Freight shipping between the UK and India : Rates -Transit time – Duties & taxes

Shipping from the UK to India doesn't have to be as spicy as a Vindaloo curry! Figuring out rates, accurate transit times, and grasping the complexities of customs regulations can feel like a daunting task. But worry not, this all-inclusive guide is designed to help you unravel the ins and outs of freight shipping between these two vibrant nations. Detailed inside, you'll find thorough explanations of air, sea, road, and rail freight, handy tips regarding customs clearance, nuances of duties and taxes, and practical advice to ensure a seamless shipping experience for your business. If the process still feels overwhelming, let DocShipper handle it for you! As a protagonist in the world of international freight forwarding, we transform the labyrinth of freight shipping into an effortless journey, turning potential headaches into your business's soaring success.

Which are the different modes of transportation between UK and India?

Non extrait

Need help with your shipment?

Need assistance with your shipment? Dont hesitate to contact us even for a simple question. Choose the option that suits you

Live chat with an expert Chat on WhatsApp Free Quote 24hHow can DocShipper help you

Sea freight between UK and India

The dance of trade between the UK and India is a complex ballet, with ocean shipping playing a vital role. It’s where Bristol meets Mumbai and Southampton waltzes with Kolkata. Sea freight, despite its stately pace, shines as the belle of the ball for transporting high-volume goods. It’s the tortoise in the race – slow but an affordable champion for businesses sending mighty cargos.

However, the path isn’t always clear, like trying to find the North Star in a cloud-stricken sky. Companies often stumble, making missteps in unfamiliar territory. This, of course, can lead to delayed shipping, excess costs and goods trapped in customs. But fear not, there’s a lighthouse to guide you through. In this part of our guide, we’ll sail into the stormy waters of common mistakes businesses make when shipping between these two vibrant nations. We’ll provide a compass of best practices, mapping out the sea route from the UK to India, so you can conquer this trade route you’re navigating with ease and assurance.

Main shipping ports in UK

London Gateway

Location and Volume: Situated in the southeast of England, the London Gateway is significant for its accessibility to London, one of the world’s banking centers, with an annual shipping volume of more than 1 million TEU.

Key Trading Partners and Strategic Importance: Partners predominantly include Asia, especially China and India, and the Netherlands, thereby playing a major role in EU trade. Its strategic importance lies in its automotive ro-ro terminal and the ability to handle sizeable container ships.

Context for Businesses: If you’re planning to conduct trade with Asian markets or aiming to gain easy access to the affluent consumer market around London, the integration of London Gateway into your shipping logistics might provide strategic advantages due to its capacity to handle large-scale traffic.

Port of Felixstowe

Location and Volume: Found on the eastern coast of England, the Port of Felixstowe is the largest container port in the UK, handling around 4 million TEUs per year.

Key Trading Partners and Strategic Importance: Key trading partners include China, Southeast Asia, North America, and the rest of Europe. It also serves as a vital transshipment hub with over 90 container shipping lines.

Context for Businesses: Businesses venturing into European and Asian markets might find Felixstowe invaluable due to its comprehensive shipping line connections and its stature as the country’s busiest container port.

Port of Liverpool

Location and Volume: Located in the northwest of England, the Port of Liverpool handles about 700,000 TEUs annually.

Key Trading Partners and Strategic Importance: The port’s key trading partners include the USA, China, Russia, and Ireland. It offers a direct maritime route to Northern America, making it vital for transatlantic trade.

Context for Businesses: Companies seeking to boost their transatlantic trade might consider integrating the Port of Liverpool into their logistical plans given its convenient access to Northern America and the well-served national highway network.

Port of Southampton

Location and Volume: Positioned on the south coast of England, the Port of Southampton manages approximately 1.9 million TEUs annually.

Main shipping ports in UK

London Gateway

Location and Volume: Situated in the southeast of England, the London Gateway is significant for its accessibility to London, one of the world’s banking centers, with an annual shipping volume of more than 1 million TEU.

Key Trading Partners and Strategic Importance: Partners predominantly include Asia, especially China and India, and the Netherlands, thereby playing a major role in EU trade. Its strategic importance lies in its automotive ro-ro terminal and the ability to handle sizeable container ships.

Context for Businesses: If you’re planning to conduct trade with Asian markets or aiming to gain easy access to the affluent consumer market around London, the integration of London Gateway into your shipping logistics might provide strategic advantages due to its capacity to handle large-scale traffic.

Port of Felixstowe

Location and Volume: Found on the eastern coast of England, the Port of Felixstowe is the largest container port in the UK, handling around 4 million TEUs per year.

Key Trading Partners and Strategic Importance: Key trading partners include China, Southeast Asia, North America, and the rest of Europe. It also serves as a vital transshipment hub with over 90 container shipping lines.

Context for Businesses: Businesses venturing into European and Asian markets might find Felixstowe invaluable due to its comprehensive shipping line connections and its stature as the country’s busiest container port.

Port of Liverpool

Location and Volume: Located in the northwest of England, the Port of Liverpool handles about 700,000 TEUs annually.

Key Trading Partners and Strategic Importance: The port’s key trading partners include the USA, China, Russia, and Ireland. It offers a direct maritime route to Northern America, making it vital for transatlantic trade.

Context for Businesses: Companies seeking to boost their transatlantic trade might consider integrating the Port of Liverpool into their logistical plans given its convenient access to Northern America and the well-served national highway network.

Port of Southampton

Location and Volume: Positioned on the south coast of England, the Port of Southampton manages approximately 1.9 million TEUs annually.

Main shipping ports in India

Port of Mumbai

Location and Volume: Situated in the country’s west region on the Arabian Sea, the Port of Mumbai is one of the oldest and most significant ports in India, handling around 63 million metric tons of cargo annually.

Key Trading Partners and Strategic Importance: Key trading partners include the Middle East, Africa, Europe, and America. It’s strategically crucial due to its proximity to key markets and its ability to handle a wide range of cargo types, including container and dry cargo.

Context for Businesses: If your strategy involves reaching markets in the Middle East, Africa, or Europe, the Port of Mumbai can be a valuable connection due to its versatile cargo handling facilities and significant shipping volume.

Port of Chennai

Location and Volume: Located on the Bay of Bengal’s Coromandel Coast, the Port of Chennai is India’s second largest port. It manages in excess of 100 million metric tons of cargo annually.

Key Trading Partners and Strategic Importance: It has strong trading connections across Asia, the Americas, and Europe. The port is a significant logistics and shipping hub, with a focus on automotive, petroleum, and iron ore shipments.

Context for Businesses: If you’re involved in the automotive industry or deal with petroleum and iron ore, the Port of Chennai’s dedicated facilities could streamline your shipping operations.

Kandla Port

Location and Volume: Found on the Gulf of Kutch, the Deendayal Port, also known as Kandla Port, is acknowledged as India’s largest port by volume, handling over 110 million metric tons annually.

Key Trading Partners and Strategic Importance: Key partnerships include countries from the Middle East, Africa, and Asia. Its strategic location in the Northern Indian Ocean makes it a pivotal player in India’s maritime trade.

Context for Businesses: For businesses looking to ship bulk commodities like salt, textiles, and grain, Kandla Port’s specialized handling facilities and its connections to key regions could significantly simplify your supply chain.

Kolkata Port

Location and Volume: Positioned on the Hooghly River in Eastern India, the Kolkata Port is one of the country’s major river ports, managing around 63 million metric tons of cargo every year.

Key Trading Partners and Strategic Importance: It primarily trades with Southeast Asia, the Americas, and Europe. It is critically important to Eastern India’s economy, especially for shipments involving tea and steel.

Context for Businesses: If your shipments necessitate river transport or are connected to the tea or steel industries, the Kolkata Port may be an optimal choice due to its unique location and specialized handling methods.

Nhava Sheva Port

Location and Volume: Also named Jawaharlal Nehru Port, Nhava Sheva is sited on the Arabian Sea in Western India. It’s the country’s largest container handling port, with an annual capacity of 5 million TEUs.

Key Trading Partners and Strategic Importance: It operates with various global partners and is strategically crucial due to its advanced container handling capabilities and modern infrastructures.

Context for Businesses: Nhava Sheva could be the port for you if you’re shipping a high volume of containerized cargo due to its commendable container handling capacity and technological advancements in cargo loading and unloading.

Vishakhapatnam Port

Location and Volume: Found on India’s east coast facing the Bay of Bengal, Vishakhapatnam Port handles over 65 million metric tons of cargo annually.

Key Trading Partners and Strategic Importance: The port trades predominantly with Asia and Africa and is strategically important due to its location and specialization in handling iron ore, coal, and general cargo.

Context for Businesses: If your business entails shipping iron ore, coal, or general cargo to Asian or African markets, Vishakhapatnam Port’s strategic location and specialized facilities could offer considerable advantages.

Should I choose FCL or LCL when shipping between UK and India?

Deciding between Full Container Load (FCL) or Less than Container Load (LCL), commonly known as consolidation, is no small task for shipping goods between the UK and India. It’s a strategic call affecting cost, delivery times, and the whole logistics process. Your business’s unique needs will determine the best fit. Buckle up for a structured comparison aimed at empowering you to make an educated decision for seamless, effective, and efficient shipping. Let’s dive into the particulars and dispel any confusion. Stay tuned!

Full container load (FCL)

Definition: FCL, which stands for Full Container Load, is an option in ocean freight where you get exclusive rights to a container - be it a 20'ft or a 40'ft container.

When to Use: FCL Shipping is both economical and secure for high volume transport. If your cargo volume exceeds 13 to 15 CBM, opting for an FCL container is a wise move. With FCL, your goods are the only ones in the container for the entirety of the journey from the UK to India, which ensures safety as the container remains sealed from origin to destination.

Example: For instance, let's imagine a UK-based supplier needs to ship 100 CBM of automotive parts to India. By choosing FCL, they can ship in 5x 20'ft containers or 2x 40'ft containers, thereby ensuring product safety and reducing the unit cost.

Cost Implications: While FCL might have a higher initial cost on your FCL shipping quote, the cost per unit is usually lower when dealing with larger volume shipments. Therefore, over time, you'll notice significant cost savings when compared with LCL or other shipping methods.

Less container load (LCL)

Definition: LCL or Less than Container Load shipping is an economical solution to transport smaller cargo volumes that do not fill a full container. It involves consolidating your shipment with others to create a full container load.

When to Use: LCL is particularly beneficial when shipping cargo less than 13/14/15 cubic metres (CBM). This provides flexibility as you only pay for the space your cargo occupies, which makes it a cost-effective method for low volume shipments.

Example: For instance, if you're a Manchester-based handicraft business shipping small quantities of merchandise to Delhi, LCL shipment offers you the advantage of sharing the container and consequently, the cost with other businesses. You avoid unnecessary expenses of booking an entire container.

Cost Implications: While less expensive in comparison to full container loads for lower volume, LCL freight charges can be higher when calculated per cubic meter. Costs also factor in terminal handling charges since your cargo shares space on a container that requires consolidation and deconsolidation at ports. It's crucial to evaluate your freight needs considering these cost implications.

Hassle-free shipping

Looking to ship your cargo between the UK and India without a hitch? At DocShipper, our mission is to streamline this process for you. Our ocean freight experts weigh up essential factors such as cost, time, the nature of goods, and various logistics before recommending the best option: consolidation or full container. Don't leave it to chance - secure the best advice now! Contact us for a free, no-obligation freight estimation today.

Sea freight between the UK and India typically takes approximately 22 to 30 days, although exact transit times may fluctuate based on factors such as the specific ports utilised, the weight of the goods, and their nature. It would be beneficial to contact a freight forwarder such as DocShipper for a bespoke quote to cater to your unique shipping needs.

Below is a text-only table indicating rough sea freight transit times between some of the main freight ports in the UK and India.

| UK Ports | India Ports | Average Transit Time |

| London | Mumbai | 26 |

| Southampton | Chennai | 28 |

| Liverpool | Kolkata | 28 |

| Felixstowe | Mundhra | 30 |

Please note that these are approximations, and actual shipping times may vary.

How much does it cost to ship a container between UK and India?

Understanding ocean freight rates from the UK to India can be a bit like solving a puzzle, with several pieces needing to align perfectly. Shipping cost per CBM can fall within a wide spectrum, reflecting the complexities of international logistics. The variables such as Point of Loading and Destination, carrier choice, nature of goods, and wavering market trends significantly impact the final cost. Still, don’t let this deter you. Our dedicated shipping specialists excel in making sense of this mosaic, tailoring quotes to your specific needs. Hence, rest assured, we’ll help you navigate this sea of possibilities efficiently, offering you the best possible rates each time.

Special transportation services

Out of Gauge (OOG) Container

Definition: An OOG container is a type of sea freight shipping method that specializes in handling out of gauge cargo, typically oversized or heavyweight items that won’t fit into standard containers.

Suitable for: OOG is apt for shipping large industrial equipment, oversized machinery, or construction materials that exceed standard container dimensions.

Examples: Companies dealing in windmill propellers, cranes, or large engine parts frequently utilize OOG for their shipping needs.

Why it might be the best choice for you: If your business revolves around transporting oversized or heavyweight products from UK to India, opting for an OOG container could be efficient and cost-effective.

Break Bulk

Definition: In break bulk shipping, cargo items are handled individually, not in containers. Once loaded onto the vessel, these individual items are then secured and protected.

Suitable for: This method is ideal for large items that do not fit into standard containers and cannot be disassembled, such as large manufacturing machines, boats, or trucks.

Examples: If your business includes handling items like large turbines, manufacturing equipment, or yachts, you might consider break bulk shipping.

Why it might be the best choice for you: Break bulk will facilitate the safe and efficient transportation of your large, non-disassemblable cargo from the UK to India.

Dry Bulk

Definition: Dry bulk shipping involves the transportation of homogenous bulk cargoes, generally a ‘loose cargo load’, in large quantities.

Suitable for: Commodities such as coal, grain, or minerals that can be piled and loaded directly into a ship’s hold.

Examples: If you deal in commodities like barley, cement, or iron ore, dry bulk shipping might be suitable.

Why it might be the best choice for you: If you’re in the business of trading bulk goods, choosing dry bulk could ensure efficient and economical transport of your commodities.

Roll-on/Roll-off (Ro-Ro)

Definition: Roll-on/Roll-off service utilizes an ro-ro vessel, permitting wheeled cargo to be ‘rolled on’ at origin and ‘rolled off’ at the destination.

Suitable for: Primarily suitable for transportation of vehicles, trailers, mobile machinery, or any other wheeled and driveable cargo.

Examples: If your business involves regular transportation of cars, trucks, or other motorized vehicles, you should consider Ro-Ro.

Why it might be the best choice for you: Ro-Ro simplifies the complex process of loading and unloading motorized items, making it an ideal choice if you frequently transport such cargo.

Reefer Containers

Definition: Reefer containers are temperature-controlled cargo containers that allow goods to be shipped at a constant temperature from origin to destination.

Suitable for: Ideal for products that need temperature control, such as food items, pharmaceuticals, or certain chemicals.

Examples: If your business deals in pharmaceuticals, fresh foodstuff, or wines, you might want to employ reefer containers.

Why it might be the best choice for you: This type of container will provide the necessary temperature regulation to ensure your temperature-sensitive products reach their destination in optimal condition.

All these shipping methods can cater to different types of needs. At DocShipper, we walk you through these options and help you choose the method that best fits your business needs. Please feel free to get in touch for a free shipping quote within 24 hours.

Air freight between UK and India

Soaring faster and higher, air freight between the UK and India can be your ticket to prompt, reliable shipping, especially with compact, pricey goods in the mix. Imagine lending your grandmother’s cherished heirloom across continents – you’d want it fast and safe, wouldn’t it? That’s air freight for you! Swap those heirlooms for your high-end electronics, fashion accessories or crucial documents, and it’s the same deal.

On the flip side, imagine setting out to cook a famous recipe but miscalculating the ingredients. The dish is doomed, isn’t it? Many shippers face a similar downfall with air freight. From incorrect weight calculations to overlooking best practices, erroneous estimations can skyrocket your expenses. Unravel these complexities with us as we unveil the secrets to mastering air freight.

Air Cargo vs Express Air Freight: How should I ship?

Tackling UK to India shipping and not sure whether to opt for air cargo or express air freight? Consider this, air cargo hitchhikes on your regular airlines while express air freight books its private plane to ensure the quickest delivery. Your choice completely depends on your unique business needs and timelines – let’s dive in and uncover what’s best for your shipments.

Should I choose Air Cargo between UK and India?

If you’re contemplating freight alternatives between the UK and India, air cargo, while not the fastest due to fixed schedules, can be a cost-effective and reliable option, especially for shipments exceeding 100/150 kg (220/330 lbs). Consider leading airlines like British Airways and Air India, well-known for their extensive cargo services. This choice might just fit your budget, ensuring your consignment reaches securely without burning a hole in your pocket.

Should I choose Express Air Freight between UK and India?

Considering shipping goods between the UK and India in less than a week? Here’s why Express Air Freight can be your go-to choice. As a dedicated service using cargo-only planes, Express Air Freight offers unbelievably quick transit times. It’s perfect for shipments under 1 CBM or 100/150 kg (220/330 lbs). Trustworthy courier firms such as FedEx, UPS, or DHL specialize in such services. For your business’s urgent or lightweight goods, this service could be an ideal, economical way to facilitate speedy cross-border trade.

Main international airports in UK

London Heathrow Airport

Cargo Volume: 1.6 million metric tonnes per year

Key Trading Partners: USA, China, Hong Kong, Germany, Japan

Strategic Importance: Heathrow primarily supports the UK’s imports and exports and is a crucial hub connecting Europe with the world.

Notable Features: Boasts two parallel runways and five terminals. Offers extensive cargo handling facilities equipped with refrigeration services for temperature-sensitive goods.

For Your Business: As Europe’s busiest airport, integrating Heathrow into your shipping strategy provides access to numerous destinations. Its advanced facilities can manage a variety of cargo types, ensuring efficient, safe transport for your goods.

East Midlands Airport

Cargo Volume: 365,000 metric tonnes per year

Key Trading Partners: Europe, USA, and Asia

Strategic Importance: East Midlands Airport is the UK’s largest pure cargo airport and stands as an express freight hub for the UK due to its central location.

Notable Features: The airport is the key hub for DHL, UPS, TNT and Royal Mail.

For Your Business: If speed and accessibility within the UK and Europe are your utmost concerns, East Midlands would play a vital role in achieving fast turnovers and short delivery times.

Manchester Airport

Cargo Volume: 123,000 metric tonnes per year

Key Trading Partners: USA, Singapore, UAE, Hong Kong, Germany

Strategic Importance: Major point of entry and exit for goods, especially for the Northern Powerhouse region in UK.

Notable Features: The airport has a £1 billion expansion plan that includes a huge logistics hub, making it a future-proof choice.

For Your Business: The airport’s expansion plan and its close proximity to major UK cities makes it a highly beneficial option for strengthening your supply chains.

Stansted Airport

Cargo Volume: 250,000 metric tonnes per year

Key Trading Partners: USA, Hong Kong, Turkey, Germany, UAE

Strategic Importance: Stansted is London’s third-busiest airport and acts as an essential gateway for goods entering and leaving the South East of England.

Notable Features: Stansted is home to one of FedEx’s and UPS’s largest cargo operations within the UK.

For Your Business: Perfect for businesses needing hefty cargo operations and fast access to London and the South East, the airport’s modern cargo facilities promise efficiency and high-quality service.

Gatwick Airport

Cargo Volume: 95,000 metric tonnes per year

Key Trading Partners: USA, UAE, China, Canada, Qatar

Strategic Importance: Gatwick serves as an important player in UK’s economic growth, linking businesses to international markets.

Notable Features: Features two terminal buildings and a world-class cargo facility.

For Your Business: Ideal for large-scale imports and exports, Gatwick’s extensive network and cargo facilities ensure effective handling of your products. Plus, its tight security measures mean peace of mind for your valuable shipments.

Main international airports in India

Indira Gandhi International Airport

Cargo Volume: Handles over 2 million metric tonnes of cargo annually.

Key Trading Partners: USA, China, UAE, Hong Kong, and the UK are the primary trading partners.

Strategic Importance: As the busiest airport in terms of cargo traffic in India, it is the primary hub for importing and exporting goods, providing vast connectivity and speedy logistics.

Notable Features: Home to two integrated cargo terminals with state-of-the-art facilities like cold storage and animal quarantine.

For Your Business: With extensive trading links and modern infrastructure, this airport can provide timely delivery, making it a reliable choice if you deal in perishable or time-sensitive goods.

Chhatrapati Shivaji Maharaj International Airport

Cargo Volume: Facilitates approximately 1 million metric tonnes of cargo every year.

Key Trading Partners: USA, UK, UAE, Singapore, and Belgium.

Strategic Importance: Located in the financial capital of India, Mumbai, it plays a vital role in facilitating international trade.

Notable Features: Features a dedicated cargo terminal, known for its cargo handling efficiency and modern facilities.

For Your Business: For businesses located in western India, considering the proximity and excellent connectivity, this airport could serve as a convenient and efficient choice.

Kempegowda International Airport

Cargo Volume: Moves over 400,000 metric tonnes of cargo annually.

Key Trading Partners: USA, UK, Germany, Singapore, and China.

Strategic Importance: As the third busiest cargo airport in the country, it significantly contributes to the South Indian economy.

Notable Features: It hosts the country’s first dedicated express cargo terminal for export and import of courier and express parcels.

For Your Business: Ideal if your business involves frequent movement of parcel or courier-type goods considering its support for express deliveries.

Chennai International Airport

Cargo Volume: Handles approximately 400,000 metric tonnes of cargo every year.

Key Trading Partners: USA, Hong Kong, UK, Germany, and Sri Lanka.

Strategic Importance: Being in the southern part of India, it acts as a significant access point to South Asian and South-East Asian countries.

Notable Features: It offers a cargo village facilitating efficient consolidation, storage, and movement of goods.

For Your Business: Its strategic location and excellent infrastructure could benefit businesses that have major transactions with South and South-East Asian markets.

Netaji Subhas Chandra Bose International Airport

Cargo Volume: Deals with about 150,000 metric tonnes of cargo annually.

Key Trading Partners: UK, Belgium, UAE, China, and Hong Kong.

Strategic Importance: Serving the eastern part of India, it handles a lot of the trade for the region.

Notable Features: It has a new cargo terminal catering to the needs of perishable and non-perishable goods.

For Your Business: It can be a significant gateway if your business involves trade with eastern India or Eastern Asia due to its geographical proximity.

How long does air freight take between UK and India?

Shipping goods from the UK to India via air freight typically takes between 3 to 5 days. However, remember that this is an average transit time. Actual shipping times can vary depending on several factors, including the specific airports in operation, the weight of your goods, and their nature. If you need more precise timings for your unique shipping needs, it’s recommended to consult with an expert freight forwarder like DocShipper.

How much does it cost to ship a parcel between UK and India with air freight?

Shipping rates for air freight parcels between the UK and India widely range from £2.50 to £5.00 per kilogram, but this can fluctuate. Factors including distance from departure and arrival airports, dimensions, weight, and nature of goods, among others, all influence the final cost. It may seem complex, but don’t worry; each quote is uniquely tailored, ensuring you get the most competitive rates. Contact us today for a free, no-obligation quote within 24 hours. We will guide you through the process to find the most cost-effective solution for your freight needs.

What is the difference between volumetric and gross weight?

Understanding gross weight and volumetric weight is crucial for air freight shipping. Gross weight refers to the actual weight of the shipment, that’s to say the weight of the goods including packaging and pallet. On the other hand, volumetric weight, also called dimensional weight, is a calculated weight based on the volume that the shipment occupies in the aircraft.

Let’s break down how these are calculated:

In air cargo services, the volumetric weight is calculated by multiplying the length, width, and height of the package (in centimeters) and then dividing by 5000. For Express Air Freight, the divisor is usually 5000 as well. But it can vary slightly among different carriers.

Here’s an example: Let’s say you have a package measuring 50cm x 40cm x 30cm and weighing 20kg. The volumetric weight would be (50 x 40 x 30) / 5000 = 12kg (or 26.46lbs). So, in this case, your gross weight of 20kg (or 44.09lbs) is the weight considered for shipping because it’s higher.

Now, why does this matter? Carriers charge based on whatever is greater between the gross and volumetric weight. It ensures that carriers are compensated fairly for the space that your shipment is taking up, regardless of its actual weight. It’s a critical aspect to consider for controlling your shipping expenses.

Door to door between UK and India

Door-to-door shipping is a one-stop solution for business transactions from UK to India. Simply put, it handles everything, from pick-up at the origin to delivery at the destination. Its appeal lies in the ease and convenience, eliminating the hassle of coordinating multiple transport providers. This method is especially viable for busy businesses eyeing UK-India trade. Let’s dive in and explore its numerous benefits.

Overview – Door to Door

Shipping goods between the UK and India can feel like a maze – but there’s a hassle-free solution: Door to Door shipping. This service, popular among our clients, eases the complexities of shipping logistics including transport, customs, and duties, making it simple and efficient. However, it can be more costly and slightly lengthier due to customs formalities, but with peace of mind as a highlight, many businesses find it worth the investment. Imagine, no more juggling multiple service providers – it’s about simplicity and absolute ownership, from pickup to delivery! With Door to Door shipping, you’re not just moving goods, you’re boosting your business efficiency.

Why should I use a Door to Door service between UK and India?

Ever thought shipping goods was more exhausting than biting into a rock-hard bagel? Fret no more! Door-to-door services orchestrating your shipment from the UK to India can literally save your day. Here’s the top 5 reasons:

1. Stress Free: Door-to-Door services take care of everything from pickup to delivery, eliminating the prickly logistics and paperwork – imagine your goods on a VIP journey, while you relax.

2. Punctuality: Urgent shipments feel like ticking time bombs? Door-to-Door options promise strict adherence to timelines, with swift customs clearance process and direct delivery, your goods won’t be out on a leisurely stroll.

3. Specialized Care: Your complex cargo deserves the best. Complex goods are handled with precision and care – think of it as the cargo equivalent of a five-star chauffeur service.

4. Comprehensive Convenience: Trade the painful process of coordinating trucking from seaport to final destination for a snooze button. Your shipment’s entire journey is organized by one service provider, ensuring seamlessness.

5. End-to-End Tracking: The satellite-TV-in-a-hotel-room equivalent for your shipment – complete visibility. Know where your goods are, from the moment they leave until they reach their destination. Your sleepless nights of ‘where’s my shipment?’ are over.

In a nutshell, door-to-door service between the UK and India is essentially peace of mind packed in a shipping container. It’s convenient, swift, offers comprehensive tracking, and offers VIP treatment for your cargo. You wouldn’t want it any other way. Trust us.

DocShipper – Door to Door specialist between UK and India

Embrace simple, stress-free shipping between the UK and India with DocShipper. Our comprehensive services cover packing, transportation, customs procedures, and delivery through all methods. With the expert guidance of a dedicated Account Executive, we streamline the process from A to Z, so you don’t have to lift a finger. Reach out to our consultants for free advice or request your no-obligation estimate – we usually respond in 24 hours or less. Trust us with your freight forwarding needs. We make global shipping lucid and convenient.

Customs clearance in India for goods imported from UK

Customs clearance a critical hurdle when shipping goods from the UK to India. Complex and full of potential pitfalls, it’s all about sidestepping unexpected fees and charges. Misunderstanding customs duties, taxes, quotas, or licenses might mean your goods hit a roadblock. But don’t worry, we’ll step through these areas in detail. crucially, misunderstanding any of these could lead to goods getting stuck in customs. Here to assist you through this labyrinth is DocShipper. Our prowess spans across all kinds of goods, anywhere in the world. For estimates tailored to your project, our team is ready to hear about the origin of your goods, their value and the HS Code. These three elements are mandatory for us to guide you effectively.

How to calculate duties & taxes when importing from UK to India?

Determining the customs duties and taxes for your shipment from the UK to India requires familiarity with several key components. The country of origin – in this case, the UK – is where the goods were manufactured or produced and is the first step to unlocking your customs calculation. You also need to have your product’s HS Code, as this code is internationally used to classify products for trade and tariff purposes. The Customs Value of your item is another crucial figure, it’s the complete cost of your product, inclusive of transportation, insurance, and any related costs until the goods arrive at the port of destination in India. And then, there’s the Applicable Tariff Rate, this rate is specific to India and varies depending on the product category and trade agreements between countries. Lastly, don’t forget that there might be miscellaneous taxes and fees applicable to your product that could influence the final cost.

With that understanding, let’s dive into it. Our first task is to identify and confirm the country where your goods originated, which serves as the stepping stone in this calculation process.

Step 1 – Identify the Country of Origin

First, let’s unpack why identifying the country of origin, in this case the UK, is more critical than it may first appear.

1. Accuracy: It authenticates the goods’ provenance, ensuring all declarations match.

2. Trade Agreements: The UK and India are in unique economic relations, your duty rates could be impacted by these.

3. Compliance: This can prevent penalties related to misinformation or non-compliance with import regulations.

4. Influence on duties: The country of origin is a significant factor in estimating import duties.

5. Import Restrictions: Some goods from certain locations might face special regulations.

Let’s talk trade agreements. India doesn’t have a free trade agreement with the UK, but they do have a bilateral trade agreement. With this, some items might have reduced duties. Key to remember, each product and agreement is unique, your duties will vary accordingly.

Now, onto import restrictions. India has specific prohibitions on items such as drones, e-cigarettes, and certain agricultural products. Cross-check your goods with India’s banned list to prevent any cross-border hiccups.

Put simply, never underestimate the power of accurate origin identification. It provides the baseline for an uncomplicated, cost-effective shipping process.

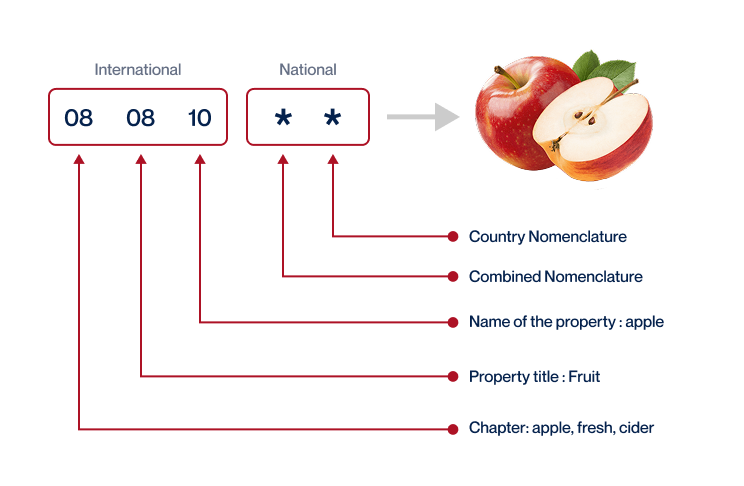

Step 2 – Find the HS Code of your product

The Harmonized System Code, or HS Code, is a global standardized system of names and numbers for classifying imported and exported products. It’s used by authorities across the world to determine and levy customs duties on goods. Knowing the HS Code of your product is crucial to streamline your shipment process.

Usually, the easiest path to finding the HS Code of your product is by asking your supplier or manufacturer. They’re likely to be familiar with the products they’re providing and the relative import and export regulations.

However, if that resource isn’t available, you can still find it yourself using an easy step-by-step process. Firstly, use an HS lookup tool, such as the Harmonized Tariff Schedule.

After opening the tool, input the name of your product in the search bar. Your search will yield results with various classifications.

From these results, look under the Heading/Subheading column to find the HS Code that most accurately reflects your product.

Yet, a note of importance is in order. Accuracy is key when selecting your HS Code. An incorrect code can lead to shipping delays, potential fines, and complications with customs authorities. Be as specific and correct as you can be.

Here’s an infographic showing you how to read an HS code. Keep this guide handy for quick and easy reference in the future.

Step 3 – Calculate the Customs Value

Understanding customs value can sometimes be tricky, but it’s essential to figure out your import duties. With this in mind, let’s tackle how customs value differs from the product’s price. The customs value, or CIF value, isn’t just the raw price of your goods. It’s a more comprehensive figure that includes the price of the goods, the cost of international shipping, and the insurance cost, all summed up.

For instance, let’s say you’re bringing in textiles from the UK priced at $5,000. Shipping charges are $500, and insurance costs $100. Here, your CIF value isn’t the product’s cost ($5,000) but rather $5,600. This CIF value is what Indian Customs will consider when calculating your duties, affecting your total import costs. Keeping this in mind can save you from surprising costs down the line and streamline your importing process.

Step 4 – Figure out the applicable Import Tariff

An import tariff refers to the tax imposed by a country on imported goods, determined based on the specific product type. The UK uses a different system, with tariff classifications that entail Most Favored Nation (MFN) Tariff, and Preferential Tariffs such as Generalized Scheme of Preferences (GSP), among others.

To determine the relevant tariff for your goods, follow these steps:

1. Visit the Trade Tariff: look up commodity codes, duty, and VAT rates page on the UK government’s website.

2. Enter the identified HS code and country of origin.

3. Check the duties and taxes that apply to your product.

Take, for example, you’re importing bicycles (HS code 8712) from the UK to India. The tool shows an MFN tariff rate of 25%. Then, suppose your CIF (cost, insurance, and freight) amount is $1000. Your import duty would be 0.25 x $1000 = $250. This means you’ll pay $250 as an import duty, over and above your CIF costs, making your total expenditure $1250. It’s practical insights like these that can help navigate the complexity of international trade.

Step 5 – Consider other Import Duties and Taxes

In the world of international shipping, knowledge is power – particularly when it comes to understanding import duties and taxes. Beyond the standard tariff rate, sometimes additional duties arise based on the product and its country of origin. These can include excise duty and anti-dumping taxes, adding an extra layer of financial complexity.

Just to clarify, let’s talk VAT – Value Added Tax. India’s standard VAT rate is approximately 18%, but be aware this is subject to variations depending on the type of product. Picture this, you’re importing electrical machinery valued at $10,000. Standard customs duty is around 7.5%, bringing your initial cost to $10,750. However, don’t forget the anti-dumping tax or potential excise duties. To top it off, let’s calculate VAT: 18% of $10,750, which equals $1935. Therefore, your final cost could be $10,750+$1935= $12,685 purchasing price.

These are hypothetical figures for illustrative purposes only, actual rates may vary. Remember, every product and shipment will likely have a different duty or tax structure, so always double-check with the respective customs department. It’s all part and parcel of ensuring a smooth and fiscally sound importing process.

Step 6 – Calculate the Customs Duties

In ‘Step 6 – Calculate the Customs Duties‘, you’re essentially calculating how much you must pay to import your goods from the UK to India. The basic formula considers three essential elements: Customs Value (CV), which is the cost of the goods + shipping + insurance; Value Added Tax (VAT); and Anti-Dumping Taxes (ADT), if applicable.

For instance, if you’re importing goods valued at $1,000 (CV), with no VAT or ADT, your customs duty calculation is fairly straightforward – it’s simply a percentage of your CV as governed by Indian customs regulations.

Alternatively, if VAT is applicable, say at 10%, and CV is still $1,000, you’ll compute the customs duties on $1,000 and then apply the 10% VAT to the sum of CV + Customs Duties.

Lastly, if you’ve to account for ADT, let’s assume it’s $100, and there’s an additional Excise Duty of 5%. Your final amount will include CV + Customs Duties + VAT + ADT + Excise Duty. Please note that the percentages can vary based on the type of goods.

Customs duties can seem complicated, but don’t worry. At DocShipper, we promise to handle every step of your customs clearance experience. Whether you’re navigating a routine procedure or tackling an unexpected hurdle, our team is on standby to ensure idyllic sailing for your cargo. Never overcharged, stocking up in over 40 countries, we’re proficient in providing timely, cost-effective solutions. Get in touch for your free quote, and let’s circumnavigate these customs mysteries together within 24 hours.

Does DocShipper charge customs fees?

DocShipper, acting as your custom broker in the UK and India, ensures smooth sailing through the complex customs landscape but doesn’t charge customs duties. Confused? Here’s the difference: customs clearance fees are services rendered by us or any custom broker, whereas customs duties and taxes are government’s share. Think of it as a cinema ticket and popcorn – the ticket gets you in (our fees), while popcorn costs extra (duties and taxes). Worried about hidden charges? Every penny you pay towards duties is accounted for – we’ll provide documentation from the customs office to prove it.

Contact Details for Customs Authorities

UK Customs

India Customs

Official name: Central Board of Indirect Taxes and Customs (CBIC), Government of India

Official website: https://www.cbic.gov.in/

Required documents for customs clearance

Untangling the knot of customs documentation can feel like a Herculean task. This section dissects must-have documents – from the Bill of Lading to Documents of Conformity – simplifying the complex and guiding you toward smoother international shipping.

Bill of Lading

Shipping goods between the UK and India? You’re going to need the Bill of Lading. Think of it as the passport for your cargo – it’s an official document that signifies the handover of your goods to the shipping line. Most importantly, this is when ownership shifts from seller to buyer. Getting the electronic version (or telex release) speeds up the whole process because it’s distributed instantly worldwide which can be a lifeline if you’re in a time crunch. For air shipments, this document is known as the Air Waybill (AWB). Remember to always check this paperwork carefully, it’s the key to a smooth shipping experience!

Packing List

Keeping tabs on your cargo when shipping from UK to India can seem difficult, but a meticulously prepared Packing List can save the day! In essence, a Packing List is your product bible, chronologically recording every item in your shipment—ranging from weight, the count of cartons, to the material description in detail. Imagine you’re sending a thousand handcrafted wooden toys for a retail chain. Your Packing List helps Indian customs verify your consignment accurately and hastens clearance, preventing costly hold-ups. Whether you’re sending your goods by sea or air, accurate documentation is vital. So, keep your Packing List error-free and make your business thrive in seamless shipping!

Commercial Invoice

When shipping goods from the UK to India, your Commercial Invoice stands as the foundation for your customs clearance. It needs to detail the product description, buyers and sellers’ addresses, terms of delivery, and the total value of goods shipped. Misalignments or errors in it can result in significant delays at customs. For example, imagine you’re shipping garments and the Commercial Invoice vaguely lists them as ‘clothing items.’ Indian customs could hold back the shipment due to this lack of clarity. So, it’s crucial to accurately detail each item with their correct harmonized system (HS) code to ensure seamless transit. And remember, the invoice should always mirror the information on the packing list and Bill of Lading for a hitch-free process. This minimizes discrepancies and the chances of encountering roadblocks, helping you deliver more quickly and reliably.

Certificate of Origin

A Certificate of Origin is your golden ticket for smoother customs clearance when shipping goods from UK to India. It provides evidence that your goods were manufactured in a particular country – in this case, UK. You’re probably wondering, Why is this important? Well, India may have preferential customs duty rates for UK-made goods, potentially slashing your shipping costs. For instance, consider you’re a furniture manufacturer in Leeds exporting teakwood chairs to Mumbai. Your Certificate of Origin reveals UK as the manufacturing country, potentially qualifying you for lower duties. Remember, getting your goods faster and cheaper is all about the detail in your documents!

Certificate of Conformity (CE standard)

When shipping goods between the UK and India, your products must comply with certain safety, health, and environmental protection standards. One such crucial document is the Certificate of Conformity (CE standard). Though ‘CE’ was traditionally a European stamp of approval, it is internationally recognized, much like the ‘UL’ standard in the United States. However, post-Brexit, the UK now employs the UKCA (UK Conformity Assessed) marking. This isn’t a measure of quality assurance, but rather a testament that your product adheres to applicable regulatory requirements. When planning your shipment, ensure your goods bear the right marking, UKCA for the UK, or CE for the EU. This will simplify customs clearance, paving the way for a smoother shipping process between the UK and India.

Your EORI number (Economic Operator Registration Identification)

Shuffling goods between the UK and India? The EORI Number will quickly become your best friend. It’s a unique identifier designed to track imports and exports, especially vital if you’re also shipping to regions that require the EORI. For instance, before Brexit, UK traders used it for EU-bound shipments. Now, for your UK-India transit, having an EORI adds credibility, helping you establish trust with customs authorities. So how to get it? Straightforward really. Simply register for an EORI in the UK. You’ll receive your unique identifier and be all set to breeze through customs. Without it, you might face hefty delays and fines. Remember, smooth commerce relies on having the right paperwork in order.

Get Started with DocShipper

Prohibited and Restricted items when importing into India

Wrangling with import rules can feel overwhelming. Just a heads-up that shipping certain items into India can be a minefield of restrictions and prohibitions. Let’s take the confusion out of your way!

Are there any trade agreements between UK and India

Yes, significant trade arrangements exist which impact your business while shipping between the UK and India. Currently, there’s no formal FTA, however discussions for a UK-India Free Trade Agreement commenced recently. Meanwhile, Indian exporters can access tariff rate quotas under Generalised Scheme of Preferences, and EU’s Economic Partnership Agreements also apply. Additionally, a proposed £1 billion renewal in infrastructural projects such as railways signals future growth. Keep an eye on these developments that could offer your business lucrative opportunities.

UK – India trade and economic relationship

The UK-India trade relationship has centuries-old roots, strengthening through a shared history and progressing into a robust economic association today. The British Empire’s role in shaping India’s economic landscape remains significant; post-independence, both countries have consistently worked towards building a cooperative trade alliance.

From IT services to healthcare, sectors have been diversified. Investment from the UK to India reached around £18 billion by 2024, making it the 6th-largest foreign direct investor. The UK has also been receiving increasing Indian investments, totaling £1 billion in the past year.

Major commodities, including textiles, metals, and machinery, dominate the bilateral trade, with the total trade volume standing at £30 billion in 2024. This dynamic relationship underscores the boundless opportunities for businesses in both nations. The coming years are potentially even brighter, with the predicted post-Brexit bilateral trade increasing by up to £120 billion by 2030.

Your first steps with DocShipper

Additional logistics services

Warehousing

Finding the right warehousing solution can be like treading in the dark, especially when crucial elements like temperature control for special goods come into play. Having a dependable partner is vital to maintaining the quality of your shipments. Discover how we make this challenge simple on our dedicated page: Warehousing.

Packing

When exporting from the UK to India, paying meticulous attention to packaging and repackaging is critical. Choosing an experienced agent becomes imperative to tackle unique challenges, like intricately packing fragile ceramics or safely enclosing auto parts. Our comprehensive service takes away the uncertainty, ensuring your cargo reaches India securely. Dive into the specifics at our dedicated page: Freight packaging.

Transport Insurance

Introducing cargo insurance: Not your typical fire insurance, it's tailored to safeguard your shipping journey. Envision this: Storms lash your shipment out at sea, but relax, your insulated cargo remains untouched. It's all about pre-empting mishaps and ensuring your financial security. Curious to learn more? Check out our specialised guide at Cargo Insurance.

Household goods shipping

When relocating from the UK to India, your treasured items need thoughtful handling. From grandma's vintage vase to your oversized reading chair, our Personal Effects Shipping puts meticulous care into your bulky or fragile belongings. Picture a seamless journey, where even your most precious objects arrive intact and on time. For additional details about packing, freight options, and customs formalities, check out our Shipping Personal Belongings page.

Procurement in Thailand

When expanding your business from the UK to India, supplier management can be a real headache. Fortunately, DocShipper's got you covered; sourcing and manufacturing in not only Asia, but also East Europe and other regions. We'll hook you up with suppliers, oversee procurement, and even sort out language barriers. It's like having a personal GPS through the sourcing world. Check out more in our Sourcing services.

Quality Control

Shipping from the UK to India? Insisting on quality inspections during manufacturing or customization can save you from costly missteps. Imagine you dealt in bespoke brass fixtures, only to discover post-shipment that a batch failed to meet UK's specific alloy composition criteria. With our Quality Control service, such costly errors are flagged early. Avert product rejections and secure your reputation with proactive checks. More info on our dedicated page: Quality Inspection

Conformité des produits aux normes

Stumped by regulatory compliance when shipping goods? With our Product Compliance Services, dealing with such challenges is a breeze! Test in our accredited labs ensures your goods meet necessary regulations before they hit the market. Don't let non-compliance stop you. Visit our Product compliance services for more information.