Ever thought about how many tea bags would fit into a shipping container from the UK to Cambodia?

Probably not, but if you're in international trade, transit times, costs, and customs regulations for freight transport might be on top of your mind! Our comprehensive guide intends to demystify the intricate layers of shipping goods between these two nations. We dissect the various shipping options - air, sea, road, or rail, highlighting the pros and cons of each. We also delve into the nitty-gritty of customs clearance, duties, taxes, and throw in tailored advice for businesses looking to streamline their shipping processes. If the process still feels overwhelming, let DocShipper handle it for you! As your international freight forwarder, we pledge to turn each shipping challenge into a success story for your business.

Table of Contents

Which are the different modes of transportation between UK and Cambodia?

Shipping goods between the UK and Cambodia? The first question to answer is: what's the best way to go? Picture this: the UK and Cambodia are over 6,000 miles apart, plus there are many countries in betwixt. It's like scaling the length of the Great Wall of China - not once, but twice! So, ditch the road and rail idea; they're impractical and time-consuming. What's left? Sea and air freight. Your optimum transport method hinges on factors like your cargo's nature, your budgetary constraints, and time. This is a critical decision-making point! Let's delve in and see what suits you best.

How can DocShipper help?

Struggling to ship your goods from the UK to Cambodia? Allow DocShipper to simplify the process for you. With our robust shipping experience and a dedicated team of consultants, we handle everything from customs clearance to administrative hurdles. Take the guesswork out of shipping! Reach out to our team for a free estimate within 24 hours. Questions? Our consultants are just a phone call away.

DocShipper Tip: Ocean freight might be the best solution for you if:

- You're dealing with large quantities or oversized items. Sea freight offers a budget-friendly way to maximize space, a particularly useful option given the UK's extensive port network.

- Your shipment isn't on a tight schedule. Ocean transport typically takes longer than air or rail, but it offers reliability.

- Your supply chain involves key ports, allowing you to take advantage of a wide-reaching network of sea lanes.

Sea freight between UK and Cambodia

The United Kingdom and Cambodia have an ever-growing economic relationship, with imports and exports continually on the rise. The South coast of UK and the Port of Sihanoukville, Cambodia’s leading maritime hub, form pivotal links in this global supply chain. Despite longer transit times, various businesses opt for ocean shipping due to its cost-effectiveness, particularly when moving mass quantities of goods.

Yet, sailing through the complexities of international shipping can sometimes feel like walking a tightrope blindfolded. Mistakes occur more often than not, with the unfamiliar paperwork, unclear customs regulations, and hidden fees turning the process into a labyrinth. The guide aims to unravel these intricacies, presenting a roadmap packed with clever tips, procedures, and overlooked aspects specific to UK-Cambodia shipments. Stay tuned as we chart the best practices to ease your shipping journey, highlighting the most common pitfalls to avoid, effectively turning your ocean freight challenges into smooth sailing.

Main shipping ports in UK

Port of Felixstowe:

Located on the east coast of England, this port is one of the most significant for trade in the United Kingdom, boasting a total shipping volume of approximately 4.1 million TEU. Its strategic location makes it a gateway to Europe, especially Belgium, The Netherlands, Germany, and Scandinavia. If your business involves extensive trading with these regions, incorporating the Port of Felixstowe into your shipping strategy could optimize your supply chain efficiency.

Port of Southampton:

Nestled on the south coast of the UK, the Port of Southampton serves as a crucial logistics hub, handling about 2.0 million TEU per annum. Its key trading partners focus around North America and the Far East. For businesses targeting these markets, the Port of Southampton's extensive intermodal connections and sophisticated infrastructure could benefit your logistics operations.

Port of London:

The Port of London, positioned on the River Thames, is an essential player in the British logistics landscape, with a shipping volume of around 1.8 million TEU. It's vitally important for trade with Western Europe and North America. Given its proximity to one of the world's most renowned cities, businesses aiming to penetrate the vibrant London consumer market should consider the Port of London a viable point of entry.

Port of Liverpool:

Situated on the west coast, the Port of Liverpool caters to around 700,000 TEU, primarily with partners from the Americas and Western Europe. Leveraging the Port of Liverpool's extensive ro-ro facilities and connections to major UK road networks might prove advantageous for businesses shipping vehicles or oversized cargo.

Grimsby & Immingham Port:

This complex in the Northeast of England is the UK's busiest port by tonnage, handling over 60 million tons, primarily fuel, cars, and food. Despite a lower container throughput, businesses dealing in these goods will find the Grimsby & Immingham Port an invaluable addition to their logistics strategy.

Port of Dover:

Primarily known for passenger ferry services, the Port of Dover also facilitates significant volumes of roll-on/roll-off cargo. The primary trade route is with France, but the port also serves broader European needs. If your operations involve speedy transit of goods to and from Continental Europe, the Port of Dover could be a useful resource.

Main shipping ports in Cambodia

Sihanoukville Autonomous Port:

Location and Volume: Situated in the southwestern part of Cambodia, near the Gulf of Thailand, Sihanoukville Autonomous Port is the country's only deep-water port. This port plays a significant role in the country's import and export activities with an annual shipping volume of approximately 541,228 TEUs.

Key Trading Partners and Strategic Importance: The Sihanoukville Autonomous Port is vital for trade with numerous countries, including China, Singapore, and Vietnam. It's acknowledged as one of the fastest-growing ports in Southeast Asia, and its strategic location on the Gulf of Thailand allows easy connection to major international maritime routes.

Context for Businesses: Should your company be considering market expansion in Southeast Asia or strengthening trade bonds with China, the Sihanoukville Autonomous Port may be an integral part of optimizing your logistics strategy, given its direct trade routes and rapid growth. Its status as a Free Trade Zone may also be beneficial in minimizing tariff costs.

Phnom Penh Autonomous Port:

Location and Volume: Positioned on the upper Mekong River, in the capital city of Cambodia, Phnom Penh Autonomous Port is a significant inland port. It handles approximately 192,300 TEUs per year, making it the second busiest port in the country.

Key Trading Partners and Strategic Importance: The Port of Phnom Penh has been instrumental in facilitating trade activities with neighboring countries like Vietnam and Laos. Its importance is signified by its role in supporting major industries like textiles, automotive, and electronics.

Context for Businesses: If your business operates in industries such as textiles or electronics and is seeking to reduce overland transportation costs, the Phnom Penh Autonomous Port, with its direct river access to the Vietnamese port of Cái Mép, could help streamline your shipments and ensure efficient distribution. Being an inland port, it additionally offers shorter transit times for landlocked regions.

Should I choose FCL or LCL when shipping between UK and Cambodia?

Deciding between consolidation (LCL) or full container load (FCL) for your UK to Cambodia shipping can feel like mastering a complex strategy game. It's about more than just slots in a vessel; it's about juggling costs, delivery times, and achieving victories in your businesses' shipping operations. In this guide, we're breaking down the 'rules', helping you understand the key differences and equipping you with the skills to make your move with confidence. Be ready to approach your next sea freight decision with a new perspective.

LCL: Less than Container Load

Definition: Less than Container Load (LCL) shipping is a method of transportation where freight isn't enough to fill a whole container by itself. Different shippers' cargo is consolidated into one container, making it an effective solution for smaller shipments.

When to Use: LCL is an ideal choice when the cargo volume is less than 13-15 cubic meters. It isn't rushed to meet tight deadlines; it offers flexibility and it is cost-efficient for low volume shipments.

Example: Let's say an antique furniture business from the UK needs to transport a small collection of artifacts to a boutique in Cambodia. As these high-value items won't fill an entire container, LCL shipping is a wise choice.

Cost Implications: With LCL freight, you only pay for the container space your shipment takes up, while the rest is divided amongst other shippers. While LCL may not be as quick as air freight or as cheap as Full Container Load (FCL) for larger volumes, it strikes an excellent balance between speed, cost, and flexibility for smaller exports or imports. Consider obtaining an LCL shipping quote for exact cost estimates.

FCL: Full Container Load

Definition: FCL, or Full Container Load, is a shipping method where a full 20ft or 40ft container is dedicated to a single shipment. It's named for the fact that the entire container (FCL container) is booked and used by a single customer.

When to Use: FCL shipping is the best choice for bulk cargo. If your cargo volume is more than 13-15 cubic meters (CBM), it is often cheaper and safer; the container remains sealed from origin to destination which further secures the goods.

Example: For instance, a furniture exporter delivering a large order from Manchester to Phnom Penh would ideally choose FCL shipping due to the high volume. An FCL shipping quote would reveal it to be more economical than LCL and offers greater security for their valuable cargo.

Cost Implications: While the initial cost for FCL can seem higher, it is often the more cost-effective option for large shipments. Savings are gained per CBM compared to LCL. Additionally, the cost of an FCL container is fixed, whether it is a 20ft or 40ft container, making it easy for businesses to predict the shipping cost. Understanding these factors will help you make informed decisions for your shipping needs.

Unlock hassle-free shipping

Discover the seamless way to ship with DocShipper! Our goal is to simplify your international trading journey. Let our ocean freight experts guide you in selecting the best shipping method between the UK and Cambodia, considering vital factors such as budget, time, cargo size, and nature of your goods. Don't get tangled in the complexities of consolidation or full container choices. Depend on us for a stress-free freight forwarding experience. Call now to get a complimentary freight estimation!

How long does sea freight take between UK and Cambodia?

On average, sea freight travel time from the UK to Cambodia typically ranges around 16 to 20 days. These transit times consider various factors, including the specific ports used, the weight of the shipment, and the nature of the goods. It's essential to remember that these are averages, and actual times may vary. For a custom quote that suits your specific shipping requirements, you might find it useful to consult with freight forwarding experts like DocShipper.

Now, let's look into the average transit times between some of the most significant freight ports in both countries.

| UK Ports | Cambodia Ports | Average Transit Time (days) |

| Port of Felixstowe | Sihanoukville Autonomous Port | 16 to 18 |

| Port of Southampton | Sihanoukville Autonomous Port | 17 to 19 |

| Port of London | Sihanoukville Autonomous Port | 17 to 19 |

| ort of Liverpool | Sihanoukville Autonomous Port | 17 to 19 |

*Note: This is a rough estimate, and actual transit times may vary.

N.B. The Autonomous Port of Sihanoukville is the only deep-water port in Cambodia. Therefore, all UK port transit times are calculated to this single destination.

How much does it cost to ship a container between UK and Cambodia?

The cost to ship a container between the UK and Cambodia? That's a good question! It's a broad spectrum, with ocean freight rates per CBM fluctuating due to factors like Point of Loading, Point of Destination, chosen carrier, nature of goods, and even monthly market swings. However, the elusive 'exact price' is elusive and not quite that simple. But worry not, our shipping specialists aren't afraid of complexities. They dive into the details and work diligently on your specific case to reach optimal shipping cost solutions. By tailoring each quote, we ensure you get the best rate possible in any given scenario.

Special transportation services

Out of Gauge (OOG) Container

Definition: Out of Gauge (OOG) shipping refers to any cargo that exceeds the dimensions of a standard shipping container. The transportation of these containers, more specifically known as 'OOG containers', often involves specialized handling and stowage to accommodate the extra dimensions.

Suitable for: OOG containers work best for large or unusually shaped goods that can't fit into standard containers. If you're looking to transport machinery, cranes, or large industrial components, this option might be the best choice for you.

Examples: For instance, transporting a large yacht or a civilian helicopter from the UK to Cambodia would be a job for an OOG container.

Why it might be the best choice for you: This option will provide you with the possibility to safely and efficiently transport your out of gauge cargo without disassembling it.

Break Bulk

Definition: Break bulk refers to goods that are loaded individually onto a vessel rather than packed in a container. The term 'break bulk' comes from the phrase 'breaking bulk' which means to extract a portion of the cargo on a ship or to begin unloading.

Suitable for: This type of shipping is suitable for large items that are not easily loaded into containers including timber, paper, steel products, and yachts.

Examples: If you need to ship turbine blades, machinery parts or construction equipment from the UK to Cambodia, you might opt for break bulk shipping.

Why it might be the best choice for you: Break bulk provides efficient handling of your oversized items, ensuring their safe arrival at the destination.

Dry Bulk

Definition: Dry bulk shipping refers to the transportation of homogenous, loose cargo loads such as grain, coal, and metal ores, in large quantities directly loaded into the ship's hold.

Suitable for: This method is particularly useful if you have large quantities of dry goods that can be poured or dumped into carriers.

Examples: Commodities like minerals, grains, or raw materials dispatched from the UK to feed Cambodia's growing production lines would be excellent candidates for dry bulk shipping.

Why it might be the best choice for you: Dry bulk shipping is the most cost-effective way to transport large quantities of dry and loose goods, making bulk trading more profitable.

Roll-on/Roll-off (Ro-Ro)

Definition: Roll-on/Roll-off (Ro-Ro) shipping is a method where vehicles are driven onto a specially designed ro-ro vessel and securely strapped to the ship's deck to prevent movement during transport.

Suitable for: Ro-Ro is perfect for wheeled cargo such as cars, trucks, trailers, caravans, and any other equipment or goods that can be rolled on and off the ship.

Examples: Say you're a car distributor and you need an efficient way to transport vehicles from the UK to Cambodia, then Ro-Ro shipping could be the perfect fit.

Why it might be the best choice for you: Relying on Ro-Ro shipping ensures your wheeled goods are safely driven onto the vessel, cutting down on excess loading and handling time.

Reefer Containers

Definition: Reefer containers, or refrigerated containers, are temperature-controlled containers used to transport perishable goods that need specific temperatures to stay fresh during transit.

Suitable for: This shipping option is ideal for perishable goods such as fruits, vegetables, dairy products, and other food items.

Examples: A UK agri-food exporter shipping cheese, vegetables or medicine that require specific cold temperatures would find reefer containers invaluable for ensuring product quality upon arrival in Cambodia.

Why it might be the best choice for you: With a reefer container, you can control the temperature to suit your product's needs, ensuring they arrive at their destination in the same condition they were sent.

At DocShipper, we understand the complexities of shipping goods internationally. Our advice is tailored to your specific needs, and we're here to guide you through each step of the process. Contact us for a free shipping quote in less than 24h. Together, we can navigate the shipping world.

DocShipper Tip: Air freight might be the best solution for you if:

- You're facing tight deadlines or need rapid delivery. Air freight is your quickest option, which aligns well with the fast-paced business environment.

- Your shipment is relatively small, under 2 CBM. Air freight is ideal for these more compact loads.

- Your cargo's destination isn't easily reached via sea or rail. This makes air freight a viable option, especially given the extensive network of airports available.

Air freight between UK and Cambodia

For speedy and trustworthy shipment of goods from the UK to Cambodia, air freight steals the show. Especially when dealing with small packages bursting with value, like important medical equipment or high-end electronics, air freight trumps other shipping methods in both speed and protection. However, the world of air freight isn't all smooth flying. Countless shippers hit turbulence due to lack of knowledge. Imagine trying to bake a cake without factoring in oven temperature, or the ratio of ingredients; it would be a total mess. Similarly, underestimating key factors like the right weight formula to estimate the price of goods can skyrocket costs. Equally, unawareness of best practices can turn your budget-friendly shipping plan into a royal wreck. We'll shine a light on these hidden pitfalls and guide you to air freight success.

Air Cargo vs Express Air Freight: How should I ship?

Deciding between air cargo and express air freight to move your goods from the UK to Cambodia? It's a pivotal choice! In layman's terms, air cargo involves transporting your goods in a scheduled airline, while express air freight whisks your shipment on a dedicated plane, promising speed over all else. This quick guide will lead you through the nuances of each, enabling you to match the method to your specific shipping requirements.

Should I choose Air Cargo between UK and Cambodia?

When shipping significant quantities between the UK and Cambodia, say, over 100-150 kg (220-330 lbs), air cargo becomes a compelling choice. Operating with high reliability and cost-effectiveness, prestigious airlines like British Airways and Cambodia Angkor Air are key players offering this service. Despite longer transit times due to scheduled flights, your budgetary needs could well be met. Do your homework, and this potentially efficient route might become your go-to solution.

Should I choose Express Air Freight between UK and Cambodia?

When it comes to shipping goods from the UK to Cambodia with speed as top priority, express air freight is an appealing option. Specialized for cargo under 1 CBM or 100/150 kg (220/330 lbs), these flights, offered by firms like FedEx, UPS, or DHL, are dedicated solely to freight with no passengers. Choosing this route can mean lightning-fast delivery times. So, if you're under a tight deadline or sending smaller packages, express air freight might be your best match. Make sure to compare services for the best fit for your business needs.

Main international airports in UK

Heathrow Airport

Cargo Volume: Heathrow Airport handles approximately 1.7 million metric tons of cargo annually.

Key Trading Partners: The United States, Canada, Germany, China, and Japan are Heathrow's primary trading partners.

Strategic Importance: Heathrow is strategically important as it's the busiest airport in the UK. It plays a crucial role in linking the UK to over 200 destinations worldwide and is a key hub for European connections.

Notable Features: The airport offers a range of air cargo solutions such as cargo forwarding and storage. It also boasts specialized facilities for the handling of perishables and pharmaceuticals.

For Your Business: If your business deals largely with the US, Canada, or Asia, Heathrow's extensive intercontinental links make it an efficient solution for air freight requirements. The broad range of services and specialized facilities available can accommodate a variety of shipping needs.

Manchester Airport

Cargo Volume: Manchester Airport processes over 100,000 tonnes of import and export freight and mail annually.

Key Trading Partners: Key trading routes include the United States, the Middle East, and European countries.

Strategic Importance: It's the UK's third-largest airport. Its strategic location in the North of England positions Manchester Airport as an ideal hub for businesses outside of London.

Notable Features: Manchester Airport features both freight and passenger services, a World Freight Terminal, and a dedicated cargo team on stand-by.

For Your Business: If your business is based in Northern England, Manchester Airport presents a local and convenient option for your shipping needs. The cargo team can provide expert advice and support throughout the freight handling process.

London Stansted Airport

Cargo Volume: London Stansted airport is a leading cargo airport with a throughput of over 250,000 tonnes each year.

Key Trading Partners: Key partners are within the European Union, United States, and Asia.

Strategic Importance: Stansted supports businesses in the London region and has significant import and export traffic with goods ranging from perishable food items to high-value electronics.

Notable Features: London Stansted Airport is home to the UK's largest cargo facility - the Stansted Cargo Centre.

For Your Business: Stansted can facilitate high-value, time-sensitive goods successfully, due to its sizable cargo facilities and strategic location near London's business hub. Its wide range of services ensures it can handle nearly any type of freight.

Glasgow Prestwick Airport

Cargo Volume: Glasgow Prestwick Airport handles over 38,000 tonnes of cargo annually.

Key Trading Partners: The primary trading partners include Europe, North America, and the Middle East.

Strategic Importance: The only airport in Scotland with its rail, sea, and road links, its strategic position is crucial for the Scottish and UK markets.

Notable Features: It has the longest commercial runway and parallel taxiway than any other Scottish airport.

For Your Business: If you're a company based in Scotland, Prestwick provides an advantage with the only integrated transport system in the region, providing an effective solution for reaching customers quickly and efficiently.

East Midlands Airport

Cargo Volume: East Midlands Airport handles over 320,000 tonnes of flown cargo every year.

Key Trading Partners: United States, Asia, and Europe are the major trading partners facilitated by this airport.

Strategic Importance: As the UK's principal pure freight airport, it's a major hub for DHL, TNT, and UPS, and Royal Mail.

Notable Features: The airport operates 24/7, enabling quick turnaround times and efficient handling of freight.

For Your Business: If your business involves late-night shipping or urgent deliveries, East Midlands Airport's round-the-clock operation enables fast and efficient freight solutions. Its extensive partner network could also be a plus for businesses wanting wide-ranging logistical support.

Main international airports in Cambodia

Phnom Penh International Airport

Cargo Volume: Handles approximately 73,000 tonnes of cargo annually.

Key Trading Partners: China, United States, Thailand, Vietnam, Japan.

Strategic Importance: Situated in the capital city, it serves as Cambodia's principal cargo gateway, playing a significant role in the import and export of goods from its major trading partners.

Notable Features: Provides efficient air traffic services, modern cargo facilities, and has advanced security measures.

For Your Business: Given its proximity to the capital and significant trading partners, shipping through this airport offers an efficient option if your business operates within these markets.

Sihanouk International Airport

Cargo Volume: Handles an emerging volume of around 15,000 tonnes of cargo yearly and experiencing a consistent growth rate.

Key Trading Partners: China, Malaysia, Thailand, Vietnam, South Korea.

Strategic Importance: Located in Cambodia's premier seaside town, it forms a vital hub connecting western and southeastern markets, particularly in apparel and textiles.

Notable Features: It offers robust cargo handling and storage facilities, supporting a wide range of commodities, including perishable goods.

For Your Business: With its growing capacity, consider this as an efficient entry point if your business deals with the textile industry catering to Southeast Asian markets.

How long does air freight take between UK and Cambodia?

The average transit time to ship goods from the UK to Cambodia by air is typically around 3-5 days. However, this duration can fluctuate depending on various factors. The specific airports used, the total weight of the shipment, and the nature of the goods being transported all play significant roles in the overall transit time. Therefore, for a more precise and personalized timeframe, it's recommended that you consult with a specialized freight forwarding service like DocShipper.

How much does it cost to ship a parcel between UK and Cambodia with air freight?

Accurately estimating air freight costs from the UK to Cambodia is complex. It generally ranges around $3 to $5 per kilogram, though this can vary. Factors like distance between departure and arrival airports, cargo dimensions and weight, and the type of goods shipped all influence the final price. However, this shouldn't deter you - our dedicated team evaluates each shipment individually to secure the best rates. By working together, we can manage your specific needs and assure you receive the most accurate estimate. Contact us and receive a free quote within 24 hours.

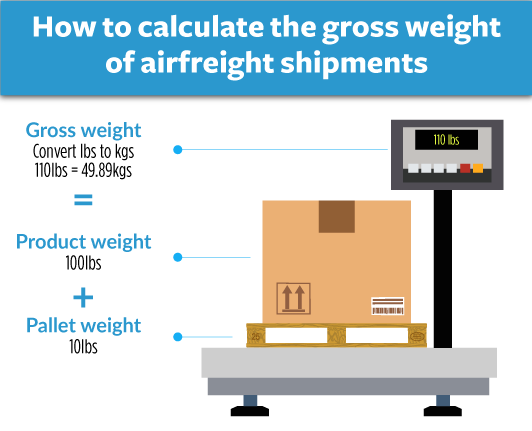

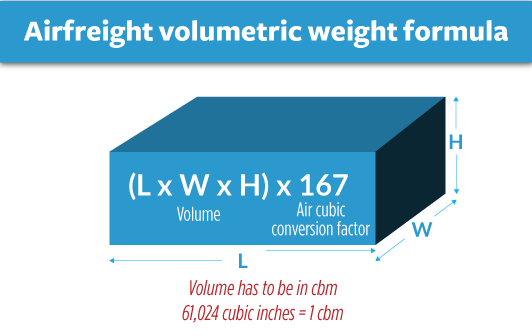

What is the difference between volumetric and gross weight?

In the realm of shipping, gross weight refers to the actual weight of your shipment, measured in kilograms (kg). On the other hand, volumetric weight is more about the space your shipment takes up on an aircraft, considering not only actual mass but also the package's dimensions.

Calculating these might seem like a lot of work, but it's key in air freight shipping. Let's start with gross weight. Suppose you have a package weighing 22 kg. That's around 48.50 lbs. Simple enough, right?

But, volumetric weight isn't as straightforward. It's calculated by multiplying the length, width, and height of the package and then dividing by a standard volumetric factor. In air cargo freight, this factor is usually 6,000.

Say your package has dimensions 40cm x 30cm x 20cm. Multiply these to get a volume of 240,000 cubic cm. Divide this by 6,000, and you get a volumetric weight of 40 kg, which is approximately 88.18 lbs.

For Express Air Freight, the typical volumetric factor is 5,000. Using the same package size, your volumetric weight would be 48 kg or roughly 105.82 lbs. Notice the difference?

So, why does this matter? It's all about the cost. Freight charges are based on whichever is higher: the gross weight or the volumetric weight. In our example, you'd be charged based on the 40 kg or 48 kg volumetric weight, not the 22 kg gross weight. This helps ensure that space on the freight aircraft is used efficiently. Remember, every kilogram counts in air shipping.

DocShipper tip: Door to Door might be the best solution for you if:

- You prioritize ease and a hassle-free shipping experience. Door-to-door services manage the entire process, from collection to final delivery.

- You appreciate the efficiency of having one dedicated contact. With door-to-door, a single agent is responsible for overseeing all elements of your shipment.

- You want to limit the number of times your cargo is transferred. Door-to-door services minimize the switches between various transport methods, lowering the chances of damage or loss.

Door to door between UK and Cambodia

International door-to-door shipping offers an effortless logistics solution, eliminating the need for you to coordinate multiple stages. For UK to Cambodia shipping, it simplifies your process, making it hassle-free and efficient - everything from customs to final delivery sorted for you. Intrigued by these benefits? Let's dive in and uncover more about this seamless transport method.

Overview – Door to Door

Door-to-door shipping from UK to Cambodia, offers a hands-off, stress-free solution. Yes, international logistics can be thorny; red tape, cultural nuances, unexpected delays . . . the list goes on. But, here's where door-to-door shipping shines, taking those complexities off your plate. It’s not without its downsides - cost being the primary one. However, the convenience it offers and the peace of mind knowing your shipment is in trusted hands, certainly makes up for this. This is why it's the preferred service among DocShipper’s clients. Can this solution be right for you? Read on to explore more practical insights and make an informed decision.

Why should I use a Door to Door service between UK and Cambodia?

Has the thought of coordinating with multiple shipping companies, tackling tedious paperwork, and tracking your shipments across countries ever felt like starring in your very own nail-biting thriller? Well then, Door to Door service shipping from the UK to Cambodia is like the plot twist that brings relief.

1. Vanquishing Logistics Stress: With Door to Door service, you don't need to worry about the logistics nightmare between the UK and Cambodia. A single service provider handles all aspects - from goods collection at the initial destination right up until the final delivery in Cambodia. This unified process minimizes confusion and potential mistakes.

2. Ensuring Timely Delivery: Need your shipment in the 'Land of the Smiles and Elephants' pronto? Door to Door services have your back! Built for speed, these services use efficient, pre-charted routes for delivering your goods, ensuring no time gets wasted in transit.

3. Special Care for Complex Cargo: If your cargo requires specialized handling or it's a complex load, Door to Door services are your knight in shining armor. With trained personnel, the service ensures that your precious cargo is well-taken care of throughout its journey.

4. Convenience of Tracking: Got trust issues with your shipments? Door to door services offer real-time tracking, keeping you in the loop through each stage. No more wondering if your shipment is enjoying a surprise vacation en route!

5. Seamless Local Trucking: Door to Door services are like your personal courier, providing end-to-end coverage. Your cargo gets the first-class treatment, whisked away from your doorstep, and delivered directly to the recipient, without you having to lift a finger.

In essence, Door to Door shipping from the UK to Cambodia is like hiring a personal chaperone for your goods, making sure your shipping experience is smoother than silk and speedier than a Mekong river boat!

DocShipper – Door to Door specialist between UK and Cambodia

Effortlessly ship with DocShipper from the UK to Cambodia! Our comprehensive service covers all - packing, transport, customs, across all modes. You just sit back and relax as your dedicated Account Executive professionally orchestrates A-Z of your shipping needs. Get a free estimate in under 24 hours or engage with our consultants at no charge. Experience our proficiency and enjoy stress-free shipping!

Customs clearance in Cambodia for goods imported from UK

Customs clearance refers to the procedures involved when importing goods from one country to another, in this case, from the UK to Cambodia. It's a complex process that can feel like navigating a maze, fraught with unexpected fees and charges. Misunderstandings or oversights concerning duties, taxes, quotas, and licenses can result in costly delays, with your goods trapped in customs limbo. Luckily, the following sections will provide in-depth insights into these potential pitfalls. Remember, DocShipper is on-hand worldwide to assist with your customs needs for any types of goods. To get started with your estimation, get in touch with our team, providing the origin of your goods, their value, and the HS Code. These three elements are crucial to move forward with your project.

How to calculate duties & taxes when importing from UK to Cambodia?

Navigating the seas of customs duties and taxes can feel like deciphering a complex maritime chart, but armed with the right knowledge, it's smooth sailing. Figuring out these charges when importing from the UK to Cambodia primarily involves pinning down five key components: the country of origin, the Harmonized System (HS) Code, the Customs Value, the Applicable Tariff Rate, and other taxes and fees that may apply to your specific products. Painting a clear picture of this process, think of it like assembling a jigsaw puzzle, where each piece contributes to the overall picture - the total cost of importing. Your first step on this voyage is to establish the country in which the goods were manufactured or produced, as this forms the cornerstone of all subsequent calculations.

Step 1 - Identify the Country of Origin

Knowing your goods' country of origin is step one. Why? For five compelling reasons:

1. Each nation has unique customs regulations, determining how the shipment is treated at the border.

2. Trade agreements hugely impact business. A UK-Cambodia trading relationship exists, with specific agreements reducing customs duties. It's not just about geography; it's economics too.

3. A product's origin can directly inform its Harmonized System (HS) code, crucial for identifying the right import duties.

4. Import restrictions vary by country. Some goods are prohibited; others face special regulations. For instance, while second-hand clothing from the UK is often welcomed, some items require special permission in Cambodia.

5. Misidentifying the country of origin can cause delays or even goods seizure at customs, potentially leading to financial loss.

Remember, knowing isn't enough. You should document this information clearly and consistently in your shipping paperwork. Always abide by Cambodia's import legislation to facilitate smooth customs clearance. Failing to do so can result in heavy fines or even business suspension.

Step 2 - Find the HS Code of your product

A Harmonized System (HS) Code, often referred to as a tariff or commodity code, is a standardized numbering method used to classify traded products internationally. It's paramount in everyday shipping, deeply interconnected with customs processes around the world. Accurate HS codes eliminate misunderstandings between the exporter and importer, smooth out customs clearance, and properly determine duties and taxes.

A straightforward solution to find the HS code of your product is to inquire directly with your supplier. Suppliers are typically well-versed with the specific codes corresponding to their goods due to constant involvement in imports and exports.

However, in some cases, this may not be an option. Do not fret! We have an easy-to-follow, step-by-step process to simplify the task.

Step 1: Visit this Harmonized Tariff Schedule tool.

Step 2: When you're there, type your product's name in the search bar and hit 'enter'.

Step 3: Check the Heading/Subheading column. Herein, you'll find your required HS code.

A word of caution to note, accuracy is of utmost importance in selecting the correct HS code. Neglecting to do so could lead to potential delays in the shipment process. In some severe instances, incorrect codes might invite fines.

To conclude, here's an infographic showing you how to read an HS code. This should provide a visual aid for better understanding of the process.

Step 3 - Calculate the Customs Value

Ever puzzled about how Customs Value in Cambodia is calculated from UK imports? The trick lies in understanding that it differs slightly from the actual value of your goods. This sum, known as the Cost, Insurance, and Freight (CIF) value, comprises not only of your product's priced tag but also the cost of international shipping and insurance.

Consider you're importing toys from UK priced at $1000 and the cost of transporting them equals $200, with an added insurance sum of $50. Your customs value is not merely $1000, but $1250 (the CIF value), which will be the base for duty calculation. Clear, isn’t it? Just remember, all values are given in USD. Keep a closer eye on these numbers and you'll master this critical step in no time!

Step 4 - Figure out the applicable Import Tariff

Import tariffs are taxes imposed by a country on goods imported from abroad. In the context of Cambodia importing from the United Kingdom, the Integrated Tariff known as the 'Trade Tariff' will apply.

To determine the tariff for your products, follow these steps using the UK's online Trade Tariff tool:

1. Visit this URL: Trade Tariff - UK Government

2. Enter the Harmonised System (HS) code identified earlier and the country of manufacture.

3. From the results, find the duties and taxes that apply to your product.

As an example, let's say you're importing wooden furniture from the UK with an HS code of 9403.60. Using the Trade Tariff tool, you might find a tariff rate of 15%. If your product, insurance, and freight (CIF) costs total to $15000, your import duties (calculated as tariff rate the CIF cost) would total $2,250.

Understanding your import tariffs upfront will help you calculate your landed costs and avoid unforeseen expenses, keeping your business competitive.

Step 5 - Consider other Import Duties and Taxes

Beyond the basic customs duty, you may encounter additional charges when importing goods from the UK to Cambodia, which could significantly impact your bottom line.

For instance, Excise Duty is a tax applied to specific types of goods like alcohol or tobacco. It can range from 10% to 90%, depending on the product's nature. Just imagine importing a batch of premium cigars - those additional charges can stack up!

Anti-Dumping Taxes are another consideration. If a product is sold to Cambodia at a price lower than its normal value, an anti-dumping duty may be enforced to protect local industry– think protecting Cambodian steel producers from cheap UK imports.

Most crucially, you'll need to account for Value Added Tax (VAT). In Cambodia, the standard rate is 10%. To calculate this, you'd add the customs value of the goods, all duties paid, and the cost of insurance and freight, then multiply by 10%. For example, if the total is 20,000 USD, you'll be paying an extra 2,000 USD for VAT.

Remember: these are hypothetical numbers and the actual rates may vary, but understanding these charges can give you a stronger handle on your total import costs. Always double-check with your customs broker or shipping agent for precise figures. Avoid surprises by factoring in all potential costs upfront.

Step 6 - Calculate the Customs Duties

Calculating customs duties in Cambodia for goods imported from the UK involves a few key elements: the customs value of your goods, along with any potential value-added tax (VAT), anti-dumping taxes, and excise duty. The formula is Customs Value x Customs Duty Rate = Duty Payable.

Let's break it down with some examples:

1. If you import products valued at $10,000 and have a duty rate of 10%, your duty will be $1,000. It's straightforward if no VAT is applied.

2. With VAT, add an extra step. If the VAT rate is 20%, calculate your VAT as ((Customs Value + Duty Payable) x VAT Rate) = VAT Payable. So, on goods worth $10,000 with a duty of $1,000 and a VAT rate of 20%, your VAT comes to $2,200.

3. For those rare cases with anti-dumping taxes and excise duty, daisy chain these extra taxes. Add each to your Customs Value before calculating the next. If your $10,000 goods also attract 15% anti-dumping taxes and 5% excise duty, your final calculation would be Duty Payable + VAT + Anti-Dumping + Excise Duty = Total Duty Payable.

Remember, navigating customs duties and taxes can be complex, even for seasoned international shippers. At DocShipper, we're experts in global customs legislation and we're here to help. We provide seamless customs clearance anywhere in the world and ensure you're not paying a cent more than necessary. Reach out to us anytime for an obligation-free quote in under 24 hours.

Does DocShipper charge customs fees?

No, DocShipper doesn't charge customs duties - an often confused term. While we handle your customs clearance, our fees are separate from duties and taxes paid straight to the government. Think of us as the facilitator, smoothing out the paperwork process and ensuring compliance. We show transparency by providing you with official documents from the customs office, proving that you'll only pay what's charged by them. Imagine it as a restaurant bill - our service fee is the tip for your waiter, while the meal's cost goes to the restaurant (the government, in this case).

Contact Details for Customs Authorities

UK Customs

Official name: Her Majesty's Revenue and Customs (HMRC)

Official website: https://www.gov.uk/

Cambodia Customs

Official name: General Department of Customs and Excise of Cambodia

Official website: http://www.customs.gov.kh/

Required documents for customs clearance

Clearing customs can feel like a daunting maze of paperwork. Understanding these critical documents – Bill of Lading, Packing List, Certificate of Origin, and Documents of Conformity (CE standard) – will unlock smoother, faster freight forwarding. Dive in, and let's make these complex processes your new strength.

Bill of Lading

When you're shipping goods from the UK to Cambodia, the Bill of Lading could be your best friend. Think of it as the résumé of your cargo - it details its origin, destination, and the journey it's set to undertake. When ownership changes hands, it's this document that makes it official. Shippers often use an electronic version, known as 'Telex' release, which adds speed and efficiency to the process. And if you're going air, the Air Waybill (AWB) plays the same role. So, a top tip? Make sure your bill of lading is always accurate and up-to-date. It's the passport that'll help your cargo glide smoothly through customs. Trust us, it will save you from a lot of potential headaches down the line.

Packing List

When exporting goods from the UK to Cambodia, the Packing List is non-negotiable. As a shipper, you're both author and curator of this document detailing which, and how many, items are inside each package. Accuracy is not just crucial, it's demanded: approximate values can’t make the cut. Imagine shipping 100 laptop computers via sea freight, and inaccuracies in your Packing List lead to a hold at customs, delaying delivery, and affecting your client relationships. Likewise, shipping an array of electronic components by air and facing additional costs due to weight discrepancies. In each case, an inaccurate Packing List can cost you precious time, money, and reputation. Your attention to detail protects your business, ensuring that goods travel smoothly from the quays of the Thames to the banks of the Mekong.

Commercial Invoice

Upfront, let's talk about your Commercial Invoice - a VIP document in the shipping world. When shipping from the UK to Cambodia, this invoice needs to crisply detail the product, quantity, price, seller and buyer details, among other specifics. Proper coordination can make customs clearance as smooth as silk. For example, say you're sending 500 handcrafted porcelain mugs from Liverpool to Phnom Penh. It's vital to ensure exactly '500' and 'handcrafted porcelain mugs' are logged across all shipping documents for a hiccup-free journey. Get this right, and you'll be coasting through your customs duties. So keep that invoice detailed, accurate, and aligned - your cargo's smooth arrival depends on it.

Get Started with DocShipper

Overwhelmed by customs clearance between the UK and Cambodia? Our experienced team at DocShipper eliminates the stress, handling every detail. Rest assured, your cargo is in capable hands. Why get tangled in red tape when we can streamline the process for you? Get in touch today for a free, no obligation quote within 24 hours. Let's make your shipping adventure a smooth sailing one.

Prohibited and Restricted items when importing into Cambodia

Ensuring a hassle-free import into Cambodia? It's well within reach. However, you may hit unexpected roadblocks if unaware of items prohibited or restricted there. We detail everything, helping you avoid fines or unwanted surprises. Let's simplify your Cambodia trade adventures.

Restricted Products

- Pharmaceuticals: You have to apply for a Pharmaceutical Import License from the Ministry of Health in Cambodia.

- Tree and Timber products: You need a Timber Export License from the Forestry Administration of Cambodia.

- Biological or Genetically-Modified Organisms: A special permit from the Ministry of Agriculture, Forestry, and Fisheries is a must.

- Firearms and Explosives: The Ministry of Interior oversees this, so you'll need their Firearm Import License.

- Archaeological artefacts: These require a permit from Cambodia's Ministry of Culture and Fine Arts which you can get from their site Ministry of Culture and Fine Arts.

- Radioactive Substances: These fall under the jurisdiction of the Ministry of Mines and Energy.

- Foods, Cosmetics, Alcohol, and Health Supplements: To import these items, you need a permit from the Cambodia Import-Export Inspection and Fraud Repression Directorate-General (CAMCONTROL).

Remember, all the licenses and permits are subject to renewal and agreements can be changed or nullified by the issuing authority. It's always best to double-check the current requirements and validity. Happy shipping!

Prohibited products

- Narcotics and psychotropic substances

- Counterfeit cash and goods

- Pornographic materials

- Treasures of national cultural heritage and history

- Animals, plants, and their products under CITES protection

- Industrial waste and toxic waste

- Weapons, ammunition, explosive materials, and military equipment of all kinds without permits

- Radioactive materials

- Electronic waste.

Are there any trade agreements between UK and Cambodia

Yes, there's indeed an ongoing dialogue for a potential Free Trade Agreement (FTA) between the UK and Cambodia. This agreement could significantly reduce customs duties, making your import and export processes more cost-effective. While details are yet to be finalised, you may want to prepare your business for this opportunity. Stay updated with recent news on this matter to fully capitalise on potential trade benefits.

UK - Cambodia trade and economic relationship

UK and Cambodia share a rich, evolving trade landscape. After the establishment of diplomatic relations in 1953, economic collaborations gradually intensified. Cambodia primarily exports garments, footwear, and rice to the UK, while UK exports machinery, mechanical appliances, and pharmaceutical products. Key sectors involving trade include agriculture, garments, and infrastructure.

The bilateral trade volume reached £791m in 2024, with a mix of goods flowing both ways. Investment also flows from the UK to budding sectors in Cambodia like renewable energy and eco-tourism. The UK remains a crucial trade partner for Cambodia, contributing significantly to its economy. As Brexit reshapes trade landscapes, the potential for future growth exists due to Cambodia's preferential access to the UK market granted by the 'Everything But Arms' initiative. This mutuality of interest presents exciting trade possibilities and robust economic ties. The fusion of rich Cambodian resources and British technical know-how could potentially unlock new opportunities.

Your Next Step with DocShipper

Unsure about the complexities of trade between the UK and Cambodia? DocShipper is your port in the storm, adept at deciphering intricate customs procedures, handling cargo with care, and delivering your goods hassle-free. Let us transform your shipping experience. Contact us now - we are ready to chart your course!

Additional logistics services

Explore beyond shipping and customs with our all-encompassing logistics services. Dive into how DocShipper can streamline your entire supply chain process, turning complexities into simplicity at every turn. Discover more, tailor-made for your every need!

Warehousing and storage

Finding the right warehouse in Cambodia from the UK can feel like threading a needle in the dark, especially when your goods require particular conditions like temperature control. Our warehousing services are all about providing reliable, tailored storage solutions that cater to these precise needs, so you can rest easy. Delve into the specifics on our dedicated Warehousing page.

Packaging and repackaging

Choose the right packaging and repackaging to safeguard your items during a UK-Cambodia transit. Trust us, a reliable freight forwarder, to professionally handle delicate ceramics or robust machinery. For instance, we use protective strapping for large machinery and bubble wrap for glass products. Each package is cautiously prepared, ensuring your goods arrive in perfect condition. Delve deeper into our process on our dedicated page: Freight packaging.

Cargo insurance

While your goodies are jetting or sailing from UK to Cambodia, things might happen - akin to a home catching fire. But unlike fire insurance, Cargo Insurance covers those unforeseen mishaps with your precious freight during transportation. For instance, inclement weather or rough handling damaging your delicate porcelainware? It has you covered. Giving that peace of mind; handling your worst-case scenarios like a champ! Dig deeper into the details on how to secure your assets with our Cargo Insurance.

Supplier Management (Sourcing)

Looking to source and manufacture products in Asia or East Europe without fuss? DocShipper has got your back. We bridge language barriers, pinpoint viable suppliers, and streamline the procurement process, end-to-end. Imagine, no more stressful supplier prowling. That's your shipping load lightened! More info on our dedicated page: Sourcing services.

Personal effects shipping

Moving from the UK to Cambodia? We get it, your personal effects aren't just 'stuff'. Our team handles your treasures with professional care, transforming the shipping of even the most fragile or bulky items into an effortless process. Did you say grand piano or antique vase? No worries. Check all the particulars on how we roll at our dedicated page: Shipping Personal Belongings.

Quality Control

Quality Control is your failsafe, ensuring your goods conform before they embark on their journey from the UK to Cambodia. Imagine detecting faulty electronics or mismatched fashion pieces before they even leave the factory – that's the power of a well-conducted quality inspection. Avoiding unhappy customers, recall debacles and shipment complications is a wise move. More info on our dedicated page: Quality Inspection.

Product compliance services

With our Product Compliance Services, shipping your goods becomes effortless, compliant, and hassle-free. We understand the weight of compliance regulations. Therefore, our team will conduct various lab tests to guarantee your product's conformity with targeted regulations. Failing to comply can lead to hefty fines – imagine a shipment of children's toys rejected due to lead levels. Avoid such costly pitfalls by leveraging our know-how and ensuring everything runs like clockwork. More info on our dedicated page: Product compliance services.

FAQ | For 1st-time importers between UK and Cambodia

What is the necessary paperwork during shipping between UK and Cambodia?

As DocShipper, we streamline the process for you. The crucial paperwork encapsulates a Bill of Lading for sea freight or an Air Waybill for air freight. Typically we manage these on your behalf. What you need to provide us with is a packing list and commercial invoice. Additional documentation may be required based on the nature of your cargo. For instance, Material Safety Data Sheets (MSDS) or other certifications might be essential. Our team is ready to guide you through every step to ensure smooth shipping from the UK to Cambodia.

Do I need a customs broker while importing in Cambodia?

Absolutely, working with a customs broker is highly advised while importing to Cambodia, given the complex process and mandatory documentation required. We at DocShipper understand the intricacies of negotiating with customs authorities and are well-equipped to handle it efficiently. Rest assured, in most cases, we proudly represent your cargo at customs, ensuring a smoother, hassle-free process. Navigating through the customs maze can be daunting, but with our expertise, we're here to guide you every step of the way.

Can air freight be cheaper than sea freight between UK and Cambodia?

Determining whether air freight is cheaper than sea freight between the UK and Cambodia can be complex as it relies on various factors including the route, weight, and volume of your cargo. Generally, if your shipment is less than 1.5 Cubic Meters or weighs under 300 kg (660 lbs), air freight might be a suitable and cost-effective option. At DocShipper, we prioritize providing our customers with the most competitive options suitable for their needs. Please note, our dedicated account executives are ready to provide the best solutions catering to your specific shipping requirements.

Do I need to pay insurance while importing my goods to Cambodia?

While we're talking about importing goods to Cambodia, it's important to know that insurance isn't compulsory. However, we at DocShipper strongly recommend opting for insurance. Despite the best precautions, unforeseen instances like damage, loss, or theft can happen during transit. Securing insurance for your goods acts as a safety net in such events, ensuring you aren't snagged by unexpected setbacks. Your peace of mind is our priority, and insurance helps provide exactly that. Keep your focus on your business - we'll handle the logistics

What is the cheapest way to ship to Cambodia from UK?

Shipping from the UK to Cambodia, you'll find sea freight as the most cost-effective method due to the long distance. It's slower than air freight, but significantly cheaper, especially for heavy or bulk shipments. With our oversight, we ensure smooth customs process and delivery to your final destination. Do note, speed-to-cost balance is crucial and we are here to assist you find that perfect medium.

EXW, FOB, or CIF?

When in a trade relationship, ensuring the logistical aspects of your transactions are handled effectively is crucial. Your supplier may not specialize in logistics, which is where DocShipper steps in. We recommend letting us manage the international freight and destination processes to minimize complications. Your supplier will commonly sell under EXW (Ex Works) or FOB (Free On Board) terms, with charges covered to their factory door or the origin terminal respectively. Regardless of these terms, you can depend on DocShipper to provide comprehensive door-to-door service, ensuring smooth, convenient shipping.

Goods have arrived at my port in Cambodia, how do I get them delivered to the final destination?

When your goods arrive at a Cambodian port and we've handled them under CIF/CFR incoterms, you'll need to secure a customs broker or freight forwarder to assist with terminal clearance, import fees, and final delivery. Alternatively, you can use our team under DAP incoterms, where we manage the entire process. Confirm this with your account executive for clarity.

Does your quotation include all cost?

Indeed, we aim for complete transparency in our quotations. They include all costs except for duties and taxes at the destination, which can be estimated by your dedicated account executive upon request. So, rest easy knowing there won't be any nasty surprises or hidden fees with us, DocShipper.