Freight Shipping between UK and Slovakia | Rates – Transit times – Duties and Taxes

What's trickier than trying to ride a unicycle across the Slovak Tatras? Understanding the nuances of freight transport between the UK and Slovakia. This guide aims to illuminate the sometimes murky waters of transit times, shipping rates, and the labyrinth of customs regulations. Drawing on our extensive experience, we'll break down your freight options, from air and sea to road and rail, and guide you through the nooks and crannies of customs clearance. Get ready to learn about duties, taxes, and business-tailored advice that will smooth your shipping operations. If the process still feels overwhelming, let DocShipper handle it for you! As an international freight forwarder, we're adept at turning the complex into the comprehensible, transforming potential challenges into sure-fire business success.

Which are the different modes of transportation between UK and Slovakia?

Understanding the best way to transport goods between the UK and Slovakia involves more than just knowing the route. It's a bit like choosing the right tool for a tough job - you have to factor in the twists and turns. With land and sea separating these countries, road and air freight are the prime candidates. Here's the deal: the closer the countries, the more viable road transport becomes. For businesses, it's like picking a sturdy van over a flashy jet - closer, easier, and often more cost-effective. But within these options, the unique demands of your shipment come into play. Choose wisely, it's your trade on the line.

Need help with your shipment?

Need assistance with your shipment? Dont hesitate to contact us even for a simple question. Choose the option that suits you

Live chat with an expert Chat on WhatsApp Free Quote 24hHow can DocShipper help you

Sea freight between UK and Slovakia

The UK and Slovakia share a bustling trade relationship, with a labyrinth of ships sailing from ports like Felixstowe and Southampton to Bratislava. If you’re a business dealing with a large volume of goods, there’s no doubt that sea freight is your wallet’s best ally. But that’s where the easy part ends. The complexities of international shipping can often feel like trying to solve a Rubik’s cube in the dark. Missing paperwork, customs befuddlement, and unknown regulations are some of the barriers you might face. Fret not, we are here to turn that darkness into dawn, providing you clear roadmaps and explaining all the nuts and bolts of the freight process. This guide will not just help you dodge common blunders, but also scale your shipping logistics making it as seamless as sailing the calm seas. So, buckle up and dive in, as we unfold the secrets to smoother ocean shipping between the UK and Slovakia.

Main shipping ports in UK

Port of Felixstowe

Location and Volume: Located in Suffolk, England, the Port of Felixstowe is a crucial hub for European trade, with a shipping volume of over 4 million TEU per year.

Key Trading Partners and Strategic Importance: This port is the largest and busiest container port in the UK and has regular feeder services to and from continental Europe. It also serves major trade routes to and from Asia and North America.

Context for Businesses: If you’re looking to transport goods to central and northern Europe, the Port of Felixstowe’s extensive rail and road links provide quick and efficient connections to inland destinations.

Port of Southampton

Location and Volume: Situated in Hampshire, the Port of Southampton records a shipping volume of around 2 million TEU per year.

Key Trading Partners and Strategic Importance: Serving a range of global trade routes, including North America, the Middle East, and Asia, it’s particularly known for facilitating the UK’s automotive industry trade.

Context for Businesses: The Port of Southampton’s specialists in handling high and heavy loads might be helpful if you’re in the construction, agricultural, or industrial machinery sectors.

Port of London

Location and Volume: The Port of London, based on the River Thames, boasts a yearly shipping volume of around 50 million tonnes of cargo, though it handles fewer TEUs than Southampton and Felixstowe.

Key Trading Partners and Strategic Importance: Serving over 80 port destinations worldwide, it’s vital for trade involving Europe, North America, and South Asia.

Context for Businesses: If your business relies on the diverse commodities market, the Port of London’s versatility in handling different cargoes, from containers to biomass, could be a valuable asset.

Port of Liverpool

Location and Volume: Liverpool2, within the Port of Liverpool, operates in the North West of England and holds a capacity of handling 2 million TEU annually.

Key Trading Partners and Strategic Importance: Accommodating trade partners from the Americas, the Far East, and Europe, Liverpool2 is strategically located to access markets in the Midlands and Northern UK.

Context for Businesses: Liverpool2’s deep-water facilities allow bigger ships to dock directly, potentially saving you transshipment costs if you’re shipping goods on a high-capacity vessel.

Port of Grimsby & Immingham

Location and Volume: Based in North East Lincolnshire, the Port of Grimsby & Immingham manages over 60 million tonnes of cargo annually.

Key Trading Partners and Strategic Importance: Key trade connections extend to Scandinavia, Northern Europe, and the Baltics. Grimsby is also the UK’s major car import terminal.

Context for Businesses: If you’re dealing in automotive imports or exports, the Port of Grimsby & Immingham’s specialized vehicle handling services can prove beneficial. These ports are also significant if your business is involved in the renewable energy sector, given their close proximity to major UK wind farm projects.

Port of Tees and Hartlepool

Location and Volume: Located in North East England, the Port of Tees and Hartlepool handles around 30 million tonnes of cargo annually.

Key Trading Partners and Strategic Importance: Serving routes to Europe, the Americas, and the rest of the world, it plays a critical role in the UK’s bulk cargo industries.

Context for Businesses: If your goods include bulk cargo like steel or wood pulp, the Port of Tees and Hartlepool’s specialized bulk handling terminals might be ideal for streamlining your shipping strategy.

Main shipping ports in Slovakia

Port of Bratislava

Location and Volume: Located on both banks of the Danube River, the Port of Bratislava is a key part of Slovakia’s trade framework, handling an impressive shipping volume of around 1.6 Million tons of cargo annually.

Key Trading Partners and Strategic Importance: This port handles trade with strategic partners such as Germany, Austria, Hungary, Czech Republic, and many other European countries, placing it at the heart of European trade. Its key achievements include becoming a crucial hub for oil shipments due to the Druzhba and Trans Alpine pipelines.

Context for Businesses: If you’re looking to significantly expand your business operations within Europe, especially Eastern parts, the Port of Bratislava’s containers, dry bulk, and liquid bulk terminals offer excellent logistic possibilities. Its excellent connections by road, rail, and inland waterways enable a seamless, multimodal transportation of goods across the continent.

Port of Komarno

Location and Volume: Situated in the southwestern part of Slovakia, the Port of Komarno offers wide-ranging trade options for a multitude of goods, with an annual shipping volume of hundreds of thousands of tons.

Key Trading Partners and Strategic Importance: The port actively trades with Slovakia’s co-Danube countries — such as Germany, Austria, Hungary, and Serbia — for a variety of goods, including coal and agricultural products. It has asserted its strategic importance by serving as a key link for transporting bulk and general cargoes.

Context for Businesses: If your business specializes in the movement of bulk cargo or requires flexible logistic solutions within the European market, the Port of Komarno provides versatile facilities, such as warehouses and open storage areas. Furthermore, by virtue of its robust connections to road and rail networks, it would make an efficient addition to your shipping strategy.

Should I choose FCL or LCL when shipping between UK and Slovakia?

When it comes to shipping goods from the UK to Slovakia, choosing between a full container load (FCL) or less than container load (LCL), commonly known as consolidation, can be a game-changer. This decision directly impacts your costs, delivery times, and the overall success of your shipment. Let’s untangle these terms and delve into their differences, empowering you to make an informed decision that aligns perfectly with your specific shipping needs. Ready to make your shipping process more efficient and cost-effective? Let’s set sail!

Full container load (FCL)

Definition: FCL, or Full Container Load, is a type of ocean freight where one shipper solely occupies a container. This option is typically used for larger shipments and allows you to seal your goods at the point of origin till they reach their destination, increasing safety.

When to Use: FCL shipping is best utilized when you've got substantial cargo, typically more than 13/14/15 CBM. That's because, unlike with LCL or 'Less than Container Load', you're not sharing space with others. This not only reduces the risk of potential damage but also potentially speeds up delivery.

Example: Consider a UK-based furniture manufacturer exporting a large order of chairs to Slovakia. Using a 20'ft or a 40'ft container, they could ship their assembly in one go, ensuring the safety of their merchandise and a quicker, more reliable delivery.

Cost Implications: FCL may seem costlier initially when you obtain an FCL shipping quote, but it's more economical for larger shipments. The rate is charged per container, not per cubic meter of goods. Therefore, the more you're shipping, the cheaper your cost per unit becomes. It's important to factor in these specifics when evaluating FCL versus LCL. Remember, securing an FCL container also means fewer customs issues and faster clearance.

Less container load (LCL)

Definition: LCL, or Less Container Load shipping, involves sharing the space and cost of a container with other shippers, making it an economical and flexible option for low-volume freight.

When to Use: If your cargo is less than 13 to 15 Cubic Meter (CBM), LCL is the solution. It balances cost while providing the opportunity to ship goods as needed without the need for storage.

Example: Say you're exporting handmade glassware. Even securely packaged, your product only occupies 12 CBM. Rather than paying for a half-empty full container, you consolidate your LCL shipment with other goods going to the same destination: Slovakia.

Cost Implications: With LCL freight, you pay only for the container space you use. This makes it affordable for smaller volumes. However, remember that there may be additional charges at the destination for deconsolidation, the process of separating your goods from others in the container.

Hassle-free shipping

Facing a dilemma between consolidation or a full container from the UK to Slovakia? Making cargo shipping hassle-free is DocShipper's mission. Our ocean freight experts carefully evaluate key factors such as your shipment size, budget, and urgency to recommend the best option. Take the guesswork out of shipping, let us orchestrate your logistics! Contact us today for a free estimation.

Sea freight from the UK to Slovakia typically takes approximately 20 days. This transit time varies based on numerous factors like the exact port of loading and destination, the weight of the shipment, and the type of goods you are shipping. It’s important to reach out to a specialised logistics service like DocShipper for a customised and accurate freight quote.

Here’s a look at the average transit times between the key ports of the two countries:

| UK Port | Slovakia Port | Average Transit Time (Days) |

| Port of Liverpool | Port of Bratislava | 17 |

| Port of Southampton | Port of Komarno | 20 |

*Please note, Slovakia is a landlocked country and does not have seaports, so the listed ports are the nearest, most commonly used ports.

How much does it cost to ship a container between UK and Slovakia?

Determining the precise cost of shipping a container from the UK to Slovakia can feel like solving a jigsaw puzzle. With several factors at play, such as Point of Loading, Point of Destination, carrier choice, nature of goods, and the monthly market’s mood swings, prices can stagger widely per CBM. Ocean freight rates and other shipping costs keep the predictability on its toes. Yet, fear not! Our shipping specialists are wizards at this game. They dive into details, juggle variables and quote you the best possible rates, tailoring solutions on a case-by-case basis. Your shipping needs, your customized solution.

Special transportation services

Out of Gauge (OOG) Container

Definition: OOG container, or Out of Gauge container, refers to the shipping method used for items that don’t conform to standard container dimensions – they are either too tall, wide, or long.

Suitable for: This shipping method is ideal for oversized items that can’t fit into regular containers.

Examples: Typical goods shipped using OOG containers include large machinery, boats, vehicle parts, and more.

Why it might be the best choice for you: If your business deals with Out of Gauge cargo, OOG containers provide a safe and secure transit mode, ensuring your cargo arrives in the same condition it was shipped.

Break Bulk

Definition: Break bulk refers to goods that are loaded individually, not in unitized or containerized form. These goods are typically bundled onto pallets for transport.

Suitable for: This method is suitable for goods that neither fit into containers nor bulk carriers.

Examples: Commodities such as timber, steel, and construction materials often travel via break bulk.

Why it might be the best choice for you: If you want to avoid the cost and space of a full container for a non-bulk, loose cargo load, break bulk might be your go-to solution.

Dry Bulk

Definition: Dry bulk refers to goods shipped in large quantities, in loose, un-packaged form.

Suitable for: Dry bulk is best suited for commodities that can be poured freely, without the need for individual packaging.

Examples: Typical examples of dry bulk cargo include coal, grains, and minerals.

Why it might be the best choice for you: If you’re shipping high-volume, low-value goods and packaging doesn’t hold any importance, dry bulk could substantially reduce your shipping costs.

Roll-on/Roll-off (Ro-Ro)

Definition: Roll-on/Roll-off (Ro-Ro) services involve vessels designed to carry wheeled cargo, such as cars, trucks, and trailers, which roll on and off the ship on their wheels.

Suitable for: This is an optimal choice for all types of motorized, rolling, and track-propelled equipment.

Examples: Common examples are automobiles, tractors, rail cars, and construction equipment.

Why it might be the best choice for you: If your business involves the regular transportation of vehicles or rolling stock, Ro-Ro vessels can provide a more direct, minimal handling, and cost-effective shipping solution.

Reefer Containers

Definition: Reefer containers are refrigerated units used for the safe transport of temperature-sensitive goods.

Suitable for: Reefer containers are ideal for items like foodstuffs, pharmaceuticals, flowers, and any other goods that need a constant controlled temperature during transit.

Examples: Common items shipped in reefer containers include fresh fruits, vegetables, meat, and dairy products.

Why it might be the best choice for you: If you deal with temperature-controlled goods, then reefer containers will ensure your products maintain their integrity and quality during the entirety of their transit to Slovakia.

Understanding which shipping option best suits your needs is crucial to achieving efficient and cost-effective shipping. Contact DocShipper today, and our team of experts will provide you with a free, custom shipping quote within 24 hours.

Air freight between UK and Slovakia

When shipping from the UK to Slovakia, fly high with air freight. It’s like our favorite super-fast, ultra-reliable postman. Perfect for delivering small, high-valued items like diamonds, or urgent medical supplies, air freight ensures your items touch down swiftly and safely. But there’s a catch! Imagine planning a party but ignoring the cost of the food—from underestimating shipment weight to overlooking best practices, businesses often run into costly blunders. Don’t let your success story turn into an uncomfortable lesson. Stick with us, and we’ll share invaluable insights to navigate the rough skies of air freighting.

Air Cargo vs Express Air Freight: How should I ship?

Wondering whether to opt for express air freight or standard air cargo for your UK-to-Slovakia shipment? When comparing these two shipping options, think of it this way: express virtually hitches a ride on a dedicated plane, speeding up delivery, while air cargo is more like buying a ticket on a commercial airline – potentially cheaper, but with a seat amongst other cargo. It’s about finding the balance for your business, whether you prioritize swift delivery or cost savings.

Should I choose Air Cargo between UK and Slovakia?

If you’re seeking reliable and cost-effective freight options between the UK and Slovakia, air cargo might be your best choice. This method, although having longer transit times due to set schedules, becomes increasingly attractive for shipments weighing over 100/150 kg or 220/330 lbs. Consider utilizing notable international airlines like British Airways and Slovak Airlines, both renowned for their extensive international air freight services. These airlines could help meet your budgetary requirements without compromising on the efficiency of your operations. Remember, the right freight partner could make a significant difference to your bottom line.

Should I choose Express Air Freight between UK and Slovakia?

Express air freight is a quick shipping method, relying on dedicated cargo planes that carry no passengers. If you’re shipping under 1 CBM or 100/150 kg (220/330 lbs) of goods from the UK to Slovakia, express air freight could save you time without blowing your budget. Major courier firms like FedEx, UPS, and DHL specialize in this service, offering reliable and speedy transportation. Their networks are vast, ensuring smooth operations and on-time delivery, making it an ideal option for urgent or smaller shipments.

Main international airports in UK

Heathrow Airport

Cargo Volume: Around 1.7 million metric tonnes in 2020

Key Trading Partners: USA, China, Germany, Netherlands, India

Strategic Importance: Heathrow is the busiest airport in the UK for cargo traffic, larger than all other UK airports combined, making it a crucial hub for import and export.

Notable Features: Boasts a state-of-the-art cargo handling facility, recently announced a £180m investment to improve its cargo infrastructure.

For Your Business: Access to numerous international routes and advanced facilities assures efficient and competent handling of your goods. The airport’s size ensures carriers have multiple flight options, helping ensure your goods arrive on time.

East Midlands Airport

Cargo Volume: Around 368,000 metric tonnes in 2020

Key Trading Partners: Continental Europe, North America, Asia

Strategic Importance: Known as the UK’s Cargo Gateway, it is second largest cargo airport in the UK.

Notable Features: Home to DHL’s largest UK operation and UPS’s main UK air hub.

For Your Business: A major hub for courier companies, ideal for businesses requiring express shipping services. The airport’s extensive network and schedule offer versatile options for your cargo delivery timetable.

Stansted Airport

Cargo Volume: Around 262,000 metric tonnes in 2020

Key Trading Partners: Eastern Europe, Middle East and the USA

Strategic Importance: It is the third busiest cargo airport in the UK, well-connected to eastern and mainland Europe.

Notable Features: Houses FedEx and UPS’s UK hubs, providing direct cargo services to USA.

For Your Business: Ideal for businesses that require significant capacity and connectivity to Eastern Europe and beyond. With its dedicated courier hubs, it provides efficient handling and rapid transit times for goods.

Manchester Airport

Cargo Volume: Around 123,000 metric tonnes in 2020

Key Trading Partners: USA, UAE, Germany, Spain, China

Strategic Importance: Catering to a wide range of long-haul routes, the airport extends beyond Europe and effectively connects the UK with worldwide markets.

Notable Features: The World Freight Terminal processes all freighter, integrator, and courier traffic.

For Your Business: Accessibility and the good mix of passenger and cargo routes allows businesses flexibility when planning their shipping, especially for long-haul cargo shipments.

Gatwick Airport

Cargo Volume: Approximately 95,000 metric tonnes in 2020

Key Trading Partners: UAE, USA, Netherlands, Spain, Germany

Strategic Importance: Gatwick provides access to key markets and offers excellent connectivity across Europe.

Notable Features: Prioritizes belly-hold cargo, which is ideal for smaller, lightweight shipments.

For Your Business: An array of airlines with varied routes makes it a practical choice for businesses with diverse shipping needs. Perfect for lightweight, high-value cargo due to its extensive reach of passenger flights.

Main international airports in Slovakia

Cargo Volume: Approximately 22,000 tonnes of cargo as of 2019.

Key Trading Partners: Key trade partners majorly include Germany, Czech Republic, China, Hungary, and Austria.

Strategic Importance: As the only international cargo airport in Slovakia, the M. R. Štefánik Airport plays a crucial role in serving the central European market, acting as a bridge to connect East and West Europe.

Notable Features: This airport is capable of handling all types of cargo, and has several state-of-the-art cargo warehouses. It operates 24/7, providing invaluable flexibility for time-sensitive cargo.

For Your Business: With its central location and excellent partnerships with many leading freight airlines, this airport could be an essential component of your European distribution strategy. It also offers freight forwarders a wide array of logistics services, from cargo handling to customs brokerage.

Cargo Volume: Over 4,000 tonnes of cargo as of 2019.

Key Trading Partners: Germany, Czech Republic, Poland and Hungary are among the most significant trading partners.

Strategic Importance: Košice Airport helps connect eastern Slovakia to the rest of Europe, providing valuable access especially for businesses operating in this region.

Notable Features: The airport has a high-tech warehouse for cargo handling that strictly follows international standards. Around-the-clock operation is available for cargo flights.

For Your Business: If your business is particularly active in eastern Slovakia or nearby regions, Košice Airport can be a strategic choice for your logistics chain with fast and efficient cargo handling services. It’s specific regional ties could provide an advantage to businesses seeking to target markets in eastern Europe.

How long does air freight take between UK and Slovakia?

Shipping between the UK and Slovakia by air freight usually takes an estimated 1-3 days. However, bear in mind that transit times may fluctuate depending on various factors. The specific airports involved, the weight of your goods, and their nature can all contribute to longer or shorter shipping times. For pinpoint accurate transit times tailored to your specific needs, it’s recommended to consult with a freight forwarding specialist like DocShipper.

How much does it cost to ship a parcel between UK and Slovakia with air freight?

Air freight shipping costs between the UK and Slovakia range broadly (€3-€10/kg). However, calculating precise costs entails considering several factors, such as distance from departure and arrival airports, package dimensions, weight, and type of goods shipped. Thus, it wouldn’t be accurate to offer an exact fee without these specifics. Our team is committed to giving you the best rates and we do this by quoting on a case-by-case basis. To know what your freight might cost, get in touch with us today. You’ll receive a free quote in less than 24 hours.

What is the difference between volumetric and gross weight?

For businesses undertaking air freight shipping, the concepts of gross weight and volumetric weight are key. Gross weight refers to the actual weight of your parcel, including all packaging and fillers. Volumetric weight, on the other hand, is a calculation of your parcel’s volume, i.e., the space it occupies on the plane.

To calculate the gross weight in air cargo, the shipment is simply weighed, and the reading is your parcel’s gross weight. For instance, if all your goods and their packaging weigh 45kg (approximately 99 lbs), then this is the gross weight of your shipment.

The volumetric weight, in contrast, is calculated using a formula: the length (in cm) by the breadth by the height of the package divided by the industry standard divisor. For air cargo, the divisor is usually 6000. Therefore, if you have a box with dimensions 60cm x 50cm x 40cm, your volumetric weight will be (60x50x40)/6000, which equates to 20kg (approximately 44 lbs).

In Express Air Freight services, the divisor used to calculate the volumetric weight is typically 5000. Hence, the same box will have a volumetric weight of (60x50x40)/5000, around 24kg (about 53 lbs).

It’s crucial to understand these calculations because freight charges are often determined by the higher of the two weights – gross and volumetric weights. This ensures that carriers are compensated for both the weight and space a shipment consumes in their aircraft.

Door to door between UK and Slovakia

Embarking on an international journey, door to door shipping is your personal courier, delivering goods straight from the UK to Slovakia securely and efficiently. This hassle-free service saves shipping time and avoids red tape. Imagine having your freight collected, managed, and unpacked right on your doorstep! So, tighten your seatbelt as we walk you through this process. Let’s dive in!

Overview – Door to Door

Door to door shipping between the UK and Slovakia takes the hassle out of international logistics. As a pivotal service at Docshipper, it’s highly valued for its simplicity and efficiency, despite higher costs than typical methods. This comprehensive solution manages each step of the journey, from dispatch to arrival. We tackle complexities of customs clearance and regulatory hurdles, alleviating concerns about missteps. Although some delays can occur, the ease and peace of mind offered by our door to door service make it a stress-free solution many of our clients prefer. Practical, reliable, and worry-free – that’s the Docshipper promise for you.

Why should I use a Door to Door service between UK and Slovakia?

Ever tried herding cats? Well, shipping goods can sometimes feel a bit like that! But worry not, the Door to Door service for shipping between the UK and Slovakia is like hiring a world-class ‘cat herder’ for your logistics needs.

1. Alleviated Stress: Managing multiple logistical details can be daunting. Door to Door service takes care of everything from pick-up to delivery, allowing you to focus on your core business. You can leave the herding to us!

2. Assured Timely Delivery: Urgent shipments demand prompt deliveries. With Door to Door, there’s no delay between transfers. Our streamlined operations ensure your deliveries reach according to schedule.

3. Optimal Handling of Complex Cargo: If your items need special handling or climate-controlled transportation, Door to Door ensures they receive top-notch care, thus reducing the risk of damages.

4. Complete Convenience: The ‘Door to Door’ label is a literal one. We handle everything right from picking goods from your location in the UK to delivering them to the doorstep in Slovakia. No need to wrangle trucking arrangements on either end.

5. Compliance Confidence: Dealing with the paperwork for customs or import taxes can be a trying task. Our service covers these processes and ensures your cargo complies with all requirements.

So, the next time you’re shipping between Slovakia and the UK, why not opt for Door to Door service, and be done with runaway cats in your logistics department?

DocShipper – Door to Door specialist between UK and Slovakia

Simplify your goods’ logistics with DocShipper’s comprehensive, stress-free door-to-door shipping service from the UK to Slovakia. We specialize in packing, transportation, customs clearance, and use all preferred shipping methods. The best part? A dedicated Account Executive is assigned to you, ensuring a smooth process, handled with proficiency. To start, reach out for a free estimate, responded to within 24 hours, or contact our consultants directly for immediate assistance. Trust in our expertise and let us shoulder your shipping burdens.

Customs clearance in Slovakia for goods imported from UK

Customs clearance – it’s a crucial yet complex part of importing goods, notably from the UK to Slovakia. Watch out; unexpected fees can give you a bitter taste if not prepared. It’s not just the shipping itself; there are customs duties, taxes, quotas, and licenses to understand, or your shipment could end up in limbo. No need to fret though. Upcoming sections will delve into these choppy waters, ensuring you’re shipshape on the process. At DocShipper, we’re not just navigators; we’re your all-weather crew, ready to handle the entire process worldwide, no matter the cargo. Need a project budget estimate? Shoot a line to our team with your goods’ origin, value, and HS Code. We need these three critical elements to get you the best estimate. Stay on course with us, and let’s set sail towards successful shipping.

How to calculate duties & taxes when importing from UK to Slovakia?

Estimating duties and taxes when you import goods from the UK to Slovakia involves a multi-step process. First, you need to gather crucial information such as the country of origin, the HS code of your goods, the customs value, and the applicable tariff rate. You may also need to find out about any additional taxes or fees that may apply to your specific products.

The kick-off point of this process is pinpointing the country where your goods were originally manufactured or produced. This is essential as it can impact the rules and regulations that apply to your shipment.

Step 1 – Identify the Country of Origin

No doubt you’re keen on figuring out those tricky import costs. The first thing you need to lock down is the country of origin. It may seem straightforward, but there are five reasons why this is crucial even before you wrestle with the Harmonized System (HS) code.

Firstly, it sets the stage for the correct calculation of duties. Secondly, it brings clarity on the applicable trade agreements. In the case of UK to Slovakia, the Trade and Cooperation Agreement (TCA) ensures no tariffs on goods, provided they meet the ‘rules of origin’.

Thirdly, knowing the country of origin helps you understand import restrictions which, for Slovakia, include specific agricultural products from the UK. Fourthly, some duties vary depending on the product’s origin. Lastly, certain privileges are accessible under bilateral trade agreements, reducing your overall cost.

Trade rules can seem as confusing as a busy shipping yard, but getting on top of the details will save you time, hassle, and unnecessary costs.

So, take a deep dive into this step, and soon, you’ll navigate the high seas of international trade like a seasoned captain.

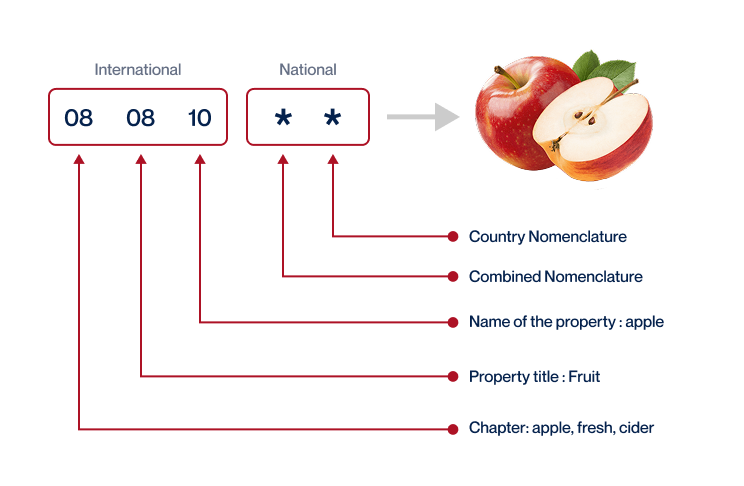

Step 2 – Find the HS Code of your product

The Harmonized System (HS) Code, developed by the World Customs Organization, is a standardized numerical method of classifying traded products. It’s used by customs authorities around the globe to identify products and implement appropriate tariffs.

Now, if you’re wondering where to find the HS Code for your product, the easiest approach is typically to ask your supplier. Given their familiarity with the goods they’re importing and the associated regulations, they should be able to provide you with the code.

But, if for some reason this isn’t possible, not to worry. We’ve laid out an easy step-by-step process to find it:

1. Visit the Harmonized Tariff Schedule on the United States International Trade Commission site.

2. In the search bar, simply type in the name of your product.

3. Take a look at the ‘Heading/Subheading’ column. This is where you’ll find the HS code associated with your product.

It’s important to note that accuracy is crucial when choosing your HS Code. An incorrect or imprecise code can lead to shipment delays and even possible customs fines.

And if you’re curious about understanding the HS code system in more depth, here’s an infographic showing you how to read an HS code.

Step 3 – Calculate the Customs Value

Understanding the concept of customs value is crucial as it’s not simply about how much you paid for your products. Think of customs value as the total cost you incurred to have your goods delivered at Slovakia’s door, all expressed in USD. It’s different and often higher than the product value because it also encompasses the CIF – Cost, Insurance, and Freight. For instance, if you bought a furniture item for $1,000 from the UK, and paid $200 for shipping, with an insurance cost of $50, your customs value isn’t $1,000 but $1,250. This amount will be used to compute any duties or taxes you owe. Remember, accurately calculating your goods’ customs value aids in a smoother customs clearance process in Slovakia. It’s the small details that sometimes make the biggest difference!

Step 4 – Figure out the applicable Import Tariff

An import tariff is a tax levied by the importing country on the foreign goods entering its borders, primarily to regulate trade and protect domestic industries. In Slovakia, as an EU member state, they use the Common Customs Tariff (CCT) which applies to all goods imported from outside the EU.

To identify the applicable import tariff for your goods, you should use the TARIC System – European Customs. Enter the previously identified HS code and the country of origin, which is the UK, and it will provide the duties and taxes applicable to your product.

Let’s take a practical example. Imagine you are importing PVC handbags (HS Code 42022210). Assume the CIF (Cost, Insurance & Freight) to Slovakia is $10,000. Enter these details into the TARIC consultation tool and it provides a tariff rate of 3%. Your import duties would be 3% of $10,000, which is $300.

Remember that import tariffs add to the cost of importing goods and are usually passed on to the consumer. Therefore, accurately identifying and calculating your import tariffs is key to financially efficient cross-border trading.

Step 5 – Consider other Import Duties and Taxes

In your import journey from the UK to Slovakia, be aware of more than just the standard tariff rates. There might be extra import duties, specific to the country of origin and the type of product.

One such fee is the excise duty, often levied on goods like tobacco, alcohol, or energy products. For instance, a batch of whisky may call for extra charges; but remember, this is just an example, actual rates may vary.

You should also be ready for anti-dumping taxes. If your imported product is priced substantially lower than a similar Slovak product, you may incur this cost.

Finally, don’t forget the VAT (Value Added Tax). In Slovakia, the standard VAT rate is 20%, but some goods may have a reduced rate of 10%. As an example, if your product has a customs value of $5000, your VAT could be $1000 (standard rate), that’s $5000 20% (again, this is an example).

Remember these additional import charges can have a significant impact on your budget. Stay one step ahead by factoring them into your transportation costs from early stages, ensuring a smoother import process.

Step 6 – Calculate the Customs Duties

In step 6, understanding how to calculate Customs Duties is critical for your import process from the UK to Slovakia. The customs duties are derived from the ‘customs value’ of your goods, which is generally based on the cost, insurance, and freight (CIF) price.

Consider these examples: In Scenario 1, you have goods valued at $1000 with a duty rate of 5% but no VAT. Your customs dues would therefore be $50. In Scenario 2, suppose the same goods also carry a 20% VAT rate. You’d pay $50 in duties and $210 in VAT (since VAT applies to the total of goods value plus duties).

Lastly, in Scenario 3, let’s say anti-dumping taxes of 10% and an Excise Duty of 15% apply. You’ll need to pay $50 for customs duties, $315 in VAT (including the anti-dumping and Excise Duty), $100 for anti-dumping taxes, and $150 for Excise Duty.

Customs duties can seem complex. Why not delegate this step to experts? DocShipper’s customs clearance service is your optimal solution. We’ll handle all details of your customs clearance globally, ensuring you’re not overpaying. Reach out to us for a free quote within 24 hours.

Does DocShipper charge customs fees?

While DocShipper, as your customs broker in the UK and Slovakia, does charge fees for customs clearance, this isn’t where your customs duties and taxes go. Those are separate, heading straight to the government. You might feel like you’re being hit from all sides, but remember, we provide all official documentation from the customs office as proof of your payment. This transparency ensures you’re only paying what’s owed, no hidden surprises. Think of it as navigating the tricky waters of customs bureaucracy, and we’re your guide!

Contact Details for Customs Authorities

UK Customs

Slovakia Customs

Official name: The Customs Directorate of the Slovak Republic

Official website: https://www.colnasprava.sk/en

Required documents for customs clearance

Sorting through paperwork for customs can be a headache. Our guide simplifies this by clearly defining essential documents like the Bill of Lading, Packing List, Certificate of Origin, and Documents of Conformity (CE standard). Say goodbye to the stress and confusion of paperwork!

Bill of Lading

When shipping goods from the UK to Slovakia, the Bill of Lading (BoL) is like your golden ticket. It guarantees the passage of your shipment, marking an essential checkpoint where goods legally transfer ownership. Modern times call for digital convenience; that’s why the ‘telex’ release comes in handy. Imagine being able to authorize the delivery of your goods remotely, without the physical exchange of BoL. Sounds nifty, right? As for air cargoes, an Air Waybill (AWB) becomes your trustworthy ally, similar to BoL, but for the skies. So, any ambitious business venturing into shipping must develop familiarity with these documents, or risk getting lost amid logistics jugglery. Make sure your paperwork is spot on to keep your shipping sailing smooth!

Packing List

When it comes to shipping your goods between the UK and Slovakia, the Packing List is your indispensable ally. Think of it as the detailed story of your shipment, holding every bit of information like types, quantities, and descriptions of items you’re shipping. Compiling a thorough and precise Packing List isn’t just good business practice, it’s your responsibility. This document gives custom officials insights needed to validate the cargo, crucial in both sea and air freight. Imagine you’re shipping an assortment of car parts; unless accurately itemized on the Packing List, your shipment could face unnecessary delays. Remember, omitting details isn’t only a risk to your timeliness but can also lead to fines. Make sure your packing list writing process is as meticulous as packing the goods themselves.

Commercial Invoice

In navigating the complexities of shipping from the UK to Slovakia, your Commercial Invoice becomes a critical ally. It’s your ‘fact sheet’, detailing vital information: product description, HS Codes, shipment value, origin, the shipping and receiving parties—ensuring no hiccups at customs. Misalignment or inaccuracies on your Commercial Invoice can stall your goods, translating into delays and financial burden. Align this document meticulously with your packing list and Bill of Lading for a smooth customs process. For instance, if your Invoice lists 1000 windshield wipers valued at £15,000, ensure identical quantities and values on other documents. This consistency streamlines customs clearance, keeping your business on the move.

Certificate of Origin

If you’re shipping goods between the UK and Slovakia, don’t underestimate the power of the Certificate of Origin. Like a passport for your goods, this document authenticates exactly where your merchandise was manufactured. Here’s the twist; using it strategically could unlock preferential customs duty rates, potentially saving your business money.

For example, let’s say you’re exporting high-quality British ceramics. Detailing United Kingdom as the country of manufacture in your Certificate of Origin might cut down costs at the Slovak border. Savvy, isn’t it? Just remember: clarity and correct information are crucial. A minor mistake could hold up your freight, and in this business, time invariably equals money. So, keep it precise, keep it straightforward. Your wallet might thank you later.

Certificate of Conformity (CE standard)

In the world of international trade, your consignments’ compliance with European health, safety, and environmental standards is paramount. Enter the Certificate of Conformity (CE standard), a document that acts as your product’s passport for the European market. Unlike quality assurance guarantees—which assure you of a product’s performance—the CE standard proves that your items comply with all of Europe’s regulatory requirements, giving you the desired access to Slovakia from the UK. Simultaneously, be aware that since Brexit, UK has initiated its own equivalent, the UKCA marking. Importantly, these markers don’t replace quality control procedures. Always remember, the key to successful shipping is ensuring your goods meet both quality and conformity standards, thereby averting delays and additional costs.

Your EORI number (Economic Operator Registration Identification)

If you’re shipping goods between the UK and Slovakia, having an EORI number is non-negotiable. It’s your golden ticket for crossing borders smoothly. You see, this unique identifier tracks your imports and exports, and it’s mandatory in the EU, UK, and countries utilizing the EORI system. Picturing it like your business’s passport puts it into context. Registering isn’t too much of a fuss – just a simple online process that your national customs authority handles. However, consider it as crucial as the goods you’re shipping – no EORI, no clearance. You wouldn’t leave on vacation without your passport, right? Similarly, start the registration ASAP to ensure your cargo doesn’t hit transportation hiccups.

Get Started with DocShipper

Prohibited and Restricted items when importing into Slovakia

Feeling overwhelmed by the long list of prohibitions and restrictions when importing goods into Slovakia? You’re not alone. From dealing with legal requirements to decoding complex customs regulations, it can be a real headache. Let’s break it down for you to help simplify your shipping journey.

Are there any trade agreements between UK and Slovakia

Yes, the UK and Slovakia do benefit from trade arrangements under the EU-UK Trade and Cooperation Agreement. While Brexit disrupted older ties, this new deal ensures tariff-free trade on many goods. This could potentially reduce your business’s shipping costs and paperwork. However, it’s important to still acknowledge some regulatory complexities and possible VAT implications. Ongoing rail infrastructure improvements also indicate future ease in land transport. Always stay updated on shifts in these arrangements to maximize your international trade advantages.

UK – Slovakia trade and economic relationship

The UK and Slovakia share a resilient trade and economic relationship, deriving strength from historical ties and policy alignments. The two countries have nurtured mutual gains, highlighted by a trade volume worth £4.6 billion in 2023. Investments are reciprocal with many UK firms operating in sectors like finance, retail, and automotive in Slovakia, enhancing job creation and economic growth.

A key milestone was Slovakia joining the EU in 2004, which unlocked new avenues for trade. The UK contributed significantly, solidifying its position as one of Slovakia’s top investors. Unsurprisingly, investor confidence has led to treats like the Pilsner Urquell, a famous Slovak beer, gracing UK shelves and automobiles, a major Slovak commodity, featuring prominently in UK markets.

In recent years, the UK’s decision to exit the EU has led to transformative changes in the economic landscape, reaffirming the crucial role of informed decision-making in international freight. Thus, understanding the intricacy of trade dynamics between the UK and Slovakia ensures seamless transitions and optimal routes for your freight needs.

Your first steps with DocShipper

Additional logistics services

Warehousing

Struggling to find a trustworthy partner for storing your goods? Good storage goes beyond just safekeeping - think temperature-controlled spaces for sensitive items like wine or pharmaceuticals. Don't overlook this critical part of your shipping process. Get the support you need and wave goodbye to nerves on warehousing. Discover how we can help on our dedicated page: Warehousing.

Packing

Managing your shipment from the UK to Slovakia? Packaging and repackaging can make or break its success. It's paramount to have a reliable expert who understands the product's nuances, say, safeguarding fragile porcelain with foam padding. Explore varying solutions to your packaging needs, keeping products safe while adhering to international regulations. Dive deeper into freight packaging at our dedicated page: Freight packaging.

Transport Insurance

Cargo insurance isn't just fire insurance at sea! It's your safeguard during the whole shipping journey, taking care of mishaps like damage during transit or loading errors, to name a few. Just imagine a pallet falls, causing content damage - cargo insurance has you covered! It's a preventive measure that buys you peace of mind. More info on our dedicated page: Cargo Insurance.

Household goods shipping

Moving between the UK and Slovakia, with bulky or fragile belongings in tow? Panic not. Our dedicated team takes care of every trinket, furniture piece, or grand piano with supreme care and adaptability. Redefining flexibility, we've even shifted sculpture studios intact! For the full lowdown, check out our in-depth guide at Shipping Personal Belongings.

Procurement in Thailand

Looking to source goods from Asia or East Europe for your UK-Slovakia route? DocShipper takes the hassle out of supplier management. We'll find those perfect suppliers for you, handle procurement, and even bridge language barriers. Imagine, no more lost in translation moments or dealing with difficult suppliers. Success in sourcing just got a whole lot easier. More info on our dedicated page: Sourcing services.

Quality Control

Avoid shipping mishaps between the UK and Slovakia by prioritising quality control inspections during manufacturing or customisation. This critical step can help weed out deficiencies before they become costly re-shipments. For instance, imagine sending 500 electronic devices, only to discover a wiring flaw upon arrival.

Conformité des produits aux normes

Sending your goods abroad? You need to ensure they meet all destination rules. With our Product Compliance Services, we take the hassle off your shoulders. We conduct laboratory tests for certification, ensuring your product aligns with all targeted market regulations. Rest easy knowing your shipment won't hit regulatory hitches. Get the details on our Product compliance services.