Freight shipping between the UK and Singapore : Rates -Transit time – Duties and taxes

Which are the different modes of transportation between UK and Singapore?

When shipping goods between the UK and Singapore, the wisdom of choosing the right transportation method is as critical as finding the North Star in a sailor's voyage. The distance is vast, and the journey crosses multiple international borders. Analysing your shipping needs while weighing your options — airborne deliveries for speed, marine routes for volume, or a combination for balance — may seem like choosing the best spice in a Chef's pantry. Your choice can make all the difference, turning your shipping journey from metaphorically navigating a choppy sea into a smooth sail under clear skies.

Need help with your shipment?

Need assistance with your shipment? Dont hesitate to contact us even for a simple question. Choose the option that suits you

Live chat with an expert Chat on WhatsApp Free Quote 24hHow can DocShipper help you

Sea freight between UK and Singapore

Seaborne trade reigns supreme in the immense bilateral relationship between UK and Singapore, joining the dots between their key industrial heartlands via bustling cargo ports like London Gateway and Singapore’s Tanjong Pagar Terminal. When shipping vast volumes of goods, you often lean towards sea freight as the most affordable solution. It doesn’t get the gold medal for speed, but it does go easy on your wallet.

However, if you’ve ever lost sleep over sending a shipment across the globe, you’re not alone. Despite the well-established routes, businesses often stumble on the frequent roadblocks and slip-ups of the shipping game when dealing between the UK and Singapore. Missed paperwork, border hiccups, you name it. The good news is, these headaches can be prevented. If you know the ins and outs, the best practices can transform this daunting process into with relative ease. Stick around to dive into the secrets of successful shipping and say goodbye to those frustrating shipping snags!

Main shipping ports in UK

Port of London

Location and Volume: Offering easy access to the region’s consumer market, the Port of London processes around 50 million tonnes of cargo each year, and is the second largest port in the UK.

Key Trading Partners and Strategic Importance: With Europe, North America, and Asia as its main partners, the port facilitates diverse international trade.

Context for Businesses: Given its proximity to London’s consumer markets and extensive storage facilities, this port is strategically important for businesses planning to meet high local demand.

Port of Southampton

Location and Volume: Situated on England’s south coast, the Port of Southampton handles around 1 million TEU annually and acts as the UK’s number one port for automotive trade.

Key Trading Partners and Strategic Importance: The port’s main business partners include North America, the Far East, and Europe. It is also an important strategic gateway to the UK, particularly for automotive industry.

Context for Businesses: If your business operates in the automotive sector and has or plans to have dealings with the main trading regions, the Port of Southampton could be a crucial part of your strategy.

Port of Felixstowe

Location and Volume: Located in Suffolk, East England, the Port of Felixstowe is the busiest port in the UK handling approximately 4 million TEU per year.

Key Trading Partners and Strategic Importance: Serving other European countries alongside parts of Asia and America, the port holds a commanding position in the UK’s maritime industry.

Context for Businesses: If you’re planning on heavy cargo movement within the European and Asian markets, the Port of Felixstowe, with its excellent railroad and road connectivity, is a favourable shipping option.

Port of Liverpool

Location and Volume: Situated on the northwest coast, the Port of Liverpool handles more than 30 million tonnes of cargo annually.

Key Trading Partners and Strategic Importance: Its key trading partners are North America, the Middle East, and Asia. The port plays a vital role in the movement of a varied range of goods including food and drink, automobiles, and chemicals.

Main shipping ports in UK

Port of London

Location and Volume: Offering easy access to the region’s consumer market, the Port of London processes around 50 million tonnes of cargo each year, and is the second largest port in the UK.

Key Trading Partners and Strategic Importance: With Europe, North America, and Asia as its main partners, the port facilitates diverse international trade.

Context for Businesses: Given its proximity to London’s consumer markets and extensive storage facilities, this port is strategically important for businesses planning to meet high local demand.

Port of Southampton

Location and Volume: Situated on England’s south coast, the Port of Southampton handles around 1 million TEU annually and acts as the UK’s number one port for automotive trade.

Key Trading Partners and Strategic Importance: The port’s main business partners include North America, the Far East, and Europe. It is also an important strategic gateway to the UK, particularly for automotive industry.

Context for Businesses: If your business operates in the automotive sector and has or plans to have dealings with the main trading regions, the Port of Southampton could be a crucial part of your strategy.

Port of Felixstowe

Location and Volume: Located in Suffolk, East England, the Port of Felixstowe is the busiest port in the UK handling approximately 4 million TEU per year.

Key Trading Partners and Strategic Importance: Serving other European countries alongside parts of Asia and America, the port holds a commanding position in the UK’s maritime industry.

Context for Businesses: If you’re planning on heavy cargo movement within the European and Asian markets, the Port of Felixstowe, with its excellent railroad and road connectivity, is a favourable shipping option.

Port of Liverpool

Location and Volume: Situated on the northwest coast, the Port of Liverpool handles more than 30 million tonnes of cargo annually.

Key Trading Partners and Strategic Importance: Its key trading partners are North America, the Middle East, and Asia. The port plays a vital role in the movement of a varied range of goods including food and drink, automobiles, and chemicals.

Main shipping ports in Singapore

Location and Volume: Located in the southern tip of the Malay Peninsula, the Port of Singapore is one of the busiest ports in the world, boasting a shipping volume of 36.15 million TEUs.

Key Trading Partners and Strategic Importance: The Port of Singapore is strategic for trade with vital market regions including China, Indonesia, Malaysia, the United States, and South Korea. Its geographical advantage enables it to connect to over 600 ports in more than 120 countries, making it an essential global maritime hub.

Context for Businesses: If you’re planning to expand your operations in Asia and beyond, the Port of Singapore offers advantages like remarkable connectivity and advanced port facilities, ideal for businesses seeking efficient shipping solutions with a broad geographical reach.

Location and Volume: Jurong Port is situated in the southwest of Singapore and serves as a multipurpose port, handling a broad range of cargo with a total annual handling capacity of 15 million tonnes.

Key Trading Partners and Strategic Importance: Key trading partners include Indonesia, Malaysia, China, and Australia. The port is strategically important as it specializes in handling general, bulk, and containerized cargo.

Context for Businesses: If your business operations involve diverse types of cargo, Jurong Port’s multipurpose facilities, integrating various logistics processes, could serve as a promising facilitator for your shipping strategy.

Ports of Pasir Panjang, Sembawang, and Tanjong Pagar

Location and Volume: The Ports of Pasir Panjang, Sembawang, and Tanjong Pagar comprise the majorly used terminals within the Port of Singapore system, contributing to its overall TEU volume.

Key Trading Partners and Strategic Importance: These ports actively participate in trade with prominent market regions, benefiting from the strategic connectivity of the overall port system.

Context for Businesses: As part of the Port of Singapore system, they offer the advantage of impressive reach and efficiency. If your business needs involve large volumes of cargo or connection to extensive port networks, these ports are worth considering.

Location and Volume: Located within the Port of Singapore, PSA Singapore Terminals contribute significantly to the overall volume processed, handling tens of millions of TEUs each year.

Key Trading Partners and Strategic Importance: As part of the largest transshipment hub in the world, these terminals play a critical role in the trade with all of Singapore’s key partners.

Context for Businesses: If you’re looking for unrivalled speed and connectivity, you might want to consider the PSA Singapore Terminals which stand as pillars of the Port of Singapore, giving your business access to speedy transshipment and direct shipping lines to major ports around the world.

Should I choose FCL or LCL when shipping between UK and Singapore?

Deciding between Full Container Load (FCL) or Less than Container Load (LCL), also known as consolidation, when shipping from the UK to Singapore is as strategic as choosing your main shipping route. This decision can be the difference between an expedited delivery and cost-efficiency. Let’s delve into both options, helping you balance cost, delivery time, and ultimate success in your shipping process. By the end of this guide, you’ll be equipped for an informed choice tailored to your unique shipping needs. Remember, every shipment tells a story!

Full container load (FCL)

Definition: FCL shipping, or Full Container Load, refers to when a single consignee books a whole 20'ft or 40'ft container for transporting goods. This method is direct, secure, and often more cost-effective for larger shippings.

When to Use: If you're sending more than 13/14/15 CBM from the UK to Singapore, FCL is your best bet. The entire fcl container carries your goods only, reducing the risk of damage and theft.

Example: An automotive parts retailer based in London needs to transfer 16 CBM of materials to a client in Singapore. Choosing FCL shipping, they book a 20'ft container and fill it exclusively with their shipment. The container is sealed in London and transported under stringent security, ensuring all parts arrive intact.

Cost Implications: Though an initial FCL shipping quote might appear steep, FCL becomes cheaper per unit cost when dealing with larger volumes. You're paying for the whole container anyway, so the more space you fill, the more cost-effective it becomes. Plus, its safer delivery alleviates potential additional finances related to product damage.

Less container load (LCL)

Definition: Less than Container Load (LCL) shipment involves sharing a shipping container with other businesses. This type of freight, sometimes referred to as an LCL freight, is consolidated at a port with other cargo before being dispatched to the destination.

When to Use: LCL can be a more price-flexible option for low volume shipments. This shipping choice might be more suitable when your cargo is under 13-15 cubic meters (CBM). It's a great solution to manage costs and avoiding holding excessive inventory.

Example: A furniture manufacturer in the UK wants to ship a small batch of chairs to a retailer in Singapore but doesn't have enough stocks to fill an entire shipping container. Instead of waiting to produce more chairs (which could mean delayed income), they can use an LCL shipment, sharing container space with other shippers and delivering orders in a timely manner.

Cost Implications: Despite a slightly higher rate per CBM compared to Full Container Load (FCL) shipping, overall costs are generally lower for LCL as you only pay for the space your cargo occupies. Note, though, that the cost can vary depending on factors like commodity type and seasonality of shipments.

Hassle-free shipping

Discover the effortless way to ship goods between UK and Singapore with DocShipper. Our ocean freight experts will guide you through the complexities of consolidation and full container options, depending on factors such as cargo volume and deadline urgency. We're committed to simplifying international shipping for businesses big or small. Contact us today for a free, no-obligation shipping estimation. Your hassle-free cargo transportation adventure is just a click away.

Sailing time between the UK and Singapore generally ranges between 22 to 30 days. These transit times can vary as they are subject to a number of variables such as the specific arrival and departure ports, the weight and volume of the items, and the type of goods being transported. It’s recommended for businesses to reach out to trustworthy freight forwarders like DocShipper for a more personalized and accurate quote.

Given below is a snapshot of average transit times between prominent freight ports in both countries:

| UK Ports | Singapore Ports | Average Transit Time (Days) |

| London | Port of Singapore | 31 |

| Liverpool | Port of Singapore | 31 |

| Southampton | Port of Singapore | 30 |

| Felixstowe | Port of Singapore | 31 |

*Again, these figures offer a general overview and specific timelines could be different. For exact figures, consider obtaining a tailored quote from a reliable source like DocShipper.

How much does it cost to ship a container between UK and Singapore?

Imagine being able to fathom the cost of shipping a container from UK to Singapore? Ocean freight rates can oscillate markedly, ranging widely per CBM due to the ever-changing blend of factors at play. Variables such as Point of Loading, Destination, the carrier selected, the nature of the goods, and monthly market fluctuations can tilt the shipping cost scale.

Hence, pinning down an exact figure is a shot in the dark. But worry not, our adept shipping specialists are at your disposal. Equipped to analyze your specific situation and armies of market data, they work vigorously to secure the most optimal quotes for you, on a case-by-case basis.

Special transportation services

Out of Gauge (OOG) Container

Definition: Out of Gauge (OOG) containers are specially designed for cargos that don’t fit standard containers due to their dimensions. This is perfect for oversized or large cargo, providing the space needed without requiring disassembly of your goods.

Suitable for: If you’re shipping oversized items, equipment, machinery or any large goods, then an OOG container would be ideal.

Examples: For example, industrial equipment, construction machinery, or even large artwork can be ideal candidates for this option.

Why it might be the best choice for you: OOG shipping offers flexibility in terms of size and shape. It allows you to ship large and non-standard goods without the restrictions of a typical container, ensuring safe and efficient transportation.

Break Bulk

Definition: Break bulk refers to goods that need to be loaded onto the vessel individually rather than in containers. This ‘loose cargo load’ term originates from the phrase ‘breaking bulk’ which means the extraction of a portion of the cargo on a ship or the beginning of the unloading process.

Suitable for: This shipping method is suitable for large items that do not fit into containers.

Examples: These could include large machinery, construction materials, or large vehicles.

Why it might be the best choice for you: If you have cargo that can’t be shipped using traditional container methods, break bulk shipping provides a solution. It’s designed to handle large, heavy, high-value pieces of cargo.

Dry Bulk

Definition: Dry bulk refers to bulk goods such as grain, coal, or ore that are shipped unpackaged in large quantities. The cargo is loaded directly into the vessel’s storage in its natural form without the requirement of any containers.

Suitable for: It’s ideal for the shipping of raw materials and commodities in large quantities.

Examples: Typically, products like minerals, grains, metals, coal, and fertilizers are transported in this way.

Why it might be the best choice for you: If you’re dealing with a large volume of bulk goods, dry bulk shipping can provide a highly efficient and cost-effective solution.

Roll-on/Roll-off (Ro-Ro)

Definition: Roll-on/Roll-off (Ro-Ro) is a type of naval vessel designed to carry wheeled cargo, such as cars, trucks, trailers, that are driven on and off the ship on their own wheels or using a platform vehicle. These ‘ro-ro vessels’ provide an efficient way of shipping large vehicles or equipment.

Suitable for: If you’re looking to transport vehicles, be they personal cars, commercial trucks, tractors, or even railway carriages, Ro-ro would be perfect.

Examples: Companies often use this method to transport masses of cars from factories to distributors globally.

Why it might be the best choice for you: Ro-ro shipping is simple, efficient, and reduces the risk of damage to your vehicles as it eliminates the need to crane-lift. It’s an ideal solution if you’re in the automotive industry.

Reefer Containers

Definition: Reefer containers are refrigerated shipping containers used to ship temperature-sensitive cargo. These containers have integrated refrigeration units to keep products at a constant, pre-defined temperature during transit.

Suitable for: These are best suited for transporting perishable goods that require specific temperature conditions.

Examples: They are widely used for foods such as fruits, meat, fish, dairy products, beverages, and pharmaceutical goods.

Why it might be the best choice for you: If you’re dealing with temperature-sensitive goods, reefer containers provide the required climate control to keep these products in optimal condition throughout their journey.

Feeling overwhelmed by the choices? At DocShipper, we are here to help. Our team of experts can guide you through the best sea freight shipping option for your specific cargo. Don’t hesitate to get in touch with us for your free shipping quote, typically provided within 24h.

Air freight between UK and Singapore

Air freight from the UK to Singapore is your go-to choice when speed, reliability, and protection of cargo are paramount. It’s unrivaled for sending small, high-value shipments such as electronics or pharmaceuticals. While pricier compared to sea or rail shipping, the expedited transit time compensates, protecting your bottom line from stockouts or missed sales.

However, many shippers stumble when forecasting costs, mainly due to miscalculating weight – a crucial factor in air freight pricing. Additionally, overlooking certain best practices can inflate shipping costs, undermining the cost-effectiveness they seek. In this part, we’ll elucidate these common pitfalls and how to sidestep them, ensuring your air freight journey is streamlined and budget-friendly.

Air Cargo vs Express Air Freight: How should I ship?

Embarking on a shipping journey between the UK and Singapore? You might be puzzling over whether to use air cargo, booked within a commercial airline, or spring for express air freight, burning rubber in a dedicated plane. Let’s clear the smog and zoom into each option, scrutinizing the nitty-gritty details best suited to your unique business needs. So buckle up, let’s hit the skies!

Should I choose Air Cargo between UK and Singapore?

Choosing Air cargo for your freight between the UK and Singapore can often be a cost-effective and reliable, yet time-consuming option. Airlines like British Airways and Singapore Airlines offer regular freight services; their well-established reputations assure secure transport although transit times can be longer due to their fixed schedules. Small volume shipper? Keep in mind that air cargo becomes more economical for shipments over 100/150 kg (220/330 lbs). Determine the suitability of this option in accordance with your specific needs and budget. Links: British Airways | Singapore Airlines

Should I choose Express Air Freight between UK and Singapore?

Express air freight, like FedEx, UPS, or DHL, may be your ideal option for shipping smaller loads between UK and Singapore. This specialized service uses standalone cargo planes, allowing for quicker, more straightforward transits. Ideal for shipments not exceeding 1 CBM or 100/150 kg (220/330 lbs), the convenience and speed offered can be a major advantage for your business. It’s an excellent choice for urgent, high-value, or sensitive goods that need to be transported as fast and securely as possible.

Main international airports in UK

Cargo Volume: 1.6 million metric tonnes per year

Key Trading Partners: USA, China, India, Canada, Australia

Strategic Importance: As the busiest airport in Europe, Heathrow facilitates substantial volumes of international cargo.

Notable Features: Its location in London allows for easy access to markets across the UK and Europe. It also hosts one of the world’s largest cargo terminals, the Heathrow Cargo Centre.

For Your Business: The broad range of international connections and frequent flights can increase the flexibility and speed of your supply chain.

Cargo Volume: Over 120,000 tonnes per year

Key Trading Partners: USA, United Arab Emirates, China, Turkey, Qatar

Strategic Importance: Manchester Airport is the North’s global gateway, connecting the region to key markets around the world.

Notable Features: Its World Freight Terminal handles all types of cargo and it connects directly to the UK-wide motorway network.

For Your Business: Excellent road and air connections can ensure the rapid transportation of your goods, making it ideal for time-sensitive cargo.

Cargo Volume: Over 365,000 tonnes per year

Key Trading Partners: EU countries, USA, United Arab Emirates, China, Hong Kong

Strategic Importance: This airport is the UK’s primary pure freight airport and a major hub for courier companies.

Notable Features: It features facilities for specific types of cargo, like pharmaceuticals and perishable goods.

For Your Business: Specialized handling and facilities ensure your products reach their destination in top condition, making East Midlands Airport a prime choice for specialized goods.

Cargo Volume: Over 250,000 tonnes per year

Key Trading Partners: Hong Kong, Turkey, United Arab Emirates, USA, China

Strategic Importance: Stansted is the third largest cargo airport in the UK, with a dedicated cargo terminal.

Notable Features: It hosts major courier companies FedEx and UPS, offering fast worldwide parcel services.

For Your Business: The broad portfolio of courier services at Stansted can accommodate fast, efficient shipment for a variety of goods, including E-commerce products.

Cargo Volume: Handles and thousand of tonnes of freight annually

Key Trading Partners: USA, Europe, Middle East

Strategic Importance: It is the only airport in Scotland with a dedicated freight apron and one of the longest runways in the UK.

Notable Features: Prestwick facilitates both scheduled and charter freight operations and is operational 24/7.

For Your Business: If your business requires large, heavy cargo or outsize freight to be shipped, Glasgow Prestwick’s runway and cargo handling infrastructure is advantageous. Its uninterrupted operations ensure your cargo is shipped and received in a timely manner.

Main international airports in Singapore

Singapore Changi Airport

Cargo Volume: Singapore Changi is one of the busiest cargo airports in the world, handling over 2 million tonnes of cargo annually.

Key Trading Partners: The airport has a strong network worldwide, with key trading partners including China, Australia, the USA, Indonesia, and Malaysia.

Strategic Importance: Singapore Changi’s strategic geographical location between East and West makes it an excellent logistics hub for global airfreight, connecting to over 100 countries.

Notable Features: It’s equipped with advanced logistics capabilities, including an Air Cargo Express hub and e-commerce airhub, allowing expedited customs clearances for e-commerce goods.

For Your Business: If your supply chain has a need for speed and connectivity, Changi presents a reliable option. Its sophisticated infrastructure and seamless customs procedures allow businesses to expedite their freight efficiently and reliably.

Seletar Airport

Cargo Volume: Although smaller than Changi, Seletar handles a substantial volume of specialized cargo, including perishable goods and oil/gas equipment.

Key Trading Partners: It primarily serves regional flights, with Malaysia and Indonesia being key trading partners.

Strategic Importance: Seletar serves as a strategic secondary hub in Singapore, focusing on handling smaller cargo aircraft and servicing the aerospace industry.

Notable Features: The airport houses a Free Trade Zone, providing opportunities for businesses to store and handle goods without incurring duty and GST.

For Your Business: If your business deals with specialized cargo, or you are engaged in the aerospace industry, Seletar provides robust and efficient services, coupled with the advantage of duty-free storage.

How long does air freight take between UK and Singapore?

Shipping between the UK and Singapore by air freight usually takes about 6-10 days. However, keep in mind that transit times can fluctuate based on certain variables. The specific airports used, the weight of the load, and the nature of the goods all play crucial roles in determining the final delivery timeline. For accurate and personalized shipping times, trust the expertise of a professional freight forwarder like DocShipper.

How much does it cost to ship a parcel between UK and Singapore with air freight?

Shipping rates for air freight from the UK to Singapore average around £5-£15 per kg. It’s challenging to give an absolute cost as factors like distance from airports, parcel dimensions, weight, and nature of goods can vary considerably. Rest assured, our team tailors quotations to your specific needs, ensuring competitive rates without compromising on service quality. Contact us and receive a free, no-obligation quote within 24 hours. Let us help expedite your shipping process.

What is the difference between volumetric and gross weight?

Gross weight refers to the actual weight of your shipment, including all packaging and pallets. Volumetric weight, on the other hand, takes into account the space your shipment occupies in the aircraft.

To calculate the gross weight in air cargo, you simply weigh your entire shipment, including any packaging or pallets, in kilos (kg). For instance, a shipment may weigh 100 kg (or around 220 lbs).

For volumetric weight, it gets a bit trickier. Here’s how it works in Air Cargo: you multiply the length, width, and height of your shipment (all in centimeters) and then divide that by 6000. The Express Air Freight services use a slightly different divisor: 5000.

Let’s illustrate with a hypothetical shipment measuring 120 cm in length, 100 cm in width, and 100 cm in height. For Air Cargo, your calculation would be (120 x 100 x 100) / 6000, giving you a volumetric weight of 200 kg (or around 440 lbs). If we used the Express Air Freight calculation, you’d have (120 x 100 x 100) / 5000, resulting in a volumetric weight of 240 kg (or around 529 lbs).

Why does this matter? Freight charges are determined by comparing the gross weight and volumetric weight of your shipment, and applying the higher of the two. This helps ensure efficiency in air transport by preventing very light, bulky items from filling up cargo space without contributing fairly to the cost. Learning how to reduce the volumetric weight of your shipments could save you a significant amount in shipping costs.

Door to door between UK and Singapore

Jumping straight into the fascinating world of Door to Door shipping, this term refers to the holistic process of transferring goods internationally, in this case from the UK to sunny Singapore. This method is a smooth ride for your goods, ensuring optimal convenience and peace of mind. So why wait? Let’s dive into the specifics of getting your cargo from pin to palace.

Overview – Door to Door

Juggling the intense demands of shipping goods from the UK to Singapore? Opt for the popular and hassle-free door-to-door service, loved by many DocShipper clients. While freight transportation often presents complex challenges, this comprehensive solution streamlines the process, handling everything from pickup to customs, all the way to your buyer’s doorstep.

Yes, it may come at a higher cost, but it saves you valuable time and effort, making it a worthy investment. Consider it a stress-reliever that will keep your logistics headaches at bay. Let us delve into the pros and cons. Strongly restated, unravel complexities and embrace simplicity with door-to-door shipping.

Why should I use a Door to Door service between UK and Singapore?

Worried about your shipment from the UK to Singapore attempting a solo career? You, my friend, need Door to Door service!

1. Flip the Stress: Organizing international shipments can feel like trying to herd cats in a thunderstorm. Door to Door service takes this stress off your back, handling everything from pick-up to final delivery.

2. Tick Tock, No Time to Dock: Got an urgent shipment? With this service, your goods aren’t waiting around in a warehouse – they’re escorted swiftly from origin to destination with no time wasted.

3. Special Pampering for Complex Cargo: Got something trickier to ship than typical cargo? The Door to Door service offers tailored solutions, ensuring your complex cargo receives the VIP treatment it deserves.

4. Unraveling the Red Tape: Customs can resemble an impenetrable fortress if you’re not prepared. The Door to Door service takes charge, navigating customs clearance on both the UK and Singapore sides with expertise.

5. Convenience, Hand Delivered: Picture this – you hand over your goods at your end, then collect the delivery at the final destination in Singapore. It’s like ordering a takeaway, but the food’s a shipment going halfway around the world!

In conclusion, the Door to Door service is an all-in-one package providing a hassle-free, streamlined, and efficient freight forwarding experience. Because who doesn’t love a one-stop-shop for all their shipping needs?

DocShipper – Door to Door specialist between UK and Singapore

Experience seamless, stress-free door-to-door shipping from the UK to Singapore with DocShipper. Our dedicated team of experts manages your transport needs from A to Z, covering packing, transit, customs clearance, and across all shipping modes. You’ll have your own Account Executive to ensure everything runs smoothly. Simply reach out for a no-obligation estimate within 24 hours, or connect instantly with our consultants for free advice. Shipping has never been this simple.

Customs clearance in Singapore for goods imported from UK

Customs clearance refers to the official process wherein goods imported from one country, like the UK, are legally approved to enter another, such as Singapore. Navigating this maze can be challenging due to the potential for unexpected fees and the intricate understanding needed of customs duties, taxes, quotas, and licenses. There’s also the risk of shipments languishing in customs. Upcoming sections of our guide will dissect these areas thoroughly.

Rest assured, DocShipper can seamlessly handle this intricate process for different types of goods worldwide. To obtain an estimate for your project, provide the origin and value of your goods, plus the Harmonized System Code (HS Code). Keep in mind, these details are crucial for progressing with the estimation. With our experts by your side, transforming these potential pitfalls into a smooth-sailing voyage is within your reach!

How to calculate duties & taxes when importing from UK to Singapore?

When transporting goods from the UK to Singapore, a firm understanding of how to estimate duties and taxes is invaluable. The crux of the calculation lies in grasping key factors like the country of manufacture or production of the goods, otherwise called the country of origin, the Harmonized System (HS) Code, the customs value of your goods, the tariff rate applicable in Singapore, along with other potential taxes and fees.

The initial step of this process is all about identification: you need to identify the country where your goods were produced or assembled, as this influences the customs duties and helps clue you into any possible duty exemptions or restrictions.

Step 1 – Identify the Country of Origin

Identifying the Country of Origin – your first step, and here’s why. (1) It determines the nation that produced your goods, not just where they shipped from – a crucial difference. (2) It influences import duties thanks to trade agreements. For instance, the UK-Singapore Free Trade Agreement might mean lower tariffs. (3) Conflict regions might lead to restrictions and increased scrutiny. (4) Special exemptions and schemes involve specific countries. A clear example is Singapore’s Reduced Concession Duty Scheme for Commonwealth countries. (5) It’s essential for accurate HS code allocation.

Trade agreements between the UK and Singapore, such as the above-mentioned FTA, can significantly affect import duties, turning a seemingly heavy tariff into an easier-to-shoulder expense.

Don’t forget restrictions! Singapore has specific limits on imports like meat products, chemicals, and radio communication equipment. To avoid tangled knots of bureaucracy, keep your nose in these rules.

Your takeaway? Know the cargo and its origin. Understand the agreements, restrictions, and your commodities. Tackling this upfront means smoother sailing (or flying, or driving!). Remember, we’re all about keeping your goods and your business on the move, without any unexpected surprises.

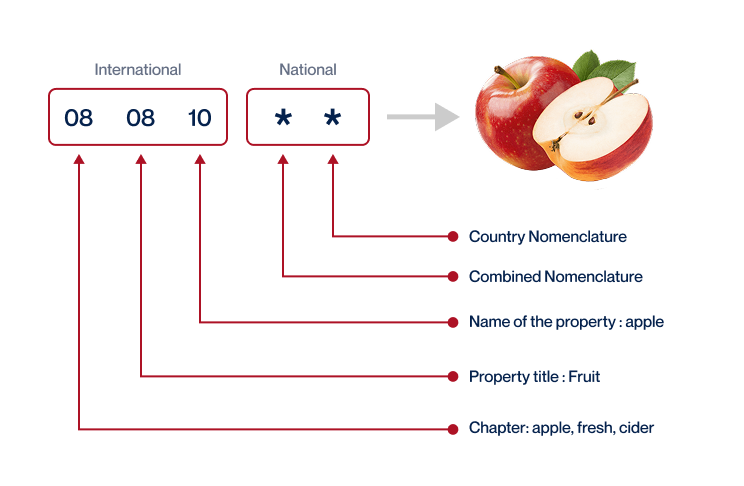

Step 2 – Find the HS Code of your product

The Harmonized System, or HS Code, is a standardized system of numbers that’s globally recognized. Used to classify traded products, these codes are crucial in ensuring your goods move through customs smoothly and efficiently.

Should you be uncertain of your product’s HS Code, there’s no cause for concern. In most cases, your supplier will be able to provide you with this necessary information since they are intimately familiar with the products they are exporting and the corresponding regulations.

But what if asking your supplier isn’t an option? Not to worry, you can find the HS Code for your product independently using our easy, step-by-step guide:

Start by using an HS lookup tool, like the Harmonized Tariff Schedule. This reliable database will guide you towards finding the correct HS Code for your goods. To begin, simply type your product name into the search bar. Then, refer to the Heading/Subheading column – this is where you will find your HS Code.

Please take note, accuracy plays a crucial role when it comes to sourcing the correct HS Code. Misclassifying your goods, on the other hand, may result in delivery delays and potential fines. Your care and attention to detail during this process could save you a great deal of time and money in the long run.

To end, we’d like to share an infographic that beautifully illustrates how to read an HS code. This visual guide will help you better understand the classification system at a glance.

Step 3 – Calculate the Customs Value

Getting your goods from the UK to Singapore involves more than just their sticker price. The ‘customs value’ includes the product’s price, yes, but also the cost of international shipping and insurance. So, looking past the sticker tag, you’re figuring out the ‘Customs Import value’ or CIF value.

Let’s say you’ve got furniture going for $10,000, shipping is $1,000, and insurance costs $500. Your CIF value isn’t just $10,000; it’s $11,500. Understanding this key component of your expenses can steer you towards smarter, more calculated business decisions. The correct calculation and declaration of your goods’ customs value is crucial for seamless shipping from the UK to Singapore.

Step 4 – Figure out the applicable Import Tariff

An import tariff is essentially a tax imposed on items imported from overseas. It forms a part of the total costs of getting your goods from the UK to Singapore. The type of tariff used in Singapore is the Harmonized System (HS) tariff, an internationally recognized method of naming and classifying products.

Here’s how you can find the rate that applies to your goods: Visit the UK’s Trade Tariff tool. Here, enter the HS code you’ve already identified and the country of destination, Singapore. You’ll find the duties and taxes that apply to your products.

Let’s consider an example for clarity. Suppose your product has an HS code of 01012100 (live horses). Also, assume your Cost, Insurance, and Freight (CIF) comes out to be $1000 USD. According to the Trade Tariff tool, the imposed rate might be 10%. Your import duties would be 10% of $1000, i.e., $100 USD.

Remember, proper classification and calculation are crucial. Any misapprehensions can lead to fines or delays in making your goods available in the Singapore market. As you navigate these processes, it’s imperative to exercise due diligence.

Step 5 – Consider other Import Duties and Taxes

Upon importing goods from the UK to Singapore, aside from the standard tariff rate, you may encounter additional taxes depending on your product’s nature and origin. It’s crucial to account for possible excise duties, anti-dumping taxes, and especially the Value Added Tax (VAT).

Take excise duty, which varies per commodity type, affecting certain alcohol, tobacco, and hydrocarbon oils. Suppose you import beer; you might see an excise duty of $1.7 per liter. These taxes help safeguard local industries from foreign competition offering products at prices substantially below fair market value.

Probably the most impactful on your budget is the VAT. In the UK, for instance, a standard VAT rate of 20% applies to most goods and services. Thus, for a product valued at $100, you’d pay $20 as VAT.

Remember, these numbers are only illustrative, not definitive. Rates fluctuate based on updates in taxation policies and the item’s tariff code. Processing these multiple layers of taxation can be taxing. Hence, it’s essential to comprehend your duties before importing, so you’re not caught up in unexpected costs. This awareness aids in establishing a more accurate budget, alleviating potential financial stress down the line.

Step 6 – Calculate the Customs Duties

Determining customs duties upon arrival in Singapore from the UK involves several factors. Primarily, you need to consider the customs value of your goods, followed by any applicable VAT, anti-dumping taxes, and excise duty.

For example, if you’re importing items valued at $10,000 USD, and the customs duty rate is 7%, the amount payable would be $700 USD. However, no VAT applies here since Singapore doesn’t charge VAT on imports.

Next, suppose your goods hold the same value with a customs duty of $700 USD and the UK’s standard VAT rate of 20%. Here, the total payable in duties and taxes would be $2,700 USD.

Lastly, consider goods with a higher risk of unfair trade practices, valued at $10,000 USD, with a 7% customs duty, 20% anti-dumping tax, and an additional excise duty of 10%. Your total payable would be $3,700 USD.

Juggling these numbers can be complex and daunting. The good news – DocShipper mitigates this stress. Our world-class customs clearance services ensure accurate calculations for your customs duties. We streamline every step, making sure you’re never overcharged. Easily reach out to us for a free, 24-hour quote. Shipping internationally has never been this simple and stress-free with DocShipper.

Does DocShipper charge customs fees?

As a UK and Singapore custom broker, DocShipper won’t bill you for any customs duties – those go directly to the government. Instead, we charge a separate fee for customs clearance services. Think of it like a restaurant service charge, separate but essential for a smooth experience. We’re transparent; you’ll receive official customs documents to show you’ve only paid for government charges. So, you can rest easy knowing there’s no shade when it comes to fees.

Contact Details for Customs Authorities

UK Customs

Singapore Customs

Required documents for customs clearance

Handling customs often feels like a puzzle, right? Misunderstood documents can cause costly delays. Let’s get clear on four crucial papers – the Bill of Lading, Packing List, Certificate of Origin, and Documents of Conformity (CE standard). Each one has a unique role in clearing your shipment.

Bill of Lading

If your business is shipping goods between the UK and Singapore, you’ll need to get familiar with the Bill of Lading. This official document is more than just a receipt—it’s proof of ownership transfer. You’ll receive it once your cargo’s loaded onto the vessel. It’s a vital ticket, whether you’re sending machinery, textiles or electronics.

To speed things up, requester can opt for an electronic, or ‘telex’, release. This means you don’t have to handle physical paperwork—great for those tight deadlines or last-minute panic moments.

If air cargo is your speed, the equivalent document is the Air Waybill (AWB). It’s faster but pricier.

These little bits of paper (or digital forms) aren’t just bureaucracy, they’re your passport to international trade. When used wisely, they can make the shipping process smoother and easier, saving your business time, money, and hassle. So, ensure they’re always completed accurately. Don’t rush this—it’s worth getting right!

Packing List

Navigating the sea of international freight can be tricky, and your Packing List sails as your captain between the UK and Singapore. Concocted by you, the shipper, it’s a treasure map of your shipment – detailing its weight, volume, type, and article quantity.

Whether you’re dispatching engineering parts via air or shipping home decor by sea, a meticulous Packing List doesn’t just ensure smooth sailing through customs, it also plots a course for your logistics partners to efficiently unload, store, and deliver your goods. A hastily-drafted list might leave your shipment lost in administrative limbo – a nightmare scenario that could result in costly delays. Accuracy is your compass here – let it guide you towards seamless trade across the sea and sky corridors between the UK and Singapore.

Commercial Invoice

When you’re shipping goods from the UK to Singapore, your Commercial Invoice is a vital document. It verifies the worth of your goods and establishes duties. It’s crucial to include accurate details like a detailed description and quantity of goods, price per unit, and full sender and receiver details. For instance, if you’re shipping automotive parts, quantity should reflect the exact number of parts, not pallets or boxes.

Inaccuracies can delay clearance, costing you time and money. Aim for alignment between your Commercial Invoice, Packing List, and Bill of Lading- discrepancies can raise red flags with customs officials. Remember, your Commercial Invoice is not just paperwork; it’s the foundation of a smooth shipping process.

Certificate of Origin

Navigating customs from the UK to Singapore? The Certificate of Origin (CoO) is your crucial passport. This document pinpoints precisely where your goods were born, so it’s essential to state the country of manufacture. Let’s say you’re sending ceramics created in a Birmingham workshop. Your CoO validates these pieces were indeed made in the UK, establishing a clear trade path. It’s not just about clarity, though.

In fact, it may unlock preferential duty rates, potentially saving your business a significant chunk of change. So, whether it’s potteries from the Midlands or tech gadgetry from the Southeast, your CoO is a golden ticket in goods transportation – don’t forget it.

Get Started with DocShipper

Prohibited and Restricted items when importing into Singapore

Understandably, shipping goods to Singapore can feel like a complex maze. The last thing you want is your shipment stalled or rejected due to overlooked restrictions. Let’s dive deep into Singapore’s import rules, specifically focusing on its prohibited and restricted items, so you can ensure a smooth delivery process.

Are there any trade agreements between UK and Singapore

UK-Singapore Free Trade Agreement (UKSFTA): Originally signed in 2020, this agreement eliminates tariffs on a wide range of goods and facilitates trade in services between the two countries. The UKSFTA continues to be a cornerstone of their trade relationship in 2024.

UK-Singapore Digital Economy Agreement (DEA): Signed in 2022, this was the world’s first Digital Economy Agreement for the UK, focusing on setting high standards in digital trade and cross-border data flows. This agreement remains crucial in 2024, helping businesses from both countries to capitalize on digital trade opportunities.

New Strategic Partnership: In September 2023, the UK and Singapore signed a new Strategic Partnership aimed at enhancing economic cooperation further. This partnership includes plans for a modern bilateral investment treaty, which would be the first new investment treaty negotiated by the UK since Brexit. This treaty is expected to boost investment flows and economic growth in both countries by providing greater confidence and protection for investors

UK – Singapore trade and economic relationship

In 2024, the trade and economic relationship between the UK and Singapore has been significantly strengthened through the establishment of a new “Strategic Partnership.” This partnership aims to deepen cooperation in various areas, including trade, investment, and technology. Both countries are working to enhance their existing trade agreements, such as the UK-Singapore Free Trade Agreement and the Digital Economy Agreement, while also negotiating a new bilateral investment treaty. This treaty is intended to promote and protect investments between the two nations, further boosting their economic ties.

Your first steps with DocShipper

Additional logistics services

Warehousing

Finding suitable warehousing in Singapore from the UK can be tough. If you're dealing with temperature-sensitive goods, mismanaged storage conditions can spell disaster. But, worry not! We've got you covered with our reliable and fine-tuned warehousing services. Keen to explore more? Dip into our dedicated page: Warehousing.

Packing

Safeguard the integrity of your goods during transit from the UK to Singapore with our Packaging and Repackaging services. Don't let transport conditions dictate your product quality; entrust this task to our dedicated professionals who expertly pack delicate crystal, protect heavyweight machinery, and everything in between. At DocShipper, we ensure your items arrive just as they set off. Curious? More info on our dedicated page: Freight Packaging.

Transport Insurance

Transferring goods over long distances is a risky affair, unlike guarding them against fire. Enter Cargo Insurance, your safety net for shipping uncertainties. Whether it's a container accident at sea or loss of your goods, this insurance covers such unfortunate events. Think about it. Isn't it better to pay a fraction to ensure your shipment rather than bearing a total loss? More info on our dedicated page: Cargo Insurance.

Household goods shipping

Shipping your valuable belongings from the UK to Singapore? We handle both fragile and bulky items with exceptional care and flexibility. Imagine your grandma's precious china sets or an oversize art sculpture transported damage-free. Our expertise ensures a stress-free move. More info on our dedicated page: Shipping Personal Belongings

Procurement in Thailand

Confused by cross-continent supplier sourcing? DocShipper's got your back. We'll find your ideal match in Asia or East Europe: high-quality, budget-friendly, and reliable. No more language panic. We'll sail you through the entire procurement process - hassle-free. See how it works at our Sourcing services page.

Quality Control

Securing quality inspections in the manufacturing process is critical when shipping between the UK and Singapore. It ensures your goods meet both your standards and international trade regulations, preventing costly and time-consuming issues at customs. For instance, our recent client avoided a potential penalty when our meticulous quality check found non-compliant electronic components. Don't leave things to chance.

Conformité des produits aux normes

Ensuring your goods meet all applicable standards is crucial when crossing borders. With our Product Compliance Services, we eliminate the complexity of the process, offering laboratory tests and obtaining all the necessary certifications for seamless shipment. By doing so, you avoid costly complications and delayed delivery timelines. More info on our dedicated page: Product compliance services