Ever tried wrestling a Greek statue across the sea? Yeah, we thought not. But shifting freight from the UK to Greece can sometimes feel just as challenging. Complexities around interpreting freight rates, enduring unsettling transit times, and grappling with intricate customs regulations are very real consequences of international freight logistics. This guide aims to be your GPS through this labyrinth, dissecting freight options like sea, air, rail and road, making sense of customs clearance processes, and explaining the nuances of duties and taxes. We're here to provide tailored advice for businesses on how to steer their cargo from the UK across the crystal-blue Aegean Sea, right to the heart of Greece. If the process still feels overwhelming, let DocShipper handle it for you! We turn the challenges of international shipping into a success story for your business.

Table of Contents

Which are the different modes of transportation between UK and Greece?

Choosing the best transport mode for shipping between the UK and Greece is like picking shoes for a hike – it depends on your path and needs! Covering land and sea, each option has unique benefits. Road transport toes the line between cost and speed but faces geographical hurdles. Sea freight sails over these challenges, offering a cost-effective if slower route. The right choice balances your specific needs, like cargo type and urgency, against these options. In understanding your shipping puzzle, you'll find the perfect fit for your transportation ‘footwear’.

How can DocShipper help?

Struggling with your UK to Greece shipment? Simplify it with DocShipper! Our team streamlines all processes from customs clearance to transportation, ensuring your goods reach safely and promptly. Need assistance? Contact our consultants for free. For a free estimate within 24 hours, get in touch today!

DocShipper Tip: Ocean freight might be the best solution for you if:

- You're dealing with large quantities or oversized items. Sea freight offers a budget-friendly way to maximize space, a particularly useful option given the UK's extensive port network.

- Your shipment isn't on a tight schedule. Ocean transport typically takes longer than air or rail, but it offers reliability.

- Your supply chain involves key ports, allowing you to take advantage of a wide-reaching network of sea lanes.

Sea freight between UK and Greece

Shifting goods between the UK and Greece through ocean freight? You're tapping into a thriving trade link, facilitated by major cargo ports like Piraeus, Greece's bustling maritime gateway, and the multifaceted Port of Felixstowe in the UK. Of course, sea freight has its charms. It's your go-to for moving heaps of goods without busting your budget, though it costs you a bit of time.

But let's address the elephant in the room - the frequent hurdles and hang-ups in this shipping journey. Ever felt like you're playing an endless game of snakes and ladders with customs clearance? Or that some elusive 'best practices' slip through your fingers as you're grappling with the specifications of your cargo? We're about to untangle those knotted issues in this section. Think of it as your handy roadmap in this maritime maze. Simple? Absolutely. Enlightening? You bet. Get ready to make ocean shipping between the UK and Greece smooth sailing!

Main shipping ports in UK

Port of London

Location and Volume: Located on the Thames River, the Port of London is a significant gateway for a variety of goods, handling over 53 million tonnes of cargo every year.

Key Trading Partners and Strategic Importance: Europe and North America are primary trading partners, with the port facilitating trade of goods such as forest products, oil, and containers.

Context for Businesses: If you're aiming to reach European or North American markets, the Port of London's extensive capabilities and strategic location could integrate smoothly into your logistics plan, providing efficient access to these regions.

Port of Southampton

Location and Volume: The Port of Southampton is located on England's South Coast and is known as the UK's premier hub for automotive trade, handling over one million vehicles annually.

Key Trading Partners and Strategic Importance: The port plays a crucial role in the trade with Asia, specifically China, India, and other parts of Europe.

Context for Businesses: If your business involves the import or export of vehicles or plans to tap into Asian markets, consider the Port of Southampton due to its specialization in these areas.

Port of Liverpool

Location and Volume: Situated on the West Coast of England, the Port of Liverpool handles over 32 million tonnes of cargo annually.

Key Trading Partners and Strategic Importance: The port has strong trading links with Ireland, the Americas, and other parts of Europe, handling food, beverages, and other consumer goods.

Context for Businesses: If your supply chain involves transatlantic shipping or you're seeking access to Irish or European markets, the Port of Liverpool's robust capabilities could align well with your shipping strategy.

Port of Felixstowe

Location and Volume: Located in Suffolk, England's East coast, the Port of Felixstowe is the busiest port in the UK, managing over 3.8 million TEU yearly.

Key Trading Partners and Strategic Importance: The port handles most of the UK's trade with Asia, making it strategically important for businesses trading with these markets.

Context for Businesses: If you're primarily trading with Asian markets, the Port of Felixstowe, with its excellent connectivity and high volume capabilities, may be of significant interest to your logistics plan.

Port of Grimsby

Location and Volume: The Port of Grimsby, located on the South Bank of the Humber Estuary in North East Lincolnshire, is known for handling up to five million tonnes of cargo annually.

Key Trading Partners and Strategic Importance: It is a key player in the trade with Northern Europe and Scandinavia, specializing in cars, forest products, and project cargo.

Context for Businesses: If you're predominantly dealing with Northern Europe or Scandinavia, or your business handles large, irregular cargo or automotive, the specialized services of Port of Grimsby might be beneficial to your logistics.

Port of Hull

Location and Volume: Based on the Humber Estuary, the Port of Hull is a versatile port handling around 13 million tonnes of cargo each year.

Key Trading Partners and Strategic Importance: The port maintains strong trade ties primarily with Northern Europe, Scandinavia, and the Baltic States.

Context for Businesses: If you're looking to access the markets of Northern Europe, Scandinavia, or the Baltic States, the Port of Hull, known for its broad coverage and diversified capabilities, could be an important part of your freight strategy.

Main shipping ports in Greece

Port of Piraeus

Location and Volume: Sitting at the heart of Greece, on the Saronic Gulf in the Aegean Sea, the Port of Piraeus serves as a significant hub for European maritime trade, managing a volume of over 5 million TEUs yearly.

Key Trading Partners and Strategic Importance: Piraeus is a major gateway for trade into the European Union, including goods flow from Asia, Africa, and the Americas. Its strategic location strengthens its role as an intermediary in the Belt and Road Initiative backed by China.

Context for Businesses: If you're planning to penetrate the European market, particularly in the South, the Port of Piraeus provides comparatively shorter shipping times and has state-of-the-art facilities to handle a variety of cargo.

Port of Thessaloniki

Location and Volume: Nestled in the northeastern part of Greece, the Port of Thessaloniki handles a shipping volume of roughly 430,000 TEUs. It facilitates the bulk of the trade activities in the northern territories of the country.

Key Trading Partners and Strategic Importance: The Port of Thessaloniki plays a pivotal role in Balkan trade. It acts as a bridging point connecting Greece to its northern trading partners. It also connects the Balkan region to major Asian and African ports, particularly those in India and South Africa.

Context for Businesses: The Port of Thessaloniki is ideal for businesses aiming to tap into the Balkan region and South Eastern Europe. Its upgraded facilities handle different types of cargo, making it a versatile option for your shipping strategy.

Port of Patras

Location and Volume: Situated on the west coast of Greece, the Port of Patras principally functions as a ferry port, performing a pivotal role in passenger and vehicle shipping.

Key Trading Partners and Strategic Importance: The Port of Patras connects Greece to several crucial European ports, such as those in Italy and Spain. It serves as the primary maritime gateway for international freight transport to/from Western Europe and Greece.

Context for Businesses: If your business involves the transportation of automobiles or you're seeking to establish links with Italy or other Western European countries, Patras' well-organized Ro-Ro facilities and strategic positioning make it an important player in your logistics planning.

Should I choose FCL or LCL when shipping between UK and Greece?

Deciding on a shipping method between the UK and Greece? Your choice between full container load (FCL) and less than container load (LCL), or consolidation, can shape the efficacy of your entire shipment journey. As two primary sea freight options, they vary greatly in cost, delivery time, and other logistics factors. An informed decision is vital as it substantially affects your shipping success. Join us as we delve into these two methods, helping you identify the best fit for your specific shipping needs. Prepare to harness the power of strategic shipping planning.

LCL: Less than Container Load

Definition: Less than Container Load (LCL) is a shipping method where different shippers' goods are consolidated into one container for transit. LCL freight allows for greater flexibility and cost-effectiveness for smaller shipments.

When to Use: LCL shipment is the ideal choice if you're transporting cargo that is less than 13-15 cubic meters (CBM). This is because you pay only for the space your cargo occupies, providing a more affordable shipping option for small volumes.

Example: For instance, if you're a UK based manufacturer of craft beers looking to export a small batch for a Greek culinary festival, your cargo could be around 10 CBM. Shipping with LCL would allow you to share a container with other businesses, reducing your overall freight costs.

Cost Implications: While LCL offers increased flexibility in terms of volume, costs can mount as every stage of the journey is charged for its handling, including consolidation, de-consolidation, and customs-related duties. It's also subject to more handling, which could potentially increase the risk of damage compared to a Full Container Load (FCL). Therefore, the cost-saving benefits must be weighed carefully against the product's value and shipment size.

FCL: Full Container Load

Definition: Full Container Load (FCL) shipping is a freight method where a single container is exclusively used for one consignment, irrespective of whether it's fully loaded or not.

When to Use: Choose FCL shipping when your cargo is more than 13/14/15 CBM. FCL is cost-effective for high volumes and guarantees safety as the container is sealed from origin to destination.

Example: For instance, if you produce olive oil in Greece and regularly ship 16 CBM to UK supermarkets, an FCL container would be your best choice. Your products would be secured in a 20'ft container or a 40'ft container, ensuring they are undisturbed until they reach the destination.

Cost Implications: While your initial FCL shipping quote might seem high, especially if comparing to LCL, the per-unit cost gets significantly cheaper when you’re shipping larger volumes. It's also worth noting that by reducing the risk of damage during transportation, FCL could potentially save you a lot down the line in terms of product replacement costs.

Unlock hassle-free shipping

Choosing between shipping consolidation or a full container from the UK to Greece might seem daunting, but not with DocShipper. As objective experts in freight forwarding, we aim to make this process hassle-free by providing our seasoned ocean freight specialists to guide you. They will take into account factors such as volume, speed, cost, and customs requirements. Ready to see the difference we can make in your business shipping? Contact us today for a free estimation.

How long does sea freight take between UK and Greece?

Typically, sea freight shipping between the UK and Greece takes around 7 to 10 days. This transit time, however, is subject to considerations including the specific ports in use, the weight of the consignment, and the nature of the goods being shipped. For a more bespoke estimate, it’s advised to consult with a professional freight forwarder like DocShipper who can provide a tailored quotation.

Here’s a summary of average transit times between the four main freight ports of both countries:

| UK Ports | Greece Ports | Average Transit Time (days) |

| London Gateway | Thessaloniki | 27 days |

| Southampton | Piraeus | 14 days |

| Felixstowe | Heraklion |

15 days

|

| Liverpool | Igoumenitsa | 31 days |

*Please remember that these times are estimates and can vary depending on a variety of factors.

How much does it cost to ship a container between UK and Greece?

Shaving away complexities, ocean freight rates between the UK and Greece revolve around a broad spectrum, typically priced per CBM. Establishing a single, definitive shipping cost isn't feasible due to mutable factors—Point of Loading, Point of Destination, carrier preference, type of goods, and monthly market alterations. Yet, there's reassurance in this vast sea of variables. Our perceptive shipping specialists stand at the ready, tailoring quotes with meticulous precision to your unique circumstances. We wade with you through the ebbs and flows, ensuring you navigate to the best possible rates and solutions.

Special transportation services

Out of Gauge (OOG) Container

Definition: OOG container is a type of shipping method uniquely designed for Out of gauge cargo, i.e., items that exceed the standard container's dimensions in either length, width, or height.

Suitable for: Goods that are oddly shaped or larger than the standardized container measurements.

Examples: Large machinery, oversized industrial equipment, windmill propellers etc.

Why it might be the best choice for you: If your consignments are too large for normal containers, OOG containers can transport these bulky items safely and efficiently from the UK to Greece.

Break Bulk

Definition: Break bulk is a shipping method designed for cargo, known as loose cargo load, that is too large or heavy to fit into standard containers. These goods are individually loaded onto the vessel.

Suitable for: Large items that can't be disassembled into smaller parts.

Examples: Large construction materials, steel girders, or enormous vehicles.

Why it might be the best choice for you: If your freight can withstand exposure to the elements and doesn't fit into standard containers, break bulk shipping offers a feasible solution.

Dry Bulk

Definition: Dry bulk goods are shipped in mass quantities without packaging. They are often commodity raw materials that are poured directly into the ship's hold.

Suitable for: Commodities such as coal, grain, and minerals.

Examples: Dry grains, ores, coals etc.

Why it might be the best choice for you: If your business deals with large quantities of granular and dry goods, utilizing dry bulk shipping can be cost-effective for UK to Greece shipments.

Roll-on/Roll-off (Ro-Ro)

Definition: RO-RO vessels are designed for wheeled cargo such as cars, trucks, semi-trailer trucks, trailers, and railroad cars that are driven on and off the ship on their own wheels or using a ro-ro vessel platform.

Suitable for: Wheeled cargo and vehicles.

Examples: Cars, buses, trucks, tractors, trailers, etc.

Why it might be the best choice for you: If your business requires the transportation of vehicles from the UK to Greece, Ro-Ro offers a quick and efficient way to do so.

Reefer Containers

Definition: Reefer containers are refrigerated shipping containers for goods that require temperature-controlled conditions.

Suitable for: Perishable goods such as food, pharmaceuticals, and other temperature-sensitive items.

Examples: Fruits, vegetables, meats, dairy products, and medicines.

Why it might be the best choice for you: Reefer containers ensure that your temperature-sensitive items retain their quality and freshness while being shipped from the UK to Greece.

Understanding the subtleties of each type of sea freight shipping can be challenging. DocShipper offers tailored help based on your specific needs. Contact us for a customized, free shipping quote within 24 hours. We handle everything from packaging to customs clearance—allowing you to focus on your business.

DocShipper Tip: Air freight might be the best solution for you if:

- You're facing tight deadlines or need rapid delivery. Air freight is your quickest option, which aligns well with the fast-paced business environment.

- Your shipment is relatively small, under 2 CBM. Air freight is ideal for these more compact loads.

- Your cargo's destination isn't easily reached via sea or rail. This makes air freight a viable option, especially given the extensive network of airports available.

Air freight between UK and Greece

Speed and reliability are the trademarks of air freight from the UK to Greece. If your cargo is time-sensitive, small, and valuable – perhaps designer fashion, electronics, or pharmaceuticals – then taking to the skies could be cost-efficient. In a world where time is money, the fast turnaround time offered by air transport is vital.

However, just as a pilot needs to keep an eye on the clouds, shippers too need to steer clear of common pitfalls. Overlooking factors such as the volumetric weight could inflate your shipping costs. Picture this: a fluffy teddy bear might not weigh much on the scale, but it takes up a lot of space on an aircraft, making its 'heavier' in air freight terms. Avoiding such gotchas can save you a small fortune, and we'll show you how.

Air Cargo vs Express Air Freight: How should I ship?

Baffled about your cargo's aerial voyage from the UK to Greece? Here's a simple rundown: Air Cargo is like riding the bus – your goods travel with others, tucked away in a commercial flight. Express Air Freight, on the other hand, is like booking a private jet – your shipment gets a dedicated plane, whisking it off to its destination, swiftly and solely. Now let's dive in and determine which one suits your business the best.

Should I choose Air Cargo between UK and Greece?

Choosing air cargo to ship goods between the UK and Greece can prove cost-effective and reliable, handling 100-150kg (220-330lbs) comfortably. Airlines like British Airways from the UK and Aegean Airlines from Greece are keys players in this sector. Fixed schedules might mean longer transit times, but the certainty and security provided often outweigh this factor. Considering your budget and the weight of your cargo, air freight might be an appealing choice for your business.

Should I choose Express Air Freight between UK and Greece?

Express air freight is a unique service utilizing cargo-only planes, bypassing the delays typically associated with passenger flights. This method might be perfect for your shipments between the UK and Greece, particularly if they're under 1 cubic meter (CBM) or 100/150 kg (220/330 lbs). It's faster and highly reliable, making it apt for urgent deliveries. International courier giants like FedEx, UPS, and DHL offer these express services, ensuring your goods reach their destination in the quickest possible time. When efficiency is paramount, express air freight is the way to go.

Main international airports in UK

Heathrow Airport

Cargo Volume: Heathrow Airport handles approximately 1.2 million metric tonnes of cargo every year.

Key Trading Partners: The United States, China, India, Australia, Japan, and various European countries.

Strategic Importance: Heathrow is the hub of the UK’s air cargo operations, crucially located centrally with proximity to many major cities.

Notable Features: Equipped with cutting-edge technology, Heathrow handles an expansive range of cargo, including pharmaceuticals, perishables and high value items.

For Your Business: If your company deals primarily in high-value goods, or you’re seeking a high-speed connection to key global markets, Heathrow could provide the best links due to its strategic location and state-of-the-art facilities.

Stansted Airport

Cargo Volume: Stansted Airport moves over 250,000 tonnes of cargo annually.

Key Trading Partners: The United States, Europe, Asia and the Middle East.

Strategic Importance: As the third busiest airport in the UK, Stansted boasts a significant cargo industry presence and is home to several major freight companies.

Notable Features: Stansted offers specialised warehouse facilities and 24/7 operations making it an excellent choice for critical and time-sensitive cargo.

For Your Business: If your operations require around the clock logistics and specialised cargo handling, consider incorporating Stansted into your shipping strategy.

East Midlands Airport

Cargo Volume: Close to 360,000 tonnes of freight are handled by East Midlands Airport each year.

Key Trading Partners: Primarily Europe, but also widespread global connections.

Strategic Importance: Situated near the heart of England, East Midlands Airport serves major manufacturing and distribution centres and is the country's top airport for dedicated cargo traffic.

Notable Features: East Midlands has the UK’s largest pure freighter capacity, meaning cargo doesn't have to share space with passenger operations.

For Your Business: If your cargo is bulky or otherwise challenging to ship, East Midlands Airport's extensive freighter capacity could make this your primary choice.

Manchester Airport

Cargo Volume: Victoria International is managing approximately 120,000 tonnes of cargo annually.

Key Trading Partners: Primarily Europe, Asia, and the US.

Strategic Importance: Serving the north of England, Manchester Airport is an essential airport for improving regional connectivity and trade links.

Notable Features: Manchester Airport has extensive perishable goods handling facilities and is one of the top airports in the UK for pharmaceutical shipments.

For Your Business: If your enterprise regularly deals with perishable goods or pharmaceutical products, Manchester Airport might be a highly recommended choice.

Gatwick Airport

Cargo Volume: Handles over 96,000 tonnes of freight each year.

Key Trading Partners: Europe, USA, and various Asian countries.

Strategic Importance: Being the second largest international airport in the UK, Gatwick plays a key role in the UK’s import and export activities.

Notable Features: Gatwick offers a wide range of services, from courier to larger airfreight items, with excellent security and time-critical delivery.

For Your Business: Gatwick Airport’s internationally focused cargo handling abilities might be ideal if your business relies on precision and timely deliveries to global partners.

Main international airports in Greece

Athens International Airport

Cargo Volume: Athens International Airport handles around 100,000 tons of air freight per year.

Key Trading Partners: Key trading partners for goods handled at Athens Airport include Germany, Italy, Cyprus, China, and the USA.

Strategic Importance: Located at the crossroads of Europe, Asia, and Africa, Athens International Airport plays a central role in the Southeast European cargo market.

Notable Features: The airport offers over 10,000m² of modern cargo facilities which provide capacity for various types of cargo. The airport also boasts a full customs service to simplify the shipping process.

For Your Business: The airport's central location and expansive facility might make Athens International Airport an ideal hub for your goods shipping across Europe, Asia, and Africa. With its variety of handled goods, your diverse shipping requirements could likely be easily accommodated.

Thessaloniki Airport Makedonia

Cargo Volume: Thessaloniki Airport harbors around 13,000 tons of cargo annually.

Key Trading Partners: Major trading partners include Germany, Cyprus, Bulgaria, the UK, and Italy.

Strategic Importance: Located in the second largest city in Greece, Thessaloniki Airport serves as a critical gateway to the Balkan region.

Notable Features: The airport features over 2,500m² dedicated to cargo handling. It has a state-of-the-art cargo facility to handle various kinds of goods including dangerous goods and live animals.

For Your Business: Thessaloniki Airport could serve as a useful entry point for your goods into the vibrant markets of the Balkans. Its capabilities to manage a diverse range of goods might offer your business a considerable advantage in reaching eastern European markets.

Heraklion International Airport N. Kazantzakis

Cargo Volume: The airport handles a modest cargo volume of around 2,500 tons annually.

Key Trading Partners: Key trading partners are Italy, Germany, UK, and Cyprus.

Strategic Importance: Positioned on Crete, the largest Greek island, Heraklion International is the country's primary air gateway to the island region.

Notable Features: The airport offers 1,250m² designated for cargo, able to handle varying types of goods. Full customs services are available for shippers.

For Your Business: Heraklion International Airport may be the ideal choice for businesses aiming to reach the island's diverse market. The airport's services might accommodate your shipment's customs clearance needs, making the process more seamless for your business.

How long does air freight take between UK and Greece?

Shipping goods from the UK to Greece by air freight usually takes between 1 to 2 days on average. However, it's important to note that this duration can vary significantly depending on factors such as the specific airports used, the weight of the shipment, and the nature of the goods. For precise timings, to avoid unexpected delays and to ensure efficient handling of your goods, it's recommended to consult with a freight forwarder like DocShipper.

How much does it cost to ship a parcel between UK and Greece with air freight?

Shipping an air freight parcel between UK and Greece generally costs between £2 to £5 per kg. However, an accurate figure is tricky to estimate. This is because the final cost is determined by several factors; including the actual distance from the departure and arrival airports, the dimensions and weight of the parcel, and the nature of the goods. Despite these variables, our team is committed to working with you to ensure the best rates are provided, as we quote on a case-by-case basis. Get in touch with us now so that we can provide a free quote in less than 24 hours.

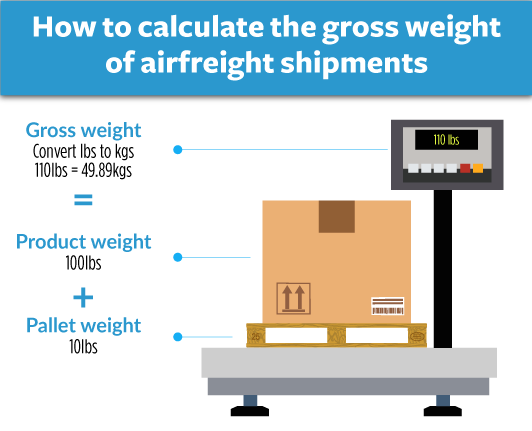

What is the difference between volumetric and gross weight?

Gross weight refers to the actual physical weight of your cargo including all packaging. It's measured in kilograms (kg). On the other hand, Volumetric weight, also known as dimensional weight, considers the amount of space your shipment occupies rather than the actual weight. It's often used in air freight shipments.

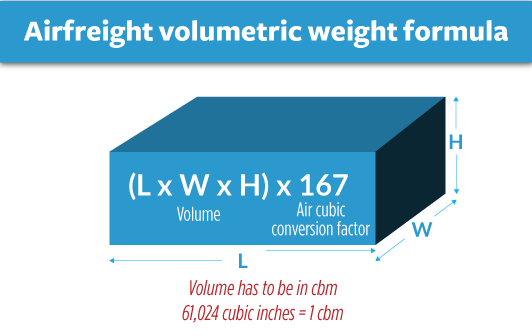

Now, let's understand how each is calculated. For air cargo, the Volumetric weight is determined by multiplying the length, width, and height of the package in centimeters and then dividing by 6000. If you have a box with dimensions 50cm x 40cm x 30cm, your calculation would look like this: (50 x 40 x 30) / 6000 = 10kg volumetric weight. In pounds, that would be approximately 22lbs.

If that same box actually weighs 15kg, then the gross weight in pounds is approximately 33lbs.

As for Express Air Freight, the calculation is a bit different. The divisor for volumetric weight changes from 6000 to 5000. So, using the same box dimensions, your calculation goes like this: (50 x 40 x 30) / 5000 = 12kg volumetric weight, roughly translating to 26.4lbs in pounds.

Understanding the difference between these two weights is crucial. Why? Because when determining freight charges, carriers charge based on the higher of the two weights, either the gross weight or the volumetric weight. So, gaining knowledge about these two concepts can help your business to better plan and manage shipping costs.

DocShipper tip: Road freight might be the best solution for you if:

- You're seeking a budget-friendly solution for shorter hauls. Road freight often comes out on top in terms of cost-effectiveness and speed for these kinds of distances.

- Your end destination is either within your own continent or just across the border. For such regional or intra-continental shipments, road freight is typically the most direct and rapid method.

- Your cargo has unique dimensions or shapes. The adaptability of trucking allows for a wide range of goods that may not conform to the size limitations of sea or air transport.

Trucking between UK and Greece

Navigating shipping between the UK and Greece? Trucking services may be your golden ticket. Though not as quick as air freight, road transportation often outweighs sea and rail in terms of cost effectiveness and convenience. Imagine goods traveling via well-established routes, with less handling and more delivery flexibility. However, keep in mind the variations in road conditions and transit times. Despite a few speed bumps like traffic or customs delays, the pros of road shipping — affordability, door-to-door delivery, and high accessibility — significantly steer it into the fast lane. Stay tuned as we discuss this smart, economical choice in detail.

What if I can’t fill a truck between UK and Greece?

Discover the world of freight transportation from the UK to Greece as we tackle the duel between Less than Truckload and Full Truckload options. This crucial segment is a must-read for businesses seeking to strike a balance between cost-effectiveness and flexibility in their logistics strategy. Dive in!

LTL: Less than Truck Load

Less Than Truckload, also known as LTL freight, is a transportation mode where various small shipments are combined to make a full truckload. This is ideal when your business has a cargo less than 13 - 15 CBM. For a practical perspective, imagine you're shipping 12 CBM of fashion accessories from London to Athens. Rather than bearing the cost of a full truck, LTL freight would allow you to pay only for the cubic meter space your accessories occupy, significantly reducing your costs.

Here’s when it makes sense to use LTL:

- Your shipment range is between 1 to 15 CBM.

- Looking to cost-effectively transport goods without urgency.

- Your products are durable and can withstand handling.

- You don't mind a lengthier transit time due to collective processing.

With this, you'll find your LTL shipment tailored to provide the most efficient and cost-effective means for smaller, regular consignments. Happy shipping!

FTL: Full Truck Load

Full Truck Load, or FTL for short, is the transportation method where your cargo occupies an entire truck on its own. It's secured, private, and goes straight to the desired destination with no stops. FTL can be the smarter choice when you're considering shipping between the UK and Greece, particularly if you're transporting goods more than 13/14/15 CBM (cubic meters).

Let's take a relatable example. Imagine filling up a truck with single-use cutlery and plates for an event, and the total volume comes up to roughly 14 CBM. In this case, an FTL shipment would be a better choice as it’s cost-effective and safer while ensuring timely, direct delivery.

When choosing FTL, consider these points:

- Your cargo takes up more than half the space of a standard truck.

- You want to minimize the handling of goods to prevent potential damage.

- Your items are high in value and need extra security measures.

- There's a narrow time window for delivery.

Remember, every FTL freight has its unique requirements. So, align your choice with your specific shipping needs, be it budget, security, or time-bound delivery.

What are the main routes between UK and Greece?

The land journey from the UK to Greece is quite a feat, spanning over 2000 miles. Starting in the UK, trucks ferry across the English Channel, entering France. Once in mainland Europe, most choose the path that runs through Belgium, Netherlands, and Germany, using the major Autobahns such as A3 and A8. Trucks then continue south crossing through Austria and Slovenia, on roads such as A10 and A1, before entering Croatia. The final leg brushes Italy's east coast then dips into the ferry across the Adriatic Sea to Greece. Your shipment can then be dispersed to major cities like Athens, Thessaloniki, or anywhere in between. Traffic congestion and varying road conditions along this extensive journey can have implications for your delivery timelines and require proper planning.

What are the road transit times between UK and Greece?

Typically, road transport between the UK and Greece averages around 40-50 hours. However, estimating the exact duration can be challenging due to variables like unpredictable traffic, circulation schedules, and varying road qualities across some countries. Keep in mind: Italian highways might speed you along, whereas you may meet with rougher terrains in rural Southeast Europe. Remember, though, these are rough estimates. Don't hesitate to get in touch with us, where you can receive your personalized cross-border freight quote within 24 hours.

How much does trucking cost between UK and Greece?

No magic number exists for trucking your goods from the UK to Greece! Costs can yo-yo due to things like weight, dimensions, and delivery deadlines. But here's good news: we're all about creating customized quotes for your unique situation. So, no surplus charges, no hidden shocks – only the best price for your pocket! Ready to get rolling? Let's chat.

DocShipper tip: Door to Door might be the best solution for you if:

- You prioritize ease and a hassle-free shipping experience. Door-to-door services manage the entire process, from collection to final delivery.

- You appreciate the efficiency of having one dedicated contact. With door-to-door, a single agent is responsible for overseeing all elements of your shipment.

- You want to limit the number of times your cargo is transferred. Door-to-door services minimize the switches between various transport methods, lowering the chances of damage or loss.

Door to door between UK and Greece

Cracking the code of international 'Door to Door' shipping, it's a hassle-free method that handles your cargo from pick-up to destination. Shipping between UK and Greece? This seamless option could be your saviour, offering a wealth of advantages - think efficiency, accountability, and reduced stress! Excited to simplify your transport process? Great, let's dive in.

Overview – Door to Door

Door-to-door shipping from the UK to Greece is your one-stop, fuss-free solution to freight forwarding. A modern remedy to traditional logistics that disentangles often knotty shipping processes, it portably delivers your goods from origin to destination in one seamless transaction. With complexities and numerous touchpoints in global shipping, this service negates the need for multiple agents-a boom among DocShipper's clients. Although slightly costlier, its wealth of benefits and stress-relief it brings far outweigh the minor uptick in expense, making it a preferred choice for your logistics needs. Pack, ship, and relax with door-to-door shipping!

Why should I use a Door to Door service between UK and Greece?

Shipping is much like your favorite drama series; it's full of unexpected twists and cliffhangers! The thrill may pump adrenaline into the veins of on-screen characters, but it's certainly not an experience you want when moving goods from the UK to Greece. Cue the superhero of our story: Door to Door service! Here are the top five reasons to give it the leading role in your shipping saga.

1. Stress-Free Experience: With Door to Door service, you can kiss logistics-related anxiety goodbye. It takes care of goods pickup from the origin point, right till the delivery at the destination. All you need to do is sit back, relax and follow the drama series we talked about.

2. Saves Time: Urgent shipments are like ticking time bombs, ready to explode if not delivered on time. Door to Door service ensures timely delivery reducing the risk of disappointments or losses owing to delays.

3. Customized Care: Complex cargo can be as moody as the on-and-off couple in your favorite show. It requires specialized care and Door to Door services cater to this need efficiently, delivering the most sensitive of goods safely.

4. Complete Convenience: The service takes convenience to a whole new level. It commits to handling all logistics, including trucking. You won't need to solve the mystery of customs and coordinate multiple shipping agents.

5. End-to-End Solution: Imagine having to watch your series on multiple platforms. Messy, right? Similarly, Door to Door service ensures your shipment journey happens under a single banner, ensuring seamless communication and accountability.

So, if shipping has been your long-running antagonist, it’s about time you introduced the Door to Door service to your storyline for a happy ever after!

DocShipper – Door to Door specialist between UK and Greece

Experience seamless door-to-door shipping from the UK to Greece with DocShipper. Leave the complexities to our skilled team handling all aspects from packing and transport, right through to customs procedures and delivery. Accessible across all shipping methods, our expertise is at your disposal. What's more, you'll have a dedicated Account Executive by your side throughout the process. Need a quick estimate? Get in touch and we'll provide a free one in under 24 hours. Or pick up the phone for free consultations. With us, international shipping is effortless.

Customs clearance in Greece for goods imported from UK

Customs clearance is the procedure involved in the acceptance or removal of goods from a country—complex and potentially littered with obstacles like hidden expenses. In Greece, if importing from the UK, it's crucial to comprehend the ins and outs of customs duties, taxes, quotas, and licenses to avoid the nightmare of your goods being stranded in customs. Thankfully, the following sections will go deeper into these critical areas. Don't fret! DocShipper can guide you through this puzzle of a process. Just provide us with your goods origin, value, and HS Code and we'll give you a budget-friendly estimate. Reach out to our team for personalized assistance. We can help with all types of goods, guiding you every step of the way, no matter where in the world you're shipping from!

How to calculate duties & taxes when importing from UK to Greece?

When you're planning to import from the UK to Greece, getting a handle on the potential duties and taxes can give you a clearer perspective on costs. Calculating these customs duties hinges on several key factors: the country of origin, which is where your goods are actually manufactured or produced; the Harmonised System (HS) code that categorised your goods; the declared customs value of your goods; the applicable tariff rate; and other potential taxes and fees that may be relevant to your products.

Cracking the code on customs begins with identifying your goods' country of origin. Are they made in Birmingham or Beijing? That's the first piece of the puzzle you need to understand. After all, loot from London very well may have different duties and taxes than products made in Paris. Your active participation in this process is critical and could save you a tons of time and money down the line. Remember, misclassifying your products could lead to costly mistakes, so it's important to be precise. Your diligence will pay off when your shipment clears customs swiftly and accurately.

Step 1 - Identify the Country of Origin

Knowing the country of origin is crucial for international trade, serving five key purposes. First, it safeguards compliance with relevant trade laws. Second, it enables accurate calculation of duties and taxes, as different countries have varying rates. Third, it confirms whether a product meets the essential criteria for being labeled as 'made in' a specific location. Fourth, it helps to determine the applicable trade agreement between the origin and destination countries. Lastly, it can indicate potential restrictions or duties exemptions.

Specifically in the UK to Greece movement, understanding the origin country helps apply the EU-UK Trade and Cooperation Agreement, thus influencing the duty calculation. It can notably affect certain businesses, like those dealing in cars or agricultural products, where different duty rates may apply.

Import restrictions are equally important to understand. For instance, specific pharmaceutical and food products from outside the EU may face stringent inspections or additional import restrictions in Greece. Always research and understand these elements before proceeding with any shipment to smooth your importing endeavour.

Remember, each trade journey is unique. Tailoring processes as per your business needs can unlock smoother, swifter, and cost-effective shipping. Happy trading!

Step 2 - Find the HS Code of your product

The Harmonized System, or HS, Code is a standardized system of names and numbers used worldwide to classify traded products. The World Customs Organization created it to facilitate the classification of goods, aligning customs and trade processes across countries. If you're a business exporting goods, knowing the HS code of your product is critical to complete your shipping paperwork correctly.

Your first point of contact for obtaining an HS code should be your product's supplier. They're often well-informed about what they're importing and the associated regulations.

Now, let's say you don't have the luxury to ask your supplier. Please don't fret because we've got you covered. Finding your HS code is easy with the Harmonized Tariff Schedule lookup tool. Write your product's name in the search bar at the top, and it will provide a list of commodities that match your description. On this list, check the 'Heading/Subheading' column and voila, you got your HS code!

Before proceeding, one piece of important advice: Please ensure the HS code you selected is the most accurate fit for your product. Acquiring the wrong code could potentially lead to unavoidable delays in shipping your goods, increased inspection rates, and even potential fines.

Now that you know how to find your HS code, have a look at this informative infographic which shows how to read an HS code.

Step 3 - Calculate the Customs Value

When shipping goods from the UK to Greece, you'll come across 'Customs Value'. This isn't just the price tag on your products; it's far more than that. It's essentially the CIF (Cost, Insurance, and Freight) value, covering the actual cost of the goods, international shipping fees, and insurance costs combined. Consider, for example, you got a batch of shoes worth $500. The shipping costs $200, and insurance sets you back another $50. In this case, your customs value is $750 ($500 + $200 + $50). It's this CIF-computed $750 that custom authorities use to calculate duties. Understanding this key concept empowers you to predict and manage your shipping expenditure. So, keep track of your numbers to stay on top of your import game!

Step 4 - Figure out the applicable Import Tariff

An import tariff is a tax imposed by a country on goods brought in from abroad. It represents a cost you as an importer need to pay to bring goods into a country.

The Tariff used in the UK is detailed in the Trade Tariff: look up commodity codes, duty, and VAT rates tool, provided by the UK Government. Here's a step-by-step guide to identify the applicable tariff for your goods:

1. Use the link to access: Trade Tariff - UK Government.

2. Enter the HS code of your product, determined earlier, and the country of origin, Greece.

3. The tool will display the duty and taxes applicable to your product.

Let's walk through an example. Suppose you're importing porcelain kitchenware, which carries an HS code 6911. Your CIF (Cost, Insurance, Freight) is $5,000. When you input these details, the tool shows a 12% tariff rate. Your import duty would be: $5,000 12% = $600. So, the total cost of your imported goods would be CIF + Import Duty = $5,000 + $600 = $5,600. This gives a real-world sense of the different elements that comprise the final cost of imported goods.

Step 5 - Consider other Import Duties and Taxes

When importing goods from the UK to Greece, you'll likely come across additional import duties and taxes apart from the standard tariff rate. These costs depend on your product's nature and its country of origin. Here are a few examples, but remember, rates may fluctuate over time:

1. Excise Duty: Products like alcohol, tobacco, and certain energy products might bear additional fees. For instance, if importing whiskey, you may incur an excise duty of around $12 per liter.

2. Anti-Dumping Taxes: If your goods are sold at a vastly lower price than their market value, anti-dumping duties might apply. This varies from case to case.

3. VAT: Probably the most important tax, the VAT for Greece is typically 24%. So, if your shipment is valued at $10,000, your estimated VAT could be $2,400.

Calculating these expenses demands a deep understanding of your goods and an up-to-date knowledge of Greece’s import laws. Consulting a local customs broker can take the guesswork out of this complex process and help you navigate these additional costs effectively. It's all about planning ahead and being aware of potential financial aspects to ensure a smooth import process.

Step 6 - Calculate the Customs Duties

Calculating customs duties in Greece when exporting goods from the UK is a multi-layered process that depends on specific variables.

Firstly, let's look into the situation where there are customs duties but no VAT. In such cases, the total payable duty can be derived from the customs value of your goods, typically including shipping and insurance costs. For example, if you're exporting a $3,000 piece of machinery and the duty rate is 10%, you'll pay $300.

Next, it's time to evaluate circumstances where both customs duties and VAT apply. VAT in Greece is currently 24%. So, for a shipment worth $5,000 with a 10% duty rate, your customs fee will be $500, and on top of that, a VAT of $1,320 will be applied (24% of $5,500).

Finally, instances where customs duties, VAT, anti-dumping taxes, and Excise Duty all apply. Assume you're shipping wine worth $10,000, with an additional $8,000 in anti-dumping taxes. Using a 15% duty rate and a $1.5 per litre Excise Duty for 1,000 litres, your total customs duty sums up to $4,185 plus an Excise Duty of $1,500, while VAT ($3,722) is charged on the entire lot.

Remember, every shipment has its specifics and these calculations can become intricate. With DocShipper customs clearance services, all these steps are handled professionally, ensuring you don't overpay. Get a free quote in less than 24h by contacting us today!

Does DocShipper charge customs fees?

Despite being a custom broker in UK and Greece, DocShipper doesn't impose customs duties - that's a government thing! But we do handle the nitty-gritty of customs clearance, for which fees apply. Confused? Let’s take a real-world scenario: You import some goods from China to Greece. We’ll prepare the necessary documents, pay duties and taxes to customs on your behalf, and provide you with receipts as proof. Rest assured, you won’t pay a dime more than what customs themselves charge. Consider us your navigators in the complex world of international shipping!

Contact Details for Customs Authorities

UK Customs

Official name: Her Majesty's Revenue and Customs (HMRC)

Official website: www.gov.uk/government/organisations/hm-revenue-customs

Greece Customs

Official name: Hellenic Republic Ministry of Finance - Customs and Excise

Official website: www.aade.gr/

Required documents for customs clearance

Understanding the documents involved in customs clearance can seem daunting. We're here to demystify these essentials, covering the Bill of Lading, Packing List, Certificate of Origin, and Documents of Conformity (CE standard). Stay tuned to master the paperwork, avoid compliance issues, and ensure a smooth freight journey.

Bill of Lading

When you're shipping goods from the UK to Greece, the Bill of Lading (BOL) is your lifeline. It's not just a receipt for your cargo. It's officially transferring the goods’ ownership from shipper to receiver, a legally binding contract, so treat it with care. Save time and hassle by embracing the telex release, equivalent to an electronic BOL, providing smoother, faster transactions without physical paperwork. If you're using air freight, consider the AWB (Air Waybill), the BOL’s air counterpart. It serves the same purpose but is non-negotiable. In crafting your international shipping strategy, understanding these documents will be as crucial as deciding what to export. Your business's successful delivery journey starts with mastering these essentials.

Packing List

Navigating between the UK and Greece, a Packing List is your knight in shining armor. It's more than a list of items – it's an invaluable tool in the shipping process, irrespective of whether your goods are sailing the sea or cruising the clouds. Your role? Be precise! Accuracy is paramount, as this document carries weight with customs. Not just a summary, it details your shipment's quantity, description, and weight – think of it as your shipment's ID in the vast sea of international trade. For instance, consider a UK-based toy manufacturer shipping a container full of teddy bears to Greece. Every bear counts, and the Packing List helps customs know exactly what's in the container. No surprises, smoother clearance, happier businesses. It's that straightforward. Make it detailed, make it accurate. Your Packing List is a lot more powerful than you think.

Commercial Invoice

Navigating customs between the UK and Greece? Your Commercial Invoice is your cornerstone. This document paints a clear picture of your shipment, from origin to destination, item descriptions, and their values. Think of it as the storybook of your freight's journey. Incorrect or missed details can cause delays. For instance, a Birmingham exporter sending ceramics must specify each item, material used, quantity, per unit value, and the total value in Euros, abiding by EU trade laws. An important trick? Consistency! Align all details with your transport documents, like Bill of Lading or Air Waybill, to master the customs battleground. Get your Commercial Invoice right, and you're one leap closer to breezing through Greek customs.

Certificate of Origin

If you're shipping goods between the UK and Greece, don't overlook the value of the Certificate of Origin. This powerful piece of paperwork confirms your goods' country of manufacture. For instance, if you're exporting traditional British pottery to Greece, the certificate clarifies that UK soil and craftsmanship were involved, authenticating its origin. Why does that matter? Let's say Greece has a preferential duty rate for goods made in the UK, in that scenario, your Certificate of Origin is your ticket to savings on customs duties. Therefore, meticulous mention of the origin is essential - it's your gateway to potentially significant cost advantages. A small detail, but one that can have a tangible influence on your shipping overheads. So, ensure your Certificate of Origin is always in order.

Certificate of Conformity (CE standard)

If you're shipping goods between the UK and Greece, you may need a Certificate of Conformity (CE Standard). This certificate states that your product complies with the necessary EU safety, health, and environmental requirements. It's not a quality assurance document, but a declaration that your goods meet regulatory demands. While the UK used to recognize this standard, they've now moved to a UKCA marking following Brexit. However, for goods entering Greece - a member of the EU - the CE marking remains critical. Think of it like the US' FCC Declaration of Conformity. Actionable advice? Always check every product in your shipment for its conformity with destination market standards. Each misstep could cost you time and money at customs, so diligence here pays off. Remember, shifting standards require ongoing attention: stay informed.

Your EORI number (Economic Operator Registration Identification)

If you're shipping goods from the UK to Greece, one crucial document you'll need is the EORI Number (Economic Operator Registration Identification). Think of it as your badge in the world of international commerce; without it, your shipment won't see the light of day in Greece's docking ports.

How do you get an EORI number, you ask? Well, it's simpler than you think. You just have to apply online through your country’s customs website, usually HM Revenue & Customs for UK businesses. Remember, each EORI number is unique, kind of like a fingerprint for your company.

Here's the kicker – it drastically simplifies tracking shipments across borders. Even though the UK isn't part of the EU anymore, for destinations like Greece within the EU, this number holds as much weight as ever. It's a non-negotiable for a seamless shipping experience.

Get Started with DocShipper

Navigating customs between the UK and Greece can be demanding. Simplify your life with DocShipper's high quality services. We handle every step of the customs clearance to ensure a hassle-free shipping experience. Ready for peace of mind? Contact us to receive a free quote within 24 hours. Let's un-complicate trade together.

Prohibited and Restricted items when importing into Greece

Avoid customs hiccups when importing to Greece! Understanding the specific laws on prohibited and restricted items can save your business time and costly mishaps. Here's your go-to guide, detailing what you can't ship and what requires extra paperwork.

Restricted Products

1. Pharmaceutical products: You need to apply for a pharmaceutical license from the National Organization for Medicines (EOF) in Greece.

2. Alcohol and spirits: You're required to get a special license by the General Secretariat for Trade and Consumer Protection website.

3. Tobacco products: For importing these, you’ll need permission from the Ministry of Health in Greece.

4. Dairy and meat products: Prior approval by the Greek Ministry of Rural Development and Food is needed.

5. Firearms and ammunition: You should secure a license from the Hellenic Police.

6. Precious metals (e.g. gold, silver): These need a license from the Bank of Greece.

7. Animals and pets: An import permit from The Ministry of Rural Development and will be necessary.

8. Plants, seeds, and fruits: You have to apply for a phytosanitary certificate from the Ministry of Rural Development and Food.

9. Cosmetic Products: A special license from the National Organization for Medicines (EOF) is needed.

10. Radioactive materials: The Greek Atomic Energy Commission is the agency to apply to for a license.

Please ensure you check in with these agencies to stay updated, as regulations can change. Happy shipping!

Prohibited products

- Narcotics and illicit drugs

- Explosives, fireworks and other dangerous substances

- Endangered plants and animals, including parts and products made from them

- Counterfeit money and goods

- Obscene material and child pornography

- Unauthorized medications or medical equipment

- Untreated hides and skins

- Items infringing upon intellectual property rights

- Cultural artifacts without the appropriate permits

- Radioactive materials

Are there any trade agreements between UK and Greece

Yes, there's a significant trade agreement between the UK and Greece. Post-Brexit, the UK has secured a tariff-free trade deal with Greece, supporting the flow of goods between the countries. This could mean easier customs procedures and no additional duties for your business when shipping. Ongoing discussions on improved maritime connections may bring more future opportunities. Thus, your cargo movement from the UK to Greece has great potential for smooth sailing.

UK - Greece trade and economic relationship

With historical ties dating back centuries, the UK-Greece economic relationship is a key aspect of their international involvement. They mutually benefit from trade, sharing a mix of commodities, majority being medicinal and pharmaceutical products from the UK, and fruits, clothing accessories from Greece. In recent years, renewable energy and technology have emerged as promising sectors for collaboration.

In terms of investment, British companies have an active presence with around €800 million worth in Greece. As of 2019, UK-Greece bilateral trade was estimated at £2.6 billion, a strong testament to their interconnectedness. Of this, UK exports to Greece totaled £1.1 billion, and the imports from Greece amounted to £1.5 billion. This gives businesses a solid foundation to expand their reach in these markets.

Your Next Step with DocShipper

Managing the logistics of shipping between the UK and Greece can be complex, especially if you're new to business importing/exporting. Why burden yourself with the stress of customs clearance, duties, and transport coordination? Let DocShipper's experts shoulder that load for you, so you can concentrate on what you do best - running your business. Ready to uncomplicate your shipping process? Contact us now!

Additional logistics services

Discover services beyond shipping and customs! Dive into a range of additional logistics offerings, tailor-made to streamline your supply chain process, ensuring an experience that's hassle-free and cost-efficient.

Warehousing and storage

Finding the right warehousing solution can be daunting. Temperature-controlled spaces, for example, are essential for shipping certain goods like wines or perishables. Boost your shipping success by leveraging top-notch storage conditions. More info on our dedicated page: Warehousing

Packaging and repackaging

Ensuring your goods are safely packaged is a critical step when shipping between the UK and Greece. Proper packaging minimizes damage risk and navigates customs seamlessly. Need a trusty resource? Our team can help with anything from fragile porcelain to heavy machinery. Discover more about how we've pivoted this process in our clients' favor on our dedicated page: Freight packaging.

Cargo insurance

Cargo Insurance is your safety net, a crucial difference from fire insurance. Unlike fire insurance that only provides coverage for fire-related incidents, cargo insurance safeguards your shipment from potential hazards like damage, theft, or loss during transit. Picture a safe transport of fine ceramics - with cargo insurance, those fragility concerns become easier to manage. Dive deeper into risk management with Cargo Insurance. More info on our dedicated page: Cargo Insurance.

Supplier Management (Sourcing)

Looking to manufacture in East Europe or Asia? Our team at DocShipper eases the path by finding reliable suppliers and managing the entire procurement process. We bridge language gaps, remove cultural misunderstandings, and simplify the complexity you might face. Think of us as a compass guiding you in these unfamiliar territories. Hop over to our dedicated page, Sourcing services, for a deeper dive.

Personal effects shipping

When you're moving from the UK to Greece, managing your personal effects – be it your grandma's vintage mirror or your massive oak wardrobe can be worrisome. We treat your precious goods with utmost professionalism and flexibility, ensuring safe arrival. Here's a real-world instance: A UK family recently relocated to Athens, trusting us with their antique piano. It arrived scratch-free, on schedule! Discover the peace of mind this service can bring on our page: Shipping Personal Belongings.

Quality Control

Mind the specs! Quality control is critical in the UK-Greece shipping route. It's not just about avoiding customs headaches, but also ensuring that your goods withstand the journey. Picture this: ceramic goods chipping or machinery parts misaligned during transport could spell just the start of your worries! With our in-depth inspections during manufacturing or customization, we make sure your shipment is up to scratch. More details on our dedicated page: Quality Inspection

Product compliance services

Sending your goods across borders? Ensure they're up to scratch with regulations by using our Product Compliance Services. From lab testing to certification obtainment, we safeguard your business against non-compliance penalties. Imagine avoiding unwanted red tape or delays just by being proactive - it's that easy! More info on our dedicated page: Product compliance services.

FAQ | For 1st-time importers between UK and Greece

What is the necessary paperwork during shipping between UK and Greece?

We, at DocShipper, streamline the entirety of your shipping process, making it as hassle-free as possible. The primary document required for seaway transportation from the UK to Greece would be the bill of lading; for airways, it's the air waybill. Rest assured, we manage these critical documents. However, you must provide a comprehensive packing list and commercial invoice. Specific goods may mandate additional documentation—for instance, Material Safety Data Sheets (MSDS), certifications, and more. Do keep in mind that having the appropriate paperwork is essential to ensure your cargo's smooth transition through customs.

Do I need a customs broker while importing in Greece?

Absolutely, using a customs broker while importing goods to Greece is highly suggested due to the complexity of customs procedures and requirements. These often involve an array of details and paperwork that may be burdensome for businesses to manage independently. That's where we step in at DocShipper. Our primary goal is to streamline this intricate process for you. In fact, for most of our shipments, we directly represent your cargo at customs, ensuring a seamless transition. Our team of customs brokers is specially trained to handle all the particularities, leaving you tension-free about the success of your import. Therefore, consider leveraging the service of a customs broker for your imports to Greece - it could save you a considerable amount of time and headache.

Can air freight be cheaper than sea freight between UK and Greece?

It's challenging to generally state whether air freight or sea freight is more affordable between the UK and Greece, as such costs greatly depend on several factors, including the route, weight, and volume of your goods. However, when your shipment is under 1.5 cubic meters or weighs less than 300 kg (approximately 660 lbs), air freight can be a viable, potentially cost-effective option to consider. Rest assured, at DocShipper, we prioritize offering you the most competitive options. Your dedicated account executive will guide you, ensuring that you make the most suitable and cost-efficient choice for your specific cargo needs.

Do I need to pay insurance while importing my goods to Greece?

At DocShipper, we strongly advise including an insurance policy when importing goods to Greece, or anywhere else for that matter. Although insurance is not a legal requirement, it offers an additional layer of protection against potential scenarios such as damage, loss, or theft during transportation. Remember, shipping is a complex process involving multiple stages and transport modes, where unexpected incidents can occur. While we make every effort to ensure a secure and safe delivery of your goods, insurance provides you that extra peace of mind.

What is the cheapest way to ship to Greece from UK?

For cost-effective shipping between the UK and Greece, we often recommend sea freight, given the geographical proximity and robust port infrastructure in both countries. However, the best option can depend on the specifics of the shipment, like its size and urgent needs. Larger, non-time-sensitive shipments typically benefit from sea freight's lower cost, while smaller, urgent shipments may find air freight more suitable, albeit pricier. At DocShipper, we can customize a solution tailored to your specific requirements.

EXW, FOB, or CIF?

Choosing between EXW, FOB, or CIF largely hinges on the nature of your relationship with your supplier. It's important to remember that your supplier may not specialize in logistics. Therefore, we at DocShipper recommend that you let a professional agency handle at least the international freight and the destination process. Suppliers often trade under EXW (from their factory door) or FOB (covering all local charges to the origin terminal). Regardless of the terms used, our team at DocShipper can provide a comprehensive door-to-door service to make your shipping experience smoother.

Goods have arrived at my port in Greece, how do I get them delivered to the final destination?

If your goods have arrived in Greece under CIF/CFR incoterms, it's necessary to hire a customs broker or freight forwarder to assist with clearing the goods at the terminal, paying import charges, and further delivery. Alternatively, we offer DAP incoterms where our team takes care of the entire process for you. We recommend confirming these details with your dedicated account executive at DocShipper to ensure smooth delivery to your final destination.

Does your quotation include all cost?

Absolutely, our quotation incorporates all costs with the exception of duties and taxes at your destination. You can confidently approach your dedicated account executive to estimate these for you. At DocShipper, we maintain total transparency, ensuring there are no hidden fees to avoid unexpected surprises.