Freight Shipping between UK and New Zealand | Rates – Transit times – Duties and Taxes

Throwing a Kiwi fruit from the UK to New Zealand would be fruitless, much like navigating international shipping without the right knowledge. Understanding shipping costs, accurate transit times, and complex customs regulations can seem like a Herculean task. That's why this guide comes in to save your day. It will empower you with comprehensive insights about the available freight options, whether air, sea, road, or rail, unmask the mysterious realm of customs clearance, break down duties and taxes into digestible bites, and provide tailor-made advice for businesses shipping between the UK and New Zealand. If the process still feels overwhelming, let DocShipper handle it for you! With decades of experience under our belt as an international freight forwarder, we decode each step of the shipping process, turning potential hazards into success stories for businesses, one shipment at a time.

Which are the different modes of transportation between UK and New Zealand?

Transporting goods all the way from the UK to New Zealand? You have quite a journey ahead! Considering the distance (almost half the globe!) and the sea separating these islands, an expedited air freight may first come to mind. But, let's not rule out ocean shipping just yet. These vast waters might seem intimidating, but they're like an expansive highway for cargo ships. Through this guide, we'll explore these practical options to figure out which one fits your shipment like a glove—just as a surfer picks the right board for the wave conditions at Piha Beach.

Need help with your shipment?

Need assistance with your shipment? Dont hesitate to contact us even for a simple question. Choose the option that suits you

Live chat with an expert Chat on WhatsApp Free Quote 24hHow can DocShipper help you

Sea freight between UK and New Zealand

Ocean shipping between the UK and New Zealand is not only a vital link bridging these two nations, but a cost-effective solution for shipping high-volume goods. Major cargo ports such as London Gateway in the UK and Ports of Auckland in New Zealand serve as bustling hubs, connecting key industrial centers across thousands of miles. Despite its efficiency in handling bulk shipments, sea freight can pose challenging hurdles for companies.

Many shippers grapple with stringent customs requirements, unfamiliar documentation, and often end up committing costly mistakes. Imagine trying to assemble a massive jigsaw puzzle without having seen the picture on the box – that’s what shipping between these two countries can feel like to many. But fear not. In this section, we’ll be your compass, guiding you through the intricate maze of ocean freight, helping you steer clear of common pitfalls and shedding light on best practices to streamline your shipping process. Now shipping won’t feel like a daunting task, it’ll be as easy as a gentle sea breeze!

Main shipping ports in UK

Port of Felixstowe:

Located in Suffolk, England, the Port of Felixstowe is an important hub due to its proximity to the major trading markets in Europe. It handles over 4 million TEU annually, making it the busiest container port in the UK.

Key Trading Partners and Strategic Importance: This port’s key trading partners are all across Europe and the Far East, specifically China. As the closest English port to Rotterdam, it is strategically placed to serve the European gateway.

Context for Businesses: If your business is keen to engage with European and Asian markets, the Port of Felixstowe could be your perfect gateway given its high level of connectivity and accessibility.

Port of Southampton:

The Port of Southampton is situated on the south coast of England and is the country’s premier automotive trading port. It handles approximately 2 million TEU per year.

Key Trading Partners and Strategic Importance: It is a major trade route connecting the UK to North America and the Far East. Significant for its container, automotive, and cruise traffic, it contributes significantly to the UK’s trade output.

Context for Businesses: Businesses specializing in the automotive sector might find the Port of Southampton particularly beneficial due to its status as the country’s number one vehicle handling port.

Port of London: Established in the city itself, the Port of London(https://www.pla.co.uk/) is one of the UK’s largest ports, handling almost 50 million tonnes of cargo annually.

Key Trading Partners and Strategic Importance: The port’s key trading regions are Western Europe, Scandinavia, the Baltic region, and North America. Its position along the River Thames allows direct shipping access to London.

Context for Businesses: If your business is targeting markets in Western Europe and North America, the Port of London can offer unparalleled convenience due to its location and trading partners.

Port of Liverpool:

The Port of Liverpool covers the West Coast and is an impressive logistical hub due to its advantageous position on the doorstep of the UK and Ireland. It handles more than 700,000 TEU per year.

Key Trading Partners and Strategic Importance: The port has a diverse range of trading partners, with the Americas being prominent. Its strategic location allows easy reach to key UK and Irish markets.

Context for Businesses: Businesses wanting to target the UK, Ireland, and the Americas may find the Port of Liverpool’s strategic location advantageous.

Port of Bristol:

Located along the Severn Estuary, the Port of Bristol handles over 12 million tonnes of cargo yearly, serving as a key gateway to the South West of England.

Key Trading Partners and Strategic Importance: Bristol has established trade routes with Northern Europe, the Mediterranean, North America, and more. Given its location, it’s ideal for serving southern England and Wales.

Context for Businesses: If your business looks to target Southern England, Wales, or Northern Europe, the Port of Bristol’s location and extensive network can be beneficial.

Port of Grimsby:

The Port of Grimsby is located on the Humber Estuary’s South Bank in North East Lincolnshire. It’s renowned for its handling of approximately 500,000 cars per annum.

Key Trading Partners and Strategic Importance: The port primarily trades with Northern Europe and Scandinavia and stands out for its specialised handling of automobiles.

Context for Businesses: If your business operates in the automobile sector and is targeting Northern Europe, the Port of Grimsby’s automotive expertise could be instrumental in your logistics strategy.

Main shipping ports in New Zealand

Port of Auckland:

Located in the heart of New Zealand’s largest city, the Port of Auckland plays a key role in the country’s import and export industries. It handles a significant shipping volume, with around 1.84 million TEU in 2023.

Key Trading Partners and Strategic Importance: The port’s primary trading partners include China, Australia, USA, and Fiji. It encompasses three container terminals and multiple bulk and breakbulk facilities, making it vital for local and international trade.

Context for Businesses: If you’re looking to tap into the New Zealand market, the Port of Auckland could very likely be a significant part of your shipping strategy due to its busy and widely-connected nature.

Port of Tauranga:

Positioned in the Bay of Plenty region, the Port of Tauranga is the largest port in New Zealand in terms of total cargo volume. It handled 27.3 million tons of cargo in 2023.

Key Trading Partners and Strategic Importance: The port’s main trading partners are China, Australia, and South Korea. Its deep-water harbor and excellent rail and road connections make it an integral part of New Zealand’s supply chain.

Context for Businesses: Businesses planning to ship large volumes of goods should consider integrating the Port of Tauranga into their logistics strategy given its capacity and connection to key markets.

Lyttelton Port:

The Lyttelton Port is located in the South Island of New Zealand and is recognized as the third-largest container port in the country. It annually handles about 400,000 TEU.

Key Trading Partners and Strategic Importance: The port is a significant trading position for exports from New Zealand to Asia, America, and Australia. It is a primary export point for South Island’s dairy, meat, and coal.

Context for Businesses: If you are engaging in the trade of basic commodities, Lyttelton Port is a possible shipping destination due to its dedicated bulk facilities.

Port of Napier:

Situated on the east coast of the North Island, the Port of Napier has strategic connections to the Hawke’s Bay’s thriving agriculture, forestry, and viticulture industries. It has a shipping volume of over 4 million tonnes annually.

Key Trading Partners and Strategic Importance: The port has strong trading links with Australia, the Pacific Islands, Europe, and the Americas. It specializes in handling refrigerated cargo, making it a leading export avenue for local produce.

Context for Businesses: If your company deals with perishable or temperature-sensitive cargo, the Port of Napier’s specialized facilities make it an attractive option for your logistic needs.

CentrePort Wellington:

CentrePort Wellington, located on the southern tip of the North Island, provides key domestic and international freight links. It served over 1.5 million tonnes of cargo in the financial year 2020.

Key Trading Partners and Strategic Importance: CentrePort’s main trading partners include Australia and Pacific Island countries. The port’s strategic importance is highlighted by its connection to Wellington’s central business district and local transport networks.

Context for Businesses: If your business requires quick transport times and effective distribution within New Zealand, CentrePort Wellington offers optimal convenience and efficiency.

Port of Nelson:

Port of Nelson is in the geographic center of New Zealand, making it a vital hub for the South Island’s seafood, horticulture, and forestry sectors. It handles approximately 3.6 million tonnes of cargo annually.

Key Trading Partners and Strategic Importance: Prominent trading partners include Australia, Europe, and the USA. Its central location makes it a strategic point of access to the South Island.

Context for Businesses: If your business includes the import or export of seafood or horticulture products, incorporating the Port of Nelson in your freight strategy can optimize logistics, taking advantage of its dedicated facilities and strategic location.

Should I choose FCL or LCL when shipping between UK and New Zealand?

Shipping between the UK and New Zealand? Sea freight is an excellent choice. But, what’s better for your needs – Full Container Load (FCL) or Less than Container Load (LCL), aka consolidation? This decision can be a gamechanger. It directly affects your costs, schedule, and ultimately, the success of your shipping process. Join us as we dive into these two options, helping you pinpoint the perfect solution for your unique shipping requirements. Because, in this business, one size definitely doesn’t fit all. Let’s take the hassle out of your shipping decisions!

Full container load (FCL)

Definition: FCL (Full Container Load) shipping is a type of ocean freight where you have exclusive access to a container, typically a 20'ft or 40'ft container.

When to Use: If your cargo exceeds 13/14/15 CBM, opting for an FCL shipping would be more beneficial. Not only it's cheaper for high volume exports, but it also enhances safety, as the FCL container remains sealed from origin (UK) to destination (New Zealand).

Example: Consider a business exporting British-made furniture to New Zealand. The bulky items easily fill up a 20'ft container. By opting for FCL shipping, the business ensures the cargo's safety during transit and reduces shipping costs.

Cost Implications: The more space your cargo occupies in a container, the less you pay per cubic meter. Therefore, for larger volumes, an FCL shipping quote can turn out to be more cost-effective compared to LCL. Moreover, FCL avoids the extra handling fees associated with LCL, as your container doesn't need to be consolidated with others.

Less container load (LCL)

Definition: LCL, or Less-than-Container-Load, is a shipping method where multiple shipments by several shippers share the same container. This is ideal for smaller consignments that don't require a full container.

When to Use: LCL is an optimal choice when your cargo is less than 13-15 cubic meters (CBM). It offers flexibility and cost-effectiveness for low-volume shipments. That is, instead of waiting to fill a whole container, you can send your smaller cargo more frequently, speeding up the delivery process.

Example: For example, if a UK-based online retailers specializing in boutique cheeses wants to test the market in New Zealand, they don't need a full container. Instead, they opt for LCL shipment, making the process leaner and faster.

Cost Implications: While the per-CBM rate for LCL freight could be higher than that of a Full Container Load, overall costs are often lower for small volume shipments. Furthermore, since you avoid the storage costs involved with waiting to fill an entire container before shipping, the total cost becomes even more competitive and manageable for your business. Be mindful, though, as LCL often involves more handling, which can require additional management and could potentially increase the risk of damage.

Hassle-free shipping

Struggling with the complex world of cargo shipping? Let DocShipper ease your concerns. As an experienced freight forwarder, we simplify your shipping decisions between the UK and New Zealand. Our ocean freight experts consider crucial factors like cost, shipping time, and cargo size to point you towards the best shipping solution, either consolidation or full container. Why not get in touch for a free estimation today? Your hassle-free shipping experience starts with us!

Shipping goods from the UK to New Zealand by sea freight generally has an average transit time of 40-45 days. These estimates, however, depend on factors that include the specific ports used, weight and nature of the goods being shipped. For a more specific transit time estimate tailored to your needs, it is recommended to contact a freight forwarder like DocShipper.

Now let’s have a look at some indicative transit times for shipments between the main freight ports in the UK and New Zealand:

| UK Port | New Zealand Port | Average Transit Time (Days) |

| London | Auckland | 40 |

| Southampton | Christchurch | 45 |

| Liverpool | Wellington | 40 |

| Felixstowe | Tauranga | 40 |

*Keep in mind these are approximate times and can change based on various factors, so always check with your freight forwarder for the most accurate information.

How much does it cost to ship a container between UK and New Zealand?

Nailing down an exact shipping cost from the UK to New Zealand can be as tricky as predicting the weather. Factors like the Point of Loading, Destination, Carrier, Goods Nature, and Monthly Market Fluctuations can cause ocean freight rates to bounce around like a cricket match. It’d be misleading to box you into a precise figure, so we’re talking a range of £50 to £200 per CBM here just for some ballpark context. But worry not, our deft shipping specialists are on hand, determined to fetch you the finest rates. Remember, we quote tailored to each unique case, no cookie cutter costs here!

Special transportation services

Out of Gauge (OOG) Container

Definition: An OOG container is designed to accommodate cargo that doesn’t fit into standard containers due to their large dimensions.

Suitable for: This type of container is suitable for shipping heavy machinery, industrial kitchen equipment, or other bulky items.

Examples: Ship industrial vehicles or oversized load like wind turbines from the UK to New Zealand.

Why it might be the best choice for you: If you have out of gauge cargo that cannot be dismantled, the OOG container will ensure a safe and efficient ocean freight shipping.

Break Bulk

Definition: Break bulk involves loading individual items separately onto the ship rather than in containers.

Suitable for: It is ideal for bulky, heavy goods that do not fit in standard containers and are too large for OOG containers.

Examples: Shipment of heavy machinery, boilers, or generators.

Why it might be the best choice for you: If your business handles large, irregularly shaped items, and loose cargo load, then break bulk could be a feasible solution.

Dry Bulk

Definition: Dry bulk refers to shipping raw, unpackaged goods in large quantities directly in a ship’s hull.

Suitable for: Commonly used for commodities that are poured like sand, fertilizer, or grain.

Examples: Grain or raw material exports from the UK to New Zealand.

Why it might be the best choice for you: Consider dry bulk when shipping large quantity of loose, unpackaged goods.

Roll-on/Roll-off (Ro-Ro)

Definition: RO-RO refers to vessels where cargo – typically vehicles – roll on at the beginning and roll off at the destination.

Suitable for: This service is primarily for motor cars, trucks, semi-trailer trucks, trailers or railroad cars.

Examples: Deliver new or used cars to dealerships in New Zealand from the UK.

Why it might be the best choice for you: If your supply chain includes wheeled cargo like automobiles, buses or trucks, using ro-ro vessel service is a compelling option.

Reefer Containers

Definition: Refrigerated containers or ‘reefers’ are temperature-controlled containers used to ship perishable goods.

Suitable for: Ideal for fresh or frozen foods, pharmaceuticals, or any goods requiring cold storage.

Examples: Perishable goods like fresh fruits, vegetables, meats, or dairy products.

Why it might be the best choice for you: If you have temperature-sensitive goods to transport from the UK to New Zealand, the reefer container offers the perfect environment to maintain product quality.

Through various shipping methods, DocShipper aims to make your cargo’s journey from the UK to New Zealand as smooth as possible. Whether you have heavy machinery or temperature-sensitive goods, feel free to contact us for a free shipping quote in less than 24 hours.

Air freight between UK and New Zealand

Picture this: shipping a diamond necklace from London to Auckland. Or a few dozen designer watches. These items are small, hold significant value, and you’d want them to reach the other end of the world swiftly. Enter air freight – the speed demon of international transport. It’s like the express mail for international trade – quick and reliable. So if time is of the essence, air freight between the UK and New Zealand operates like a rapid, round-the-clock courier service for your goods.

But here’s something many businesses stumble on – the hidden traps of air freight costs. It’s like preparing a recipe but miscalculating the weights of the ingredients. If you don’t use the unique weight formula for air freight, hello inflated costs! A lot of businesses miss out on this, ending up with higher bills and dented profits. And believe us, there are plenty more such time and money-saving secrets to unravel in air freight. Let’s dive deeper.

Air Cargo vs Express Air Freight: How should I ship?

Thinking of shipping goods between the UK and New Zealand and can’t decide between regular air cargo and express air freight? Here’s the scoop: air cargo makes use of shared airline space, while express air freight whisks your goods on a dedicated flight. Let’s take a deep dive to understand which option aligns better with your business needs, considering factors like volume, speed, cost, and more. Stay tuned, and we’ll help you streamline your transcontinental shipping strategy.

Should I choose Air Cargo between UK and New Zealand?

Choosing air cargo for freight between the UK and New Zealand can be both cost-effective and reliable, especially if your consignment weighs between 100/150 kg (220/330 lbs). By engaging carriers like British Airways and Air New Zealand, you can benefit from their extensive networks and proven reliability. However, one thing to bear in mind is the slightly longer transit times due to fixed schedules. So, if your budget allows for it and your freight fits the weight criteria, air cargo can be an attractive option for your shipping needs.

Should I choose Express Air Freight between UK and New Zealand?

Express air freight – a specialized service involving dedicated cargo planes – could be your go-to solution for shipments between UK and New Zealand under 1 CBM or 100/150 kg (220/330 lbs). These shipments are quickly delivered via global courier giants such as FedEx, UPS, or DHL. Choosing express air freight means putting premium on speed, perfect for time-sensitive, smaller cargo. Remember, while it’s fast, it also comes with a higher price tag as compared to other shipping modes.

Main international airports in UK

Heathrow Airport

Cargo Volume: Heathrow Airport shipped around 1.8 million metric tonnes of cargo in 2023.

Key Trading Partners: The US, UAE, and China are major trading partners.

Strategic Importance: As Britain’s busiest airport, Heathrow is crucial for UK imports and exports.

Notable Features: It has dedicated cargo facilities and services to handle special goods like perishables or valuable items.

For Your Business: If your business is dealing regularly with markets in the US, UAE, or China, Heathrow might be a powerful ally, providing you with fast and safe shipping service.

London Gatwick Airport

Cargo Volume: Shipped approximately 120,000 tonnes of cargo in 2023.

Key Trading Partners: Major partners include the US, Dubai, Canada, and Dublin.

Strategic Importance: With excellent links to London and the South East, Gatwick is a key player in the UK economy.

Notable Features: Gatwick offers designated cargo carriers and ample capacity for cargo flights.

For Your Business: For operations centered around the South East of England, utilizing Gatwick for your cargo needs could significantly reduce transport and delivery times.

Manchester Airport

Cargo Volume: In 2023, Manchester Airport processed around 130,000 tonnes of cargo.

Key Trading Partners: The US, UAE, and Hong Kong are the main trading partners.

Strategic Importance: Serving the North of England, it’s a crucial airport for businesses located in this region.

Notable Features: Manchester has the largest freight terminal outside of London and offers an array of logistics solutions.

For Your Business: If your company is based in the North of England, leveraging Manchester Airport can help cut down transport times and streamline your supply chain.

Stansted Airport

Cargo Volume: In 2023, Stansted handled around 285,000 metric tonnes of freight.

Key Trading Partners: Major trading partners are the US, Hong Kong, and Germany.

Strategic Importance: One of the largest cargo airports in the UK and located conveniently near London.

Notable Features: Houses a specialist Border Force International Trade Team that supports all customs and freight forwarding needs.

For Your Business: Stansted can be an important asset if your commerce frequently deals with American, Asian, or European markets.

East Midlands Airport

Cargo Volume: East Midlands Airport handled over 332,000 metric tonnes of cargo in 2023.

Key Trading Partners: The main partners are Brussels, Frankfurt, and Dublin.

Strategic Importance: It is Britain’s busiest pure cargo airport, playing a vital role in UK trade.

Notable Features: It houses a FedEx hub and other major international couriers.

For Your Business: If your business operates during the evening or nighttime, East Midlands Airport could be your industry’s knight in shining armor, as it specializes in overnight freight.

Main international airports in New Zealand

Auckland Airport

Cargo Volume: The Auckland Airport handles over 2 million tonnes of cargo each year.

Key Trading Partners: Asia-Pacific regions including China, Australia, and the USA.

Strategic Importance: As New Zealand’s largest and busiest airport, Auckland Airport is a major cargo entry and exit point with a strong network of direct flights throughout the world.

Notable Features: It has advanced cargo facilities, including temperature-controlled areas for perishable goods and special facilities for handling dangerous goods.

For Your Business: The airport’s connections to key markets and state-of-the-art facilities might make it the ideal fit if you are looking to ship high-value or sensitive goods.

Christchurch International Airport

Cargo Volume: Christchurch International Airport processes around 30,000 tonnes of air cargo annually.

Key Trading Partners: Primarily Australia, China, Hong Kong, and the United States.

Strategic Importance: Located on the South Island, it offers direct international transport to Australasia and the broader Asia-Pacific region.

Notable Features: Christchurch Airport facilitates wide-bodied freighters and has a significant capacity to handle export cargo.

For Your Business: Its substantial cargo handling capacity and South Island location may make it a strategic choice if your goods originate from, or are destined for, Southern regions.

Wellington International Airport

Cargo Volume: Wellington International Airport annually handles about 23,000 tonnes of air freight.

Key Trading Partners: Major trading partners include Australia, Fiji, and South-East Asia.

Strategic Importance: Located in the capital city, it serves as a key international travel and trade centre, offering connections to key destinations in Australasia.

Notable Features: Wellington Airport offers a wide range of cargo services, including special cargo handling, with facilities of compact size that can ensure rapid loading and unloading.

For Your Business: If speed is crucial for your shipments, consider this airport given its relatively rapid cargo transfer times.

Queenstown Airport

Cargo Volume: Queenstown Airport oversees approximately 19,000 tonnes of freight annually.

Key Trading Partners: Main partners include Australia and the Pacific Islands.

Strategic Importance: Nestled in a key tourist location, it offers accessibility to the Otago and Southland districts, vital for businesses in the tourism and hospitality sectors.

Notable Features: The airport presents exceptional handling of small to mid-sized freight sizes.

For Your Business: For businesses heavily involved in the tourism and hospitality sectors, this airport may offer additional advantages with its location and accessibility.

Dunedin Airport

Cargo Volume: Annually, Dunedin Airport handles a modest estimated 5,000 tonnes of air freight.

Key Trading Partners: Predominantly Australia and Pacific Island countries.

Strategic Importance: Serving the Otago region, it provides opportunities for businesses in the lower South Island.

Notable Features: Dunedin Airport has handling facilities for small to medium-sized freight items and features a streamlined process for handling perishable and live goods.

For Your Business: If your operations are in the Otago region, or if you ship smaller cargo items, Dunedin Airport’s strategic location and specialized services could be an asset.

How long does air freight take between UK and New Zealand?

Typically, air freight shipping from the UK to New Zealand takes around 3-6 days. However, this timeframe isn’t set in stone. Factors such as specific departure and arrival airports, the weight of the goods, and their nature can subtly influence the final timeline. For a more accurate and tailored estimate, reach out to a trusted freight forwarder like DocShipper.

How much does it cost to ship a parcel between UK and New Zealand with air freight?

Navigating the cost of air freight from the UK to New Zealand can be tricky due to numerous influencing factors. On an average, the cost might range between £2.50 – £4.50/kg, however, rates can fluctuate based on the proximity to departure and arrival airports, package dimensions, weight, and nature of goods. We understand that every shipment is unique, which is why our team is dedicated to providing a tailor-made quote to ensure you receive the most cost-effective solution. Don’t hesitate to reach out for a free, no-obligation quote within 24 hours. Reach out to us today!

What is the difference between volumetric and gross weight?

Gross weight refers to the actual weight of the item, including its packaging. It’s the weight you’d get if you put your packaged item on a scale – simple and straightforward.

On the other hand, volumetric weight, sometimes known as dimensional weight, takes into account the space the package occupies on the aircraft, rather than just its actual weight. It’s an estimation of the density of a package, which is especially important for light, bulky packages.

Calculating these variables goes as follows:

For gross weight in air freight, the items are weighed in their ready-to-ship packaging. The total weight is the sum of the individual weights and is simply expressed in kilograms (kg).

Volumetric weight is a bit more complex. It’s calculated by multiplying the package’s length, width, and height (in centimeters), and then dividing the result by 5000. In air express services, the figure used is 5000 due to IATA regulations.

For instance, a shipment with dimensions of 50cm x 30cm x 20cm and a gross weight of 10 kg would have a volumetric weight of (503020)/5000 = 6kg. This is roughly 13.2 lbs, while the gross weight of 10 kg is about 22 lbs.

Now, why is this all important? Well, airlines charge for freight based on either gross weight or volumetric weight – whichever is higher. This is known as chargeable weight. Understanding this difference equips you to package your goods more efficiently and potentially save on shipping costs.

Door to door between UK and New Zealand

Navigating the world of international shipping? Door to Door service might be your personal knight in shining armor. Simplifying the journey between UK and New Zealand, this service takes charge of your cargo from start to finish, providing unparalleled ease and convenience. With the hassle taken care of, you can focus on what really matters – your business. Ready to dive in? Let’s decode Door to Door shipping together.

Overview – Door to Door

Door to door shipping from the UK to New Zealand alleviates your logistics burden, dealing with the convoluted shipping process for you. Although it’s slightly costlier, the peace of mind it offers is invaluable. The complexity of the customs clearance, administrative procedures, and continuous transport coordination is all handled, making it DocShipper’s most requested service. However, beware of possible delays due to external factors like weather conditions. Save yourself the headache of international shipping and let the experts streamline the journey of your goods from A to B!

Why should I use a Door to Door service between UK and New Zealand?

Ever juggled too many tasks and thought, ‘There’s gotta be a better way?’ Well, if shipping goods from the UK to New Zealand is on your chore list, ‘Door to Door’ service could save your day (and your sanity). Here’s how:

1. Stress-free Logistics: With door to door service, your only job is to hand over the goods. From picking them up at your doorstep to delivering them to the destination address in New Zealand, every logistics detail is taken care of – no more wrestling with shipping schedules!

2. Clockwork Precision: Have an urgent shipment? Door to door services can offer on-the-dot delivery, often negotiating tricky routes and tight schedules better than you could while managing your business.

3. Specialized Care: Got complex cargo? Your provider will have the experience to handle fragile or unusual goods, ensuring they reach their destination in perfect condition.

4. End-to-End Responsibility: The service providers assume responsibility for the entire process. If a challenge arises, their professional expertise will resolve it swiftly, without dragging you into the fray.

5. Ultimate Convenience: Imagine no more liaising with multiple trucking providers – here, you’ll mere point A to point B, with no more alphabet to worry about.

To sum up, Door to Door service isn’t just a convenience – it’s your ticket to peace of mind in international shipping. So, why not give yourself a break and let the pros handle the complexity?

DocShipper – Door to Door specialist between UK and New Zealand

Effortlessly ship your goods from the UK to New Zealand with DocShipper’s full-service, door-to-door solution. Our unrivaled expertise in this domain ensures a seamless shipment process. We handle everything, packing and transportation, right through to navigation of customs procedures across all shipping methods. You don’t have to worry about a thing. Plus, you get a dedicated Account Executive, ensuring personalized service. Contact us to get a free estimate in less than 24 hours or speak with our friendly consultants for free. Shipping has never been this stress-free!

Customs clearance in New Zealand for goods imported from UK

Navigating through customs clearance, a crucial stage in importing goods, is often a challenging maze. When shipping goods to New Zealand from the UK, it’s easy to stumble upon unforeseen obstacles like unexpected fees, or find your goods marooned in customs due to mishandled paperwork. Understanding customs duties, taxes, quotas, and licenses is essential to avoid pitfalls. Such complexities can become overwhelming, but rest easy – our guide will demystify these areas. As a seasoned freight forwarder, DocShipper streamlines the process for all types of goods worldwide. To kickstart your project, simply share the origin, value, and HS code of your goods. Reach out to our team anytime, and we’ll gladly steer you through your customs clearance journey.

How to calculate duties & taxes when importing from UK to New Zealand?

Navigating the world of customs duties and taxes can feel like a confusing maze, but we’re here to simplify it for you when importing from the UK to New Zealand. At the core, estimating these critical fees hinge on several factors, you need to be keenly aware of: the origin country of the goods, the Harmonised System (HS) Code, the Customs Value, the Applicable Tariff Rate, and any other taxes and fees that could apply to your products. It all begins with identifying the country where your products were initially manufactured or produced—a vital pin on your importing compass directing you towards an accurate duty and tax calculation approach. By having this as your first step, you essentially map out your journey in the vast duty and tax landscape, making its navigation hassle-free.

Step 1 – Identify the Country of Origin

Knowing your goods’ origin is crucial, not just mandatory. First, it unmasks any hidden costs. You might confront unsuspected customs duties if your products are British or if parts of them are. Second, it opens the door to preferential rates. The UK and New Zealand have trade agreements which can provide lower customs duties, but only for goods truly ‘made in UK’.

Next, you’ll avoid import restrictions. Certain categories of goods from particular places face restrictions or outright bans in New Zealand. Ensure your cargo doesn’t fall into this metier. Fourth, you’ll sidestep unnecessary delay at ports. A clear origin label on your goods expedites customs checks. And fifth, it’s a formality. To determine your Harmonized System (HS) code, which classifies your product for customs, you need your item’s origin.

So, dig in, learn your product’s roots and reap the rewards. Remember, smooth sailing across trade lanes means doing your homework and wearing multiple hats – a detective uncovering your product’s backstory, a negotiator understanding trade agreements, and a strategist weaving through import restrictions. Crack on with it, you’ve got this!

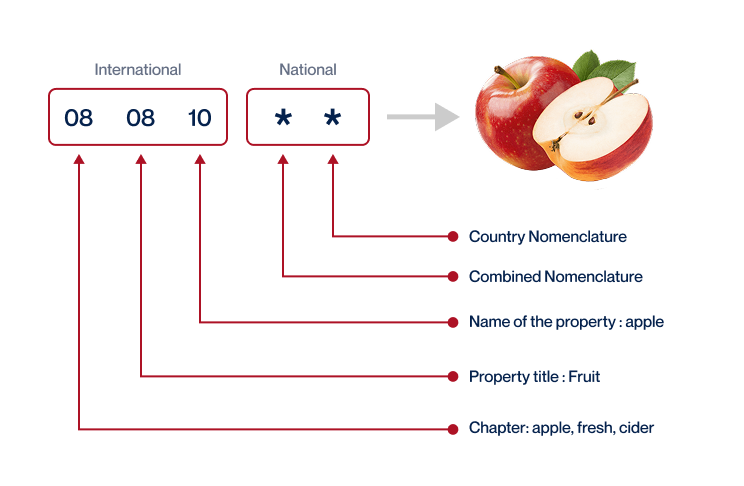

Step 2 – Find the HS Code of your product

The Harmonized System (HS) code is a standardized numerical method of classifying traded products. It is used by customs authorities worldwide to identify products for the purpose of levying duties and taxes. When it comes to shipping goods internationally, locating the correct HS code of your product is paramount.

Typically, the fastest way to ascertain the HS code is to ask your supplier directly. They are normally familiar with the goods they’re importing and the associated regulations in detail.

In case reaching out to the supplier isn’t an option, don’t fret. We’ve got a simple, straightforward process for you to find the code on your own.

Step one, navigate to the Harmonized Tariff Schedule website.

In step two, simply input the name of your product in the search bar.

Step three, look at the ‘Heading/Subheading’ column where your HS code will be displayed.

Please note: Accuracy is vital when deducing your HS code. An incorrect code could result not only in delays, but also potential fines. Therefore, ensure you double-check before proceeding.

Here’s an infographic showing you how to read an HS code.

Step 3 – Calculate the Customs Value

Knowing the customs value is critical when importing goods from the UK to New Zealand. It might be tempting to think of customs value as simply the price of your products, but alas, it’s more than that. It’s actually based on the CIF value—that’s the cost of the goods (in USD), plus the cost of international shipping, and yes, the insurance cost too. For instance, if you bought goods worth $1,000, paid $200 for shipping, and $50 for insurance, your customs value isn’t $1,000—it’s $1,250. Armed with this knowledge, you can better anticipate your total import costs, ensuring no unpleasant surprises in your shipping journey. Remember, the devil is in the details, and in shipping, these details could mean the difference between a smooth delivery and unexpected costs.

Step 4 – Figure out the applicable Import Tariff

In the labyrinth of international shipping, an import tariff is a tax imposed by the destination country on goods imported from abroad. In the case of New Zealand, duties are generally imposed on a CIF basis (i.e., Cost, Insurance, and Freight) using various types of tariffs, including MFN (Most Favoured Nation) tariff and Preferential Tariffs.

Now, let’s say you’re importing bicycles from the UK with the HS code 8712.00. The tool to identify their tariff is the UK’s Trade Tariff: https://www.gov.uk/trade-tariff. This step-by-step guide will help:

1. Navigate to the Trade Tariff and enter the HS code and country of origin, in this case, the UK.

2. Confirm the duties and taxes applied to bicycles.

Let’s consider that the tariff rate provided is 5%. If your CIF costs for importing the bicycles total $10,000 USD, the import duties to be paid would be 5% of $10,000, so $500. It’s crucial to accurately calculate these costs to avoid any surprises during the customs clearance process.

Step 5 – Consider other Import Duties and Taxes

While it can feel like a victory once your shipment clears customs in New Zealand, don’t forget about additional import duties and taxes you might owe. Beyond the standard tariff rate, there may be other costs associated with the product and the country of origin. Predominantly, you could be looking at Excise Duty, Anti-Dumping Taxes, and VAT.

Let’s assume, for example, you’re importing wine (affected by Excise Duty) from the UK. You’ve already paid the standard tariff, but now you may also face an Excise Duty of $$14 per liter – keep in mind this rate varies greatly, this is just an illustrative number.

Anti-Dumping Taxes may apply if your goods from the UK are cheaper than the goods of the same kind in New Zealand, aiming to prevent ‘dumping’. These taxes can be as high as 5% of the value of the goods – another hypothetical figure.

Lastly, there’s the VAT. In New Zealand, VAT (GST) is a standard 15% rate applied on the Customs Value of the goods plus all duties, levies and other taxes (like Excise Duty).

Understanding how these additional charges apply to your specific shipment can help avoid costly surprises upon delivery and ensure a smooth importing process.

Step 6 – Calculate the Customs Duties

Calculating customs duties when importing goods into New Zealand from the UK involves several parameters:

Example 1: Let’s consider a shipment of designer clothes valued at $10,000. The customs duty rate for clothes is 10%. So, the customs duty payable is $10,000 10% = $1,000. No VAT or other taxes apply in this case.

Example 2: Now, suppose you’re importing machinery valued at $20,000, and both customs duties (5%) and VAT (15%) apply. The customs duty would be $20,000 5% = $1,000. VAT applies on the sum of the customs value and customs duty, calculated as ($20,000 + $1,000) 15% = $3,150.

Example 3: Lastly, if you’re importing steel valued at $30,000, customs duties (3%), VAT (15%), anti-dumping taxes (4.5%), and excise duties (10%) apply. Customs duty is $900; VAT is ($30,000+$900)15%=$4,635; anti-dumping taxes are $30,0004.5% =$1,350, and excise duty is $30,00010% = $3,000.

Figuring it all out can be complex, but don’t fret! DocShipper’s customs clearance services can manage every step, ensuring you’re never overcharged. Contact us for a free quote within 24 hours! We are your global logistics partner.

Does DocShipper charge customs fees?

As a customs broker in the UK and New Zealand, DocShipper distinguishes between customs clearance fees and customs duties/taxes – the former is our service charge, while the latter goes directly to the government. An often confusing distinction, consider it like this: when dining out, the tip goes to the server, while the meal cost heads straight to the restaurant. Similarly here, our fees ensure smooth customs navigation and paperwork; government duties and taxes are separate. We uphold transparency, providing official customs documents as proof you’ve only paid government-imposed charges.

Contact Details for Customs Authorities

UK Customs

New Zealand Customs

Required documents for customs clearance

Facing challenges in managing international deliveries? Let’s ease the process for you. This section highlights the essentials- Bill of Lading, Packing List, Certificate of Origin and CE standard documents- key tools for a seamless customs clearance procedure. Learn their importance and dexterity in the transport process for a smoother, timely, and efficient shipping outcome.

Bill of Lading

The Bill of Lading (BOL) is your golden ticket when shipping between the UK and New Zealand. Think of it as a legal receipt that identifies your goods, proves the carrier has received them, and designates the point at which ownership is transferred. Nowadays, electronic or Telex release is a game changer, eliminating paper documents and accelerating your shipment’s journey. In air cargo, it’s cousin, the Air Waybill (AWB), governs transportation. Want to make your shipping experience smoother? Then embrace Telex release, and avoid the nightmares of lost or delayed documents. With BOL in your corner, you can ship smarter, faster, and with greater confidence.

Packing List

Navigating customs can feel like a maze, especially when shipping between the UK and New Zealand. Your guiding light through it all? The Packing List, a true unsung hero. As a shipper, you’re charged with creating a Packing List that details the contents, weight, and volume of your freight. Picture trying to process a birthday gift without a tag – confusing, right? It’s the same with freight. Customs officials in both countries use the Packing List to verify your cargo, whether it’s traveling by sea or air. Precision is key here. Any discrepancies can send your goods into bureaucratic limbo or lead to hefty penalties. So, before you send that container of specialist machinery or case of Kiwi Sauvignon Blanc, triple-check your Packing List. It’s your safeguard for a smooth customs clearance.

Commercial Invoice

Keeping your Commercial Invoice in perfect order is vital for smooth shipping from the UK to New Zealand. This document is your ticket through customs clearance; it outlines your shipment’s complete description, including the HS code, value, origin, and recipient details. Any misunderstandings here could mean delayed goods – a costly misstep. To avoid this, ensure your invoice aligns accurately with your Bill of Lading or Air Waybill. That way, discrepancies won’t raise eyebrows at customs. An actionable step? Always double-check your paperwork. Accurate documents mean your shipments smoothly transition from the breezy British Isles to the gorgeous shores of New Zealand. Remember, precision is not just a recommendation, but a requirement in international shipping. Ready to conquer the customs?

Certificate of Origin

Clearing goods through customs between the UK and New Zealand can seem daunting, right? But here’s the thing, with a Certificate of Origin, it’s really not that complex. This document, stating your goods’ country of manufacture, is really your secret weapon. In fact, it can unlock preferential custom duties – a winner for your bottom line!

Picture this: You’re a UK-based electronics retailer shipping goods from China. Since your goods are not made in the UK, declaring China as your manufacturing country with a Certificate of Origin helps clearly state the origin, ensuring you pay the correct tariff rates and prevent any hiccups at the New Zealand customs. Without it? Well, let’s just say it can be a headache needing quick aspirin! And yes, documenting your goods’ origins accurately really is that critical to successful, hassle-free shipping. So, never underestimate the power of a Certificate of Origin!

Certificate of Conformity (CE standard)

When it comes to shipping between the UK and New Zealand, having a Certificate of Conformity (CoC) is a game changer. This document is evidence that your goods meet specific standards, predominantly the CE standard within EU. But remember, the UK isn’t in the EU anymore, and the UKCA marking holds sway now. This isn’t a blanket no-hassle guarantee but rather proof that your goods meet essential safety and environmental standards. Compare it to the Approach FC Standards in the U.S – similar idea, different territory. For those of you dealing in products like toys, electronics, or machinery, having CoCs can smooth your goods’ journey, reducing delays at customs. So, take the time to understand these markings and align your products accordingly. This can make your shipping process between UK and New Zealand more efficient and favorable.

Your EORI number (Economic Operator Registration Identification)

Think of an EORI number as the passport for your imported or exported goods. This unique ID, required in the UK, ensures a smooth journey through customs clearance when shipping to or from Europe. It’s your business’s fingerprint in the world of international trade, letting authorities easily track your transactions. Registering for it is straightforward and a must-do for UK-based importers or exporters. While not strictly required for direct UK-New Zealand trade, it does hold relevance if your goods route through an EU country. And remember, no two businesses share the same EORI, it’s yours and yours alone.

Get Started with DocShipper

Prohibited and Restricted items when importing into New Zealand

Facing a hard time figuring out what’s off-limits for your NZ imports? Let’s take the guesswork out of the equation! Our guide will de-mystify those daunting customs rules, shedding light on the items banned or restricted in New Zealand. You’ll definitely want to avoid unpleasant surprises at customs!

Are there any trade agreements between UK and New Zealand

Certainly! The UK and New Zealand have a recently signed Free Trade Agreement (FTA), beneficial for businesses shipping goods between these locations. This innovative deal covers goods, services, and investments, promising to boost two-way trade. Plus, prospects for further agreements are bright, including potential expansions in infrastructure development. Such changes might streamline your shipping experience. Stay updated to seize these opportunities as they come.

UK – New Zealand trade and economic relationship

The UK and New Zealand share a rich history of trade relations, dating back to the colonial-era, rooted in mutual cooperation and shared commercial interests. Key sectors like agriculture, manufacturing and service industries have remained pivotal, with dairy products, meat, wool, and commodities like machinery and vehicles forming the bulk of traded goods. The volume and value of goods traded reflect this synergy, with the UK being New Zealand’s fifth-largest bilateral trading partner amounting to £3.3bn in 2023. Investments too, are substantial, with British firms investing £13bn in New Zealand. This partnership took a significant leap forward with the UK-NZ Free Trade Agreement announcement in 2021, set to bolster sectors such as digital trade, sustainability, and services. This economic relationship is a testament to their enduring ties and shared belief in a rule-based global trading system.

Your first steps with DocShipper

Additional logistics services

Warehousing

Finding a warehouse that ensures your goods' safety can be tricky, especially when temperature control is crucial for items like dairy products or fine wines. Your merchandise deserves a reliable home between transportation legs. Discover how we simplify the process with our exceptional warehousing solutions, geared to handle even the most specific storage needs. More info on our dedicated page: Warehousing.

Packing

Ensuring your goods are packaged right is key when shipping between the UK and New Zealand. With the right agent, you're assured expert packing and repacking to protect anything - from fragile ceramics to bulky machinery - during transport. An example: the repackaging service that helps recondition wooden furniture unscathed. Discover more about securing your shipments on our dedicated page: Freight packaging.

Transport Insurance

While both cargo and fire insurance protect your resources, they differ in scope. Cargo insurance specifically safeguards your shipment from warehouse-to-warehouse, acting as a safety net in unpredictable shipping scenarios. Imagine this: Without cargo insurance, an unexpected storm at sea could lead to substantial loss. Conversely, fire insurance defends against damages from a fire breakout in your business premises.

Household goods shipping

You're relocating from the UK to New Zealand and have fragile or bulky items? Professional handling is essential! Be it Grandma's antique mirror or your bulky elliptical trainer, our team wraps & maneuvers them with utmost care. Enjoy an adaptable service that prioritizes your concerns and makes the big move hassle-free. Handle your personal effects shipping with ease. More info on our dedicated page: Shipping Personal Belongings

Procurement in Thailand

Struggling with offshore manufacturing between the UK and New Zealand? DocShipper manages it all - from sourcing suppliers in Asia, East Europe, and beyond, to overcoming language barriers and streamlining your procurement. Imagine, a stress-free operation where materials arrive just as you want. More info on our dedicated page: Sourcing services.

Quality Control

Checking product quality before it sails from the UK to New Zealand can save time, money, and reputation. For instance, imagine discovering a fault in your LED light shipment upon arrival in Auckland. Unanticipated costs and delays, right? With our Quality Control service, we step in during manufacturing or customisation to ensure your goods meet both countries' standards. Dodge the avoidable headaches. More info on our dedicated page: Quality Inspection.

Conformité des produits aux normes

Shipping can get complicated when dealing with compliance. Your goods might need tests in certified labs to meet overseas regulations. Let us handle your product compliance requirements seamlessly; samples are tested and certified to ensure full regulation conformity, saving you the headache. Why guess when you can be certain? For more insights, visit our dedicated page: Product compliance services.