Freight between UK – Vietnam | Rates – Transit times – Duties – Taxes – Advices

Why did the shipping container go to Vietnamese class? Because it’s about to be part of the bustling trade between the UK and Vietnam! Businesses often grapple with parsing complex freight rates, understanding transit times, and adhering to stringent customs regulations. This comprehensive destination guide aims to eliminate such complexities by providing detailed information about various freight options like ocean, air, road, and rail. It will dissect the customs clearance process, duties, taxes, and offer tailored advice to smooth your UK to Vietnam shipping journey. If the process still feels overwhelming, let DocShipper handle it for you! With their extensive experience and proficiency, they strive to turn potential shipping challenges into triumphant success for your business.

Which are the different modes of transportation between UK and Vietnam?

Non extrait

Need help with your shipment?

Need assistance with your shipment? Dont hesitate to contact us even for a simple question. Choose the option that suits you

Live chat with an expert Chat on WhatsApp Free Quote 24hHow can DocShipper help you

Sea freight between UK and Vietnam

The United Kingdom-Vietnam trade lane – bustling with possibilities, but scattered with obstacles, and threaded by the deep-blue veins of ocean shipping. This symbiotic connection manifests tangibly at the cargo ports: Southampton, Felixstowe, and London Gateway in the UK, met by the likes of Hai Phong and Ho Chi Minh City, Vietnam’s industrial powerhouses. Yet, amidst the economic dance, intricacies emerge.

Despite its sluggish pace, ocean freight champions in cost-effectiveness, making it ideal for high-volume shipments. The ‘Turtle and the Hare’ concept in full swing. But take caution, ocean shipping between these nations is no walk in Hyde Park. Seamlessly traversing this path is a mythical beast for many businesses. Missteps are common, frustrations aren’t rare.

And that’s where we come in. Over the course of this section, we’ll dissect the shipping process, pinpoint common snags, and furnish you with best practices and tips. We’ll master the sea route together, making your business shipping experience smoother than Vietnamese silk.

Main shipping ports in UK

Port of Felixstowe

Location and Volume: Located in Suffolk on the UK’s Eastern coastline, the Port of Felixstowe is a critical nexus for European trade, boasting a shipping volume of over 4.1 million TEUs.

Key Trading Partners and Strategic Importance: It holds strategic importance due to its shipping routes, with key trading partners including China, other parts of Asia, and European countries. It is not only the busiest port in the UK but also the 6th busiest in Europe.

Context for Businesses: For businesses keen to expand their market footprint in Europe and Asia, the Port of Felixstowe presents a robust and reliable logistics solution given its excellent rail and road links and its strong trade connections.

Port of Southampton

Location and Volume: Located on England’s south coast, the Port of Southampton is a hub for transatlantic and European trade, handling around 2 million TEUs per year.

Key Trading Partners and Strategic Importance: Its key trading partners include the United States, Far East Asia, and European Union nations. The port is known primarily for its sizable cruise terminal and being the UK’s number one vehicle handling port.

Context for Businesses: For businesses in the automotive sector or those that require passenger and freight services, the Port of Southampton, with its strategic geographical position and its state-of-the-art facilities, may prove invaluable.

Port of London

Location and Volume: Located in the heart of England’s capital city, the Port of London handles over 50 million tonnes of cargo each year.

Key Trading Partners and Strategic Importance: Most of its trade is with Western Europe, followed by Asia and North America, and it is especially important for the handling and export of waste materials and containers.

Context for Businesses: If your business requires a dedicated waste shipment solution or wants to capitalize on London’s booming logistics network, the Port of London is a lucrative option given its extensive network and handling capacity.

Port of Liverpool

Location and Volume: Situated on the River Mersey, the Port of Liverpool provides direct panamax size vessel access between the heart of the UK and the Americas, handling more than 700,000 TEUs per year.

Main shipping ports in UK

Port of Felixstowe

Location and Volume: Located in Suffolk on the UK’s Eastern coastline, the Port of Felixstowe is a critical nexus for European trade, boasting a shipping volume of over 4.1 million TEUs.

Key Trading Partners and Strategic Importance: It holds strategic importance due to its shipping routes, with key trading partners including China, other parts of Asia, and European countries. It is not only the busiest port in the UK but also the 6th busiest in Europe.

Context for Businesses: For businesses keen to expand their market footprint in Europe and Asia, the Port of Felixstowe presents a robust and reliable logistics solution given its excellent rail and road links and its strong trade connections.

Port of Southampton

Location and Volume: Located on England’s south coast, the Port of Southampton is a hub for transatlantic and European trade, handling around 2 million TEUs per year.

Key Trading Partners and Strategic Importance: Its key trading partners include the United States, Far East Asia, and European Union nations. The port is known primarily for its sizable cruise terminal and being the UK’s number one vehicle handling port.

Context for Businesses: For businesses in the automotive sector or those that require passenger and freight services, the Port of Southampton, with its strategic geographical position and its state-of-the-art facilities, may prove invaluable.

Port of London

Location and Volume: Located in the heart of England’s capital city, the Port of London handles over 50 million tonnes of cargo each year.

Key Trading Partners and Strategic Importance: Most of its trade is with Western Europe, followed by Asia and North America, and it is especially important for the handling and export of waste materials and containers.

Context for Businesses: If your business requires a dedicated waste shipment solution or wants to capitalize on London’s booming logistics network, the Port of London is a lucrative option given its extensive network and handling capacity.

Port of Liverpool

Location and Volume: Situated on the River Mersey, the Port of Liverpool provides direct panamax size vessel access between the heart of the UK and the Americas, handling more than 700,000 TEUs per year.

Main shipping ports in Vietnam

Port of Saigon

Location and Volume: Located in the bustling city of Ho Chi Minh, the Port of Saigon handles a significant amount of Vietnam’s shipping volume, processing more than 4 million TEU annually.

Key Trading Partners and Strategic Importance: This port maintains strong trade relations with many ASEAN countries as well as the United States and China. It serves as a strategic hub for goods travelling between Asia and the West.

Context for Businesses: If your business is aiming to infiltrate the Asian markets, particularly China or countries in the ASEAN region, the Port of Saigon could be pivotal in your shipping plans due to its strong and stable trade connections.

Port of Hai Phong

Location and Volume: Situated in Northern Vietnam, the Port of Hai Phong is another major maritime hub. It handles a shipping volume of 2.5 million TEU annually.

Key Trading Partners and Strategic Importance: Hai Phong enjoys trading partnerships mainly with China, South Korea, and several European countries. It holds a strategically important position, connecting Northern Vietnam with these vital trade regions.

Context for Businesses: If your ambition is to break into the Chinese, Korean, or European markets, then the Port of Hai Phong might be your best choice because of its convenient trade pathways to these regions.

Port of Da Nang

Location and Volume: Located in Central Vietnam, the Port of Da Nang is the third largest in terms of volume, with a shipping volume of over 1.8 million TEU.

Key Trading Partners and Strategic Importance: This port trades with a network of countries across Asia, Europe, and the Americas, rendering it a strategically important port for trans-Pacific shipping.

Context for Businesses: If your company is targeting the American or European markets, the Port of Da Nang could be a great inclusion in your shipping plan considering its established trans-Pacific and European routes.

Port of Cai Mep

Location and Volume: The Port of Cai Mep is situated in the Ba Ria–Vung Tau Province, in the southeast of Vietnam boasting a shipping volume of 1.6 million TEU annually.

Key Trading Partners and Strategic Importance: Main trading partners include the USA and other European nations. As a deep seaport, it can accommodate larger vessels, maximizing the shipping potential.

Context for Businesses: If your enterprise is contemplating large-scale shipping to the West, the Port of Cai Mep, with its ability to handle massive vessels, might be a strategic element in your shipping strategy.

Port of Qui Nhon

Location and Volume: Found in the city of Qui Nhon, this port manages a shipping volume of nearly 1.2 million TEU.

Key Trading Partners and Strategic Importance: Qui Nhon’s main trading partners are other Asian countries. It serves important trade routes around the region.

Context for Businesses: If you’re dealing with regional trades within Asia, the Port of Qui Nhon could tie into your logistics, offering efficient intra-Asian routes.

Port of Vung Tau

Location and Volume: Located in South Vietnam, the Port of Vung Tau has a trading volume of 1.1 million TEU annually.

Key Trading Partners and Strategic Importance: This port serves major trade routes to Australia and South Asia, positioning it as an essential port for traffic traveling into these regions.

Context for Businesses: If you’re planning to penetrate Australian or South Asian markets, the Port of Vung Tau may play a crucial role in your logistics thanks to its access to these specific regions.

Should I choose FCL or LCL when shipping between UK and Vietnam?

Choosing between consolidation shipping and booking a full container for shipments from the UK to Vietnam isn’t a guesswork game. It’s a pivotal decision that impacts the cost of your freight, the timing of its delivery, and ultimately the success of your global trade operations. In the following section, you’ll uncover the defining elements of these sea freight options helping to align them with your specific shipping needs, enabling you to make an informed decision that sets you on a smooth sailing course to Vietnam.

Full container load (FCL)

Definition: FCL, or Full Container Load, is a type of shipping where an entire container is used for one consignee's cargo. It's called 'fcl shipping' because the container is not shared with other shippers.

When to Use: If you're shipping in high volume - usually more than 14-15 cubic metres (CBM) - FCL can be the cost-effective and secure option. Since your goods occupy a full container (20'ft or 40'ft), the container is sealed from origin to destination. This ensures the safety of your items and can limit damage potential.

Example: If you're a furniture manufacturer in the UK exporting a large order of sofas to a chain in Vietnam, opting for an FCL container can keep your shipment intact and minimize handling-related damages, compared to sharing a container with different cargoes (LCL).

Cost Implications: An 'fcl shipping quote' can be more complex than just the per-container charge. It often comes down to a cost-per-unit basis. A fully loaded FCL container can deliver a lower price per unit, making FCL shipping cost-effective for larger volumes. Do note, charges like destination port charges are typically flat, regardless of the container size or shipment volume.

Less container load (LCL)

Definition: LCL or Less than Container Load shipment refers to a shipping mode where multiple shippers' freight share a container. It's ideal if the cargo is less than half of the total container space, around 13/14/15 CBM (Cubic Meters).

When to Use: If you're a small to medium-sized company shipping goods from the UK to Vietnam, or you don't have enough cargo to fill a whole container, LCL might be best for you. It grants price advantage for lower volumes, allowing the flexibility to pay only for the space you use instead of paying for an entire container.

Example: A manufacturer in the UK has a shipment of electric parts measuring 10 CBM. Instead of opting for a full container, they use an LCL service. This way, they only pay for the 10 CBM they are using within the shared container, reducing their overall shipping costs.

Cost Implications: The financial benefit of LCL freight is primarily in its flexibility. LCL allows you to manage your costs better, especially if your freight volume varies. However, bear in mind that the cost per CBM for LCL may be slightly higher compared to a Full Container Load (FCL) shipping method due to handling and service charges.

Hassle-free shipping

Making international shipping effortless is our primary goal at DocShipper. Our ocean freight experts work relentlessly to guide businesses to choose between consolidation or a full container. We consider factors like the volume, weight, and fragility of your goods. Our experience in shipping between the UK and Vietnam ensures you get the most effective solution. Ready for stress-free shipping? Get a free estimation today and start your journey with us.

On average, sea freight transit times between the UK and Vietnam are typically between 25 to 30 days. However, always keep in mind that several factors such as the specific ports of origin and destination, weight and nature of the goods, can impact these times. To get a detailed and tailored quote for your specific shipment requirements, consulting a professional freight forwarder like DocShipper is highly recommended.

Now, let’s dive into the approximate shipping times between the main freight ports in both countries. This table gives you a basic idea:

| UK Port | Vietnam Port | Average Transit Time (in days) |

| Port of Felixstowe | Port of Hai Phong | 30 |

| London Gateway Port | Port of Da Nang | 29 |

| Port of Southampton | Port of Ho Chi Minh City | 28 |

| Tilbury Port | Port of Quy Nhon | 30 |

Please note that these ‘XX’ placeholders represent the average transit times in days. They are specific to each route and can be filled once the exact details are determined.

How much does it cost to ship a container between UK and Vietnam?

Shipping a container between the UK and Vietnam? Cost-wise, you can expect a broad range in ocean freight rates starting from as low as $13 per CBM to over $50. But why the wide range? Precise shipping cost calculations can be complex, with variables like Point of Loading and Destination, the carrier, nature of goods, and seasonal market fluctuations playing a major role. While that might sound daunting, worry not! Our experienced shipping specialists are ready to simplify this process for you and offer the best individualized quote. Promise. Your shipping needs are our top priority, and we’ll navigate these costs together for an optimal solution.

Special transportation services

Out of Gauge (OOG) Container

Definition: An OOG container is used when the cargo dimensions exceed the standard container sizes, meaning the cargo is either too tall, wide, or long. The containers come with flat racks for easy loading and offloading.

Suitable for: Heavy machinery, large equipment, construction materials.

Examples: A large excavator for a construction project, oversized turbines for a power plant, boat hulls.

Why it might be the best choice for you: Because of their design, OOG containers can accommodate your out of gauge cargo efficiently and securely, ensuring your expansive or unique assets arrive in Vietnam undamaged and intact.

Break Bulk

Definition: Break bulk refers to goods that need to be loaded individually rather than in containers or bulk. These can be goods shipped on pallets, in crates, drums, or sacks.

Suitable for: Large, oversized cargo, and equipment or goods that don’t fit into standard containers.

Examples: Heavy machinery parts, wind turbine blades, steel beams.

Why it might be the best choice for you: Break bulk offers flexibility for your loose cargo load. By eliminating the need for standard-sized containers, it allows you to transport large or uniquely shaped items easily and safely to Vietnam.

Dry Bulk

Definition: Dry bulk shipping involves loose, dry materials that are poured directly into a ship’s hold.

Suitable for: Large quantities of dry commodities, including coal, grain, and metal ores.

Examples: A shipment of rice from the UK, coal for energy production.

Why it might be the best choice for you: This technique offers the most cost-effective way of transporting large volumes of dry goods to Vietnam without the need for packaging or containers.

Roll-on/Roll-off (Ro-Ro)

Definition: Ro-ro is a shipping method where vehicles are driven on and off a specialized ro-ro vessel. The ship is equipped with built-in ramps which facilitate the process.

Suitable for: All types of wheeled cargo, including cars, trucks, semi-trailer trucks, trailers, and railroad cars.

Examples: A fleet of UK manufactured vehicles for a dealership in Vietnam.

Why it might be the best choice for you: For vehicles or wheeled machinery, Ro-Ro shipping offers the fastest and simplest way of transport. There’s minimal handling, which reduces the risk of damage and can mean quicker delivery times to Vietnam.

Reefer Containers

Definition: Reefer containers are refrigerated containers used to ship temperature-sensitive cargo.

Suitable for: Foods, pharmaceuticals, and any other commodities that must be kept at a specific temperature.

Examples: A shipment of refrigerated medicines, UK cheeses that need to be transported at cool temperatures.

Why it might be the best choice for you: If you’re sending goods that need to remain in a chilled or frozen state throughout their journey, reefer containers offer a reliable way to maintain a set temperature for your shipment all the way to Vietnam.

At DocShipper, we understand that each type of shipping has its own unique benefits depending on your specific logistics requirements. Contact us for a free shipping quote within 24 hours, and let us help navigate you through your sea freight shipping options between the UK and Vietnam.

Air freight between UK and Vietnam

Air freight between the UK and Vietnam is like an express train – quick, reliable, and perfect for valuable light-weight loads. Think electronics or designer apparel. It’s speedy, getting your goods from London to Hanoi in a blink compared to sea or road freight. But be warned, it’s not just about filling up your cargo pallet and shipping it off. Many businesses trip over when they miscalculate costs, ignoring the important ‘chargeable weight’ formula which combines weight and size. It’s like buying a plane ticket without checking baggage rules – surprises can be costly! Here we’ll dive into these common mistakes and offer smart handling tips to keep your costs down and efficiency up.

Air Cargo vs Express Air Freight: How should I ship?

Deciding between express air freight and air cargo for your UK-Vietnam shipments? Here’s what you need to know: express air freight whisks your goods away on a dedicated plane, while air cargo tucks them into the belly of a commercial airline. Let’s dive deeper into these two options to help identify the best choice for your unique shipping requirements.

Should I choose Air Cargo between UK and Vietnam?

Air cargo shipping between the UK and Vietnam, serviced by airlines such as British Airways and Vietnam Airlines, is a reliable and cost-effective option. Even the transit times, longer due to fixed schedules, offer a consistent estimate for your business planning. This approach shines particularly for shipping goods exceeding 100/150 kg (220/330 lbs) when costs level out. So, if your business exports bulkier items, air cargo is keenly worth considering. Visit the official websites of British Airways and Vietnam Airlines for more details.

Should I choose Express Air Freight between UK and Vietnam?

Express air freight, which uses dedicated cargo air transport without passengers, mainly from firms like FedEx, UPS, and DHL, is a stellar pick for delivering shipments under 1 Cubic Meter (CBM) or 100/150 kg (220/330 lbs). This swift and reliable service ensures your cargo arrives in Vietnam from the UK promptly, perfect for urgent or high-value goods. With less space and weight to consider, you’ll likely experience less hassle and lower costs too. So, if quick, secure transport is your priority, express air freight could be just the solution your business needs.

Main international airports in UK

Heathrow Airport

Cargo Volume: Heathrow Airport handles over 1.7 million metric tons of cargo annually.

Key Trading Partners: United States, Germany, Qatar, China, and India are top trade partners.

Strategic Importance: Serving over 180 destinations globally, Heathrow is a critical hub for international trade.

Notable Features: Boasts dedicated cargo handling facilities and is the busiest airport in the UK.

For Your Business: Heavy cargo and frequent flights to worldwide destinations could support your shipping strategy for quicker and larger-scale deliveries.

East Midlands Airport

Cargo Volume: Handles more than 300,000 tonnes of flown cargo every year.

Key Trading Partners: Important cargo lanes include locations in Europe, North America and Asia.

Strategic Importance: Central UK location makes it an ideal hub for businesses operating across the country.

Notable Features: It operates 24/7, making it particularly flexible for shipments with sensitive timelines.

For Your Business: Ideal location to distribute goods nationally, and 24/7 operations can potentially speed up your supply chain.

Manchester Airport

Cargo Volume: Manages over 100,000 tones of import and export freight and mail annually.

Key Trading Partners: Main trading partners include the USA, Europe, Middle East, and Africa.

Strategic Importance: It’s the North of England’s major gateway to the world and handles large volumes of time-sensitive cargo.

Notable Features: Extended runway enables larger cargo planes, and it has multiple cargo handling agents to enhance efficiency.

For Your Business: Ideal for shipments to Northern England and Scotland, and handles a vast array of cargo types.

Stansted Airport

Cargo Volume: Approximately 250,000 tonnes of freight pass through Stansted every year.

Key Trading Partners: Provides connections to Europe, North America and Asia.

Strategic Importance: Geographic location in South-East England underpins its role as a gateway for London and the region.

Notable Features: It’s one of the largest freight hubs in the UK with a secure cargo area and customs facilities.

For Your Business: Dependable for shipping diverse types of cargo with expedient access to London – one of the world’s leading financial centers.

Gatwick Airport

Cargo Volume: Gatwick processes over 95,000 tonnes of cargo per year.

Key Trading Partners: Connects mainly with the United States, UAE, Germany, Spain, and France.

Strategic Importance: Second-largest airport in the UK, providing key links to many international markets.

Notable Features: Unique advantage of operating two terminals, North and South, provide added capacity and flexibility.

For Your Business: With a broad network of destinations and intensive passenger traffic, Gatwick could offer promotional opportunities for your products.

Main international airports in Vietnam

Tan Son Nhat International Airport

Cargo Volume: Handling over 400,000 metric tons of cargo every year.

Key Trading Partners: Mainly services Asian partners including China, Taiwan, Singapore, and South Korea.

Strategic Importance: As Vietnam’s busiest airport, located in Ho Chi Minh City, the nation’s economic hub, it plays a crucial role in international trade.

Notable Features: This airport is known for modern handling facilities that support both cold storage and general cargo shipments.

For Your Business: If your company operates primarily in Southeast Asia and needs access to a massive consumer market, this might be your ideal cargo hub.

Noi Bai International Airport

Cargo Volume: Consistently processing around 700,000 metric tons of cargo per year.

Key Trading Partners: Significant trading connections with Western countries like the United States and Germany, besides neighboring Asian nations.

Strategic Importance: Noi Bai, located in Vietnam’s capital city, Hanoi, serves as a crucial northern entry point for international cargo.

Notable Features: With two cargo terminals, it’s well-equipped for import, export, and transshipment of goods.

For Your Business: If your shipping strategy includes trading with Western nations or you want a well-connected location in Northern Vietnam, Noi Bai is a strategic choice.

Cam Ranh International Airport

Cargo Volume: Handles over 100,000 metric tons of cargo annually.

Key Trading Partners: Predominantly services trade with Russia, South Korea, Malaysia, and China.

Strategic Importance: Formidable military history as a former US airbase, now a thriving civilian airport, supports its standing as a secure, reliable cargo location.

Notable Features: Known for its modern amenities and high efficiency in cargo handling.

For Your Business: For businesses seeking a reliable, efficient port in central Vietnam with established connections to Russia and select Asian countries, Cam Ranh represents an excellent choice.

Da Nang International Airport

Cargo Volume: Moves over 30,000 metric tons of cargo each year.

Key Trading Partners: Primarily handles imports and exports to/from countries in East Asia, like China, Japan, and South Korea.

Strategic Importance: On the eastern seacoast, it’s the third international gateway, making it a central point of access for cargo traffic in and out of Vietnam.

Notable Features: Known for its extensive cargo storage facilities, including refrigerated storage which can handle perishable goods.

For Your Business: Da Nang International Airport could be your preferred choice if your trade requires robust storage facilities and your main shipping destinations are within East Asia.

Cat Bi International Airport

Cargo Volume: Handling upwards of 20,000 metric tons of cargo annually.

Key Trading Partners: Major trading with regional partners, especially China, South Korea, and Taiwan.

Strategic Importance: Cat Bi is strategically located in the major port city of Haiphong, which is on key trade routes.

Notable Features: Offers modernized cargo infrastructure, including high-capacity storage and effective screening systems.

For Your Business: Is your business heavy on imports/exports with regional neighbors? Then Cat Bi’s strategic location and modern facilities might give you an edge.

How long does air freight take between UK and Vietnam?

On average, shipping between the UK and Vietnam via air freight could take anywhere from 3 to 5 days. However, keep in mind, the exact duration can vary considerably based on certain factors. These include the specifics of your chosen airports, the weight of the goods, and the nature of the items you’re shipping. Every single shipment comes with its unique timeline, so to get a more accurate idea of delivery times, don’t hesitate to consult with a freight forwarder like DocShipper.

How much does it cost to ship a parcel between UK and Vietnam with air freight?

Air freight prices from UK to Vietnam can range broadly, averaging £4-£7 per kilogram. However, a set rate is elusive due to factors such as airport proximity, package dimensions, weight, and type of goods. At our firm, we acknowledge these complexities and provide bespoke, cost-effective solutions. Every quote is crafted uniquely to your shipment’s specifications, ensuring optimal balance between cost and efficiency.Transparency and client satisfaction are our north stars. Contact us today and receive a personally tailored quotation within the next 24 hours. Experience how we turn the intimidating into the achievable.

What is the difference between volumetric and gross weight?

Gross weight refers to the actual weight of your shipment, including packaging and pallets; it’s simply measured on a scale. Volumetric weight, on the other hand, is a weight estimate that considers the space your cargo occupies in an aircraft.

To calculate gross weight in air cargo, you use a scale to measure the total weight of the goods including pallets, packaging, and other securing materials. The same technique is used for both Air and Express Air Freight services. For example, if your shipment including packaging weighs 120 kg, that’s 264.5 lbs.

On the other hand, volumetric weight is calculated differently. For Air cargo, the formula is L(cm) x W(cm) x H(cm)/6000 = volumetric weight(kg). Express Air Freight uses a slightly different formula: L(cm) x W(cm) x H(cm)/5000 = volumetric weight(kg). Suppose the dimensions of your packaged goods are 110cm100cm90cm. For Air Cargo, your volumetric weight is 165 kg (363.7 lbs). For Express Air Freight, it’s 198 kg (436.5 lbs).

Your freight charges are based on the higher of the gross and volumetric weight to ensure carriers cover their costs in all scenarios – dense heavy items use up weight capacity while light, bulky items use up cubic space. So it’s essential to calculate both, to avoid surprises on your shipping invoice.

Door to door between UK and Vietnam

Navigating the logistics world can often seem like a complex maze. That’s where Door to Door shipping comes into play. It stands as an all-inclusive option that simplifies the process from the UK to Vietnam. An appealing choice due to its hands-off approach, convenience, and hassle-free customs clearance. But what exactly is it and how can it benefit your business? Grab your compass, we’re about to dive in!

Overview – Door to Door

Finding the shipping process between UK and Vietnam daunting? Door-to-door service is a lifesaver, tackling complex logistics so you don’t have to. From pickup to customs clearance to delivery, this popular DocShipper service streamlines your shipment, ensuring it reaches its destination hassle-free. While more costly, the convenience and reliability make it a favourite among clients. Be aware, though, some unexpected complexities may require your attention. Despite these, the overwhelming benefits mark it as an effective solution for your shipping woes. So sit back and let us handle the journey!

Why should I use a Door to Door service between UK and Vietnam?

Ever tried herding cats? That’s what dealing with international shipping can feel like! Here’s your lifeline: consider using a Door to Door service between the UK and Vietnam.

1. Bye-Bye, Logistic Tensions: With Door to Door service, enjoy the bliss of having professionals handle all the nitty-gritty details; from wrapping and crating to secure your goods, transporting them to the port, through customs clearance, and finally, to your destination.

2. Race Against Time: In the swift-paced business world, every second counts. This service guarantees fast and fuss-free transportation for your high priority shipments, keeping your business dynamic and agile.

3. Special Treatment: Got a heavyweight champ or fragile antique? Door to Door service also extends to intricate consignments requiring extra care, ensuring your cargo’s safe voyage.

4. Straight to the Spot: Why pause at the port when you can go full steam ahead to your final destination? With this service, goods are trucked from the port to their endpoint without you lifting a finger.

5. Convenience – The Cherry on Top: The luxury of simplicity cannot be overstated in international freight forwarding. By managing multiple aspects of the shipping journey, Door to Door service gifts you time and peace in your business operations.

Frankly, this service isn’t just a solution; it’s your game-changer in the complex shipping saga from the UK to Vietnam.

DocShipper – Door to Door specialist between UK and Vietnam

Experience worry-free shipping with DocShipper! Our skilled team ensures seamless door to door shipping from the UK to Vietnam, handling all aspects – from packaging and transport, to customs and choosing the suitable shipping method. With a personal Account Executive, benefit from efficient communication and peace of mind. Get your free estimate in under 24 hours or tap into our consultants’ expertise at no extra charge. We’re here to provide a successful freight forwarding journey from start to finish.

Customs clearance in Vietnam for goods imported from UK

Customs clearance is a complex maze, especially when importing goods from the UK to Vietnam. It’s a crucial process where goods are assessed for customs duties and taxes, and checked for any quotas or licenses. A lack of insight can lead to unexpected charges or the nightmare of your goods stuck at the border! Each section in this guide delves into these critical areas, enlightening you on the nuances of Vietnamese customs. Remember, DocShipper can simplify this process for any goods, globally. Contact our team with your goods’ origin, value, and HS Code to budget your journey through customs. We’ve got you covered!

How to calculate duties & taxes when importing from UK to Vietnam?

Diving into the intricacies of international shipping, it’s essential to understand that estimating duties and taxes for imports from the UK to Vietnam isn’t as daunting as it may appear. To correctly calculate these requirements, you have to first gather a few key details – the country of origin where the product was produced, the product’s HS Code, the Customs Value of the product, the Applicable Tariff Rate and any additional taxes or fees that could apply to the products. Remember, to sail smoothly through this process, the initial step demands identifying the country where the goods were originally manufactured or produced, as this forms the basis of the rest of the calculations.

Step 1 – Identify the Country of Origin

Country of origin is key in international shipping. Not trivial, but mighty. Here are five reasons why.

First up, Customs, they’re a stickler for rules. Identified wrong, you’ve got a lengthy, costly delay. Correctly? Smooth sailing, quick clearance at the Vietnamese port.

Second – here comes ‘Harmonized System’ or just HS; each code originates from a country, so triple-check your supplier’s credentials.

Third reason, little word, big impact – ‘Tariffs’. UK-Vietnam free trade agreement means that many goods enjoy preferential tariffs, greatly lowering the import duty.

Fourth, import restrictions apply differing since every country plays by their own rules. For instance, UK-made textiles need import licenses in Vietnam, so double-check your product’s eligibility.

Lastly, calculating taxes in advance helps, specially if your consignment’s in bulk. It’s all figures game. If you have the correct country of origin, you’re ahead in line.

So, before you dive in, nail the basics. Be Sherlock. Investigate, verify, calculate. Your package, your responsibility. A simple mistake can turn into customs chaos, and we all want to avoid that, right?

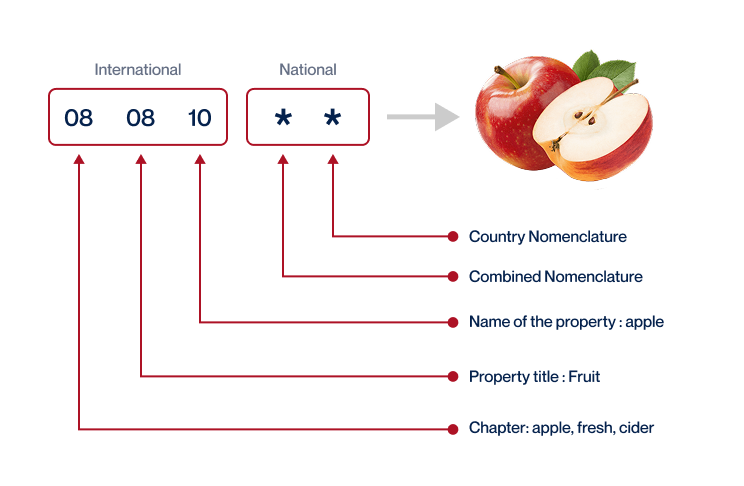

Step 2 – Find the HS Code of your product

Understanding the Harmonized System (HS) Code of your product is the key to a smooth shipping process. The HS Code is a universally accepted classification system for goods, used to standardize and identify products across borders. When you know your HS Code, it allows for accurate declarations to customs authorities, determining applicable taxes and duties, and helping you estimate the total landed cost of your shipment.

Normally, the easiest method to find out the HS Code is to ask your supplier. They are undoubtedly familiar with the products they’re importing/exporting and the corresponding regulations.

If this approach isn’t feasible, don’t worry. Here, we’ll guide you through a simple, step-by-step process to find the HS Code:

1. Visit the Harmonized Tariff Schedule, a reliable HS code lookup tool.

2. Type the product name into the search bar.

3. Examine the Heading/Subheading column to find the applicable HS Code.

Please note, it’s incredibly important to choose the correct HS Code. Inaccuracies can lead to delays in shipping and may even incur fines. Double-check your code to ensure precision.

To aid you further, here’s an infographic showing you how to read an HS Code.

Step 3 – Calculate the Customs Value

Ever feel confused about how ‘Customs Value‘ differs from the actual value of the products you want to ship from the UK to Vietnam? Here’s a simple explanation. Customs Value is the total amount Customs uses to calculate duties, it’s not just against the price of the goods. This value is actually the CIF value – the sum of the cost of the goods, international shipping fees, and insurance costs. Suppose you have air-freight goods with a price of $1000. If the international shipping comes to $200 and insurance is $50, the Customs Value is $1250, not just $1000! It’s this amount they’ll use when working out the duties payable. That seemingly small difference can make a big impact on your overall shipping costs, so always ensure you calculate the Customs Value accurately!

Step 4 – Figure out the applicable Import Tariff

An import tariff is a tax imposed on commodities from one country that enter another country’s borders. Vietnam, for instance, levies tariffs on goods imported from the UK based on a set tariff schedule.

To identify what applies to your product, follow the guide below:

1. Visit the UK Government’s online tool Trade Tariff: look up commodity codes, duty, and VAT rates.

2. Enter the Harmonized System (HS) code you identified in the previous steps, and country of origin.

3. The tool will then display relevant duties and taxes for your product.

Let’s consider a simple example, with a hypothetical HS Code 9403.60, for wooden furniture from the UK. You input the details in the tool and discover a tariff rate of 15%. Let’s say your Cost, Insurance, and Freight (CIF) costs total $10,000 USD. From this information, you can calculate the exact import duties.

Import Duty = CIF Value x Tariff Rate = $10,000 x 15% = $1,500

Thus, you would be required to pay $1,500 in import duties for your cargo of wooden furniture. This understanding equips you to cogently plan for import expenses and navigate through the customs clearance process more easily.

Step 5 – Consider other Import Duties and Taxes

Unlike the standard tariff rate, some additional import duties and taxes can apply when shipping goods from the UK to Vietnam, depending on both the product nature and its origin.

Take the excise duty, for instance, which is an internal tax charged on specific goods such as petroleum or alcohol. There are also anti-dumping duties to prevent cheap imported goods from destabilizing the local market, imposed when the export price is significantly lower than the fair market value.

Yet another tax to consider is Value Added Tax (VAT), a hefty charge that applies to the cumulative value of the product and any tariffs paid upon entering Vietnam. For example, if your shipment is worth $20,000 and incurs a 10% tariff ($2000), the 10% VAT will apply to the overall $22,000, costing you an additional $2200.

Remember, these rates and figures are hypothetical examples to illustrate the point, actual figures could vary. It’s always prudent to consult with a local customs expert or your logistics partner to get precise rates and make sure you’re meeting all import duty and tax obligations.

Step 6 – Calculate the Customs Duties

Calculating customs duties for goods shipped from the UK to Vietnam involves a few factors. Consider the customs value (CV) of your goods, any Value Added Tax (VAT), anti-dumping taxes, and potentially excise duties.

Take, for instance, a shipment valued at $1,000:

1. With only customs duties of 10%, your costs tally at $1,100 ($1,000 CV + $100 duty).

2. Add to this a VAT of 15% and your total rises to $1,265 ($1,100 + $165 VAT).

3. Weaving in an anti-dumping tax of 5% and an excise duty of 5%, the final calculation becomes $1,400.95 ($1,265 + $63.25 anti-dumping tax + $72.70 excise duty).

These calculations are important but can be intricate and sometimes overwhelming. Avoid the trouble and potential overpaying by letting DocShipper handle everything! We provide worldwide customs clearance services, making sure you’re paying just the right amounts on your shipments. Reach out to us, we’ll get you a free quote in less than 24 hours!

Does DocShipper charge customs fees?

Navigating the maze of customs? Here’s a simple fact: DocShipper doesn’t charge customs duties! As your trusty customs broker in UK and Vietnam, we only handle customs clearance fees. Think of it like your shipping partner bridging the gap between you and the government. The real hero is your wallet, only paying what’s due to the government and not a penny more. Remember, customs duties and taxes go directly to the government, not us. We ensure transparency by handing you customs office documents showing you’ve paid the right amount!

Contact Details for Customs Authorities

UK Customs

Official name: Her Majesty’s Revenue and Customs (HMRC) Official website: https://www.gov.uk/

Vietnam Customs

Official name: General Department of Vietnam Customs Official website: https://www.customs.gov.vn/

Required documents for customs clearance

Dealing with customs can be a real headache, especially when you’re unsure about documents. This guide lays out key paperwork like the Bill of Lading and Certificate of Origin, helping you sail smoothly through the clearance process. For a stress-free transit, let’s dig into these essential documents.

Bill of Lading

Navigating the complexities of international freight? The Bill of Lading is your best friend! This official shipping document marks the handover of goods from your business to the shipping line for transit from the UK to Vietnam. It’s proof of ownership that ensures your cargo arrives as planned. Nowadays, most shippers leverage the telex (electronic) release—a game-changer that speeds up documentation. You’ll bypass the traditional paper chase, making processing times faster, so your shipment isn’t stuck idling in port. And if you’re shipping by air, the Air Waybill (AWB) has a similar role. Practical tip? Always double-check the details on these documents for accuracy—it can make or break your hassle-free shipping experience! Remember, every detail is crucial when it comes to your cargo making its journey safely and efficiently.

Packing List

When you’re shipping goods from the UK to Vietnam, your Packing List is the unsung hero of the process. It’s your obligation to create this crucial document, which must accurately list the details of every item in your shipment, from product descriptions and quantities to weights and dimensions. Think about this as the DNA of your cargo, unique to each shipment. Customs authorities, whether in Cardiff or Can Tho, will scrutinize your Packing List down to the smallest detail. Why? Because it’s used in determining customs duties and even in inspections. A mismatch between your declared and actual goods? That invites delay, surprise costs, or worse. Imagine: your shipment of handcrafted ceramics, delayed in Ho Chi Minh City port due to unclear descriptions. Not the best way to start your venture in Vietnam, right? Double-checking your Packing List is non-negotiable, whether it’s for sea or air freight. Accuracy with this document can be your smooth sailing ticket in the complex seas of international freight.

Commercial Invoice

Shipping between the UK and Vietnam? Your Commercial Invoice will play a key role in ensuring a smooth customs clearance. It must include details such as the seller, buyer, and a detailed description of the goods, their Harmonized System (HS) codes, and the total value. These details must align with other shipping documents to avoid discrepancies. For example, if you’re sending die-cut machines from Birmingham to Hanoi, ensure the HS code matches across all papers. Accurate and clear documentation can reduce delays and unnecessary costs during customs clearance. Always double-check your invoice—it’s worth the extra minute.

Certificate of Origin

When shipping your goods from the UK to Vietnam, the Certificate of Origin (CoO) is a passport for your product. This crucial document declares the ‘nationality’ of your goods and verifies where the product or goods were actually manufactured. Let’s say, for example, you’re shipping electronics made in Manchester to Hanoi. The CoO showcases the British roots of your products, which can swing preferential customs duty rates in your favour, making trade more cost-effective. Remember, for every export, the Certificate of Origin paints a clear manufacturing history – making your shipping smoother and more efficient. It’s not just a paper; it empowers your business!

Certificate of Conformity (CE standard)

Moving goods between the UK and Vietnam means that your products need to comply with certain standards. The Certificate of Conformity to CE standards used to be your go-to. This certificate proved that your products conformed with health, safety, and environmental standards for products sold within the European Economic Area. However, since the UK’s exit from the EU, CE markings are being phased out and replaced with the UKCA (UK Conformity Assessed). So, if you’re shipping goods from the UK, you’ll need to ensure they carry this UKCA marking. Just like the CE marking, the UKCA is not a quality assurance declaration, but a regulatory market access requirement. In comparison, US standards focus more on quality assurance and testing. Don’t confuse the two. Understand where your goods will be marketed, and ensure you comply with the right standards. Check out the UK government’s guide on using the UKCA marking for further instructions. Remember, every non-compliance can lead to significant delays at the customs.

Your EORI number (Economic Operator Registration Identification)

Shipping between UK and Vietnam requires a crucial document – the EORI number. Designed for tracking imports and exports, each EORI number is unique to the business or individual using it, offering a means to monitor goods moving in and out of countries like UK. If you’re a UK-based business, your transactions with Vietnam will need this identifier. The process? Simple. Register with the relevant UK government platform – it’s digital, free, and generally answers in a few days. Just think of it as your business’s passport, ensuring your goods can travel seamlessly. Remember when you couldn’t track a parcel and panicked? EORI helps avoid similar situations in international freight!

Get Started with DocShipper

Prohibited and Restricted items when importing into Vietnam

Recognizing the tricky terrain of what can and can’t be imported into Vietnam? Spare yourself the headaches of customs penalties by knowing exactly which items are prohibited or restricted. Let’s acquaint you with the essentials right here.

Are there any trade agreements between UK and Vietnam

Yes, the UK and Vietnam enjoy a robust trading relationship embodied in the UK-Vietnam Free Trade Agreement (UKVFTA). Rolled out in January 2021, this agreement allows your business to benefit from reduced tariffs on various goods, enhancing profitability on trade between the two nations. Additionally, other collaborative initiatives like the Vietnam-UK Network aim to fortify bilateral relations, potentially opening up more trade opportunities. So, whether you’re shipping machinery or importing textiles, this friendly business climate may just be the perfect springboard for your international expansion.

UK – Vietnam trade and economic relationship

With roots dating back to diplomatic relations established in 1973, the UK and Vietnam have cultivated a deep economic rapport. Evolving into a strategic partnership in 2010, major sectors including education, finance, and renewable energy have seen significant growth. Crude oil, footwear, and garments are noteworthy Vietnamese exports to the UK while machinery, pharmaceuticals, and iron steal the show on the UK’s end. In 2024 alone, the UK’s direct investment in Vietnam was £700m, underscoring the positive environment for bilateral investment. To add, the volume of traded goods has been on an upward trajectory, with £7.5 billion worth of traded goods recorded in 2024

Your first steps with DocShipper

Additional logistics services

Warehousing

Finding that just-right warehousing solution in the UK or Vietnam can be as frustrating as the London traffic! That's especially true when your goods require specific conditions, like temperature control. Let us take that load off your shoulders. More info on our dedicated page: Warehousing

Packing

In the sometimes-tricky logistics landscape of UK-Vietnam shipping, flawless packaging isn't just an add-on, it's essential. Fancy shipping antique ceramics or machinery parts? A trusted agent ensures your items are safely packed and, if necessary, repackaged to ensure they withstand international transit. Explore the peace of mind proper packaging can bring on our dedicated page: Freight packaging.

Transport Insurance

Cargo Insurance differentiates from fire insurance as it explicitly covers the hazards of international shipping. Picture your goods hitting a pothole on a bumpy road, or braving a storm while at sea. Awful, right? Our Cargo Insurance mitigates these risks, giving your shipment a safety net. Curious to learn more? Visit our dedicated page: Cargo Insurance for the full scoop.

Household goods shipping

Moving from the UK to Vietnam, or vice versa, and worried about your bulky or fragile items? You can breathe easy knowing we provide professional, flexible handling for all your precious cargo. And, let's say you're fretting over how to safely ship that grand piano of yours; our team has handled it all! Find out more about this invaluable service on our dedicated page: Shipping Personal Belongings.

Procurement in Thailand

Struggling to find trustworthy suppliers in Asia or East Europe? Let DocShipper streamline the process. Benefit from our extensive network and expertise in bridging language gaps. We guide you through procurement processes, from identifying reliable suppliers to overseeing production. Enjoy a hassle-free sourcing experience. More info on our dedicated page: Sourcing Services.

Quality Control

When shipping goods from the UK to Vietnam, quality control is paramount. A misstep here could be costly, like sneakers that split at the seams, or taps that leak. Our quality inspection ensures your products live up to expectations before they're shipped off. It's an insurance policy for your reputation, saving you stress and re-shipping costs. More info on our dedicated page: Quality Inspection

Conformité des produits aux normes

Meet trade regulations effortlessly with our Product Compliance Services. Avoid potential mishaps with authorities by ensuring your goods align with all destination requirements. We’re talking rigorous laboratory testing and faultless certification procurement to precisely match regulations. Picture a toy shipment smoothly crossing borders sans delays - that could be your reality. More info on our dedicated page: Product Compliance Services.