Freight between the UK and Germany Tariffs – Transit times – Duties and taxes – Advice

Did you hear about the ship that became a national celebrity? It was always in the spotlight because it never left the dock! But when it comes to shipping goods between the UK and Germany, it's a different story. Various factors to consider like decoding rates, minimizing transit times, and unraveling complex customs regulations can make the whole process overwhelming. This guide is here to shed light on these gray areas. You'll learn about different types of freight options - from air and sea to rail and road – and get a firm grasp on customs clearance procedures, duties, and taxes. This guide is brimming with expert advice designed to help you navigate the choppy waters of cross-border trade successfully. If the process still feels overwhelming, let DocShipper handle it for you! As a professional international freight forwarder, we turn these shipping challenges into triumphant success for businesses like yours.

Which are the different modes of transportation between UK and Germany?

When moving goods from the UK to Germany, consider it like planning a road trip. Sure, flying is quickest, but not when you have an entire house to move! Here, land and sea rule. Distance is short, borders are open, rendering options like air or rail freight less practical. The choice then boils down to trucking or ocean shipping. Weigh these methods, keeping in mind your specific cargo, time sensitivity, and budget. Picking the best transport means balancing the needs of your load with the geography and customs between these two neighbors. Easy as a Sunday drive!

Need help with your shipment?

Need assistance with your shipment? Dont hesitate to contact us even for a simple question. Choose the option that suits you

Live chat with an expert Chat on WhatsApp Free Quote 24hHow can DocShipper help you

Sea freight between UK and Germany

Ocean freight is a cornerstone of the thriving trade relationship between the UK and Germany, connecting major industrial hubs via bustling ports like the Port of Hamburg and the Port of Felixstowe. It’s a cost-effective transport solution, especially when you’re shipping high-volume goods. However, the sea route between these European mainstays, albeit vital, isn’t without its challenges. Many a shipper has tangled with confusing customs regulations, logistical hiccups, and baffling bureaucratic snags. It’s easy to stumble, but luckily, smooth sailing is within your reach.

In this section, we’ll chart the course for successful shipping practices between these two countries. You’ll learn how to keep your cargo shipshape from Port to Port. We’ll tackle those pesky pain points head-on, making tricky regulations a breeze instead of an obstacle course. By the end, you’ll have a firm grasp on the sea freight route from the UK coastlines to the bustling harbours in Germany, fully equipped to navigate the ebb and flow of overseas logistics.

Main shipping ports in UK

Port of Felixstowe

Location and Volume: Located in Suffolk and overlooking the North Sea, the Port of Felixstowe is Britain’s largest and busiest port, dealing with over 40% of Britain’s containerised trade. With a shipping volume of more than 3.8 million TEU, it is a critical link in UK trade.

Key Trading Partners and Strategic Importance: The port’s key trading partners reside predominantly in Asia, with China and Hong Kong taking a significant share. Additionally, relationships with the USA, Spain, and Belgium contribute to the international reach of the port.

Context for Businesses: If you’re exploring expansion, especially in Asian markets, the Port of Felixstowe can facilitate your needs at scale with its substantial shipping volume and multicultural trade relationships.

Port of Southampton

Location and Volume: Nestled on the south coast, the Port of Southampton is an important moment in the UK’s freight forwarding industry. Handling over 1.9 million TEU annually, it underlines its significance in the country’s logistics scene.

Key Trading Partners and Strategic Importance: The port has significant trading relations with China, the USA, India, and several European countries. It houses the country’s second-largest container terminal, which further boosts its strategic importance.

Context for Businesses: If your business aims to foster relations with diverse markets, the Port of Southampton’s wide trading partnerships make it an ideal location for your shipping strategy.

London Gateway

Location and Volume: Situated in the Thames Estuary, the London Gateway is one of the newest but very strategic ports with a shipping volume of around 1.4 million TEU.

Key Trading Partners and Strategic Importance: The port solidifies the UK’s trading connections with Germany, USA, India, and China. It’s labeled as one of the UK’s most automated and innovative ports, which adds to its strategic significance.

Context for Businesses: If your company focuses on optimized and technologically advanced operations, the automation and innovative solutions offered by the London Gateway port will enhance your logistics management efficiency.

Port of Liverpool

Location and Volume: Placed in Merseyside, overlooking the Irish Sea, the Port of Liverpool is a crucial fixture of UK’s West Coast. It manages shipping volumes of around 0.7 million TEU annually.

Main shipping ports in UK

Port of Felixstowe

Location and Volume: Located in Suffolk and overlooking the North Sea, the Port of Felixstowe is Britain’s largest and busiest port, dealing with over 40% of Britain’s containerised trade. With a shipping volume of more than 3.8 million TEU, it is a critical link in UK trade.

Key Trading Partners and Strategic Importance: The port’s key trading partners reside predominantly in Asia, with China and Hong Kong taking a significant share. Additionally, relationships with the USA, Spain, and Belgium contribute to the international reach of the port.

Context for Businesses: If you’re exploring expansion, especially in Asian markets, the Port of Felixstowe can facilitate your needs at scale with its substantial shipping volume and multicultural trade relationships.

Port of Southampton

Location and Volume: Nestled on the south coast, the Port of Southampton is an important moment in the UK’s freight forwarding industry. Handling over 1.9 million TEU annually, it underlines its significance in the country’s logistics scene.

Key Trading Partners and Strategic Importance: The port has significant trading relations with China, the USA, India, and several European countries. It houses the country’s second-largest container terminal, which further boosts its strategic importance.

Context for Businesses: If your business aims to foster relations with diverse markets, the Port of Southampton’s wide trading partnerships make it an ideal location for your shipping strategy.

London Gateway

Location and Volume: Situated in the Thames Estuary, the London Gateway is one of the newest but very strategic ports with a shipping volume of around 1.4 million TEU.

Key Trading Partners and Strategic Importance: The port solidifies the UK’s trading connections with Germany, USA, India, and China. It’s labeled as one of the UK’s most automated and innovative ports, which adds to its strategic significance.

Context for Businesses: If your company focuses on optimized and technologically advanced operations, the automation and innovative solutions offered by the London Gateway port will enhance your logistics management efficiency.

Port of Liverpool

Location and Volume: Placed in Merseyside, overlooking the Irish Sea, the Port of Liverpool is a crucial fixture of UK’s West Coast. It manages shipping volumes of around 0.7 million TEU annually.

Main shipping ports in Germany

Port of Hamburg

Location and Volume: Situated on the Elbe river, the Port of Hamburg is Northern Europe’s central hub for freight, shipping a whopping 8.5 million TEU in 2019.

Key Trading Partners and Strategic Importance: Key trading partners include China, Russia, and the USA. Being Germany’s largest universal port, this port plays a key role in the supply chain across various industries, such as automotive, food and beverages, and electronics.

Context for Businesses: If your strategy involves accessing both European and international markets, the Port of Hamburg, with its exceptional rail and road connectivity, could be an essential piece of your logistics.

Ports of Bremen Bremen and Bremerhaven

Location and Volume: Located in the Federal State of Bremen, these twin ports handled over 5.5 million TEU in 2019, making them the fourth-largest container port complex in Europe.

Key Trading Partners and Strategic Importance: Bremen ports boast a wide range of trading partners including China, USA, and Turkey. Known for its facilities for car handling, Bremen ports are also a global hub for logistical services related to the automotive sector.

Context for Businesses: If your business needs intricate automobile logistics or you’re engaged in trade with Asia or North America, the Ports of Bremen and Bremerhaven are well positioned to meet your needs.

Port of Wilhelmshaven

Location and Volume: Located in the Jade Bight bay, Wilhelmshaven is Germany’s single deepwater container terminal, with a capacity to handle approximately 2.7 million TEU annually.

Key Trading Partners and Strategic Importance: Wilhelmshaven has predominantly traded with Asia and the European Union. The port is also strategically located to serve the markets in Germany’s industrial hinterland.

Context for Businesses: Given its capacity for handling ultra-large vessels, if you’re a business planning for large volume shipments, the Port of Wilhelmshaven offers a strategically beneficial option for your logistics.

Port of Rostock

Location and Volume: Situated in the federal state of Mecklenburg-Western Pomerania, Port of Rostock recorded 9,286 ship arrivals and transshipments of 25.2 million tons of cargo in 2019.

Key Trading Partners and Strategic Importance: Partnering mainly with Sweden, Finland, and Russia, Rostock is a significant export and import port that handles various cargo types.

Context for Businesses: If your business heavily includes ferry traffic or bulk and liquid cargo, Port of Rostock, with its broad range of services, is a viable solution for your shipping requirements.

Port of Kiel

Location and Volume: Located on the Kieler Förde inlet, the Port of Kiel handled more than 7 million tons of cargo and nearly 2.4 million passengers in 2019.

Key Trading Partners and Strategic Importance: The port’s main trading partners are Norway, Sweden, and Russia. It accommodates various types of cargo and is also a significant ferry and cruise liner port.

Context for Businesses: If your market leans towards Scandinavia, the Baltic States, or Russia, or if you’re in the cruise industry, the Port of Kiel can play a major role in your logistical plans.

Port of Lubeck

Location and Volume: Situated on the Trave River, the Port of Lubeck is the largest German port on the Baltic Sea, handling around 22.5 million tons of cargo in 2019.

Key Trading Partners and Strategic Importance: Lubeck trades with partners such as Russia, Scandinavia, and the Baltic States. It specializes in handling and storage of forest products and is Europe’s number one RoRo port for the transport of paper.

Context for Businesses: For businesses dealing in forest products and goods that require RoRo Roll-on/Roll-off services, Port of Lubeck could be your perfect European gateway.

Should I choose FCL or LCL when shipping between UK and Germany?

When shipping goods between the UK and Germany, choosing the right sea freight option can have a momentous impact on your business. Are you grappling with whether to go for a Full Container Load (FCL) or opt for Less than Container Load (LCL), also known as consolidation? This critical decision affects not just cost and delivery time, but can also be the linchpin to your shipping success. Ready to dive deeper? Let’s equip you with the knowledge to make the best sea freight choice tailored to your specific needs.

Full container load (FCL)

Definition: FCL (Full Container Load) shipping refers to the use of an entire container for one consignee's cargo, whether it's a 20'ft or a 40'ft container. It consolidates goods from one sender to one receiver, which translates to better security as the container remains sealed from origin to destination, reducing the risk of damage or loss.

When to Use: FCL is an ideal option when the volume of your cargo exceeds 13/14/15 CBM. The larger the cargo volume, the cost-effectiveness of FCL improves due to the set cost per container.

Example: Suppose you're a car manufacturer shipping multiple units from the UK to Germany. Given the high volume, you'd choose FCL shipping, packing the cars into a 40'ft container. This ensures they travel under lock and key from departure to arrival, bolstering safety.

Cost Implications: The FCL shipping quote is often cheaper than LCL for shipments with a larger volume, thanks to its fixed rate per container nature. This way, even if you don't fill the entire container, you pay for it as a whole, making FCL more economic for bigger shipments. Remember, however, that any added services or custom duties are separate, affecting the final cost.

Less container load (LCL)

Definition: Less than Container Load (LCL) shipping is a method where multiple separate consignments are loaded into a single container.

When to Use: This service offers flexibility and cost-effectiveness, especially for low volume shipments. Typically, if your cargo is less than 15 cubic meters (CBM), LCL shipment is the better option.

Example: For instance, if a business needs to ship 10 CBM of automotive parts from Bristol, UK, to Hamburg, Germany, they could use an LCL service. By sharing the container space with other shipments, they won't pay for unused space.

Cost Implications: While LCL freight may initially seem costlier than Full Container Load (FCL) on a per CBM basis, the total cost is often less for smaller shipments. This is because you only pay for the space you use in the container, compared to paying for the whole container in FCL, regardless of the actual volume used. It's also important to consider the storage cost at destination, which is often higher for FCL. LCL can therefore prove more cost-effective for shipments under 15 CBM.

Hassle-free shipping

Struggling to choose between consolidation and full container shipping from the UK to Germany? Let DocShipper take the load off. Our expert team simplifies the complexities of freight forwarding, considering factors like the volume and nature of your cargo, transit time, and cost-effectiveness. Partner with us on your ocean freight journey—it’s the smart move to a hassle-free shipping experience. Click here for a free, no-obligation estimate. No guesswork, just streamlined cargo solutions.

When shipping goods between the UK and Germany, the average sea freight transit time typically ranges from 4 to 6 days. However, it’s crucial to note that these transit times can change, depending on specific factors such as the port used for shipping, the weight and nature of the goods being transported. For an accurate, individualized quote tailored to your shipment’s specific needs, we advise reaching out to an experienced freight forwarder like DocShipper.

As for the specifics, here’s a table showcasing the approximate transit times between the main freight ports in both countries:

| UK Port | Germany Port | Avg. Transit Time (days) |

| Port of Felixstowe | Port of Hamburg | 5 |

| Port of Southampton | Port of Bremerhaven | 6 |

| Port of Tilbury | Port of Rostock | 5 |

| Port of Liverpool | Port of Kiel | 6 |

How much does it cost to ship a container between UK and Germany?

Estimating an exact shipping cost between the UK and Germany isn’t quite cut and dried. Ocean freight rates fluctuate because of several variables, including the Point of Loading and Destination, choice of carrier, nature of goods, and monthly market trends. The cost per CBM could range widely. That’s why we prefer to give personalized quotes to ensure you get the best value. Our shipping specialists are ready to partner with you, understanding your unique requirements, and providing the most competitive rates. Remember, each freight quote is tailored to match your shipping needs – because in international logistics, one size doesn’t fit all!

Special transportation services

Out of Gauge (OOG) Container

Definition: An OOG container is designed to transport cargo which dimensions exceed those of standard containers. They provide a secure and efficient means for bulky or heavy goods.

Suitable for: Especially significant for cargo that can’t be disassembled into smaller units such as boats, machinery, or industrial equipment.

Examples: This is highly beneficial for industries such as construction, manufacturing, or the marine sector requiring the shipping of out of gauge cargo like heavy machinery, windmill blades, or yachts.

Why it might be the best choice for you: If your business often deals with oversized cargo, then OOG containers are designed with your needs in mind. Ease, efficiency, and the peace of mind that comes from knowing your cargo is secure can make this the optimal choice.

Break Bulk

Definition: Break bulk refers to the method of shipping goods individually, in bags, boxes, crates, drums, or barrels instead of containerized.

Suitable for: Break bulk is perfect for large and heavy cargo that is either impossible or not cost-effective to divide, such as construction materials or heavy machinery.

Examples: Industries involved in large-scale infrastructure or equipment production projects will find it incredibly useful. Think large girders, excavators, or ship parts.

Why it might be the best choice for you: If you need to ship bulky items that don’t fit into a container and aren’t suited to Disassemble, break bulk shipping might be your best option.

Dry Bulk

Definition: Dry bulk shipping involves the transportation of homogenous loose cargo load commodities like grain, coal, or metal ores in large quantities.

Suitable for: Mostly utilized by sectors that deal with raw materials like mining, energy, or agriculture.

Examples: For instance, German steel producers shipping iron ore from the UK or British coal distributors shipping to Germany might consider this option.

Why it might be the best choice for you: If your business requires the transport of large quantities of unprocessed materials and speed is not the utmost priority, then dry bulk shipping is the cost-effective and efficient choice.

Roll-on/Roll-off (Ro-Ro)

Definition: Ro-ro vessel allows vehicles to be driven on at the origin and driven off at the destination, facilitated by built-in ramps.

Suitable for: This option is tailored for the transport of mobile machinery, trucks, cars, trailers, or railway wagons.

Examples: So, for a UK-based automaker exporting cars to Germany, or a construction company transporting heavy machinery could find Ro-Ro the most convenient.

Why it might be the best choice for you: If your cargo comes with wheels or is trailer-mounted and requires minimal handling, then the quick and easy Roll-on/Roll-off method might just be what you need.

Reefer Containers

Definition: Refrigerated containers maintain cargo at a steady temperature and are highly suited for perishable goods.

Suitable for: Ideally meant for the transportation of foodstuffs, pharmaceuticals, plants, or other temperature-sensitive materials.

Examples: For a UK fisheries exporting fresh seafood to Germany or pharmaceutical companies transporting temperature-sensitive medications, reefer containers are a must.

Why it might be the best choice for you: If your business involves goods that require consistent temperatures during transit, then the technologically advanced reefer containers might be the safest and most reliable choice.

Whatever your shipping needs, DocShipper can offer professional guidance to help determine the best shipping method for your cargo. Contact us to get a free shipping quote in less than 24 hours.

Air freight between UK and Germany

Shipping between the UK and Germany can be a breeze with air freight. Known for its speed, your luxury watches or urgent machine parts can make the one-way trip in just 1-2 days. While typically more expensive, air freight becomes cost-effective when shipping smaller, high-value items. Think about it like ordering express delivery for your online purchases – it’s worth the extra bucks because you’re paying for peace of mind and time efficiency.

However, we must caution, one shouldn’t dive headfirst into air freight without understanding the nuances. Imagine trying to bake a cake without knowing the right measurements – it can end up a costly mess. Many shippers often miscalculate the price by using a wrong weight formula, or overlook industry’s best practices, just like forgetting to preheat the oven in our cake scenario. This could result in a pricey bill that takes them by surprise. Stay tuned as we delve into these hidden pitfalls of air freight in our guide.

Air Cargo vs Express Air Freight: How should I ship?

When your business needs to zip goods between the UK and Germany, choosing the best air freight option can be a bit of a head-scratcher. Sure, we have standard Air Cargo hitching a ride in your regular airlines, but there’s also Express Air Freight with its own dedicated plane. So let’s dive right into the differences, helping you decide which sky-high solution best suits your business. It’s all about picking the fastest or the most cost-effective, or sometimes striking the perfect balance.

Should I choose Air Cargo between UK and Germany?

Air cargo between the UK and Germany can be a highly reliable and cost-effective shipping option, especially for packages exceeding 100/150 kg (220/330 lbs). Airlines like Lufthansa and British Airways offer robust schedules and extensive network capabilities. However, be aware of longer transit times due to set schedules. If affordable rates and assured delivery are your prime concern, this could be an ideal choice for you. Visit the official websites of Lufthansa and British Airways to learn more about their freight services.

Should I choose Express Air Freight between UK and Germany?

Express Air Freight is a precision service employing cargo-only aircraft, bypassing commercial passenger flights. This approach is perfect for shipments under 1 cubic meter or weighing less than 100/150 kg, such as sensitive items or rapid delivery requirements. Partnering with international delivery giants like FedEx, UPS, or DHL, can ensure your goods reach Germany from the UK swiftly and securely. If rapid delivery is critical for your business, or your shipment is on the lighter, smaller side, Express Air Freight might be a game-changer for you.

Main international airports in UK

Heathrow Airport

Cargo Volume: Heathrow handled 1.6 million metric tonnes of cargo in 2019, making it the busiest airport in the United Kingdom for freight.

Key Trading Partners: The US, China, and the EU are the major trading partners, with nearly 30% of all UK exports by value going through Heathrow.

Strategic Importance: Due to its location in London, Heathrow is often the first choice for importers and exporters operating in the south of England.

Notable Features: Heathrow offers state-of-the-art cargo infrastructure, including specialist facilities for perishable and precious goods.

For Your Business: If your enterprise focuses on high-value products or requires large freight volumes, Heathrow’s strategic location and superb facilities could be ideal for your logistics needs.

East Midlands Airport

Cargo Volume: East Midlands, the UK’s largest pure freight airport, handled over 320,000 tonnes of cargo in 2020.

Key Trading Partners: Major trading partners include the EU, the US, and Asia, with strong connections to emerging markets in these regions.

Strategic Importance: With its central location, it serves as an excellent hub for businesses targeting customers in the Midlands and Northern England.

Notable Features: It boasts a 24-hour operation, meaning expedited deliveries and overnight express services are a strongpoint.

For Your Business: East Midlands could be a good fit if you’re after speed and the flexibility to ship at any time of day.

Manchester Airport

Cargo Volume: Manchester processed approximately 120,000 tonnes of cargo in 2019.

Key Trading Partners: Europe, Asia, and the Americas are key trading regions, facilitated by an extensive network of airlines.

Strategic Importance: Situated in the north of England, Manchester Airport serves as a key freight hub for businesses in that region.

Notable Features: As well as general cargo, Manchester has dedicated facilities to handle pharmaceuticals, and perishable goods.

For Your Business: If you deal with specialized goods, or seek easy access to northern England and Scotland, consider incorporating Manchester Airport into your shipping strategy.

London Gatwick Airport

Cargo Volume: Gatwick processed around 95,000 tonnes of cargo in 2019.

Key Trading Partners: Key regions include Europe, the Middle East, and North America.

Strategic Importance: Gatwick is the second largest airport in London. It offers diverse options for southern businesses, complementing Heathrow’s services.

Notable Features: Gatwick presents an efficient cargo handling system with a quick transit time.

For Your Business: If your business is located in the South and you’re targeting clients in Europe and Middle East, Gatwick could provide a robust alternative to Heathrow.

Stansted Airport

Cargo Volume: In 2019, Stansted Airport handled over 250,000 tonnes of imported and exported goods.

Key Trading Partners: The EU, North America, and Asia form the majority of its trading links.

Strategic Importance: It serves predominantly eastern England and London. As a hub for major delivery networks like FedEx and UPS, Stansted has a rich courier and express shipment ecosystem.

Notable Features: It operates 24 hours, ensuring uninterrupted freight services.

For Your Business: If your strategy involves e-commerce or time-critical shipments, Stansted would be an excellent addition to your freight network.

Main international airports in Germany

Frankfurt Airport

Cargo Volume: Frankfurt Airport is the busiest cargo airport in Europe, handling over 2.3 million metric tons of cargo annually.

Key Trading Partners: Major trading partners include the US, China, and the UAE, covering sectors like automobile, IT, pharmaceuticals and manufacturing.

Strategic Importance: With its central location in Europe, Frankfurt Airport serves as a primary hub for many international freight routes.

Notable Features: It boasts dedicated cargo terminals, modern cargo handling facilities and infrastructure for quick handling of perishable and sensitive freight.

For Your Business: If your business frequently ships to or from Europe, considering Frankfurt might make sense due to its competitive transit times, extensive network, and comprehensive freight facilities.

Leipzig/Halle Airport

Cargo Volume: Leipzig/Halle Airport ranks second in Germany and fifth in Europe, processing over 1.3 million metric tons of cargo each year.

Key Trading Partners: Key trading partners include Russia, the USA and China, mainly serving industries such as automotive, IT and pharmaceuticals.

Strategic Importance: Known as Germany’s ‘Cargo Hub’, it serves night-time express freight shipments for its close proximity to the geographical center of Europe.

Notable Features: The airport features a direct connection to the autobahn and railway routes, facilitating quicker distribution across Europe.

For Your Business: Businesses that require quick turnarounds and mail/express shipments should take advantage of Leipzig/Halle’s 24/7 operations and its excellent multimodal transport links.

Cologne Bonn Airport

Cargo Volume: Cologne Bonn Airport handles more than 850,000 metric tons of cargo annually.

Key Trading Partners: Major trading partners are mostly Asian countries like China and Japan, along with the USA.

Strategic Importance: It is a significant cargo hub owing to its ideal position in the freight-intensive region of North Rhine-Westphalia.

Notable Features: The airport operates around-the-clock, featuring dedicated freight terminals and a dedicated highway and rail network.

For Your Business: If your business operates in high-value and time-critical sections, Cologne Bonn’s 24/7 operation and superior accessibility might be an asset for your distribution strategy.

Munich Airport

Cargo Volume: Munich Airport handles over 350,000 metric tons of cargo each year.

Key Trading Partners: The airport predominantly serves trading partners such as the US and various European countries.

Strategic Importance: With its close proximity to major industries including high-tech, pharmaceuticals and automotive, Munich Airport has a strategic economic importance.

Notable Features: It offers state-of-the-art cargo facilities and designated logistic areas for optimized handling of goods.

For Your Business: If your enterprise regularly trades with European and US markets, having Munich Airport in your shipping plan could facilitate cost-effective and efficient trade operations.

Hamburg Airport

Cargo Volume: With an annual turnover of approximately 150,000 metric tons of freight, Hamburg Airport is Northern Germany’s most significant air freight center.

Key Trading Partners: Major partners include the US, China, and several European countries.

Strategic Importance: It is of strategic importance for high-tech, mechanical engineering and bio-technological segments due to its location in a strong industrial region.

Notable Features: The cargo center at Hamburg Airport offers state-of-the-art infrastructure and logistics services for a wide range of air freight.

For Your Business: If you’re active in the high-tech or engineering sectors, the strategic location and comprehensive services offered by Hamburg Airport may be beneficial for your business.

How long does air freight take between UK and Germany?

Shipping goods from the UK to Germany by air freight typically takes between 1 to 3 days. However, this timescale is not fixed as it can fluctuate depending on a range of factors. Your exact airports of origin and destination, the weight of your shipment, and the specific nature of the goods can all impact this duration. To get the most accurate timing for your shipment, it’s advised to consult with a freight forwarder like DocShipper.

How much does it cost to ship a parcel between UK and Germany with air freight?

Shipping air freight packages between the UK and Germany comes with a broad average cost range per kg, partly due to factors such as the distance between departure and arrival airports, parcel dimensions and weight, and the nature of goods. Hence, pinpointing an exact price becomes challenging. However, rest assured, our team is dedicated to providing each client with the most competitive rates. We offer custom quotes since each shipping requirement is unique. Reach out and benefit from our assistance today. Contact us and receive your free quote in less than 24 hours.

What is the difference between volumetric and gross weight?

Weighing your shipment is crucial, but did you know not all weights are equal in shipping? Let’s unpack these two essential measurements – gross weight and volumetric weight.

In air freight shipping, gross weight equates to the actual weight of the shipment, being the weight of the goods themselves as well as any packaging; measured in kilograms (kg). Moving to volumetric weight, it represents the shipment’s space it occupies as compared to its actual weight; calculated in kilograms (kg).

When it comes to calculation, gross weight is pretty straightforward. It involves weighing all of your cargo once packed, together with any crating and packaging involved.

Volumetric weight requires a bit more math. In Air Cargo, volumetric weight in kg is calculated by multiplying the package’s length, width, and height (in cm) and dividing by 6000. On the other hand, for Express Air Freight services, you’ll divide by 5000 instead.

Let’s take a hypothetical scenario. You have a box measuring 50cm x 40cm x 30cm, and it weighs 23kg. Using the Air Cargo formula, the volumetric weight would be 504030/6000 equals to 10kg, or 22 lbs. For Express Air Freight the weight would be 504030/5000 equals 12kg, or 26.5 lbs.

Understanding these calculations is not just academic. Shipping isn’t always charged on gross weight alone, but rather whichever of the two weights – gross or volumetric – is higher. This impacts the overall freight charges, enabling fair pricing for both lightweight, bulky items and heavy, compact items. So, always run both calculations to estimate the closest freight charges.

Door to door between UK and Germany

Experience the convenience of door-to-door shipping, an effortless solution that delivers goods directly from the UK to a location in Germany. With this method, you’re free from bothersome logistics, as it covers everything from collection to final delivery. Economical and uncomplicated, door-to-door shipping can often be a smart choice. Tempted? Let’s dive in and explore the nuances together!

Overview – Door to Door

Struggling with the intricacies of international shipping between the UK and Germany? Our Door to Door shipping service is your stress-free solution, overcoming complexities in transport and customs procedures. While a tad costlier, it’s a comprehensive service favored by most DocShipper clients, providing priceless peace of mind. Your goods, be it a single package or substantial freight, are meticulously handled from pickup right up to the final delivery point. Favored for its efficiency and simplicity, this method is a game-changer for any business seeking a smooth and reliable logistics partner. Unlock seamless shipping today!

Why should I use a Door to Door service between UK and Germany?

Ever tried herding cats? It’s not far off logistics! Here’s how Door to Door service just like the best cat herder, keeps things simple and stress-free for your shipments from the UK to Germany.

1. Stress-Free Logistics: Forget about coordinating different shipments, contacting diverse carriers, or dealing with the headache of customs. Door to Door service does all the legwork, minimizing your involvement and stress.

2. Timely Delivery: Time-sensitive shipment? Choose Door to Door. It optimizes the transit process, ensuring your goods arrive in Germany just when you need them.

3. Specialized Care: With Door to Door service, you get white-glove treatment for complex cargo. Be it fragile items or heavy machinery, careful handling is a prime focus.

4. Convenience: From pickup in the UK to delivery in Germany, this service saves you the effort. You won’t need to find a trucking service to haul your cargo from the port to the final destination; it’s all included.

5. Simplification: One point of contact, one company responsible. Easy to track, easy to control! It’s logistics made simple.

Door to Door service is like having a logistics wizard, invisibly orchestrating your shipping needs, leaving you to focus on what really matters — growing your business. Now, isn’t that peace of mind worth considering?

DocShipper – Door to Door specialist between UK and Germany

Experience the ease of door-to-door shipping with DocShipper, pioneering the UK-Germany route. Our commitment is stress-free shipping, from packaging to customs, across all methods of transportation. We assign you a dedicated account executive, ensuring proficiency and smooth communication at every stage. Gear up for a shipping experience where you sit back while we handle it all. Contact us for a prompt and free estimate within 24 hours, or a no-fee consultation with our experts. Let us make logistics simple for you.

Customs clearance in Germany for goods imported from UK

Navigating the complexities of customs clearance – the process of transporting goods across international borders – can feel daunting, especially when bringing goods from the UK into Germany. This task holds surprises in store, like sudden fees and charges, which could upset your business’s bottom line. Moreover, missteps in understanding customs duties, taxes, quotas, and licenses could potentially blockade your goods in customs. However, don’t stress. This guide will delve deeper into each of these aspects to help you steer clear of these pitfalls. You’re not alone in this journey; DocShipper can handle it end-to-end, regardless of the type of goods or their global whereabouts. Hit us up with the origin, value, and HS Code of your goods for an accurate budget estimate. We’re just one call away!

How to calculate duties & taxes when importing from UK to Germany?

Understanding the intricacies of import duty estimation becomes crucial when shipping goods from the UK to Germany. Essentially, the calculation of customs duties hinges on a few key variables – the country of origin, the HS code of your products, the customs value of goods, the tariff rate applicable, and any additional taxes or fees that might come into play. Your initial step in this maze of customs calculation is pinpointing the country where your goods were originally manufactured or produced. It is this information that sets the groundwork for determining the eventual cost of importation duties and taxes. With the right knowledge and approach, navigating through this process can be more manageable and less daunting.

Step 1 – Identify the Country of Origin

Identifying the ‘Country of Origin‘ is your first step. It’s crucial for five key reasons:

1. Each country has unique trade agreements, affecting duties and taxes.

2. Regulations and restrictions vary by country, impacting what and how you can export.

3. Customs duties depend on specific product classifications, which change as per a country’s trade policies.

4. Identification helps in paperwork accuracy, avoiding delays.

5. If you’re importing into Germany from the UK, knowing the country of origin ensures you benefit from the EU and UK trade arrangements.

In the case of UK-to-Germany imports, the post-Brexit Trade and Cooperation Agreement influences the customs duties. Goods originating in the UK and meeting certain criteria are duty-free in Germany. Conversely, goods from other countries, even if shipped from the UK, may not enjoy this benefit.

Be aware of peculiarities, too. Certain goods like animal products or chemicals have specific restrictions, requiring extra documentation or tests. Your freight forwarder or the EU TARIC database can help navigate this maze. Stay proactive to keep your imports smooth and pocket-friendly.

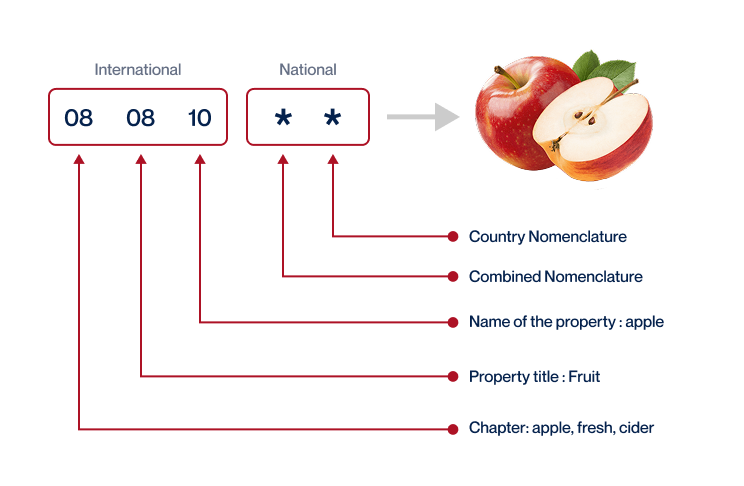

Step 2 – Find the HS Code of your product

The Harmonized System Code, or HS Code, is a standardized system of classification for traded goods worldwide. It serves a crucial role in international trade by facilitating tax assessment, collection of customs duties, and enforcement of trade rules.

Your product’s HS code can usually be obtained from your supplier. Given their experience in the export business, suppliers are typically well-informed about their products’ HS codes and relevant regulations.

On the off chance that this information isn’t readily available from your supplier, don’t worry; we’ve got you covered. You can look up the HS code by following the steps below:

1. Access the Harmonized Tariff Schedule using this HS lookup tool: Harmonized Tariff Schedule

2. Input the name of your product in the search bar.

3. Scroll over to the ‘Heading/Subheading’ column, your product’s HS code can be found there.

Bear in mind, choosing the correct HS code is paramount. Inaccuracies in your HS code can lead to shipment delays and may even result in financial penalties. Extra care when finding your HS code ensures smooth customs processes and prompt delivery.

Here’s an infographic showing you how to read an HS code.

Step 3 – Calculate the Customs Value

Unpacking customs value can feel like unraveling a puzzle, so let’s break it down. The customs value isn’t the same as your product value – it’s actually a combination of several costs, referred to as the CIF value. This amalgamation includes the price of your goods (in USD), international shipping costs, and insurance costs.

Suppose you’re shipping antiques priced at $2000. Let’s say your international shipping cost is $300 and insurance costs $50. Here’s how you’d calculate it: $2000 (Goods) + $300 (Shipping) + $50 (Insurance) = $2350. This ‘meaty’ sum of $2350 is your customs value!

By understanding how to calculate the customs value, you’re better prepared for any cost-related surprises during the customs clearance process in Germany when importing from the UK. Remember, being informed is being empowered!

Step 4 – Figure out the applicable Import Tariff

An import tariff is a tax imposed on items brought into a country. It’s designed to protect domestic industries by adding a cost to goods coming from abroad. In our case, Germany primarily uses the Harmonized System (HS) to categorize goods for customs purposes.

To get a clear idea of your import tariff, you’ll need to identify your product’s HS code noted earlier. This code is critical, as it determines the duties and taxes applied to your product. Now, since we’re dealing with an item from the UK, you’ll need to consult the UK’s own Trade Tariff tool. Here’s a quick guide:

1. Open the UK’s Trade Tariff tool.

2. Enter the identified HS code and country of origin.

3. Review the duties and taxes applied to your product.

Let’s look at an example: We have a shipment of furniture with an HS code of 9403.10, valued at $20,000 USD, and the Trade Tariff tool shows a duty rate of 2.7%. We’ve also spent $1,000 on freight and insurance (CIF costs). The duty calculation is: (Product Value + CIF) Tariff Rate = Import Duty. So, (20,000 + 1,000) 2.7% equals $567. That’s your expected import duty.

Remember, this process might appear cumbersome, but gaining clarity on your potential costs up front can save you unexpected charges later.

Step 5 – Consider other Import Duties and Taxes

Beyond the standard tariff rate, you should also account for other import duties and taxes for goods imported from UK to Germany. These vary based on your product’s nature and country of origin. Here are a few for your understanding, but remember these are example rates and can vary.

Excise Duty: If your shipment includes items like alcohol, tobacco, or energy products, an Excise Duty could apply. An example could be a 3% charge on your product’s value.

Anti-Dumping Taxes: In cases where your goods are sold below market value, anti-dumping duties may apply to prevent damage to the industry in the importing country. For instance, anti-dumping duty on aluminum products can be 30%.

VAT (Value Added Tax): This is perhaps the most significant aspect. VAT is levied on the total value of the goods, combined with customs duties. Currently, Germany’s standard VAT rate is 19%. For goods valued at $100, the VAT would be $19 (19% of $100).

Understanding these costs is paramount to avoiding any potential financial surprises during customs clearance. Always consult a customs expert or use a customs duty calculator to get more accurate figures.

Step 6 – Calculate the Customs Duties

Understanding and accurately calculating customs duties is essential when importing goods from the UK to Germany. You’ll need to know the ‘Customs Value’ of your goods which is usually the cost, insurance, and freight (CIF) value.

Let’s look at three scenarios:

Scenario 1: Let’s say your CIF cost totals to $5000, and the customs duty rate is 5%. Here, your Customs Duty equals $250 ($50000.05). No VAT is applied.

Scenario 2: If the CIF cost is the same, but Germany’s VAT (19%) applies, start by adding the CIF cost ($5000) and the Customs Duty ($250) to get $5250. Then apply the VAT to get $997.5 ($52500.19).

Scenario 3: Importing certain goods? You might need to pay additional penalties known as anti-dumping taxes and Excise Duty. If an anti-dumping tax of 3.5% is applied and Excise Duty of 2%, calculate these based on the CIF cost to get $175 and $100 respectively. Add these to your previous total of $6247.5, to get a final cost of $6522.5.

Sounds complex? DocShipper is here to help. Our expert team ensures accurate customs clearance worldwide, minimizing the risk of overcharges. Get in touch for a free quote within 24 hours, ensuring every step of your customs clearance is handled professionally.

Does DocShipper charge customs fees?

While DocShipper does facilitate your journey in Customs Land by charging a service fee for the customs clearance process, we don’t get a dime of the customs duties and taxes. These are payable directly to the government. And to illustrate our commitment to transparency, you’ll receive all official customs documents, showing you’ve only parted with the exact amount the government expected – not a penny more! It’s the cost of doing international business, but with us, you’ll know precisely where your bucks are going.

Contact Details for Customs Authorities

UK Customs

Official name: Her Majesty’s Revenue and Customs (HMRC) Official website: https://www.gov.uk/

Germany Customs

Official name: Generalzolldirektion (General Customs Directorate) Official website: https://www.zoll.de/

Required documents for customs clearance

Tangled in the web of customs paperwork? We’ll untangle it, focusing on crucial documents like the Bill of Lading, Packing List, Certificate of Origin, and CE standard Documents of Conformity. Goodbye confusion, hello streamlined importing!

Bill of Lading

In any sea freight movement between the UK and Germany, your Bill of Lading (BOL) is your golden ticket – it’s both a receipt for your goods and a contract with your carrier. As the pivotal document marking the transition of ownership, it’s the crucial link in your supply chain. Going digital with a telex release can simplify things even further, providing a fast and paperless transfer of ownership.

If you’re an air cargo aficionado, the Air Waybill (AWB) holds the same gravitas. Considering the time-sensitive nature of air freight, this document’s prompt issue and delivery can make all the difference.

And remember that every document tells a story. Your BOL or AWB needs to be thorough and accurate to prevent any customs hiccups. Don’t rush it – a small mistake can lead to a costly delay. Treat them with the respect they deserve and they’ll pave a smooth path for your goods through the customs labyrinth.

Packing List

When shipping from the UK to Germany, the packing list is your lifeline. This isn’t just a simple list; it’s an inventory of each item in your shipment, detailing the quantity, description, weight, and value. Incorrect or incomplete data? You’re inviting delays. Let’s say you are shipping engine parts by sea. If your packing list mismatches the actual goods, customs officials might hold up your consignment until the problem is resolved. The same accuracy is key for airfreight. Imagine your consignment of designer lamps getting stuck at Frankfurt Airport because of discrepancies! It’s not just about prompt delivery; proper documentation can also prevent potential penalty charges. So next time, double-check your packing list – your hassle-free transit between UK and Germany depends on it.

Commercial Invoice

True to its name, a Commercial Invoice is your business ally that packs a punch. Much more than just an invoice, it’s the go-to document for customs authorities. Be it the UK or Germany, this document lays bare the crucial details needed for a seamless shipping process. It houses key information about your consignment – description, value, terms of payment, and shipping. A perfectly aligned Commercial Invoice can fast-track your goods through the stir of customs, dodging unnecessary delays. It’s your shipping wand, align it meticulously with your other transport docs. Say, for instance, your Bill of Lading spells ‘10 boxes of ceramic tiles’, make sure your Commercial Invoice echoes the same. Keep it clear, centrally placed, and accessible. It’s not paperwork; it’s gate-pass to global markets.

Certificate of Origin

Managing your shipments from the UK to Germany? Then you’ll need a Certificate of Origin (CoO). Think of it as your product’s passport, stating where it was made. For instance, if you’re shipping UK-made car parts to Germany, the CoO verifies their UK origin. Why does this matter? Well, it can land you preferential customs duty rates, reducing the overall cost of your shipment – a nifty savings pass! Remember, it’s not enough to just say ‘Made in the UK’; that CoO needs to be in your stack of paperwork. Without it, your goods might end up stuck in customs limbo. So, keep your shipments sailing smoothly by ensuring every box’s CoO is shipshape.

Certificate of Conformity (CE standard)

If you’re shipping goods from the UK to Germany, don’t forget: the Certificate of Conformity (CE standard) is your friend. A CE marked item has passed all the safety, health, and environmental standards for the European market – a clear thumbs-up for product quality, not just your standard quality assurance. This little mark tells German customs, all clear to enter! Do note that despite Brexit, CE marking is still applicable until June 30, 2023 for most products. Afterward, the UKCA marking will come into play. The situation a bit like the UL standards in the US; similar to the CE mark, it’s a seal of safety approval on products. So next time when you’re ready to ship, double-check your goods for CE marking to ensure a smooth journey across the borders.

Your EORI number (Economic Operator Registration Identification)

Here’s the scoop on the EORI number – the unsung hero of UK-Germany shipping. As a unique identifier for your business, it’s vital for track and trace. Whether you’re a Londoner importing Berlin’s famous beers or a German business exporting car parts to Birmingham, the EORI ties every customs clearance process together. It makes shipping smoother and customs happier. Just register once in the UK or Germany, and voila, you’re set for all EU trade and beyond! Maximise efficiency, minimise errors – that’s EORI magic. Never underestimate this crucial number’s role in your logistics game plan!

Get Started with DocShipper

Prohibited and Restricted items when importing into Germany

Facing mystery and confusion with what goods are blacklisted for import into the Deutschland? Wipe that sweat off your brow. Our guide cuts through the jargon, helping you understand Germany’s import restrictions and prohibited items like a pro. Knowledge is power; let’s power up.

Are there any trade agreements between UK and Germany

Yes, there are strong trade relationships between the UK and Germany. After Brexit, the UK and the EU, including Germany, sealed a Trade and Cooperation Agreement, eliminating tariffs and quotas on goods to keep trade fluent. So, if you’re importing or exporting goods between these nations, you’ll benefit from zero tariffs, maintaining the competitiveness of your trade. Additionally, ongoing transport initiatives, such as the Rail Baltica project, might offer faster, more efficient freight routes in the future, offering potential improvements to your supply chain.

UK – Germany trade and economic relationship

The UK-Germany trade relationship continues to be strong, with Germany remaining the UK’s second-largest trading partner in 2024. As of the latest data, bilateral trade between the two nations has reached £149 billion, reflecting growth compared to the 2019 figure of £134 billion. The UK is now Germany’s sixth-largest trading partner, and these two economies maintain deep ties across various sectors, notably in manufacturing, automobiles, pharmaceuticals, and finance. Regarding investments, over 2,500 UK companies still operate in Germany, while approximately 1,500 German firms are active in the UK.

This robust partnership remains vital, despite political changes such as Brexit, and the trade volume underscores the continued mutual economic synergy between the two nations.

Your first steps with DocShipper

Additional logistics services

Warehousing

Finding the right warehousing solution, especially when dealing with goods requiring temperature control, can feel like a cold and daunting task. You want to keep your goods safe, we understand. From charming chocolates to prime pharmaceuticals, our tailored warehousing solutions ensure optimal conditions, right from the UK to Germany. Dive deeper into how we take the hassle out of handling your goods here. For More info, on our dedicated page: Warehousing.

Packing

When shipping goods from the UK to Germany, adequate packaging and repackaging is a game-changer. Optimal packaging safeguards your items from transit damages, while repackaging can streamline logistics and reduce shipping costs. Let's say you deal with fragile ceramics - a trusted agent can ensure your products arrive intact. Or maybe you're dispatching bulk electronics, our service can repackage these into manageable, cost-saving units. For the nitty-gritty, check out Freight packaging right here.

Transport Insurance

When moving goods, transport insurance is your ally, not fire insurance. Why? Simply put, it covers mishaps fire insurance cannot. It's like wearing a seatbelt and having airbags. Suppose your container encounters a rough sea, resulting in damaged products - covered. Or a warehouse fire ruins your cargo - also covered. Prevention is key in the logistics world, and cargo insurance gives you that peace of mind. So, hesitate no longer. Get covered. More info about it on our dedicated page: Cargo Insurance

Household goods shipping

Shipping your personal effects between the UK and Germany? It's a breeze handling even your most fragile or bulky items with our professional care and service flexibility. Imagine feeling relieved as your grandmother's antique mirror safely reaches Munich from Manchester. Find out more about our tailor-made solutions for moving your cherished belongings on our dedicated page: Shipping Personal Belongings.

Procurement in Thailand

Looking to source goods for your UK-Germany operations? DocShipper can steer you through Asia's, East Europe's, and other regions' procurement maze. We've got you covered, from finding top-tier suppliers to ironing out the often tricky language barriers. Think of us as your compass in the complex procurement landscape. Get the full scoop on our dedicated page: Sourcing services.

Quality Control

Quality control is your insurance against messy surprises in the UK-Germany freight pipeline. Think of it like this. You've arranged a large shipment of bespoke Bavarian beer steins to Southampton. But what if the paint is sub-par, or the logo misprinted? Quality inspections during manufacturing can catch these errors before they cross the English Channel. Save headaches, money, and uphold your business reputation. More info on our dedicated page: Quality Inspection.

Conformité des produits aux normes

Shipping your products without ensuring regulatory compliance can yield perplexing obstacles. Our Product Compliance Services are designed to eliminate such problems. We give you access to laboratory testing, making sure your products are certified and compliant with the destination's regulations. Real-world example? Imagine the fines you can avoid for non-compliant circuits on your electronics. Don't leave it to chance, consult our Product compliance services.