As a buyer expert of international trade and freight, Docshipper is an ideal choice for you to focus on your business and handling your purchase operations, as well as one of the most important payment operation, with a reliable partner in Asia is the golden solution for many traders. We customize your need with multi-industry structure during sourcing process and accompany your whole sourcing process from A to Z. If you are not an expert in sourcing or even struggling for the international payments terms and rules, Docshipper is always available for your business and freight.

DocShipper Info

If you are struggling for international payment terms and rules cross countries during your shippment.Do not hesitate to contact our experts.

The definition of international payment terms

There should have been a way to determine the payment schedule, regardless of the payment terms customers pick.

DocShipper Alert

The disputes can always happen if there is the misunderstanding of terms of payment.

To avoid necessary troubles during shipment, it is quite important to ask for advice from our experts..

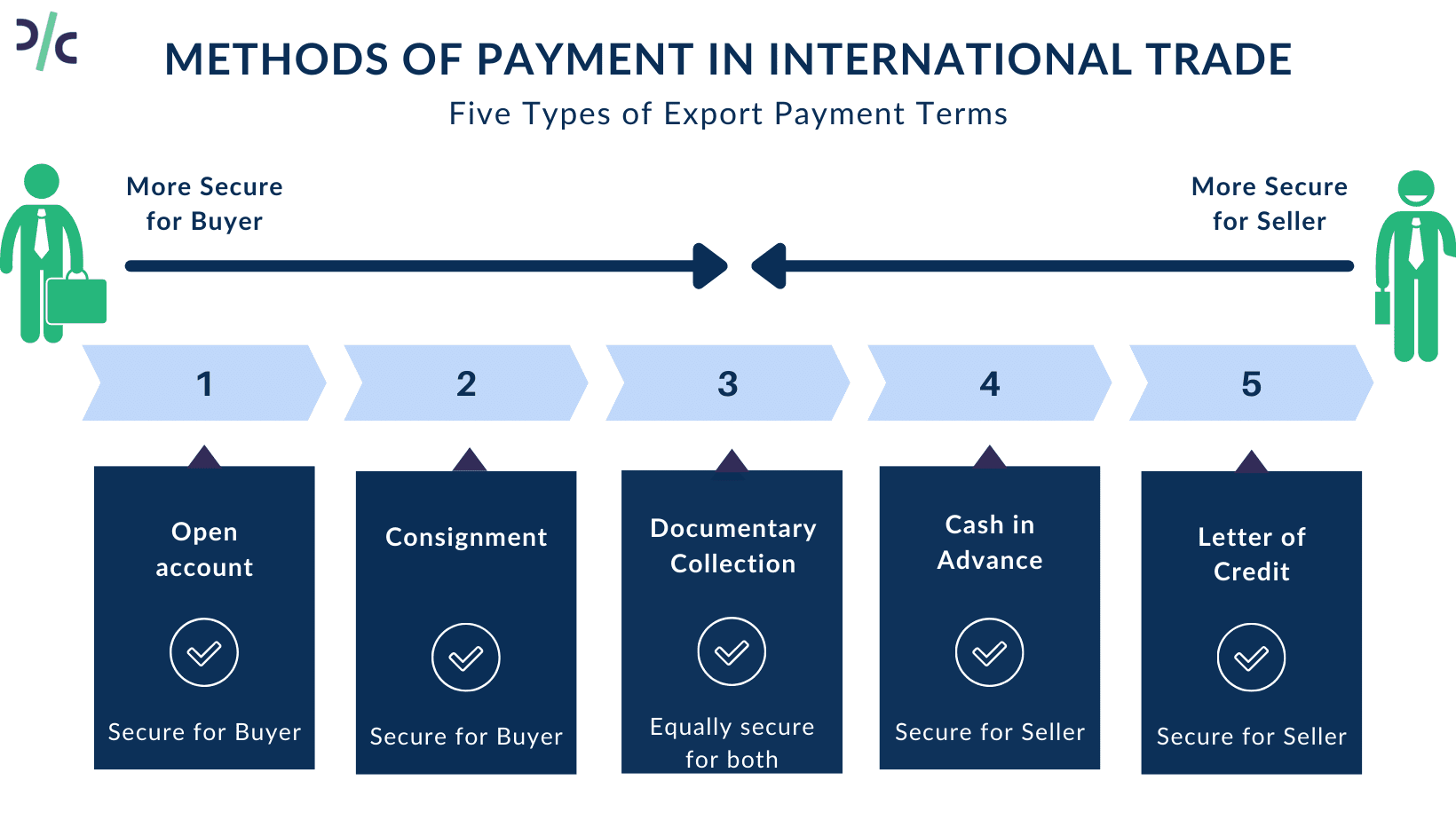

The most widely used terms of payment

- Advanced Payment

- Documentation against acceptance

- Documentation against international payment

- Credit letter

- Open Accounts

- Consignment account

More information regarding Worldwide Pays

Advanced payment

Because the term implies that payment has been made in advance. After the buyer has paid, the supplier may begin manufacturing. Before mass manufacturing, the supplier may propose that the customer pay a portion of the pending invoices. After fabrication is completed, items are transported to the destination, or products are on ships, to pay the balance of pending invoices. You might well have noticed an 80 percent advance plus 20% beyond thirty days following the invoice date in certain circumstances. Here, the terms of payment are a mixture of advanced and DA. You might well have come across circumstances where the payment period was stated as 100percent upon BL/TT. The customer requests that payment be made only after receiving the drafted BL, but the payment period remains advanced payment.

Nevertheless, if the products are paid for before they are shipped. In global payment terminology, it is regarded as advance payments.

Documentation required to Make advance payment

The vendor signs or stamps pro forma invoices.

It’s important to note that advance payment is made even against Pro forma invoices, not really commercial invoices. The vendor should provide you with Pro forma Invoices (PI). Please double-check that the provider’s payment terms are “Advance” and that their bank information is correct in the PI.

The next step once money had been paid

You’ll have to have the transaction advice or debit advice as well as SWIFT document from banks to gain Customs clearance. If payment terms are 100 percent advanced, you need not produce original documentation for shipment approval. It would be sufficient to have the banks’ copy paperwork endorsed. As a result, you could ask the provider to email scanned copies of the original papers to save time while waiting for the originals.

Telex

Telegraphic payments or TT payments are terms that you may have heard. Have you ever wondered what the distinction is between Telegraphic transfer and advanced payments? Telex, often known as telegraphic transfers (TT), is a means by which banks notify one another of a payment made by a party to the other party. The majority of people use Telex to make advance payments. Remember that Telex is merely a technique for interbank communications and that the payment period should be stated like advanced payments.

DocShipper Tip

As the documents required during the international trades are a bit complex, so we provide you with a complete guide of required documents for your shipping process.

Also,if you still can not be sure about certain requirements, don’t forget to contact our experts.

The meaning of endorsed documentation

To banks, provide a version of the original invoices, packaging lists , and advice of payment. Then they’ll stamp it along with the seal, confirming that the payments you made earlier match the business invoice and that payments to the provider were done lawfully. The number of references will be mentioned in the credit instruction or SWIFT copies inside the invoices by the bank. That means the payments you made underneath the number of references you provided were for the invoices the bank has chopped.

Documentation against acceptance

Documentation Regarding Acceptance is just a word used when a supplier gives the customer payment terms, thirty Days or sixty Days…are the most regularly used DA phrases. The payment term will begin on the invoices or the bill of landing schedule, whichever comes first. The supplier provides the original paperwork to the purchaser via their banks once the terms are DA. Without first obtaining payment from the bank, every original version of paperwork is shredded and released to the purchaser in clearing the freight. The buyer is entitled to a payment term that has been agreed upon. Simultaneously, they are obligated to make payment well during the agreed-upon time frame. Whenever payment terms are specified as Gross 30 or 60 Days, it signifies that payment must be made within these days after the invoice. Remember to include the duration within your credit period.

Similar to DP terms, suppliers may transmit original documents straight to the purchaser without passing via their banks with a personal letter of introduction.

Also, include an Exchange Bill with the documents once the terms are DA. Keep in mind that the purchaser should sign an Exchange bill and then deliver it to his or her bank.

Documentation against international payment

The original shipping documentation is required for clearing the consignment through Customs. Original versions of commercial documents are sent to the purchaser through the supplier’s bank under the DP term. After you pay the invoice value, you can pick up the original version of the documents. The word DP is referred to as cash against documents or net cash against documents.

In some circumstances, suppliers submit authentic commercial documents straight to the purchaser, instead of passing the vendor’s bank. In such cases, the vendor should attach their bank credentials to the set of documents separately to effect payments underneath the DP period. The vendor frequently delivers an original BL along with the paperwork without relinquishing it. Whenever a seller provides papers straight to a purchaser’s bank, most banks use their own forms that the supplier must fill up, then include in the set of documents. This is referred to as “direct collection order or direct covering letter”

Pay a Bill to open an account

Open account payment is similar to the terms of DA payments, but it is more simple for purchasers. There is no involvement of banks in the document transfer in this case. The supplier transmits the original copy straight to the customer, who completes the clearing well with the terms of payment and opens accounts. The purchaser is given payment terms by the provider. The buyer presents “Commercial Invoices, Customs Declaration, and bill of landing” to banks and arranges payment within the specified time frame. When there has been a healthy relationship between the provider and the customer, this strategy can be used. The reason seems to be that the provider has a risk of not obtaining payment because no bank guarantees payment.

Combination of advance payment and documentation in regard to DP/DA payment terms

The agreed-upon proportion of the pending invoices must be set up in advance by the consignees. If the remainder needs to be paid as DP or DA, the vendor should deliver the original copy sets to the purchaser’s banks. Original paperwork must be shown for freight clearance. Furthermore, the outstanding payment shall be made in accordance with the DP agreement or DA agreement. The banks will approve the papers and release them to the purchaser according to payment terms specified in commercial invoices.

DocShipper Tip

Here we provide you some tips about the strategy of sourcing process and requirements of payments.

If you have any other questions, our experts are willing to help you.

The essential info related to the consignment account

Transactions take place in both directions here. Inside one transaction, a consignee has become the vendor in the other. The vendor is in the same boat. Both sides agree on a time to prepare their account in a consigned account. This period of time can be one year or every 3 months. You must see the case below to get a clear concept of a consignment account.

Consider how individual A from nation C would interact with individual B from country E. B sends clothing to A, whereas A sends coffee to B. A and B need not plan payment for every delivery underneath these terms of payment. They monitor the commodities flow at conclusions of the agreed-upon period and determine who must pay whom. The payment will thereafter be settled.

The needed materials for building up credit letter

- The vendor’s signed copy of Pro forma Invoices or Sales Verification

- Letters to the banks requesting the issuance of a letter of credit for the required vendors

- Central Banks form with a properly filed LC application provided by banks

These documents may differ significantly depending on the legislation in your country.

The purchaser has the option of opening the LC. The banks would open an LC after the buyer presents the relevant papers. Again, when the cargo has been shipped from the source nation, the transporter will submit the original paperwork to the purchaser’s banks via the vendor’s banks, same as under DP or DA terms. When the customer paid the documents, it will compare them to the completed LC application. If there will be some differences, the purchaser will be notified by the bank. If the purchaser is unconcerned about the inconsistencies, the bank may approve and issue the papers. When issuing the original documentation, the bank assumes responsibility for ensuring that the buyer pays and that the supplier receives the complete amount on time.

The Unified Customs and Practices on Documentary Credit establish common norms and regulations for LC. Furthermore, UPS considers a letter of credit to be an “Irrevocable” instrument, which means that one side cannot amend the originating LC’s agreed-upon provisions lawfully. This promotes both sellers and buyers to participate in significant multinational transactions while yet being protected by the law.

If the terms of payment are LC at the sights, the banks will transfer the payment amount to the vendor’s bank accounts and issue the LC’s original documentation set.

When credit periods are offered by the vendor, they will be noted as LC from the BL date.

Letter of Credit

LC Expired Place

The country where the LC will expire ought to be the vendor’s country.

LC Expired date

By this time, the cargo should’ve just left its origins and the purchaser’s bank ought to have received the original documentation. And after the shipment’s shipping day, the vendor is usually given a certain amount of period to complete the documentation and deliver them to a purchaser’s bank. When the documentation presenting term is applied to some of the most recent date of shipment, the expiration date could be computed. If the purchaser does not specify the document presenting term when filling out the LC applications, it is calculated automatically as three weeks as a common procedure.

Requesters

The candidate is the one who submits the application, fills it out, and obtains an LC from banks. The purchaser or consignees are always applicants.

Beneficiaries

It means the party that profits from the LC being opened under monitory terms. A vendor is the business’s benefit.

Most recent shipping dates

The delivery should leave the source before this time. LSD is the most common name for this drug. The LSD would be determined by the vendor and buyer’s agreed-upon shipment date.

Banks for issuing

These kinds of banks, as the names suggest, are the banks that issue LC. Because the purchaser requests for LC, the purchaser’s bank would be the bank for issuing.

Banks for negotiation

If there isn’t direct contact between the advising banks and the banks for issuing, the advising banks act as intermediate banks to ensure that the banking program operates well.

Advising Banks

This means the vendor’s banks or the banks that receive the LC.

FAQ | A full guide to international payment terms [definition, types, documents and Consignment Account]

Read more

Looking for more? These articles might interest you:

DocShipper info: Do you like our article today? For your business interest, you may like the following useful articles :

- How to guarantee a successful international delivery ? [Freight – Logistics ]acts on import/export business

- CUSTOMS CLEARANCE SERVICES

- 💡A complete guide to order goods from another country

- IMPORT PERSONAL EFFECTS TO THAILAND [REGULATION]

- What is Strategic Sourcing and How Does It Work?

- How a sourcing strategy can rocket your margin?

Need Help with Logistics

or Sourcing ?

First, we secure the right products from the right suppliers at the right price by managing the sourcing process from start to finish. Then, we simplify your shipping experience - from pickup to final delivery - ensuring any product, anywhere, is delivered at highly competitive prices.

Fill the Form

Prefer email? Send us your inquiry, and we’ll get back to you as soon as possible.

Contact us