Freight shipping between the UK and Spain: Rates -Transit time – Duties & taxes

Why did the parcel go to therapy? Because it had a lot of baggage! Jokes aside, if you're finding freight transport between the UK and Spain a complex haul, you're not alone. The maze of understanding rates, transit times and troubling customs regulations can be enough to make anyone's head spin.

Our comprehensive guide will shine a light on this daunting process, encapsulating various types of freight options and their advantages, the nitty gritty of customs clearance, and a deep dive into duties and taxes. Expect detailed advice targeted specifically for businesses looking to venture or expand into this shipping route. If the process still feels overwhelming, let DocShipper handle it for you! As an established international freight forwarder, we juggle every step of your shipping process, transforming these daunting challenges into success stories.

Which are the different modes of transportation between UK and Spain?

Non extrait

Need help with your shipment?

Need assistance with your shipment? Dont hesitate to contact us even for a simple question. Choose the option that suits you

Live chat with an expert Chat on WhatsApp Free Quote 24hHow can DocShipper help you

Sea freight between UK and Spain

In the intricate dance of international freight, shipping goods between the UK and Spain can feel like performing the Bolero in a maze. There’s a tremendous scope, with both nations boasting robust trade ties. Ports such as Felixstowe in the UK and Algeciras in Spain form crucial transport nexus, allowing smooth flow of commodities amid their buzzing industrial landscapes. Then, there’s the eye-catching affordability of ocean shipping, especially for hefty volumes. But before you rush to lasso your goods onto the next sea freight, consider this: the ocean’s route, compared to air or road, isn’t the fastest. Imagine a tortoise pitted against a hare, only sans the sudden nap.

Sounds complicated? It’s because it can be. Shipping between these countries often perplexes even the best in business, leading to nagging mistakes. But don’t fret. Our guide’s got you covered – we will delve deep into the gritty details, discussing practical know-hows and ‘ship-smart’ strategies to simplify your sea freight expedition. It’s a sailor’s map for the modern shipper, cutting through the fog of freight complexities. Let’s set sail together.

Main shipping ports in UK

Port of Felixstowe

Location and Volume: Located on the southeastern coast of Suffolk, England, the Port of Felixstowe is known for being the busiest container port in the UK, handling over 40% of the country’s container cargo – reaching around 4 million Twenty-Foot Equivalent Units (TEU) per year.

Key Trading Partners and Strategic Importance: Key trading partners include countries across Europe and Asia, notably China, India, and many Northern European countries. As one of the most naturally deep ports, it has significant strategic importance, offering superb access to the highly populated regions of the UK as well as mainland Europe.

Context for Businesses: If you’re looking to distribute goods within the UK and Europe broadly, Felixstowe can be a linchpin in your shipping strategy, with its extensive rail and road connections providing seamless onward transport.

Port of Southampton

Location and Volume: Based in the southern English county of Hampshire, the Port of Southampton boasts the second largest shipping volume in the UK, seeing over 1.9 million TEU annually.

Key Trading Partners and Strategic Importance: It has a strong connection with Far East trade routes, its key trading partners including China, USA, and other nations in Southeast Asia. Being the UK’s number one port for automotive trade, it holds considerable economic relevance.

Context for Businesses: For businesses operating in the automotive sector, or increasingly connected industries like high-tech manufacturing, its port centric logistics offering, and state-of-the-art vehicle handling capabilities make Southampton an attractive shipping endpoint.

Port of London

Location and Volume: The Port of London, based on the River Thames, is an essential logistic hub, dealing with over 50 million tonnes of import/export goods each year.

Key Trading Partners and Strategic Importance: Key trading partners primarily fall across Europe, North and South America, and parts of Asia. Besides its strategic importance as the gateway into London, it serves a vast hinterland through the UK’s largest concentration of warehousing space.

Context for Businesses: If your operations demand proximity to the UK’s capital city and utilising storage space for goods, the Port of London could be a key part of your shipment strategy.

Main shipping ports in UK

Port of Felixstowe

Location and Volume: Located on the southeastern coast of Suffolk, England, the Port of Felixstowe is known for being the busiest container port in the UK, handling over 40% of the country’s container cargo – reaching around 4 million Twenty-Foot Equivalent Units (TEU) per year.

Key Trading Partners and Strategic Importance: Key trading partners include countries across Europe and Asia, notably China, India, and many Northern European countries. As one of the most naturally deep ports, it has significant strategic importance, offering superb access to the highly populated regions of the UK as well as mainland Europe.

Context for Businesses: If you’re looking to distribute goods within the UK and Europe broadly, Felixstowe can be a linchpin in your shipping strategy, with its extensive rail and road connections providing seamless onward transport.

Port of Southampton

Location and Volume: Based in the southern English county of Hampshire, the Port of Southampton boasts the second largest shipping volume in the UK, seeing over 1.9 million TEU annually.

Key Trading Partners and Strategic Importance: It has a strong connection with Far East trade routes, its key trading partners including China, USA, and other nations in Southeast Asia. Being the UK’s number one port for automotive trade, it holds considerable economic relevance.

Context for Businesses: For businesses operating in the automotive sector, or increasingly connected industries like high-tech manufacturing, its port centric logistics offering, and state-of-the-art vehicle handling capabilities make Southampton an attractive shipping endpoint.

Port of London

Location and Volume: The Port of London, based on the River Thames, is an essential logistic hub, dealing with over 50 million tonnes of import/export goods each year.

Key Trading Partners and Strategic Importance: Key trading partners primarily fall across Europe, North and South America, and parts of Asia. Besides its strategic importance as the gateway into London, it serves a vast hinterland through the UK’s largest concentration of warehousing space.

Context for Businesses: If your operations demand proximity to the UK’s capital city and utilising storage space for goods, the Port of London could be a key part of your shipment strategy.

Main shipping ports in Spain

Port of Barcelona

Location and Volume: Located on the northeastern coast of Spain, the Port of Barcelona is an essential hub for Mediterranean and European trade, with a shipping volume of around 3 million TEU.

Key Trading Partners and Strategic Importance: The Port of Barcelona maintains strong trading partnerships with destinations all over the world, including key European countries, North America, and Asia. It’s identified as the best Europort for connecting Mediterranean arch routes and Atlantic arch lanes.

Context for Businesses: If you’re looking to extend your reach to Mediterranean or European markets, the Port of Barcelona could become a sizeable aspect of your logistics, thanks to its excellent connectivity and the ability to handle large volumes.

Port of Valencia

Location and Volume: Situated on the eastern coast of Spain, the Port of Valencia plays a significant role in domestic and international trade, with a shipping volume standing at over 5 million TEU.

Key Trading Partners and Strategic Importance: Specializing in container transport, the Port of Valencia has key trading partners in South America, North Africa, and the rest of Europe. It’s considered the leading Mediterranean port in terms of container traffic.

Context for Businesses: If your business is involved in containerized cargo, the Port of Valencia is a good choice due to its capacity, efficiency, and extensive trading connections.

Port of Algeciras Bay

Location and Volume: The Port of Algeciras Bay is located in the Strait of Gibraltar, positioning it strategically for international trade. It facilitates a substantial shipping volume exceeding 5 million TEU.

Key Trading Partners and Strategic Importance: This port has a global reach, with Africa, America, and Asia as key trading partners. The Port of Algeciras Bay is strategically important for transshipment activities.

Context for Businesses: Given its excellent transshipment facilities and strategic location, the Port of Algeciras Bay is ideal for businesses with high transshipment needs or target markets across several continents.

Port of Bilbao

Location and Volume: Situated in the north of Spain, Port of Bilbao is a versatile location accommodating a sizable variety of goods. Its shipping volumes reach approximately 1 million TEU.

Key Trading Partners and Strategic Importance: The port has key relations with countries in Northern Europe, America, and Asia, alongside possessing a major role in the Bay of Biscay.

Context for Businesses: If you deal with diverse types of cargo and require versatile port services, the Port of Bilbao might be an integral part of your shipping strategy, due to its versatility and wide-ranging services.

Port of Las Palmas

Location and Volume: Approximately 2 million TEU pass through the Port of Las Palmas, which is strategically located in the Canary Islands.

Key Trading Partners and Strategic Importance: The port’s key trading partners largely lie in West Africa, Europe, and North America. It’s recognized as a major hub for refueling and supplying ships.

Context for Businesses: If your business requires frequent refueling or ship supply services, the Port of Las Palmas could form a key part of your logistical arrangements due to its top-notch facilities.

Should I choose FCL or LCL when shipping between UK and Spain?

In the complex world of international shipping, understanding the distinctions between Full Container Load (FCL) and Less than Container Load (LCL), or consolidation, can significantly affect your bottom line and transit time when shipping goods between the UK and Spain. Selecting the correct freight option is more than just choosing between two differently sized containers; it’s a strategic decision that can influence your business operations, costs, and timelines. In this guide, we’ll explore the nuances, offering valuable insights to help you make an informed choice that serves your unique shipping requirements.

Full container load (FCL)

Definition: FCL, or Full Container Load, is a type of shipping where your goods fill a whole container, either a 20'ft or 40'ft FCL container. The benefit of this service is that the container is sealed from origin to destination, enhancing security and mitigating damage risk.

When to Use: You should opt for FCL shipping when your cargo volume is more than 13/14/15 CBM. A complete container load offers efficiencies, especially for higher-volume shipments. Essentially, it can be a more cost-effective option when transporting large amounts of goods.

Example: Consider a manufacturer of bikes in the UK aiming to ship 500 units to a retailer in Spain. Given the voluminous cargo, they'd choose FCL shipping because it safely accommodates their high-volume shipment in a sealed container.

Cost Implications: While an FCL shipping quote might initially seem expensive, it can work out cheaper per unit for high-volume shipments. With FCL, you're paying for the entire container space irrespective of whether it's fully utilized or not, so loading it to capacity extracts more value.

Less container load (LCL)

Definition: LCL, or Less than Container Load, is a type of ocean freight where multiple shippers share the same container to ship smaller volumes of cargo.

When to Use: This method is perfect when your shipment is less than 15 CBM, offering an affordable, flexible option for smaller cargo volumes.

Example: Let’s say you’re a toy manufacturer in London needing to ship 6 CBM of products to Barcelona. With LCL, your goods would be consolidated with other shippers' goods to fill up a container, ensuring you only pay for the space you used.

Cost Implications: An LCL shipping quote is usually based on the volume of your goods, making it cost-effective for low-volume freight. It eradicates the financial burden of paying for an entire container, which might remain partially empty. However, as your shipment will be consolidated with others, it can add slightly complex charges such as deconsolidation or handling fees at the destination port. So, while LCL freight is usually more economical for smaller consignments, keep in mind these additional charges that could be part of your total LCL shipment cost.

Hassle-free shipping

Discover the ease of international shipping with DocShipper, your dedicated freight forwarder. Our ocean freight experts, using their insight, factor in volumes, timeliness, and costs to tailor the perfect shipping solution for you, whether it's consolidation or a full container shipment between the UK and Spain. Elevate your business strategy; reach out now for a free estimation to kickstart your hassle-free shipping journey.

On average, sea freight shipping between the UK and Spain can take anywhere from 2 to 6 days. Please note that this is a broad estimation and actual transit times can vary significantly, depending on various factors such as the specific ports used, weight, and nature of the goods. To get a precise and personalized quote that fits your unique shipping requirements, we highly recommend reaching out to a specialized freight forwarder like DocShipper.

Now, let’s take a closer look at the average transit times between the four main freight ports in both the UK and Spain.

| UK Ports | Spain Ports | Average Transit Time |

| London | Barcelona | 5 |

| Liverpool | Valencia | 6 |

| Southampton | Bilbao | 4 |

| Felixstowe | Algeciras | 6 |

Do bear in mind that these are broad benchmarks and for accurate timing, it’s best to engage with a freight forwarder.

How much does it cost to ship a container between UK and Spain?

Estimating the cost to ship a container between the UK and Spain can be complex. Rates vary extensively, with shipping costs per CBM falling within a wide price range. This variation is due to varying factors such as the Point of Loading, Point of Destination, the nature of goods, the used carrier, and monthly market fluctuations. Precise ocean freight rates fluctuate consistently, making it challenging to provide an exact figure. Rest assured, our shipping specialists work diligently, quoting on a case-by-case basis, to ensure the best and most competitive freight rates for you.

Special transportation services

Out of Gauge (OOG) Container

Definition: Out of Gauge (OOG) containers are used for shipping items that can’t fit within conventional container dimensions due to their size or shape. An OOG container goes beyond the standard container in height, width, or length.

Suitable for: These containers are ideal for large machinery, construction equipment, or any out of gauge cargo that has unusual dimensions.

Examples: Industrial boilers, large vehicles, statues, or turbines.

Why it might be the best choice for you: If your business involves the transportation of oversized goods, OOG containers ensure damaging the cargo is minimal and it reaches its destination in the condition you’d want it to be in.

Break Bulk

Definition: Break bulk is a shipping method where goods are loaded individually, and not in containers or in bulk, as with loose cargo load. They’re generally loaded on a pallet or crate and then loaded onto a vessel.

Suitable for: Break bulk is ideal for large items that are too big or heavy to fit into a container.

Examples: Construction equipment, oil and gas materials, or windmills.

Why it might be the best choice for you: Break bulk offers greater flexibility, as it allows for goods of different sizes and weights to be transported together. It’s a versatile solution if you’re sending varied consignments.

Dry Bulk

Definition: Dry bulk refers to the transportation of unpackaged goods in large quantities. These are loaded directly into the ship’s hold.

Suitable for: Dry bulk is appropriate for commodities like coal, grain, cement, or ores.

Examples: Sand, fertilizers, or metals like iron or bauxite.

Why it might be the best choice for you: If you’re dealing with large quantities of homogeneous goods that don’t require individual packaging, dry bulk is your go-to option, as it is economical and efficient.

Roll-on/Roll-off (Ro-Ro)

Definition: Ro-Ro is a method where vehicles can be driven on and off a specialized ro-ro vessel. The name comes from the ability to roll the cargo directly onto the ship, hence ‘roll-on/roll-off’.

Suitable for: Rolling stock or any wheeled cargo such as automobiles, trucks, semi-trailer trucks, trailers, and railway carriages.

Examples: Cars, buses, trucks, or heavy equipment like tractors.

Why it might be the best choice for you: Ro-Ro is a convenient, safe, and cost-effective method if your business involves the movement of vehicles, or heavy rolling machinery from the UK to Spain.

Reefer Containers

Definition: Reefer containers are refrigerated shipping containers that control temperature, making them suitable for perishable goods.

Suitable for: Products sensitive to temperature such as food produce, pharmaceuticals, or any goods that require a controlled climate.

Examples: Dairy products, fruits and vegetables, flowers, or pharmaceuticals.

Why it might be the best choice for you: If you’re in the business of shipping products that require specific temperature control from the UK to Spain, reefer containers will ensure your goods reach their destination in optimal condition.

Choosing the right shipping method is key to ensuring your cargo arrives safely. Regardless of your shipping needs, DocShipper is here to assist you. Feel free to contact us for a free shipping quote in less than 24h.

Air freight between UK and Spain

Choosing air freight for your business shipments from the UK to Spain is akin to picking the ‘express train’ of global logistics. It’s speedy – shipments typically arrive in a matter of hours, and it’s highly reliable, minimizing the risk of delays. Look at your berried treasures, for instance! Ship your succulent Scottish strawberries via air and behold the sweet victory of their arrival in Seville, in freshest form ready for tapas garnishing.

But hold your horses! Many shippers miss a critical puzzle piece – the correct weight estimation. It’s not about the actual weight but the volumetric weight. Picture this – stacking feathers would occupy more space but weigh less compared to a box of books. Yet both would cost nearly the same to transport! That’s the tricky part many shippers miss, leading to underestimated shipping costs and unpleasant surprises. Buckle up as we delve into these common slip-ups and ways to steer clear of them. Remember, it’s not just about shipping fast, but also shipping smart.

Air Cargo vs Express Air Freight: How should I ship?

Choosing between air cargo and express air freight for shipments between the UK and Spain can seem like a tough call. Here’s a simple way to see it: air cargo is like booking your goods a seat on a commercial airline, while express is more like chartering a dedicated plane specifically for your shipment. Let’s unpack these options to help you pick what suits your business needs best.

Should I choose Air Cargo between UK and Spain?

Air cargo can be optimal when shipping goods between the UK and Spain, and it becomes particularly attractive with over 100/150 kg (220/330 lbs) of cargo. It offers cost-effectiveness, reliability, and leverages established airlines such as British Airways and Iberia. While you benefit from structured pricing, be aware of potentially longer transit times due to fixed flight schedules. If aligning budgets with transit times and freight weight is critical, air cargo could be your best fit.

Should I choose Express Air Freight between UK and Spain?

If your shipment to Spain from the UK is less than 1 Cubic Meter or weighs under 100-150kg (220-330lbs), Express Air Freight could be your best option. This specialized service, offered by recognized courier firms like FedEx, UPS, or DHL, uses dedicated cargo planes, ensuring speedy delivery without passenger-related delays. Caring for smaller, urgent, high-value or perishable goods? Express Air Freight prioritizes these, making it an ideal solution. Make the most of this option to meet your shipment deadlines efficiently.

Main international airports in UK

Heathrow Airport

Cargo Volume: Over 1.6 million metric tons of cargo annually.

Key Trading Partners: USA, China, Hong Kong, Japan, and UAE are the largest partners.

Strategic Importance: As the busiest airport in the UK, Heathrow acts as a major hub for international trade, connecting the country with over 180 destinations worldwide.

Notable Features: The airport offers 24/7 cargo operations. It also has specialised facilities for time- and temperature-sensitive cargo like pharmaceuticals.

For Your Business: If you regularly ship large quantities or high value goods, Heathrow’s extensive network and advanced facilities could help expedite your supply chain.

East Midlands Airport

Cargo Volume: Over 360,000 metric tons of cargo annually.

Key Trading Partners: European Union countries, the USA and the Middle East.

Strategic Importance: It’s the UK’s main pure freight airport, and the second largest in terms of cargo volume. The airport is centrally located in the UK giving easy access to key infrastructure.

Notable Features: It is the UK hub for several major courier companies. It offers dedicated cargo handling facilities, integrated road networks, and seamless customs clearance services.

For Your Business: If your business is located in the Midlands or the Northern part of the UK, this airport might provide faster lead times for your cargo. It’s also ideal for businesses that require express or overnight delivery solutions.

Manchester Airport

Cargo Volume: Approximately 120,000 metric tons of cargo transport every year.

Key Trading Partners: Europe, Asia, and the USA.

Strategic Importance: It is the third largest airport in the UK and offers more than 200 direct flight routes. It is capable of handling a diverse array of cargo.

Notable Features: The airport boasts significant investment into its cargo facilities including extensive storage and state-of-the-art security systems.

For Your Business: This might be the right fit if you have diverse shipping needs and you are looking for high security levels for your goods. Its position in Northern England with excellent motorway access can also help reduce domestic transportation times.

Stansted Airport

Cargo Volume: More than 250,000 metric tons a year.

Key Trading Partners: The USA, Hong Kong, Turkey, UAE, and Germany.

Strategic Importance: As the home to the UK’s largest cargo aircraft, Stansted is an important player in the country’s import and export business, especially for high value and delicate goods.

Notable Features: Houses one of the largest freight hubs in the country, and dedicates special facilities for perishable cargoes, like seafood and flowers.

For Your Business: Should you deal in perishable goods, Stansted’s specialized facilities may help ensure that your goods reach their destination in the best possible condition.

Gatwick Airport

Cargo Volume: Facilitates roughly 100,000 metric tons of cargo annually.

Key Trading Partners: USA, UAE, Hong Kong, and the EU.

Strategic Importance: Connects UK businesses to over 220 destinations and located conveniently just outside London.

Notable Features: Offers a comprehensive cargo handling infrastructure with dedicated logistics service providers.

For Your Business: With flexibility in cargo type and extensive global reach, Gatwick provides a versatile shipping option for companies needing to import or export a broad range of goods.

Main international airports in Spain

Madrid-Barajas Adolfo Suárez Airport

Cargo Volume: Approximately 500,000 tons of cargo annually.

Key Trading Partners: Major trading partners include countries from the European Union along with China, United States, and Latin America.

Strategic Importance: As Spain’s busiest airport and a key European cargo hub, it offers extensive connections to Latin America and Europe.

Notable Features: Multiple dedicated cargo terminals and freight services, advanced infrastructure, passenger to cargo (P2C) conversions availability.

For Your Business: If you’re looking for a versatile and highly connected hub for your cargo, particularly for routes to Latin American and European markets, Madrid-Barajas presents a prime location with extensive services.

Barcelona El Prat Airport

Cargo Volume: It processes over 150,000 tons of cargo annually.

Key Trading Partners: Primarily trades with the European Union, Middle East, and North America.

Strategic Importance: As the second largest airport in Spain, it’s a key link to the Mediterranean region, Europe, Middle East and North America.

Notable Features: Home to several major logistics companies and provides robust freight services including cargo handling and storage.

For Your Business: If your shipping scope involves Mediterranean, Middle Eastern, or North American markets, Barcelona El Prat’s strategic location and robust freight services can accommodate your needs.

Zaragoza Airport

Cargo Volume: About 120,000 tons of cargo annually.

Key Trading Partners: Primarily trades within Europe, North America, and Asia.

Strategic Importance: Known as a cargo-dedicated airport, it’s centrally located between Madrid and Barcelona adding value to its strategic importance.

Notable Features: It has modern cargo facilities and dedicated freight airlines, along with specialized air cargo handling services.

For Your Business: If your business focuses on European, Asian, or American markets and prioritizes efficiency, Zaragoza’s modern cargo facilities and central location can streamline your logistics.

Vitoria Airport

Cargo Volume: Processes over 50,000 tons of cargo annually.

Key Trading Partners: Main trading partners are within the European Union along with Middle Eastern countries.

Strategic Importance: A key player for logistics in Northern Spain, it’s a critical access point to the European market, particularly for perishable goods.

Notable Features: This airport has specialized infrastructure for shipping perishable goods under optimal conditions.

For Your Business: For businesses dealing in perishable goods, Vitoria’s specific infrastructure and location can ensure your freight maintains its quality all the way to the market.

Valencia Airport

Cargo Volume: Handles over 15,000 tons of cargo annually.

Key Trading Partners: Primarily trades with Europe, especially Germany, and the UK, and also North Africa.

Strategic Importance: Located on the east coast of the country, it’s a significant link to the Balearic Islands and North Africa.

Notable Features: Known for its ability to deal with both large volumes and small parcels with equal efficiency.

For Your Business: If your shipping needs require efficient handling of diverse load sizes, particularly for routes to the Balearic Islands, North Africa, or Europe, Valencia airport is well-equipped to meet your demands.

How long does air freight take between UK and Spain?

When shipping by air freight between the UK and Spain, expect an average transit time of approximately 1-2 days. However, it’s important to remember that numerous factors can influence these timings, such as the specific airports involved, the weight and size of the shipment, as well as the nature of the goods being transported. Therefore, for the most accurate shipping time estimates, consider consulting with a professional freight forwarder like DocShipper.

How much does it cost to ship a parcel between UK and Spain with air freight?

Air freight charges between the UK and Spain vary greatly, usually ranging from £1.50 to £4.50 per kg. Final costs, however, depend on multiple factors such as proximity to departure and arrival airports, parcel dimensions, weight, and the nature of the goods. Therefore, it’s unfeasible to quote a universal cost. Rest assured, our team tailors quotes to your specific needs, ensuring the most competitive rates. Remember, every shipment is unique and deserves a carefully calculated estimate. Contact us today and receive a free quote within 24 hours; we’re here to facilitate your international shipping endeavors.

What is the difference between volumetric and gross weight?

Gross weight refers to the actual weight of a shipment, including all packaging. In terms of air freight, it’s the total weight of the cargo you’re shipping as measured on a scale. On the other hand, volumetric weight, sometimes called dimensional weight, is a pricing technique for commercial freight transport that uses an item’s volume rather than its actual weight.

The calculation of gross weight for air cargo is straightforward: it’s simply the total weight of your items and their packaging. Express air freight services also work with gross weight, which includes packaging, pallet weight, and any other handling units.

Volumetric weight for air cargo transportation is computed by the formula Length x Width x Height (in cm) / 6000. The divisor is different for express air freight services, where the formula becomes Length x Width x Height (in cm) / 5000.

Let’s say you’re shipping a box from the UK to Spain with dimensions 40cm x 50cm x 60cm, and it weighs 25kg. With these measurements, your volumetric weight for air cargo would be 40 x 50 x 60 / 6000 = 20kg (or 44lbs). However, for express air freight, it would be 40 x 50 x 60 / 5000 = 24kg (or 53lbs).

Freight charges are potent to your logistics cost. Carriers will base your shipping rate on either gross or volumetric weight, whichever is greater. This is why understanding these concepts and how they impact costs can help you optimize packaging and potentially save on shipping costs.

Door to door between UK and Spain

Understanding the ins and outs of door-to-door shipping can be a real game changer. It’s an all-inclusive service, taking your goods from your doorstep in the UK right to the recipient’s place in Spain. You’ll find it saves time, reduces handling, and offers fewer headaches. Ready to unlock smoother and faster transports? Let’s dive into door-to-door shipping between the UK and Spain!

Overview – Door to Door

Shipping between the UK and Spain can be a complex process. Embrace the simplicity of door-to-door shipping; it’s a stress-free solution relieving you from the worry of customs, handling, and transport management. Despite longer transit times, the unparalleled convenience of this service will balance out any downside. Imagine having your goods picked in the UK, and next, they’re at the designated location in Spain! That’s why our customers consistently choose door-to-door service, the practical choice in the labyrinth of international shipping.

Why should I use a Door to Door service between UK and Spain?

Ever feel like Frodo on his journey to Mordor – except all you’re trying to do is get a shipment from the UK to Spain? If your answer is ‘yes’, consider the convenience of Door to Door service. Here are five reasons why it’s worth considering:

1. Stress-Free Shipping: Logistics can be as tense as a thriller movie. But with Door to Door service, transporting goods becomes a breeze – from pickup at the original location to delivery at the final destination.

2. Timeliness: When your shipment needs to move faster than a tapas dinner disappears, Door to Door is your best bet. It streamlines the process and ensures your shipment reaches its destination on time – every time.

3. Specialised Care: Let’s face it, not all cargo is made equal. For complex or fragile cargo, Door to Door services offer specialised care – treating your goods as carefully as a matador treats his cape.

4. One-Stop Solution: With Door to Door, think of your freight forwarder as your shipping concierge, handling not just the transportation, but also customs clearance and trucking until the drop-off at the final destination.

5. Added Convenience: It’s like having your paella and eating it too! The service provider takes the reins, allowing you to focus on tasks that need your attention, making your logistics journey feel more like a gentle flamenco than a frenzied fandango.

So next time you find yourself faced with shipping between the UK and Spain, remember: just as every great tapas spread brings together the best dishes, Door to Door services combine the best aspects of shipping for an easy, breezy experience.

DocShipper – Door to Door specialist between UK and Spain

Experience stress-free shipping from the UK to Spain with DocShipper. We cover everything, from packing your goods to navigating customs, utilising all shipping methods best suited to your needs. You don’t have to lift a finger – our skilled team has everything under control. Plus, enjoy the dedicated service of your own Account Executive. Reach out today for a free estimate delivered to you within 24 hours, or make a free call to our expert consultants. Smooth, efficient, hassle-free – that’s DocShipper’s commitment to you.

Customs clearance in Spain for goods imported from UK

Customs clearance, the hurdle where your goods must jump from the UK to Spain, is a labyrinth of complexity. Beware! Ambushes of sudden fees and surprise charges can catch you off-guard, souring business relations. Grasping duties, taxes, quotas, and licenses can feel like trying to catch smoke with your hands, and the threat of your precious cargo stranded in customs is a persisting nightmare. But fret not! We’re about to dive deep, unmasking the details of this conundrum. To sweeten the deal, DocShipper can captain your ship through these stormy waters, handling any goods from any corner of the globe. Need a ballpark figure to plan? Our expert team is a click away. Just remember: the origin, value of goods, and HS Code are necessary to sail ahead with the estimation. Navigate with us for a safer journey to the other side!

How to calculate duties & taxes when importing from UK to Spain?

Estimating duties and taxes when importing goods from the UK to Spain requires a deeper understanding of multiple factors. At the heart of this process lies understanding the country of origin: where your goods were manufactured or produced. You need to pinpoint this first as it forms the bedrock of your customs duties calculation, which is also coupled with knowing the HS (Harmonized System) Code, the Customs Value of your goods, the Applicable Tariff Rate, amongst other possible taxes and fees tied to your products. Now let’s get started, shall we? The first step in this rewarding process is to identify the country of manufacture or production of the goods in question.

Step 1 – Identify the Country of Origin

Identifying the Country of Origin crucially sets the stage for your shipping journey from the UK to Spain. First, it confirms if any trade agreements between the countries affect your transaction. A favourable agreement could lead to reduced or zero customs duties, a nice bonus! Second, it helps identify any country-specific import restrictions, essential to avoid any unexpected hitches in your transport plan. Third, knowing the origin is a must before getting your Harmonized System (HS) code.

An interesting detail! Not all goods processed in the UK automatically have it as their origin. A misstep there, and you could face some stern words from customs officials. Fourth, some goods might have tariff quotas, where the exact origin determines how much you pay. And lastly, a clear defined origin allows for easy calculation of potential Value Added Tax (VAT) and duties owed.

The EU-UK Trade and Cooperation Agreement alleviates some concerns. No tariffs on goods, certainly a relief. However, pay attention to Rules of Origin requirements. Speciality goods, such as chemicals, might also have industry-specific agreements to factor in.

Good luck! Remember, knowing the Country of Origin isn’t just a box to tick; it’s the cornerstone to a smooth import process.

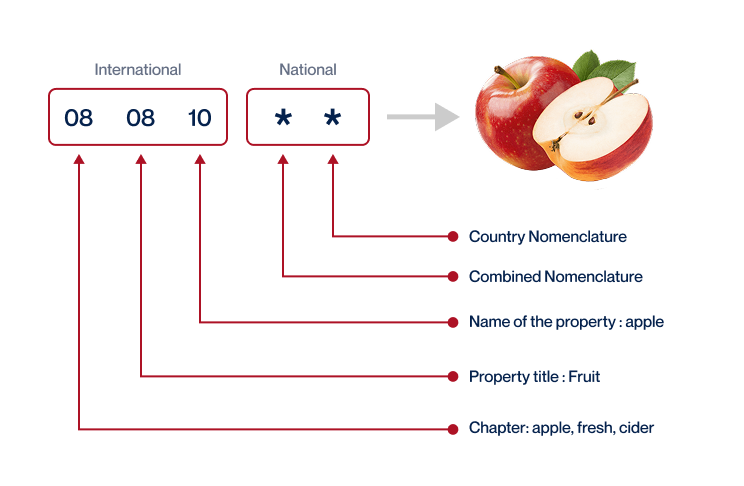

Step 2 – Find the HS Code of your product

The Harmonized System (HS) Code is essentially a universal economic language and code, developed by the World Customs Organization, for goods. It’s a unique identifying code utilized in international trade. This code is pivotal for customs authorities all over the globe, enabling them to precisely identify products and levy the appropriate customs duties.

One of the simplest ways to find the HS Code for your product is to ask your supplier. They’re well-acquainted with their products and relevant regulations and can likely provide this information quickly and precisely.

If obtaining this code from your supplier isn’t an option, you can use an HS lookup tool to determine it. An outstanding platform for this is the Harmonized Tariff Schedule .

To use it, follow these steps:

1. Enter the name of your product into the search bar.

2. Check the Heading/Subheading column. Here, you will find the HS Code for your product.

However, a word of caution: Accuracy in selecting the HS Code is crucial. Mistakes in coding can lead to unwelcome outcomes such as incorrect duty assessments, delays in shipping procedures, and could even render you liable for potential fines. So, while using these tools, ensure that you’re meticulous and as accurate as possible.

Finally, to help you better understand, here’s an infographic showing you how to read an HS code.

Step 3 – Calculate the Customs Value

Ever wondered why the customs value of your goods differs from the purchase value? Let’s break it down. The customs value isn’t just about the price of the goods. Instead, customs authorities in Spain calculate this value using the CIF method, which stands for Cost of Goods, Insurance, and Freight.

Say, you bought a product for $1000 from the UK. But then you paid $200 for shipping and, just to play it safe, added $50 insurance. In this case, the customs value of the product isn’t $1000, but $1250. That is the CIF customs value.

This necessity to pay additional duties based on the CIF value can be frustrating. But remember, understanding this process could save your business from avoidable expenses in the long run. So, do your math rightly: cost of goods + cost of shipping + insurance = customs value.

Step 4 – Figure out the applicable Import Tariff

An import tariff is a tax classically imposed on imported goods. In the UK, the main tariff used is called the Most Favoured Nation (MFN) tariff. To identify the specific tariff you’ll pay when importing goods from the UK to Spain, you can follow the steps below:

1. Navigate to the ‘UK Trade Tariff: Look up Commodity Codes, Duty, and VAT Rates’ tool,

2. Type in the HS code that we determined earlier and select the country of origin (in this case, the UK).

3. From the results, you can see your product’s specific MFN tariff.

Let’s take a practical example. Suppose you’re importing bicycle parts, with an HS code 8714. The tariff rate shown is 4.5%. If your CIF (Cost, Insurance, and Freight) is $1000, your import duty is calculated as:

Import Duty = CIF Value x Duty Rate

Import Duty = $1000 x 4.5%

Therefore, your estimated import duty should be around $45.

Remember, this is a simplified example. Real-life scenarios might involve other taxes or additional customs clearance fees. It is integral to consider all these components when budgeting your import operations.

Step 5 – Consider other Import Duties and Taxes

Beyond standard tariffs, your imported goods may occasionally be subject to other duties, significantly impacting your final cost. Let’s break it down with examples; remember, these are illustrative, so rates might not be accurate.

Firstly, there’s the excise duty. Consider importing whisky from the UK; it might attract an excise duty.

Next up we have anti-dumping taxes. Let’s say you’re bringing in cheap steel products undercutting local Spanish market rates; you could face anti-dumping taxes to level the playing field.

Perhaps most notable is the VAT rate. Assume a standard Spanish VAT rate of 21%; for imports valued at $1000, this translates into an additional $210.

To calculate, use the formula: Value of goods + Duty (if any)VAT rate = Import VAT

For our example, ($1000+$0)21%=$210

Your costs can stack up quickly when these additional charges kick in. Knowing what to expect is vital for successful, cost-effective imports. Carefully research and understand all possible charges applicable to your imports and brace for them accordingly. It’s all part of the unparalleled adventure we call international trading.

Step 6 – Calculate the Customs Duties

In this crucial step, the final amount owed in customs duties is derived from the customs value – the sum of the goods’ actual price, shipping cost, and insurance. This sum undergoes various tax types depending on the specifics of your import.

The first scenario, where only customs duties apply, let’s consider goods with a customs value of $1000. If Spain’s duty rate for these goods is 3%, you pay $30 in customs duties.

Moving to the second scenario, include VAT. If the VAT in Spain is 21%, apply this to both the goods’ customs value and the customs duty – so the VAT would be ($1000 + $30) 21% = $216.30. The total cost including duties and VAT becomes $1246.30 ($30 customs duties and $216.30 VAT).

In the last complex scenario, you’ve goods subject to customs duties, VAT, anti-dumping taxes, and Excise Duty. Suppose an anti-dumping tax of 4.8% and excise duty of $32. Add both to previously calculated values – our final sum becomes ($1000 + $30 + $216.30) 4.8% + $32 = $1304.37.

These are just examples, the actual numbers can vary considerably. Customs clearance is a complex process and it’s easy to overpay.

Our team at DocShipper provides customs clearance services worldwide, ensuring accurate calculation of your costs. We’re committed to preventing overpayment and ensuring smooth, cost-effective shipping. For a free quote in under 24 hours, reach out to DocShipper today.

Does DocShipper charge customs fees?

DocShipper, as a customs broker in the UK and Spain, won’t bill you for customs duties. These charges go directly to the government, not your freight forwarder. It’s crucial to distinguish between these duties and the customs clearance fees, which are indeed charged by brokers like DocShipper. We aim for transparency, providing you with official customs office documents, proving you’re only paying necessary government charges. Picture it like going out for a meal: you pay for the food (goods), service charge (clearance fees), and taxes (customs duties), but the taxes go to the government, not the restaurant!

Contact Details for Customs Authorities

UK Customs

Spain Customs

Official name: Agencia Tributaria (Spanish Tax Agency)

Official website: https://www.agenciatributaria.es/

Required documents for customs clearance

Uncertain what documents are necessary for customs clearance? In this section, we’ll break down the paperwork needed, from the Bill of Lading to CE standard Documents of Conformity, dispelling any confusion and smoothing your path towards successful shipping.

Bill of Lading

When you’re arranging a shipment from the UK to Spain, the Bill of Lading acts like a passport for your goods. It’s an essential document that announces ‘ownership transition time!’ and it goes wherever your goods go. Nope, it doesn’t take a coffee break. It essentially proves the feasibility of your transactions at customs.

Remember the time when you had to run around for printouts? Well, with electronic (aka ‘telex’) release, you can forget all that stress. It brings you benefits like quicker turnaround times and less paperwork. Want to feast on less bureaucracy? Telex release is your meal ticket.

Switching gears a bit – if you’re sending goods by air, you’ll become friends with the Airway Bill (AWB). It’s similar to the Bill of Lading but strictly for air cargo.

So ship smart, folks! Ensure you’ve got your Bill of Lading or AWB ready and choose electronic release to save time. Happy shipping!

Packing List

Picture yourself hustling to ship goods from UK to Spain. One vital document in your toolbox is the Packing List. Think of it as your lifeline, detailing your shipment type, quantity, and accurate description. Let’s say you’re sending machinery parts – an accurate Packing List ensures your shipment doesn’t get mistaken for those bicycle parts next in line. While sending via sea or air, accuracy matters. Being vague here might earn you a red card at customs, piling up unnecessary delays and costs. So, whether it’s child’s toys or heavy-duty tools, a meticulous Packing List makes your journey smoother, faster, and stress-free, making your business operations in Spain tick like clockwork. Remember: a well-prepared Packing List is more than just paper; it’s your passport to efficient international shipping.

Commercial Invoice

Navigating the customs process between the UK and Spain? Your Commercial Invoice is key. This isn’t just a receipt for your goods—it’s a customs declaration, outlining the items’ purpose of export, value, harmonized system codes, and the terms of delivery (Incoterms). For instance, a shipment of ceramic tiles from Birmingham to Barcelona should have an accurate value, the HS code (6907.10 for ceramic tiles), and highlight the Incoterm (say, DAP). Misalignment between this invoice and other shipping documents can cause shipping delays or even fines. Keep it accurate, keep it concise, and you’ll sail through customs like a breeze!

Certificate of Origin

Navigating trade between the UK and Spain? You’ll need your Certificate of Origin. It’s your golden ticket to secure preferential customs duty rates, potentially saving your business a packet. This vital document bears witness to your goods’ manufacturing homeland. Let’s say you’re exporting iconic Liverpool-made guitars to Spain. Your Certificate of Origin verifies the British roots, making your shipment eligible for any beneficial trade agreements between the UK and Spain. But remember, paperwork mishaps can cause a headache and hold-ups, so ensure the country of manufacture is accurately stated. Keep your trade moving smoothly, and your wallets a bit heavier, by seeing this document as the hero it truly is.

Certificate of Conformity (CE standard)

When shipping goods from UK to Spain, a Certificate of Conformity adhering to CE standards is essential. CE mark on your product demonstrates it meets EU bootstrapped safety, health, and environment specifications, asserting free marketability in the European Economic Area. However, as the UK has left the EU, UK-based manufacturers will require the new UKCA marking for product certification instead. Now, let’s clarify how it differs from quality assurance. While quality assurance ensures processes have been followed in manufacturing, the CE or UKCA mark denotes that your product meets specific standards. For instance, safety standards for a car seat. They’re like the US’s FCC Declaration of Conformity; the safeguards and guidelines they check against may differ, but they serve the same purpose. So, before you ship, ensure your products bear the correct certification mark!

Your EORI number (Economic Operator Registration Identification)

Watch out, business operators shipping between the UK and Spain! The EORI number isn’t just another document; it’s your golden ticket in the world of importing and exporting. Why? It’s your unique identifier, tracking your goods as they swirl around in the global commerce dance. Want seamless movements, faster customs clearance and avoiding potential delays? Then you’ve got to secure this number. Take a quick detour to the HMRC website or the Spanish Tax Agency portal to register. Remember, the UK may have sauntered out of the EU, but for movements between the UK and Spain, an EORI number is still essential for the customs procession. So, stay on top of your game, and get your EORI number ready!

Get Started with DocShipper

Prohibited and Restricted items when importing into Spain

Understanding what you can’t send to Spain is just as crucial as knowing what you can. Your shipment could face delays or seizures if you unknowingly include prohibited or restricted items. Get to grips with Spain’s import laws to ensure smooth, uninterrupted deliveries.

Restricted Products

– Pharmaceutical products: You have to apply for a Prior Import License (PIL) from the Spanish Agency of Medicines and Medical Devices (AEMPS).

– Sanitary products: Needing a Sanitary Registration Number through the Spanish Agency for Consumer Affairs, Food Safety and Nutrition (AECOSAN) is required before shipping sanitary items to Spain.

– Tobacco and alcohol: Get a permit through the State Tax Administration Agency (AEAT). Remember, items may be restricted based on the age of the recipient as well as quantity, so always double-check.

– Precursors of explosives: You are required to apply for a permit with the General Director of Civil Guard (DGC) before shipping.

– Endangered fauna and flora (covered by CITES): Remember to obtain a permit for imports of CITES controlled fauna and flora from the Ministry of Ecological Transition (MITECO).

– Firearms and ammunition: Before you ship, obtain an authorization through the General Director of Civil Guard (DGC).

This is not a fully exhaustive list, but should cover most of the big-ticket items. Take note, though, restrictions and requirements can change, so it’s always a good idea to do some quick due diligence each time you ship.

Prohibited products

– Narcotics and illegal drugs: Such substances are strictly controlled by Spanish law and are completely prohibited from import.

– Toxic chemicals: Spain adheres to international laws prohibiting the import of potentially hazardous chemicals.

– Certain wildlife products: There might be a ban on the importation of some wildlife products, especially those that are endangered, such as ivory, skins, and shells.

– Counterfeit goods and pirated content: Spain law is stringent about the copyright, and products violating this are not allowed, including counterfeit clothing, accessories, and DVD’s with pirated content.

– Certain fruits and vegetables: Some species of fruits and vegetables are not allowed due to the potential risk of bringing pests or diseases into the country.

– Unauthorized pharmaceuticals: Certain medicines that are not approved by the Spanish health authorities are prohibited from import.

– Explosives, firearms and ammunition: These are strictly controlled and generally prohibited unless the necessary licenses have been obtained.

– Some meat and dairy products: Importing these items from non-EU countries may have certain restrictions.

– Radioactive substances: These include certain types of scientific equipment and substances that emit radiation.

When importing to Spain, make sure to thoroughly check the list of prohibited items and get expert advice if you are unsure. Spanish customs laws can change, so it’s important to stay up to date to avoid any issues with your shipment.

Are there any trade agreements between UK and Spain

Absolutely, Spain and the UK maintain a Trade and Cooperation Agreement (TCA), establishing zero tariffs and quota-free trade on goods. This directly benefits your business, as you can ship goods free of customs duties. Additionally, an ongoing initiative is the expansion of rail freight corridors, poised to further streamline the delivery process. Stay tuned for these future developments, they could offer you substantial advantages.

UK – Spain trade and economic relationship

The UK and Spain have a robust trade relationship deeply rooted in history. In recent years, bilateral trade reached an impressive £42 billion annually. The UK ranks as Spain’s fifth-largest trading partner, with key sectors comprising automotive, pharmaceuticals, and alcoholic beverages. Specifically, British whiskey and gin exports to Spain now value at over £450 million. Spanish export strengths continue in fresh produce, wine, and olive oil. Remarkably, in 2024, Spain attracted British foreign direct investments worth a staggering €62 billion, largely influencing sectors like energy and finance. Concurrently, Spanish investment in the UK focused on infrastructure projects and telecommunications. As this dynamic economic rapport evolves, the potential for growth in trade between these two nations continues to flourish.

Your first steps with DocShipper

Additional logistics services

Warehousing

Struggling to find trustworthy storage options for your goods? Temperature control is crucial, especially when dealing with perishable or sensitive items. Don't fret over these challenges; we've got you covered. Learn more on our dedicated page: Warehousing. Find solutions that meet your specific needs, maintain your product's integrity, and give you peace of mind.

Packing

Securing and transporting goods from the UK to Spain requires impeccable packaging and repackaging to prevent damage. Let our team at DocShipper provide the assurance you need, from safeguarding fragile ceramics to securely packing hefty industrial equipment. More info on our dedicated page: Freight packaging

Transport Insurance

Facing potential risks during transit? Think cargo insurance. Unlike fire insurance, cargo insurance covers a range of damages potentially caused by weather, theft or transportation issues. It's the key to mitigating shipping vulnerabilities. Imagine your goods facing unexpected torrential rain at sea. With cargo insurance, damage costs won't eat into your revenues. Our advice? Prevention first. With cargo insurance, you're equipped, protected, and ready. More info on our dedicated page: Cargo Insurance.

Household goods shipping

When relocating from the UK to Spain, handling your cherished personal items, be it a porcelain doll collection or a grand piano, can be daunting. Let professionals take over, ensuring your precious belongings are packaged, transported, and delivered with utmost care, even if they're uniquely large or delicate. Real-world example? Custom crating your antique mirror for a worry-free journey. More info on our dedicated page: Shipping Personal Belongings.

Procurement in Thailand

Small business owner dreaming of sourcing goods from Asia or East Europe, but not sure how to find a reliable supplier? DocShipper has your back, tackling the tedious procurement process and breaking language barriers. Imagine trading Asian toys or East European ceramics without breaking a sweat. More info on our dedicated page: Sourcing services.

Quality Control

Ensuring your goods meet the mark is paramount, especially when shipping from the UK to Spain. Our Quality Control service acts as your eyes and ears on the ground. Picture this - you've got a custom ceramic tile shipment, and an unnoticed flaw could cost massive reworks. Our eagle-eyed inspections prevent such scenarios, keeping your product integrity intact. Peek into the process and power behind quality checks on our dedicated page: Quality Inspection.

Conformité des produits aux normes

Shipping goods between countries comes with its unique set of regulations. That's where our Product Compliance Services step in. We ensure your consignments align with the necessary standards by conducting comprehensive laboratory tests. Making sure your product meets all requirements is not just a good idea—it's crucial. This helps prevent shipment delays or the risk of goods being withheld by customs. Want the nitty-gritty on this process? Head over to Product compliance services for a deep-dive.