There’s always a hectic documentation process for export shipping, and it’s even harder when you don’t have an idea of what to do and how to get started with it, what documents are needed, and how to get them. This article will provide you with all the necessary information regarding the topic.

Receiving the inquiry for the shipping services.

If someone is intrigued by your shipping services, you will receive an inquiry by mail or post which will be outlining all the necessities, conditions, and terms of the future customer along with an exact or rough quote.

If someone is intrigued by your shipping services, you will receive an inquiry by mail or post which will be outlining all the necessities, conditions, and terms of the future customer along with an exact or rough quote.

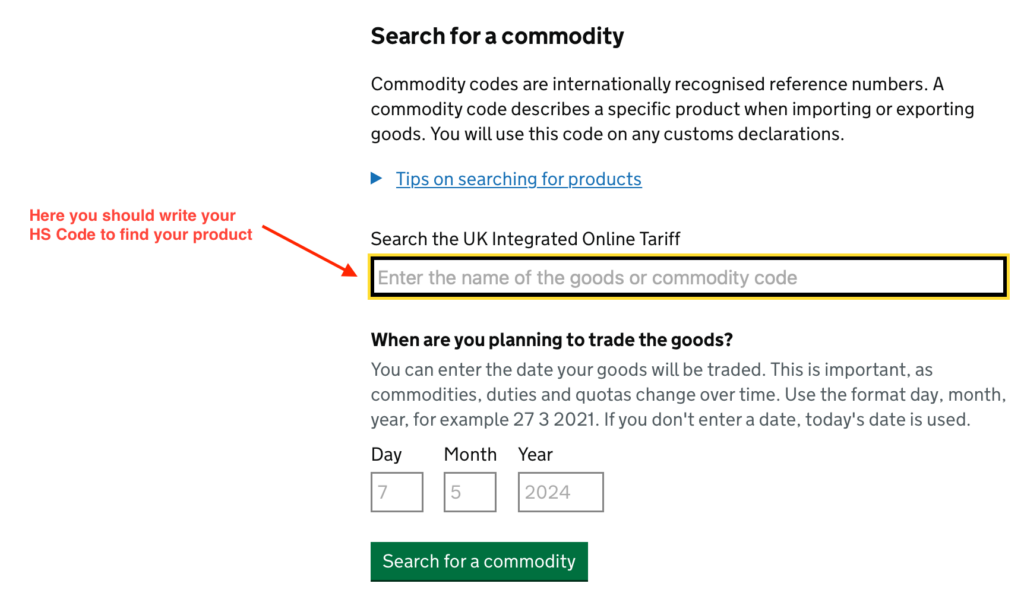

Verifying the country and potential user

After receiving the inquiry letter, the first step will be to make sure that it’s a legitimate inquiry and that both parties are eligible to get to engage in the trade. This means verifying them against all kinds of legal factors which will restrict you to make a deal. You also need to check if you can ship it to the customer’s country, you might even require an export license in some cases, so it’s advisable to apply for it prior.

Present a pro forma invoice

After verifying all the information about the buyer and their country, you might need to present the customer with a pro forma invoice it’s a gesture of goodwill to provide them with a pro forma invoice. It’s useful in sorting the finances. It’s similar to a commercial invoice. Furthermore, it also works as a proposal of quotation.

After verifying all the information about the buyer and their country, you might need to present the customer with a pro forma invoice it’s a gesture of goodwill to provide them with a pro forma invoice. It’s useful in sorting the finances. It’s similar to a commercial invoice. Furthermore, it also works as a proposal of quotation.

Costs and quotations are identical in pro forma invoice and commercial invoice if an order is the result of the pro forma invoice. Certain countries do require pro forma invoices as per their strict guidelines and rules.

Seal the trade

The next step post pro forma will be a decision to be made by the buyer whether to accept or reject the offer made by the contractor. This might lead to negotiations and which will result in the formation of a verbal or written contract agreed upon by both parties.

Negotiations should include :

- The terms of the payment

- Terms and rules of the sales

- Method of shipment of goods

- Responsibility for the shipment of goods

- Responsibility for filing the electronic export information

- Payment of transaction

- List of documents required by both parties

Prefacing the goods and necessary documents

After the trade between both parties is agreed upon and sealed, you need to prepare the goods for departure/export and even the preparation of a few documents might be necessary, specifically these five.

Packing list

In some cases, you might need to provide the packing list/details for the reference of the freight forwarder, consignee, and other involved parties. This will give the responsible parties the reference no. on the boxes and details about the goods/items and other necessary information.

In some cases, you might need to provide the packing list/details for the reference of the freight forwarder, consignee, and other involved parties. This will give the responsible parties the reference no. on the boxes and details about the goods/items and other necessary information.

This list will also be used by the importing country for cross-checking the elements of the shipment for the security and customs authorities. This can also be used to claim insurance in future situations of loss/damage to goods.

Certificate of origin

The certificate of origin is a necessary document that works as evidence for proving the origin of the goods is from the declared country. The country of origin is declared on the certificate of origin, commercial invoice, and packing list.

The certificate of origin is a necessary document that works as evidence for proving the origin of the goods is from the declared country. The country of origin is declared on the certificate of origin, commercial invoice, and packing list.

Most countries do accept the country of origin as stated on the commercial invoice, but few countries do require specifically the certificate of origin.

Docshipper Tip: You must also prepare and keep copies of all your related documents. All the processes should be documented. To help you with these hectic documentation processes and customs clearance, contact DocShipper as they are keen on saving you time and money.

Commercial invoice

The commercial invoice is a necessary and important document that must be added to the list of documents.

It is used by numerous parties and also used by customs and border protection may even have a look at it for export review purposes. It is also used for the clearance of imported goods by the respected authorities of the receiving country. It might also work as a guarantee for the buyer to transfer funds from his account to the seller’s account safely. It might also be helpful for exporters to claim insurance in case of any damage or loss.

Generally, there are three copies of the document (commercial invoice) sent, one of which is an original signed with blue ink for identification purposes. The commercial invoice also contains these necessary data information/titles.

Shipper’s Letter of Instruction

There will be a need for the shipper’s letter of instruction or the buyer’s after you have discussed and agreed on the terms mutually. A shipper’s letter of instruction works as a written proof/record mentioning certain details like the person receiving the shipping documents, your contact person for any sort of queries, and the person responsible for the necessary documents required for the export.

If you are hiring an agent for the export, you must provide them with the SLI and the power of attorney for filing it through AES if it is the case.

There is always a requirement of at least one bill of lading, but you might require multiple bills of lading depending on the export.

You might need different bills of lading to accompany your domestic and international export. In such case of transferring your goods from a port to an airport and then from the airport to another country internationally, you will have to get different bills of lading for each purpose.

RE restricted party checking

The second last step would be to recheck or reanalyze that everything is the same. All the details and goods are not changed. There is automated software used for this purpose to do your screening, which you can easily find on the internet. This step is sort of a double-check to ensure that everything is in line and ready to be exported and nothing else is in need.

Additional documents and finalizing the shipment of goods.

You might find yourself in need of other miscellaneous documents which might be needed for the export to be done smoothly. You might find this document in your contract or might be labeled as terms of credit, forms demanded by the freight forwarder, etc. These forms may also include a draft from the bank or an ATA carnet.

Conclusion

To conclude, the most important documents for the export of goods are the pro forma invoice, the packing list, the certificate of conformity, the commercial invoice, and the Shipper’s Letter of Instruction

If you have difficulties in understanding and using all the necessary documents we have listed for the export shipping process, do not hesitate to use our shipping services. Contact our experts, and you will be taken care of in less than 24 hours!

FAQ | What is the documentation you need in the export shipping process?

What is the export shipping documentation process?

The export shipping documentation process is basically the process of arranging all the necessary documents related to your export. Which also concerns the legitimacy and the accordance with all the rules and regulations.

How do I get all the goods and documents prepared?

Preparation of goods and documents can be a hectic and lengthy process. You should consult a professional team like Docshipper to prepare it for you. As they have a wide range of networks and a competent staff all your processes will be carried out professionally with precision.

Which guideline should I follow while exporting the goods?

The guideline is basically the rules and regulations of the respected country. Different countries have different regulations and if you are exporting goods internationally in that case you need to respect all the guidelines of both countries.

How do I prepare the packing list?

Packing list is an essential document and to be prepared carefully. It should precisely mention all the goods and list of documents as it is necessary for claiming the insurance and even use of the reference of the authorities if necessary.

DocShipper info: Do you like our article today? For your business interest, you may like the following useful articles :

DocShipper Advise : We help you with the entire sourcing process so don’t hesitate to contact us if you have any questions!

- Having trouble finding the appropriate product? Enjoy our sourcing services, we directly find the right suppliers for you!

- You don’t trust your supplier? Ask our experts to do quality control to guarantee the condition of your goods!

- Do you need help with the logistics? Our international freight department supports you with door to door services!

- You don’t want to handle distribution? Our 3PL department will handle the storage, order fulfillment, and last-mile delivery!

DocShipper | Procurement – Quality control – Logistics

Alibaba, Dhgate, made-in-china… Many know of websites to get supplies in Asia, but how many have come across a scam ?! It is very risky to pay an Asian supplier halfway around the world based only on promises! DocShipper offers you complete procurement services integrating logistics needs: purchasing, quality control, customization, licensing, transport…

Communication is important, which is why we strive to discuss in the most suitable way for you!