Freight shipping between the UK and Canada: Rates -Transit time – Duties & taxes

Why did the package go on a vacation? Because it finally got shipped! All silliness aside, decoding freight transport between the UK and Canada can feel like cracking a cryptic code with its complex rates, fluctuating transit times, and intricate customs regulations. This guide is your key. Prepared by seasoned industry professionals, it cuts through the jargon to explain all aspects of shipping goods between the two countries. From air and sea to rail and road freight, to customs clearance, duties, taxes, and valuable advice tailored specifically for businesses, this guide has you covered. If the process still feels overwhelming, let DocShipper handle it for you! As your dedicated international freight forwarder, we turn the most daunting shipping challenges into successful business solutions.

Which are the different modes of transportation between UK and Canada?

Need help with your shipment?

Need assistance with your shipment? Dont hesitate to contact us even for a simple question. Choose the option that suits you

Live chat with an expert Chat on WhatsApp Free Quote 24hHow can DocShipper help you

Sea freight between UK and Canada

Gearing up to transport goods between the UK and Canada? The cultural and economic ties between these age-old allies have cemented a thriving trade relationship, making sea freight a popular choice. Ocean shipping is a cost-effective way to transport high volumes, albeit slower. The industrious ports of London, Liverpool, and Southampton are hubs that connect with Canadian counterparts in Vancouver, Montreal, and Halifax.

Yet, despite being economical, many shippers grapple with the complexities surrounding shipping procedures. It’s like learning a new board game; challenging at first, but gets easier with familiarity. Unawareness of specifics often leads to costly blunders. So, we’re here to turn the tide in your favor. Watch out for our deep dive into the best practices that will help you tackle shipping with ease, ensuring your freight sails smoothly from the UK to Canada. Remember, knowledge is your compass in the vast sea of international trade.

Main shipping ports in UK

Port of London

Location and Volume: Situated along the River Thames, the Port of London is the second largest in the United Kingdom, handling over 50 million tons of cargo annually.

Key Trading Partners and Strategic Importance: It is a major trading hub with key partners including the EU, Middle East, and Asia. The port’s strategic importance lies in its location, as it serves the largest consumer market in the UK.

Context for Businesses: If your target market includes UK consumers, the Port of London can be an instrumental part of your shipping route, given its direct access to this large demographic.

Port of Southampton

Location and Volume: Positioned on the South Coast of England, the Port of Southampton is one of the UK’s busiest and most important ports, handling over a million TEUs annually.

Key Trading Partners and Strategic Importance: As the UK’s number one vehicle handling port, it is vital for trade with the European Union, US, and Asia. Moreover, it is renowned as a major hub for cruise liners.

Context for Businesses: If you are involved in the automotive industry or trade significantly with Europe, using the Port of Southampton can optimize your logistics due to its specialized handling facilities.

Port of Felixstowe

Location and Volume: Located in Suffolk, England, the Port of Felixstowe handles over 26% of the country’s trade, making it the UK’s largest container port.

Key Trading Partners and Strategic Importance: Its main trading partners are China, the EU, and the Americas. The port plays a strategic role nationally due to its size and is crucial for the trade of a wide range of goods.

Context for Businesses: Businesses that require large volume shipping, particularly to/from Asia, may find the Port of Felixstowe advantageous because of its established shipping routes and capacity.

Port of Liverpool

Location and Volume: The Port of Liverpool, located on the Northwest Coast, is one of the largest, busiest, and most diverse ports in the UK, handling about 33 million tons of cargo a year.

Key Trading Partners and Strategic Importance: It facilitates trade mainly with the Americas, Asia, and European markets. The port serves a vital role due to its access to a vast hinterland via canal and rail networks.

Main shipping ports in Canada

Canada’s strategic location in North America, bordering three oceans, has led to the operation of several international ports responsible for substantial imports and exports. Here are detailed descriptions of the major international ports in Canada for businesses:

Port of Vancouver

Location and Volume: Strategically situated in the southwestern part in the province of British Columbia, the Port of Vancouver is the largest port in Canada, with a shipping volume exceeding 142 million tonnes annually.

Key Trading Partners and Strategic Importance: The key trading partners include China, the US, Japan, South Korea, and India. It serves as the main gateway to the Pacific Rim, handling approximately 20% of the country’s total trade.

Context for Businesses: If you’re exporting goods to the Asia-Pacific region, incorporating the Port of Vancouver into your logistics strategy may be crucial due to its great capacity and connections to these markets.

Port of Montreal

Location and Volume: Located in Quebec, east coast of Canada, the Port of Montreal handles approximately 35 million tonnes of cargo annually, making it the second busiest port in the country.

Key Trading Partners and Strategic Importance: Its primary trading partners include Europe and the Mediterranean area. It is the closest North American port to Europe, offering strategic advantages for transatlantic trade.

Context for Businesses: If your company is involved in transatlantic trade, the Port of Montreal’s significant role and location make it an attractive choice for bolstering your shipping operations.

Port of Prince Rupert

Location and Volume: Positioned in British Columbia, the Port of Prince Rupert is Canada’s leading edge in the Asia-Pacific Gateway and Corridor, carrying over 29 million tonnes of cargo in 2019.

Key Trading Partners and Strategic Importance: Key trading partners include China, Japan, and South Korea. It is the closest North American port to Asia by up to three days via the Northern Sea Route.

Context for Businesses: For businesses targeting Asian markets, the Port of Prince Rupert provides a shorter route to these markets, potentially reducing shipping costs and time.

Port of Halifax

Location and Volume: Situated in Eastern Canada in the province of Nova Scotia, the Port of Halifax handles nearly 15 million tonnes of cargo per year.

Key Trading Partners and Strategic Importance: Major trading partners include China, Europe, the Middle East, the Indian Subcontinent, and Mediterranean countries, serving as a direct link to these significant markets.

Context for Businesses: For businesses shipping to European and Middle Eastern markets, consider the Port of Halifax due to its geographic advantages and substantial capacity.

Port of Saint John

Location and Volume: The Port of Saint John, in New Brunswick, handles roughly 30 million metric tonnes of cargo annually.

Key Trading Partners and Strategic Importance: The port’s trade partners are predominantly located in North and South America, and it is a vital player for exporting Canada’s natural resources to global markets.

Context for Businesses: If your company exports natural resources or goods to the Americas, the Port of Saint John may be beneficial for your trade requirements given its access and expertise in this area.

Port of Quebec

Location and Volume: The Port of Quebec is located in Eastern Canada, on the shore of the Saint Lawrence River. It handles over 28 million tonnes of cargo per year.

Key Trading Partners and Strategic Importance: The port’s principal trading partners encompass Europe and the Americas, catering to a diversified range of industrial sectors.

Context for Businesses: If your business involvement spans multiple sectors and targets European and American markets, the Port of Quebec, with its diversified operations, might be an essential part of your logistics.

Should I choose FCL or LCL when shipping between UK and Canada?

Deciding between Full Container Load (FCL) and Less than Container Load (LCL) shipping can make or break your transit between the UK and Canada. This choice isn’t just a toss-up—it governs cost, transit time, and the ultimate success of your shipment. This section will equip you with the knowledge you need to confidently pick the right sea freight option tailored to your business needs. Let’s dive into the implications of these choices and illuminate the path to your shipping victory.

Full container load (FCL)

Definition: FCL (Full Container Load) shipping involves hiring an entire container, typically a 20'ft or 40'ft container, for the exclusive use of shipping your goods.

When to Use:FCL is often the most cost-effective option when shipping higher volumes of goods, specifically if your cargo is more than 13 to 15 CBM. Moreover, FCL ensures the safety of your items because the container remains sealed from origin to destination.

Example:Let's consider a company that manufactures heavy machinery parts in the UK. They recently received an order for shipping 15 CBM of goods to Canada. Choosing FCL shipping will not only be economical due to the high volume but also guarantee the safety of these sensitive parts.

Cost Implications:It's important to obtain an FCL shipping quote upfront to understand the cost involved. Rates can fluctuate based on several factors like type of goods, shipping route, fuel prices, and demand. However, remember that FCL does not indicate full usage; even partially filled containers can still be economical if your cargo surpasses the 13 to 15 CBM threshold. Irrespective of the filled levels, the cost of the FCL container stays the same. This means, the more goods you ship, the more you save per unit.

Less container load (LCL)

Definition: LCL, or Less than Container Load, refers to a type of shipping method in which a cargo is grouped with others to fill up a container. This is a popular choice for small to medium-sized businesses shipping smaller quantities to destinations such as Canada from the UK.

When to Use: LCL shipment is ideal when you have low-volume cargo, typically less than 13-15 CBM. It allows you to share space with other shippers, making it economically viable and flexible.

Example: Suppose you're an artisanal cheese producer in the UK sending a monthly consignment of 10 CBM of cheeses to specialty stores in Canada. Opting for LCL freight service can save costs since you're splitting the container space and cost with other shippers.

Cost Implications: Although the per-CBM cost might be slightly higher in LCL compared to a full container (FCL), the overall shipping charge will be lower for low-volume shipments. However, bear in mind that there may be additional handling charges owing to the consolidation and deconsolidation processes, so an LCL shipping quote always requires thorough review before proceeding.

Hassle-free shipping

Shipping between the UK and Canada, and pondering whether to use consolidation or a full container? It's no easy decision! Trust DocShipper, committed to making international trade smooth and stress-free. Our ocean freight experts assess your unique requirements, considering aspects like your budgets, timelines, and cargo size. We'll guide you to the best choice, eliminating guesswork. Ready to make seamless shipping a reality? Contact us for a free, no-obligation estimate. Your global trade journey starts here.

Sea freight from the UK to Canada typically takes around 12-16 days. These transit times, however, are influenced by several factors including the specific ports of loading and discharge, the weight and nature of the goods, and various other logistical parameters. For a detailed and customized freight quote tailored to your specific requirements, getting in touch with a trusted freight forwarder like DocShipper would be highly beneficial.

Below is a text-only table showcasing the average transit times in days, via sea freight, between the four main freight ports in the UK and Canada. However, please do take into account that these are only average times and actual transit times can vary.

| UK Ports | Canada Ports | Average Transit Time (Days) |

| Port of Felixstowe | Port of Vancouver | 16 |

| Port of Southampton | Port of Montreal | 12 |

| Port of Liverpool | Port of Halifax | 12 |

| Port of London | Port of Saint John | 14 |

In scenarios where a country doesn’t hold four ports or a terminal, we feature the ones available, ensuring we provide the most accurate information possible.

How much does it cost to ship a container between UK and Canada?

Estimating the shipping cost per CBM from the UK to Canada is tricky, as it can fluctuate widely — think in the ballpark of $60 to $1000. Many variables impact ocean freight rates such as the Point of Loading, Point of Destination, the specific carrier used, the nature of your goods, and monthly market shifts. Remember, every shipment is unique, and getting an exact quote requires careful consideration of all these myriad factors. But rest assured, our shipping specialists are here to navigate these complexities and work with you to obtain the most competitive rates tailored to your specific needs. We provide bespoke quotes on a case-by-case basis, ensuring you get the best value every time.

Special transportation services

Out of Gauge (OOG) Container

Definition: OOG containers, or Out of Gauge containers, are specially designed for cargo that doesn’t fit within the dimensions of standard shipping containers.

Suitable for: Oversized equipment, machinery, construction materials, and other items too large or heavy for regular containers.

Examples: Large industrial equipment, turbines, yachts, tractors, etc.

Why it might be the best choice for you: If your business deals in heavy machinery or oversized products, an OOG container ensures your cargo can be safely and efficiently transported from the UK to Canada.

Break Bulk

Definition: Break bulk involves shipping goods piece by piece, or unit by unit. This method eliminates the need for containers, providing an excellent solution for large, diversified cargo loads.

Suitable for: Items that are too heavy or too large to be loaded onto a container.

Examples: Construction equipment like cranes, or large items like propellers, beams, or windmill blades.

Why it might be the best choice for you: For merchandise or equipment that’s too large even for OOG containers, break bulk shipping allows transport without costly disassembly or reassembly.

Dry Bulk

Definition: Dry bulk involves the transportation of granular and dry goods packed in bulk, without any packaging medium.

Suitable for: Commodities that are shipped in large quantities like coal, grain, iron ore, and so on.

Examples: Gravel, sand, sugar, fertilizer, or other commodities transported in high volumes.

Why it might be the best choice for you: If your business deals in high-volume, unpackaged goods or loose cargo loads and needs an efficient, cost-effective shipping method, dry bulk transport can offer a solution.

Roll-on/Roll-off (Ro-Ro)

Definition: Ro-Ro vessels or Roll-on/Roll-off ships are designed for transporting vehicles which can be driven or towed on and off the ship on their own wheels.

Suitable for: Cars, trucks, semi-trailer trucks, trailers, and railroad cars.

Examples: New or used cars for export/import, trucks, mobile construction machinery, or trailers with goods.

Why it might be the best choice for you: If your business involves the transportation of vehicles from the UK to Canada, Ro-Ro is an efficient and safe shipping method.

Reefer Containers

Definition: Reefer containers are temperature-controlled shipping containers used to transport temperature-sensitive cargo.

Suitable for: Perishable goods like fruits, vegetables, dairy products, pharmaceuticals and other goods requiring controlled temperatures.

Examples: Fresh produce, pharmaceuticals, seafood, etc.

Why it might be the best choice for you: If your company deals in perishable or temperature-sensitive goods, reefer containers can maintain the necessary conditions for your cargo during transit.

At DocShipper, we understand the complexities of international shipping. Let us guide you through it all to find your optimal shipping solution. Whether you’re dealing with oversized machinery, or temperature-sensitive goods, we’re ready to work with you. Contact us today for a free shipping quote in less than 24h.

Air freight between UK and Canada

Fast and reliable, air freight offers the perfect solution for transporting small, high-value goods from the UK to Canada. Perhaps you’re shipping urgently needed machine parts or high-end designer clothes. In this case, air freight shines like your beloved childhood express delivery service. After all, nothing else offers such speed and reliability, making it cost-effective for specific shipments.

Yet here’s where many shippers trip up: like sprint runners miscalculating their steps, they often overlook vital considerations in pricing, particularly the correct weight formula. As a result, costs spiral unexpectedly, leaving them shell-shocked. And that’s the tip of the iceberg —many best practices get missed out, leading to unnecessary heavy charges. Join us as we dive deeper into these topics. Get ready to arm yourself with cost-saving measures and become a savy shipper.

Air Cargo vs Express Air Freight: How should I ship?

Zooming across borders, UK to Canada, and wonder if Air Cargo or Express Air Freight better suits your business needs? Consider it this way – Air Cargo is like taking a trip with friends on a commercial airline, every cargo sharing the ride. In contrast, Express Air Freight is renting your own dedicated plane, a VIP treatment that ensures your goods reach their destination on your timeline. Determining which choice will be your perfect match is what we’ll decipher next.

Should I choose Air Cargo between UK and Canada?

Selecting air cargo for your UK-Canada shipments might align with your budget and reliability needs. Renowned airlines, including British Airways and Air Canada, offer cost-effective freight services. However, prepare for longer transit times due to fixed schedules. This method particularly shines for cargo upwards of 100/150 kg (220/330 lbs), with cost-effectiveness increasing as weight does. Be sure to evaluate your shipment size and frequency to make the most out of air freight between these nations.

Should I choose Express Air Freight between UK and Canada?

When shipping smaller cargo from UK to Canada, express air freight can be an optimal choice. Here’s why: It’s a specialized service, leveraging dedicated cargo planes without passengers, designed for swift, efficient cargo delivery. This high-speed global service is brilliant for shipments under 1 CBM or around 100/150 kg (220/330 lbs). Using reputable courier firms such as FedEx, UPS, or DHL, your goods will get first-class treatment across skies. If swift delivery and fewer cargo handling steps matter for your business, then express air freight might suit you perfectly. Remember, every shipment is unique, so consider all factors before deciding.

Main international airports in UK

Heathrow Airport

Cargo Volume: Heathrow is the top airport for cargo in the UK, handling over 1.7 million tons of cargo a year.

Key Trading Partners: US, China, and the EU are among the important trading partners.

Strategic Importance: Located in London, it provides direct flight access to over 180 destinations, and it is well connected with the rail and road networks.

Notable Features: Heathrow offers modern and secure facilities and is skilled in handling a variety of cargo, including perishables, animals, and hazardous materials.

For Your Business: If you’re looking to reach a wide range of international markets, Heathrow’s broad network of destinations and cargo handling capabilities cater to diverse shipping needs.

Gatwick Airport

Cargo Volume: As the second-largest airport in the UK, Gatwick handles over 100,000 tons of cargo annually.

Key Trading Partners: Europe, the Middle East, and the Americas.

Strategic Importance: It is located close to London and offers direct flights to over 150 destinations.

Notable Features: Gatwick offers facilities for both freight and courier services.

For Your Business: For regional, short-haul shipments, particularly to Europe, Gatwick could be a suitable option due to its location and direct flight accessibility.

Manchester Airport

Cargo Volume: Manchester Airport handles over 120,000 tons of import and export freight annually.

Key Trading Partners: Major trading partners include the US, Asia, and Europe.

Strategic Importance: The airport is a key gateway to the Northern regions of the UK, thus providing significant regional accessibility.

Notable Features: Manchester Airport has comprehensive facilities with 24/7 customs availability.

For Your Business: If your shipment is destined for the North of the UK, Manchester Airport could lower your ground transport costs.

East Midlands Airport

Cargo Volume: Handling over 320,000 tons of freight annually, East Midlands Airport is the top pure freight airport in the UK.

Key Trading Partners: Mainly European countries, though it has strong links to North America and the Far East.

Strategic Importance: It is centrally located in the UK, with rapid road access to many cities in England.

Notable Features: Has specialist facilities for handling express courier and mail consignments.

For Your Business: East Midlands Airport may be an excellent choice for fast, efficient shipping of smaller, high-priority items to Europe and beyond.

Stansted Airport

Cargo Volume: London Stansted is one of the largest freight hubs in the UK with over 250,000 tons of freight each year.

Key Trading Partners: Strong networks in Europe, the Middle East, and North America.

Strategic Importance: Being in proximity to London and the southeast, it’s a busy and highly connected cargo airport.

Notable Features: Stansted is equipped to handle all cargo types, including horses and large, outsize cargo.

For Your Business: If your cargo is particularly large or unusual, Stansted’s excellent facilities and close proximity to London can provide a solid shipping solution.

Main international airports in Canada

Toronto Pearson International Airport

Cargo Volume: Around 1.4 million tonnes of cargo in 2019.

Key Trading Partners: United States, Mexico, China, Japan, Germany.

Strategic Importance: One of Canada’s busiest airports, playing a crucial role in Canada’s export and import, particularly in the automotive, machinery, and pharmaceutical industries.

Notable Features: State-of-the-art logistics facilties, 24/7 operation, can handle large volumes of various types of cargo.

For Your Business: A valuable hub if your business frequently deals with exports or imports from Canada’s key trading partners, with robust facilities to handle high volumes or specialized transportation needs.

Vancouver International Airport

Cargo Volume: Over 334,500 tonnes of cargo in 2019.

Key Trading Partners: China, Japan, South Korea, United States.

Strategic Importance: The gateway to and from Asia, supporting major industries such as seafood, agriculture, electronics, and machinery parts.

Notable Features: Efficient cargo handling services, direct flights to major Asian markets, specialized facilities for shipping perishables.

For Your Business: If your company trades significantly with Asian markets, the Vancouver International Airport would be a key asset, enabling rapid shipment of goods, including perishables.

Calgary International Airport

Cargo Volume: More than 147,000 tonnes of cargo in 2019.

Key Trading Partners: United States, China, Mexico, Japan.

Strategic Importance: Serves as a crucial hub for oil and gas, machinery, and agricultural products.

Notable Features: Large-scale handling facilities, specialized services for dangerous goods, efficient customs processes.

For Your Business: If your business is in the energy, machinery, or agriculture sectors, Calgary International Airport offers substantial benefits in terms of handling facilities and efficient customs procedures.

Montréal–Pierre Elliott Trudeau International Airport

Cargo Volume: Almost 13,000 tonnes of cargo in 2019.

Key Trading Partners: United States, European Union, China.

Strategic Importance: Critical connector for goods traveling between North America and Europe. Industries served are predominantly aerospace, pharmaceuticals, and electronic goods.

Notable Features: Dedicated cargo facilities, 24/7 operation, focus on rapid processing of cargo goods.

For Your Business: If your business deals with the aerospace, pharmaceutical, or electronics industries, especially in Europe, Montréal–Pierre Elliott Trudeau International Airport would provide rapid and efficient shipping.

Edmonton International Airport

Cargo Volume: Over 46,000 tonnes in 2019.

Key Trading Partners: United States, China, Europe.

Strategic Importance: Major hub for the shipment of goods from Northern Canada, especially natural resources.

Notable Features: Excellent access to road and rail networks, dedicated cargo terminal for heavy and outsized goods.

For Your Business: If you’re dealing with heavy goods or resources from the northern parts of the country, the Edmonton International Airport’s comprehensive cargo services would make shipping significantly easier for you.

How long does air freight take between UK and Canada?

Shipping goods between the UK and Canada typically takes 5-7 days via air freight. However, this is a rough estimate and actual transit times can vary due to factors such as the specific airports involved, the weight of the goods, and their nature. For a more accurate estimate tailored to your specific shipping requirements, it is recommended to consult with a freight forwarding service like DocShipper.

How much does it cost to ship a parcel between UK and Canada with air freight?

The average per kg rate for air freight between the UK and Canada broadly ranges from $4 to $8. However, the exact costs are contingent on numerous factors, including the distance between departure and arrival airports, parcel dimensions, weight, and the nature of the goods. It’s also crucial to note that these rates can fluctuate due to market conditions. Rest assured, our team is dedicated to providing comprehensive, bespoke quotes based on your specific shipping requirements, ensuring optimal value. Don’t hesitate, contact us now and receive a free, personalized quote within 24 hours.

What is the difference between volumetric and gross weight?

Gross weight refers to the actual weight of your shipment, including the goods and packaging. On the other hand, the volumetric weight, sometimes known as dimensional weight, takes into account the space your package occupies on the aircraft relative to its actual weight.

In Air Cargo shipping, the formula to calculate volumetric weight is Length (cm) x Width (cm) x Height (cm) / 6000 = Volumetric Weight in kilograms (kg). Express Air Freight has slightly different standards, with the divisor being 5000.

Let’s take an illustrative example. Suppose your package weighs 20 kg and its dimensions are 50cm x 40cm x 30cm. In Air Cargo, your volumetric weight would be 50cm x 40cm x 30cm / 6000 = 10 kg (or 22 lbs). For Express Air Freight, the calculation would be 50cm x 40cm x 30cm / 5000 = 12 kg (or 26.46 lbs).

The significance of both measurements comes into play when determining shipping costs. Freight charges are calculated based on the higher of the two weights – either volumetric or gross. Thus, understanding these weights ensures you don’t get blind-sided by higher than expected shipping costs.

Door to door between UK and Canada

International door-to-door shipping is your all-inclusive transport solution from the UK to Canada, ensuring seamless delivery from sender’s doorstep to recipient’s. Eliminating multiple handovers, it offers greater security and time efficiency. So, if you desire a hiccup-free shipping experience and want to understand why door-to-door might be your best choice, let’s dive in!

Overview – Door to Door

Facing the daunting complexity of shipping goods from the UK to Canada? Door-to-door shipping dissolves your worries, providing an unrivaled blend of efficiency and simplicity. As DocShipper’s most popular service, it catapults your goods from origin to destination, clearing the thorny hurdles of customs and logistics along the way. But remember, convenience often mirrors cost – you could see your budget stretch. Despite this, the peace of mind and time saved often outweigh the expense. Trust in a solution that’s creating waves in the business world. So, ready to bid farewell to shipping stress? Door-to-door service holds the key.

Why should I use a Door to Door service between UK and Canada?

Ever thought ‘logistics is as complex as a spaghetti junction?’ Well, using door-to-door services from the UK to Canada can turn that maze of noodles into a stroll in the park. Here’s why:

1. Stress-Beater: Gone are the days when you had to grapple with complex logistics. Door to door services take charge from the get-go, picking up your goods and ensuring they travel seamlessly from the UK to Canada.

2. Speed Supreme: Got an urgent shipment? No worries. Door to door services use streamlined operations that ensure swift and timely delivery. So you can relax while your shipments zip across continents.

3. Complex Cargo, Simplified: Got something that’s not a standard shipping item? Leave it to the door to door service. They are specialists at handling complex cargo with the care and expertise it requires.

4. The Ultimate Convenience: Forget about coordinating with various logistics services, door-to-door takes care of everything — from the pickup in the UK to trucking until the final destination in Canada.

5. Hands-Off, Eyes-On: While door-to-door service takes care of all the grunt work, you get to maintain visibility and control of your shipment at all times.

No more tangled spaghetti, just a smooth shipment journey! Now, doesn’t that sound positively delightful!

DocShipper – Door to Door specialist between UK and Canada

DocShipper is your expert partner in door-to-door shipping between the UK and Canada. We manage every step for a stress-free experience, from packing to customs clearance, with proficiency across all transport methods. With us, you gain a dedicated Account Executive, ensuring custom solutions tailored to your needs. Dive into stress-free shipping with DocShipper – we offer a free estimate in less than 24 hours or instant advice from our consultants. Just reach out to us, sit back and let us handle the complexities of international logistics, saving you time and giving you peace of mind.

Customs clearance in Canada for goods imported from UK

Customs clearance is a pivotal, yet complex process which entails passing goods shipped from one country through the customs authority in another. For merchandise entering Canada from the UK, navigating this maze can be daunting, filled with unscheduled costs, duties, taxes, and potential bottlenecks like licensing and quotas. Businesses often grapple with the risk of goods getting held up at the border. But fear not. The forthcoming sections will shed light on navigating this intricate landscape smoothly. And remember, with DocShipper, you’re never alone in this journey. We offer support for the entire process for all types of goods, worldwide. Need an estimate for your project? Just reach out to our team with your goods’ origin, value, and HS Code. With these crucial details, we’ll gladly facilitate your estimation and the entire shipping process.

How to calculate duties & taxes when importing from UK to Canada?

Shipping goods from the UK to Canada might seem quite simple, but it’s crucial to accurately estimate the duties and taxes that will apply to your imported products. Everything from the place where your goods were manufactured, the Harmonized System (HS) Code of your goods, the Customs Value or the price paid for the goods, the specific Tariff Rate applicable to the category of products you’re shipping, not mentioning the potential extra charges such as VAT, Excise Tax or other local taxes and fees – all these contribute to the final cost calculation. This process might look complex, but with the right guidance, you can navigate it smoothly. As an importer, your first step is to pinpoint the exact nation where your goods were created or produced. This information is crucial because it sets the stage for classifying your goods and applying the appropriate tariffs and charges.

Step 1 – Identify the Country of Origin

Grasping your product’s country of origin seems simple, but trust us, it’s more than meets the eye. Here are five reasons why this matters.

First, the origin country dictates the Harmonized System (HS) code. This code equates to your product’s DNA for customs officials. Without it, your shipment won’t cross borders.

Second, trade agreements rule, literally. UK and Canada share a well-established Trade Continuity Agreement (TCA). It impacts duties, often in your favor, so knowing the origin country reaps rewards.

Third, identifying the origin country uncovers import restrictions. Consider honey: Canada restricts certain types of honey from the UK, so knowing your product’s origin saves headaches.

Fourth, imagine marking your goods incorrectly as Canadian, when they are British. That slip-up leads to incorrect duties and potential legal action. You don’t want that.

Lastly, brokering the customs process is easier when you have the right origin information. Officials will sail your shipment through customs if you play by the rules and present the correct country of origin.

Remember, navigating the sea of customs needs a well-informed captain. Your ship’s sailing depends on it.

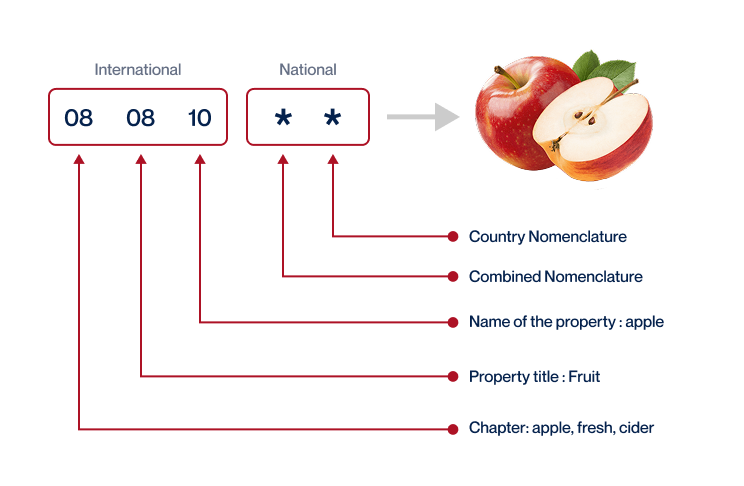

Step 2 – Find the HS Code of your product

The Harmonized System (HS) code is a universally recognized system of names and numbers to classify traded products. It is used by customs authorities around the world to identify products when assessing duties and taxes and for gathering statistics.

Normally, your supplier would be the easiest source for obtaining this code as they are familiar with the regulations related to their products. If reaching out to them is not an option, however, you can still find the HS code on your own.

You just need to follow a few simple steps using the Harmonized Tariff Schedule. The first step involves using an HS lookup tool. Subsequently, you’ll just enter your product’s name in the search bar and then locate the HS code in the Heading/Subheading column.

A word of caution: accuracy is vital when determining the HS code for your product. An incorrect code could lead to unnecessary delays in shipping and the potential for fines.

Here’s an infographic showing you how to read an HS code. Remember, understanding your product’s HS code is instrumental in ensuring smooth and efficient shipping for your business.

Step 3 – Calculate the Customs Value

Understanding the customs value of your goods is a crucial step in the import process. You might think that the customs value is just the price you paid for the goods, right? Not exactly – it’s a bit more comprehensive. In fact, the customs value, also known as the ‘CIF’ value, includes the cost of the goods you’re importing, the cost of international shipping, and the insurance cost. So, if your goods cost $50, shipping was $10, and insurance was $5, the CIF value would be $65. And it’s this $65 value that Canadian customs will use to calculate your duty. Remember to keep all receipts and invoices. This accurate, up-front calculation saves you surprises and potential obstacles at Canadian customs.

Step 5 – Consider other Import Duties and Taxes

If you’re importing goods from the UK to Canada, it’s crucial to remember that your financial obligations aren’t always covered by the standard tariff rate alone. Beyond this, you might be responsible for additional import duties and taxes contingent on your product’s origin and nature.

For instance, an excise duty, a tax applied to specific goods like alcohol or tobacco, might hold relevance for your shipment. Another potential levy could be anti-dumping taxes, enforced to protect Canadian industries from unfairly priced imported products.

Nevertheless, the Value Added Tax (VAT) might be the most significant extra charge. VAT is a form of consumption tax, added to a product’s value at each stage of the supply chain, from production to the point of sale. In Canada, the VAT is known as the Goods and Services Tax (GST). As a rough guide, if your product’s value was $5000, and Canada’s GST is 5%, you’d owe an additional $250 in GST. However, these calculations are just illustrative and could vary in real scenarios.

Keep in mind, keeping track of these costs can feel overwhelming, but understanding them could prevent unexpected expenses that can impact your bottom line.

Step 6 – Calculate the Customs Duties

In Step 6, understanding how customs duties in Canada are reached when importing goods from the UK is crucial. Essentially, the customs duty is calculated using the customs value of the goods. Say, for instance, you import goods valued at $10,000. If the general customs duty rate is 5%, you’d pay $500 in customs duties.

However, when Value-Added Tax (VAT) is also applied, the calculation changes. If the rate of VAT is 20%, you would first calculate the customs duty ($500), then apply VAT to the total value, including customs duty ($10,500), making your VAT charge $2,100.

In instances where anti-dumping taxes and Excise Duty are also levied, let’s assume they total $300. They are added to the customs value ($10,300), then the customs duty and VAT are calculated based on this new total value, leading to $515 in customs duties and $2,163 in VAT.

Ensuring the correct calculations can be complicated; this is where DocShipper shines. We will handle your customs clearance, guaranteeing you aren’t overcharged. Contact us for a free quote within 24 hours, wherever you are in the world. We ensure stress-free, cost-effective shipments from the UK to Canada.

Does DocShipper charge customs fees?

Contrary to common misconception, DocShipper, as a customs broker in the UK and Canada, doesn’t charge customs duties. These are payments made directly to the government. You’ll be billed separately for our customs clearance service, a distinct aspect of our job to streamline your shipping experience. Rest assured, you’ll receive documentation from the customs office, backing that you’re only compensating precisely what they demand, keeping transparency at the core of our services. Think about when you pay just the service charge but not the total bill at a restaurant, that’s how it works here.

Contact Details for Customs Authorities

UK Customs

Canada Customs

Required documents for customs clearance

Tangling with customs paperwork can leave you feeling lost in a sea of acronyms. In this section, we’ll define and simplify the crucial documents, such as the Bill of Lading, Packing List, Certificate of Origin, and Documents of conformity (CE standard), helping you sail smoothly through the customs clearance process.

Bill of Lading

Navigating international waters for shipping between the UK and Canada can be complicated, especially if you’re new to the rules of the game. Enter the Bill of Lading: your indispensable sidekick. Acting as your receipt, contract, and title for the goods, it’s pivotal for your shipping journey. Its electronic sibling, the telex release, is a quicker, smoother alternative, freeing you from the snail mail hassles. Imagine turbo-charging your clearance process; that’s what it does!

Air shipments? Don’t panic, we’ve got you covered. The equivalent to a Bill of Lading for air transport is an Air Waybill (AWB). It serves similar purposes but doesn’t confer ownership—a key difference to keep in mind. For your business, it’s critical to know when and how to use these documents effectively, avoiding common pitfalls and ensuring your cargo reaches its destination without a hitch.

Packing List

Imagine the Packing List as your shipment’s comprehensive biography. It provides customs officers with all the vital details they need: the types and quantity of goods shipped, their weight, dimensions and value. Thoughtfully prepared by you, the shipper, it’s your responsibility to ensure its information matches what’s loaded onto the vehicle – whether it’s a sea freight container or an air cargo pallet. Accuracy is paramount here. Let’s take the example of an automotive parts supplier shipping engines from Birmingham to Ontario. A small miscommunication or discrepancy in the packing list could mean your cargo gets held up at Halifax Sea Port or Toronto Pearson Airport. So, triple check that packing list. It’s more than just paperwork – it’s the passport that allows your cargo to travel smoothly between the UK and Canada.

Commercial Invoice

If you’re shipping goods from the UK to Canada, your Commercial Invoice is a key document that customs pay close attention to. It must clearly detail what you’re shipping, its value, and the details of buyer and seller. Think of it like your passport to successful customs clearance, inaccuracies can lead to delays! So, let’s say you’re shipping wooden furniture – mention wood type, quality, and quantity. Curating this document with precision ensures it aligns with other shipping documents, like the packing list. This accuracy is your best defence against unforeseen hold-ups. Remember, a well-prepared Commercial Invoice helps you navigate customs smoothly, getting your shipment quickly from the bustling streets of London to the towering skyscrapers of Toronto. Keep it accurate and keep it clear!

Certificate of Origin

Securing the Certificate of Origin (COO) is one crucial step in your UK-Canada shipping journey. It vouches for where your goods were made – like your tech gadgets from Birmingham or maple syrup from Ottawa. Accurate identification isn’t just paperwork; it could unlock preferential customs duty rates! Say you’re shipping clothing made in the UK to Canada; with the UK-Canada Trade Continuity Agreement, a valid COO could mean lower tariffs, making your fashion products more price-competitive. So, double-check those details in your COO – it could be your key to smoother, more cost-effective transatlantic trade.

Get Started with DocShipper

Prohibited and Restricted items when importing into Canada

Cracking the code of what you can and can’t import into Canada can feel like tackling a puzzle. If you’re scratching your head over custom regulations, don’t panic. We’ve got you covered with a comprehensive overview of prohibited and restricted items for smooth Canadian imports.

Restricted Products

1. Alcohol: You have to apply for an Import License from the Canada Revenue Agency (CRA) for bringing in any alcohol-based products.

2. Tobacco: If you’re looking to import tobacco products into Canada, you’ll need a permit from the CRA.

3. Firearms and Weapons: For any firearms and ammunitions, you’re required to obtain a Canadian Firearms License. It can be obtained from the Royal Canadian Mounted Police website.

4. Prescription Drugs: When dealing with prescription drugs, you have to get a Drug Establishment License from Health Canada.

5. Food and Agricultural Products: Bringing in food and agricultural products? You have to look to the Canadian Food Inspection Agency for permits and regulations.

6. Animals and Animal Products: If you’re interested in importing animals and animal products, the Canadian Centre for Veterinary Biologics may require a permit.

7. Plants and Plant Products: In case you’re shipping plants or plant-related products, you might need to comply with Canadian Plant Protection Regulations.

Remember, this is not an exhaustive list as some products may require special licenses or permits from various other departments. It’s always a good practice to check the status of your items before importing.

Prohibited products

– Narcotics and controlled substances: Substances like marijuana, cocaine, heroin, and any other drugs not authorized by the Canadian government are strictly prohibited.

– Obscene materials: Any products or materials that could be considered pornographic or obscene are not allowed.

– Endangered animal and plant species: This includes items made from elephant ivory, sea turtle shells, and certain furs and skins.

– Counterfeit products and currency: Any products or money that has been forged or reproduced without proper authorization is prohibited.

– Cultural property: Illegal trade of cultural property is not allowed. This includes artefacts, works of art, manuscripts, books, and other objects of cultural importance trafficked illegally.

– Baby walkers: Specifically, baby walkers that do not meet the Canadian regulations are prohibited.

– Health and beauty products: Certain health and beauty products that contain ingredients not approved by the Health Canada cannot be imported.

– Certain weapons: Many types of firearms and weapons are prohibited, including automatic firearms, short-barreled handguns, and weapons disguised as other items.

Are there any trade agreements between UK and Canada

Yes, the United Kingdom and Canada have an ample trade setup that benefits your business. Their trade bond is strengthened through the Trade Continuity Agreement (TCA), preserving the benefits of CETA, their previous FTA. While tariffs remain low, your shipping costs may also be reduced. Currently, there’s an ongoing dialogue for an Enhanced Trade Agreement to further boost bilateral trade. This evolving trade landscape indicates promising prospects and future opportunities for businesses shipping between the UK and Canada.

UK – Canada trade and economic relationship

Deeply rooted in history, the UK-Canada trade relationship represents a prosperous union. This alliance skyrocketed in the 19th century with Canada’s vast timber exports. Today, it encompasses diverse sectors, with vehicles and machinery being key traded commodities. But it’s not merely a story of goods – service sector investments are noteworthy, with the UK investing over £30 billion in Canada in 2019. Bridging the Atlantic, their bilateral trade stands strong at £20.6 billion annually, boosting economies on both sides. Despite Brexit-led alterations, the relationship remains steady, fuelled by their mutual Comprehensive Economic and Trade Agreement (CETA). Interweaving history and economics, this is more than just international trade, it’s a connection that represents strength, growth, and mutual respect.In 2023, Canada’s total merchandise imports from the UK amounted to CAD 3.151 billion, representing 0.7% of total Canadian imports.

Your first steps with DocShipper

Additional logistics services

Warehousing

Storing goods can often feel like a game of Tetris, especially when you're managing products with special temperature needs. Whether you're shipping chocolates or pharmaceuticals, the right warehousing environment is crucial. Need a surefire shelter between the UK and Canada? We've got you covered. More info on our dedicated page: Warehousing.

Packing

Choosing the right packaging can make or break your goods' journey from the UK to Canada. With numerous product-specific requirements, it's crucial to have a reliable partner who understands every detail. Imagine shipping antique ceramics without sufficient padding, or food items without the right preservatives - chaos, right? Don't fret, our packaging and repackaging services adjust to your product's needs, ensuring a smooth and safe passage. More info on our dedicated page: Freight packaging.

Transport Insurance

When it comes to safeguarding your consignments, cargo insurance trumps fire insurance, covering far more hazards. Examples? Theft at sea, damage from rough handling, and even natural disasters! To keep your venture sailing smoothly, it's the lighthouse amidst troubled waters. Defend those profits and avoid logistical headaches - opt for full-throttle protection. More info on our dedicated page: Cargo Insurance.

Household goods shipping

Moving from the UK to Canada and got extra-large artwork, heirloom furniture, or other bulky items? Our Personal Effects Shipping caters to such fragile or hefty parcels with exemplary care and flexibility. Imagine your great-grandma's vintage cabinet delivered with the same love and respect you have for it. For all the details, jump to our dedicated page: Shipping Personal Belongings.

Procurement in Thailand

Seeking reliable suppliers in Asia or East Europe? With DocShipper, rest easy. We simplify sourcing and manufacturing, locating dependable suppliers and buckling down on the procurement process for you. We'll bridge those tricky language gaps and steer you smoothly through the process. Challenges in sourcing? Visit our Sourcing services page for more insights.

Quality Control

Fulfilling quality standards is crucial when shipping goods from the UK to Canada. Quality Control ensures your products are up to the mark – Warding off expensive returns and time-wasted remediation. Picture this: your latest batch of handcrafted mugs, scrutinized to ensure mint condition, ready to wow Canadian customers. This service's got your back, safeguarding your reputation and hard work. More info on our dedicated page: Quality Inspection.

Conformité des produits aux normes

Ensuring your goods meet local standards is crucial when shipping goods. With our Product Compliance Services, we help you avoid regulatory hurdles by providing crucial laboratory testing for certification. Let's eliminate nasty surprises at customs. More info on our dedicated page: Product compliance services.