Freight Shipping between UK and Luxembourg | Rates – Transit times – Duties and Taxes

Ever tried to play wall ball with a shipment container? Me neither! But managing your freight transport between the UK and Luxembourg might feel just as challenging, especially when it comes to understanding rates, transit times, and wave-like customs regulations. In this comprehensive destination guide, you'll step into the world of international freight, exploring diverse shipping options – air, sea, road, and rail. We simplify the labyrinth of customs clearance and shine a light on the complex landscape of duties and taxes, offering well-curated advice tailored for businesses. If the process still feels overwhelming, let DocShipper handle it for you! As a seasoned International freight forwarder, we transform your logistics challenges into smooth successes, guiding your goods safely and promptly from point A to B. Enjoy the journey without the worry – Welcome to the DocShipper experience.

Which are the different modes of transportation between UK and Luxembourg?

Choosing the best way to ship items from the UK to Luxembourg could feel like selecting the perfect chocolate – strong yet smooth. The close proximity and well-connected borders mean road freight’s often a sweet choice. Direct and efficient, trucks make their way smoothly, just like a chocolate melting delightfully. That said, air freight, like an instant burst of cocoa, provides speed for time-critical situations. Your selection ultimately depends on your goods and timing, much like choosing between dark, milk, or white chocolate. In the end, it's about aligning flavor profiles, or in our case, shipping requirements.

Need help with your shipment?

Need assistance with your shipment? Dont hesitate to contact us even for a simple question. Choose the option that suits you

Live chat with an expert Chat on WhatsApp Free Quote 24hHow can DocShipper help you

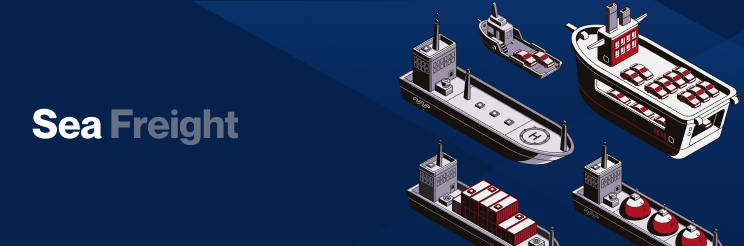

Sea freight between UK and Luxembourg

Highly dense with bustling industry, the UK and Luxembourg share a robust maritime trade link, with ocean freight providing a practical gateway. It’s hardly surprising; the volumes in which these countries trade goods make them perfect candidates for cost-effective sea freight. Key industrial centers are bridged through major cargo ports like London Gateway in the UK and Port de Mertert in Luxembourg.

However, while sea freight is indeed cost-effective for high-volume goods, it’s also renowned for its slow logistics – and that’s just one of the pain points businesses often grapple with. Handling complex paperwork, navigating customs regulations, and even understanding the ways of the trade can often appear as a daunting labyrinth. The gravity of these mistakes? Severe.

But there’s a silver lining. While shipping between these pivotal European countries is riddled with frequent mishaps, there is also a treasure trove of best practices to follow – pearls of wisdom that can turn the tides in your favor! Wishlist for practical oversight and step-by-step instructions? Your search ends here. Welcome aboard our comprehensive guide, designed to offer a smooth sail through your maritime shipping needs!

Main shipping ports in UK

Port of Felixstowe

Location and Volume: Situated in Suffolk, England, the Port of Felixstowe is the busiest in the UK, handling over 4 million TEUs annually.

Key Trading Partners and Strategic Importance: This port serves as a major link to trading partners including Holland, Belgium, Ireland, and Germany. It also holds the crown for being the first port in the UK to handle one million containers in a single year.

Context for Businesses: For businesses seeking to expand in Europe, particularly in the mentioned countries, Felixstowe’s vast handling capacity and efficient dock services pave the way for seamless shipping transactions.

Port of London

Location and Volume: The Port of London, located along the River Thames, caters to a wide range of cargoes, with an annual shipping volume exceeding 50 million tonnes.

Key Trading Partners and Strategic Importance: The port’s expansive reach, servicing over 80 berths in the Greater London area, ensures a strong connection with worldwide trading partners.

Context for Businesses: If your business operations incorporate a diverse cargo selection, from containers to aggregates, the Port of London presents a versatile shipping solution with its wide-ranging dock facilities.

Port of Southampton

Location and Volume: On the south coast of England lies the Port of Southampton, accommodating over one million TEUs per year.

Key Trading Partners and Strategic Importance: It has a reputable status for being Europe’s leading turnaround cruise port and ranks high among the UK’s ports for handling automotive and container cargoes.

Context for Businesses: If your enterprise specializes in vehicle export or regular freight forwarding services, the Port of Southampton, with its efficient vehicle and container handling capabilities, stands as an ideal choice.

Port of Liverpool

Location and Volume: The Port of Liverpool, positioned on the northwest coast of England, handles volumes close to 700,000 TEUs annually.

Key Trading Partners and Strategic Importance: The port’s strategic location supports trade with more than a hundred countries worldwide, with the Irish Sea and the Manchester Ship Canal among its major trade routes.

Context for Businesses: As the port provides excellent intermodal connections and direct access to the UK market, businesses targeting the domestic market might find the Port of Liverpool advantageous.

Port of Dover

Location and Volume: Boasting the title as the ‘Gateway to Europe,’ the Port of Dover, located in Kent, processes over 2.5 million passengers, 2 million tourist vehicles, and £122 billion of trade each year.

Key Trading Partners and Strategic Importance: It serves as an important gateway to France, as well as a crucial link to the global supply chain.

Context for Businesses: Businesses with a significant reliance on European markets, especially French markets, could greatly benefit from prioritizing Dover in their shipping strategies due to its its extensive ferry services and proximity to Mainland Europe.

Port of Glasgow

Location and Volume: Found on the River Clyde, the Port of Glasgow sees shipping volumes of over 1 million tonnes per annum.

Key Trading Partners and Strategic Importance: With deep-sea, short-sea, and Ro-Ro facilities, the port has strong trading ties with Europe, the Americas, the Middle East, and Asia.

Context for Businesses: The Port of Glasgow could serve as your focal point for a cost-effective shipping strategy if your enterprise demands diversified shipping routes to various global regions.

Main shipping ports in Luxembourg

Port of Mertert

Location and Volume: Placed on the Moselle river, the Port of Mertert serves as Luxembourg’s sole international shipping port. It offers a strategic connection point between seaports and the European hinterland. The port handles approximately 1.2 million tons of freight per year.

Key Trading Partners and Strategic Importance: Given its central location within Europe, the Port of Mertert’s key trading partners include numerous European countries, particularly those accessible via the Rhine-Rhone and Moselle-Saar river systems. The port is strategically important for industries such as steel, oil, and construction materials due to its convenient access to multimodal transportation options road, river, and rail.

Context for Businesses: If your business model involves frequent transportation of goods within the European region, the Port of Mertert could potentially play a crucial role in your shipping strategy. Its exceptional connectivity to major European transport networks, multimodal transport facilities, and customized logistic services can provide an efficient and flexible solution to your shipping needs.

Should I choose FCL or LCL when shipping between UK and Luxembourg?

Shipping your goods from the UK to Luxembourg? It all hinges on making the right call between FCL (Full Container Load) and LCL (Less than Container Load), also known as consolidation. Your choice could make or break your shipping objectives: cost-effectiveness, punctuality, or even guaranteeing a smooth journey of your consignment. Let’s dive into the specifics of these two sea freight options, enabling you to tailor the decision to your unique shipping needs. Ready to hit the high seas?

Full container load (FCL)

Definition: Full Container Load (FCL) shipping denotes when a single consignor books an entire container for their shipment. This option offers exclusivity and safety, as the container is sealed at the origin and remains unopened until it reaches its destination.

When to Use: If your cargo exceeds 13/14/15 CBM, FCL shipping is your best option. With high-volume shipments, costs per unit can decrease significantly, making it an economical choice.

Example: A UK-based furniture manufacturer is sending a shipment of 20'db (around 33 CBM) sofas to Luxembourg. An FCL container would be preferable in this case due to the large volume of the furniture.

Cost Implications: As the volume of shipment increases, an FCL shipping quote becomes more cost-effective. For instance, shipping a 20'ft container may cost more upfront than an LCL (Less than Container Load) shipment, but you pay a flat rate, regardless of how much you fill it. In the example above, despite the higher initial fcl shipping quote for a 20'ft or 40'ft container, the overall unit cost would significantly decrease due to the larger volume.

Less container load (LCL)

Definition: LCL (Less than Container Load) shipping, also known as consolidation shipping, means your goods will not occupy an entire container and will be shipped together with other importers' goods.

When to Use: If your cargo is less than 13-15 cubic meters (CBM), or you have flexible delivery timelines, LCL shipping presents a cost-effective and flexible solution.

Example: Suppose a UK-based furniture manufacturer wants to send 10 CBM of handmade chairs to a boutique store in Luxembourg. Shipping these through LCL will allow the manufacturer to save costs, as they only pay for the space that their cargo occupies in the container.

Cost Implications: In comparison to full container shipping, LCL freight can offer lower prices as it shares container cost among multiple shippers. However, it's important to note that LCL shipments undergo more handling, which can increase the risk of losses and damages. Additionally, the eventual cost might be higher than quoted due to fees like port charges or customs inspection fees. These added costs are generally taken into account in an LCL shipping quote.

Hassle-free shipping

Choosing between consolidation and full container for shipping from the UK to Luxembourg can be daunting. This is where DocShipper steps in, simplifying complex choices for your business. Our experienced ocean freight experts evaluate essential factors such as cargo volume, shipment frequency, and budget to help you select the best mode - consolidation or full container. Connection with comprehensive logistics solutions is easier than you think. Reach out to us now for a free estimate, allowing you to dispatch your goods hassle-free.

How long does sea freight take between UK and Luxembourg?

Sea freight shipping between the UK and Luxembourg typically takes around 6 days. It’s important to remember though, transit times can be affected by various factors like the specific ports used, weight of your goods, and their nature. This is just a rough estimate – for an accurate quote tailored to your cargo’s specific needs, you’ll want to get in touch with a trusted freight forwarder like DocShipper.

How much does it cost to ship a container between UK and Luxembourg?

Cracking the code on ocean freight rates can be daunting, especially the mystifying cost of shipping a container between the UK and Luxembourg. While we can say the rates reside broadly within a specific cost per cubic meter (CBM), we can’t pinpoint an exact figure. Why? Shipping cost relies heavily on factors such as the Point of Loading, Point of Destination, the carrier used, the type of goods, and even the often unpredictable monthly market fluctuations. Here’s the good news – you don’t have to navigate this alone! Our shipping specialists are at your service for a customized quote, ensuring optimal pricing tailored to your unique shipments. Got freight? Get in touch!

Special transportation services

Out of Gauge (OOG) Container

Definition: Out of Gauge, or OOG container, refers to non-standardized containers used to transport goods that exceed the dimensions of a standard container. This type of shipping is advantageous for oversized or irregularly shaped cargo such as machinery or industrial equipment.

Suitable for: Large, bulky items that do not fit within the dimensions of standard containers due to their length, width, or height.

Examples: Large industrial equipment, construction materials, oversized machinery.

Why it might be the best choice for you: If your cargo sizes are unconventional and won’t fit in a standard container, an OOG container allows for the safe and secure transportation of your goods from the UK to Luxembourg.

Break Bulk

Definition: Break bulk refers to goods that are loose, or not in a container, loaded individually onto a vessel.

Suitable for: Cargoes that can’t be containerized due to size or shape.

Examples: Heavy machinery, construction equipment, or large bales of raw materials.

Why it might be the best choice for you: If your cargo consists of items that are too large or heavy to be containerized, break bulk shipping might be your go-to solution.

Dry Bulk

Definition: Dry bulk cargo refers to goods that are shipped in massive quantities, directly loaded into the hold of a ship such as coal, grains, or minerals.

Suitable for: Loose, dry materials that are loaded directly onto a freight ship.

Examples: Commodities such as coal, grain, or iron ore.

Why it might be the best choice for you: Dry bulk shipping could be the most advantageous option for you, especially if you’re dealing with vast quantities of loose cargo.

Roll-on/Roll-off (Ro-Ro)

Definition: Roll-on/Roll-off, also known as ro-ro, involves vehicles that are driven onto a ro-ro vessel and secured for transport.

Suitable for: Vehicles and machinery that can be driven on and off the ship.

Examples: Cars, trucks, tractors, trailers, or any wheeled cargo.

Why it might be the best choice for you: If your cargo involves vehicles or heavy machines that require minimal handling during loading and unloading, Ro-Ro is your ideal choice.

Reefer Containers

Definition: Reefer containers are refrigerated shipping containers used to transport goods requiring temperature-controlled conditions.

Suitable for: Perishable goods needing refrigeration or freezing during transit.

Examples: Foods, pharmaceuticals, chemicals, and other temperature-sensitive cargo.

Why it might be the best choice for you: If your business involves the shipping of perishable or temperature-sensitive goods, utilizing reefer containers is a smart move.

At DocShipper, we’re specialists in freight forwarding from the UK to Luxembourg and can help you determine which shipping option best meets your needs. Contact us for a free shipping quote in less than 24 hours and start mapping your journey towards successful freight forwarding.

Air freight between UK and Luxembourg

Experience the speed and dependability of air freight when shipping your goods between the UK and Luxembourg! Perfect for dispatching small yet precious cargo, this method is not just fast but surprisingly cost-efficient. Imagine shipping the latest smartphones or precious watches, where quick delivery and safety are paramount.

However, this formula entails more than just booking a flight for your cargo. It’s much like prepping for a marathon – you wouldn’t just lace up and start running, right? You need the right strategies. Shippers often stumble by glossing over crucial details like using the right weight formula for their goods, incurring unnecessary costs. Let’s explore these details to ensure your air freight journey is as smooth and successful as a pilot’s take-off!

Air Cargo vs Express Air Freight: How should I ship?

Deciding whether to use air cargo or express air freight to transport your goods from the UK to Luxembourg can seem challenging at first. Here’s the skinny: air cargo uses space aboard commercial airlines, while express air freight has a designated plane devoted solely to freight. Your business-specific needs, cost considerations, and required delivery speed will influence your ultimate choice. Let’s dive into the ins-and-outs of each method to best support your shipping needs and bottom line.

Should I choose Air Cargo between UK and Luxembourg?

Deciding on air cargo for shipping from the UK to Luxembourg? This might be the right choice, especially if you’re moving goods above 100/150 kg (220/330 lbs) – air freight becomes increasingly cost-effective at this weight. Well-known airlines such as British Airways and Cargolux operate on these routes, promising reliable service. Keep in mind, though, fixed schedules can result in longer transit times. However, the reliability and budget-friendly nature of this method may outweigh these factors. Your choice boils down to weighing business priorities against shipment characteristics.

Should I choose Express Air Freight between UK and Luxembourg?

Express air freight, a service making use of dedicated cargo planes with no passengers, can be the ideal choice for shipments under 1 CBM or 100/150 kg of cargo. This speedy option, often handled by operators like FedEx, UPS, or DHL, promises quick delivery and efficient tracking. If your business needs to transport goods rapidly or frequently between the UK and Luxembourg, with cargo within the specified limits, express air freight might be the most suitable, offering the perfect balance of speed, efficiency, and security for your goods.

Main international airports in UK

Heathrow Airport

Cargo Volume: Handles over 1.7 million metric tons of cargo annually.

Key Trading Partners: Mainly United States, China, Hong Kong, Japan, and India.

Strategic Importance: It is the largest and busiest airport in the UK. Its location near London makes it highly convenient for businesses in various industries.

Notable Features: The airport hosts over 80 airlines and caters to over 180 destinations.

For Your Business: With its vast network, Heathrow ensures a comprehensive global reach for your shipments, and its high-tech cargo handling facilities guarantee efficient processing times.

Gatwick Airport

Cargo Volume: Processes over 95,000 metric tons of cargo a year.

Key Trading Partners: Primarily European countries, with increasing volumes to and from Asia and the Americas.

Strategic Importance: Second busiest airport in the UK and situated in close proximity to London.

Notable Features: High value, urgent, and perishable goods are key cargo types at Gatwick.

For Your Business: Gatwick Airport would be an excellent choice for time-sensitive shipments due to its infrastructure optimised for expeditious processing.

Manchester Airport

Cargo Volume: Manages over 120,000 metric tons of cargo annually.

Key Trading Partners: Dubai, Hong Kong, New York, Amsterdam, and Frankfurt.

Strategic Importance: The global gateway to Northern England.

Notable Features: Three main passenger terminals and one cargo-specific terminal.

For Your Business: If your business is based in or ships frequently to Northern England, using Manchester Airport can significantly reduce lead times and costs.

Stansted Airport

Cargo Volume: Handles roughly 250,000 metric tons of cargo each year.

Key Trading Partners: United States, China, Hong Kong, and Turkey.

Strategic Importance: It’s known as the ‘cargo hub’ of UK with the highest volume of cargo traffic.

Notable Features: Holds the largest airfreight center in the UK by capacity.

For Your Business: For businesses that frequently deal with bulk cargo shipments, Stansted is an ideal shipping hub given its robust freight infrastructure.

East Midlands Airport

Cargo Volume: Processes approximately 320,000 metric tons of cargo per year.

Key Trading Partners: Largely intra-European cargo market, as well as the US, China and the Middle East.

Strategic Importance: Known as the ‘gateway to the North,’ and handles 50% of all UK air cargo.

Notable Features: Specialises in express freight, serving the major express freight companies.

For Your Business: If your operation is heavily reliant on express or overnight shipment, East Midlands Airport, with its dedicated 24/7 operation, is a natural fit for your business.

Main international airports in Luxembourg

Luxembourg Findel Airport

Cargo Volume: Luxembourg Findel Airport, managed by LuxairCargo, is the 5th busiest freight airport by volume in Europe, handling over 1.125 million tons of goods in 2021.

Key Trading Partners: The airport’s main trading partners are China, the US, and the Middle East, serving as a vital link to supply chains around the globe, particularly advantageous for businesses with these trade routes.

Strategic Importance: It hosts the Cargolux Airlines, which is the world’s leading all-cargo airline, enhancing its strategic value for businesses needing reliable and extensive international freight services.

Notable Features: The airport accommodates a variety of airplane types and sizes due to its massive and technologically advanced cargo center. It operates 24/7, enabling businesses to have flexible freight scheduling.

For Your Business: If unrivaled speed, round-the-clock operations, and powerful logistics infrastructure are essential to your business, Luxembourg Findel Airport could be your optimum shipping solution. It offers reliable services to key markets, making it a strategic base for your global shipping operations.

How long does air freight take between UK and Luxembourg?

Average transit times for air freight shipments between the UK and Luxembourg can range from 1-5 days. This duration, however, is not set in stone and can fluctuate depending on factors including the airports involved, the weight and nature of the items being shipped. Specifically, oversized or hazardous materials might require additional handling and thus extend the timeline. For detailed, accurate timelines tailored to your specific shipping needs, it’s advisable to touch bases with a knowledgeable freight forwarder like DocShipper.

How much does it cost to ship a parcel between UK and Luxembourg with air freight?

Shipping an air freight parcel from the UK to Luxembourg can range widely, with a broad average price standing around £3 to £10 per kg. However, an exact cost is challenging to provide as it hinges on multiple factors including distance from departure and arrival airports, parcel dimensions, weight, and nature of goods. At our firm, we assure you of our commitment to provide the most competitive rates. Each quote we provide is uniquely tailored, addressing the specific nature of your shipment. Contact us today, and receive a customised quote in less than 24 hours.

What is the difference between volumetric and gross weight?

Gross weight refers to the actual weight of a shipment, including all packaging and handling materials. Volumetric weight, on the contrary, contemplates the space your shipment occupies on an aircraft.

Calculating these two is quite different. Gross weight is straightforward; it involves weighing your packed shipment. If it weighs, say, 35 kg, that’s its gross weight (around 77.16 lbs). Volumetric weight calculation is a bit more nuanced. You’ll need to measure your shipment’s three dimensions- length, width, and height (in cm). Then, multiply these values together and divide the result by 5000 for air cargo and by 5000 for express air freight services.

To illustrate, if the package is 50cm long, 40cm wide and 30cm high, the volumetric weight for Air Cargo would be: (504030)/5000 = 12 kg (roughly 26.45 lbs) and for express air freight services the same calculation would apply, resulting in the same volumetric weight.

Understanding these calculations is key as freight charges are defined by either the gross weight or the volumetric weight- whichever is greater. This helps to ensure fair pricing, accounting for both the weight and space a shipment takes.

Trucking between UK and Luxembourg

Delving into cross-border trucking services between the UK and Luxembourg, it’s notable that this is often a greatly cost-effective and efficient shipping approach. Rolling via various road networks, transit times hinge on routes and current conditions, with costs often skewing lower than other freight modes. However, a balance is vital; road freight, despite its economic advantage, might encounter unavoidable delays. Despite this, for businesses seeking optimised control over delivery schedules, this shipping method presents some distinct advantages: it’s more flexible, directly accessible, and leaves a lower carbon footprint – a nifty overview to consider for efficient, cost-effective solutions.

What if I can’t fill a truck between UK and Luxembourg?

Discover how to balance cost and flexibility when shipping goods between the UK and Luxembourg. This comparison of Less Than Truckload (LTL) and Full Truckload (FTL) freight options offers businesses an in-depth look at how to optimize their distribution strategies while keeping expenses in check. With an understanding of these choices, better shipping decisions await.

Remember, the volume of your cargo plays a significant role when choosing between LTL and FTL freight, ensuring your business can navigate international shipping with ease and effectiveness.

What are the main routes between UK and Luxembourg?

Initiating your road freight journey from the UK, the prevalent route to Luxembourg traverses high-traffic cities such as London, Dover, and Calais. The M20 highway in the UK shuttles you to the channel ports, where you can catch a ferry to Calais, France. Once in Calais, drivers typically jump on the A16, connecting to the A1 leading up to Luxembourg. Be prepared for variable traffic conditions, particularly around major cities, and plan for possible delays during peak travel periods. Gel with the times of day and season to strike a perfect balance between timeliness and cost-efficiency in your road freight endeavors.

What are the road transit times between UK and Luxembourg?

Under ideal conditions, road transport between the UK and Luxembourg typically takes about 8-10 hours. However, the exact duration can be uncertain, owing to fluctuating traffic, varying circulatory patterns, and occasionally, poor road conditions, as experienced in regions like E411 in Belgium or A1 in Germany. Keep in mind, these are ballpark figures. Feel free to reach out to us anytime, we can provide a precise cross-border freight quote within 24 hours.

How much does trucking cost between UK and Luxembourg?

Sure thing, shipping goods by truck from the UK to Luxembourg isn’t a flat-rate game. Just like a pick ‘n’ mix at the candy store – each item adds up separately. Distance, cargo weight, and specific handling needs could swing your cost. But don’t fret! We tailor fit every quote to ensure you’re getting the best bang for your buck. So, no more guessing games – reach out, and we’ll whip up your custom quote in a jiffy!

Door to door between UK and Luxembourg

Navigating the international shipping scene? Door to Door shipping, your turnkey solution, can easily bridge the UK-Luxembourg route. Imagine bypassing transit worries by letting professionals handle the journey end-to-end. Boasting guaranteed delivery, maximized efficiency, and centralized responsibility, it propels your business forward. Ready to revolutionize your shipping strategy? Let’s dive in!

Overview – Door to Door

Unraveling the complexities of shipping from the UK to Luxembourg? Say no more. Door to door shipping is your hassle-free ticket to stress-free logistics. While regular shipping can be daunting with customs and transportation hiccups, this method lifts that weight off your shoulders. Pros? Absolute convenience and time-saving. The catch? Slightly higher costs. But isn’t peace of mind worth it? Don’t just take our word for it – it’s the go-to for many DocShipper clients in situations just like yours. Dive in with us to explore this promising avenue for your shipping needs.

Why should I use a Door to Door service between UK and Luxembourg?

Ever thought cargo logistics and stress-free could exist in the same sentence? Welcome to Door to Door service between UK and Luxembourg!

1. Hassle-Free Logistics: From goods pickup to final delivery, Door to Door service manages the entire logistics process. You don’t have to juggle multiple logistics partners – it’s one solution that handles it all. Say goodbye to logistics headaches!

2. Timely Delivery: Do you have an urgent shipment? This service ensures the quickest routes and timelines are used. The clock is watched so you don’t have to.

3. Specialized Cargo Care: Complex cargo requires expert attention. With Door to Door, rest easy knowing your goods receive the specialized care they need while maneuvering international landscapes.

4. All-Inclusive Trucking: Forget about the complexities of transport modes. This service manages trucking from your warehouse, through ports, to the final destination in Luxembourg. It’s like having a personal chauffeur for your freights!

5. Total Convenience: No need to stress over paperwork or customs, the Door to Door service handles all administrative procedures. Think of it as your shipping concierge – leaving you to focus on your business.

So, for a smooth, time-efficient and convenient shipping experience between the UK and Luxembourg, Door to Door service is your ticket to success!

DocShipper – Door to Door specialist between UK and Luxembourg

Ease your shipping woes with DocShipper! We offer streamlined door-to-door shipping between the UK and Luxembourg. Our skilled team fully manages every detail – from packing to customs clearance, across all transport modes. Your dedicated Account Executive ensures hassle-free experiences every step of the way. Reach out for a free estimate within 24 hours or engage with our consultants at no cost. Trust us, you’re in capable hands.

Customs clearance in Luxembourg for goods imported from UK

Sailing smoothly through customs clearance, a process where goods get approval to enter a country, can feel like navigating a stormy sea – especially when importing goods from the UK to Luxembourg. With potential quicksand pits like unexpected fees and lurking dangers of goods getting stranded in customs, it’s vital to arm yourself with knowledge about customs duties, taxes, quotas, and licenses. Fret not! The following sections will delve into the nitty-gritty and act as your lifeline in this complex process. Remember, DocShipper can take the helm of this entire voyage, assisting with all kinds of goods, anywhere in the world. Need an estimate for your project? Contact our team with the origin, value, and HS Code of your goods – your passport to advancing through the estimation stage.

How to calculate duties & taxes when importing from UK to Luxembourg?

Unraveling the complexities of customs duties can seem like decoding a foreign language. But fear not! Armed with the right knowledge, you’ll be navigating these waters with ease. It all hinges on knowing essential details such as the country of origin, the HS Code (A global standard that describes your product in detail), the Customs Value (Also known as the cost, insurance and freight or CIF value), the applicable Tariff Rate and any additional taxes and fees that your products might attract. To kickstart this process, you’ll first need to identify the country where your goods were manufactured or produced. This might seem elementary, but it’s a primary factor that’ll impact how much duty you’ll be required to pay.

Step 1 – Identify the Country of Origin

Knowing the country of origin is a game-changer, and here’s why:

Firstly, trade relations. UK and Luxembourg, both EU members, have preferential trade agreements that can lower your duties. Second, product classifications: Certain goods might require different HS codes based on their origin. Third, import restrictions: Some products, depending on where they’re made, could have limitations. Fourth, anti-dumping duties: These additional duties aim at protecting Luxembourg industries from unfairly cheap UK imports. The last one is about potential sanctions; seldom, but in some cases, products from certain countries may face restrictions.

Remember, the UK left the EU, but trade deals still stand from the Brexit accord. Be aware though, even minor disruptions in EU-UK ties can make things volatile.

Import rules can be tricky – is it a UK native product or just a stopover? Trace your goods back to their birthplace. The wrong answer might cost you at huge tariffs.

Understanding your shipment’s origins isn’t always straightforward, but it’s crucial to be one step ahead of the potential curveballs when importing from the UK to Luxembourg. You’ve got this! Let’s move on to the HS code.

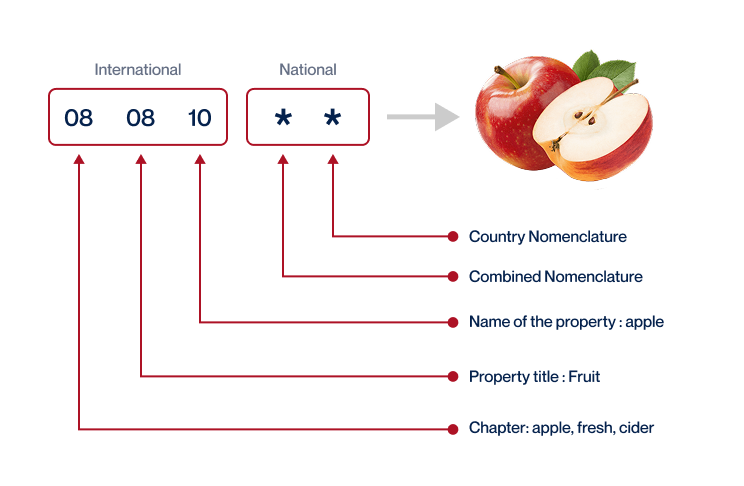

Step 2 – Find the HS Code of your product

The Harmonized System Code, or HS Code, is a product-specific code utilized around the world to classify traded goods. It’s an essential tool for calculating customs duties, managing quotas, compiling statistics, and conducting international trade negotiations.

Typically, the simplest way to identify your product’s HS Code is to request it from your supplier. They will be well-versed in their goods and relevant regulations, and therefore can provide you with accurate information.

Alternatively, should this method not be feasible, you can discover your HS Code by using a step-by-step approach. The first step is to utilize an HS lookup tool such as the Harmonized Tariff Schedule. By entering your product’s name into the search bar, you should receive the information you need. The HS code is located in the Heading/Subheading column.

It is crucial to exercise care when securing your HS Code. A misclassified code has serious implications ranging from delays in shipping to potential financial penalties. Accurate classification ensures smooth and efficient international trade.

Here’s an infographic to show you how to read an HS code.

Step 3 – Calculate the Customs Value

Think of a customs value like your all-inclusive vacation package. It’s not just the product price, but it bundles in the cost of shipping and insurance costs too. So, if your Manchester-manufactured widgets cost $500, your shipping charges are $100, and the insurance is $20, your CIF (Cost, Insurance, and Freight) customs value isn’t just $500; it would be $620. It’s this combined CIF value that Luxembourg customs will assess your import duty on, not just the widget’s value. Grasping this principle is crucial to avoid unexpected charges and to ship your goods without hassles. Always remember: product price + shipping cost + insurance cost = customs value. Keep this formula handy and make your shipping experience to Luxembourg smoother.

Step 4 – Figure out the applicable Import Tariff

An import tariff, also known as a custom or duty, is a tax imposed on goods imported from another country. In the context of Luxembourg, import tariffs are specific to the item being imported and its country of origin.

For businesses looking to import goods from the UK, you can determine the accurate tariff using the UK government’s Trade Tariff tool. To do so, follow these steps:

1. Click the link to access the UK Trade Tariff tool .

2. Enter the Harmonized System (HS) code of your product, which should have been identified in earlier steps.

3. Provide the item’s country of origin – in the case, the UK.

4. Check the system to learn about the duties and taxes applicable to your product.

For instance, let’s say you’re importing a table from the UK with the HS code 940360. According to the tool, the tariff rate is 2.7%. You’ve calculated a Cost, Insurance, and Freight (CIF) value of $1000 for your consignment. Your import duties can be calculated as:

Import Duty = Tariff Rate x CIF Cost

(2.7/100) x $1000 = $27

Therefore, the import duty for the table would be $27. Remember, this import duty forms part of your landed cost, which includes the buying price, freight cost, insurance, and other fees. It is key to calculate it correctly to avoid unexpected expenses and ensure a profitable transaction.

Step 5 – Consider other Import Duties and Taxes

Ready to dive into the finer details of customs in Luxembourg? In addition to the standard tariff, depending on both the product you’re importing and its country of origin, you might need to account for other import duties and taxes. These extras aren’t always obvious, but they can sneak up you and substantially raise your costs.

One type of this is the excise duty, typically levied on goods like alcohol, tobacco, and certain energy products. Let’s say you’re importing a speciality whisky from the UK. Using hypothetical rates for effect, if the excise duty on whisky in Luxembourg is $5 per liter, you’d be paying an extra $100 on a shipment of 20 liters.

Next, there’s the potential for anti-dumping taxes, applied if the product is selling for significantly less in Luxembourg than it is in the UK, potentially harming local industries. Suppose you’re importing inexpensive UK-made steel—that’s where anti-dumping taxes might apply.

Finally, you can’t overlook the Value Added Tax (VAT). One way to calculate it would be: (Cost of goods + shipping + insurance + import duties) x VAT rate. For instance, if you’ve spent $2000 in total importing and the VAT rate is 17%, your VAT would be $340.

Remember these are merely simplified scenarios designed to bring the theory to life. The actual rates can and will probably vary. It just goes to show that when it comes to importing, it pays to know what you’re getting into! So, arm yourself with knowledge and avoid those unexpected expenses.

Step 6 – Calculate the Customs Duties

To calculate your customs duty, start by identifying your goods’ customs value (the cost, insurance, and freight/CIF value). This will be taxed at the globally agreed rate depending on your commodity. For example, if your commodity is taxed at 5% and your customs value is $10,000, your customs duty will be $500.

VAT (Value Added Tax) in Luxembourg is 17%. This is levied on the sum of the customs value and duty. So, if we take the previous example, your VAT will be 17% x ($10,000+$500) = $1785.

Occasionally, goods from the UK might attract anti-dumping taxes or Excise Duty. Anti-dumping taxes are unique to each product and protect local industries from cheap imports. If your goods attract an anti-dumping tax of 10%, you will pay an additional $1000.

To illustrate, let’s look at three examples:

1. Goods worth $10,000 with a duty of 5% but no VAT: you will be charged a $500 customs duty.

2. Goods worth $10,000 with a duty of 5% and 17% VAT: your customs duty is $500, and VAT is $1785.

3. Goods worth $10,000 with a duty of 5%, 17% VAT, a 10% anti-dumping tax, and an added Excise Duty will accrue more charges.

At DocShipper, we strive to protect you from unnecessary charges. Our customs clearance services are designed to handle all administrative tasks, ensuring accurate and timely clearance anywhere in the world. Contact us today for a free quote delivered in less than 24h to help avoid any added expenses.

Does DocShipper charge customs fees?

Clearing up misconceptions: DocShipper, as your customs broker, doesn’t impose customs duties. Customs duties and taxes go directly to the government, not us. Our services gravitate towards customs clearance, for which we do charge. We’re transparent – you’ll receive documents from the customs office to verify you’re paying what’s owed, not a penny more. Picture this: it’s like paying a concierge for the paperwork, but your hotel taxes go to the city. Understand the distinction and feel at ease knowing your charges are warranted and verified.

Contact Details for Customs Authorities

United Kingdom Customs

Official name: Her Majesty’s Revenue and Customs (HMRC)

Official website: www.gov.uk/government/organisations/hm-revenue-customs

Luxembourg Customs

Official name: Customs and Excise Administration of Luxembourg

Official website: www.do.etat.lu/

Required documents for customs clearance

Dealing with customs can be daunting, especially figuring which documents are required. We’ll break down the purpose and importance of the Bill of Lading, Packing List, Certificate of Origin, and Documents of Conformity (CE standard) to steer clear of holdups at the border. This knowledge could be your golden ticket to smooth international shipping.

Bill of Lading

When heading goods your way from the UK to Luxembourg, a crucial document is the Bill of Lading (BoL). Think of it as proof of purchase for your shipment, marking the transition of ownership from the shipper to the consignee. With its details about the type, quantity, and destination of the cargo, it guides customs clearance, and helps ensure a smooth journey for your goods. More and more businesses are preferring the electronic or telex release over traditional methods. Why? It’s faster, erases the hassle of handling physical papers, and reduces the risk of lost documents. Got an air cargo shipment? Then, you’ll need an Air Waybill (AWB) instead. Remember, whether it’s BoL or AWB, keep these documents well-managed. They can make or break your shipping experience!

Packing List

A Packing List is your go-to document on your shipping journey from the UK to Luxembourg. Picture it as a detailed rundown of everything tucked into your cargo. Whether you’re rooting for sea or air freight, this document is a must-have. Accuracy insisted, it helps customs officers confirm what’s in your shipment, avoiding any unwanted surprises. Imagine sending a container filled with electronics, but there’s a mix-up and it’s labelled as furniture. Chaos, right? That’s why meticulous Packing Lists are crucial to dodge those mix-ups. As the shipper, it’s your responsibility to ensure everything adds up. So, next time you’re boxing up, give your Packing List the attention it deserves – your smooth transit depends on it.

Commercial Invoice

Shifting goods from the UK to Luxembourg? The heart of your documentation is the Commercial Invoice. More than a transaction slip, it ensures smooth sailing through customs. Make sure it includes details like product classification, shipper and receiver contacts, along with the INCOTERM stating the distribution of costs and risks. Accuracy is king; any mismatch between this document and others like the packing list can stir up a customs storm. So, double-check your figures, align details across all documents, ensuring an uninterrupted journey for your goods. Remember, the correct Harmonized System (HS) code is vital. For instance, if you’re shipping electronic equipment, code 85.40.40 can help dodge unnecessary custom halts or additional duties. Guidance always wins the race against guesswork in the international shipping business!

Certificate of Origin

Navigating customs between the UK and Luxembourg? A Certificate of Origin plays a pivotal role. It’s your proof of where your goods were made – a critical detail for customs officers. Suppose you’re shipping artisanal chocolates from your London factory to a gourmet food store in Luxembourg city. Without a Certificate of Origin, your shipment may be delayed or even returned. More than just a paperwork, it could even swing preferential customs duty rates your way, slashing your costs. So, never overlook paperwork, it might just be your passport to smoother, faster, and cheaper international trading.

Certificate of Conformity (CE standard)

The Certificate of Conformity (CoC), an essential document for customs clearance between the UK and Luxembourg, verifies the compliance of your product with the CE standards – a crucial market-entry passport for the European market. While quality assurance focuses on the process to create the products, the CoC confirms the product itself adheres to EU legislations. Just like the ‘UL’ or ‘FCC’ mark in the United States, this certification can speed up your customs clearance process. Post-Brexit, however, the UKCA mark replaces the CE mark for goods entering the UK. So, if you’re shipping products from the UK to Luxembourg, validating them with CoC (CE standard) helps in smoother clearance at Luxembourg customs. Similarly, if shipping from Luxembourg to the UK, adhere to the UKCA marking. Researching, understanding, and applying the correct marking in your shipping process will help keep your business running smoothly across borders.

Your EORI number (Economic Operator Registration Identification)

When shipping goods from the UK to Luxembourg, your EORI number is crucial. Think of it as your business’s passport within Union’s trade scene. Since Brexit, the UK has its version, so despite being out of the EU, for trade with Luxembourg, it’s still a must-have. The EORI is your unique trade ID and tracks goods entering or leaving the EU, making customs clearance smooth and efficient. Don’t have one? Don’t fret. Applying is straightforward: register with your local HM Revenue and Customs (HMRC) in the UK, and it’s similar in Luxembourg. Without it, delayed shipments and extra costs are almost certain. Secure your EORI and ensure a frictionless freight experience.

Get Started with DocShipper

Prohibited and Restricted items when importing into Luxembourg

Avoid unnecessary customs issues when shipping to Luxembourg by understanding the country’s import restrictions. Knowing which items are outright banned or need special permits can save you headaches down the line. Let’s dive into this essential information.

Are there any trade agreements between UK and Luxembourg

Indeed, the UK and Luxembourg enjoy a well-established trading relationship, bolstered by common ties within the wider European region. The Trade and Cooperation Agreement (TCA), effective since 2021, governs their trade, ensuring tariff-free and quota-free trade in goods. Additionally, the two nations are part of important trade associations that foster economic integration. Any future improvements, such as expanding the rail freight network, could offer promising opportunities. So, keep informed and adapt your shipping strategies accordingly.

UK – Luxembourg trade and economic relationship

Ever since 1867, the UK and Luxembourg’s trade ties have been flourishing, marking pivotal milestones. Once centered on steel and industrial goods, the link has diversified into finance and ICT sectors nowadays. Luxembourg’s strategic location has placed it as the UK’s 3rd largest investment recipient, while the UK ranks 6th in Luxembourg’s outward investments.

During 2020, the UK exported goods worth over £ 2 billion to Luxembourg, with vehicles, machinery, pharmaceutical products being primary commodities. Similarly, Luxembourg exported around £1.7 billion to the UK, led by iron and steel industries. The robust figures underline the well-integrated trade and economic relationship, built over an impressive span of 154 years. No matter where their trade journey evolves, historical trends highlight their robust cooperation and potential for future growth.

Your first steps with DocShipper

Additional logistics services

Warehousing

Finding the right warehousing solution between the UK and Luxembourg can be fraught with obstacles. Imagine you're shipping temperature-sensitive craft beers - a single degree off, and your mystery blend flatlines! Prioritising conditions like temperature control is key. Discover hassle-free, adaptable warehousing services tailor-made for your unique needs. More info on our dedicated page:Warehousing.

Packing

Meticulous packaging and repackaging can make or break your UK-Luxembourg shipping. Luckily, our trustworthy agents take utmost care guarding grandma's china plate set or the latest tech equipment. Crisp electronics packaging? Cushioned antique repackaging? Check and check. Ace your UK-Luxembourg shipment packaging, no sweat. More info on our dedicated page: Freight Packaging.

Transport Insurance

Transporting goods isn't without hazards! Unlike fire insurance, cargo insurance provides broader protection, safeguarding your shipments from diverse risks like damage in transit or theft. Imagine this - a storm at sea damages your goods, or your truck gets in an accident. With cargo insurance, these risks are mitigated. More info on our dedicated page: Cargo Insurance

Household goods shipping

Moving from the UK to Luxembourg and worried about your treasured items? We handle bulkiness and fragility with ease. Like your great aunt's china set with sentimental value, we pack and transport it with the utmost care. Explore our flexible solutions tailored to your unique needs. More info on our dedicated page: Shipping Personal Belongings.

Procurement in Thailand

Taking your UK-Luxembourg shipments to new heights, DocShipper sourcing service might be your secret sauce. Struggling with finding reliable suppliers in Asia or East Europe? Overwhelmed by language barriers? We’ve got you covered. We simplify the procurement process for you, from supplier scouting to managing the entire procurement. Here's how XYZ Company benefitted from our approach. Find more on our dedicated page: Sourcing services.

Quality Control

Ensuring your products meet standards is key when shipping from the UK to Luxembourg. Quality Control plays a crucial role in this process, spotting potential issues before your shipment leaves the factory. For example, if you're shipping customized watches, our team will inspect every piece's accuracy and craftsmanship before it gets packed. This service reduces the chances of costly returns or damaged reputation. More info on our dedicated page: Quality Inspection

Conformité des produits aux normes

Understanding product conformity is crucial when shipping items. Our Product Compliance Services ensure your shipments meet all necessary regulations. Our lab tests certify that your goods adhere to destination regulations, avoiding potential complications. Stay stress-free and confident knowing your shipments will comply every time. Discover more on our page: Product Compliance Services.