Why did the crates cross the Irish Sea? To up their business game, of course! But in real terms, what keeps business owners up at night is often the confusion about rates, the uncertainty of transit times, and the maze of customs regulations. Our comprehensive guide aims to dispel these fears, clearly explaining every aspect of freight transport from the UK to Ireland. We delve into different types of freight options, break down the often complex customs clearance process, provide information on duties and taxes, and even offer advice and tips tailored for businesses. If the process still feels overwhelming, let DocShipper handle it for you! As an experienced international freight forwarder, we take care of every step of the shipping process, turning logistical challenges into successful, smooth shipments for businesses.

Table of Contents

Which are the different modes of transportation between UK and Ireland?

Choosing the right transport for shipping goods from the UK to Ireland hinges heavily on the unique geographical bond they share. Imagine your cargo's journey as a short, quaint afternoon hike rather than an epic cross-continental adventure.

With the Irish Sea as a cosy hurdle, sea freight, with its cost effectiveness and large cargo capacity, often emerges as a smart choice. However, for time-sensitive deliveries, availing the quick and efficient air freight might be your winning ticket. Deciding appropriately can transform this logistics conundrum into a seamless supply chain ballet.

How can DocShipper help?

Shipping between UK and Ireland can be a tough nut to crack! DocShipper streamlines this process, managing transport, customs, and bureaucracy. No more headaches about documentation or routing. Need assistance? Contact our expert consultants for free advice or get a free estimate in less than 24 hours. Take the stress out of shipping with DocShipper.

DocShipper Tip: Ocean freight might be the best solution for you if:

- You're dealing with large quantities or oversized items. Sea freight offers a budget-friendly way to maximize space, a particularly useful option given the UK's extensive port network.

- Your shipment isn't on a tight schedule. Ocean transport typically takes longer than air or rail, but it offers reliability.

- Your supply chain involves key ports, allowing you to take advantage of a wide-reaching network of sea lanes.

Sea freight between UK and Ireland

Ocean shipping between the UK and Ireland bears the weight of a significant trade relationship. This bustling maritime exchange is steered by major cargo ports like Liverpool, Southampton, and Bristol in the UK and Dublin, Cork, and Shannon on the Irish side.

Essentially, it's like a regular ferry service, only for goods on a massive scale. Serving as a lifeline for high-volume goods, sea freight is the unsung hero offering cost-effective service, albeit a bit slowly.

And yes, it's not all smooth sailing! Many businesses feel like explorers lost at sea, battling the waves of shipping errors and complexities. Missteps in paperwork, overlooked customs regulations - it's like showing up to a surprise test unprepared!

But fear not, this section will be your compass, shedding light on best practices, little-known specifications, and more to steer clear of common pitfalls. Armed with this knowledge, you'll soon be cruising through the shipping process like a seasoned captain!

Main shipping ports in UK

Port of Dover

Location and Volume: The Port of Dover, situated as the nearest British port to mainland Europe, is a major hub for international trade, handling an astounding £122 billion worth of goods a year. Known for being a pioneer in roll-on/roll-off operations, the port is an essential entry point for smooth transit between the United Kingdom and Europe, greatly enhancing the effectiveness and agility of cross-border logistics. Apart from its economic significance, the port manages a significant amount of containers, with an approximate yearly throughput of 5.4 million TEUs, highlighting its role in promoting strong trade ties and seamless cargo transportation.

Key Trading Partners and Strategic Importance: France, Germany, and Belgium are the key trading partners. This port's strategic importance lies in its use by thousands of businesses due to its close proximity to Western continental Europe.

Context for Businesses: If your strategy involves quick delivery times to and from European markets, the Port of Dover offers fast and efficient connections.

Port of Felixstowe

Location and Volume: The Port of Felixstowe, which is located in Suffolk, is the busiest container port in the United Kingdom and is considered to be the best. It is astonishing that it oversees more than forty percent of the country's containerized trade, with a yearly shipping volume that routinely exceeds 3.8 million TEUs.

Key Trading Partners and Strategic Importance: Major trading partners include China, the USA, and European countries. It is a crucial part of the UK’s trade infrastructure as it has the UK's largest and busiest container facility.

Context for Businesses: For businesses seeking optimal reach to Asian, American, and European markets, the Port of Felixstowe can be a strategic choice due to its extensive network.

Port of Southampton

Location and Volume: Tucked away on the scenic south coast of England, the Port of Southampton is a major player in the maritime scene, well-known for being one of the top car and cruise ports in the country. The port makes a substantial contribution to the nation's maritime activities, promoting effective trade and acting as a gateway for the automotive and cruise industries, with an annual shipping volume of almost 1.5 million TEUs.

Key Trading Partners and Strategic Importance: The USA, China, and India are primary trading partners. Southampton is strategically essential as it is the UK’s number one vehicle handling port.

Context for Businesses: If your export strategy involves a strong automotive component, the Port of Southampton might be the optimal fit due to its specialized vehicle handling services.

Port of Liverpool

Location and Volume: Situated in the northwest of England, the Port of Liverpool has a significant worldwide presence and is a major participant in the maritime sector. With a focus on efficiency, the port oversees the annual processing of about 700,000 TEUs, demonstrating its significance as a link in the chain that facilitates international trade and boosts the local economy.

Key Trading Partners and Strategic Importance: Notable trading partners include Spain, China, and Canada. The port’s significant role in global trade is demonstrated by its connection to over 200 parts of the world.

Context for Businesses: For those businesses looking to tap into markets in North America, the Port of Liverpool, with its strong transatlantic connections, might be a wise choice.

London Gateway

Location and Volume: The London Gateway, positioned on the northern bank of the River Thames, provides essential access to Greater London and serves as a key entry point for goods into the UK. With a shipping volume exceeding 1.5 million TEUs, this maritime hub plays a crucial role in facilitating the flow of diverse goods, contributing significantly to the nation's trade. Its strategic location, world-class facilities, and efficient infrastructure make it a preferred choice for international trade, stimulating local industries and fostering economic growth. The London Gateway is not just a physical gateway for goods; it symbolizes the UK's connectivity to the broader world and underscores the importance of strategic port infrastructure in sustaining a thriving global economy.

Key Trading Partners and Strategic Importance: The Netherlands, China, and Germany are the primary trading partners. The London Gateway's strategic importance is underlined by its position as one of the UK's most technologically advanced ports.

Context for Businesses: If you're considering a stronger presence in the UK, especially in London, the advanced technology and strategic location of the London Gateway may factor into your logistics planning.

Port of Grimsby

Location and Volume: Located on the south bank of the River Humber, the Port of Grimsby, with a shipping volume of 500,000 TEUs, is a vital gateway for goods. Its efficient facilities contribute to the smooth flow of goods, playing a crucial role in the trade dynamics of the UK. Beyond its quantitative importance, the port stimulates local economic activities, creating jobs and fostering development in the region. The Port of Grimsby symbolizes regional connectivity to national and international markets, highlighting its dynamic role in the global trade landscape.

Key Trading Partners and Strategic Importance: Germany, Denmark, and the Netherlands are key trading partners, and the ability to handle a wide variety of goods, including cars, containers, and bulk commodities, underscores its strategic value.

Context for Businesses: If a diversified goods portfolio is part of your business strategy, the Port of Grimsby, renowned for its versatility, could contribute to efficient logistics management.

Main shipping ports in Ireland

Port of Dublin

Location and Volume: Situated at the core of Ireland's road and rail network, the Port of Dublin plays a crucial role in the country's trade infrastructure. Handling approximately two-thirds of Ireland's containerized trade, and managing 7.1 million gross tonnes in 2023, it stands as a key component of the nation's logistical landscape. Its strategic location and impressive capacity, exemplified by the substantial TEU numbers, underscore its significance in facilitating efficient trade and contributing to Ireland's economic vitality.

Key Trading Partners and Strategic Importance: This port has strong ties with the UK and Continental Europe. Sustainably growing and securing an expanded European trade footprint remains a strategic priority for Dublin port.

Context for Businesses: If you're looking to tap into the Irish market, especially in fast-moving consumer goods, the Port of Dublin, with its industry-advancing Smart Port initiatives, offers an opportunity to efficiently reach a vast customer base.

Port of Cork

Location and Volume: Sitting on the southern coast of Ireland, the Port of Cork stands as the second-largest port in terms of volume. Annually managing a substantial cargo throughput exceeding 12 million tonnes, the port plays a pivotal role in facilitating trade and commerce in the region. With an impressive handling capacity of over 800,000 TEUs, its strategic location and extensive capacity contribute to its prominence, making it a vital hub for goods transportation.

Key Trading Partners and Strategic Importance: This port is a significant conduit for exports to the UK and the rest of Europe. Additionally, it houses the only dedicated container terminal in Ireland.

Context for Businesses: For businesses seeking significant shipping flexibility, the Port of Cork, with its modern container handling facilities and multi-modal transport links, is ideal for easy and cost-effective access to European markets.

Port of Shannon Foynes

Location and Volume: The Port of Shannon Foynes, situated on the west coast of Ireland, is a maritime giant handling an average of 11 million tonnes of cargo each year. With a diverse range of goods passing through its docks, the port's significance in Ireland's trade infrastructure is underscored by its efficient operations and substantial tonnage handling capacity, exceeding 900,000 TEUs.

Key Trading Partners and Strategic Importance: This port focuses on bulk cargo, such as coal and agricultural products, with substantial trade links to the UK and Europe.

Context for Businesses: Businesses involved in agriculture, energy, and construction might find the Port of Shannon Foynes optimal for their shipping needs due to the port's specialized bulk cargo handling and facilities.

Port of Waterford

Location and Volume: Located in the southeast of Ireland, the Port of Waterford oversees a significant portion of the country's container, bulk, and breakbulk traffic. With an annual volume surpassing 1.5 million tonnes and a TEU capacity of 150,000, the port's comprehensive capabilities contribute to the seamless flow of goods, supporting economic activities in the region. Its strategic position and adaptability make it a crucial link in Ireland's trade network.

Key Trading Partners and Strategic Importance: The port handles regular trade with Northern Europe, the Mediterranean, and the Middle East, underpinning Ireland’s international trade.

Context for Businesses: If you're looking to expand your reach into these regions, the Port of Waterford’s diverse freight handling capabilities and excellent ro-ro facilities can offer a competitive edge.

Port of Rosslare

Location and Volume: The Port of Rosslare, Ireland’s leading passenger ferry port, not only facilitates passenger travel but also manages large volumes of ro-ro freight traffic. Having achieved a throughput of 7.5 million tonnes in 2022, the port's multifaceted operations and substantial TEU handling capacity of 600,000 contribute significantly to the country's maritime trade landscape.

Key Trading Partners and Strategic Importance: This port offers regular ferry connections to the UK, France, and Spain, providing a significant shipping avenue for the Irish export sector.

Context for Businesses: For companies emphasizing speed and efficiency, the Port of Roslare's robust ro-ro facilities serve as a valuable gateway to European markets.

Port of Galway

Location and Volume: Situated on Ireland's west coast, the Port of Galway specializes in handling over half a million tonnes of goods annually, with a focus on bulk and project cargo. Its strategic location and tailored capabilities position it as a key player in facilitating the transportation of specialized goods, with a TEU capacity of 70,000, contributing to the diversification of Ireland's maritime trade.

Key Trading Partners and Strategic Importance: The port sustains strong trade ties with the UK, Continental Europe, and Scandinavia, particularly in areas of oil, gas, and wind energy.

Context for Businesses: Businesses targeting energy sector growth may consider using the Port of Galway for its superior handling of project and bulk cargo shipments in this sector.

Should I choose FCL or LCL when shipping between UK and Ireland?

Choosing the right sea freight option between the UK and Ireland can make a world of difference for your business. Understand the ins and outs of Full Container Load (FCL) and Less than Container Load (LCL), commonly known as consolidation, to help you drive down costs, nail your delivery timings, and ensure a smooth shipping process.

This section demystifies these options and empowers you to make an informed decision that fits your specific shipping needs like a glove. Get ready to unravel the intricacies of sea freight and streamline your logistics like never before.

LCL: Less than Container Load

Definition: LCL (Less than Container Load) is a method of shipping that combines cargos from multiple shippers into a single container. This is typically used for smaller shipments and presents a cost-effective alternative to Full Container Load (FCL) for businesses with lower cargo volumes.

When to Use: LCL is better when the volume of the cargo is less than 13/14/15 cubic meters (CBM). It offers flexibility as you only pay for the space you use, rather than a whole container, making it a preferred option if the freight volume is not sufficient to justify the cost of a full container.

Example: Consider a sports equipment exporter in the UK. The exporter needs to ship 10 CBM of footballs to a client in Ireland. Here, an LCL shipment would be the ideal choice, offering a balanced solution between cost-effectiveness and logistic efficiency.

Cost Implications: While several charges like picking up the cargo, consolidating it, and delivering it affect LCL freight cost, the major benefit arises due to the division of these costs between several shippers sharing the same container. Consequently, you end up paying significantly less than what you would for an FCL freight, especially for lower volume shipments.

FCL: Full Container Load

Definition: FCL, which stands for Full Container Load, is a type of fcl shipping where you rent a full container for your cargo. This option ensures that your goods are sealed and secure from the origin to the destination.

When to Use: FCL is ideal when your shipment is substantial - more than 13, 14, or 15 cubic meters (CBM). It provides both cost-efficiency and safety by sealing off your own exclusive container. This guarantees that only your items are inside, minimizing the risk of damage or delay.

Example: Let's say you're an auto parts dealer shipping a batch of components that occupies an entire 20'ft container. Going for an FCL would ensure that only your goods are in that container, offering better protection and streamlined handling at both ends of the journey.

Cost Implications: The initial fcl shipping quote for an fcl container may seem high compared to Less than Container Load (LCL). However, it becomes worthwhile when shipping large volume, as the cost per unit is significantly lower. The cost typically remains consistent regardless of whether you opt for a 20'ft or a 40'ft container, making it a preferred choice for high volume shipments.

Unlock hassle-free shipping

Entrust your UK-Ireland cargo shipping to DocShipper, a freight forwarder committed to simplifying your shipping process. Our ocean freight experts guide you through crucial factors like volume, weight, and timings to ensure you choose between consolidation or a full container wisely. Don't be flustered by shipping complexities. Let us help you make an informed choice. Reach out now for a free, no-obligation freight estimation. Choose us for a hassle-free shipping experience.

How long does sea freight take between UK and Ireland?

The average sea freight shipping time between the UK and Ireland typically ranges from 2 to 5 days. This transit time, however, is dependent on a variety of factors such as the specific ports used, the weight, and the nature of the goods being transported. For a more tailored quote, it's recommended to get in touch with a freight forwarder like DocShipper.

Shipping Times for Main Ports:

| UK Ports | Ireland Ports | Average Transit Time (days) |

| Port of Felixstowe | Port of Dublin | 2-3 days |

| Port of London | Port of Cork | 2-4 days |

| Port of Southampton | Port of Shannon Foynes | 3-5 days |

| Port of Liverpool | Port of Waterford | 3-5 days |

*Please note these are average transit times and actual times may vary.

How much does it cost to ship a container between UK and Ireland?

Understanding the cost to ship a container between the UK and Ireland hinges on several factors, making it hard to pinpoint an exact shipping cost. Variables like the Point of Loading and Destination, choice of carrier, the nature of your goods and monthly market fluctuations can significantly impact ocean freight rates. We understand that this broad pricing spectrum can be challenging! But fear not, our seasoned shipping specialists are here to help. Operating on a case-by-case basis, they'll work tirelessly to secure the best rates for you, handling the complexities so your journey towards international shipping remains smooth and affordable.

Special transportation services

Out of Gauge (OOG) Container

Definition: An Out of Gauge, or OOG container, refers to cargo that exceeds the standard dimensions of a container (either in height, width, or length) and protrudes beyond the container’s limits.

Suitable for: Large machinery, construction materials, and any shipment that cannot fit into regular sized containers.

Examples: Heavy machinery or oversized construction elements like large pipes, turbines, or industrial equipment.

Why it might be the best choice for you: If your goods can't fit into standard containers because they are oversized or irregularly shaped, an OOG container offers a safe and secure transportation method.

Break Bulk

Definition: Break bulk refers to the practice of shipping goods individually, in bags, boxes, or drums, that are loaded and unloaded onto a cargo ship rather than in a container.

Suitable for: Items too large or heavy to be loaded onto a containerized vessel.

Examples: Heavy equipment, construction materials, large vehicles, steel or iron beams.

Why it might be the best choice for you: Break bulk may be a good choice if your goods are heavy, oversized, or if packaging them into containers may be impractical or costly.

Dry Bulk

Definition: Dry bulk involves the transportation of homogenous, loose cargo loads such as grain, coal, or ore that are poured directly into a ship's hold.

Suitable for: Commodities that are traded in large quantities and do not require packaging.

Examples: Coal, grains, iron ore, or cement.

Why it might be the best choice for you: If you’re shipping high-volume commodities that require minimal packaging, dry bulk is a cost-effective method that facilitates easy loading and unloading.

Roll-on/Roll-off (Ro-Ro)

Definition: Roll-on/Roll-off, or Ro-Ro, refers to the method of shipping wheeled cargo, where vehicles are rolled onto a ro-ro vessel at the source port and rolled off at the destination.

Suitable for: Any type of wheeled cargo, including cars, trucks, semi-trailer trucks, trailers, and railroad cars.

Examples: Automobiles, construction machinery with wheels, tractors, or RVs.

Why it might be the best choice for you: If your goods are self-propelled or towable, the Ro-Ro method provides a straightforward and efficient method of shipping, eliminating the need for cranes or forklifts.

Reefer Containers

Definition: Reefer containers are refrigerated containers used to transport goods that require a specific temperature to remain fresh during the transit.

Suitable for: Perishable and temperature-sensitive goods.

Examples: Fruits, vegetables, dairy products, meat, and pharmaceuticals.

Why it might be the best choice for you: If you’re shipping goods that must be kept at a certain temperature throughout the journey, reefer containers ensure that your products arrive in perfect condition.

Remember, selecting the right shipping option for your goods is crucial, and that's where DocShipper comes in. We understand that each shipment is unique and we're here to help you navigate your options. Contact us for a free shipping quote in less than 24 hours. Your shipping needs are our priority.

DocShipper Tip: Air freight might be the best solution for you if:

- You're facing tight deadlines or need rapid delivery. Air freight is your quickest option, which aligns well with the fast-paced business environment.

- Your shipment is relatively small, under 2 CBM. Air freight is ideal for these more compact loads.

- Your cargo's destination isn't easily reached via sea or rail. This makes air freight a viable option, especially given the extensive network of airports available.

Air freight between UK and Ireland

When it comes to speed and reliability, air freight between the UK and Ireland is hard to beat. Ideal for smaller, high-value items – think designer apparel or critical medical equipment – it provides rapid transit times, tight security, and swift customs clearance. For example, send that haute couture gown or time-sensitive lab apparatus, and they’ll be airborne, sailing the skies with speed and assurance. Quite straightforward, right?

But hold on... many shippers stumble by not factoring in key details before choosing air freight. Ever calculated the shipment cost using incorrect weight parameters? That could punch a hole in your budget. Or what about knowing your way around 'best practices'? Falling short here can kick costs sky high. This part of the guide dives deep into these oft-overlooked factors, shedding light on the art of getting your goods in the air without your budget going up in smoke.

Air Cargo vs Express Air Freight: How should I ship?

Choosing between traditional air cargo and express air freight for shipping goods from the UK to Ireland isn't always clear cut. Air cargo involves transporting your goods in a shared airline, while express air freight whisks them off in a dedicated plane - a speedy but potentially pricier choice. Let's untangle this and see which route best fits your business needs.

Should I choose Air Cargo between UK and Ireland?

Choosing air cargo for shipments between the UK and Ireland can be a cost-effective and reliable solution. Prominent airlines offering such services are British Airways and Aer Lingus. Their fixed schedules might lead to longer transit times, yet reliability is assured. If your shipments are above 100/150 kg (220/330 lbs), air cargo becomes increasingly attractive. Evaluate if this choice aligns with your budget and timelines. Find out more about their services at British Airways and Aer Lingus.

Should I choose Express Air Freight between UK and Ireland?

Express Air Freight is a tailored service using cargo-only aircraft, ideal for consignments under 1 CBM or 100/150 kg. This might be the best option for you if your shipment between the UK and Ireland fits these parameters - it's fast, secure, and ensures door-to-door delivery. Pioneers in this field, like FedEx, UPS, or DHL, might be your go-to choice, offering streamlined customs process, reducing shipment time and potential hang-ups at the border. This could be the optimal solution for quickly moving small- to medium-size cargo.

Main international airports in UK

Heathrow Airport

Cargo Volume: London Heathrow moved 1.2 million metric tonnes of cargo per year.

Key Trading Partners: Ensures trade with key global markets such as USA, China, India, and many countries in the EU.

Strategic Importance: As UK's premier international airport, London Heathrow holds a strategic importance in the global cargo industry.

Notable Features: The HAL Cargo Center, enabling swift consignment processing at a 300,000 square foot center.

For Your Business: As Heathrow provides connections to over 180 destinations worldwide, it offers abundant options for routing your shipments. The robust infrastructure at the Heathrow ensures your freight is professionally handled, aiding in smooth and timely deliveries.

East Midlands Airport

Cargo Volume: One of UK's top cargo airports, moved over 360,000 tonnes of cargo per year.

Key Trading Partners: Primarily Europe and North America, including major markets like Germany, France, and the USA.

Strategic Importance: Known as the UK’s most important pure freight airport, it is a key logistics hub strategically located at the heart of the country.

Notable Features: Home to one large cargo terminal, a Royal Mail hub, and several courier companies.

For Your Business: If your business is highly time-sensitive, East Midlands Airport, with its 24/7 operations, could prove to be a feasible option. It sets no restrictions on nighttime flights, ensuring around-the-clock freight operations.

Manchester Airport

Cargo Volume: Over 120,000 metric tonnes of cargo transported yearly.

Key Trading Partners: Includes the US, UAE, and European partners like Germany and France.

Strategic Importance: As a major airport in Northern UK, it serves as a strategic link to international markets.

Notable Features: Houses World Freight Terminal - a comprehensive suite of logistics services.

For Your Business: For goods originating from or destined for Northern UK, Manchester Airport could potentially save you inland transportation costs. Its World Freight Terminal provides integrated solutions for handling and storing freight.

Stansted Airport

Cargo Volume: Ships over 250,000 tonnes of cargo annually.

Key Trading Partners: Primarily Europe, North America, and Asia, including countries like Spain, Germany, and China.

Strategic Importance: It is the third largest air cargo gateway in the UK.

Notable Features: The Diamond Hangar, a 160,000 square foot storage and handling facility.

For Your Business: As a hub for FedEx/TNT and UPS, it could facilitate your express consignments, especially if your trade partners lie in Europe, North America, or Asia.

Glasgow Prestwick Airport

Cargo Volume: Moves about 14,000 metric tonnes yearly.

Key Trading Partners: Primarily USA, followed by other European countries.

Strategic Importance: Scotland's largest commercial airfield, providing important logistics capabilities for businesses in Scotland.

Notable Features: The only airport in Scotland with a dedicated railway station.

For Your Business: If you are a business based in Scotland and regularly ship towards the USA, Prestwick might bring down your domestic transit fees, while its 24-hour operation facilitates consistent, timely delivery of shipments.

Main international airports in Ireland

Dublin Airport

Cargo Volume: Annually manages over 139,000 tonnes of cargo.

Key Trading Partners: Primarily connects with the USA, UK, Germany, and UAE for air freight.

Strategic Importance: Dublin Airport is the busiest airport in Ireland and the gateway to the country's dynamic economy. It offers direct flights to major cities in Europe, North America, the Middle East, and Asia.

Notable Features: The airport hosts a range of cargo handlers and airline services, including Fedex, DHL, Aer Lingus, and Ryanair. There are extensive facilities for the efficient handling of many types of goods, from perishables and pharma to high-value items.

For Your Business: If speed is critical and your shipments are heading to or coming from Europe or North America, Dublin Airport might offer the most direct and time-efficient route.

Shannon Airport

Cargo Volume: Handles approximately 13,000 tonnes of cargo per year.

Key Trading Partners: Primarily facilitates trade with the USA, Europe, and Asia.

Strategic Importance: Famous for being the first European airport with direct transatlantic flights, Shannon has a proud aviation history. It presents a strategic location for connecting the West of Ireland to the rest of the world.

Notable Features:Offers a unique Pre-clearance facility for US-bound cargo significantly simplifying the logistic process to the U.S.

For Your Business: Its strategic location and unique pre-clearance option make it an excellent choice if your freight is US-bound.

Cork Airport

Cargo Volume: Processes almost 2,500 tonnes of cargo annually.

Key Trading Partners: Mainly trades with UK, Spain, France, and Poland.

Strategic Importance: Cork Airport is Ireland's second-largest airport located in the country's largest maritime and shipping hub, making it a strategic choice for combined sea-air freight movement.

Notable Features: It is home to global freight companies such as DHL and FedEx, as well as a dedicated logistics hub for Amazon.

For Your Business: If you're considering a combined sea-air shipping strategy, Cork Airport's strategic location in Ireland's largest shipping hub might be just what your business needs.

How long does air freight take between UK and Ireland?

The average shipping time between the UK and Ireland via air freight is typically between 1-2 days. However, keep in mind that these transit times can vary depending on factors such as the specific airports involved, the weight of the goods, and their nature. As such, it's recommended to consult a freight forwarder like DocShipper for the most accurate timeframes.

How much does it cost to ship a parcel between UK and Ireland with air freight?

Air freight rates between the UK and Ireland can vary broadly, with a rough average of €1.20-€4.50 per kg. However, an exact price is challenging to pinpoint due to multiple variables including distance from the airport, parcel dimensions, weight, and the nature of goods. That's why our dedicated team evaluates each case individually, ensuring we provide you with the most favorable rates. We understand your unique needs and strive to offer tailored solutions. Reach out today and receive your free, no-obligation quote within 24 hours.

What is the difference between volumetric and gross weight?

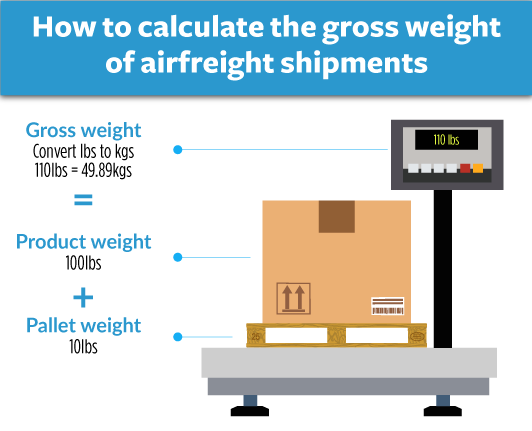

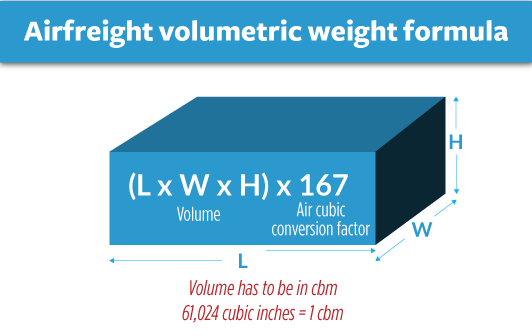

Gross weight is the actual physical weight of your shipment, measured in kilograms. On the other hand, volumetric weight, sometimes called dimensional weight, is a calculation that considers the width, height, and length of your package.

To calculate the gross weight in air freight shipping, you simply weigh the entire shipment, including packaging, using a weighing scale. If, for example, your package weighs 10 kg, that’s the gross weight. However, a conversion into pounds is also crucial for some industries, and 10 kg is equivalent to approximately 22 lbs.

The calculation of volumetric weight takes into account the size of your package, not just its weight. In air cargo, the formula is length x width x height in centimeters, divided by 6000. In Express Air Freight services, they use a different divisor; the formula is length x width x height in centimeters, divided by 5000. This difference arises from the specific cargo hold dimensions of planes.

Let us take a hypothetical package with dimensions 50 cm x 40 cm x 30 cm. For air cargo, you'll calculate the volumetric weight as 50 x 40 x 30 / 6000, which equals to roughly 10 kg (or 22 lbs). For Express Air Freight, using their specific divisor, the resulting volumetric weight is 50 x 40 x 30 / 5000, which gives us 12 kg (approximately 26.46 lbs).

The result of these calculations is material because freight charges in the shipping industry usually rely on the greater value between gross and volumetric weight. Therefore, understanding these calculations ensures you are informed and prepared to make cost-effective shipping decisions.

DocShipper tip: Road freight might be the best solution for you if:

- You're seeking a budget-friendly solution for shorter hauls. Road freight often comes out on top in terms of cost-effectiveness and speed for these kinds of distances.

- Your end destination is either within your own continent or just across the border. For such regional or intra-continental shipments, road freight is typically the most direct and rapid method.

- Your cargo has unique dimensions or shapes. The adaptability of trucking allows for a wide range of goods that may not conform to the size limitations of sea or air transport.

Trucking between UK and Ireland

Navigating the roads between the UK and Ireland? Let's make it clear and concise for your business shipping needs. With prime overland routes and excellent road conditions, trucking offers swift transit times, potentially speeding past sea, air, or rail options.

While Affordability varies, road freight often stands as a cost-effective contender. Yet, every coin has two sides – congestion and potential delays may pose challenges. However, the ability to do door-to-door delivery and relatively less dependency on schedules makes it a top pick for many businesses.

Above all, it's a straightforward, ground-level solution steeped in flexibility. It's now your choice to hit the road or not!

What if I can’t fill a truck between UK and Ireland?

Choosing between Less than Truck Load (LTL) and Full Truck Load (FTL) shipping becomes key when exporting goods between UK and Ireland. Strike the perfect balance between flexibility and cost-effectiveness for your business as we delve into choosing the right method. Get set to ride the wave of success in international trading!

LTL: Less than Truck Load

Let's talk 'Less than Truckload', or simply LTL. This type of freight could be your golden ticket if you're regularly shipping cargo that takes up less than 13/14/15 cubic meters (CBM). With LTL, you're only paying for the space your cargo occupies in the truck, which can be a cost-effective alternative to renting the whole truck.

Picture this, you run an e-commerce business shipping box-packed artisanal cheeses weighing under 15 CBM from UK to Ireland. Instead of hiring a full truck (FTL), you share it with other businesses in an LTL freight model, saving costs and resources.

When should you use LTL?

- Your cargo is between 1-15 CBM: LTL is designed for smaller loads.

- The route is short, like from UK to Ireland: LTL gets more cost-effective over shorter distances.

- Flexibility is required: LTL allows for easier schedule modifications if your needs change.

- Reducing environmental impact is an objective: Sharing a truck space in an LTL shipment helps to lessen your carbon footprint.

- You want more services: LTL could include options for inside pickup and delivery, or even freeze protection for perishable goods like our artisanal cheeses.

Remember, it's all about optimizing your shipping strategy to match your specific needs.

FTL: Full Truck Load

Full Truck Load, or FTL, refers to a shipment method where the entire truck is utilized for one consignment. It's the preferred option when you're shipping a heavy load, especially if the cargo exceeds 13/14/15 CBM. Let's say you're a British manufacturer shipping 20 CBM of machinery parts to a distributor in Ireland. Going for an FTL shipment would be the most economical and efficient route.

When should you consider using FTL freight?

- If you have a large enough cargo volume regularly, exceeding 13/14/15 CBM.

- When time is critical, as FTL shipments usually involve fewer stops.

- For fragile or high-value cargo, FTL provides less handling and greater security.

- If your business demands predictable delivery times, as FTL has less variance compared to other shipping options.

Thus, choosing between FTL and Less than Truck Load (LTL) freight largely depends on your cargo's size and your shipping requirements. Always weigh your options, keeping in mind the value and bulkiness of your goods.

What are the main routes between UK and Ireland?

The pulse of road freight between the UK and Ireland beats along several key routes. The most popular involves catching a ferry from Holyhead, Wales to Dublin, then reaching various Irish cities using primary routes - M1, M7, and the M8.

Hitting the road from Liverpool, Birkenhead, or Cairnryan, you'll find yourself at Belfast, connecting to the Irish roads via the M2 or M22. Keep in mind, these roads buzz with peak periods, often congested during holiday seasons and weekdays.

Also, weather conditions impact ferry schedules and road safety, especially during wintertime. Choose timing wisely for a smoother journey.

What are the road transit times between UK and Ireland?

On average, road transport between the UK and Ireland takes roughly 6 to 12 hours. However, it's crucial to note that these timings are subject to many variables. Traffic can be unpredictable, regulations on circulation can alter routes, and in some regions, lower-quality roads can slow the journey, such as some rural areas in Ireland.

These are merely estimates, and for precise information tailored to your freight needs, you can contact us for a cross-border freight quote that we will deliver in less than 24 hours.

How much does trucking cost between UK and Ireland?

Determining the exact bean-counting in land-freight costs between the UK and Ireland is like nailing jelly to a cat; slippery business indeed! Factors like load volume, item type, and route can spike the cost graph. But, hey, don't pull your hair out! Our trucking pros will crunch the numbers for you and wrestle the best rates. After all, each business is as unique as a unicorn, and we quote based on your particular needs. Promise!

DocShipper tip: Door to Door might be the best solution for you if:

- You prioritize ease and a hassle-free shipping experience. Door-to-door services manage the entire process, from collection to final delivery.

- You appreciate the efficiency of having one dedicated contact. With door-to-door, a single agent is responsible for overseeing all elements of your shipment.

- You want to limit the number of times your cargo is transferred. Door-to-door services minimize the switches between various transport methods, lowering the chances of damage or loss.

Door to door between UK and Ireland

International door-to-door shipping is a full-service freight solution, taking your goods from A in the UK to B in Ireland, with the freight forwarder handling every step. No worries about the handovers, customs or paperwork - it's all taken care of! And what's best for this route? Efficiency meets peace of mind. Let's dive in!

Overview – Door to Door

Door-to-door shipping UK to Ireland simplifies your logistics struggle! It's a stress-free solution streamlining complexities of shipping, customs clearance, and delivery, all under one roof. This holistic solution eliminates multiple points of contact, reducing chances of error and delays.

A major plus, considering the regulatory challenges in international freight. Be aware, it might cost higher than port-to-port shipping, but many of our clients find the minimal hassle worth the extra penny.

With DocShipper, trusting your goods to one company means consistency, efficiency and peace of mind rolled into one. Take the leap, ditch the fuss, ease your shipping concerns now!

Why should I use a Door to Door service between UK and Ireland?

Cracking open a joke here, why take the steering wheel when you can ride shotgun, right? The concept applies just as well in the context of freight-forwarding. Here's why a door-to-door service between UK and Ireland is your one-way ticket to a peace-of-mind.

- Work Less, Gain More: With door-to-door, just sit back and relax. The service picks up your goods right from your doorstep, so you can bid farewell to the stress of logistics.

- Tick-Tock on the Clock: Urgent shipment? No worries! Timely delivery is the golden rule. We understand every second counts for your business and so, beating deadlines becomes our top priority.

- Handle with Care: When you've got complex cargo, you need that special kind of TLC. The specialist teams ensure careful handling of your goods, from packing to unpacking, at all stages of transit.

- Road Map to Success: The service transports your cargo by road, handling all the complexities of trucking until it reaches its final destination. So, forget about the curves and bumps on the road ahead!

- It's All Inclusive: The door-to-door service is like an all-you-can-eat buffet. It's a comprehensive solution that includes freight transport, customs clearance, tariffs, and delivery. Now if that's not convenience served on a platter, what is?

So, why not take this smooth ride? Let the door-to-door service from the UK to Ireland navigate the complexities so you can focus on making your business come out on top!

DocShipper – Door to Door specialist between UK and Ireland

Experience hassle-free shipping with DocShipper. Trust us to tackle all aspects of your UK-Ireland transportation needs, from arranging the packing and transport to managing customs procedures for all shipping methods.

We are known for our proficiency and excellence, ensuring a smooth and stress-free service. Our dedicated Account Executives are always at your disposal, ready to provide a free estimate in less than 24 hours.

It's time to break free from shipping worries and enjoy seamless door-to-door service with DocShipper. Consult with our expertise for free today!

Customs clearance in Ireland for goods imported from UK

Customs clearance is a crucial yet daunting task when importing goods from the UK to Ireland. It's a labyrinth of complexities that can lead to unexpected fees and charges, making a dent in profits.

Understanding the nitty-gritty of customs duties, taxes, quotas, and licenses is not optional–missteps can result in your goods gathering dust in a customs warehouse. The upcoming sections will demystify these processes, helping you navigate the murky waters of customs with ease.

Moreover, with DocShipper's world-class service, help is always at hand. We can shoulder your customs clearance burdens, ensuring your goods smoothly sail through customs.

All we require is the origin of your goods, their value, and the HS Code to provide you with an estimate tailored to your specific needs. With DocShipper, you can focus on business; we'll handle the rest. Unlock your business potential – get in touch today!

How to calculate duties & taxes when importing from UK to Ireland?

Mastering the art of estimating duties and taxes is crucial when importing goods from the UK to Ireland.

The calculation is primarily based on a few key factors: the country of origin, the Harmonized System (HS) code, the customs value of the product, the applicable tariff rate, and any additional taxes or fees that might be levied on your goods. Amongst these, the first determinant is the country of manufacture or production of the goods, helping to establish a roadmap for how you will be taxed on your imports.

Stepping into the intricate world of customs can initially feel overwhelming, but with a good grasp of these factors, your shipping process will become much smoother and more predictable.

Step 1 - Identify the Country of Origin

Step 1 in the estimation of duties and taxes when importing goods from the UK to Ireland is to identify the Country of Origin - this isn't a pointless formality!

First off, this step helps monitor international trade flows, essential for governments' economic planning. Secondly, it's about ensuring accurate customs declarations, avoiding hefty penalties. The third point pertains to preferential trade agreements, and this is good news for importers - the UK and Ireland do have a unique trade deal which can affect import duties. Fourth, restrictions matter - some items require specific import licences, and others, are outright forbidden. And finally, the origin helps determine whether anti-dumping, countervailing or safeguard duties apply to your goods.

As an importer from the UK, keep abreast of the agreed trade conditions, as they directly impact customs duties. Things change, so stay updated! If it all gets too dense, hiring a professional customs agent can be a smart move – they know the ropes. Remember, identifying the Country of Origin may seem like a no-brainer, but it's a crucial part of the import process. Get it right, and you're off to a good start!

Step 2 - Find the HS Code of your product

The Harmonized System Code, commonly known as HS Code, is a universal coding system that classifies goods and commodities for international trade. This system has been adapted for use by over 200 countries worldwide, and it's an essential tool for businesses when exporting or importing goods. HS Codes identify the product and are used to calculate duties and taxes, complete shipping paperwork, and meet other import/export regulatory requirements.

If you're wondering how to identify your product's HS code, a quick tip is to reach out to your supplier directly. Suppliers usually have a good grasp of what they're importing or exporting, and they'll likely have information on the relevant regulations, including HS codes.

However, if you're unable to obtain the information from your supplier, don't worry! We have a simple, step-by-step process that will help you find the HS code for your product.

First, navigate to this Harmonized Tariff Schedule tool. Once there, use the search bar to enter the name of your product. Proceed to check the ‘Heading/Subheading’ column where you will find the HS code you're looking for.

A word of caution: the importance of accuracy in choosing the HS Code can't be overstated. Inaccurate HS codes could lead to delays in shipping, additional inspections, and potential fines. Therefore, it's highly advised to be meticulous and ensure you have the right HS code.

Lastly, to help you understand the structure of an HS code, here's an infographic showing you how to read an HS code.

Step 3 - Calculate the Customs Value

Ever stared at your imported goods and wondered how their 'customs value' varies from the product price? Fret not! The customs value, quite different from your goods' price, is essentially the CIF value, i.e., the Cost of raw materials, Insurance, and Freight (shipping). So, if you've bought goods worth $5000, paid an insurance of $200 and $800 for shipping from UK to Ireland, your customs value won't be just $5000. It'll be the sum of all these components, totalling to $6000. This value is crucial, as it forms the basis for calculating your customs duties. So, a keen understanding helps to optimise your total import costs, ensuring your Irish business venture moves smoother than a pint of rich, creamy Guinness!

Step 4 - Figure out the applicable Import Tariff

Import tariffs, essentially the tax applied on imported goods, vary depending on the product's nature and origin. For products imported from the UK to Ireland, the tariff is determined using the UK Government's Trade Tariff service.

To determine your tariff, you'll need the Harmonised System (HS) code for your product, which you've figured out in a previous step. Here's how you use this tool:

- Visit the UK Trade Tariff: look up commodity codes, duty and VAT rates web page.

- In the search box, enter the HS code of the product along with the country of origin.

For instance, if you're importing synthetic rubber (HS code 48102930) from the UK, the tool might indicate a tariff rate of 3%. Moreover, let's say your Cost, Insurance, and Freight (CIF) costs total $1000, then your import duty would be 3% of $1000, equating to $30.

Step 5 - Consider other Import Duties and Taxes

Amid the luggage of freight forwarding, you might stumble upon a variety of additional import duties and taxes that are above the standard tariff rate. These additional costs can vary greatly depending on the country of origin and the nature of your product.

Think of excise duty: this is a tax levied on certain goods like fuel, alcohol, and tobacco. Let's say you're importing a batch of whiskey from the UK. Apart from tariff charges, you may need to consider the excise duty—imagine around $13 per liter of pure alcohol (note: example rate for illustration purposes only).

Anti-dumping taxes could be another consideration. Suppose you're importing goods below fair market price, potentially harming local industry. To counteract this, anti-dumping duties may be enforced.

Lastly, don't overlook the VAT rate. For example, in Ireland, the standard VAT rate is 23%. So, if you import office supplies valued at $10,000, you would typically add 23% and end up paying around $2,300 in VAT.

Understanding these duties can save you from unexpected costs and keep your shipping smooth. Confirm the exact rates and how they apply to your specifics with your local customs authority or a customs broker. This will help you better plan your shipping expenses.

Step 6 - Calculate the Customs Duties

With your goods all set to arrive in Ireland from the UK, calculating customs duties is an imperative yet complex task. The duty amount is primarily calculated based on the customs value of your goods, but can also involve VAT and anti-dumping taxes. Diving into the specifics:

- If you have customs duties, but no VAT, you directly multiply a predetermined percentage (tariff rate) by the customs value of your goods. For example, if your goods are worth $20,000 with a tariff rate of 5%, your customs duty will be $1000.

- When customs duties and VAT apply, you first calculate customs duties as above, then add the duties to your goods' value and calculate VAT on this sum. Imagine the above example is now subject to 20% VAT, your VAT will be ($20,000+$1,000) 20% = $4,200.

- In case your goods encounter customs duties, VAT, anti-dumping taxes (say 10%), and Excise Duty (say 3%), first calculate each duty or tax individually, then add all to compute the total sum. Revisit the first case, your anti-dumping tax will be $20,000 10% = $2,000, and the Excise Duty $20,000 3% = $600. The total payable tax becomes $1,000 (customs duties) + $4,200 (VAT) + $2,000 (anti-dumping tax) + $600 (Excise Duty) = $7,800.

Remember, each case is unique and exact rates may vary. Navigating customs can be taxing and keeping ahead of potential charges even more so. With DocShipper customs clearance services on your side, we handle every step for you ensuring no unexpected costs arise. Contact us today for a free quote in less than 24 hours so we can get you effectively and safely to your destination.

Does DocShipper charge customs fees?

Despite handling customs clearance, DocShipper, as your UK and Ireland customs broker, doesn't collect any customs duties or taxes - those payments go directly to the government. Instead, we charge a fee for our customs clearance service. For transparency, we provide official customs documents to attest all charges are government-imposed. Think of it like a supermarket: while you do pay at the checkout, the supermarket isn't charging you VAT; that portion goes directly to the tax authorities.

Contact Details for Customs Authorities

Required documents for customs clearance

Ever felt baffled by the labyrinth of customs clearance? We're going to break down four crucial documents: the Bill of Lading, Packing List, Certificate of Origin, and Documents of Conformity (CE Standard). You'll walk away with everything you need to master this tricky process and avoid delays or unnecessary costs in your shipping journey. Let's dive in!

Bill of Lading

Dashing between the UK and Ireland with your goods? You'll need a Bill of Lading - it's like your shipment's passport and ownership deed all rolled into one. This official document is critical in transitioning cargo ownership from sender to receiver. And as freight's digital age dawns, favour the electronic or 'telex' release. It streamlines the process, making transfers quicker and reduces paperwork. Shipping by air? Then get acquainted with the AWB, or Air Waybill. A must-have for air cargo, it works just like a Bill of Lading. Practical tip: always double-check Bill of Lading details, any errors can cause delays. In a digitized world, it's wise to embrace the telex release for more efficiency in your shipping process.

Packing List

Navigating the trade waters between the UK and Ireland? The packing list is your sail. It's more than just an inventory; it's your legal proof of what's being shipped, from weight and quantity to the description of goods. Imagine, your shipment is a book, and without the packing list, customs are judging it by its cover. Ever had a mystery box held up in customs? Yup, that's why accuracy matters. Consider it when shipping via sea or air freight - the packing list is just as essential as your passport at an airport. Ship smart and reduce your stress by keeping your packing list precise and updated.

Commercial Invoice

A Commercial Invoice is your lifeline when shipping from the UK to Ireland. It outlines the specifics of your goods, like descriptions, values, the shipper, and the receiver. It's crucial this aligns with your packing list for a hitch-free customs clearance. For instance, if you're shipping car parts, the invoice must detail the type, car model, quantity, and unit prices. Miss out on any detail or misalign it with other documents, and you've got yourself a customs delay. So, let's keep it accurate – double-check those descriptions and verify all values match those in your other shipping documents. Remember, the smoother your paperwork, the swifter your shipment sails through customs.

Certificate of Origin

Navigating customs between the UK and Ireland? You'll need your Certificate of Origin (CoO) on hand. This critical document pinpoints where your goods are made - it's like a product's birth certificate, so to speak. Correctly filing your CoO could even unlock the door to better duty rates, adding a nice little boost to your bottom line. For example, manufacturing widgets in Birmingham? Your CoO verifies UK origin, potentially qualifying your widgets for preferential customs duty rates. Remember, each shipment needs its own CoO; it's a small step, but can make a huge difference when shipping goods across the Irish Sea. After all, it's all about keeping the wheels of commerce turning smoothly!

Certificate of Conformity (CE standard)

Moving goods between the UK and Ireland, you'll encounter the need for a Certificate of Conformity (CE standard). The CE marking is essentially a declaration that the product complies with EU safety, health, and environmental standards. It's often mistaken for a quality assurance certificate but primarily focuses on safety standards. It's akin to the FCC Declaration of Conformity or the UL listing in the US.

However, with the UK's departure from the EU, this has changed. The UK now uses its own UKCA marking for goods sold in England, Wales, and Scotland. So, when shipping UK-manufactured goods to Ireland, ensure they carry the CE marking, while goods bound for the UK must have the UKCA marking. Do cross-check from the official government UKCA site(https://www.gov.uk/guidance/using-the-ukca-marking) to understand these guidelines thoroughly.

Brace for these shifts and your shipping experience between the UK and Ireland will be smooth sailing.

Your EORI number (Economic Operator Registration Identification)

When shipping goods from UK to Ireland, having an EORI number is non-negotiable. It's like a passport, allowing your goods to clear customs smoothly. Operating without one can cause delays at the border, frustrating when you've deadlines to meet. Getting an EORI isn't as daunting as it might sound. Basically, if your business is based in the UK, you apply via the HM Revenue and Customs (HMRC) website. If you're Ireland-based, it's through Revenue's online service. Remember, it's a unique code, identifying your business in all customs procedures within the EU (Yes, Ireland is part of the EU) and countries where EORI applies. So, avoid the hassle and get registered!

Get Started with DocShipper

Navigating customs between the UK and Ireland can be complex and time-consuming. Let DocShipper streamline the process for you. We are customs clearance experts, offering comprehensive services to ease your stress. Ready to simplify your shipping? Contact us now for a free quote. We guarantee a response within 24 hours.

Prohibited and Restricted items when importing into Ireland

When shipping goods to Ireland, understanding what you can't send is equally crucial as knowing what you can. Let's break down the list of prohibited and restricted items to save your time, avoid unexpected troubles, and ensure a seamless customs clearance process.

Restricted Products

- Agricultural Products: You need to get a license from the Department of Agriculture, Food and the Marine.

- Animal + Animal Products: To import these, you need a health certificate from the Irish Department of Agriculture, Food and the Marine.

- Fish + Fishery Products: If you want to import these, make sure to secure a permit from the Sea-Fisheries Protection Authority (SFPA).

- Medicines: Importing these requires a license from the Health Products Regulatory Authority (HPRA).

- Radio equipment: Radio equipment requires your approval from the Commission for Communications Regulation (ComReg).

- Plants + Plant Products: For these, you will need a permit from the Department of Agriculture, Food and the Marine.

- Hazardous Chemicals: If dealing with these, be wary that you require a license from the Health and Safety Authority (HSA).

- Firearms + Ammunitions: Importing these requires a license from the Garda Síochána, Ireland's National Police Service.

Remember, this list might not be exhaustive and it's always crucial to double-check if your product needs any special permits or licenses based on your circumstances. Better safe than sorry, right?

Prohibited products

- Narcotics and illicit drugs (such as cocaine, heroin, cannabis, ecstasy, LSD, and synthetic drugs)

- Counterfeit and pirated goods, including software, DVDs, clothing, and accessories

- Offensive weapons like switchblades, flick knives, gravity knives, and knuckle-dusters

- Indecent or obscene materials encompassing pornographic material, violent video games, and similar content

- Products made from endangered species, including ivory, tortoise shell, coral, reptile skin, and seashells

- Hazardous and toxic substances that are harmful to human health or the environment

- Unlicensed radio transmitters and telecommunication devices

- Meat or milk and any items containing them from non-EU countries

- Certain plants, plant products, or soil from outside the EU

- Certain animals or animal products such as birds, snails, and eggs.

Are there any trade agreements between UK and Ireland

There are two main trade agreements between the United Kingdom and Ireland:

-

The Trade and Cooperation Agreement (TCA), which was agreed between the UK and the European Union (EU) in December 2020 and entered into force on 1 January 2021. The TCA is a comprehensive agreement that covers a wide range of trade-related issues, including goods, services, investment, and intellectual property. It also includes provisions on cooperation in areas such as fisheries, transport, and security.

-

The Protocol on Ireland and Northern Ireland, which is part of the TCA and is designed to ensure that there is no hard border on the island of Ireland. The Protocol means that Northern Ireland remains part of the EU's single market for goods, while the rest of the UK is not. This means that there are some additional checks and paperwork required for goods moving between Northern Ireland and the rest of the UK.

In addition to these two main agreements, there are also a number of other trade agreements between the UK and Ireland, including:

-

The Common Travel Area (CTA), which allows citizens of the UK and Ireland to travel freely between the two countries without the need for visas or passports.

-

The Single Electricity Market (SEM), which allows for the exchange of electricity between the UK and Ireland.

-

The All-Island Food Supply Chain Agreement, which ensures that food can move freely between Northern Ireland and the Republic of Ireland.

These agreements are important for maintaining close economic ties between the UK and Ireland. They help to facilitate trade and investment between the two countries, and they also help to protect the peace process on the island of Ireland.

UK - Ireland trade and economic relationship

Navigating the animated ebb and flow of the UK-Ireland trade relationship uncovers deep historical roots and substantial economic significance. Tracing back to the Common Travel Area agreement in 1922, these trade friendly nations have spawned noteworthy milestones, cementing their economic reciprocity. As the top trading partner of Ireland, the UK holds a significant share in sectors such as food, live animals, and manufactured goods, with trade value exceeding €1 billion per week in 2021.

With a whopping €1.7 billion worth of investment from the UK in 2023, Ireland is the fifth-most attractive EU location for UK Foreign Direct Investment. Similarly, Ireland reciprocates by directing 10% of its overseas investments to the UK, reinforcing the symbiotic relationship between these two economies. Such deeply intertwined economic ties and substantial trading volumes make the UK-Ireland trade collaboration a shining example of cross-border partnership.

Your Next Step with DocShipper

Don't let logistical complexities hinder your UK-Ireland shipping ambitions. Trust in DocShipper's expertise to simplify the entire process! Our seasoned professionals understand every facet of international trade. Eliminate the choice paralysis of air, sea, road, or rail options. Avoid customs hassles and surprise costs. Ready for seamless, stress-free shipping solutions? Contact us today to start your journey.

Additional logistics services

Discover more! Beyond shipping and customs, DocShipper covers your entire supply chain process. Unearth your business growth potential with our comprehensive logistics solutions.

Warehousing and storage

Finding the right warehousing can feel like a puzzle. The quest for perfect temperature control for your delicate goods, coupled with the demand for sterling reliability, often poses a challenge. Luckily, we have a solution! With our specialised services, these obstacles become stepping stones. Curious? Uncover more on our dedicated page: Warehousing.

Packaging and repackaging

Transporting goods between the UK and Ireland? Packaging matters, big time. It protects your products from damage, ensures compliance with shipping regulations and can even help you avoid customs delays. Trustworthy agents, like us, tailor these services to your needs. Whether it's delicate electronics or sturdy construction materials, we've got your back. Curious about how we can make your shipping process smoother? More info on our dedicated page: Freight packaging.

Cargo insurance

Shipping goods? Unlike fire insurance, cargo insurance offers you a safety net for your valuable goods en route. Think prevention, not just protection. It can cover those unexpected hiccups: from damaged cargo due to rough sea voyages, to goods delayed by accidents on the railroad track. Don’t risk your freight travelling uncovered. More info on our dedicated page: Cargo Insurance.

Supplier Management (Sourcing)

In today's global market, finding the right overseas supplier can feel like searching for a needle in a haystack. Lucky for you, DocShipper offers a holistic sourcing solution, taking the guesswork out of procurement. From scouring East Europe to Asia to find suitable manufacturers, smoothing out communication hurdles, and overseeing the complete procurement process, we've got your back. A real gem from our experience? It's working with a furniture retailer who now successfully sources sustainable materials from Asia! More info on our dedicated page: Sourcing services.

Personal effects shipping

Struggling to safely maneuver your Granny's China or that bulky antique armoire between the UK and Ireland? Rest easy! Our Personal Effects Shipping caters to those tricky-to-handle items. With utmost care and professional flexibility, we ensure your personal belongings are transported seamlessly across the Irish Sea. Wondering how we operate? Catch a glimpse here Shipping Personal Belongings.

Quality Control

Exporting from UK to Ireland isn't child's play, especially with quality standards at stake. Think about it - you've got this trend-setting eco-friendly shoe line, but a missed stitch could mean a world of difference in the market. That's where Quality Control comes in. By catching such hitches during manufacturing, it ensures that your shoes are more than ready to meet the discerning Irish customers' expectations. Questions? Dive deeper here: Quality Inspection.

Product compliance services

Shipping your goods comes with rigorous regulations. Our Product Compliance Services ease this burden, ensuring your merchandise fits all required standards. Leveraging lab tests, we certify that your products will meet all destination regulations. This ensures a smoother shipping process, and no nasty compliance surprises. Curious to know more? Visit our dedicated page: Product compliance services.

FAQ | Freight Shipping between UK and Ireland | Rates - Transit times - Duties and Taxes

What is the necessary paperwork during shipping between UK and Ireland?

When shipping from UK to Ireland, it's paramount to have a few things in order. We at DocShipper handle the mandatory paperwork, including the bill of lading for sea freight or air way bill if it's air freight. It becomes your responsibility to provide a packing list and commercial invoice, ensuring we have the details of the cargo. Keep in mind that shipping certain goods e.g. those needing Material Safety Data Sheets (MSDS) or other certifications may require additional documents. Our team will guide you through these processes, ensuring a smooth transportation and clearing procedure.

Do I need a customs broker while importing in Ireland?

While it's not mandatory to have a customs broker for importing goods in Ireland, we highly recommend it due to the complex customs processes and myriad of mandatory documents required. As your trusted partner, we at DocShipper, take care of this crucial aspect for the majority of shipments. We interact directly with the customs authority on your behalf, handling all necessary procedures and paperwork, so you can focus on your core business without worrying about customs clearance. With our expert team navigating the intricacies of customs, you can be assured of a smooth and hassle-free shipping experience.

Can air freight be cheaper than sea freight between UK and Ireland?

We understand that cost effectiveness is vital for your shipping needs. While it's difficult to provide a general answer due to variables like route, weight, and volume, we want you to know air freight can be more cost-effective than sea freight in certain cases. For instance, if your cargo is less than 1.5 Cubic Meters or 300 kg (660 lbs), air freight may be the better option. Our expert account executives at DocShipper will analyze your specific scenario and guide you to the most affordable solution. We aim to offer competitive options that cater to your unique business requirements.

Do I need to pay insurance while importing my goods to Ireland?

Absolutely, when it comes to importing goods to Ireland, we at DocShipper want to clarify that insurance isn't obligatory. However, it is indeed strongly encouraged. This is due to the various incidents that can occur during transit, such as potential damage, loss, or theft of your goods. While we strive to ensure the most secure and efficient shipping routes, unforeseen issues can arise. Thus, to protect your valuable cargo, we highly suggest opting for insurance coverage for your own peace of mind and business's financial safety.

What is the cheapest way to ship to Ireland from UK?

For shipping goods from the UK to Ireland, the most economical option tends to be road freight, due to the close geographical distance. At DocShipper, we consolidate items from multiple customers into a single shipment, further reducing costs. However, the best option depends on the specifics like goods nature, volume, and urgency. We recommend contacting our team for personalized advice based on your unique needs.

EXW, FOB, or CIF?

Choosing between EXW, FOB, or CIF largely depends on your relationship with your supplier. Remember, your supplier may not be an expert in logistics, so it's advisable to have a professional agency like us, DocShipper, manage the transportation procedures from international freight to destination. Suppliers typically sell under EXW (at their factory's door) or FOB (including all local charges until the origin terminal). However, we at DocShipper can help streamline the process with our door-to-door service, providing a stress-free shipping experience for you. Trust us to handle your shipment, while you focus on your business.

Goods have arrived at my port in Ireland, how do I get them delivered to the final destination?

If your goods have arrived in Ireland under CIF/CFR incoterms, you'll need to arrange for a custom broker or freight forwarder to clear your cargo at the terminal, pay import charges, and manage delivery to the final location. However, we at DocShipper can streamline this for you with DAP incoterms – handling the entire process. To benefit from this service, please confirm with your dedicated account executive.

Does your quotation include all cost?

Absolutely, our quotation encompasses all costs, save for the duties and taxes due at your destination. You're free to request an estimate of these duties and taxes from your dedicated account executive. We pride ourselves on transparency, ensuring there are no hidden fees that might take you by surprise.

DocShipper info: Do you like our article today? For your business interest, you may like the following useful articles :

- Freight between the UK and Germany Tariffs – Transit times – Duties and taxes – Advices

- Freight between UK - Vietnam | Rates – Transit times – Duties – Taxes – Advices

- Freight between UK and Thailand | Rates – Transit times – Duties – Taxes – Advices

- Freight between the UK and Switzerland | Rates - Transit time - Duties and taxes - Advices

- Freight between the UK and the Netherlands - Prices - Delays - Customs clearance - Transport

- Freight between the United Kingdom and the United States | Rates - Delays - Customs clearance - Taxes

DocShipper | Procurement - Quality control - Logistics

Alibaba, Dhgate, made-in-china... Many know of websites to get supplies in Asia, but how many have come across a scam ?! It is very risky to pay an Asian supplier halfway around the world based only on promises! DocShipper offers you complete procurement services integrating logistics needs: purchasing, quality control, customization, licensing, transport...

Communication is important, which is why we strive to discuss in the most suitable way for you!