Shipping goods from UK to Sri Lanka doesn't have to feel like you've been asked to guard a ship full of finest Darjeeling tea from ravenous British sailors in the 1800s!

We understand the troubles faced - discerning freight rates, figuring out transit times, and navigating the labyrinth of customs regulations. This comprehensive destination guide is here to help. We'll delve into the specifics of various freight options, shed light on the intricacies of customs clearance, break down duties and taxes, and provide expert advice tailored to suit unique business needs.

If the process still feels overwhelming, let DocShipper handle it for you! As an extensive international freight forwarder, we turn intricacies of international shipping into successful, hassle-free operations for businesses.

Table of Contents

Which are the different modes of transportation between UK and Sri Lanka?

Understanding the best method of transport between UK and Sri Lanka is like choosing the best route in a relay race - you must consider the hurdles (distance, borders) and your strengths. In our case, air and sea shipping take the lead given the 5,500-mile ocean separating us. But remember, there's no one-size-fits-all answer.

Selecting the right candidate—be it the fast-paced jet or the load-bearing cargo ship—depends on your specific shipping needs, like the urgency, the size, and the type of your goods. Which baton will you pass, and which runner suits your business best?

How can DocShipper help?

Transporting goods between the UK and Sri Lanka? Let DocShipper take care of the complexities. Our seasoned experts handle everything from customs clearance to choosing the right mode of transport. All you need is to sit back and watch your business thrive. Speak to our consultants for free advice, or request a no-obligation estimate in under 24 hours. It's time to ship smarter with DocShipper.

DocShipper Tip: Ocean freight might be the best solution for you if:

- You're dealing with large quantities or oversized items. Sea freight offers a budget-friendly way to maximize space, a particularly useful option given the UK's extensive port network.

- Your shipment isn't on a tight schedule. Ocean transport typically takes longer than air or rail, but it offers reliability.

- Your supply chain involves key ports, allowing you to take advantage of a wide-reaching network of sea lanes.

Sea freight between UK and Sri Lanka

Embarking on the deep blue of ocean shipping between the UK and Sri Lanka? A well-trodden route, this sea corridor links two vibrant economies, carrying everything from textiles to tech components. Key ports like Colombo in Sri Lanka and Southampton in the UK, act as vital connectors, setting the rhythm of international commerce.

Yet, even such established trade links can be fraught with perils for shippers and businesses. Unseen hurdles, nuances in paperwork, or just the sheer patience needed for the long-haul sea journey, shipping isn't for the faint-hearted.

But don't worry, we've got your back. This guide will illuminate the often murky world of maritime shipping, unearthing golden nuggets of practical insights, just for you. From the nitty-gritty of the customs clearance process in both countries, to foolproof packing methods, we’ll steer you clear of common pitfalls and onto smoother shipping lanes. So let's set sail together and discover the best practices for pain-free shipping between the UK and Sri Lanka. Welcome aboard!

Main shipping ports in UK

Port of Felixstowe

Location and volume: In Suffolk, Eastern England, the Port of Felixstowe is the busiest and biggest container port in the country. Handling over 4 million TEU (Twenty-Foot Equivalent Units) per year, it plays a vital role in UK trade.

Key Trading Partners and Strategic Importance: Felixstowe has crucial transit links with Asia, Europe, and America. It's well-known for having the largest container services within the European trading routes.

Context for Businesses: If you're looking to expand to European markets or tap into the massive Asian market, the Port of Felixstowe should definitely be on your radar. Its colossal size and throughput allow it to handle large volumes efficiently.

Port of Southampton

Location and volume: The Port of Southampton is a key player in the UK port industry. It's situated in Southern England and handles over 1.9 million TEU per year.

Key Trading Partners and Strategic Importance: It's a hub for trade routes to Far East Asia, North America, and Europe. It's also one of the UK's leading vehicle-handling ports, moving over 900,000 vehicles annually.

Context for Businesses: If your business deals in automotive or you're targeting markets in the Far East or North America, the Port of Southampton offers immense strategic value.

Port of London

Location and volume: Situated along the River Thames, the Port of London ranks second in the UK for total tonnage, moving approximately 50 million tonnes of products each year.

Key Trading Partners and Strategic Importance: The port maintains key trade links primarily with Europe, and also has important ties with Asia and the Americas. Its strategic importance lies in its versatility, handling a wide range of cargo including oil, containers, and bulk goods.

Context for Businesses: If you need a versatile port that can handle a diverse range of goods and caters to numerous trading routes, the Port of London makes a good choice.

Port of Liverpool

Location and volume: Located on the Northwest coast of England, the Port of Liverpool handles approximately 700,000 TEU per year, making it a significant presence in the UK port sector.

Key Trading Partners and Strategic Importance: The port has key relationships with markets in America, the Far East, and Europe. It also boasts the largest concentration of cold storage facilities in Europe.

Context for Businesses: If your business involves perishable goods or your target market includes the Americas or East Asia, you might find the Port of Liverpool advantageous for its refrigeration options and strategic ties.

Port of Grimsby & Immingham

Location and volume: Situated on the East coast of England, the Port of Grimsby & Immingham is crucial for bulk commodities, with an estimated volume of 60 million tons of goods annually.

Key Trading Partners and Strategic Importance: The port enjoys strong trade links primarily with Europe, particularly in energy commodities such as oil, gas, and renewables.

Context for Businesses: If your aim is to tap into the energy markets or to connect with European markets, the Port of Grimsby & Immingham has a strong presence in this domain, handling a significant portion of the UK's energy commodities.

Port of Dover

Location and volume: The Port of Dover handles up to 2.5 million trucks annually and is the busiest ferry port in Europe, making it an essential gateway for European trade.

Key Trading Partners and Strategic Importance: Predominantly serving European markets, it's also an accessible point for international cruise ships.

Context for Businesses: If you're focusing on fast and efficient land-based shipments within Europe, the Port of Dover excels at this, providing an essential link to the continent.

Main shipping ports in Sri Lanka

Port of Colombo

Location and Volume: Located on the western coast of the island, the Port of Colombo is the largest and busiest port in Sri Lanka. It handles over 7 million TEUs annually, serving as a critical link in the country's import and export activities.

Key Trading Partners and Strategic Importance: This port has an extensive network of connections, trading with major international partners like India, China, and Singapore. The port is a significant transshipment hub in South Asia, particularly for Indian cargo.

Context for Businesses: If you're planning to tap into the Indian market or any other trading hotspot in Asia, the Port of Colombo can be a critical component of your shipping strategy due to its comprehensive connectivity and significant transshipment activity.

Port of Hambantota

Location and Volume: The Port of Hambantota, situated on the southern coast of Sri Lanka, has a lesser volume than its counterpart in Colombo, handling around 1.2 million TEUs per year. Still, its geographical position makes it important for East-West trade routes.

Key Trading Partners and Strategic Importance: Due to its proximity to major Asian shipping lanes, the port has potential trading partners in China, India, and the Middle East. Its strategic importance lies in its potential for handling bulk and breakbulk shipping, with particular facilities for vehicle transshipment.

Context for Businesses: Should your business involve bulky or oversized cargo or if your target market involves India, China or the Middle East, the Port of Hambantota presents a great advantage with its location and specialized facilities.

Port of Galle

Location and Volume: The Port of Galle, located at the island's southwestern tip, has a lesser shipping volume compared to Colombo and Hambantota. However, it remains essential for regional trade and services a wide range of vessels.

Key Trading Partners and Strategic Importance: This port primarily supports the nearby coastal and regional trade, catering to a variety of vessels ranging from small coastal crafts to international bulk carriers. It has an integral role in Sri Lanka's regional trade and fuel bunkering services.

Context for Businesses: If your business requires regional coastal shipping or refueling services, the Port of Galle could fulfill your specific logistical needs, given its diverse capacities and regional connections.

Port of Trincomalee

Location and Volume: Located in the northeastern coast, the Port of Trincomalee serves less volume but stands out with its natural deep-water harbor, one of the finest of its kind in the world.

Key Trading Partners and Strategic Importance: Its key trading partners are generally regional partners due to its smaller volume, but it holds significant strategic importance due to its location near the major East-West shipping route.

Context for Businesses: If your business involves deep-water vessels or sectors such as mining and heavy industry, Trincomalee's deep-water capabilities and proximity to key shipping lanes might make this a viable choice for your logistics process.

Should I choose FCL or LCL when shipping between UK and Sri Lanka?

With sea freight between the UK and Sri Lanka, your choice between Full Container Load (FCL) and Less than Container Load (LCL), commonly known as consolidation, can be a game changer. This crucial decision impacts not just costs and delivery times, but the overall success of your shipping journey.

Understanding the nuances of both will empower you to make thoughtful, informed decisions tailored to your specific needs. Dive into this guide to grasp these options and steer your shipping strategy efficiently.

LCL: Less than Container Load

Definition: LCL, or Less than Container Load, refers to shared shipping, where your cargo is combined with others in a single container. This is a viable option in freight forwarding, particularly when you don't have enough goods to fill an entire container.

When to Use: You should consider LCL shipment when your cargo is comparatively low volume, typically less than 13, 14, or 15 cubic meters.

Example: Let's say you're a specialty tea importer bringing in smaller amounts of unique teas from various estates in Sri Lanka to the UK. Your total volume doesn't warrant the use of an entire container. In this case, LCL shipment would be optimal as it allows you to only pay for the space you actually use.

Cost Implications: Since an LCL freight service means you're sharing container space with others, you pay only for the space your cargo occupies. This can make it more cost-effective for smaller shipments. However, bear in mind that there can be additional handling charges because your goods will need to be loaded and unloaded with others at each port of transit.

FCL: Full Container Load

Definition: FCL, or 'Full Container Load', is an industry term in fcl shipping referring to when an entire container is used solely for a single shipment.

When to Use: If your cargo measures more than 13 or 15 cubic meters (CBM), FCL might be your best choice. It's cost-effective for larger shipments because a full fcl container is priced lower per unit of freight. Plus, your cargo remains sealed in the same container during the entire journey, from the UK to Sri Lanka, offering additional safety.

Example: Consider a business exporting a large shipment of furniture from the UK to Sri Lanka - their cargo volume is 27 CBM. It would be more economical and safer for them to book a 20'ft container (approx 33 CBM) or 40'ft container (approx 67 CBM) rather than dividing this shipment into multiple LCL (Less Container Load) consignments.

Cost Implications: The cost of FCL tends to be higher upfront compared to LCL. However, it becomes more cost-effective with larger volume shipments. The specific costs involved depend on the type of container chosen (20 or 40 feet) and the cargo's size and weight. Additionally, bear in mind that the fcl shipping quote will include not just the sea freight charges, but additional costs like port charges, customs clearance, and documentation fees.

Unlock hassle-free shipping

Choose wisely between consolidation or a full container for your UK-Sri Lanka shipment with DocShipper’s expertise. Our ocean freight professionals can provide tailored guidance considering your cargo size, type, budget, and urgency level. Dodging the obstacles of international shipping has never been easier. Leap into a hassle-free cargo shipping experience engineered just for your business with us. Seize your opportunity for a free estimation and let us pilot your shipment seamlessly across the high seas.

How long does sea freight take between UK and Sri Lanka?

Shipping goods between the UK and Sri Lanka by sea freight typically takes approximately 25 to 40 days, depending on a variety of factors. These elements include the chosen ports in both countries, the weight of the shipment, and the type of goods being shipped. For an accurate, tailored quote that takes into account your specific shipping needs, we recommend reaching out to a freight forwarder like DocShipper.

With regard to specific transit times, below is a text-only table showing average shipping durations between key ports in both countries. As the actual transit times can vary, '30' is used as a placeholder.

| UK Port | Sri Lanka Port | Average Transit Time (Days) |

| London | Colombo | 34 |

| Felixtowe | Colombo | 31 |

| Southampton | Hambantota | 26 |

| Liverpool | Trincomale | 35 |

*Please note that these are only estimates and actual times can vary depending on a range of factors. Don't hesitate to reach out for a more customized quote based on your specific needs.

How much does it cost to ship a container between UK and Sri Lanka?

Determining the precise shipping cost between the UK and Sri Lanka isn't straightforward, as it can oscillate broadly due to several factors. The specific Point of Loading and Destination, the chosen carrier, what your cargo comprises, and even monthly market flux all play key roles in these ocean freight rates.

Nevertheless, stay assured that comprehensive and competitive quotes are our constant commitment. Each case receives custom attention from our dedicated shipping specialists, ensuring the rates you receive not only fit the market conditions but also your specific needs.

Special transportation services

Out of Gauge (OOG) Container

Definition: An Out of Gauge (OOG) container is designed for cargo that doesn't fit within the dimensions of a standard container. It's ideal for exceptionally large or heavy items.

Suitable for: OOG is perfect for irregularly shaped or oversized items that exceed the dimensions of general containers e.g., construction materials, machinery.

Examples: Large industrial machinery or huge artworks, oversized pipes for the construction sector.

Why it might be the best choice for you: If standard container dimensions don't meet your goods' size requirements or you require freedom in packaging for your oversized, awkward freight between UK and Sri Lanka, OOG container shipping might be your solution.

Break Bulk

Definition: Also known as loose cargo load, break bulk is a method where goods are not containerized but shipped individually.

Suitable for: It's typically used for cargo that's too large or heavy to be loaded onto containers.

Examples: Construction equipment, wood planks, steel beams.

Why it might be the best choice for you: If your cargo is heavy, oversized, and can withstand exposure to elements during sea voyage, you might consider using break bulk shipping.

Dry Bulk

Definition: Dry bulk is an un-packaged, loose form of cargo, commonly shipped in large quantities.

Suitable for: Usually used for commodities like grain, coal or minerals.

Examples: Iron ore, coal, cereals, sand, cement.

Why it might be the best choice for you: If you need to transport large quantities of un-packaged loose goods from the UK to Sri Lanka, dry bulk shipping offers a cost-effective solution.

Roll-on/Roll-off (Ro-Ro)

Definition: A Roll-on/Roll-off (Ro-Ro) system is a vessel with built-in ramps that allow cargo, which is driven on and off the ship on their own wheels or using a platform vehicle.

Suitable for: Perfect for any vehicle or machinery that can be rolled on and off the vessel.

Examples: Cars, buses, trucks, construction vehicles, tractors.

Why it might be the best choice for you: If you're looking to transport motorised vehicles, or large static machinery needing a trailer for mobilisation, choosing a ro-ro vessel will provide the most streamlined service.

Reefer Containers

Definition: Reefer containers are refrigerated containers used to ship temperature-sensitive cargo.

Suitable for: Ideal for perishable goods that need to be kept at a steady, cool temperature.

Examples: Fruits, vegetables, meat, seafood, dairy products, pharmaceutical goods.

Why it might be the best choice for you: If your business deals with perishables or goods that require specific temperature conditions during the journey from the UK to Sri Lanka, reefer containers are your go-to option.

Remember, understanding your cargo thoroughly is essential in picking the most suitable shipping method. Do you have specific shipping needs not addressed here? Don't hesitate to reach out to DocShipper. Our team is always ready to provide a tailored shipping solution and a free quote in less than 24 hours.

DocShipper Tip: Air freight might be the best solution for you if:

- You're facing tight deadlines or need rapid delivery. Air freight is your quickest option, which aligns well with the fast-paced business environment.

- Your shipment is relatively small, under 2 CBM. Air freight is ideal for these more compact loads.

- Your cargo's destination isn't easily reached via sea or rail. This makes air freight a viable option, especially given the extensive network of airports available.

Air freight between UK and Sri Lanka

Shipping goods between the UK and Sri Lanka? Consider air freight. Quicker than sea freight, air freight get your shipment in Sri Lanka in no time. This reliability comes at a price, but what if you're shipping small, high-value goods like medical equipment or electronics? Suddenly, air freight makes financial sense. That way, your top-of-the-range smartphones reach the markets before your competition.

However, many shippers drop the ball, often quite literally. Missteps often come in estimating the cost of shipments. Rather than using the right weight formula, shippers misjudge, resulting in nasty surprises on the freight bill. And there's more. Many miss the industry's best practices, meaning their goods cost way more to ship than they expected. Stay tuned, and we'll guide you on how to avoid these common pitfalls in air freight.

Air Cargo vs Express Air Freight: How should I ship?

Struggling to pick between air cargo and express air freight for your UK-Sri Lanka deliveries? It's a pickle, isn't it! Air cargo snuggles your goods into an airline's cargo hold, while express air freight zips them off in a plane dedicated simply for freight—quite the VIP treatment! Let's break this down and see which air shipping method will get your products flying across the skies in the most business-savvy way.

Should I choose Air Cargo between UK and Sri Lanka?

Air cargo from the UK to Sri Lanka is a reliable and cost-effective option, particularly if budgetary considerations are forefront for your business. It's an especially attractive choice if your freight exceeds 100/150 kg (220/330 lbs).

Key players like British Airways and SriLankan Airlines offer regular scheduled flights, ensuring a more predictable delivery process. However, keep in mind that fixed schedules might result in longer transit times. Carefully considering the specifics of your shipment and business can help determine if air cargo is the best choice for you.

Should I choose Express Air Freight between UK and Sri Lanka?

Contemplating shipping between the UK and Sri Lanka and not sure how to go round it? Express Air Freight, offered by internationally recognized courier firms like FedEx, UPS, or DHL, can be a game changer, especially for shipments under 1 CBM or 100/150 kg.

These dedicated cargo planes - with no passengers - offer faster delivery and fewer restrictions on goods you're shipping. So, if you're dealing with urgent or small freight, this high-speed delivery option might be just right for your business.

Main international airports in UK

London Heathrow Airport

Cargo Volume: It is the largest cargo volume airport in the UK, handling over 1.7 million metric tonnes per year.

Key Trading Partners: Some of London Heathrow's top trading partners include the United States, Germany, and France.

Strategic Importance: With its location in the capital, it is a significant hub for both cargo and passenger traffic, making it incredibly strategic for import/export operations.

Notable Features: It offers dedicated facilities for handling perishable goods and features the latest in freight security systems.

For Your Business: If speed and location are paramount to your shipping strategy, London Heathrow's high cargo volume and strategic location could help your business maintain a smooth flow of goods.

Manchester Airport

Cargo Volume: Manchester Airport handles over 120,000 tonnes of cargo per year.

Key Trading Partners: The airport's key cargo trading partners include the United States, China, and Italy.

Strategic Importance: Manchester Airport serves North England, potentially linking your business to a vibrant and less crowded cargo route.

Notable Features: It is equipped with extensive warehousing and handling facilities catering to varied types of cargo.

For Your Business: Manchester Airport's comprehensive cargo services and accessibility could provide your business with greater flexibility in managing your shipments to Northern England.

East Midlands Airport

Cargo Volume: East Midlands Airport handles over 360,000 tonnes of cargo annually.

Key Trading Partners: Notably, they have strong cargo links with countries like Germany, France, and the USA.

Strategic Importance: It's recognized as the UK's most important cargo airport after London Heathrow, due to its central location in the UK.

Notable Features: The airport has a dedicated cargo village, including warehouses with two million square feet of operational space.

For Your Business: If you primarily ship goods to the central UK, using East Midlands Airport can put your products right in the heart of the country, reducing subsequent road freight times.

Edinburgh Airport

Cargo Volume: Handling over 40,000 tonnes of cargo per year.

Key Trading Partners: The airport's key partners for cargo include the United States, Spain, France, and more.

Strategic Importance: As Scotland's busiest airport, it plays a crucial role in connecting the region to the rest of the world.

Notable Features: It offers diverse facilities catering to pharmaceuticals, livestock, high-value goods, and dangerous goods.

For Your Business: For businesses connected with Scotland, using Edinburgh Airport can help you link directly with a substantial Scottish market.

Stansted Airport

Cargo Volume: Stansted handles over 250,000 tonnes of cargo annually.

Key Trading Partners: Importantly, it maintains strong trade links with Spain, USA, China, and Hong Kong.

Strategic Importance: Located in London, Stansted offers a beneficial alternative to Heathrow due to less congestion.

Notable Features: Stansted's cargo facilities include a vast perishables handling centre.

For Your Business: Stansted Airport could provide a more flexible shipping schedule for your business, given the lower congestion compared to Heathrow.

Main international airports in Sri Lanka

Bandaranaike International Airport

Cargo Volume: With over 850,000 metric tons of cargo processed annually.

Key Trading Partners: Major trading partners include China, India, the Middle East, and various European countries.

Strategic Importance: Bandaranaike International is Sri Lanka's largest airport and serves as a hub for both passenger and cargo traffic for many global airlines. It's conveniently located in Katunayake, approximately 32.5 km north of Colombo.

Notable Features: Apart from comprehensive air cargo services, it offers modern storage facilities, including cold storage, and 24-hour operational capabilities.

For Your Business: Its vast network can provide a quicker and more efficient way to reach numerous global markets. If your goods need to be shipped swiftly and your business trades largely with Asian, European, or Middle Eastern countries, Bandaranaike International could be a vital part of your shipping strategy.

Mattala Rajapaksa International Airport

Cargo Volume: Capacity to handle up to 50,000 metric tons of cargo per year.

Key Trading Partners: Main trading partners involve India, the Middle East, and East Asian nations.

Strategic Importance: It's the second-largest international airport in Sri Lanka and is located in the southern Hambantota district, making it perfect for businesses located in or targeting the southern Sri Lankan market.

Notable Features: Equipped with a dedicated cargo area and facilities to handle standard, perishable, and transshipment cargo. It also has an available capacity, promising shorter waiting times.

For Your Business: Given its geographical location and lesser congestion, Mattala Rajapaksa is an excellent option for businesses looking for an efficient shipping strategy with lower turnaround times, especially if trading with India, Middle East, and East Asian nations.

How long does air freight take between UK and Sri Lanka?

On an average, air freight shipping between the UK and Sri Lanka spans around 4-6 days. However, this is a pretty general window and the actual transit time can often be subjected to a number of key factors. These include the specific airports of departure and destination, weight of the goods being shipped, and nature of your cargo. For exact shipping times tailored to your unique needs, seeking advice from freight forwarding experts like DocShipper would be a wise choice.

How much does it cost to ship a parcel between UK and Sri Lanka with air freight?

Shipping costs for air freight between the UK and Sri Lanka average between £3 to £6 per kilogram. However, it's vital to note that the exact cost is influenced by various factors including distance from departure and arrival airports, parcel dimensions and weight, and nature of goods. Hence, a fixed price is not feasible.

Understand that our team is here to ensure you receive the best possible rates, as we provide custom quotes for each transaction. So, don't hesitate - contact us and receive a free quote in less than 24 hours.

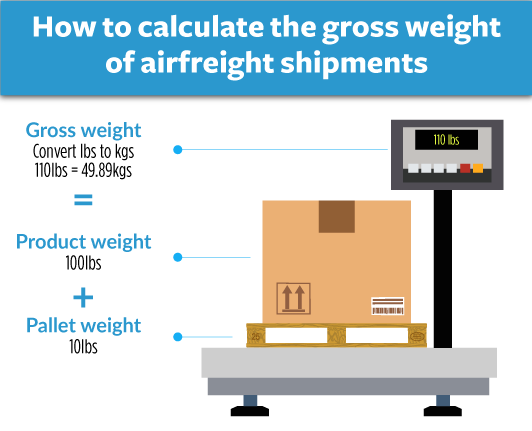

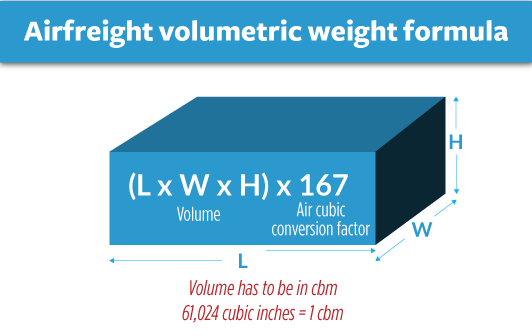

What is the difference between volumetric and gross weight?

Gross weight refers to the actual physical mass of your shipment, while the volumetric weight, also known as dimensional weight, takes into account the amount of space your shipment occupies in relation to its weight. Saying it simply, gross weight is the actual weight of your shipment, and volumetric weight is the size of your shipment.

To calculate the Gross weight in air freight shipping, you simply weigh your package. As for the calculation of Volumetric weight for air cargo, the International Air Transport Association (IATA) defines it as (Length x Width x Height in cm) / 6000. For Express Air Freight, the formula differs slightly, it’s (Length x Width x Height in cm) / 5000.

Let's use an example to illustrate, suppose your shipment is a box with dimensions 50cm x 40cm x 30cm and the actual weight is 12kg. The volumetric weight for Air cargo would be (50 x 40 x 30) / 6000 = 10kg, and for Express Air Freight, it would be (50 x 40 x 30) / 5000 = 12kg. In lbs, this equates to approx. 22lbs and 26lbs respectively.

It's imperative to understand these calculations as often, freight charges are determined based on either the gross weight or the volumetric weight, whichever is higher. This ensures fair pricing for both lightweight, bulky cargo, and small, heavy shipments, and helps shippers plan and budget their shipments accordingly.

DocShipper tip: Door to Door might be the best solution for you if:

- You prioritize ease and a hassle-free shipping experience. Door-to-door services manage the entire process, from collection to final delivery.

- You appreciate the efficiency of having one dedicated contact. With door-to-door, a single agent is responsible for overseeing all elements of your shipment.

- You want to limit the number of times your cargo is transferred. Door-to-door services minimize the switches between various transport methods, lowering the chances of damage or loss.

Door to door between UK and Sri Lanka

Navigating international shipping can be daunting, that's where door-to-door service shines! This is a comprehensive service, covering pickup, transport, customs, and delivery from the UK to Sri Lanka. Convenience, time saving, and easy tracking - it bundles all that businesses need! So, grab your explorer's hat, let's dive into the nitty-gritty of door-to-door shipping!

Overview – Door to Door

Shipping between the UK and Sri Lanka can feel like navigating a maze. But with door to door shipping service, that's a worry of the past. Offering unmatched convenience, it handles all logistics from sourcing to delivery, mitigating any potential pitfalls. However, its premium nature may inflate costs.

Nevertheless, despite the price tag, it's a popular choice amongst DocShipper's clientele. You could say it takes the 'ship' out of 'shipping', offering a stress-free solution. More than just a transportation method, it's a preferred business strategy. So, why grapple with complexities when you can sit back and let professionals handle it all?

Why should I use a Door to Door service between UK and Sri Lanka?

Ever tried juggling flaming torches while balancing on a unicycle? That's what managing the logistics of delivering goods from the UK to Sri Lanka can feel like. Thankfully, a door-to-door service is your safety net. Here are five reasons why you might choose this hassle-free service.

1. No Logistics Nightmare: A door-to-door service eliminates the stress of logistics. With this service, your goods are picked from their starting point and delivered directly to the final destination. Gone are the days of liaising with multiple carriers. Time to bid farewell to your logistics demons and focus on what you do best.

2. Lightning-Fast Delivery: Urgent shipment? Need it there yesterday? No worries. Door-to-door services prioritize timely delivery, so your shipment arrives when it's needed. It's your personal time machine for freight.

3. Specialized Care: Have sophisticated equipment, high-value goods, or complex cargo? Door-to-door services ensure your cargo gets the VIP treatment it deserves. They handle your shipment with care, ensuring it arrives in the same condition it left.

4. Convenience: It's as convenient as getting your morning coffee. Your shipping service fully manages the trucking from origin to destination. They handle all the shipping nuances, so you don't have to.

5. Uninterrupted Chain of Responsibility: With door-to-door service, one company takes responsibility from start to finish, ensuring tighter control over the supply chain. Fewer handovers mean fewer mistakes, and that's music to your business's ears.

Balancing on a unicycle, or efficient shipping? The choice seems clear with door-to-door services.

DocShipper – Door to Door specialist between UK and Sri Lanka

Discover the ease of door-to-door shipping from the UK to Sri Lanka with DocShipper. We offer a hassle-free experience, handling everything from packaging to transportation, utilizing air, sea, road, or rail shipping methods. Rest easy as we navigate the complexities of customs.

Benefit from having a dedicated account executive guiding you through each step. Reach out to us for a free cost estimate within 24 hours or feel free to tap into our experts' knowledge through a free consultation. Let us simplify your international shipping needs!

Customs clearance in Sri Lanka for goods imported from UK

Navigating customs clearance in Sri Lanka for goods from the UK can feel like a maze of paperwork and potential snags. This intricate process can spring surprises in the form of unforeseen fees or goods getting stuck at the border.

Crucial to your freight journey is grasping customs duties, taxes, quotas, and licenses. But no worries - that's where we come in. As we dive into the following sections, we'll untangle the complexities and guide you through every step of the way.

Remember, DocShipper is ready to assist you with any type of goods, anytime, anywhere. Just provide the origin, value, and the HS code of your goods, and our team will help you budget your export project. Straightforward, isn't it? Get in touch now and let's get your goods moving!

How to calculate duties & taxes when importing from UK to Sri Lanka?

When it comes to importing goods from the UK to Sri Lanka, understanding the estimated duties and taxes involved is key to avoiding unexpected costs and delays. To calculate these duties, you'll need to gather specific information including the country of origin, the HS codes of the products, the customs value, and the applicable tariff rate. Additionally, be aware that there may be other taxes and fees that apply depending on the nature of the products.

The initial step in this process is identifying the country in which your goods were manufactured or produced because this directly impacts the customs duties calculation. With this information in hand, you'll be better equipped to navigate the complexities of international shipping and keep your freight forwarding operations running smoothly.

Step 1 - Identify the Country of Origin

Identifying the Country of Origin is your first footprint in the smooth import journey from the UK to Sri Lanka. Here's why this step shines:

1. Customs Duties Depend on It: Based on the trade agreements, goods originating from the UK can benefit from reduced or exempt customs duties.

2. Trade Regulations Vary: Sri Lanka may have specific import regulations for goods arriving from the UK - knowledge saves from unexpected issues.

3. Knowing Fees: Accurate country classification clarifies the duties and taxes you need to prepare for.

4. Smooth Clearance: A clear-cut Country of Origin helps avoid unnecessary customs delays.

5. Trade Agreement Benefits: Sri Lanka and the UK have several trade agreements that could affect your customs duties. For example, the Generalized System of Preferences (GSP) allows tariff reductions for specific goods.

Take into account the import restrictions Sri Lanka has - they cover some pharmaceuticals, cosmetics, and more. Importers found non-compliant could face penalties or cargo hold-ups. Being familiar with these factors equips you for a streamlined, knot-free import process, and gives your business a necessary edge. Turn over every stone, and you'll pass through the customs gates with ease.

Step 2 - Find the HS Code of your product

An essential step in international shipping is identifying the Harmonized System (HS) Code of your product. The HS code, agreed upon by most countries worldwide, is a six-digit number used to classify all traded goods. It is crucial in determining the tariffs, regulations, and other guidelines associated with your shipped product.

Engaging your supplier in the process of finding the HS code is usually the easiest way forward. Suppliers typically have a good handle on the products they export and are familiar with the corresponding guidelines and regulations such as the HS code.

However, if this route isn't feasible, there's no need to worry. Here's a simplified step-by-step process you can use. Firstly, find a reliable lookup tool, an excellent option being the Harmonized Tariff Schedule. Secondly, input the product’s name in the search bar. Lastly, look into the Heading/Subheading column for the HS code.

Note of caution: The importance of accuracy when selecting an HS Code cannot be overstated. A mistaken code could lead to significant delays, strict customs inspections, or even financial penalties.

Here's an infographic showing you how to read an HS code. This information should get you well on your way to understanding and leveraging the HS classification system to effectively ship your goods internationally.

Step 3 - Calculate the Customs Value

Sure, let's talk customs value. This isn't just the price tag on your goods. It’s a combination of the product price, shipping costs, and insurance charges, also known as the CIF (Cost, Insurance and Freight).

To make this more digestible, let’s imagine you ship 500 t-shirts from the UK to Sri Lanka with each shirt costing $10. Your shipping cost stands at $500 and the insurance amounts to $50. Here, your customs value isn't $5000 (500 shirts x $10), but actually $5550 ($5000 + $500 + $50). This sum influences the customs duties and taxes applied by Sri Lanka's customs authority, impacting the final cost of getting your t-shirts to the market. It's essential to calculate this accurately to avoid any unexpected expenses.

Step 4 - Figure out the applicable Import Tariff

An import tariff is a tax imposed on goods when they are moved across international borders. This tariff is often based on a percentage of the product's value, also known as ad valorem tariff, which is the type predominantly used by Sri Lanka.

To discover the applicable tariff rate for your goods, use the UK Integrated Online Tariff tool. Your first step is to locate the HS code identified earlier for your product in this tool.

For instance, let's assume you're importing ceramic tableware (HS code: 691200). The listed tariff might be 10%. If your goods have a CIF (Cost, Insurance, and Freight) value of $10,000 from the UK, you would calculate the import duty as 10% of $10,000, resulting in a tariff of $1,000.

Having this knowledge in hand, you'll be better equipped to financially plan your overall shipping costs and avoid any potential surprises. This example demonstrates a simplified scenario, so consider other applicable customs charges and taxes while calculating your final costs.

Step 5 - Consider other Import Duties and Taxes

When shipping goods from the UK to Sri Lanka, besides the standard tariff rate, it's important to assess any additional import duties and taxes. These vary based on the origin country and nature of the product.

One potential charge is the excise duty. This is often applied to goods like alcohol or tobacco, although it can be relevant to other types of goods too.

Anti-dumping taxes are another consideration. For instance, if a company is exporting steel at a price lower than the normal value in Sri Lanka, an anti-dumping duty could be imposed to balance the situation.

Most critical among these duties, however, is the Value Added Tax (VAT). It's crucial to have a clear understanding of how VAT is calculated to avoid any surprises. Let's use an example for clarity: Suppose your total cost for imported goods (including insurance and freight) is $10,000. If Sri Lanka's standard VAT rate is 15%, you would have an additional VAT amount of $1,500.

Remember, these are just examples and actual rates can vary. Knowledge of these additional responsibilities helps in accurate cost estimation and smooth clearance of goods at customs. Even so, it can be complex, and it's recommended to work with a trusted freight forwarder or legal adviser to ensure you're fully informed and prepared.

Step 6 - Calculate the Customs Duties

In Step 6 - Calculate the Customs Duties, you'll determine your total charges when importing goods from the UK to Sri Lanka. The formula for calculation: Customs Duties = Customs Value x Duty Rate. Let's put it to practice:

1. Say you're importing goods valued at $400 with a duty rate of 15%, but no VAT. Your Customs Duties would be: $400 x 0.15 = $60.

2. If you're importing goods worth $1,000 with a duty rate of 8% and a VAT rate of 12%, your duties are: ($1,000 x 0.08) + ($1,000 x 0.12) = $200.

3. If you're importing goods valuing $5,000, slapped with a duty rate of 5%, VAT rate of 15%, an anti-dumping tax of 3%, and an Excise Duty of 10%, the formula would add all: ($5,000 x 0.05) + ($5,000 x 0.15) + ($5,000 x 0.03) + ($5,000 x 0.10) = $1,350.

With DocShipper, you don't need to worry about complexities of custom duties. As your logistics partner, we offer customs clearance services globally, ensuring you're never overcharged. Receive a free quote in less than 24 hours - leverage our expertise for your peace of mind.

Does DocShipper charge customs fees?

While DocShipper, acting as a custom broker in UK and Sri Lanka, does handle customs clearance, it does not charge the actual customs duties - these go directly to the government. Think of it like paying for someone to queue and fill forms for you at a government office. You'd still have to pay the actual government fees yourself.

What you're paying DocShipper for is navigating all the bureaucratic hassle on your behalf. We provide all the documents produced by the customs office, ensuring full transparency so you only pay what's levied by customs.

Contact Details for Customs Authorities

Required documents for customs clearance

Navigating the labyrinth-like procedure of customs clearance can feel like a formidable task. In this section, we'll decode crucial documents including the Bill of Lading, Packing List, Certificate of Origin, and the often puzzling Documents of Conformity (CE Standard). We aim to transform these challenges into streamlined processes for your business, paving the path for smooth and hassle-free international shipping.

Bill of Lading

Picture this: Your shipping container packed with high-value goods leaves the UK shores, destined for Sri Lanka. The Bill of Lading is your golden ticket, a legally binding document confirming the cargo’s handover from the seller to the carrier. Think of it as your shipment's passport, detailing weight, dimensions, destination and more; it's essential for a hassle-free customs clearance process.

Got a tight schedule? Opt for the convenience of an electronic (or telex) release to speed up cargo release, once paid in full, reducing paperwork churn. If flying goods, bear in mind the AWB is your go-to document instead. Without these, your valuable cargo might face a vacation at the customs office! So, keep your documents in order and the transition from UK to Sri Lanka will be smooth sailing (or flying).

Packing List

Navigating international shipping can have its hurdles, and the Packing List is your trusted friend to avoid potential pitfalls. Whether you're shipping by sea or air from the UK to Sri Lanka, preparing an accurate Packing List is your responsibility. It details every item in your shipment, from weight to dimensions, adding transparency to your transaction and assisting in easy customs clearance.

Imagine you're shipping Ceylon tea sets to Birmingham; an accurate list helps avoid unexpected fees and delays, thereby ensuring that your shipment reaches your customers on time. So don't forget, accuracy equals efficiency when it comes to your Packing List. It truly is a simple yet powerful tool in your shipping armor!

Commercial Invoice

Navigating customs between the UK and Sri Lanka can challenge even seasoned shippers, but getting your Commercial Invoice right plays a key role. It’s your official transaction record, detailing product type, quantity, price - essential for determining customs duties.

Avoid hiccups by ensuring alignment with your Bill of Lading or Airway Bill. Misaligned descriptions or inconsistent HS codes are red flags for customs officials! Here's a tip: when shipping artisan British teas, clearly distinguish between your Earl Grey and Herbal blends on the Commercial Invoice. Exact items classifications can expedite clearance and avoid delays. Your goal is a hassle-free, timely shipment - precision in your paper trail is a positive step towards it.

Certificate of Origin

Navigating the labyrinth of customs can be tricky, especially when you're shipping goods between Sri Lanka and the UK. But don't fret—you've got the Certificate of Origin in your arsenal. This document, a declaration of your goods' birthplace, can unlock the door to preferential customs duty rates.

Remember, it isn't just a piece of paper; it's a cost-saving tool. Let's say you're exporting handmade pottery from Stoke-on-Trent to Colombo. Mention 'United Kingdom' on your Certificate of Origin, and you might just benefit from lower duty rates, which means more profit in your pocket. Always ensure it’s correctly filled, for every journey, for every consignment. The 'country of manufacture' field? More significant than you might think. Happy shipping!

Get Started with DocShipper

Tired of intricate customs procedures between the UK and Sri Lanka? Shift all your worries onto us! At DocShipper, we streamline every step of your shipment's customs clearance, saving you time, effort and preventing costly hang-ups. Ready to simplify shipping? Contact us. Our experienced team can provide a free, no-obligation quote within 24 hours. Cast off your customs concerns and chart a smoother course with DocShipper!

Prohibited and Restricted items when importing into Sri Lanka

Understanding what you can't ship to Sri Lanka is crucial to avoid customs nightmares and unexpected costs. This section demystifies Sri Lanka's import rules, helping you steer clear of trouble and ensuring your goods arrive timely and hassle-free. Let's delve into the subject to make your shipping experience smoother.

Restricted Products

- Live Plants and Animal Products: You'll need to secure an import permit from the Department of Agriculture in Sri Lanka. They'll guide you through the whole process and make everything clearer.

- Pharmaceuticals and Narcotics: The country is quite strict with these. For importing such items, you must get a license from the National Medicines Regulatory Authority.

- Precious Metals, Gems and related items: If you're dealing with these, you've got to apply for an import license from the National Gems and Jewelry Authority. They've got you covered.

- Arms and Ammunition: Looking to import arms and ammunitions? You have to obtain a permit from the Ministry of Defense.

- Cultural goods, art, and antiquities: You have to apply for an import license from the Department of Archaeology. They're keen to protect the country's rich history.

- Products of Animal Origin: Like the Live Plants, you have to secure an import permit from the Department of Animal Production and Health.

Please note that changes may occur in how these applications are processed due to regulations. Always check the latest from their official websites.

Prohibited products

- Narcotic drugs and psychotropic substances

- Inflammatory material (e.g. ideologically offensive content)

- Obscene publications, photographs, films, and sculptures

- Counterfeit currency and forged documents

- Material infringing on copyright

- Fresh meat, fish, and vegetables

- Live plants and harmful biotic materials

- Endangered species of animals or plants, whether alive or dead

- Radioactive materials

- Pesticides that are not licensed for use

- Hazardous and flammable substances

- Used tires and certain kinds of plastics

- Unregistered pharmaceutical products

- Chemical weapons and related substances.

Are there any trade agreements between UK and Sri Lanka

Yes, there exists a trade relationship between UK and Sri Lanka, based on Generalised Scheme of Preferences Plus (GSP+) agreement. However, discussions for a full-fledged Free Trade Agreement (FTA) are ongoing. Although there are no significant infrastructure projects currently, being aware of such future initiatives can bring untapped opportunities for your exports to Sri Lanka. Stay updated on progress in negotiations and align your business strategy to thrive amidst these evolving trade conditions.

UK - Sri Lanka trade and economic relationship

The UK and Sri Lanka share a long history, dating back to the colonial era, fostering a deep-rooted economic alliance. Key sectors of trade include textiles, tea, and precious stones, with Sri Lanka's gem industry particularly reliant on the UK market. UK investment in Sri Lanka was valued at more than £300 million in 2021, displaying a firm commitment to elevating their mutual growth.

The trade numbers are equally appealing; in 2023, total trade and services between the two countries reached £1.4 billion. This meaningful exchange of commodities not only enriches both economies but also strengthens their bilateral ties. Boasting an average yearly increase in trade volume, partially attributable to the UK leading as a top investor in Sri Lankan growth sectors, both nations are committed to expanding this prosperous partnership. With reciprocity at its core, this economic camaraderie sets a bright trajectory for future growth.

Your Next Step with DocShipper

Looking to bridge the logistics gap between the UK and Sri Lanka? Overwhelmed by customs obligations, duties, or transport peculiarities? Hand over your shipping stress to us at DocShipper! Our experienced team will streamline your logistics, giving you peace of mind and more time to focus on your business. Don't let shipping complexities slow you down. Let's conquer your international shipping together. Contact us now!

Additional logistics services

Dive into our wider logistics offerings! Beyond freight and customs, discover how DocShipper takes comprehensive charge, streamlining your entire supply chain for a worry-free shipping experience. Let’s unravel this process so you can stay ahead!

Warehousing and storage

Struggling to find solid warehousing in the UK and Sri Lanka? Trust us, you're not alone. Keeping goods like wine or pharmaceuticals at the right temperature can be trickier than a London bus route. Our reliable warehousing solutions offer the just-right conditions your precious freight needs.

Packaging and repackaging

Ensuring your goods traverse the UK-Sri Lanka route intact calls for impeccable packaging and repackaging. Our adept agents, proficient in handling a diverse range of products, from ceramic ware to delicate tea leaves, will finesse each process. Thus, ensuring your consignments withstand the rigours of international transit and arrive at their destination in perfect condition.

Cargo insurance

Mishaps happen! While fire insurance offers some protection, it doesn't account for all potential risks during cargo transportation. Opting for cargo insurance, which is similar in ways yet different from fire insurance, provides comprehensive coverage including damages from accidents, theft, or natural disasters.

For example, your shipment could be damaged due to severe weather on its way to the port. The cargo insurance would cover this. It's all about safeguarding your shipment against unforeseen complications.

Supplier Management (Sourcing)

Want a seamless supplier management experience between the UK and Sri Lanka? With DocShipper's expertise, you can effortlessly tap into productive regions like Asia or Eastern Europe. Language barriers and procurement processes? They're no sweat when you've got our team on your side. We find the suppliers and manage the whole buying procedure, simplifying your journey from sourcing to shipping.

Personal effects shipping

Relocating and concerned about your delicate or hefty items from UK to Sri Lanka? Our Personal Effects Shipping has you covered. Skilfully we handle Grandma's fine china or that bulky heirloom clock, ensuring they reach their destination intact. Expertise powered by flexibility - whether its air or sea freight, your possessions are in secure hands.

Quality Control

Quality Control is your secret weapon when shipping between the UK and Sri Lanka. It minimises risk by ensuring your goods meet both countries' standards before they journey half-way around the world. Think of the toy manufacturer who avoided a recall thanks to our rigorous inspections catching a paint-quality issue. Or the tech-startup that nixed needless costs when our team identified a component mismatch. Don't leave the quality to chance.

Product compliance services

Shipping internationally? Ensuring product compliance with your destination's regulations is crucial. Missteps can lead to costly penalties, shipment delays, or goods being held at customs. With our Product Compliance Services, you're not alone. We conduct meticulous lab tests to certify that your goods meet all legal requisites, avoiding unpleasant surprises at the end of your journey.

FAQ | For 1st-time importers between UK and Sri Lanka

What is the necessary paperwork during shipping between UK and Sri Lanka?

The essential paperwork for UK to Sri Lanka shipping involves a few key documents. We at DocShipper take care of the Bill of Lading for sea freight or the Air Way Bill in case of air freight, so you don't have to worry about that. On your side, the documents needed are the packing list and the commercial invoice foundationally. Depending on the nature of the goods you're transporting, other documents such as Material Safety Data Sheets (MSDS) or specific certifications may also be necessary. It's all about ensuring your shipment meets all international customs and shipping requirements.

Do I need a customs broker while importing in Sri Lanka?

Yes, we highly recommend using a customs broker when importing goods into Sri Lanka. The process is quite intricate with numerous steps to follow and specific, mandatory documents to provide. These complexities can lead to delays and potential penalties for non-compliance. At DocShipper, we understand these challenges and offer our expertise to represent your cargo during customs clearance. We handle the majority of shipments, navigating bureaucratic processes and paperwork on your behalf, which can help ensure your goods pass smoothly through customs. This service is not only more efficient but helps you avoid unforeseen issues that may arise during the import process.

Can air freight be cheaper than sea freight between UK and Sri Lanka?

Determining whether air freight is cheaper than sea freight from the UK to Sri Lanka depends on various factors like the route, weight, and volume of your cargo. Generally, if your shipment is less than 1.5 Cubic Meters or weighs under 300 kg (660 lbs), you might find air freight to be a viable option. Regardless, at DocShipper, our dedicated team continually works to provide you with the most cost-effective solution, considering the unique requirements of your shipping needs. This way, you always get the best value for your money, whether you choose air or sea freight.

Do I need to pay insurance while importing my goods to Sri Lanka?

While insurance isn't a compulsory element during local or international shipments, we at DocShipper highly advise considering it. Shipment processes inevitably carry inherent risks, such as damage, loss, or theft. Insuring your goods provides a safety net in these unpredictable circumstances, ensuring you won't bear heavy losses. Therefore, for smooth imports into Sri Lanka, even though insurance isn't obligatory, it's a smart business move.

What is the cheapest way to ship to Sri Lanka from UK?

Given the geographical distance between the UK and Sri Lanka, sea freight is usually the most cost-effective method for shipping large or heavy goods. However, for smaller items or urgent deliveries, air freight may be a more practical choice. At DocShipper, we review your specific needs to propose the most efficient and economical shipping solutions.

EXW, FOB, or CIF?

Choosing between EXW, FOB, or CIF largely hinges on your relationship with your supplier, who may not specialize in logistics. Thus, it's advisable to rely on freight forwarders like us at DocShipper for international freight and destination processes. Suppliers typically sell under EXW (right from their factory) or FOB (inclusive of all charges up to the origin terminal). However, we're equipped to offer you a door-to-door service, handling all potential logistical complexities, regardless of your contracted Incoterms. By parceling out these responsibilities to us, you're free to focus on your core business operations while we ensure your shipment reaches its destination smoothly and efficiently.

Goods have arrived at my port in Sri Lanka, how do I get them delivered to the final destination?

When your goods reach their destination port in Sri Lanka, under CIF/CFR incoterms, you'll need a customs broker or freight forwarder for goods clearance and final delivery, including paying import charges. Alternatively, our DocShipper team offers DAP incoterms service, where we manage the entire process for you. Please confirm these details with your dedicated account executive for clarity.

Does your quotation include all cost?

Absolutely, our quotation encompasses all costs, with the exception of duties and taxes at your destination – these can be estimated for you by your dedicated account executive. At DocShipper, we are committed to transparency and strive to avoid hidden fees, ensuring no unpleasant surprises.