, ensuring they align with the destination's regulations. This can make the difference between a routine shipment and a logistical nightmare. Say goodbye to uncertainty - we've got you covered! Interested? Explore our Product compliance services

FAQ |Freight Shipping between UK and Egypt | Rates - Transit times - Duties and Taxes

What is the necessary paperwork during shipping between UK and Egypt?

When shipping from the UK to Egypt, we, at DocShipper, will manage key documents like the bill of lading for sea freight or the air waybill for air freight on your behalf. However, it's pivotal for you to provide us with at least the packing list and the commercial invoice. Some shipments may necessitate additional paperwork, dependent on your specific goods. These might include Material Safety Data Sheets (MSDS), certifications, among others. Your DocShipper consultant can assist in clarifying exactly what's required based on your specific shipment needs. Trust us to make your shipping experience as smooth as possible!

Do I need a customs broker while importing in Egypt?

Yes, we would highly recommend employing the services of a customs broker for imports into Egypt. In fact, at DocShipper, we handle this aspect on behalf of our clients in the majority of our shipments. The customs process is fraught with complexities, requiring a meticulous approach toward regulations and documents. Our expert team bridges this gap, providing seamless customs interactions. This ensures you avoid costly errors or delays, relieving you of what can otherwise be a cumbersome process. Having a customs broker can make your import experience in Egypt smoother and stress-free.

Can air freight be cheaper than sea freight between UK and Egypt?

Whether air freight is cheaper than sea freight from the UK to Egypt depends on numerous factors, including your cargo's route, weight, and volume. Typically, if your shipment is under 1.5 cubic meters or weighs less than 300 kg (660 lbs), air freight could indeed be a cost-effective alternative. Rest assured, as your dedicated team at DocShipper, we are committed to providing the most competitive option tailored to your specific shipping needs. We closely analyze each shipment's individual circumstances to decide the best, and the most economical mode of transport.

Do I need to pay insurance while importing my goods to Egypt?

While we believe it is important to protect your imports, insurance for shipping goods, including to Egypt, is not required. However, we strongly advise securing insurance for your goods. This is because several unforeseen circumstances such as damage, loss, or theft can occur during transit. It all boils down to having peace of mind knowing your shipment is protected, particularly when shipping goods offshore. As DocShipper, we can further provide advice on insurance options tailored to your shipping requirements.

What is the cheapest way to ship to Egypt from UK?

When shipping from the UK to Egypt, we at DocShipper generally recommend sea freight as the most cost-effective method. This option is especially suitable for bulky or heavy shipments, given the geographical proximity across the Mediterranean Sea. Nevertheless, the best mode for your specific needs can depend on various factors such as urgency, the nature of goods, and volume. Always feel free to contact us for a tailored consultation.

EXW, FOB, or CIF?

Choosing between EXW, FOB, or CIF primarily depends on your unique relationship with your supplier. However, as suppliers usually aren't logistics experts, we recommend letting a logistics agent take charge of the international freight, customs clearance, and other processes at the destination. Suppliers typically sell under EXW or FOB terms, where EXW is at their factory doorstep, and FOB includes all local charges until the origin terminal. Regardless of these terms, at DocShipper, we take pride in offering door-to-door services, shouldering all the logistics burdens for you. Trust us to handle all that's required, and we'll ensure a seamless transaction, helping you to focus on what you do best: your business.

Goods have arrived at my port in Egypt, how do I get them delivered to the final destination?

If your cargo is handled under CIF/CFR incoterms at the port or airport in Egypt, you'll need a custom broker or a freight forwarder to clear the goods, pay import charges, and facilitate delivery. However, our team at DocShipper can manage the process using DAP incoterms, meaning we take care of everything for you. It's recommended you discuss this with your account executive for clarification.

Does your quotation include all cost?

Absolutely, we make sure there are no unwelcome surprises. Our quotation encompasses all costs, excluding duties and taxes at your destination. Should you need an estimate of these costs, your dedicated account executive is always ready to assist. At DocShipper, we're committed to transparency, ensuring no hidden fees sneak up on you.