Freight Shipping between UK and RDC | Rates – Transit times – Duties and Taxes

Why did the freight get deported? Because it couldn't clear customs! But, jokes aside, businesses often struggle to understand freight rates, transit times, and the ins and outs of customs regulations when shipping goods between the UK and the Democratic Republic of Congo (RDC). This guide is here to streamline your shipping journey by explaining the various types of freight options including air, sea, road, and rail, demystifying the customs clearance process, clarifying duties, taxes, and providing valuable recommendations specific to your business needs. If the process still feels overwhelming, let DocShipper handle it for you! As an international freight forwarder, we manage every step of your shipping process, turning obstacles into opportunities for success in your international trade endeavors.

Which are the different modes of transportation between UK and RDC?

Non extrait

Need help with your shipment?

Need assistance with your shipment? Dont hesitate to contact us even for a simple question. Choose the option that suits you

Live chat with an expert Chat on WhatsApp Free Quote 24hHow can DocShipper help you

Sea freight between UK and RDC

Understanding ocean shipping from the UK to the Democratic Republic of Congo can feel like diving headfirst into the Atlantic without a map. First, let’s set the scene. Trade between these powerhouses thrives, primarily driven by manufactured goods and raw materials. Key ports like Felixstowe, Southampton, and London Gateway in the UK serve as major hubs, funneling goods towards the bustling port of Matadi in DR Congo. Ocean freight presents a tempting alternative, being pocket-friendly for bulky volumes; however, it’s the slow-and-steady of the freight world, akin to a marathon runner beside the sprint of air freight.

Now, let’s talk challenges; like trying to assemble flat-pack furniture without instructions. Shipping between differing cultural and regulatory landscapes presents hurdles. Missteps in paperwork, unrealistic expectations about delivery times, or even misguided cost-cutting can leave businesses in a sea of confusion. Fear not, we’ll peel back the layers of complexity, revealing practical best practices and specifications. Dive into this guide and let’s make safe passage through the choppy waters of international shipping.

Main shipping ports in UK

Port of Southampton

Location and Volume: Located on the south coast of England, the Port of Southampton is an integral part of UK trade, handling around 1.9 million TEUs annually.

Key Trading Partners and Strategic Importance: The port’s key trading partners include China, the USA, and Australia, given its strategic location and significance, it stands as one of the UK’s largest, busiest, and most versatile ports.

Context for Businesses: If you’re looking to transport consumer goods, containers, or automobiles, the Port of Southampton offers a myriad of specialized services and is equipped to handle general cargo.

Port of Felixstowe

Location and Volume: Located in Suffolk, this port is the busiest in the United Kingdom. With a volume steeping over 3.8 million TEUs, it plays a prominent role in the country’s trade landscape.

Key Trading Partners and Strategic Importance: It’s main trading partners include China, The European Union, and the United States. Known for being the largest and busiest container port in the UK, Felixstowe holds strategic importance in European trade.

Context for Businesses: Particularly suited for businesses trading in Asia and Continental Europe. The Port of Felixstowe provides a direct rail link to 16 train terminals across the UK, illustrating its extensive reach in the domestic market.

Port of Grimsby

Location and Volume: Situated on the South Bank of the River Humber, the Port of Grimsby has a substantial annual cargo volume and one of the UK’s major car-handling ports.

Key Trading Partners and Strategic Importance: The port sees its primary trading associates in Europe and the Americas. This port plays a vital role in the UK’s offshore wind sector.

Context for Businesses: If your business is in the renewable energy sector or automotive distribution, the Port of Grimsby could be a favourable focal point for your shipping route.

Port of London

Location and Volume: Located along the River Thames in South East England, it handles over 50 million tonnes of cargo every year, making it one of the primary ports in the country.

Main shipping ports in UK

Port of Southampton

Location and Volume: Located on the south coast of England, the Port of Southampton is an integral part of UK trade, handling around 1.9 million TEUs annually.

Key Trading Partners and Strategic Importance: The port’s key trading partners include China, the USA, and Australia, given its strategic location and significance, it stands as one of the UK’s largest, busiest, and most versatile ports.

Context for Businesses: If you’re looking to transport consumer goods, containers, or automobiles, the Port of Southampton offers a myriad of specialized services and is equipped to handle general cargo.

Port of Felixstowe

Location and Volume: Located in Suffolk, this port is the busiest in the United Kingdom. With a volume steeping over 3.8 million TEUs, it plays a prominent role in the country’s trade landscape.

Key Trading Partners and Strategic Importance: It’s main trading partners include China, The European Union, and the United States. Known for being the largest and busiest container port in the UK, Felixstowe holds strategic importance in European trade.

Context for Businesses: Particularly suited for businesses trading in Asia and Continental Europe. The Port of Felixstowe provides a direct rail link to 16 train terminals across the UK, illustrating its extensive reach in the domestic market.

Port of Grimsby

Location and Volume: Situated on the South Bank of the River Humber, the Port of Grimsby has a substantial annual cargo volume and one of the UK’s major car-handling ports.

Key Trading Partners and Strategic Importance: The port sees its primary trading associates in Europe and the Americas. This port plays a vital role in the UK’s offshore wind sector.

Context for Businesses: If your business is in the renewable energy sector or automotive distribution, the Port of Grimsby could be a favourable focal point for your shipping route.

Port of London

Location and Volume: Located along the River Thames in South East England, it handles over 50 million tonnes of cargo every year, making it one of the primary ports in the country.

Main shipping ports in RDC

Port of Matadi

Location and Volume: Situated in the southwestern corner of the Democratic Republic of Congo DRC, this port is vital for the country’s international trade. It conducts a sizable volume of the region’s maritime traffic, handling nearly 85% of all import and export activities of DRC.

Key Trading Partners and Strategic Importance: The Port of Matadi receives the majority of its cargo from key trading partners in China, South Africa, Belgium, France, and Brazil. As the DRC’s main seagoing port, its strategic location on the Congo river makes it a natural gateway connecting the country, and its surrounding landlocked regions, to international markets.

Context for Businesses: An important consideration for businesses operating in central Africa, Port of Matadi could serve as an integral part of a logistics strategy. Due to its capacity and well-established trade routes, focusing on Matadi could expedite shipping times and streamline customs procedures, which could be the key to optimizing your operations in the region.

Port of Boma

Location and Volume:Approximately 470 km from Matadi, Port of Boma is the country’s second most important maritime port. Because of its convenient location to the Atlantic and its strategic position for intercontinental trade, specifically with Europe and America, the Port of Boma is an imperative segment in the DRC’s maritime trade system.

Key Trading Partners and Strategic Importance: Recognized as a thriving hub for countries in western Africa, Port of Boma is highly frequented by traders from the United States, the European Union, and Australia apart from its neighboring African countries. As the second-largest international port in DRC, it carries considerable strategic significance within the region and even beyond.

Context for Businesses: For companies seeking to establish a presence in Western Africa or wanting to tap into the rich natural resources of DRC, Port of Boma could be a practical option, given its substantial range to facilitate transport across the globe. Utilizing Boma’s vast network could strengthen your supply chain, making your operations more cost-effective.

Please note that while we have provided official websites for both ports, information on these pages may not always be available in English. It might be helpful to use a web translation tool to understand the details.

Should I choose FCL or LCL when shipping between UK and RDC?

Deciding between full container load (FCL) and less than container load (LCL), also known as consolidation, is a pivotal part of orchestrating an efficient UK to RDC sea freight operation. Your choice could spell the difference in cost, delivery timescale, and overall success of your shipment. This section unravels these two options, eyeballing their distinct advantages, and helps you look through the lens of your own shipping requirements. Let’s make sense of these terms and steer your decision-making toward the most favorable outcome for your business.

Full container load (FCL)

Definition: FCL, or Full Container Load, is a type of shipping service where one consignor reserves the entire space of a shipping container, either a 20'ft, 40'ft, or larger. An FCL container is completely sealed from origin to destination, making it a safe option.

When to Use: Choose FCL shipping when your cargo volume is more than approximately 13/14/15 cubic meters (CBM). By doing so, you can leverage the efficiency and cost-effectiveness of larger volume shipments.

Example: Imagine you're a UK-based bicycle manufacturer looking to ship 500 units to RDC. The combined volume of your shipment significantly exceeds 15 CBM, making FCL the optimal choice—your bicycles fill a 40'ft container perfectly, so there's no wasted space and you're not paying for unused cargo room.

Cost Implications: Since FCL shipping charges are on a per-container basis, high-volume shipments result in lower cost per unit—especially when compared to Less than Container Load (LCL). To determine the precise cost, you would need an FCL shipping quote, which takes into account factors like container size and route complexity. Remember, while FCL could be pricier upfront, your per unit shipping cost decreases significantly with greater volumes.

Less container load (LCL)

Definition: LCL (Less than Container Load) refers to a shipping method where your cargo doesn't fill an entire container and shares the space with cargo from other shippers.

When to Use: LCL shipment is beneficial when your cargo volume is under 13/14/15 cubic meters (CBM). This option is not only cost-effective but offers flexibility in terms of timing and space management.

Example: For instance, a small furniture retailer in the UK that imports unusual and artisan pieces from RDC on a sporadic basis might find LCL to be an excellent choice. Using an entire container may be wasteful and expensive since they don't have the volume of items to justify it.

Cost Implications: However, it's essential to account for the fact that LCL freight charges are typically higher per unit than if you filled a whole container (FCL). This is due to the additional handling required at the consolidation and deconsolidation points. Nevertheless, if your shipment volume is low, LCL can still be a cost-efficient way to ship your goods between the UK and RDC.

Hassle-free shipping

Shipping to the DRC from the UK? Let DocShipper, your dependable freight forwarder, simplify the complexities for you. Our ocean freight experts evaluate factors such as volume, cost, destination, and urgency, guiding you on whether to opt for consolidation or a full container. Remember, the right choice can significantly impact your bottom-line. Ready for hassle-free cargo shipping? Contact DocShipper today for your free estimation. Life just became a whole lot easier!

Sea freight from the UK to RDC typically takes in the vicinity of 25-35 days. However, this duration is influenced by a plethora of factors, including but not limited to the specific ports used, the weight, and the type of goods being shipped. For a more accurate estimate, we recommend contacting freight forwarding experts like DocShipper for a tailored quote.

Here are the approximate transit times for sea freight between key ports in both countries:

| UK Ports | RDC Ports | Average Transit Time (Days) |

| Port of Felixstowe | Port of Matadi | 20 |

| Port of Southampton | Port of Boma | 30 |

| Port of Liverpool | Port of Matadi | 25 |

| Port of London | Port of Boma | 34 |

*Please note, these are average times and can vary. For precise transit times, please consult with a reliable freight forwarder.

How much does it cost to ship a container between UK and RDC?

Ocean freight rates when shipping a container from the UK to the Democratic Republic of the Congo (RDC) can vary tremendously. The key elements impacting your shipping cost include your selected Point of Loading and Destination, the carrier, the nature of the goods, and even the monthly market conditions. This variability is why offering a precise, one-size-fits-all rate isn’t feasible. However, fret not. With our proficient shipping specialists, you’ll receive the best rates tailored to your specific needs. We assess each client’s requirements on an individual basis, ensuring an affordable, bespoke shipping experience.

Special transportation services

Out of Gauge (OOG) Container

Definition: An OOG container is designed for items that can’t fit in a standard container due to their height, weight, or length. They often feature flat racks, open tops, or extendable ends.

Suitable for: These are best suited to transport large, heavy items such as machinery, vehicles, and construction equipment.

Examples: Large manufacturing equipment, turbine blades, yachts

Why it might be the best choice for you: If dimensions exceed standard containers, the OOG container offers a feasible solution without dismantling your Out of gauge cargo.

Break Bulk

Definition: Break bulk is a shipping method where goods are individually, bagged, boxed, or crated then loaded onto a vessel. This method is often used when cargo is too large to fit into a container or has an odd shape.

Suitable for: Project freight, oversized equipment, large volumes of packed cargo

Examples: Wind turbines, transformers, timber or paper reels.

Why it might be the best choice for you: Break bulk is perfect for large pieces of cargo not suitable for containers, providing more flexibility in terms of cargo shape and size.

Dry Bulk

Definition: Dry bulk refers to shipping of loose cargo like coal, grain, or minerals that are packed directly into the vessel’s hold.

Suitable for: transporting unpackaged goods in large quantities.

Examples: Coal, grains, iron ore.

Why it might be the best choice for you: If transporting highly homogeneous, large quantity and unpackaged goods, Dry bulk is a cost-effective solution.

Roll-on/Roll-off (Ro-Ro)

Definition: In a ro-ro vessel, cargo is driven on and off the ship on their own wheels or using a platform vehicle, which makes this shipping method absolutely suitable for vehicles.

Suitable for: All types of motor vehicles and machinery.

Examples: Cars, trucks, trailers, and heavy plant machinery.

Why it might be the best choice for you: If you’re shipping large wheeled machinery or vehicles, Ro-Ro allows for simple and safe loading and unloading.

Reefer Containers

Definition: Reefer containers are refrigerated shipping containers for freight that requires temperature-controlled transportation, keeping cargo at preset temperatures.

Suitable for: Shipment of perishable goods like fruits, vegetables, meat, fish, dairy, pharmaceuticals, and also non-food goods like flowers and chemicals.

Examples: Pharmaceuticals, fresh produce, and frozen goods.

Why it might be the best choice for you: If your commodities need to remain frozen or chilled in transit, reefer containers provide the perfect climate-controlled environment.

Whatever your product, understanding the type of freight that suits your needs is essential. At DocShipper, we are ready to help. Contact us today for a free shipping quote within 24 hours. No matter what your cargo, we’ll find the most suitable solution for you.

Air freight between UK and RDC

For businesses shipping goods between the UK and the Democratic Republic of Congo (DRC), air freight pops up as a brilliant choice. It stands out with its speed and reliability, being the go-to choice for small, high-value items—think critical medical equipment or precious gemstones. A racehorse championing the trade route; however, many shippers inadvertently stumble out of the starting gate. Common missteps including miscalculating shipping costs, not using the appropriate weight formula, Chargeable weight- think of it like stuffing a suitcase for an airplane trip, it’s not just about how heavy it is, but how much space it takes up. Or simply lacking awareness of cost-cutting best practices. But don’t fret! We will navigate these choppy waters together in this guide! With informed planning and decision-making, air freight can truly be a cost-effective treasure.

Air Cargo vs Express Air Freight: How should I ship?

Transporting goods between the UK and RDC? A pivotal decision point hinges on whether to utilize air cargo – the method of loading your consignment onto a commercial airline along with other freight – or express air freight, where your shipment sails the sky alone on a dedicated aircraft. But which option is right for your business? The tactics differ, just as your shipment and business needs might differ, so let’s dive into the nuances of both and help you make the informed choice.

Should I choose Air Cargo between UK and RDC?

Choosing air cargo for your UK to RDC shipments might be an optimal choice, particularly if you have over 100/150kg (220/330 lbs) of cargo. Not only can air cargo be cost-effective, but it is also highly reliable. Carriers like British Airways and Air France are key players in this sector. Keep in mind, however, that transit times may be longer due to fixed schedules. So, if meeting strict deadlines isn’t crucial, air cargo could satisfy your budgetary requirements while ensuring a steady shipping rhythm.

Should I choose Express Air Freight between UK and RDC?

Choosing Express Air Freight for shipping between UK and RDC can be highly convenient if you’re sending less than 1 CBM or 100/150 kg, as this service utilizes dedicated cargo planes sans passengers. This ensures quick and efficient delivery of your goods. Companies like FedEx, UPS, and DHL lead the way in this sector, offering reliable services that could adequately meet your shipping needs. So, if you want your goods transported swiftly and professionally, this agile and speedy service might just be the perfect option.

Main international airports in UK

London Heathrow Airport

Cargo Volume: London Heathrow has a remarkable cargo throughput of around 1.7 million metric tonnes annually.

Key Trading Partners: Transporting goods to over 180 destinations worldwide with the USA, China, India, and Australia being predominant trading enthusiasts.

Strategic Importance: Located in the heart of the UK, it’s Europe’s busiest airport for passenger traffic and an essential cargo hub for the UK economy.

Notable Features: Heathrow offers specialized facilities for perishable goods, precious cargo, and has one of the world’s largest animal reception centers which makes it suitable for diversity of cargo types.

For Your Business: Its world-spanning reach, advanced facilities, and efficient services can mean quicker transit times and safer handling of your goods.

East Midlands Airport

Cargo Volume: Handling approximately 370,000 tonnes of cargo per year.

Key Trading Partners: Mainly transports to European locations including Spain, France, Germany and also domestic UK cities.

Strategic Importance: It’s the UK’s largest pure cargo airport, located near the country’s industrial heartland.

Notable Features: Offers extensive rapid cargo services and a dedicated cargo village, making it ideal for urgent or high-value shipments.

For Your Business: Ideal if your business needs 24/7 cargo operations with good coverage of domestic and European markets, even for larger volumes of goods.

Manchester Airport

Cargo Volume: Reaching an annual cargo volume of over 120,000 tonnes.

Key Trading Partners: Primarily conducts trades with the USA, Spain, Egypt, and United Arab Emirates.

Strategic Importance: As UK’s third-largest airport, it offers superb connectivity across Europe, North America, the Middle East, and Asia.

Notable Features: Offers high-quality warehousing facilities with dedicated areas for valuable goods and hazardous materials.

For Your Business: The airport is a good choice if you’re shipping to or from the North of England and require a wide range of international connections.

London Stansted Airport

Cargo Volume: Annually handles over 250,000 tonnes of cargo.

Key Trading Partners: Predominantly trades with Hong Kong, US, Turkey and UAE.

Strategic Importance: Located in London’s innovative tech hub with excellent transport links, it’s a key part of the UK’s freight network.

Notable Features: Among the largest cargo hubs in the UK, it’s equipped with a dedicated Cargo terminal and a specialist perishables handling facility.

For Your Business: If you’re transporting perishable goods, or technology-oriented items, this airport’s capabilities will likely align with your freight needs.

London Gatwick Airport

Cargo Volume: Annually, it handles around 100,000 tonnes of cargo.

Key Trading Partners: Major trading partners encompass Spain, Portugal, UAE, and the USA.

Strategic Importance: Nestled in the London metropolitan area, it’s the second-largest airport in the UK.

Notable Features: The airport offers comprehensive cargo handling capabilities including storage, palletizing, dangerous goods handling, and cold storage.

For Your Business: Gatwick’s wide reach and comprehensive services make it a strong choice for a variety of cargo types, especially if your business is in the Southeast of England.

Main international airports in RDC

N’djili Airport

Cargo Volume: N’djili airport, handling over 40,000 tons of cargo annually, is the busiest airport of Democratic Republic of Congo in terms of cargo volume.

Key Trading Partners: Main trading partners are South Africa, Belgium, China, and Zambia, with most cargo comprising minerals, fresh produce, and general consumer goods.

Strategic Importance: Located in Kinshasa, the capital, N’djili is a prime hub for domestic and international freight, connecting Africa’s central region to worldwide markets.

Notable Features: Dedicated cargo terminals equipped with modern cargo processing technologies ensure efficient cargo handling.

For Your Business: N’djili Airport provides a gateway to the abundant markets of central Africa. If your supply chain involves these regions, consider strategizing your shipping through N’djili for efficient operations.

Lubumbashi International Airport

Cargo Volume: With an annual cargo turnaround of over 20,000 tons, Lubumbashi is the second busiest cargo airport in DRC.

Key Trading Partners: Key trading partners include China, South Africa, and Germany, dealing in commodities like minerals, especially copper, agricultural products, and machinery.

Strategic Importance: As the heart of the copperbelt region, Lubumbashi International plays a significant role in transporting mineral resources, making it a vital link in the global mining supply chain.

Notable Features: Apart from general cargo handling, the airport excels in handling and storage of minerals and bulk commodities.

For Your Business: Lubumbashi Airport is optimally positioned if your business trades in minerals. Leveraging the airport’s facilities could streamline your supply chain, reduce transit times and better meet your delivery schedules.

Goma International Airport

Cargo Volume: Goma handles around 10,000 tons of cargo annually.

Key Trading Partners: Important trading partners are primarily neighboring countries, including Uganda, Rwanda and Tanzania. Goods traded include consumer goods, timber, and relief supplies.

Strategic Importance: Located near the eastern border, Goma Airport not only facilitates regular commerce but is also crucial for humanitarian operations in the region.

Notable Features: Expertise in the handling of humanitarian freight, and it has a strategic location for easy access to remote parts of central Africa.

For Your Business: Goma International Airport is uniquely positioned for businesses that aim to reach remote African markets or are involved in humanitarian goods’ trading. A well-planned supply chain strategy utilizing Goma could mean timely deliveries and expanded market reach.

How long does air freight take between UK and RDC?

On average, air freight shipping between the UK and the Democratic Republic of Congo (RDC) may take approximately 4-7 days. However, your specific transit time will be influenced by a few factors: the particular airports you’re shipping from and to, the weight of your cargo, and the nature of the goods being transported. For the most accurate transit times specific to your consignment, consulting with a specialist freight forwarder like DocShipper is highly recommended.

How much does it cost to ship a parcel between UK and RDC with air freight?

Air freight cost between the UK and the Democratic Republic of Congo can roughly range between £3.50 to £7.00 per kg. However, an exact quote isn’t feasible–specific prices depend on various factors including distance from airports, dimensions, weight, and the nature of goods. Be assured that our team is committed to offering competitive rates tailored to your shipping needs. Since we quote on a case-by-case basis, we ensure cost-effectiveness without compromising on service quality. Contact us to receive a free quote in less than 24 hours.

What is the difference between volumetric and gross weight?

Gross weight refers to the actual physical mass of your shipment, including the goods and any packaging. In essence, it’s how heavy your cargo is when you put it on a scale.

On the other hand, volumetric weight, sometimes called dimensional weight, considers the space your shipment occupies in relation to its weight. It’s estimated based on your parcel’s length, width, and height.

For air cargo, the volumetric weight is calculated by multiplying the structure’s length, width, and height (in centimeters) and then dividing the result by 6000. For instance, if a shipment measures 50cm x 40cm x 30cm, the volumetric weight is 50x40x30/6000 = 10kg. This is approximately 22 lbs.

Gross weight is simpler. It’s straightforwardly the measurement on the scale in kilograms, which can then be converted to pounds (1kg is approximately 2.2lbs).

For Express Air Freight services, the calculation for volumetric weight is slightly different, using a divisor of 5000 instead of 6000. Following the same dimensions as above, the volumetric weight becomes 12kg (or around 26.4 lbs).

These calculations matter because when determining freight charges, carriers charge based on whichever is higher between the gross and volumetric weight. This encourages efficient packaging and ensures carriers receive fair compensation for the space occupied by your shipment, regardless of weight.

Door to door between UK and RDC

International door-to-door shipping orchestrates the entire freight journey, all the way from the UK to the RDC, handling every logistic detail in-between. This service offers you convenience, cost-savings, and the peace of mind knowing your goods are taken care of. Fancy simplifying your shipping needs while enjoying a smooth transit experience? Let’s dive in!

Overview – Door to Door

Shipping between the UK and RDC may seem daunting, but not when you opt for the low-hassle door-to-door delivery. It’s a top notch service, popular among our clients like yourselves, offering ease, cost-effectiveness, and a streamlined process. Embrace this solution to avoid the complexities tied to customs, logistical management and disparate shipping stages. On the flipside, it can be pricey than other options but the benefits certainly outweigh the cost. Let’s unpack how this could be the game-changer for your shipping needs.

Why should I use a Door to Door service between UK and RDC?

Ever tried herding cats only to realize shipping goods is trickier? If so, Door to Door service between the UK and RDC might just be the perfect solution for you. Here’s why:

1. Stress-free Logistics: Opting for Door to Door service ensures you don’t need to juggle between multiple cargo services. From loading and offloading the goods to transiting them through various modes of transport, everything is handled meticulously by an adept team.

2. Timely Delivery for Urgent Shipments: With a dedicated routing trajectory and cuffs-free customs clearance, Door to Door service can fast track your shipment, ensuring your goods reach their destination on time.

3. Specialized Care for Complex Cargo: Worried about delicate, high-value, or otherwise tricky-to-transport cargos? Keep your anxiety at bay as this service encompasses specific protective measures which can handle your goods with extreme care.

4. Trucking to Final Destination: Once arrived at RDC, ensuring your goods reach their final destination can be a logistics maze. Door to Door service covers this last-mile delivery, making sure your goods reach the right address without you having to lift a finger.

5. Convenience: Above all, Door to Door service combines all these perks into one single convenient package. This means you can focus on running your business without having to constantly worry about your international freight.

Choosing Door to Door service thus paves the way for a less stressful, more reliable logistics strategy for your UK to RDC shipments. Shipping goods may still be trickier than herding cats, but at least it’s a whole lot neater!

DocShipper – Door to Door specialist between UK and RDC

Stress-free shipping from the UK to the Democratic Republic of Congo is just a call away with DocShipper’s comprehensive freight forwarding services. We manage your cargo with complete transparency and efficiency, from packaging and driving to managing customs and the complexities of shipping via air, sea, road, or rail. Our dedicated account executives are equipped with the right skills to assist you at every step. Get in touch for a free estimate in less than 24 hours, or speak to our experts at no charge. It’s as easy as shipping from A to Z. Choose DocShipper, because we deliver peace of mind.

Customs clearance in RDC for goods imported from UK

Customs clearance is a crucial step when importing goods from the UK to the Democratic Republic of Congo (RDC). It’s a labyrinth of codes, fees, taxes, quotas, and licenses that, if not navigated correctly, can result in unexpected expenses or your shipment stranded at the border. Understanding how this intricate system works is absolutely vital to ensure smooth passage for your goods. In the coming sections, you’ll find a thorough guide into every aspect of this process. With our expertise, DocShipper can navigate this network for you. Whether your goods are large or small, commonplace or boutique, we offer assistance worldwide. To get an estimate, contact our team with your goods’ origin, value, and HS code. Let these be your first steps in mastering the customs clearance in RDC.

How to calculate duties & taxes when importing from UK to RDC?

When importing goods from the UK to the Democratic Republic of Congo (RDC), the task of estimating duties and taxes can appear complex, but it’s actually a process you can master. The calculation primarily relies on key factors such as the country of origin, the specific classification of your goods under the Harmonized System (HS) Code, the customs value assigned to your goods, the applicable tariff rate set by the RDC, and any extra taxes or fees correlated with your items.

Step one in this procedure? Tracking down the exact location where your goods were manufactured or produced, as clear identification of the country of origin is vital. Why? The place of origin can significantly influence the applicable tariff rates and partner country agreements can dramatically affect the import duties. This is just the genesis of the freight-forwarding journey, but it’s a pivotal starting point which sets the stage for successful, well-informed importing.

Step 1 – Identify the Country of Origin

Knowing the country of origin matters greatly, and here’s why:

1. Customs Duty Impact: Even small differences in the geographical source can alter the customs duty requirements.

2. Trade Agreements: These compacts between the United Kingdom and the Democratic Republic of Congo (DRC) can influence your duty rates. Some goods enjoy lower tariffs, or even duty-free status due to preferential trade agreements.

3. Import Restrictions: Certain goods from specific origins have restrictions. Stay in the know to avoid any impounding of the shipment.

4. Accurate Documentation: Wrong country of origin on your paperwork adds complications, leading to delays and extra costs.

5. Precision Is Key: It’s not just the duty. A misstep in country of origin can affect other charges, like value-added tax (VAT).

The UK-DRC trade agreement provides duty-free access for most goods. However, certain import quotas apply, which might affect your project. Consult the Database Application for Tariff Quotas to confirm the quota status. When in doubt, reach out to our team for precision in detail, thus ensuring smooth sailing for your imports from the UK to DRC.

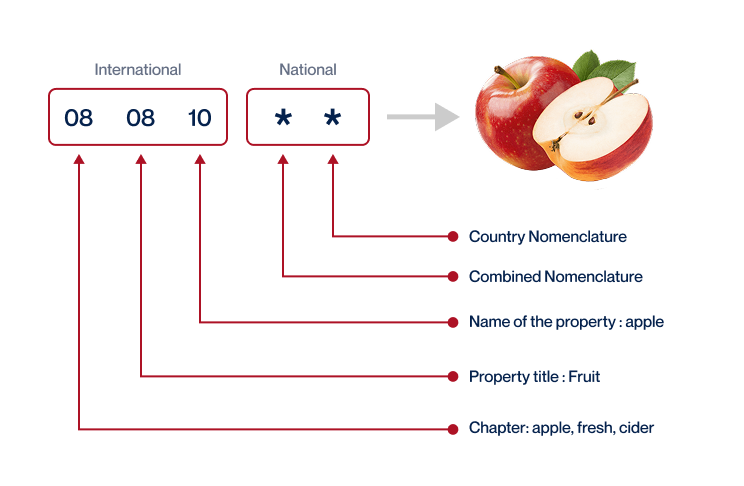

Step 2 – Find the HS Code of your product

The Harmonized System (HS) Code is a standardized numerical method of classifying traded products. It is used by customs authorities globally to identify products for the purpose of levying duties and taxes, facilitating trade negotiations, monitoring controlled goods, and much more.

Your supplier is usually the easiest way to find your product’s HS code. They’re quite familiar with the products they’re importing and the corresponding regulations.

However, if this isn’t possible, you can find it yourself by using an easy step by step process. First, proceed to the Harmonized Tariff Schedule here. After you’ve accessed the page, enter your product’s name in the search bar. From the results, examine the Heading/Subheading column to locate your product’s HS code.

One thing to consider is the accuracy in choosing the correct HS Code for your product. Making a mistake in your code can result in shipping delays and potential fines, so make sure to double-check everything and ensure its correctness.

Here’s an infographic showing you how to read an HS code. Remember, knowledge is power! The more you understand about these codes and shipping processes, the better decisions you’ll make for your business.

Step 3 – Calculate the Customs Value

Grasping the concept of ‘customs value’ can be tricky, but it’s crucial for your import process. This isn’t simply the amount you’ve paid for your goods. Rather, customs value, in the context of Democratic Republic of Congo, refers to the CIF value, a term you’ll often encounter. This is the sum of the cost of your goods, international shipping fees, and insurance costs – all in USD.

For practical context, imagine you’ve bought a batch of shoes from the UK for $2000. The shipping costs you $500, and insurance costs are $100. This makes your CIF value $2600, not just $2000! Understanding these nuances can save you from RDC customs headaches. Remember, the correct calculation of this CIF value plays a central role in determining the duties and taxes for your shipment. So, take your time to get it right.

Step 4 – Figure out the applicable Import Tariff

Import tariffs are the taxes imposed on imported goods, often categorized as a percentage of the goods’ overall value. In the Democratic Republic of Congo (DRC), the categorization of imported UK goods for these tariffs is determined by Harmonized System (HS) codes.

For instance, you may be importing a type of plastic – polyethylene (HS code 390110). The applicable UK Global Online Tariff Tool is your go-to guide.

To find the tariff rate, follow these steps:

1. Visit the UK Global Online Tariff Tool.

2. Enter 390110 (the HS code for your product) and select the country of origin – in this case, the UK.

3. Review the duties and taxes applied to your product.

Now, let’s say your CIF (Cost, Insurance, and Freight) value is USD 10,000, and the determined tariff rate is 15%. To calculate the import duty, multiply the tariff rate by the CIF value (15% x $10,000 = $1,500). Therefore, your import duties would amount to USD 1,500.

Remember, while it may seem complex at first, correctly identifying your HS codes and understanding applicable tariffs can significantly streamline your shipping process and avoid unexpected costs.

Step 5 – Consider other Import Duties and Taxes

In addition to paying standard tariff rates on goods imported from the UK to the RDC, you may also encounter several other duty fees. For instance, an excise duty might apply to specific categories of goods like alcohol or tobacco. This duty is typically calculated as a percentage of the commodity’s cost, insurance, and freight (CIF) value. Anti-dumping duties could also be levied to protect domestic industries by increasing the price of cheap imports.

Now, let’s not forget the Value Added Tax (VAT), a critical charge that applies to almost every import. It’s notably calculated on the total sum of the CIF value, the tariff, and any other applicable duties. Let’s say, for example, you are importing goods valued at $10,000 with a tariff of 5%, excise duty of 10% and a VAT rate of 18%. You’d first calculate the tariff ($500) and excise duty ($1,000). Then, you’d add these duties to the CIF value for a sum of $11,500. Afterward, the VAT is derived from this sum, which in this case would be $2,070. Please note, these are example rates and could differ.

Be aware, these additional charges can add substantially to the cost of your shipment and need careful consideration when importing goods into the RDC. Having a comprehensive understanding of these duties helps avoid surprising costs. Professional advice can be invaluable.

Step 6 – Calculate the Customs Duties

Calculating customs duties for goods transported from the UK to the Democratic Republic of Congo (RDC) depends on a few key factors. The basic formula follows:

Customs Duties = Customs Value Duty Rate

But in real-life scenarios, it may look as follows:

1. Customs Duties Only: Suppose you’re importing machinery valued at $10,000, with a 5% duty rate. Simply multiply the two ($10,000 0.05), leading to a customs duty of $500.

2. Customs Duties and VAT: Now, suppose your goods are valued at $20,000, with a duty rate of 15% and a VAT rate of 16%. Calculate the customs duties ($20,000 0.15 = $3,000). Then, calculate the VAT on the total Value + Duty ($23,000 0.16), getting $3,680. Therefore, total due is $6,680.

3. Customs Duties, VAT, Anti-Dumping Taxes, and Excise Duty: Let’s say your goods are valued at $50,000, with anti-dumping tax of $3,000, a duty rate of 10%, VAT of 16%, and excise duty of $500. First, evaluate customs duties and VAT following the previous process, then add the anti-dumping taxes and excise duty.

These calculations can be tedious! At DocShipper, we specialize in accurate, affordable and fast customs clearance worldwide. With us, there won’t be extra charges. Opt for a free quote within 24h, letting us ease your customs clearance process.

Does DocShipper charge customs fees?

As your UK and DRC customs broker, DocShipper won’t bill you for any customs duties – those are governmental charges. However, we do charge for customs clearance services. Picture it like this: while applying for a visa, you pay the visa fee directly to the government and the service charge to the agency handling your application. We ensure you only pay what’s mandated by the customs office and provide you with their paperwork for full transparency. Simply put, you’ll only pay us for navigating the process on your behalf, while all official taxes go straight to the government.

Contact Details for Customs Authorities

UK Customs

RDC Customs

Official name: Direction Générale des Douanes et Accises (DGDA)

Official website: https://www.dgda.cd/

Required documents for customs clearance

Clearing customs can seem like decoding hieroglyphics with endless documentation. This section simplifies that journey, breaking down key documents like the Bill of Lading, Packing List, and Certificate of Origin, plus essential conformity proofs such as CE standard. At the end, you’ll be a paperwork pro!

Bill of Lading

Navigating the waters of international shipping can be daunting, but a key tool for smooth sailing is the Bill of Lading. This official document signals the transition of ownership – the moment your shipment leaves UK shores en route to the RDC, the baton has officially passed. But did you hear about the electronic or telex release? Imagine a world with less paper, where you can release your goods swiftly without having to surrender a physical document. Now, that’s 21st-century logistics! When you’re opting for air freight, the Air Waybill (AWB) is the equivalent, with similar features. So, don’t miss it when preparing your paperwork. Harness the benefits of digitization and kiss those long waits goodbye, your business will thank you for it.

Packing List

In the world of freight forwarding, the Packing List stands as a key player, especially between the UK and RDC. As a shipper, it’s your duty to ensure precision in this document, considering both air and sea freight need it to proceed smoothly. Picture it as your shipment’s ID – detailing essential info like the weight, measurements, or the type of goods you’re moving. Suppose you’re shipping a batch of imported machinery parts – in this case, the Packing List not only helps customs identify your shipment but also accelerates the clearance process. An accurate Packing List equals fewer hold-ups, ensuring swift movement of your goods from the UK to RDC. So, always verify your Packing List – it’s a small step that makes a big difference in your shipping experience.

Commercial Invoice

When you’re shipping goods from UK to RDC, your Commercial Invoice is a must-have. It’s the backbone of your customs paperwork, containing detailed information such as seller’s and buyer’s details, description of goods, and terms of delivery. Don’t overlook the Harmonized System (HS) codes; this standardised system makes it clear what your shipment contains, reducing customs confusion.

Ensuring your Commercial Invoice aligns with other documents, like the Bill of Lading, is crucial. Inconsistencies can downshift your customs clearance process to a crawl, and nobody wants that!

So, familiarise yourself with the nitty-gritty of a Commercial Invoice. Duplicating information across documents is not redundant; it’s a belt-and-braces approach. Tidying up these details can be the wildcard in your hand, accelerating your shipping journey between the UK and RDC. Keep your data consistent, precise, and correct across the board. Your goods will thank you by reaching their destination swiftly and without hiccups.

Certificate of Origin

The Certificate of Origin (COO) is your golden ticket in the shipping adventure between the UK and the Democratic Republic of the Congo (RDC). Acting as a passport for your goods, it verifies where they were manufactured. Picture sending a shipment of famous British tea to the RDC. Without a Certificate of Origin indicating that it’s authentically ‘Made in the UK,’ you could face issues at customs and miss out on preferential duty rates. So, ensure to include the ‘country of creation’ accurately on your COO because it can save you a fair chunk of change, speed up clearance, and help sidestep any uninvited trade policy bristles. Remember, the devil’s in the details – the more accurate you are, the smoother your shipping journey.

Certificate of Conformity (CE standard)

As you navigate the shipping of goods between the UK and the RDC, you might come across the term CE Standard. This mark is significant as it signals conformity to health, safety, and environmental protection standards for products sold within the European Market. Unlike quality assurance, which is more of an internal guideline, the CE Standard is a legal prerequisite for entering certain markets. For instance, in the US, you have a comparable UL Standard which provides similar product assurances. Now, with the UK having left the EU, you’ll need to work towards the updated UKCA marking. To avoid last-minute scrambles – plan ahead and ensure all your goods meet the mandatory standard for the targeted region before shipping.

Your EORI number (Economic Operator Registration Identification)

European freight can be a complex beast, particularly when dealing with the customs clearance process between the UK and the Democratic Republic of Congo (RDC). One key document you need is the EORI number – think of it as your passport in the world of freight shipping. It’s your unique identifier, permitting you to import or export goods. Despite the UK no longer being part of the EU, if your trade interactions involve EU countries, this identifier is crucial. Registration is a smooth online process done via the UK Government website. Remember, without this, your shipments might be stuck at the border, slowing down your supply chain. It’s a small step with a big impact. Staying on top of these details will streamline your UK-RDC freight operations. Remember, in the shipping world, knowledge is power, and power is timely and hassle-free deliveries.

Get Started with DocShipper

Prohibited and Restricted items when importing into RDC

Understanding what can and can’t be imported into the Democratic Republic of Congo (RDC) saves you from the headache of goods being held up at customs, or even worse, facing legal issues. Here’s the lowdown on the prohibited and restricted items.

Are there any trade agreements between UK and RDC

Currently, there isn’t an established Free Trade Agreement (FTA) or Economic Partnership Agreement (EPA) between the UK and the Democratic Republic of Congo. However, discussions are ongoing and the situation may change in future. As a business shipping goods between these countries, closely monitoring these potential developments can open up new opportunities for you. Don’t overlook the planned extension of the Kisangani-Ethiopia railway line, which promises to streamline transport, potentially reducing your shipment time and cost.

UK – RDC trade and economic relationship

In the shadow of colonial history, the UK-RDC relationship has flourished into an intricate web of trade and economic interdependence. The UK’s interests are deeply rooted in DRC’s mineral-rich sectors such as copper, cobalt, and diamonds. Notably, multi-million dollar investments by giant British corporations such as Glencore in the mining sector propelled DRC as a critical trading partner. In recent years, bilateral trade has surged, reaching an impressive £16.4 billion in 2023. Fast-growing sectors such as telecommunications and manufacturing are witnessing British investment, emulating the mining sector’s success. The ever-increasing economic entanglement reflects robustly in the trade volumes, with the UK importing goods worth over £364 million in 2023. Looking forward, these numbers manifest the immense potential and rich opportunities for both nations in this prosperous cross-border economic liaison.

Your first steps with DocShipper

Additional logistics services

Warehousing

Finding the right warehouse in the UK or RDC can feel like maze-running, especially when your goods need special love, like temperature control. Don't worry! We're here to uncomplicate it for you. Imagine a world with reliable storage, preserving your goods in the just-right conditions they deserve. Intrigued? Dive deeper into the world of warehousing here.

Packing

Shipping between the UK and RDC? Remember, product safety is everything. A reliable agent guarantees efficient packaging and repackaging to protect your goods - be they delicate ceramics or rugged machinery parts. Think expert wrapping, padding, and crating specific to your product type. It's all about securing your goods and your peace of mind. Dive deeper into the details on our dedicated page: Freight packaging.

Transport Insurance

Shipping freight has its share of risks. Unlike limited fire insurance, cargo insurance provides comprehensive coverage, ready for any transit-related curveballs. This insurance becomes your safety net, protecting you from the unexpected - think damaged goods due to poor handling or even theft. Imagine sending high-value electronics or precious antiques, the tiniest mishap could spell disaster! Prevention is key, and that's where our cargo insurance shines. Safeguard your items and sleep easier. Check our dedicated page for more: Cargo Insurance.

Household goods shipping

Moving cherished belongings from the UK to the RDC? Our Personal Effects Shipping service ensures delicate and large items are handled with the utmost care. For instance, a beloved grandfather clock or a large piece of art will reach its new home safely and conveniently. More info on our dedicated page: Shipping Personal Belongings.

Procurement in Thailand

Moving goods between the UK and RDC? DocShipper revamps your procurement process, grounding the search for suppliers and manufacturing solutions in Asia, East Europe and beyond. We break language barriers and steer you through the process, making your cross-continental venture a breeze. Pinpoint real-life solutions with us. Want to dive deeper? Visit our dedicated page: Sourcing services.

Quality Control

Ensuring your products are up to mark is pivotal when shipping from the UK to RDC. Our quality control service performs rigorous inspections, catching defects or discrepancies early on. Remember that time when Apple recalled routers due to faulty plugs? They could have avoided the mishap with quality inspections. Make sure your goods pass scrutiny - it's better safe than sorry. More info on our dedicated page: Quality Inspection.

Conformité des produits aux normes

Entrusting your goods' regulatory adherence to us means ensuring they meet standards and certifications without hassle. Our dedicated labs thoroughly test products, providing assurance of compliance before hitting foreign markets. Smooth out potential bumps on your logistics journey with our Product Compliance Services.