Are you planning to import goods from Hong Kong to the UK? Or on the opposite, to export goods from the UK to Hong Kong? This guide is for you!

Our experts at DocShipper UK have written this guide based on their many years of experience in the logistics industry. Below you will find all the information you need to make your transport from the UK to Hong Kong run smoothly.

Transport means, transit times, prices and customs clearance between the UK and Hong Kong will no longer hold any secrets for you!

Table of Contents

What is the best method of transportation between the UK and Hong Kong?

To transport your goods from one country to another, the existing modes of transportation are sea freight, air freight, rail freight, and road freight.

To help you choose the most suitable mode of transportation, we have analyzed and compared the different transportation available between the UK and Hong Kong. We will not mention road freight because due to the long distance between the two countries, this mode of transportation is neither cost-effective nor fast.

Sea freight from the UK to Hong Kong

DocShipper Recommendation: Sea freight is the best option for you if :

- The total weight of your shipment is more than 2 CBM

- You want the cheapest way of transportation

- Your shipment is not urgent

DocShipper Note: If you want some advice, don't hesitate and contact us, we will answer you in less than 24 hours !

Transport by ship from the UK to Hong Kong

Sea freight is a widely used mode of transport to move goods between the UK and Hong Kong. The historical trade between the two countries and the ability of ships to carry large quantities of goods are key factors in this popularity. Sea freight offers lower costs than air freight, although certain risks, such as delays and loss of goods, must be considered. In the next part of this guide, we will take a closer look at the details of sea freight between the UK and Hong Kong, including the main ports in both countries, the different types of containers, transit times, rates, and the advantages and disadvantages.

Main ports of the UK

The Port of Felixstowe

Located on the east coast of England, the Port of Felixstowe is the largest container port in the United Kingdom and the sixth largest in Europe, with an annual capacity of over 4 million containers. It is equipped with modern terminals, automated cranes, and multimodal transport infrastructure, including rail connections to major UK cities.

In 2020, the port handled more than 3.9 million standard containers, an increase of 3.7 percent over the previous year.

The Port of Southampton

Located on the south coast of England, the Port of Southampton is the second-largest container port in the United Kingdom, with an annual capacity of over 2.8 million containers. It has modern terminals for handling containers and general cargo, as well as significant storage capacity.

In 2020, the port handled more than 1.5 million standard containers, a 3% decrease from the previous year.

The Port of London

In 2020, the port handled more than 1.5 million standard containers, an 11 percent decrease from the previous year.

The port of Hong Kong

The Port of Hong Kong is one of the largest ports in the world in terms of cargo volume and container traffic. It is located on Hong Kong Island in the center of the city.

The Port of Hong Kong is managed by the Hong Kong Port Authority and includes a wide variety of docks and terminals, such as the Kwai Tsing Container Terminal, Kai Tak Cruise Terminal, and Tuen Mun Passenger Terminal. In 2020, the port handled more than 18 million standard containers, a 1.5 percent decrease from the previous year.

The Port of Hong Kong plays an important role in the economy of Hong Kong and China as a logistics hub for international and regional trade. It is connected to more than 500 ports worldwide and offers sea freight services to Asia, Europe, North America, and other important destinations.

Transit time from UK ports to the port of Hong Kong

Here is a table summarizing the average transit times between the main UK ports and the port of Hong Kong.

| Felixstowe | Southampton | London | |

| Hong Kong | 46 days | 47 days | 45 days |

These transit times are indicative and may vary depending on various factors.

Should I ship by groupage or full container between the UK and Hong Kong?

There are three main categories of standard container sizes:

- The 40-foot HQ (High Cube), with a capacity of 76 cubic meters.

The 40-foot container, with a capacity of 67 cubic meters.

The 20-foot container, with a capacity of 33 cubic meters.

These three types of containers can be shipped by two different methods, groupage or full container.

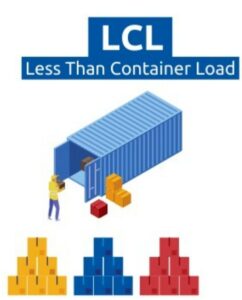

Maritime consolidation or LCL (Less than Container Load)

Shipment in LCL consists in the sharing of a container by several different customers. It is used for small shipments that do not require a full container and saves on transportation costs.

DocShipper advice: LCL is recommended if you have less than 15 m3 of goods to transport.

Advantages of Maritime Consolidation

- More cost-effective for shipments under 15m3.

- Possibility to ship small quantities of goods more often and therefore save on storage costs.

Disadvantages of Maritime Consolidation

- Increased risk of loss or damage to your goods due to multiple openings in the container.

- Possibility of increased transit time due to loading and unloading of goods from different customers.

FCL (Full Container Load)

The FCL shipment consists of filling a container with the goods of a single customer. It is recommended for shipments of large quantities of goods. The container is sealed all the way and never opened.

DocShipper advice: It is recommended for a larger volume, even if it is only half full because it will be cheaper and safer. It will be profitable from 15 m3 of goods.

Advantages of FCL

- More cost-effective for shipments over 15m3.

- Safer because the container is sealed throughout the journey.

- Faster because there are usually no stops on the way.

Disadvantages of FCL

- A minimum volume of 15m3 to be profitable.

- Often requires advance planning, as containers must be reserved and scheduled for loading in advance.

Special sea transport between the UK and Hong Kong

Reefer container

A reefer container is a specialized container designed to transport temperature-sensitive cargo, such as perishable goods like fruits, vegetables, and meats. It has built-in refrigeration and insulation systems that can maintain a specific temperature range, usually between -25 °C to +25 °C, to keep the cargo fresh and prevent spoilage. Reefer containers are commonly used for the international shipping of food products and pharmaceuticals.

Roro/OOG

RoRo (Roll-on Roll-off) and OOG (Out of Gauge) containers are two different types of specialized containers used for oversized or irregularly-shaped cargo that cannot fit into a standard container. Roro containers have open sides or are completely open, allowing cargo to be rolled onto or off the container on wheels, such as cars, trucks, or heavy machinery. OOG containers are used for cargo that is too large or bulky for a standard container and usually requires special handling and securing methods, such as flat-racks or open-top containers.

Bulk

A bulk container is a specialized container used to transport bulk cargo, such as grains, coal, ores, and liquids, that are not packaged or containerized. It is designed to load and unload the cargo through a top opening or a hatch on the side, rather than through the standard doors on the end of the container. Bulk containers are commonly used for shipping large quantities of raw materials and commodities.

How much does sea freight cost between the UK and Hong Kong?

The cost of sea freight between the UK and Hong Kong can vary depending on several factors, such as the volume and weight of the shipment, the type of cargo, the shipping company, and the transit time.

DocShipper Tip: If you want to know the exact price of your sea freight, contact us with the necessary information, and we will give you a free quote within 24 hours.

If you know the exact weight and volume of your goods, you can estimate the cost of transport yourself. Here's how to do it:

- Determine the UP (paying unit) of your shipment. To do this, compare the weight and volume of your shipment and choose the highest value. For example, if your shipment weighs 45 tons and measures 40 m³, the PU will be 45.

- Calculate the base freight by multiplying the UP cost by the number of UPs needed for your shipment. For example, if the UP cost is $600 and the UP for your shipment is 45 tons, the base freight will be $27,000.

- Add the additional charges to the base freight to get the net freight. Additional charges may include BAF (bunker adjustment factor), CSP (currency surcharge percentage), and any rebates. You can calculate the net freight with the following formula: Base freight + BAF + CSP - Rebate.

Tariff surcharges

Here is a list of some of the tariff surcharges that may apply when importing goods into the UK:

- Customs Duty: a tax applied to imported goods based on their value.

- Anti-Dumping Duty: a surcharge applied to imported goods sold at a lower price than the domestic market price.

- Countervailing Duty: a surcharge applied to imported goods that receive subsidies from the exporting country's government.

- Excise Duty: a tax applied to certain goods such as alcohol, tobacco, and fuel.

- Value Added Tax (VAT): a tax applied to the value of goods being imported.

- Tariff rate quotas (TRQs): a quota limit on the amount of a certain type of goods that can be imported at a lower tariff rate.

Airfreight from the UK to Hong Kong

DocShipper Recommendation: Airfreight is the best solution for you if :

- The total volume is less than 2 CBM.

- The shipment is urgent.

- Your goods are precious.

DocShipper Note: If you require any information, fulfil our online form and our experts will get back to you in less than 24 hours.

Classic or express air freight

The air freight industry between the UK and Hong Kong is well-established and offers regular services for shipping goods between the two locations. Hong Kong International Airport is a major transportation hub in Asia, connecting to many destinations in Europe, North America, and other regions, making it a popular choice for air freight shipments from the UK.

There are two different forms of air freight:

Conventional air freight: This option uses the space available on commercial aircraft and is used by airlines such as British Airways, Cathay Pacific, and Emirates to ship goods on scheduled flights.

Express air freight: In this second, more expensive option, items are transported by specialized freight operators such as DHL, FedEx, and UPS. The frequency of these flights and the availability of cargo space may vary depending on the season and demand.

Main airports in the UK

Main airport of Hong Kong

DocShipper Advice: Do you want to ship precious goods, or do you need your products to reach their destination quickly? Then the perfect transportation method for you is air freight. We offer a complete air freight service where you don't need to worry about anything! Contact us for more information.

What are the advantages of air freight?

- Speed: Air freight is the fastest way to transport goods over long distances. Goods can be transported from one country to another in just a few hours or days, making it ideal for time-sensitive shipments.

- Reliability: Airlines have a high level of reliability when it comes to delivery times, as they operate on a fixed schedule and have fewer disruptions due to weather or road conditions.

- Security: Air freight offers a high level of security for valuable or sensitive goods. Airports have strict security measures in place to ensure that cargo is not tampered with or damaged during transit.

- Global reach: With airlines operating in virtually every country in the world, air freight offers a truly global reach. This makes it possible to transport goods to even the most remote destinations.

What are the disadvantages of air freight?

- Cost: Air freight is generally more expensive than other modes of transportation, such as sea or land freight. The high cost is due to the speed, security, and convenience of air transport.

- Weight and size limitations: Air freight has weight and size limitations that may restrict the types of goods that can be shipped. Some airlines may also have restrictions on the types of goods that can be transported, such as hazardous materials.

- Environmental impact: Air freight has a higher carbon footprint compared to other modes of transportation, contributing to global warming and climate change.

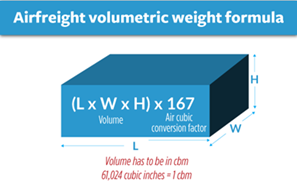

How much does air freight cost between the UK and Hong Kong?

The cost of air freight between the UK and Hong Kong can vary depending on several factors, including the weight and dimensions of the shipment, the distance between the airports, the urgency for delivery, and the current market rates.

Generally, air freight rates are calculated based on the volumetric weight or gross weight, with the greater of the two determining the shipping cost. The shipping cost can range from a few hundred to several thousand dollars.

How to calculate the volumetric weight of your shipment?

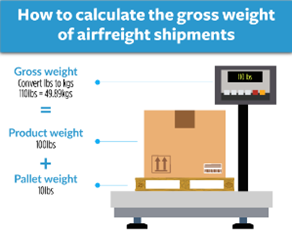

The gross weight of the load includes the weight of the goods and the weight of their packaging or pallet.

The volumetric weight is the volume occupied by a package, based on its dimensions and gross weight. To calculate the volumetric weight, you must first measure the dimensions of the package (length, width, and height) and then convert them into cubic meters. Then use the following formula:

Volumetric weight = (length x width x height) / 5000

(where 5000 is a standard conversion factor used in air freight)

Rail freight from the UK to Hong Kong

DocShipper Recommendation: Rail freight is the best solution for you if :

- Your total shipment is very big or heavy

- You want your merchandise to arrive quicker than with sea freight

DocShipper Note: If you require solutions for you transportation, ask a free quotation, our experts are here to help you.

Transport by train between the UK and Hong Kong

Rail freight has played an important role in the history of trade relations between the UK and Hong Kong. Although the distance between the two countries is considerable, the popularity of rail transport has been maintained through close historical ties and technological advances in rail infrastructure.

Rail connections between the two countries were established more than a century ago, and since then, both countries have continued to strengthen their rail networks. Today, rail freight is an increasingly popular option for shipping goods between the two countries.

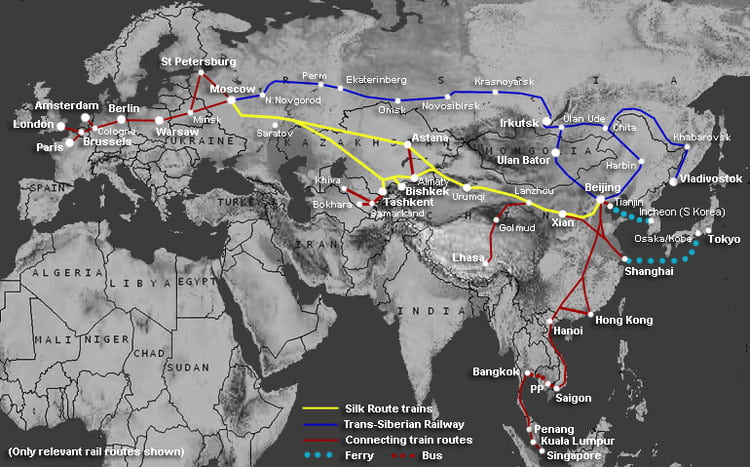

Modern rail lines, such as the Silk Road, the China-Europe railway, and the Trans-Siberian Railway, offer efficient and cost-effective routes for freight shipments, further enhancing the popularity of rail transport between the UK and Hong Kong.

What are the train transit times from the UK to Hong Kong?

Depending on various factors such as departure and arrival stations, type of train, and customs clearance, rail transit times between the UK and Hong Kong can vary between 18 and 22 days.

What are the advantages of rail freight?

- Cost-effective: Rail freight can carry a larger volume of goods at one time, reducing the cost per unit of cargo.

- Environmentally friendly: Rail freight produces fewer greenhouse gas emissions per ton of cargo transported, making it an ideal choice for companies looking to reduce their carbon footprint.

- Reliable: Rail freight is less affected by traffic congestion and weather conditions, reducing the likelihood of delays.

- Safe: Trains are less likely to be involved in accidents compared to road vehicles, and rail freight is less prone to theft and damage compared to other modes.

What are the disadvantages of rail freight?

- Limited flexibility: Rail freight is less flexible compared to other modes of transportation, particularly when it comes to last-mile delivery. Rail transportation requires infrastructure such as tracks and stations, which may not be available in all locations.

- Limited handling capabilities: Rail freight may have limited handling capabilities, particularly for fragile or perishable goods. This can require additional handling and packaging to protect the goods during transportation.

Door-to-door delivery between the UK and Hong Kong

Door-to-door delivery service refers to the transportation of goods from the point of origin to the final destination, including the pickup, transportation, and delivery of goods. This service provides convenience and time savings for shippers, as they do not have to worry about the logistics of transporting their goods. Door-to-door delivery is commonly used for e-commerce shipments, parcel deliveries, and other small to medium-sized shipments.

To take advantage of this service, you can use specialized companies such as DocShipper, who will handle the entire process for you. With our team of experts and our partners around the world, you can be sure that you will receive professional and quality service.

What are the advantages of door-to-door services?

- Convenience: Door-to-door delivery is a convenient option for shippers, as it simplifies the shipping process. The carrier handles the pickup, transportation, and delivery of goods, which saves time and effort for the shipper.

- Time savings: Door-to-door delivery is a time-saving option, as it eliminates the need for the shipper to drop off the goods at a transportation hub or terminal. The carrier will pick up the goods from the shipper's location and deliver them directly to the final destination.

- Reduced risk of damage or loss: With door-to-door delivery, the carrier is responsible for the transportation of goods from the point of origin to the final destination. This reduces the risk of damage or loss during shipping, as the carrier is responsible for handling the goods throughout the entire transportation process.

- Flexibility: Door-to-door delivery provides flexibility for shippers, as they can arrange for the transportation of goods at a time that is convenient for them. This allows for greater control over the shipping process and ensures that the goods are delivered on time.

Customs clearance in the UK for goods imported from Hong Kong

Customs clearance is a crucial process that importers and exporters must go through when transporting goods across international borders. In the United Kingdom, customs clearance is required for all goods imported from non-EU countries. Hong Kong is a Special Administrative Region of China, and as such, goods imported from Hong Kong to the UK are subject to customs clearance procedures. The process of customs clearance involves several steps, including the submission of import declarations, payment of duties and taxes, and compliance with regulatory requirements. In this context, it is important to understand the customs clearance process in the UK and the key requirements that importers must meet when importing goods from Hong Kong.

DocShipper Alert: The process of customs clearance can be very complex and can make you lose precious time. To avoid this, the easiest way is to use our professional customs clearance service! We will take care of all the administrative tasks, and even the negotiations with the customs. Do not hesitate to contact us for more information.

The customs value

The customs value is the value of goods as determined by customs officials for the purpose of assessing duties, taxes, and other charges on imports or exports. The value of goods is a critical component of customs clearance, as it determines the amount of duties and taxes that must be paid by the importer or exporter. In the UK, customs value is determined based on the transaction value of the goods, which is the price paid or payable for the goods when sold for export to the UK. The transaction value includes all costs associated with the goods up to the point of importation, including transportation, insurance, and other charges. However, there are certain adjustments that may be made to the transaction value, such as for certain discounts, royalties, and commissions. It is important for importers and exporters to ensure that the customs value of their goods is properly declared, as incorrect or incomplete declarations may result in penalties or delays in customs clearance.

What are the customs duties and taxes?

The amount of customs duties and taxes varies depending on the type of goods being imported and their country of origin. Some of the key customs duties and taxes in the UK include:

- Import Duty: Import duty is a tax that is levied on certain imported goods, such as textiles, food, and electronics. The rate of import duty depends on the type of goods being imported and their country of origin.

- Value Added Tax (VAT): VAT is a tax that is levied on the value of goods and services. In the UK, VAT is charged on the importation of goods, and the rate of VAT is currently set at 20% of the customs value of the goods.

- Excise Duty: Excise duty is a tax that is levied on certain goods, such as alcohol and tobacco products. The rate of excise duty depends on the type of goods being imported and their country of origin.

- Anti-dumping Duty: Anti-dumping duty is a duty that is levied on imported goods that are sold at a lower price than the domestic market price, in order to protect domestic industries.

How to calculate customs duties and taxes?

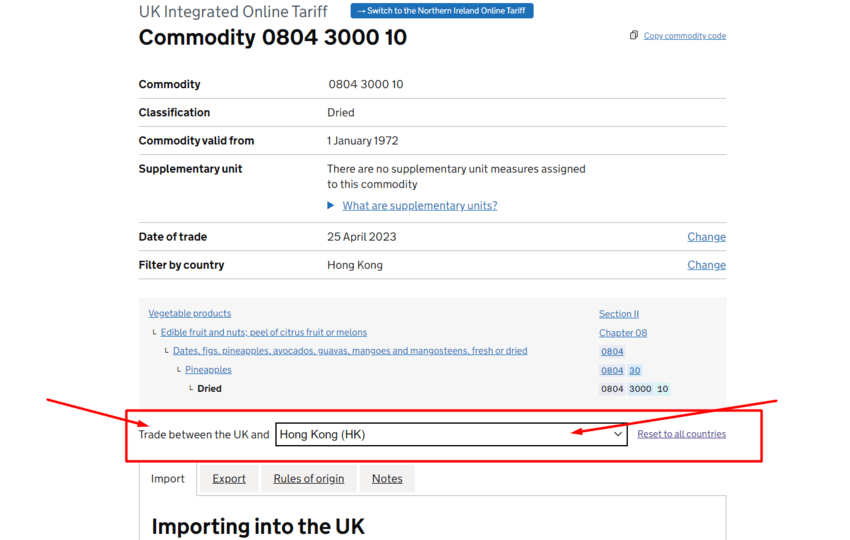

To find out what taxes and customs duties apply to your goods, you will need to determine the HS code. The Harmonized System (HS) is a standardized system used to classify goods for customs purposes.

Here is how an HS code is composed:

How to find the HS code?

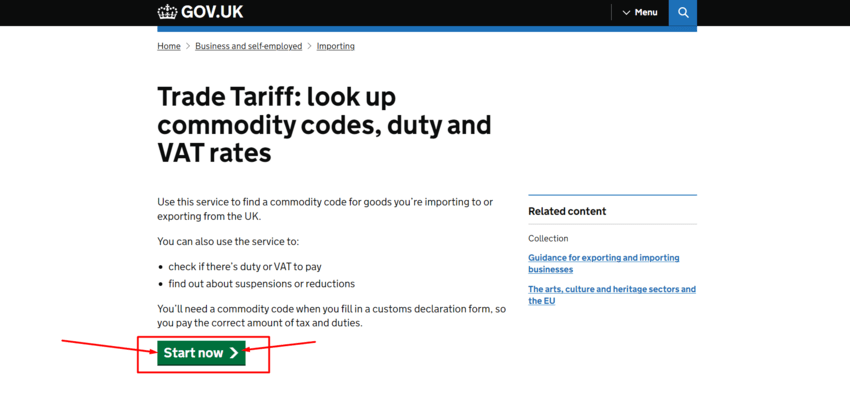

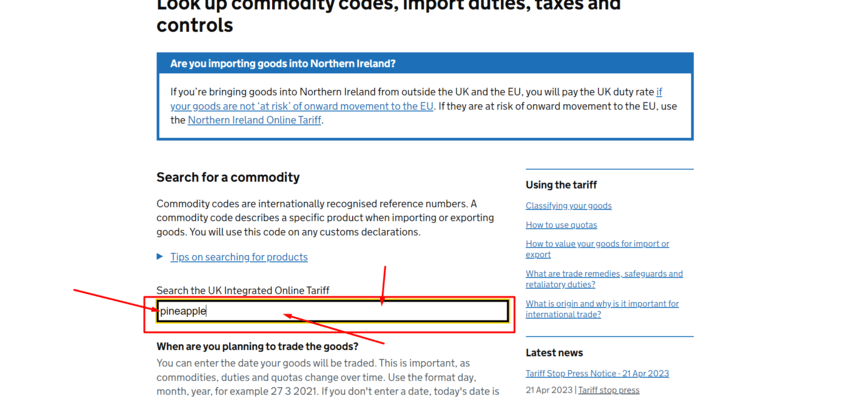

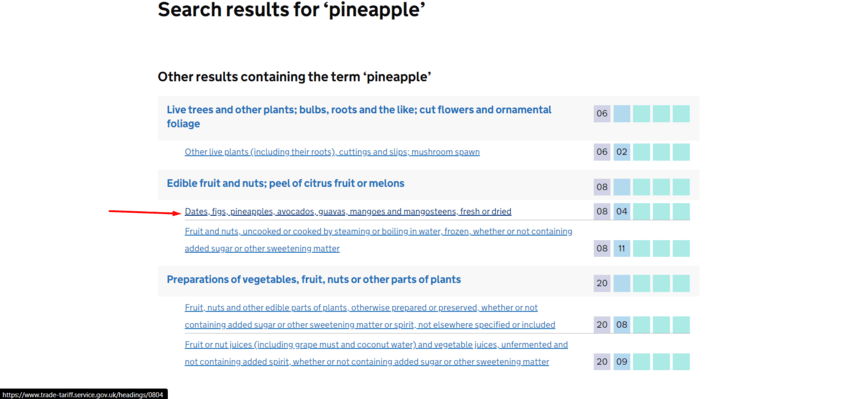

To find the HS code of your products, the easiest way is to go to the official website of UK Customs and apply the following procedure.

Step 1: Click on "Start now".

Step 2: Enter the name of your product.

Step 3: Look at the results and select the right one.

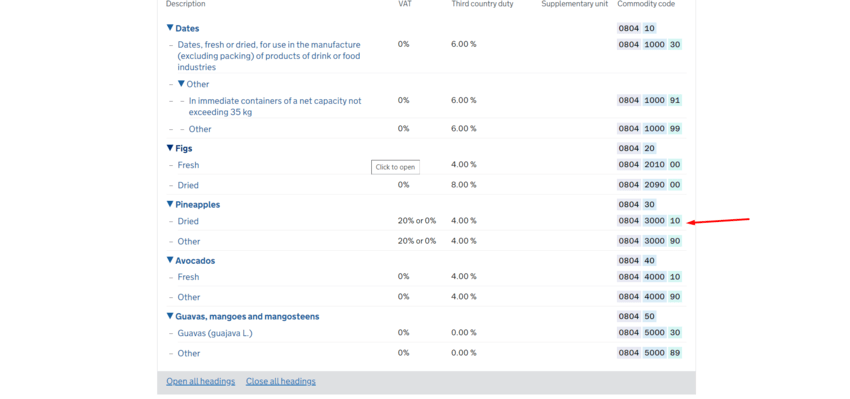

Step 4: You now can see the right HS code of your product.

Calculate customs duties with the HS Code

Also on the previous page where you found your HS Code, click on the HS code of your product. Then select the country of origin of the products.

Now you can see what taxes and customs duties apply to your product from Hong Kong.

For our example, we can see that for pineapple from Hong Kong, the import duties are 4% and the VAT is 20%.

Does DocShipper charge duty?

No, no commission is taken from DocShipper. As a matter of fact, we will provide you with all the official documents provided by UK Customs. We will only collect customs clearance fees, as we declare your goods to customs on your behalf.

Any fees associated with customs duties and taxes will be collected by the UK government.

Procedures and customs contact

Required documents

When importing goods into the UK, you must ensure that you have the necessary documentation to comply with customs regulations. While specific requirements may vary depending on the type of goods and their origin, the following list provides a general overview of the documents you may need:

- Commercial Invoice: This document provides information on the goods being imported, including the seller and buyer, a description of the goods, their value, and the terms of the sale. It serves as the primary document used by customs authorities to assess duties and taxes.

- Packing List: This provides details on the goods being shipped, such as the types of items, quantities, and packaging. It may also include information on the dimensions and weight of the packages.

- Bill of Lading (for sea freight) or Air Waybill (for air freight): These documents serve as proof of shipment and provide details on the carrier, consignee, and the shipment itself.

- Certificate of Origin: This document certifies the country where the goods were produced or manufactured. It may be required to determine the applicable import duties or to comply with specific trade agreements.

- Import License or Permit: Depending on the type of goods being imported, you may need a license or permit from the relevant UK government department or agency.

- Health Certificates, Inspection Certificates, or Other Regulatory Documents: Depending on the nature of the goods being imported, you may need additional certificates, such as phytosanitary certificates for plants, veterinary certificates for animal products, or other regulatory documents.

- Import Declaration: You'll need to submit an import declaration, also known as a Customs Declaration, to HM Revenue & Customs (HMRC) using the Customs Handling of Import and Export Freight (CHIEF) system or the newer Customs Declaration Service (CDS).

Keep in mind that this list is not exhaustive, and additional documentation may be required based on the specifics of your import. Always consult with a customs broker or freight forwarder like DocShipper to ensure you have all the necessary documents for your shipment.

DocShipper Additional Services

Storage Service

We offer storage services at flexible short, medium, and long-term rates. Available 24 hours a day, 7 days a week, under video surveillance, with the option of swipe card access, for the highest level of security. All our premises are ultra-secure and insured against fire hazards.

You can visit our dedicated page: Storage Services

Transport insurance

Transport insurance will allow you to cover any damage or breakage that your goods may suffer. Without insurance, you will be exposed to risks. We have negotiated with the best-certified insurers in order to offer you the most efficient insurance contract possible, both from a financial and a security point of view.

Visit our dedicated page: Insurance Services

Packaging service

The packaging of your products is an essential element during your transport. Indeed, good packing ensures the perfect stability of the product throughout the transport and protection during the loading, unloading, and storage. Do not hesitate to contact our team if you need competent personnel to pack any type of goods.

More information on our dedicated page: Packaging Services

Moving service

Use our international moving service to guarantee a perfect move. We offer several moving packages to always meet your needs. By going through us, you can save up to 30% on your moving estimate.

Visit our dedicated page: International Moving Services

FAQ | Freight shipping between UK and Hong Kong | Rates -Transit time - Duties and taxes

There are many products that are prohibited from being imported into the UK for various reasons, such as health and safety, environmental, and legal considerations. Some examples of prohibited products include:

There are several ways to ship goods from Hong Kong to the UK, and the best method may depend on a variety of factors such as the size and weight of the goods, the urgency of the shipment, and your budget.

Of course, we offer a complete customs clearance service. We will manage the entire process for you without charging you any additional fees.

The fastest mode of transportation from Hong Kong to the UK is by air freight. Shipping goods by air freight is faster than sea freight or rail freight, as air cargo can be transported directly from Hong Kong to the UK in a matter of hours or days, depending on the airline and the specific route. Which products are prohibited from being imported into the UK?

What is the best way to ship goods from Hong Kong to the UK?

I find the customs clearance process too complicated, do you have a solution?

What is the fastest mode of transportation from Hong Kong to the UK?

DocShipper info: Do you like our article today? For your business interest, you may like the following useful articles :

- Exploring Business Opportunities with Chat GPT: applied to the Supply Chain Management

- What is the documentation you need in the export shipping process?

- How to invent a product that sells? What beginners need to know?

- How to defeat your most difficult E-commerce cashflow challenge ?

- The Benefits and Drawbacks of Overseas Manufacturing

DocShipper Advise : We help you with the entire sourcing process so don't hesitate to contact us if you have any questions!

- Having trouble finding the appropriate product? Enjoy our sourcing services, we directly find the right suppliers for you!

- You don't trust your supplier? Ask our experts to do quality control to guarantee the condition of your goods!

- Do you need help with the logistics? Our international freight department supports you with door to door services!

- You don't want to handle distribution? Our 3PL department will handle the storage, order fulfillment, and last-mile delivery!

DocShipper | Procurement - Quality control - Logistics

Alibaba, Dhgate, made-in-china... Many know of websites to get supplies in Asia, but how many have come across a scam ?! It is very risky to pay an Asian supplier halfway around the world based only on promises! DocShipper offers you complete procurement services integrating logistics needs: purchasing, quality control, customization, licensing, transport...

Communication is important, which is why we strive to discuss in the most suitable way for you!