Why did the British package go to Nigeria? To become a 'parcel' of the global economy! Transitioning your business practices from a domestic to an international scale, particularly in freight transportation between the UK and Nigeria, brings complex challenges, with understanding rates, transit times, and customs regulations topping the list.

From selecting the most suitable freight method, whether air, sea, road, or rail, to understanding the intricacies of customs clearance processes, our guide is here to shed light on every aspect of your journey. We'll dive into topics such as duties, taxes, and offer practical advice tailored for businesses aiming to streamline their shipping process.

If the process still feels overwhelming, let DocShipper handle it for you! As a trusted international freight forwarder, we provide end-to-end solutions turning challenges into successful business expansions, helping you navigate this global economy seamlessly.

Which are the different modes of transportation between UK and Nigeria?

Choosing the ideal method to transport goods from the UK to Nigeria isn’t as simple as it may seem. It's like picking the fastest route in a cycling race, where different terrains mean different strategies. Sure, it's a long journey, too vast for a lorry to drive and too landlocked for a channel-hopping ferry. But don’t fret, economical and speedy solutions do exist--like the reliable services of air and sea freight. Yet, each comes with its own pros and cons, much like choosing between a mountain bike and a racer. Let's delve into which might be the perfect fit for your cargo and destination.

How can DocShipper help?

Shipping between the UK and Nigeria? Leave the hassle to us at DocShipper. We simplify every aspect, from customs clearance to logistics, for your peace of mind. Curious how we can benefit your business? Contact us today for a free estimate in less than 24 hours or chat with our consultants, completely free of charge.

![]()

DocShipper Tip: Ocean freight might be the best solution for you if:

- You're dealing with large quantities or oversized items. Sea freight offers a budget-friendly way to maximize space, a particularly useful option given the UK's extensive port network.

- Your shipment isn't on a tight schedule. Ocean transport typically takes longer than air or rail, but it offers reliability.

- Your supply chain involves key ports, allowing you to take advantage of a wide-reaching network of sea lanes.

Sea freight between UK and Nigeria

Ocean transportation from the UK to Nigeria, what's in the mix for you? A vibrant trade partnership is buzzing between these nations, with key industrial hotspots interconnected by hubs like Port Harcourt and Lagos in Nigeria, and London Gateway and Felixstowe in the UK. If that humming factory of yours churns out high-volume goods, sea freight could be your new best pal. It's the tortoise in the shipping world - slow but steady - and your wallet will thank you for it!

However, treading the nautical mile isn't always smooth sailing. Shippers and businesses often stroll into a maze of unexpected complications and costly errors while trying to bridge these waters. Like threading a needle in the dark, isn't it? But here's our silver lining - every labyrinth has its blueprint. Through this space, we'll throw light on those best practices and specifics that are your lifelines to a less strenuous, more hassle-free shipping experience between the UK and Nigeria. Hang on tight; it's time to demystify the sea journey!

Main shipping ports in UK

Port of Felixstowe

Location and Volume: Situated in Suffolk on England's East Coast, the Port of Felixstowe is the United Kingdom's busiest container port, handling approximately 4 million TEUs per year (about 40% of the UK's container traffic).

Key Trading Partners and Strategic Importance: Its key trading partners involve the European Union, Asia, and North America, having direct access to major shipping routes. It stands out for its comprehensive and technologically advanced facilities.

Context for Businesses: For businesses targeting major European and Asian markets, the Port of Felixstowe's extensive reach might be a game-changer. The port flaunts superb rail, road networks, and storage facilities to support high-volume logistics operations.

Port of Southampton

Location and Volume: Located on England's South Coast, the Port of Southampton is significant for its versatility, dealing with about 1.9 million TEUs annually.

Key Trading Partners and Strategic Importance: Recognized as the UK's leading link to the Far East, with trading partners like China, Singapore, and Australia. This port offers vast ro-ro facilities, and stands out as the nation's second largest container terminal.

Context for Businesses: If your interests are in the Far East, considering the Port of Southampton could be strategically beneficial due to its deep-water port advantages and easy access to the UK's road networks.

Port of London

Location and Volume: The Port of London, on the Thames River, is well-placed for access to South-East England and London's consumers, handling over 50 million tonnes of cargo annually.

Key Trading Partners and Strategic Importance: Key trading partners include countries in Europe, Asia, and North America. As a multipurpose port, it is key for ro-ro, bulk cargo, and container handling.

Context for Businesses: For businesses looking to access the South-East England market directly, the Port of London's strategic location, versatility, and strong connectivity to multiple transport modes could provide a unique advantage.

Port of Liverpool

Location and Volume: In North-West England, the Port of Liverpool manages about 32 million tonnes of cargo per year, making it a significant port in the region.

Key Trading Partners and Strategic Importance: Trading with over 100 countries worldwide with an emphasis on America and Europe. The port is renowned for its large-scale logistics services, including vast cold storage.

Context for Businesses: Businesses looking for extensive worldwide connections should consider the Port of Liverpool. The port's large-scale services particularly enhance the trade of perishable goods.

Port of Immingham

Location and Volume: The Port of Immingham, on the East Coast of England, is the UK's biggest port by tonnage, handling around 55 million tonnes annually.

Key Trading Partners and Strategic Importance: Its trade focuses primarily on Northern Europe, handling substantial bulk freight, general cargo, and liquid goods.

Context for Businesses: Companies dealing with bulk freight might find the Port of Immingham an excellent logistical choice due to its strategic geographical advantage, especially for north European markets.

Port of Grimsby

Location and Volume: Located adjacent to the Port of Immingham, the Port of Grimsby is critical for its activity with the automotive industry, receiving nearly two million vehicles annually.

Key Trading Partners and Strategic Importance: It trades with Europe and Asia, functioning primarily as an import hub for vehicles.

Context for Businesses: For businesses engaged in the automotive industry, the Port of Grimsby's specific infrastructure serves as an indispensable gateway for importing vehicles into the UK.

Main shipping ports in Nigeria

Port of Lagos

Location and Volume: Located on the southwestern tip of Nigeria, this maritime port is crucial to Nigeria's economy as it accommodates over 75% of Nigeria's national seaborne traffic, with a shipping volume of 1.2 million TEUs.

Key Trading Partners and Strategic Importance: Some of its major trading partners include China, U.S., Netherlands, India, and Belgium. The port holds importance for businesses shipping to African and European markets due to its strategic location.

Context for Businesses: If you're considering expanding your business operations to the Nigerian market and beyond, the Port of Lagos can be a critical part of your strategy, given its high traffic volume and strategic location in West Africa.

Port Harcourt

Location and Volume: Situated on the Bonny River in the Niger delta, this port is another vital hub for shipping in Nigeria. It accommodates mostly bulk cargo and has a significant petroleum shipping capacity given Nigeria's sizeable oil industry.

Key Trading Partners and Strategic Importance: Major trading partners are primarily oil-importing countries such as the U.S., India, and Holland. Its strategic importance lies within its proximity to the Niger delta's petroleum industry.

Context for Businesses: If you're in the oil and gas industry or dealing with bulk cargo, Port Harcourt can be a vital part of your operational strategy considering its proximity to Nigeria's oil industry and its specialization in handling bulk cargo.

Calabar Porthttp

Location and Volume: Located in the southeastern part of Nigeria, Calabar Port is another important shipping point in the nation. Though smaller than Lagos and Port Harcourt, it has three terminals handling a wide range of goods.

Key Trading Partners and Strategic Importance: Its major trading partners include other West African countries, such as Ghana, Côte d'Ivoire, and Cameroon. Calabar serves as an essential seaport for businesses targeting West African countries.

Context for Businesses: If you aim to tap into the West African markets, incorporating Calabar Port in your shipping strategy can be beneficial due to its strategic location.

Warri Port

Location and Volume: Located in the oil-rich Niger delta of Nigeria, Warri Port is particularly suited for oil and gas shipping and has a bulk cargo terminal.

Key Trading Partners and Strategic Importance: Its key partners are primarily countries involved in the oil and gas trade. Its strategic position in the region's oil production makes it significant for businesses dealing in this field.

Context for Businesses: If your enterprise lies in the domain of oil and gas, or you deal extensively with bulk cargo, incorporating Warri Port in your navigation can be an advantage due to its location in the oil-rich Niger delta and its terminal dedicated to bulk cargo.

Onne Port

Location and Volume: Sitting on the Bonny River, Onne Port serves as Nigeria's main oil and gas free zone. It handles exports of oil and gas, making it strategically important for Nigeria's economy.

Key Trading Partners and Strategic Importance: Its partners primarily include countries importing oil and gas from Nigeria. The significance of Onne is reinforced by its status as West Africa's premier oil and gas free zone.

Context for Businesses: If your enterprise operates within the oil and gas sector, Onne Port's strategic positioning can provide efficient access to the oil and gas markets in Nigeria and West Africa.

Tincan Island Port

Location and Volume: Situated in Lagos, Tincan Island Port complements the Port of Lagos by handling around 30% of Nigeria's total container traffic, making it another main gateway for goods into the country.

Key Trading Partners and Strategic Importance: China, U.S., Netherlands, India, and Belgium are its significant trading partners. Tincan's strategic standing stems from its mounting role in supporting Nigeria's overall import-export economy due to its high container traffic volume.

Context for Businesses: If you're considering escalating your import-export business dealings within Nigeria, using Tincan Island Port can be a crucial component of your logistics due to its capacity to manage a significant percentage of Nigeria's container traffic.

Should I choose FCL or LCL when shipping between UK and Nigeria?

Deciphering the best choice between consolidation shipping (LCL) and full container load (FCL) when exporting goods from the UK to Nigeria can feel like a game of chess. It's a strategic decision with potential impacts on your budget, delivery timeline, and overall success. But fear not! Our goal is to demystify FCL and LCL, helping you make a well-informed choice tailored to your specific sea freight needs. Ready to dive in? Let's explore the differences between these shipping strategies, setting you up to conquer the sea freight game.

LCL: Less than Container Load

Definition: LCL (Less than Container Load) is a type of ocean freight where your cargo shares a container with other shippers' goods.

When to Use: Opt for LCL shipping if your cargo's volume is less than 13-15 CBM, allowing price flexibility and suitable for smaller scale shipments.

Example: Suppose you're transporting fashion accessories from Manchester, UK to Lagos, Nigeria. The volume is 10 CBM, not warranting a full container. LCL shipment becomes your best choice, delivering goods alongside other shipments within the same container.

Cost Implications: With LCL freight, you only pay for the space you occupy in the container, meaning your costs correspond directly to your cargo size. It can be more economical for small shipments, though it has added handling fees due to the consolidation and de-consolidation of cargos. Be aware as well, since your goods share a container with others, there’s also a slight risk of delays if any other shipment in the container is targeted for customs inspection.

FCL: Full Container Load

Definition: FCL (Full Container Load) shipping refers to the use of an entire container for a single shipment. It's popular because the container is sealed at origin and only opened at the destination, thereby providing enhanced security for your cargo.

When to Use: FCL shipping is your go-to option when dealing with larger shipments, generally more than 13/14/15 CBM (Cubic Meters). If you have enough merchandise to fill a 20'ft or a 40'ft container, FCL is most often the cheaper and safer method compared to LCL (Less than Container Load).

Example: Suppose you're a UK-based machinery exporter sending heavy-duty industrial equipment to a client in Nigeria. The machinery fills a 20'ft container. Choosing FCL shipping here would not only ensure your equipment travels securely, but also proves very cost-effective given the volume of your shipment.

Cost Implications: The main factors impacting an FCL shipping quote are the size of the container (20'ft or 40'ft), the cargo type and the route. Once the container is full, you pay a flat rate, no matter the cargo's size or weight. In summary, high-volume shipments are more economical with FCL shipping due to the per-unit shipping cost decrease.

Unlock hassle-free shipping

Ensure a smooth and efficient shipping process between the UK and Nigeria with DocShipper. Our expert team specializes in offering simplified cargo shipping solutions, making your business experience hassle-free. We assess specific aspects such as cargo size, budget, and time constraints to determine whether consolidation or a full container is best for you. Ready to simplify your international shipping? Reach out to our ocean freight experts now for a free estimate!

How long does sea freight take between UK and Nigeria?

Typically, ocean freight shipping times from the UK to Nigeria hover around 22 to 35 days. These figures, however, consider various factors such as the specific ports used, the weight, and the nature of your commodities. For a more detailed, customised quote taking into account your unique needs, it's highly recommended to consult with a freight forwarder like DocShipper.

Here's an overall view of transit times for main sea freight shipping routes from the UK to Nigeria:

| UK Port | Nigeria Port | Average Transit Time |

| Port of London | Port Harcourt | 32 |

| Port of Southampton | Port of Calabar | 20 |

| Port of Felixstowe | Port of Onne | 28 |

| Port of Liverpool | Port Harcourt | 31 |

*Please keep in mind these are only averages. Your shipping time could vary based on several circumstances.

How much does it cost to ship a container between UK and Nigeria?

The cost to ship a container between the UK and Nigeria can span a broad spectrum. Ocean freight rates and shipping costs fluctuate due to numerous variables, from the Point of Loading and Destination to the type of goods and the carrier selected. Adding to the complexity, monthly market dynamics come into play. Consequently, delivering an accurate price without the specifics is challenging. However, fret not! With our shipping specialists by your side, you'll receive a tailored, competitive quote based on your unique needs, ensuring the most cost-effective solution every time. Your journey to hassle-free, economical shipping starts here.

Special transportation services

Out of Gauge (OOG) Container

Definition: Out of Gauge (OOG) container refers to the shipping containers that carry oversized cargo sticking out of gauge, beyond the normal confines of standard containers.

Suitable for: OOG container shipping is the ideal choice when your cargo exceeds the dimension of standard containers.

Examples: Examples of Out of gauge cargo that might be shipped in OOG containers could be large machinery, yachts, or construction equipment.

Why it might be the best choice for you: Helping you handle the oversized logistics challenges, OOG container can cater to your unique shipping needs, in a safe and secure manner.

Break Bulk

Definition: Break Bulk refers to cargo that must be loaded individually rather than in containers or bales, making it a loose cargo load.

Suitable for: Break Bulk shipping is suitable for goods that are oversized and heavy, and cannot be easily containerized.

Examples: Heavy machinery, timber, industrial equipment, or construction materials are suitable types of cargo for Break Bulk shipping.

Why it might be the best choice for you: If your business shipments include sizable equipment that doesn't adhere to standard container dimensions, Break Bulk could be your ideal shipping solution.

Dry Bulk

Definition: Dry Bulk refers to the transportation of unpackaged goods like grain, coal or iron ore in large quantities.

Suitable for: Dry Bulk shipping is most beneficial for businesses needing to transport large volumes of unpackaged commodities.

Examples: Major dry bulk commodities include iron ore, coal, grain, or fertilizer.

Why it might be the best choice for you: If your business focuses on the transportation of significant volumes of unpackaged goods, Dry Bulk shipping could offer an efficient and cost-effective solution.

Roll-on/Roll-off (Ro-Ro)

Definition: Roll-on/Roll-off (Ro-Ro) shipping involves vessels designed to carry wheeled cargo like cars, trucks, semi-trailer trucks, trailers, and railroad cars that roll on and roll off the ro-ro vessel on their own wheels.

Suitable for: Ro-Ro shipping is best suited for businesses that transport automobiles or heavy equipment that are better suited to transportation on their wheels.

Examples: Cars, trucks, tractors, motor homes, buses, even trains are perfect candidates for Ro-Ro shipping.

Why it might be the best choice for you: If your business handles the shipment of vehicles or other self-mobile machinery, Ro-Ro is a convenient and efficient method of getting it transported around the globe.

Reefer Containers

Definition: Reefer containers are refrigerated shipping containers used for transporting perishable goods that require temperature-controlled conditions in transit.

Suitable for: Reefer containers are the best choice for businesses shipping perishable items or goods sensitive to temperature variations.

Examples: Perishable products such as fruits, vegetables, meat, seafood, dairy, and pharmaceutical products are typical items shipped in reefer containers.

Why it might be the best choice for you: If your business revolves around sending perishable products or temperature-sensitive goods worldwide, Reefer containers can ensure preservation and freshness of your goods during transit.

Confused about which shipping option is best for your goods? DocShipper provides customized and cost-effective sea freight solutions between the UK and Nigeria. Reach out to us now to get a free shipping quote in less than 24 hours! We're here to streamline your logistics process and fulfill your global shipping needs.

![]()

DocShipper Tip: Air freight might be the best solution for you if:

- You're facing tight deadlines or need rapid delivery. Air freight is your quickest option, which aligns well with the fast-paced business environment.

- Your shipment is relatively small, under 2 CBM. Air freight is ideal for these more compact loads.

- Your cargo's destination isn't easily reached via sea or rail. This makes air freight a viable option, especially given the extensive network of airports available.

Air freight between UK and Nigeria

For a speedy and trustworthy method to transfer petite, high-value goods, look no further than air freight between the UK and Nigeria. Imagine urgently needing to ship sensitive medical equipment or pricey tech gadgets; it's a bit like delivering a vital letter - you'd rely on a swift courier, not a slow mail train, right? The same principle applies here. Yes, it's true that weighty gold bars are attractive, but they might leave your wallet feeling feather-light due to incorrect weight formula application. This guide will shine some light on costly mistakes like these, gearing you towards best practices, ensuring your shipment journey is smooth, swift, not a treasure drainer!

Air Cargo vs Express Air Freight: How should I ship?

Confused about how best to send your goods from the UK to Nigeria? It all boils down to if you want your shipments to fly economy or first-class: air cargo hitches a ride in passenger airlines, while express air freight enjoys the luxury of travel in private jets. Find out the pros and cons of both in this guide, tailored to help you ace your international shipping game.

Should I choose Air Cargo between UK and Nigeria?

Air cargo can be a cost-effective and reliable choice for shipping goods between the UK and Nigeria, particularly if you're moving significant quantities (over 100/150 kg or 220/330 lbs). Renowned airlines like British Airways or Arik Air, make this method convenient. Though transit times may be longer due to fixed schedules, the predictability of costs is a key benefit. So, if you're planning a shipment around these parameters, choosing air cargo might fit your budget quite well.

Should I choose Express Air Freight between UK and Nigeria?

Express air freight refers to a dedicated cargo service, where no passengers are involved, offering a quicker and more reliable transportation option. Provided by global courier giants like FedEx, UPS, or DHL, these express air services ensure your package reaches Nigeria from the UK swiftly. Optimally suited for sending freight under 1 CBM or less than 100/150kg, this could be your preferred choice if time is of essence in your business. Whether it's essential mining equipment or time-sensitive medical supplies, these services can get your cargo to its destination on schedule, ensuring smooth operation of your business.

Main international airports in UK

Heathrow Airport

Cargo Volume: Heathrow is the largest cargo airport in the UK, with 1.81 million metric tons transported yearly.

Key Trading Partners: Trading partners include the US, China, and EU countries.

Strategic Importance: As one of the busiest airports in the world, Heathrow’s strategic relevance can help enhance your brand's global reach.

Notable Features: Heathrow offers direct, scheduled freighter services and has sophisticated cooling systems for temperature-sensitive products.

For Your Business: With robust infrastructure for cargo handling and its strategic location, Heathrow is an excellent option for businesses looking to ship products across the globe efficiently and swiftly.

East Midlands Airport

Cargo Volume: East Midlands Airport handles over 320,000 metric tons of freight per year.

Key Trading Partners: Significant trading partners include EU countries, the US, and Asia.

Strategic Importance: This is the hub for integrator operations in the UK, including DHL, UPS, and TNT, therefore prime for express shipments.

Notable Features: East Midlands provides 24/7 operations and allows for a fast, dedicated cargo transit arrangement.

For Your Business: If prompt, time-sensitive delivery is your prime concern, East Midlands Airport could be your go-to point.

Manchester Airport

Cargo Volume: Manchester Airport handles over 100,000 metric tons of cargo annually.

Key Trading Partners: The Airport has well-established routes to North America and the Middle East.

Strategic Importance: Given its well-connected road and rail links, Manchester Airport can serve an efficient transportation hub.

Notable Features: Offering extensive warehouse facilities, the Airport is well-equipped to handle a variety of cargo types.

For Your Business: If you need cargo storage and a well-connected distribution network, consider integrating Manchester Airport into your shipping strategy.

Stansted Airport

Cargo Volume: More than 243,000 metric tons of cargo pass through Stansted annually.

Key Trading Partners: Its vast network connects with key locations in Europe, North America, and Asia.

Strategic Importance: Known for its cargo handling capabilities, Stansted serves FedEx and UPS' European hub.

Notable Features: The Airport hosts one of the largest cargo facilities in the UK.

For Your Business: With excellent freight handling infrastructure, Stansted is another strong consideration for your global shipping requirements.

Gatwick Airport

Cargo Volume: Gatwick handles over 95,000 metric tons of cargo yearly.

Key Trading Partners: Key destinations include the US, EU countries, and the Middle East.

Strategic Importance: Gatwick's position as the second-largest airport in the UK enhances its strategic importance.

Notable Features: Gatwick offers a reliable infrastructural network for seamless cargo operations.

For Your Business: As an essential part of one of the world's busiest air corridors, Gatwick can play an integral part in your global logistics plan.

Main international airports in Nigeria

Murtala Muhammed International Airport

Cargo Volume: The Murtala Muhammed International Airport is the busiest in Nigeria, handling approximately 170,000 metric tons of cargo annually.

Key Trading Partners: Major trading partners include countries like China, US, UK, and Germany, handling goods such as petroleum products, rubber, cocoa, and manufactured goods.

Strategic Importance: As the main gateway into Nigeria, this airport plays a pivotal role in Nigeria’s international trade, being crucial for shipping and receiving goods.

Notable Features: The airport boasts a large cargo terminal and a special cargo handling division for perishables and hazardous materials.

For Your Business: If your firm deals with time-sensitive or specialty goods, the dedicated cargo handling facilities provide an advantage in terms of specialized care and expedited handling of your goods.

Nnamdi Azikiwe International Airport

Cargo Volume: Handling about 30,000 metric tons of cargo annually, it is the second busiest airport in Nigeria.

Key Trading Partners: Key trading partners include China, South Africa, US, and UK. Most cargo includes agricultural products, machinery, and equipment.

Strategic Importance: Its location in Nigeria's capital, Abuja, connects to the country’s political and business hub.

Notable Features: A new terminal launched in 2018 has increased the airport’s cargo handling capacity and efficiency.

For Your Business: If your business involves frequent interactions with government or wide-ranging commercial sectors, shipping through Abuja can simplify logistics and potential bureaucratic procedures.

Mallam Aminu Kano International Airport

Cargo Volume: At around 18,000 metric tons annually, this airport has significant cargo traffic mainly due to its rich agricultural region.

Key Trading Partners: Trade flows majorly with Asian countries like China and India and European countries like Germany and Netherlands.

Strategic Importance: Located in Kano, the economic nerve of Northern Nigeria, it serves as a strategic entry point to reach northern markets.

Notable Features: Known for its large Apron, large enough to accommodate large cargo planes.

For Your Business: If your enterprise engages in agricultural trade, this airport’s location and amenities could be particularly beneficial, affording easier access to northern Nigerian markets and beyond.

Port Harcourt International Airport

Cargo Volume: Annually, it handles around 7,000 metric tons of cargo.

Key Trading Partners: Partners majorly with Asia and Europe, transporting oil and gas products, equipment, and machinery.

Strategic Importance: Sited in the oil-rich region, this airport is important for exporting Nigeria's oil and gas.

Notable Features: Special facilities for oil and gas product transportation.

For Your Business: If you’re operating within the oil and gas sector, this airport offers specialized infrastructure, making it an optimal choice for shipping oil-related products.

Akanu Ibiam International Airport

Cargo Volume: The cargo volume is relatively smaller, managing about 5,000 metric tons annually.

Key Trading Partners: Predominantly trades with Asian nations like China, Japan, and particularly India.

Strategic Importance: Based in Enugu, a coal-rich region, it's important for coal exportation and agricultural goods.

Notable Features: Regularly improving facilities and ease of cargo procedures.

For Your Business: If you're in the coal or agriculture sectors, this airport, with its lower traffic, could offer a more predictable and smooth shipping experience.

How long does air freight take between UK and Nigeria?

Air freight services between the UK and Nigeria typically span a period of 1 to 3 days. However, specific transit times can fluctuate depending largely on the chosen airports, the weight of the cargo, and the particular type of goods being transported. Therefore, for a more accurate delivery time relevant to your specific shipping needs, it is recommended to consult with an experienced freight forwarder such as DocShipper.

How much does it cost to ship a parcel between UK and Nigeria with air freight?

The cost to ship air freight between the UK and Nigeria widely varies, with rates generally ranging from £4 to £8 per kilogram. However, it's difficult to provide an exact quote as the price depends on factors such as distance from the departure and arrival airports, the dimensions and weight of the parcel, and the nature of the goods. Rest assured, our team is committed to offering you the most competitive rates tailored to your specific needs, as we meticulously quote on a case-by-case basis. Contact us today to receive a free quote in less than 24 hours.

What is the difference between volumetric and gross weight?

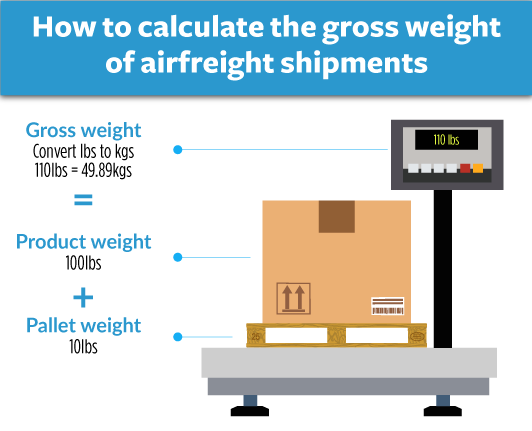

Gross weight is the actual physical weight of your shipment, including goods, packaging, pallets, etc., measured in kilograms. In contrast, volumetric weight considers the space your shipment occupies on the aircraft, not just its physical weight.

To calculate the gross weight for Air Cargo, simply weigh your package and record it in kilograms. For instance, if you're shipping a box of sneakers that weighs 15 kg, that's your gross weight (equivalent to 33.07 lbs).

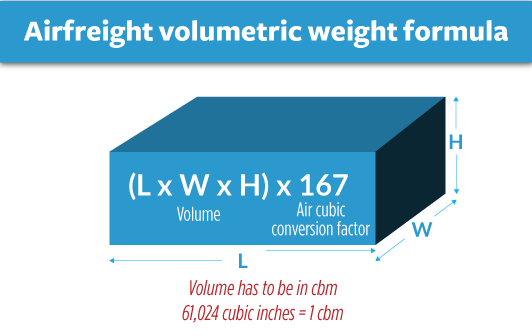

Calculating the volumetric weight is a bit more complex. In Air Cargo, you measure your shipment's dimensions in centimeters (length, width, height), multiply these three dimensions together, and then divide the result by 6000. Say your box of sneakers measures 75cm in length, 25cm in width, and 25cm in height. Multiply these together (752525), and you'll get 46875 cubic cm. Divide this by 6000, and your volumetric weight is 7.8 kg (or 17.2 lbs).

In Express Air Freight, the calculation is just a little different: you would divide by 5000 instead of 6000. With the same box's dimensions, your volumetric weight becomes 9.4 kg (or 20.7 lbs).

The importance of these calculations lies in the cost. Freight charges are based on either gross or volumetric weight - whichever is higher. This means that a light but large box may cost more to ship than a smaller, heavier box. Understanding this helps businesses optimise their packaging and potentially save on shipping costs.

![]()

DocShipper tip: Door to Door might be the best solution for you if:

- You prioritize ease and a hassle-free shipping experience. Door-to-door services manage the entire process, from collection to final delivery.

- You appreciate the efficiency of having one dedicated contact. With door-to-door, a single agent is responsible for overseeing all elements of your shipment.

- You want to limit the number of times your cargo is transferred. Door-to-door services minimize the switches between various transport methods, lowering the chances of damage or loss.

Door to door between UK and Nigeria

Door-to-door shipping is your hassle-free transport solution, taking your goods from the UK straight to your destination in Nigeria. It handles everything - pick up, transit, customs, and finally, delivery! With time and cost savings, it brilliantly simplifies your international trade journey. Now, let's dive into the specifics of door-to-door shipping between these two vibrant nations.

Overview – Door to Door

Rolling out the red carpet in logistics, door-to-door shipping from the UK to Nigeria eliminates your stress, serving as the ultimate problem-solver for the freight complexities you might witness. It's the most popular choice among DocShipper's clients—thanks to its seamlessness and convenience. This all-in-one solution has its drawbacks, like slightly higher costs, yet the simplicity it offers is priceless, sparing you the headache of administrative procedures. Remember, shipping isn't just about moving goods; it's about moving them the right way. So, go for the stress-free options—you've got enough on your plate.

Why should I use a Door to Door service between UK and Nigeria?

Ever tried to herd cats? Well, organizing a shipment from the UK to Nigeria can often feel the same! But don't fret— a Door to Door service comes to the rescue. Here are 5 stellar reasons why this might just be the gold solution for your shipping needs:

1. Alleviates Stress: Door to Door service completely steers away the nerve-wracking logistics hubbub. By taking care of everything from pickup to delivery, it's like hiring a personal assistant for your goods!

2. Prompt Delivery: Tick-tock says the clock, but you won't need to pay it any mind. With streamlined operations for speedy delivery, no shipment is 'too urgent' for Door to Door service.

3. Specialized Care: Got complex cargo? No sweat. Your unusual, delicate, or laborious to handle goods receive the dove-like care they deserve. Plus, comprehensive handling reduces the risk of damage during transfers.

4. Seamless Trucking: Forget about trucking concerns like scheduling, routing, or unavailability. The service ensures smooth road transportation until the cargo reaches its final Nigerian destination.

5. Extreme Convenience: Ship and sip your coffee! Door to Door service takes the burden off your shoulders completely so you can concentrate on what's really important - running your business.

Door to Door service is like your very own shipping chaperone, ensuring a stress-free, timely, and attentive process that unloads your logistics concerns. Go ahead, give it a try!

DocShipper – Door to Door specialist between UK and Nigeria

With DocShipper in charge, experience stress-free door-to-door shipping from the UK to Nigeria. Trust in our proficiency, managing everything from packing to customs; utilising all modes of transportation. Your very own Account Executive is there to guide you, ensuring a seamless process. Request your free estimate today or speak directly to our consultants at your convenience. Your shipping needs, our expertise.

Customs clearance in Nigeria for goods imported from UK

Understanding customs clearance - the administrative hoop-jumping required to import goods from the UK into Nigeria - is pretty crucial. This process may seem as tangled as spaghetti, loaded with surprise fees and potential pitfalls, not to mention the looming threat of your goods playing hide-and-seek in customs over overlooked duties, taxes, quotas, and licenses. Fear not! Over the next sections, we'll simplify these complexities and short-circuit potential headaches. DocShipper is on standby to assist you with any kind of goods from anywhere in the world. Need to budget? Hit up our team with the origin of your goods, their value, and the HS Code for an estimate. Let's untangle this process together!

How to calculate duties & taxes when importing from UK to Nigeria?

Navigating the intricate world of customs duties and import taxes can often appear daunting, yet understanding it is essential for smooth operations. The calculation of customs duties hinges on several variables which include the country of origin, Harmonized System (HS) code, Customs Value, and Applicable Tariff Rate, among other possible taxes and levies that may apply to your freight. A fine comb needs to be run through your product specifics to capture these factors accurately. The first frontier in this journey is pinpointing the manufacturing or production site of your goods. This is the 'country of origin', a fundamental cornerstone for any subsequent computations and allows for a degree of compliance with international trade agreements.

Step 1 - Identify the Country of Origin

Unlocking a successful UK to Nigeria import route starts with one powerhouse move - identifying the Country of Origin. It might seem elementary, but here's why it's crucial.

First, you get to discern potential hiccups via import restrictions. For instance, secondhand clothes from the UK face a severe no-entry policy in Nigeria. Second, countries of origin determine duty rates. Dude, it's all about the trade agreements. A small red tape leads to big budget impacts! Third, this step sets the path for accurate Harmonized System (HS) Code classification. Fourth, it safeguards against violations of importation rules. Last but not least, it ensures proper documentation thus avoiding delays.

As for UK-Nigeria trade relations, they enjoy a cordial bond without a specific trade agreement. Generally, import duties in Nigeria vary between 0% to 35% based on the product. Use this rule of thumb - the more value-added or 'finished' a product is, the higher the duty.

In conclusion? Make a beeline for your origin country discovery. It's your key to crack open a world of smooth, cost-effective UK to Nigeria shipping. Remember, knowledge is power in the logistics game!

Step 2 - Find the HS Code of your product

The Harmonized System Code, often referred to as the HS Code, is a universally accepted classification system for products. It's used by customs authorities worldwide to identify products for the purpose of levying duties and taxes.

If you're looking to ship products internationally, it is crucial to know the HS Code of your goods. Most of the time, your supplier will be able to provide this code for you as they are deeply familiar with what they're exporting and the associated regulations.

However, if you need to figure it out on your own, don't worry, it's a straightforward process. You can use an HS code lookup tool; one reliable option is the Harmonized Tariff Schedule. Simply type your product's name into the search bar; the tool will then generate a list of matching or related terms. Just scroll through and look under the Heading/Subheading column - that's where you'll find the HS code.

Remember, each step should be kept separate. One, search the product name. Two, cross-check the results. Three, locate the HS Code under the specified column.

A word of caution: choosing the correct HS Code is vital. A mistake can lead to shipping delays, confusion, and even extra charges or fines. Therefore, ensure accuracy to facilitate a smooth customs clearance process.

For further clarification, here's an infographic showing you how to read an HS code. Keeping this guide handy will certainly aid you in understanding and effectively using HS codes.

Step 3 - Calculate the Customs Value

When you're exporting goods from the UK to Nigeria, understanding the 'Customs Value' is key. So, what is it and how does it differ from your product's value? Simply put, 'Customs Value' is the total cost that customs uses to calculate duties and taxes. It is not merely the price of your goods. Instead, it also includes the cost of international shipping and insurance.

Let's say you're shipping widgets that cost $5,000. With transportation and insurance, it reaches $6,000; that’s your 'Customs Value'. So, duties won't apply solely on your product cost but the entire figure. Staying one step ahead and knowing how to calculate this saves you from any surprises at the Nigerian border - and keeps those wheels of commerce turning.

Step 4 - Figure out the applicable Import Tariff

Import tariffs, often referred to as customs duties, are taxes that you, as an importer, pay on goods coming into a country. In the context of Nigeria, when importing from the UK, these tariffs vary based on the goods and their Harmonized System (HS) code.

Here's a clear approach on how to determine the applicable tariff rate:

1. Access the UK's Trade Tariff tool UK Trade Tariff Tool

2. Input the HS code corresponding to the appropriate goods. For example, let's take 2202.90.90.10- it's the HS code for a specific kind of Mineral water.

3. Based on the input HS code, you'll get the tariff rate; let's say 25%.

For cost calculation, let's assume your Cost, Insurance, and Freight (CIF) value is $10,000. The import duty will be:

Import Duty = CIF value Tariff Rate = $10,000 25% = $2,500.

So, before importing from the UK to Nigeria, understanding your tariff rate and calculating your total import duty ensures a smooth customs clearance process. And remember, each commodity has a unique HS code that carries a specific tariff rate.

Step 5 - Consider other Import Duties and Taxes

Moving beyond standard tariffs, it's critical to uncover other potential costs when importing goods from the UK to Nigeria. Among these are excise duty, anti-dumping taxes, and notably, VAT.

Think of excise duty as a form of tax applied to certain types of goods specifically, such as alcohol and tobacco. For instance, if you're shipping premium whisky, an excise duty may apply, however, the rates can fluctuate. You'll need to check the latest figures to avoid getting blindsided.

Anti-dumping taxes aim to prevent the import of goods priced significantly below their market value. If your cargo is suspected of 'dumping', an additional tax may be imposed.

Lastly, and perhaps most importantly, VAT is applied to the total value of your imported goods. In Nigeria, for instance, the VAT rate currently sits at 7.5%, so if you're shipping goods valued at $10,000, expect to pay around $750 in VAT.

Remember, these are example figures and the actual rates might differ. Always consult with a customs expert or check with the relevant authorities for accurate, up-to-date information.

Step 6 - Calculate the Customs Duties

Precisely assessing your customs duties can greatly affect your import costs. Customs duties are primarily based on the customs value of your goods (cost, insurance, and freight included), often demanding the addition of other charges like Value Added Tax (VAT) and Anti-Dumping Duties.

Here's a brief look at three separate scenarios:

Scenario 1: Suppose you're shipping commercial electronics worth $10,000. Let's say the duty is 20%, that would result in $2,000 of customs duties, with no VAT incurred.

Scenario 2: In the case of importing textiles at a customs value of $15,000 with a duty and VAT rate of 15% and 5% respectively, your customs duties will be $2,250 and $750 of VAT.

Scenario 3: If you import steel with a value of $20,000 to which a duty of 10%, VAT of 5%, anti-dumping tax of 15% and an excise duty of 5% apply, you would face $2,000 in customs duties, $1,000 in VAT, $3,000 in anti-dumping taxes, and an extra $1,000 in excise duties.

While these calculations can get complex, you won’t struggle with any of them if you entrust your customs clearance to DocShipper. Our dedicated team ensures you never overpay, handling every step, anywhere globally. Contact us now for a free quote within 24 hours.

Does DocShipper charge customs fees?

Understanding customs fees can be tricky. Here at DocShipper, we're all about transparency. As a custom broker in the UK and Nigeria, we don't charge customs duties. Instead, what we charge are customs clearance fees for handling your cargo during customs processes. Customs duties and taxes? Those are government charges, not ours. We'll supply you with official customs documents to prove you've only paid what's required by the customs office. It's like going to a restaurant - you pay for the meal and the service, not the ingredients. That's how we operate. No hidden costs, just honest service.

Contact Details for Customs Authorities

UK Customs

Official name: Her Majesty's Revenue and Customs (HMRC)

Official website: https://www.gov.uk/

Nigeria Customs

Official name: Nigeria Customs Service

Official website: https://www.customs.gov.ng/

Required documents for customs clearance

Understand the document hustle of customs clearance? It's a crucial, often labyrinth-like task. We'll unravel it in this section, highlighting the significance of bills of lading, packing lists, certificates of origin, and conformity documents (CE standard). Let's conquer this complexity together!

Bill of Lading

Navigating the waters of customs clearance between the UK and Nigeria? Then you'll need a trusty sidekick - the Bill of Lading. This vital document signals the transfer of your goods, acting as proof of ownership. Picture it like a baton pass in a relay race, marking a smooth transaction. In a digital age, an electronic or 'telex' release speeds things up, especially handy for businesses on tight schedules. Aren't a fan of sea freight? When shipping by air, an Air Waybill (AWB) will be your go-to, performing a similar role. So, whether it's tea from London or textiles to Lagos, each successful journey starts with proper documentation. Keep those papers in order and sail through your customs clearance with ease!

Packing List

The Packing List is a behind-the-scenes star in your UK-to-Nigeria shipping journey. Consider it your loads very own CV, outlining the 'who, what, when, where, and how' of your shipment. Let's say you're shipping textiles. Your Packing List will detail every bolt of fabric, its weight, dimensions, and its exact slot on the cargo pallet. Errors or inaccuracies on this document can spell delays or even fines. So getting it spot-on is your responsibility as a shipper, whether you're using sea or air freight. Picture it like a cook's ingredients list - without it, things could mix up, throwing your whole process out of rhythm. Your accuracy in compiling this list plays an essential part in clearing customs swiftly and ensuring your business runs smoothly.

Commercial Invoice

The Commercial Invoice proves the value of your goods when shipping from the UK to Nigeria. It's more than just a list - it tells border authorities what's coming in, its value, and how it’s classified. Pay meticulous attention to fill it accurately and consistently with other shipping documents to avoid customs delays. For instance, ensure the goods’ descriptions on both your Commercial Invoice and Bill of Lading align. Note that under-exporting or over-exporting, reflected in a disparity between the declared and actual value of your goods, may lead to penalties or seizure. Also, using HS codes relevant to Nigeria would speed up the process. Detailed, accurate invoices are your gate pass, so don't leave room for guesswork!

Certificate of Origin

Navigating the sea of customs clearance? The Certificate of Origin is your surefire compass, particularly important when shipping goods from the UK to Nigeria. This document is a declaration, vouching for where your goods were made, the origin in its name. Think of it like a passport for your products identifying their nationality, which could influence the amount of customs duty you'll pay. So say you're shipping Manchester-made machinery to Lagos, producing this certificate may qualify you for preferential duty rates. Remember, the power of the Certificate of Origin lies in its accuracy and detail!

Certificate of Conformity (CE standard)

Shipping goods between the UK and Nigeria mandates the Certificate of Conformity to European's CE standard. Do you wonder why, despite the UK now embracing UKCA marking? Well, it's a holdover from when the UK was an EU member. It shows that the product complies with the strict EU safety, health, and environmental protection standards. Unlike simple quality assurance, this ensures the product meets legally binding standards for sale within the European Economic Area. It's akin, for instance, to the USA's FCC Declaration of Conformity. If your commodities have this certification, they're eligible for trade between the UK and Nigeria. Now, remember to cross-verify as regulations continually change. Refer to www.gov.uk/guidance/using-the-ukca-marking for the latest UK conformity markings.

Your EORI number (Economic Operator Registration Identification)

When shipping goods between UK and Nigeria, obtaining an EORI number isn't just a formality—it's crucial. Think of it as your personal ID in the global trade scene, used across the EU and additional countries and it's still required in the UK despite Brexit. This unique identifier is crucial for efficient customs clearance. It's your tracker, documenting your imports and exports within the EU, mitigating confusion, and speeding up the process. Don't have one? Fear not. Registration is relatively straightforward: a quick online form filled with your business details and you're typically good to go within a week. Remember, without your EORI, your goods may face delays or even seize-ups at customs, costing you time and money. Act on this to ensure smooth shipping operations between UK and Nigeria.

Get Started with DocShipper

Just navigated the complexities of customs clearance? Now, breathe easy and let us do the heavy lifting. At DocShipper, we streamline the entire customs process for you, ensuring your goods move smoothly from the UK to Nigeria, hassle-free. Don't get tangled in paperwork; reach out to us. We promise a free, no-obligation quote in less than 24 hours. Act now, we're just a click away.

Prohibited and Restricted items when importing into Nigeria

Steering your goods into Nigeria isn't plain sailing due to stringent regulations on importation. Unforeseen snags await if you don't know what items are marked 'prohibited' or 'restricted'. Keep your cargo clear from legal hassles or delays - familiarize yourself with these vital rules.

Restricted Products

- Pharmaceuticals: You have to get a permit from the National Agency for Food and Drug Administration and Control (NAFDAC).

- Machinery: You'll need an import license from the Ministry of Industry, Trade and Investment.

- Chemicals: A permit from the National Environmental Standards and Regulations Enforcement Agency (NESREA) is required.

- Livestock and Animal Products: Get the necessary permit from the Department of Veterinary and Pest Control Services.

- Firearms and Ammunition: You have to apply for a special permit from the Nigeria Police Force.

- Radio Equipment and Transmitters: Obtaining an approval from the Nigerian Communications Commission (NCC) is essential.

Remember, it's crucial to ensure you've got the right permits before shipping restricted items to Nigeria to avoid unnecessary delays and potential legal issues. Check these sites for updates, as requirements can change.

Prohibited products

- Narcotics and illegal substances such as cocaine, heroin, cannabis, and other illegal drugs

- Counterfeit and pirated goods or materials

- Items utilized for fraud such as blank cheques, blank invoices, and other fraudulent documents

- Materials that breach copyright laws such as books, DVDs, and software

- Currency and counterfeit money

- Weapons, including firearms, ammunition, explosives, and knives

- Pornographic material

- Endangered animal and plant species

- Hazardous chemicals

- Live animals, except with a permit

- Precious metals and stones, except under special conditions

- Materials that carry an offensive or malicious intent, such as those promoting racism, hatred, or discrimination.

Are there any trade agreements between UK and Nigeria

Yes, trade between the UK and Nigeria is governed by the UK-Nigeria Economic Partnership Agreement (EPA). This ensures tariff-free access for goods, which could make your shipping more cost-effective. However, it's essential to comply with the agreement's regulations to enjoy its benefits. Infrastructure projects like the Lagos-Kano Railway Line might influence future shipping routes and open new opportunities. Keep an eye on these developments as they could significantly impact your business.

UK - Nigeria trade and economic relationship

UK-Nigeria trade relations have flourished over time, with roots dating back to the colonial era. Today, the UK is Nigeria's 2nd largest trading partner after China, with bilateral trade valued at £5.6bn in 2023. Major sectors include oil and gas, as Nigeria supplies around 16% of the UK's crude oil. Increasingly, agriculture and digital services are becoming critical areas of exchange. British investment in Nigeria is robust, exceeding £6.1bn in projects spanning energy, infrastructure, and fintech. Their relationship continues to evolve as they gear towards a sustainable and diversified economy. This growth shows its commitment to strengthen their economic ties further.

Your Next Step with DocShipper

Shipping between the UK and Nigeria never looked so easy! Save time, free up your resources and leave the complexities of customs compliance to us. Our team of experts at DocShipper is here to facilitate a seamless freight process for your business. Contact us today, let's take your shipping experience to a whole new level!

Additional logistics services

Explore our suite of logistics services beyond shipping and customs! With DocShipper, you can streamline your entire supply chain process for a hassle-free business voyage. Dive in to discover more!

Warehousing and storage

Finding the right warehousing solutions in and between the UK and Nigeria can seem daunting. Conditions like temperature control matter a lot, especially for goods like foodstuffs and pharmaceuticals. A reliable and right-fit warehouse ensures your goods arrive as expected. Head over to Warehousing to ease this crucial process with expert-led solutions.

Packaging and repackaging

Ensuring your goods reach Nigeria in one piece starts with correct packaging. Whether it's ceramics or machinery, each item requires a unique touch. With a reliable partner, repackaging becomes a breeze, allowing your product to withstand the rigours of UK-Nigeria shipment. Packed shoes might sit in a 20-footer, while breakable glass wares may need particulars attention. Discover more about tailor-made solutions on our dedicated page: Freight packaging

Cargo insurance

Cargo insurance goes beyond just fire coverage. It's a safe bet to ward off unforeseen shipping perils. Picture this: A hefty bill hits after a road mishap or a toppled shipping container. With proper insurance, that's a non-issue! It's about being proactive to evade these roadblocks. Give yourself peace of mind. More info on our dedicated page: Cargo Insurance.

Supplier Management (Sourcing)

Facing challenges sourcing from Asia or East Europe for your UK-Nigeria trade route? DocShipper eases the task by finding reliable suppliers and managing your procurement process. We decipher the language, cultural nuances and guide you through the complexities. Plus, our real-world examples demonstrate success. Curious to learn more? Check out our Sourcing services.

Personal effects shipping

Moving between the UK and Nigeria? We expertly pack and handle your delicate and oversized items with utmost care. Picture heirloom furniture or your art collection, in professional hands, swiftly managed from customs clearance to doorstep delivery. Bulky to fragile, we've got you covered. More info on our dedicated page: Shipping Personal Belongings.

Quality Control

Avoiding surprises on arrival in Nigeria begins with effective Quality Control in the UK. Ensuring your goods stand up to both countries' standards, our inspection service is invaluable. Imagine shipping electronics, only to find faulty wiring—costly and damaging to your reputation. Don't risk it; let us safeguard your products' quality. More info on our dedicated page: Quality Inspection

Product compliance services

Ensure your goods make the cut with our Product Compliance Services! No surprise seizures or rejections at customs. With us, your merchandise goes through meticulous lab tests for necessary certifications, ensuring every box ticks off for regulations! No more compliance woes; let's pave smoother shipping for you. More info on our dedicated page: Product compliance services

FAQ | For 1st-time importers between UK and Nigeria

What is the necessary paperwork during shipping between UK and Nigeria?

To ensure a smooth shipment from the UK to Nigeria, we'll manage all necessary paperwork, such as the bill of lading for sea freight and air waybill for air freight. However, you'll need to provide us with a few key documents. At minimum, a packing list and commercial invoice are required. Keep in mind that depending on the nature of your goods, additional documents like Material Safety Data Sheets (MSDS) and certain certifications might be necessary. We're here to guide you through the entire process, ensuring each item reaches its destination without any hassle.

Do I need a customs broker while importing in Nigeria?

Yes, for importation into Nigeria, having a customs broker handle the process is highly recommended. Prompt navigation through Nigeria's customs proceedings requires a firm grasp of intricate protocols and compulsory documentations. As such complexities can make the process daunting, that’s where we, at DocShipper, step in. In the majority of cases, we represent your cargo at customs, ensuring seamless interaction with the customs authority. By leveraging our expertise, you can avoid potential hurdles and expedite the clearance. We handle all mandatory formalities on your behalf, simplifying your importing experience in Nigeria.

Can air freight be cheaper than sea freight between UK and Nigeria?

While it wouldn't be accurate to universally declare one freight method cheaper than the other, the difference often hinges on specifics like route, weight, and volume of your shipment. As a general guidance, if your cargo is less than 1.5 Cubic Meters or under 300kg (660 lbs), air freight could be a cost-effective choice between the UK and Nigeria. Rest assured, our team at DocShipper is committed to offering the most competitive, tailor-made shipping solution for your needs. Your dedicated account executive will guide you through every step, ensuring optimal cost and efficiency balanced against your unique requirements.

Do I need to pay insurance while importing my goods to Nigeria?

While insurance isn't a requirement for shipping goods, including imports to Nigeria, we strongly advise considering it. This recommendation springs from the variety of potential incidents that could result in damaged, lost, or stolen goods during transit. Insurance can provide an essential safety net, ensuring that your business isn't financially impacted by such unforeseen circumstances. So, even though it's not mandatory, it's a smart and worth-considering measure for the protection of your shipped goods.

What is the cheapest way to ship to Nigeria from UK?

Shipping from the UK to Nigeria may vary in cost depending on the cargo's weight and volume. In general, we at DocShipper find ocean freight to be the most cost-effective method, primarily due to the comparatively short distance across the Atlantic. While aircraft might offer speedier transit times, their higher expenses often outweigh the benefits. Nevertheless, the best mode of transport will always hinge on the specifics of your shipment.

EXW, FOB, or CIF?

Choosing between EXW, FOB, or CIF hinges on your rapport with your supplier. Often, they're not well-versed in logistics, so it's judicious to delegate the process, especially international freight and destination procedures, to logistics professionals. Typically, suppliers sell under EXW terms (from their factory door) or FOB (inclusive of all local charges till the origin terminal). Nevertheless, we at DocShipper can simplify this for you with our door-to-door service, ensuring your freight handling is smooth and hassle-free.

Goods have arrived at my port in Nigeria, how do I get them delivered to the final destination?

With our service, if your cargo is handled under CIF/CFR incoterms, you'll need a customs broker or freight forwarder for goods clearance, import fee payment, and final delivery. However, our team can manage a comprehensive DAP incoterms service, where we look after the whole process. Please confirm these details with your designated account executive for clarity.

Does your quotation include all cost?

At DocShipper, we pride ourselves on transparency, which is why our quotation includes everything with the exception of duties and taxes at the destination. You won't encounter hidden fees or unexpected surprises with us. If needed, you can also request an estimation of duties and taxes from your dedicated account executive.