Freight Shipping between UK and Kazakhstan | Rates – Transit times – Duties and Taxes

Ever tried to map a route from London to Almaty without losing a shipment or two?

Well, you're not alone. Tackling the complexities of freight movement between the UK and Kazakhstan - understanding fluctuating rates, varying transit times, and intricate customs regulations - can feel like mounting an expedition into the unknown. In this guide, we aim to chart a clear course for your shipping journey. We'll explore different freight options including air, sea, road, and rail. Dive into customs clearance formalities, demystify duties and taxes, and offer you practical advice, tailored for businesses aiming to simplify their international logistics. If the process still feels overwhelming, let DocShipper handle it for you! As experienced international freight forwarders, we manage every step of your shipping process, turning potential logistics challenges into profitable outcomes.

Which are the different modes of transportation between UK and Kazakhstan?

Choosing the right transport method between UK and Kazakhstan - a journey across almost 6,000km - is much like solving a puzzle. Do you go for speed or cost-saving? Maybe air transport appeals for its speed, but your wallet nudges you towards ocean freight. Or perhaps rail and road transport crosses your mind due to no sea link. Every aspect holds weightage, painting a different picture for your business's unique needs, depending on factors like volume, type of goods, and delivery urgency. So let's dig deeper into finding that perfect match for your international shipping needs.

Need help with your shipment?

Need assistance with your shipment? Dont hesitate to contact us even for a simple question. Choose the option that suits you

Live chat with an expert Chat on WhatsApp Free Quote 24hHow can DocShipper help you

Sea freight between UK and Kazakhstan

The UK and Kazakhstan enjoy a vibrant trade relationship, with goods traveling across the waves from the bustling ports of Dover, Southampton, and Grimsby to the lesser-known, but equally crucial Aktau and Bautino ports in Kazakhstan. Ocean shipping between these nations, although one of the slower means of transport, is particularly cost-effective when dealing with high-volume goods, making it a favored choice.

But it’s no secret that this tide can turn treacherous! Many businesses experience challenges in navigating the logistical oceans between these two countries – whether it’s figuring out the most efficient route, decoding the complexities of customs clearance, or coping with the sheer physicality of ensuring secure packing. This section delves into these hurdles and how to leap over them, giving you a lifejacket of best practices and insider knowledge to stay afloat. Get ready to ride a wave of information that will help simplify your shipping process and steer your business to success.

Main shipping ports in UK

Port of London:

Location and Volume: Situated along the River Thames, the Port of London is an essential gateway for goods bound for the capital city and southeast England, with a shipping volume of approximately 50 million tonnes annually.

Key Trading Partners and Strategic Importance: Major trading partners include countries in Western Europe, particularly Germany, Netherlands, and Belgium. The port holds strategic importance due to its large container and cargo terminals that handle a variety of goods, including food, petroleum, and building materials.

Context for Businesses: If you’re looking to expand your operations to London or Southeast England, the Port of London could be a crucial part of your logistics due to its comprehensive facilities and proximity to a key consumer market.

Port of Felixstowe:

Location and Volume: Located in Suffolk on the eastern coastline of the UK, the Port of Felixstowe is the busiest and largest container port in the country, handling over 4 million TEU annually.

Key Trading Partners and Strategic Importance: It serves as a crucial link to markets in Asia, North America, and Europe. The port’s strategic importance is heightened by its railway terminals, which connect it directly to the major logistics hubs in the midlands and the north.

Context for Businesses: For businesses needing to import or export a large volume of goods in containers, especially from Asia or the Americas, the Port of Felixstowe stands out due to its exceptional capacity and infrastructure.

Location and Volume: Located on the Humber Estuary in Lincolnshire, Grimsby & Immingham is the UK’s largest port by tonnage, handling over 60 million tonnes annually.

Key Trading Partners and Strategic Importance: The port links predominantly with Scandinavia and other parts of Northern Europe. Its strategic importance is mainly found in its handling of a variety of cargoes, including cars, coal, and bulk cargo.

Context for Businesses: If your business trades predominantly with northern European markets and deals in bulk or specialized cargo, Grimsby & Immingham port offers significant capacity and diverse cargo handling abilities.

Main shipping ports in Kazakhstan

Port of Aktau:

Location and Volume: Situated on the East shore of Caspian Sea, the Port of Aktau is vital to the Kazakhstan’s trade with a shipping volume of 8.9 million tons per annum.

Key Trading Partners and Strategic Importance: Being the only maritime gateway to Kazakhstan, it’s a crucial link with Azerbaijan, Russia and Iran. Strategically, it forms a part of Trans-Caspian International Transport Route promoting seamless connectivity in Eurasia.

Context for Businesses: If your business strategy involves reaching markets of Caucasus, Russia, and Middle East, Aktau’s well-established network can provide a strong logistical advantage.

Port of Atyrau:

Location and Volume: Located on the Northern branch of the delta of the Ural River and designated as a river port, Atyrau moves substantial shipments of oil, given the region’s rich oil fields.

Key Trading Partners and Strategic Importance: Major trading partners include countries along the Ural River like Russia. It’s an optimal choice for businesses involved in oil trade in Kazakhstan.

Context for Businesses: If your company deals with oil and petroleum products, consider Atyrau for navigable connections to the Caspian sea and cargo handling efficiency.

Unfortunately, as Kazakhstan is landlocked and mainly surrounded by deserts and plains, there aren’t more maritime ports. For any additional transportation needs, businesses should explore other logistics solutions such as rail freight which Kazakhstan invariably promotes, like the popular New Silk Road.

Should I choose FCL or LCL when shipping between UK and Kazakhstan?

Embarking on the shipping journey between UK and Kazakhstan? Your sea freight’s success rides on a key decision: opting for Full Container Load (FCL) or Less than Container Load (LCL) – a.k.a. consolidation. This choice impacts not only your budget but also your delivery timelines. In the upcoming sections, we’ll dissect these two options to help you get the shipping strategy just right. Remember, what works best for your business hinges on your specific needs and circumstances. Let’s dive in to unravel the mystery of FCL and LCL, guiding you to a cost-effective, efficient shipping decision.

Full container load (FCL)

Definition: FCL, or Full Container Load, refers to a method of shipping where an entire container is used for a single consignee's goods.

When to Use: This method is ideal when your cargo exceeds 13/14/15 cubic meters, converting your shipment into an FCL container. FCL is favored for high-volume shipping as it tends to be cheaper and safer. Safety is ensured as the container is sealed from origin to destination, dramatically reducing the risk of theft or damage.

Example: Imagine a business owner in the UK exporting 16 CBM of automotive parts to a client in Kazakhstan. Opting for FCL shipping, they'd have a sealed 20'ft container solely for their goods, providing peace of mind against potential damage or loss during transit.

Cost Implications: While an FCL shipping quote generally has a higher upfront cost compared to LCL (Less than Container Load), the cost per unit is lower. For instance, shipping a 40'ft container may cost twice as much as a 20'ft one, but it can carry over twice the amount of goods, translating into significant savings for high-volume shippers.

Less container load (LCL)

Definition: Less Than Container Load (LCL) shipping, also known as consolidation, involves multiple shippers' cargo compiled into one container.

When to Use: LCL shipping is beneficial for businesses with low volumes of cargo. If your freight equates to less than about 13 to 15 CBM (cubic meters), LCL could be an optimal solution. It offers enhanced flexibility as your freight can be moved more frequently as part of routine LCL schedules.

Example: Imagine if your company manufactures a specialty beverage mix in the UK, with a monthly shipment of around 10 CBM to distributors in Kazakhstan. As this quantity is less than a full container, using LCL freight saves unnecessary expenditure on cargo space you don't need.

Cost Implications: With LCL shipping, you only pay for cubic space your goods occupy, making it quite price advantageous for smaller volumes. However, consider that it may also include additional fees due to the extra handling required for consolidating and de-consolidating containers. Bear in mind that an lcl shipping quote encapsulates these factors. Remember, efficiency in logistics often hinges on striking the right balance between shipping costs and operational needs.

Hassle-free shipping

Discover the simplicity of shipping with DocShipper, your committed freight forwarder. Whether it's consolidation or a full container, our ocean freight experts are here to guide you. We'll help determine the best option for your business based on cargo volume, budget, and timeline. Don't let complex shipping processes hold you back; let us handle the logistics. Maximize your global trade potential with DocShipper. Reach out now for a free shipping estimate!

Sea freight from the UK to Kazakhstan takes roughly between 25-30 days, depending on the specific ports of departure and arrival, the weight and nature of the goods being shipped, and other individual factors. For a personalized and accurate quote considering all these variables, businesses are encouraged to reach out to a freight forwarder like DocShipper.

Now let’s look at some average freight times between key ports in both countries.

| UK Ports | Kazakhstan Ports | Transit Time (Days) |

| Port of Felixstowe | Aktau | 16 to 22 |

| Port of London | Aktau | 16 to 22 |

| Port of Southampton | Aktau | 15 to 20 |

| Port of Liverpool | Aktau | 16 to 21 |

*it is important to note that this is only an approximation, and that actual times may vary according to various factors

Note: Kazakhstan being a landlocked country, the seaport in our comparison is in Aktau, the main freight port which is accessed via the Volga-Don Canal or the Caspian Sea.

How much does it cost to ship a container between UK and Kazakhstan?

Shipping a container from the UK to Kazakhstan can be a cost-effective solution, but the exact ocean freight rates can range widely due to several variables. These include your Point of Loading, Point of Destination, the specific carrier chosen, the nature of your goods, and even monthly market fluctuations. Given these complexities, an accurate shipping cost cannot be nailed down without investigation. Whilst this may sound daunting, fear not. Our shipping specialists are here for you, tailoring quotes on a case-by-case basis to ensure you receive the most competitive and suitable rate for your unique requirements. Rest easy knowing we’re in your corner, making international shipping simpler and cost-effective for you.

Special transportation services

Out of Gauge (OOG) Container

Definition: An OOG container is designed to ship oversized or out of gauge cargo that doesn’t fit conventional shipping containers.

Suitable for: Heavy and oversized equipment like machinery, industrial parts, and large vehicles.

Examples: Construction equipment, windmill propellers, oversized pipes, etc.

Why it might be the best choice for you: This opens up possibilities for shipping large or irregularly shaped items without disassembly, minimizing the risk of damage during transit and saving assembly time at destination.

Break Bulk

Definition: Break bulk involves shipping commodities individually, bundled or in barrels rather than in containers. An excellent way to transport items that are bulky or oversized.

Suitable for: Large apparatus, oversized machinery, construction materials.

Examples: Large turbines, railroad tracks, construction beams.

Why it might be the best choice for you: It allows for maximum flexibility when dealing with heavy, awkwardly sized goods. This mode of shipping is particularly useful when your items are simply too big or heavy for traditional containers.

Dry Bulk

Definition: Dry bulk refers to transporting goods in large quantities, loaded directly into a ship’s hull, usually in loose form.

Suitable for: Commodities like minerals, coal, and grains.

Examples: Hundreds of tons of grain, coal, or other raw material.

Why it might be the best choice for you: It’s an economical and efficient way to move large quantities of loose cargo, such as large volumes of coal for energy production or grain for food production.

Roll-on/Roll-off (Ro-Ro)

Definition: Roll-on/Roll-off (Ro-Ro) shipping is a method where vehicles are driven on and off a specialized ro-ro vessel.

Suitable for: All types of wheeled cargo including, cars, trucks, semi-trailer trucks, trailers, and railroad cars.

Examples: Transportation of cars, trucks, tractors, and even heavy plant machinery.

Why it might be the best choice for you: It offers the convenience and straightforwardness of end-to-end transit for wheeled and tracked vehicles, without the need for disassembly and reassembly.

Reefer Containers

Definition: Reefer containers, or refrigerated containers, are temperature-controlled containers used to transport perishable goods.

Suitable for: Perishables like vegetables, fruits, meat, dairy products, and pharmaceuticals.

Examples: Transporting fresh produce from farms in the UK to markets in Kazakhstan, or ensuring critical temperature-sensitive pharmaceuticals reach their destination intact.

Why it might be the best choice for you: It guarantees temperature regulation safeguarding the quality of your temperature-sensitive products from the point of origin to the destination.

For any shipping needs, rely on DocShipper’s network of expert logistics partners from the UK to Kazakhstan. Capitalize on our knowledge and experience to find the right shipping solution for your business. Don’t hesitate to contact us for a free shipping quote in less than 24 hours!

Air freight between UK and Kazakhstan

Shipping goods between the UK and Kazakhstan? Air freight can get your merchandise there swiftly and reliably. It’s perfect for those small, high-value items – think high-tech gadgets or exclusive designer wear. Despite being often pricier than sea or rail transport, it’s worth every penny given its speed, lesser handling, and reduced risk of damage.

However, here’s a cracker: many businesses unintentionally drain their wallets, tripped up by common misconceptions. Imagine shopping for a couch, only to be shocked at the checkout because you based the price on its size, not its weight – both factors crucial in air freight costing. Or even worse, getting slapped with surprising charges because you didn’t know that a small tweak in your packaging could’ve saved you a lot. We’ll dive into these and other firecrackers to make your air freight journey between the UK and Kazakhstan a smooth flight.

Air Cargo vs Express Air Freight: How should I ship?

Juggling between air cargo and express air freight for your UK-Kazakhstan shipments? Let’s simplify it: consider air cargo as hitching a ride on an airline, while express air freight is booking a dedicated plane just for your goods. In this guide, we’ll dive into which one suits your business best, analysing variables such as cost, speed, and reliability. Let’s start unpacking these options.

Should I choose Air Cargo between UK and Kazakhstan?

Opting for air cargo between the UK and Kazakhstan can bring significant benefits. Airborne transport is reliable and cost-effective, especially with large consignments above 100/150 kg (220/330 lbs). If time isn’t a pressing concern, fixed schedules mean you can plan well ahead. High-profile airlines like British Airways and Air Astana play major roles in the freight market. Your decision depends on your unique needs and budget. Despite longer transit times, the efficiency and security of air cargo might be just what your business requires.

Should I choose Express Air Freight between UK and Kazakhstan?

Express Air Freight is a service offered by dedicated cargo airlines, like FedEx, UPS, or DHL, transporting shipments swiftly and securely with no passengers on-board. This solution could be ideal for your business if your shipment to Kazakhstan from the UK is under 1 CBM or weighs less than 100/150 kg (220/330 lbs). With Express Air Freight, you’ll enjoy rapid transit times and higher flexibility, making it a strong choice for time-sensitive, smaller cargo. Don’t forget, it’s often more expensive than other modes, so balance speed with budget.

Main international airports in UK

London Heathrow Airport

Cargo Volume: Heathrow handles more than 1.7 million tonnes of cargo a year, making it one of the busiest cargo airports in Europe.

Key Trading Partners: United States, China, India, Japan, and Australia are some of its key trading partners.

Strategic Importance: Located in London, Heathrow is strategically positioned to reach major economic centers around the globe. With over 80 airlines serving 180 destinations, it is key to international and local economies.

Notable Features: Heathrow has dedicated facilities for all types of cargo, from temperature-sensitive pharmaceuticals to bulky manufacturing components.

For Your Business: If you need quick and reliable access to major international markets, especially in North America and Asia, Heathrow Airport’s extensive network could be beneficial for your business.

East Midlands Airport

Cargo Volume: With more than 1,000 tonnes daily, it is the UK’s busiest pure cargo airport.

Key Trading Partners: East Midlands trades heavily with European countries, the United States and China.

Strategic Importance: Located in the heart of the UK, East Midlands Airport offers 24/7 operations, allowing constant circulation of goods.

Notable Features: Known for handling express courier traffic, it is a favourite for time-critical distributors.

For Your Business: If your business relies on timely deliveries and unrestrictive operation times, East Midlands could be a strategic choice for your cargo operations.

Manchester Airport

Cargo Volume: Manchester handles over 120,000 tonnes of imported and exported goods every year.

Key Trading Partners: Major trading partners include the United States, Middle East, and European Union countries.

Strategic Importance: Being the third busiest airport in the UK, it presents a strategic point of import and export to and from the Northern parts of the UK.

Notable Features: The World Freight Terminal at Manchester Airport is dedicated solely to cargo, providing a high-quality, efficient service.

For Your Business: If your market lies in the northern UK or you’re exporting goods to the US, Middle East, or the EU, Manchester Airport could fit into your shipping strategy.

Stansted Airport

Cargo Volume: Over 250,000 tonnes of cargo pass through Stansted each year.

Key Trading Partners: United States, European Union countries, and the Middle East are its major trading partners.

Strategic Importance: Located just outside London, Stansted offers flights to more than 190 destinations and serves over 22 million passengers a year.

Notable Features: Stansted’s Cargo terminal has a storage area of 2,500 square meters, offering excellent facilities.

For Your Business: If your business is dealing with large, heavier freight and cargo, Stansted Airport could provide a streamlined and efficient logistics solution for you.

Gatwick Airport

Cargo Volume: Gatwick handles over 100,000 tonnes of cargo annually.

Key Trading Partners: Europe, North America, and the Middle East are the key trading partners.

Strategic Importance: Despite being primarily a passenger airport, Gatwick’s location just south of London makes it a vital cargo hub.

Notable Features: Gatwick’s strong road and rail links make it simple for cargo to reach its final destination from the airport.

For Your Business: If your business needs a seamless transition from air to land transportation, especially in and around the London area, Gatwick’s well-connected transport links could be crucial for your operation efficiency.

Main international airports in Kazakhstan

Astana International Airport

Cargo Volume: Approximately 40,000 tonnes of cargo each year.

Key Trading Partners: Primarily European and Asian economies, including China, Russia, Germany, and Turkey.

Strategic Importance: Serves as the second-busiest airport in Kazakhstan, with cargo transport connections to both sea and rail.

Notable Features: Astana has an impressive freight terminal capable of storing all types of cargo carefully, securely and efficiently.

For Your Business: Since Astana International Airport has regular cargo flights to Europe and Asia, it could be integral to your shipping strategy if these regions are among your key markets.

Almaty International Airport

Cargo Volume: Handles over 50,000 tonnes annually, the most in Kazakhstan.

Key Trading Partners: Predominantly the EU, Russia, China, and several Middle East nations such as UAE.

Strategic Importance: Almaty is the busiest airport in Kazakhstan, and its cargo services play an essential role in the Central Asian logistics system.

Notable Features: It hosts significant cargo operators and has dedicated freighter services.

For Your Business: Its strategic location and extensive connections make it an ideal hub for businesses engaged in trade with both Europe and Asia.

Atyrau International Airport

Cargo Volume: Approximately 15,000 tonnes annually.

Key Trading Partners: Mostly linked to neighboring CIS countries and the European Union.

Strategic Importance: Atyrau is of strategic importance to the oil and gas industry, serving as a key connection to oil bases in Kazakhstan.

Notable Features: Serves numerous cargo airlines and charter services.

For Your Business: If your business belongs to the oil and gas or energy sectors, Atyrau can be an excellent choice for cargo shipping due to its industry-specific connections.

Aktobe International Airport

Cargo Volume: Around 10,000 tonnes annually.

Key Trading Partners: Primarily services Russia, Turkey, and the European Union.

Strategic Importance: Aktobe is an important logistics hub in the western part of Kazakhstan, serving as a vital access point for the region.

Notable Features: It has a dedicated cargo terminal for efficient handling of goods.

For Your Business: If your business operates in the West Kazakhstan region, Aktobe could serve as a valuable asset for your shipping strategy.

Shymkent International Airport

Cargo Volume: Handles approximately 5000 tonnes of cargo each year.

Key Trading Partners: Primarily trading with CIS countries and Middle Eastern nations.

Strategic Importance: Located in Southern Kazakhstan, Shymkent serves as an important hub for the entire region.

Notable Features: Regularly services several major cargo airlines.

For Your Business: For companies focused on trade within the southern region of Kazakhstan or aiming to expand to Central Asia, Shymkent offers a direct and efficient routing option.

How long does air freight take between UK and Kazakhstan?

Shipping goods from the UK to Kazakhstan by air freight typically takes between 3 and 6 days, although this is just an average. The actual transit time can vary significantly depending on specific factors such as the departure and arrival airports, total weight, and type of goods being shipped. For the most accurate delivery times, it’s recommended you consult with an experienced freight forwarder such as DocShipper.

How much does it cost to ship a parcel between UK and Kazakhstan with air freight?

Shipping costs between the UK and Kazakhstan can roughly range from $3 to $9 per kilogram for air freight. However, actual prices can fluctuate due to factors like proximity to departure and arrival airports, dimensions, weight, and nature of goods. We understand that every business need is unique, which is why we provide custom quotes that meet your specific demands. Our experienced team is ready to work closely with you to secure the best possible rates. Want to know more? Contact us and receive a free quote within 24 hours.

What is the difference between volumetric and gross weight?

Gross weight refers to the actual weight of your shipment, including goods and packaging, and is measured in kilograms (kg). In contrast, volumetric weight, also known as dimensional weight, estimates the weight of a package considering the space it occupies during air transportation.

Air Cargo calculation uses the formula: Length (cm) x Width (cm) x Height (cm) / 6000 = Volumetric Weight in kg. Let’s take an example. If your box measures 40cm x 30cm x 50cm, the calculation would be: 40x30x50/6000 = 10 kg volumetric weight. That’s approximately 22 lbs, in case you’re more familiar with the pound system.

Express Air Freight calculation is different though. It’s calculated as: Length (cm) x Width (cm) x Height (cm) / 5000 = Volumetric Weight in kg. For the same box dimensions, you’d get: 40x30x50/5000 = 12 kg. Simply put, 26.45 lbs.

So, difference in these calculations may significantly impact your costs. Freight charges are determined by comparing gross and volumetric weight. You pay for whichever is higher. This is why understanding these calculations is critical – it greatly impacts your shipping costs.

Door to door between UK and Kazakhstan

Diving into the world of international door-to-door shipping, a method that takes the hassle out of sending goods from the UK straight to Kazakhstan. It stands as a convenient choice, cutting through complex processes with agility, speed, and ease. Smooth sailing your operations, it’s a top pick for many businesses. So, why not give it a try? Let’s dive in!

Overview – Door to Door

Door-to-door shipping between the UK and Kazakhstan eliminates stress associated with logistics. As one of the most sought-after services from DocShipper’s clientele, it streamlines a usually complex, costly process. The hassles of customs clearance, procedures, and tracking are handled efficiently, ensuring your cargo reaches its destination hassle-free. However, this convenience may come at a higher cost. If wrestling with these complexities seems daunting, this is your solution. It’s like having a personal courier escorting your goods, navigating every challenge along the way. Cool, right? Let’s delve deeper to see if this is a perfect fit for your shipping needs.

Why should I use a Door to Door service between UK and Kazakhstan?

Ever tried juggling bowling balls whilst riding a unicycle? I thought not! Logistics can feel the same, especially when shipping from the UK to Kazakhstan. But here’s where Door to Door services can make a world of difference.

1. Simplification of Logistics: Door to Door service makes the process as simple as ordering a pizza! From picking up goods at the starting point in the UK to trucking it right to the final destination in Kazakhstan, it literally takes logistical worries off of your plate.

2. Timely Delivery: Got a deadline tighter than jeans after holiday season? No worries! Door to Door service ensures seamless, swift transport across air, sea, road, or rail, ensuring your goods arrive when you need them – without any last-minute dash.

3. Specialized Care: If your cargo feels more like a Rubik’s cube than a standard shipment, don’t panic! Door to Door service providers have specialized knowledge to handle complex goods, ensuring they’re treated with the care they deserve.

4. Stress Reduction: Shipping internationally can sometimes feel like resolving a Sherlock Holmes mystery – but it doesn’t have to! With everything handled by professionals, from customs clearance to administrative tasks, you’ll have more time to focus on the things that really matter to your business.

5. Absolute Convenience: Imagine having a world-class shipping team, at your fingertips. That’s what you get with a Door to Door service. No running around organising different stages of transport. Just professional, all-in service only a call away.

Choose Door to Door service for your shipping needs, and enjoy smooth and worry-free transportation from the heart of the UK to the vast steps of Kazakhstan. It’s like a magic carpet ride for your goods!

DocShipper – Door to Door specialist between UK and Kazakhstan

Stress-free door-to-door shipping from the UK to Kazakhstan – that’s what DocShipper guarantees! Skilled in all facets of goods transportation, we ensure hassle-free packing, transport, customs handling, and more! With us, you get complete support from a dedicated Account Executive, guiding you through each step of the process. Get a free estimate in less than 24 hours or tap into our resident experts for free advisory services. Shipping has never been so simple!

Customs clearance in Kazakhstan for goods imported from UK

Customs clearance is the critical process of officially importing goods into a country, in this case, transitioning goods from the UK to Kazakhstan. It’s crucial to get this right as this can be filled with complexities, including unexpected fees and charges. Understanding customs duties, taxes, quotas, licenses, is essential to prevent your goods from being held up in customs. This guide’s upcoming sections will delve deep into these areas, making it a must-read for businesses involved in cross-border trade. Let DocShipper be your ally through this process – we can assist with customs clearance for all kinds of goods, globally. Need an estimate for budgeting your project? contact our team with the origin, value, and HS Code of your goods; these are essential to proceed with an accurate estimate.

How to calculate duties & taxes when importing from UK to Kazakhstan?

Navigating the maze of customs regulations and duties can feel like a monumental task, especially if you’re importing from the UK to Kazakhstan! The first thing you need to understand is that estimating duties and taxes is not a one-size-fits-all process, but rather a unique calculation dependent on several key factors. These factors include the country of origin, the Harmonized System (HS) Code, the customs value, and the applicable tariff rate, along with any additional taxes and fees that might apply to the product in the destination country.

The initial step in this sequence is to establish the country of origin of the goods. This typically refers to the country where the goods were manufactured or produced. Remember, it’s not just about where the goods were bought or sold, but where they were actually made. This insight not only influences the duty rate but also proves crucial in determining if any trade agreements or restrictions come into play.

Step 1 – Identify the Country of Origin

Understanding your product’s Country of Origin is the first crucial step in estimating duties and taxes for imports from the UK to Kazakhstan. Why?

1. Specific Trade Agreements: The UK and Kazakhstan enjoy a strategic Partnership and Cooperation Agreement (PCA). Thus, particular goods might benefit from reduced or even zero tariffs, making it vital to identify the goods’ origin.

2. Value-Based Duties: Duties owe hinge on the goods’ value. Identifying the right origin helps in accurate valuation, impacting the final customs duties you pay.

3. Compliance with Import Restrictions: Certain products from specific countries face import restrictions in Kazakhstan. Knowing your product’s origin helps you navigate these barriers smoothly.

4. Accurate Classification: Each product’s origin can influence its Harmonized System (HS) code, a universal classification system affecting duty rates.

5. Avoid Legal Complications: Misrepresenting a product’s origin can result in legal issues, fines, or seizures at the border.

Your next move? Dig into your product’s details. Ensure it complies with reductions under the PCA. Check for potential restrictions and get a precise HS code. Remember, correct and careful classification is your key to smooth customs clearance. Ultimately, you’ll safeguard your shipment and save valuable time and money.

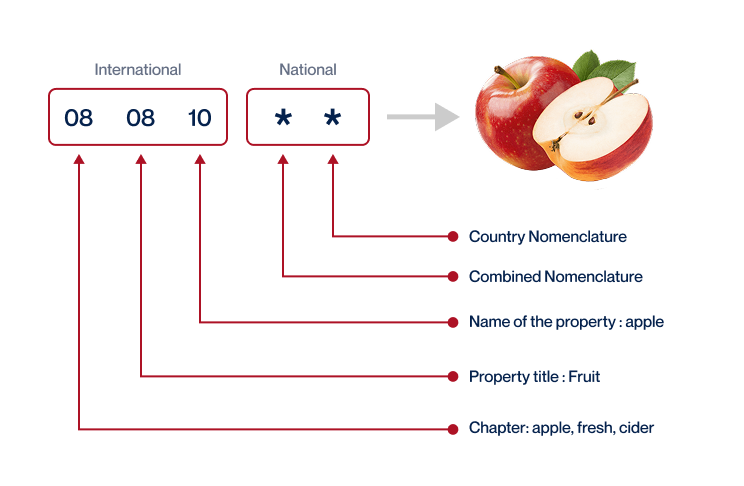

Step 2 – Find the HS Code of your product

The Harmonized System Code, or HS Code, is a standardized system of names and numbers to classify traded products. These codes are used by customs authorities around the world to identify products for the purpose of duties and taxes.

When it comes to discovering the HS code for your product, your supplier is usually a good point of contact. Suppliers are often very familiar with their products and relevant import regulations, and they can certainly provide you with the needed code.

However, if communicating with your supplier isn’t feasible, don’t fret. We’re here to guide you through this with an easy step-by-step approach.

Your first step is to use a Harmonized Tariff Schedule lookup tool.

Once opened, simply input the name of your product in the search bar.

You then will need to check under the ‘Heading/Subheading’ column of the results, which will reveal the HS code for your product.

Please note the importance of being absolutely accurate when determining the HS code. This is vital as any discrepancy or error can lead to shipment delays and potential fines. Accuracy in this step ensures a smoother customs clearance process.

Here’s an infographic showing you how to read an HS code.

Step 3 – Calculate the Customs Value

Getting the customs value right for your goods entering Kazakhstan from UK can be tricky, but it’s crucial to avoiding delays and additional costs. The customs value isn’t the market price of your items – it’s actually the CIF value. So, let’s say you’re shipping widgets worth $1000 with a shipping cost of $200 and an insurance cost of $50. Here, the CIF value (and thus your customs value) isn’t just the $1000 but it’s $1250. Yep, it’s your product price, shipping, and that sometimes forgotten element – insurance – all bundled together. Remember, erring in this calculation can lead to incorrect duty payments or penalties, which can throw a wrench in your shipping timeline. So, a better understanding of your CIF value can keep your goods moving smoothly.

Step 4 – Figure out the applicable Import Tariff

An import tariff is essentially a tax imposed on goods when they are transported across international borders. In the context of shipping goods from the UK to Kazakhstan, you’d encounter a particular type, the Import Duty Tariff.

This tariff can be determined using the Trade Tariff lookup tool provided by the UK government. Here are the steps:

1. Visit the Trade Tariff lookup

2. Enter the HS code that you’ve identified earlier and select the country of origin.

3. Review the duties and taxes that apply to your product.

For instance, let’s assume you are shipping bicycles (HS Code 871200), from the UK to Kazakhstan. The tool might indicate a tariff rate of 10%. If your insurance and freight costs (CIF) total $5,000 USD, the import duty will be calculated as follows:

10% of $5000 (CIF cost) = $500.

So, the total import duties will amount to $500. It’s crucial to understand these calculations, as they significantly impact your final costs and can affect the profitability of your imports.

Step 5 – Consider other Import Duties and Taxes

Concurrency in customs clearance is critical, and Step 5 can’t be taken lightly as it involves understanding other Import Duties and Taxes that impact your transcontinental trade. Not everything is covered by the standard tariff rate. Sometimes, your origin country and the type of product being shipped can escalate the costs due to additional import duties.

For instance, excise duty, a tax on specific goods like tobacco or alcohol, could be levied. Anti-dumping duties are another example. They work as protective measures, applied when goods are deemed to be sold below their fair value, potentially hurting the local industry.

Yet, VAT (Value Added Tax) is arguably your biggest concern. This could vary significantly and is usually calculated based on the value of the product, plus any international shipping costs and any import duty owed. Here’s how it usually rolls out: if you’re shipping cell phones valuing $10,000 with a 10% VAT, your payable VAT would be $1,000.

These are general estimates; you need an accurate calculation. It’s essential to verify these insights with a customs officer or an experienced freight forwarder for your specific needs. The goal is to circumvent any miscalculations leading to additional costs or delays. Remember, precision in logistics is everything.

Step 6 – Calculate the Customs Duties

Customs duties in Kazakhstan from UK shipments are based on the customs value, VAT, and possible anti-dumping taxes and excise duty. The basic formula for calculating customs duty is:

Customs Duty = Customs Value x Duty Rate.

Let’s look at three examples to give you a better insight:

1. For a $5000 machinery part with a duty rate of 5%, the customs duty is simply $5000 x 5/100 = $250.

2. For electronic merchandise valued at $3000 with a 10% duty rate and a 12% VAT, calculate the customs duty first ($3000 x 10/100 = $300). Then calculate the VAT on the sum of customs value and customs duty ($3300 x 12/100 = $396). The total fee is $696.

3. Lastly, let’s say you’re importing a $10000 alcoholic product with 20% duty, a 12% VAT, a 5% anti-dumping tax, and a $500 excise duty. The customs duty is $10000 x 20/100 = $2000, VAT is ($12000+ $500) x 12/100 = $1500, and anti-dumping tax is $10000 x 5/100 = $500. Together, this sums to $4500.

Remember, calculations could get complex, which is where DocShipper steps in. We can handle every step of your customs clearance, ensuring you aren’t overcharged. Contact us for a tailored, obligation-free quote returned within 24 hours.

Does DocShipper charge customs fees?

As a customs broker, DocShipper manages customs clearance procedures, which does involve fees. However, these are distinctly separate from customs duties and taxes, which are levied directly by the government. Everything you pay as duties and taxes will come with official documentation from the customs office, reassuring you that you’re only paying the legitimate, government-imposed charges. It’s like when you pay your taxes; you’re not giving that money to your accountant, rather, it’s going directly to the tax authorities.

Contact Details for Customs Authorities

UK Customs

Kazakhstan Customs

Official name: Committee of Customs Control – Ministry of Finance of the Republic of Kazakhstan.

Official website:

Required documents for customs clearance

Tackling customs can be a tough game with each document being a crucial player. We’ll clarify the rules by exploring four key ‘players’: the Bill of Lading, Packing List, Certificate of Origin, and Documents of conformity (CE standard), helping you dodge any penalties and delays. Here’s to efficient, surprise-free shipping!

Bill of Lading

Navigating the logistics terrain from the UK to Kazakhstan? The Bill of Lading, an integral part of the freight puzzle, warrants your attention. This official document verifies the lawful transfer of ownership from you to your buyer in Kazakhstan, making it quintessential for customs clearance. For instance, you’ve just shipped 500 designer lamps and the Bill of Lading shows they’re now under your buyer’s name – congratulations, you’ve secured your sale legally! With our digital era in full swing, consider a telex release. It speeds up the process by electronically transmitting your Bill of Lading, saving on tedious shipping or couriering efforts. If the sky’s your route, instead of the B/L, you’ll need an Air Waybill (AWB). Your takeaway? Understanding your transport method’s key documents can clear customs quicker and smoother – keep this top of mind for your next shipment.

Packing List

Navigating the logistics pipeline between the UK and Kazakhstan can be complex, but your Packing List is a steadfast ally. Thought of it as your shipment’s ID card—it pertinently details what, and how much of it, is in your cargo. If you’re shipping medical supplies, for example, an accurate list ensures those crucial heart monitors aren’t mistaken for simple stethoscopes. Whether it’s sea or air freight, customs officials in both nations use this document to verify your cargo against their stringent import regulations. Meticulously compiling this list not only expedites the customs clearance process but also prevents unexpected hitches like cargo hold-ups or penalties. Remember, a well-crafted Packing List is key to smooth sailing (or flying) for your goods.

Commercial Invoice

Crafting a Commercial Invoice for your UK-Kazakhstan shipments? It’s more than just a bill, it’s your permission key for customs clearance. Make sure it includes key data, like the accurate description of items, total value, country of origin, and importantly, your HS Code. This information eases the decryption of your shipment for customs officers. Misalignment with other documents like the Packing List can derail your customs clearance process. Here’s a tip, ensure your invoice contains details consistent with other documents. It’s a small effort that makes a big difference. For a hassle-free shipping experience, consider employing a logistics expert who’s familiar with the Kazakhstan customs regulations. With this insight, you’re now equipped to navigate the turbulences of international shipping.

Certificate of Origin

The Certificate of Origin is your superpower for smooth shipping from the UK to Kazakhstan. It’s the document that verifies where your goods were made, ensuring transparency in global trade. Imagine shipping a batch of Milton Keynes-manufactured electronics to Nur-Sultan. To qualify for favorable trade agreement rates, you need to confirm their UK origin. Enter the Certificate of Origin. This nifty document will add credibility to your claims, possibly lowering your customs duty bill. Remember to clearly mention ‘Made in UK’ to avoid any customs hiccups in Kazakhstan. So, arm yourself with your certificate, and let’s smash those shipping hurdles together.

Get Started with DocShipper

Prohibited and Restricted items when importing into Kazakhstan

Getting your goods into Kazakhstan can be a challenge when you’re not sure what’s off-limits. It’s crucial to know about the items that Kazakhstan customs won’t let through, alongside those with special regulations. Missteps here could cost time and money. Read on for essential insights.

Are there any trade agreements between UK and Kazakhstan

Yes, as a UK business shipping to Kazakhstan, you’ll benefit from the Enhanced Partnership and Cooperation Agreement (EPCA) between the European Union and Kazakhstan, which the UK continues to be part of post-Brexit. This agreement simplifies trade by lowering customs duties and bureaucratic procedures. Additionally, new trade initiatives are under discussion, offering potential advantages in the future. Keep an eye on the development of the Trans-Caspian International Transport Route, a railway line aiming to improve connections between Europe and Asia, including the UK and Kazakhstan.

UK – Kazakhstan trade and economic relationship

UK-Kazakhstan economic relations trace back to Kazakhstan’s independence in 1991, an epoch marked by strengthened ties through robust trade and investment. Attracting predominant UK investors, energy and mining are the pivotal sectors, with BG Group and Rio Tinto among major players. These countries’ intrigue doesn’t stop at fossil fuels and minerals – Kazakh firms have also shown a keen interest in the UK’s vibrant banking and finance sectors.

Over £6 billion investment was made by the UK into Kazakhstan between 2002-2024, establishing it as one of Kazakhstan’s key foreign investors. Likewise, trading between countries witnessed a whopping £2 billion in 2024 with commodities like machinery, vehicles, and pharmaceuticals leading the way.

In summary, the economic symbiosis between the UK and Kazakhstan — fuelled by rich historical context and shared interests — paints a promising picture for businesses looking to navigate these waters. It’s not just about moving goods, it’s about embracing an economic relationship tested by time and laden with opportunities.

Your first steps with DocShipper

Additional logistics services

Warehousing

Are you vexed with hunting down dependable warehousing in UK or Kazakhstan, particularly for specific goods requiring temperature control? Beyond just storing, your goods’ state is paramount. Check out Warehousing for a comprehensive solution to these challenges. We ensure they remain in an optimal environment, maximising their shelf life. Get all the details and kiss your warehousing woes goodbye. Warehousing.

Packing

Shipping between the UK and Kazakhstan? Proper packaging and repackaging is key. It's not just about protecting your goods but also meeting international regulations. A trustworthy agent can help avoid any hiccups - Imagine shipping antiques, for example. They'd need special care and a professional touch, right? Our service caters to diverse products, so you can rest easy. More info on our dedicated page: Freight packaging

Transport Insurance

Cargo insurance isn't your everyday fire insurance; it's specifically designed for your shipping needs. Take a TV shipment; unexpected mishaps can cause a pricey screen shatter. This is where cargo insurance steps in to cover these unforeseen risks, offering prevention that fire insurance can't provide. Want to avoid potential financial loss due to cargo damage? Look no further. More info on our dedicated page: Cargo Insurance.

Household goods shipping

Relocating to Kazakhstan from the UK? Dealing with bulky or delicate items can be daunting. Our Personal Effects Shipping service is just what you need. We ensure these items are handled with utmost care and provide flexible options tailored to your needs. Think a grand piano or a priceless art collection - we've moved it all, assuring peace of mind during transit. Wish to know how we do it? More info on our dedicated page: Shipping Personal Belongings

Procurement in Thailand

Struggling to manufacture in Asia or East Europe? We've got you covered. At DocShipper, we'll find suitable suppliers and manage the entire procurement process for you. Worried about language barriers? Don't be, we'll bridge that gap and guide you through every step. Whether it’s shipping goods from the UK to Kazakhstan or vice versa, we’re your go-to choice. Want to learn more? Check out our Sourcing services.

Quality Control

Quality inspections before shipping from the UK to Kazakhstan can be a game-changer, dodging unexpected compliance issues or wasted expenditure on defective goods. Imagine you're shipping porcelain figurines - a pre-shipment inspection could be the difference between delighted customers or costly returns. Our quality control service ensures your products meet Kazakhstani and international standards before they even hit the road. More info on our dedicated page: Quality Inspection

Conformité des produits aux normes

Keeping your goods on the right side of international regulations can feel like a tall order. That's why our Product Compliance Services are essential - not only do we help ensure your shipment adheres to all necessary standards, but we also provide in-lab testing for certification, guaranteeing a smooth transit. Discover the difference doing it right can make. More info on our dedicated page: Product compliance services